Exhibit 99.16

MANAGEMENT DISCUSSION AND ANALYSIS

FOR THE FISCSAL QUARTER ENDED MARCH 31, 2012

The following management’s discussion and analysis (‘‘MD&A’’) of the financial condition and results of operations of Rio Alto Mining Limited (the “Company” or “Rio Alto”) together with its subsidiaries is as of May 14, 2012. It is intended to be read in conjunction with the Company’s unaudited condensed interim consolidated financial statements (the “Financial Statements”) for the fiscal quarter ended March 31, 2012 and other corporate filings available at www.sedar.com(“SEDAR”). The Financial Statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) and the Financial Statements and MD&A are presented in United States dollars.

This MD&A contains forward-looking information and forward-looking statements. Readers are referred to the cautionary statement regarding forward-looking information under the heading “Cautionary Statement on Forward Looking Information”, which forms part of this MD&A.

Management is responsible for the Financial Statements referred to in this MD&A, and provides officers’ disclosure certifications filed with securities commissions on SEDAR.

Additional information about Rio Alto may be found at the Company’s website at www.rioaltomining.com or within the Company’s SEDAR profile at www.sedar.com.

Company Overview

The Company was formed in 1987 under the laws of British Columbia, Canada. Following a continuation under the laws of Alberta, Canada and a number of name changes, the Company became Rio Alto in July 2009. The principal business of the Company is the development of the La Arena gold oxide/copper-gold project (the “La Arena Project”) in northwestern Peru. In March of 2011 the Company commenced pre-production activities at a dump leach gold mine (the “La Arena Gold Mine”) located within the La Arena Project and commenced a feasibility study on the copper-gold deposit within the La Arena Project. Commercial production levels were achieved at the La Arena Gold Mine in late December 2011. Commercial production commenced in January 2012.

The Company changed its fiscal and financial year end from May 31 to December 31 in November 2011; consequently, the unaudited condensed interim consolidated financial statements are for the fiscal quarter ended March 31, 2012 compared to February 28, 2011. The change was made to allow it to provide its continuous disclosure information on a comparable basis with its peer group and to align its year end with the year end of La Arena S.A. (“La Arena”), a wholly-owned subsidiary that carries on the principal business of Rio Alto.

Rio Alto has three wholly-owned subsidiaries – La Arena and Rio Alto S.A.C. each incorporated under the laws of Peru and Mexican Silver Mines (Guernsey) Limited incorporated under the laws of Guernsey.

On February 9, 2011 the Company completed the purchase of 100 per cent of La Arena, which held mining rights over approximately 21,000 hectares in Peru, including the La Arena Project. The La Arena Project is approximately 1,000 hectares and contains two mineral deposits – a gold oxide deposit that hosts the La Arena Gold Mine and an adjacent copper-gold sulphide deposit.

The Company is a producing, reporting issuer in British Columbia, Ontario and Alberta and its common shares trade on the TSX and the Bolsa de Valores de Lima under the symbol “RIO”, the OTC QX® under the symbol “RIOAF” and on the Frankfurt Stock Exchange under the symbol “A0MSLE”.

Highlights for the three months ended March 31, 2012

During the first quarter of 2012 the Company:

Commenced commercial mining operations at the La Arena Gold Mine;

Produced 55,973 ounces of gold;

Sold 54,947 ounces of gold at an average price of $1,664 per ounce realizing cash sales of $91.4 million;

Generated net income of $33.2 million ($0.19 per share);

Realized cash from operating activities of $54.6 million; and

Achieved a mine site cash cost per ounce of gold sold of $428.

Summary of Development and Operating Activities

Development at La Arena is ongoing, with $12.4 million incurred on development activities and capital expenditures during the quarter ended March 31, 2012. The Company recorded revenue $94.6 million from metal sales during the period resulting from cash proceeds of $91.4 million and deferred revenue of $3.2 upon the delivery of 3,971 ounces under the Prepayment Agreement. The Company had a net income of $33.2 million in the quarter ended March 31, 2012, compared to a net loss of $2.6 million during the quarter ended February 28, 2011.

Operating Activities

La Arena reached commercial production levels in December 2011, and commercial production commenced in January 2012. The following table sets out the materials mined in the first quarter of the year:

| | | | | |

| | | | | Dry | |

| | Dry Metric | | | Metric | |

| | Tonnes of Ore | | Contained | Tonnes | Waste to |

| Month | to Pad | Au g/t | Au Ozs | of Waste | Ore Ratio |

| | | | | |

| January | 413,026 | 1.31 | 17,356 | 1,063,452 | 2.58 |

| | | | | | |

| February | 326,600 | 1.56 | 16,381 | 935,461 | 2.86 |

| | | | | |

| March | 549,857 | 1.31 | 23,229 | 263,125 | 0.48 |

| | | | | | |

| Total/Average | 1,289,483 | 1.37 | 56,966 | 2,262,038 | 1.75 |

An additional 338,395 tonnes of previously mined ore grading 0.84 Au g/t were placed on the leach pad resulting in a total of 66,091 ounces of gold placed on the pad.

Ounces of gold sold in the January 1 to March 31, 2012 period were:

| | | |

| | Ounces of gold |

| | | | To Settle |

| Month | Refined | Sold | Prepayment |

| | | |

| January | 19,815 | 12,920 | 3,971 |

| | | | |

| February | 17,371 | 22,705 | - |

| | | | |

| March | 18,787 | 19,322 | - |

| | | |

| Total | 55,973 | 54,947 | 3,971 |

After March 31, Rio Alto made additional deliveries amounting to 4,949 ounces of gold to settle 5,822 notional ounces under the Prepayment Agreement. At the date of this MD&A, future gold delivery requirements in respect of this agreement will, depending on the price of gold at the time of delivery, fall within a range between 32,992 ounces and 44,636 ounces as follows:

2

| | | | | | | | | |

| | | Gold ounces to be delivered | |

| | | Maximum | | | Notional | | | Minimum | |

| | | | | | | | | |

| | | Less than | | $ | 1,150- | | | More than | |

| Gold price | $ | 950 | | $ | 1250 | | $ | 1,450 | |

| | | | | | | | | |

| Monthly – March 2013 to October 2014 | | 2,232 | | | 1,941 | | | 1,650 | |

| | | | | | | | | |

| Total | | 44,636 | | | 38,814 | | | 32,992 | |

La Arena Gold Mine Costs

Mine site cash cost of $25.2 million resulted in cash per ounce of $428 for ounce of gold sold in the period. The total cash cost per ounce sold of $909 includes corporate overhead and accruals for workers’ profit participation, Peru income tax, Peru government royalty and Peru special mining tax that will have to be paid over the next twelve months:

(000’s of dollars, except ounces and per gold ounce amounts)

| | | | | | |

| | | ($000's) | | | $per oz(1) | |

| Production costs | $ | 19,923 | | | | |

| Silver by-product revenue | | (78 | ) | | | |

| Lima office costs | | 901 | | | | |

| Workers’ profit share | | 4,449 | | | | |

| Mine site costs | | 25,195 | | $ | 428 | |

| Vancouver office | | 834 | | | 14 | |

| Income tax | | 15,446 | | | 262 | |

| Royalty | | 5,250 | | | 89 | |

| Special mining tax | | 6,811 | | | 116 | |

| Total cash costs | $ | 53,536 | | $ | 909 | |

| Ounces of gold sold | | 58,918 | | | | |

| (1) | The Company has included non-IFRS performance measures – mine site and total cash costs per gold ounce sold – throughout this document. In addition to conventional measures, the Company uses these performance measures to monitor its operating cash costs and believes these measures provide investors and analysts with useful information about the Company’s underlying cost structure. These measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The Company reports cash costs per ounce on a sales basis. In the gold mining industry, this is a common performance measure but does not have any standardized meaning. |

3

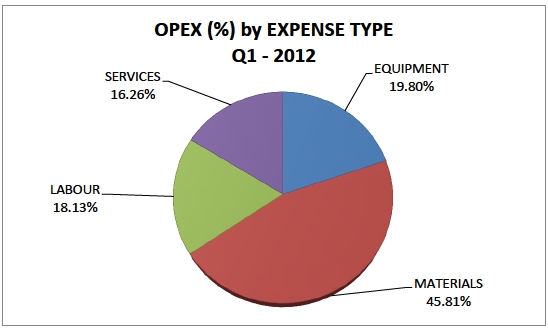

The breakdown of mine site cash costs for the first quarter were:

The major cost elements for mining include equipment rental, diesel, materials (mostly blasting materials) and labour. Processing costs are dominated by materials (chemicals), diesel generated electrical power and labour. Other costs include insurance, administrative and environmental services and health, safety and community related expenditures.

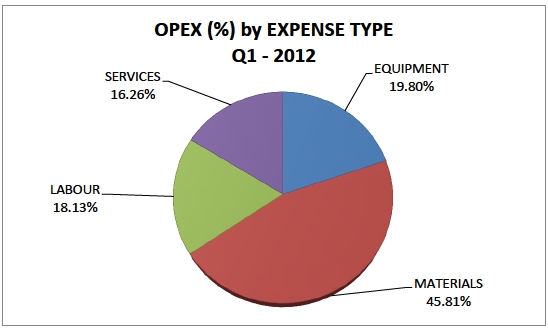

The mine site cost elements for the first quarter of 2012 were:

4

Results of Operations

The following table provides selected quarterly financial information:

| | | | | | | | | | | | | | | | | | | | | | | | |

(thousands of US

dollars, except per

share amounts) | Prepared using international financial reporting standards | Prepared

using

Canadian

generally

accepted

accounting

principles |

| | For the three

months

ended | For the

four

months

ended | For the three months ended |

| |

| |

| |

| | | March 31, | | | December | | | August 31, | | | May 31, | | | February | | | November | | | | | | | |

| | | | | | 31, | | | | | | | | | 28, | | | 30, | | | August 31, | | | May 31, | |

| | | 2012 | | | 2011 | | | 2011 | | | 2011 | | | 2011 | | | 2010 | | | 2010 | | | 2010 | |

| Revenue | $ | 94,594 | | $ | - | | $ | - | | $ | - | | $ | - | | $ | - | | $ | - | | $ | - | |

| Total assets | | 260,200 | | | 197,506 | | | 166,287 | | | 157,944 | | | 127,847 | | | 51,285 | | | 29,442 | | | 26,594 | |

| Working capital | | 60,931 | | | 35,050 | | | 7,739 | | | 20,337 | | | 6,242 | | | 14,462 | | | 4,943 | | | 5,807 | |

| Shareholders’ equity | | 152,365 | | | 115,309 | | | 102,090 | | | 112,036 | | | 111,752 | | | 44,690 | | | 28,965 | | | 23,487 | |

| Net income(loss) | | 33,178 | | | 9,715 | | | (10,263 | ) | | (1,377 | ) | | (2,586 | ) | | (3,837 | ) | | (904 | ) | | (9,908 | ) |

| Basic earnings(loss) per share | | 0.19 | | | 0.06 | | | (0.06 | ) | | (0.01 | ) | | (0.02 | ) | | (0.03 | ) | | (0.01 | ) | | (0.12 | ) |

| Diluted earnings(loss) per share | | 0.18 | | | 0.05 | | | (0.06 | ) | | (0.01 | ) | | (0.02 | ) | | (0.03 | ) | | (0.01 | ) | | (0.12 | ) |

The Company had net income of $33.2 million for the quarter ended March 31, 2012, compared to a loss of $2.6 million for the quarter ended February 28, 2011. The significant improvement in 2012 is due to the start of commercial production.

Gross profit from operations was $63.8 million in the three months ended March 31, 2012 compared to nil in the three months ended February 28, 2011.

La Arena sold 58,918 ounces of gold and recognized sales revenue of $94.6 million. Revenue included cash sales of 54,947 ounces of gold at an average price of $1,664 per ounce for $91.4 million, and settlements under the Gold Prepayment Agreement of 3,971 ounces of gold resulting in the recognition of $3.1 million of revenue deferred under the Gold Prepayment Agreement. La Arena also had $78,000 in silver revenue related to 2,838 ounces of silver sold at a price of $27 per ounce.

General and administration expenses

General and administrative costs were $2.0 million for the quarter ended March 31, 2012 compared to $2.5 million in the quarter ended February 28, 2011, including costs for the Vancouver corporate office and the Lima office which supports the La Arena Project and include the following:

| | | | | | | |

| | | | For the three | | | For the three | |

| | | | months ended | | | months ended | |

| | (000's) | | March 31, 2012 | | | February 28, 2011 | |

| Vancouver office costs | | $ | 834 | | $ | 1,177 | |

| Lima office costs | | | - | | | 236 | |

| Stock based comp | | | 1,215 | | | 1,061 | |

| | | $ | 2,049 | | $ | 2,474 | |

Vancouver office costs were $0.8 million for the quarter ended March 31, 2012, compared to $1.2 million in the quarter ended February 28, 2011. The decrease is due to a cash severance payment of $390,000 and a performance based bonus payment in the amount of $145,000 to a former officer and director included in 2011,

5

partially offset by a one-time listing fee of $196,000 due to changing the Company’s public listing to the TSX from the TSX-V. Other costs include salaries, office costs, travel, professional fees and other public company costs.

The Lima office supports the La Arena Gold Mine and since the start of commercial production substantially all of its costs are charged to the mine site.

Stock-based compensation expense was $1.2 million for the quarter ended March 31, 2012 compared to $1.0 million in the quarter ended February 28, 2011. Stock based compensation represents amortization of the fair value of granted options over their vesting periods. In the quarter ended March 31, 2012, the Company granted 200,000 options with a fair value of $377,000. In the three months ended February 28, 2011, the Company granted 385,000 options with a fair value of $710,000. Fair value is recognized over the periods in which the options vest which range from immediate vesting to vesting over a three-year period.

Exploration expense

During the three months ended March 31, 2012, the Company agreed to enter into a five-year option and purchase agreement with a private, arm’s length Colombian company to acquire up to an 80 per cent interest in properties held by the company within Colombia. During the first year of the agreement the Company agreed to spend $2 million on exploration, land holding and administration costs. Expenditures to-date amounted to $412,000. After the first year of the agreement, the Company may elect to continue funding additional expenditures of $8 million over the five-year term to acquire 80 per cent of the prospects.

Other income (loss)

Other income (loss) amounted to a loss of $667,000 in the three months ended March 31, 2012 compared to a gain of $35,000 during the three months ended February 28, 2011, due primarily to an increase of $360,000 in the unrealized loss on the Purchase Agreement and an accretion expense related to the asset retirement obligation for the La Arena Gold Mine.

Other income (loss) consists of (000’s):

| | | | | | |

| | | | | | For the three | |

| | | For the three | | | months ended | |

| | | months ended | | | February 28, | |

| | | March 31, 2012 | | | 2011 | |

| | | | | | |

| Unrealized gain (loss) on derivative liability | $ | (360 | ) | $ | 440 | |

| | | | | | | |

| Accretion expense | | (415 | ) | | - | |

| | | | | | |

| Foreign exchange gain (loss) | | 233 | | | (414 | ) |

| | | | | | | |

| Other income (loss) | | (125 | ) | | 9 | |

| | | | | | |

| | $ | (667 | ) | $ | 35 | |

At May 31, 2011, the Company recorded an asset retirement obligation of $14.8 million for the La Arena Gold Mine. The accretion related to this obligation was $415,000 for the quarter ended March 31, 2012. The estimated undiscounted value of the closure obligation is $34.7 million. The closure plan was approved in February 2012 and the Company is required to post a bond or other security with the Peruvian authorities of approximately $3.2 million in January 2013.

Foreign exchange gain was $233,000 for the three months ended March 31, 2012, compared to a foreign exchange loss of $414,000 in the three months ended February 28, 2011. The $414,000 loss in 2011 resulted from holding US dollars in anticipation of the La Arena acquisition during a period when the Canadian dollar appreciated relative to the United States dollar. The Company’s functional currency at the time was the Canadian dollar.

Other expenses in the three months ended March 31, 2012 amounted to $125,000, and consists primarily of interest expense on a $3 million credit facility bearing interest at 3-month LIBOR plus 6 per cent compounded annually and maturing in October, 2014.

6

Peru Taxes

Taxes in Peru applicable to Rio Alto are:

| 1) | Special Mining Tax is applied on operating mining income based on a sliding scale of rates ranging from zero up to 8.40%. |

| 2) | Modified Royalty Based on Operating Income is applied on the Company’s operating income. The amount payable is determined on a sliding scale with marginal rates ranging up to 12% applied to operating margin, subject to a minimum royalty of 1% of the sales value of mineral resources. |

| 3) | Workers in the mining industry are entitled to participate in a company’s income before income tax. This participation is 8% of income before income subject to income tax. The amount paid directly to the Company’s workers is capped at 18 months of gross monthly salary. Amounts over this threshold are paid to the government. Substantially all payments to be made to workers are included in Cost of Sales. Any excess payments will be included within the tax provision. |

| 4) | The corporate income tax after deduction of worker participation is 30%. |

The following table sets out the calculation of the total Peruvian tax burden for the Company for the three months ended March 31, 2012 (in 000’s):

| | | | | | |

| Sales | $ | 94,594 | | | | |

| Cost of sales | | 20,824 | | | | |

| Depreciation, depletion and amortization | | 5,508 | | | | |

| Operating Margin | $ | 68,262 | | 72.2% | | of sales |

| Modified Royalty | | 5,250 | | 7.7% | | of operating margin |

| Special Mining Tax | | 6,811 | | 10.0% | | of operating margin |

| Interest Expense | | 113 | | 0% | | of operating margin |

| Income Before Worker Profit Share | $ | 56,088 | | | | |

| Worker Profit Share | | 4,602 | | 6.7% | | of operating margin |

| Income Before Income Tax | $ | 51,486 | | | | |

| Income Tax | | 15,446 | | 23% | | of income operating margin |

| Total government charges | $ | 32,109 | | | | |

| | | | | | | |

| Worker participation included in cost of sales | | 4,449 | | | | |

| Worker participation capitalized | | 153 | | | | |

| Taxes included in the provision for income taxes | | 27,507 | | | | |

| Total Taxes | $ | 32,109 | | | | |

Liquidity and Capital Resources

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company manages liquidity risk through forecasting its cash flows from operations and anticipating investing and financing activities. Senior management and the board of directors review and approve planned expenditures. Management believes that the ability to fund operations through cash generated from operations is sufficient to meet sustaining capital and operating requirements. Expansion of the La Arena Gold Mine and completion of the feasibility study for the copper-gold deposit will be funded from the Company’s working capital. Development of the copper-gold sulphide project may, depending on the timing of the expenditures, require additional financing.

The Company’s cash receipts are from the sale of mineral products; however, the profitability of developing and producing mineral products is affected by many factors including the cost of operations, variations in the grade of

7

ore mined, metal recovered and the price of metals. Depending on the price of metals and other factors, the Company may determine that it is impractical to continue production. Metals prices have fluctuated widely in recent years and are affected by many factors beyond the Company’s control including changes in international investment patterns, economic growth rates, political developments, sales or accumulation of metal reserves by governments, and shifts in private supplies of and demands for metals. The supply of metals consists of a combination of mine production, recycled material and existing stocks held by governments, producers, financial institutions and consumers. If the market price for metals falls below the Company’s full production cost and remains at such levels for any sustained period of time, the Company will experience losses and may decide to discontinue operations or development of other projects at one or more of its properties.

The Company’s cash balance at March 31, 2012 was $70.8 million, which was an increase of $44.9 million from the year ended December 31, 2011. Working capital of $60.9 million (including the IGV receivable of $31.7 million) at March 31, 2012 increased by $25.8 million from $35.1 million at December 31, 2011 due to cash provided from operating activities.

The increases in cash, cash equivalents and working capital were due to the following activities:

Operating Activities:

Cash provided by operating activities increased to $54.6 million in the quarter ended March 31, 2012 compared to $908,000 used in the quarter ended February 28, 2011. The cash from operating activities for the three months ended March 31, 2012 stems from net earnings of $33.2 million adjusted for non-cash items, totaling $4.4 million and changes in non-cash working capital of $17.0 million. The non-cash items include depreciation of $5.5 million and stock-based compensation of $1.2 million and partially offset by deferred revenue of $3.1 million.

Changes in non-cash working capital provided $17.0 million of cash flow in the quarter ended March 31, 2012 compared to $913,000 in the quarter ended February 28, 2011. The changes in non-cash working capital in quarter ended March 31, 2012 included $26.5 million in taxes payable and $1.4 million in accounts payable and accrued liabilities, offset by $5.1 million charged to inventory, which, along with development expenditures caused a $6.0 million increase in the IGV receivable. The changes in non-cash working capital in the quarter ended February 28, 2011 included $2.5 million increase accounts payable and accrued liabilities and a $134,000 increase in prepaid expenses, offset by an increase in IGV receivable of $1.5 million and $308,000 of accounts receivable.

Under Peruvian law the Impuesto General a las Ventas (“IGV”) is a tax imposed at a rate of 18 per cent of the value of any goods or services purchased. IGV is generally refundable within the year in which it is paid. Refund applications may only be made by companies that are trading within Peru and collecting IGV from customers, by exporters or by companies that have an agreement with the tax authority for the early collection of IGV. Once the Company exports mineral production and files the necessary tax statements, it will be eligible for refunds of IGV. As at March 31, 2012, the Company has an IGV receivable of $31.7 million (December 31, 2011 - $25.6 million).

Financing Activities:

Net cash received from financing activities during the quarter ended March 31, 2012 was $2.7 million compared to $63.6 million in the quarter ended February 28, 2011.

In the quarter ended March 31, 2012 proceeds of $2.2 million were received on the conversion of 1,094,340 common share purchase warrants and $462,000 were received on shares issued upon the exercise of 486,033 stock options.

In the quarter ended February 28, 2011 net proceeds of $59.9 million were received for 32,499,682 common shares issued under a private placement, net of costs. Proceeds of $4.6 million were received on the conversion of 3,633,192 common share purchase warrants and $135,000 were received on shares issued upon the exercise of 225,000 stock options. There was a net outflow of $1.3 million for subscription receipts paid.

Investing Activities:

The investing activities in the quarter ended March 31, 2012 were to develop the La Arena Project and consisted of additions to mineral properties and plant and equipment. Additions to plant and equipment were $9.9 million. Additions to mineral properties were $3.5 million, of which $2.5 million was paid in cash, and $1.0 million was a non-

8

cash addition. All of the development work capitalized to mineral properties was related to the copper-gold sulphide project.

In February 2011, Rio Alto exercised its option to acquire 100% of La Arena S.A. upon a payment of $48.8 million. Cash acquired in this transaction was $6.7 million. Throughout the quarter ended February 28, 2011, the Company spent $1.4 million on mineral property development, $3.1 million on the purchase of property, plant and equipment and $18.1 in the investment of La Arena prior to the completion of the acquisition of 100% of La Arena S.A.

Financial Instruments

Use of derivatives

The Purchase Agreement described in this MD&A is characterized as a written option for accounting purposes and recorded as a liability. Gains or losses arising from the periodic revaluation of the liability are credited to or charged against operations. A more detailed description of the accounting for this option is presented in Note 10 to the Financial Statements.

Fair values

The carrying values of cash and cash equivalents, receivables, promissory note receivable, accounts payable and accrued liabilities and due to related parties approximate their fair values due to their short term to maturity. The derivative liability, embedded within the Purchase Agreement, is carried at fair value and is estimated by an option pricing model that considers changes in the price of gold. In the quarter ended March 31, 2012, the Company recognized a loss of $360 thousand related to the revaluation of the derivative liability. The IGV receivable is denominated in Peruvian Nuevo Soles (“sol”) and its carrying amount will vary as the sol to US dollar exchange rate changes; however, the IGV receivable partially hedges the Company’s sol denominated operating costs and Peruvian tax liabilities.

Liquidity risk

Liquidity risk is managed by maintaining sufficient cash balances to meet working capital requirements. The Company’s cash and cash equivalents are invested in business accounts or guaranteed investment certificates with chartered banks that are available on demand.

Credit risk

The Company’s credit risk is primarily attributable to its liquid financial assets and doré and would arise from the non-performance by counterparties of contractual financial obligations. The Company limits its exposure to credit risk on liquid assets by maintaining its cash with high-credit quality financial institutions and shipments of doré are insured with reputable underwriters. Management believes the risk of loss of the Company’s liquid financial assets and doré to be minimal. Taxes receivable result from prepayments to the Peruvian and Canadian governments and management believes that the credit risk concentration with respect to these receivables is minimal.

Currency risk

The Company operates in Canada and Peru and is therefore exposed to foreign exchange risk arising from transactions denominated in foreign currencies.

The operating results and the financial position of the Company are reported in US dollars. Prior to June 2011 the functional currency of Rio Alto Mining Limited, the parent company, was the Canadian dollar. Sales of gold from the La Arena Gold Mine during 2011 caused management to review the currency exposure of the parent company and management concluded that the currency exposure and functional currency was the United States dollar. Changes in the Canadian dollar and sol exchange rates relative to the US dollar will have an impact upon the reported results of the Company and may also affect the carrying value of the Company’s assets and liabilities. The Company has not entered into any agreements or purchased any instruments to hedge possible currency risk.

9

Interest risk

The Company invests its cash in instruments that are redeemable at any time without penalty, thereby reducing its exposure to interest rate fluctuations. Other interest rate risks arising from the Company’s operations are not considered material.

Commodity Price risk

The Company is exposed to price risk with respect to commodity prices. The ability of the Company to operate and develop its mineral properties and its future profitability are directly related to the market price of precious and base metals and oil. The Company monitors commodity prices to determine whether changes in operating or development plans are necessary. The future gold production, with the exception of the Purchase Agreement (Note 10) is un-hedged in order to provide shareholders with exposure to changes in the market gold price.

Critical Accounting Estimates

Management makes judgments when applying the Company’s accounting policies in the preparation of the Financial Statements. In addition, the preparation of financial information requires that the Company’s management make assumptions and estimates of effects of uncertain future events on the carrying amounts of the Company’s assets and liabilities at the end of the reporting period and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from those estimates as the estimation process is inherently uncertain. Estimates are continuously reviewed in light of historical experience and other factors considered to be relevant. Revisions to estimates and the resulting effects on the carrying amounts of the Company’s assets and liabilities are accounted for prospectively. The critical judgments and estimates applied in the preparation of the Company’s unaudited condensed interim consolidated financial statements are consistent with those applied and discussed in Note 3 to the Company’s consolidated financial statements for the financial year ended December 31, 2011.

Changes in Accounting Standards

The accounting policies applied by the Company in preparing the unaudited condensed interim consolidated financial statements are the same as those applied by the Company in its consolidated financial statements as at and for the financial year ended December 31, 2011, except for the following standards and interpretations, applicable to the Company, adopted in the current financial period:

Financial instruments disclosure

The IASB issued amendments to IFRS 7 - Financial Instruments: Disclosures that expand the disclosure requirements in relation to transferred financial assets.

Income taxes

The IASB issued an amendment to IAS 12 - Income Taxes that provides standards for the determination of deferred income taxes related to the recovery of investment properties.

There was no significant impact on the condensed consolidated interim financial statements as a result of adopting these standards and interpretations.

International Financial Reporting Standards

The Company’s IFRS accounting policies presented in consolidated financial statements for the financial year ended December 31, 2011 have been applied in preparing the unaudited condensed interim consolidated financial statements for the period ended March 31, 2012, the comparative information and the opening consolidated statement of financial position at the Transition Date.

10

Reconciliation of consolidated statement of loss and comprehensive loss (in 000s):

| | | | | | | | | | |

| | | Three months ended February 28, 2011 |

| | | | | | Effect of | | | | |

| | | | GAAP | | transition to | | | IFRS | |

| | | | | | | IFRS | | | | |

| | Note | | | | | | | | | |

| General and administrative expense | | $ | 2,421 | | $ | 53 | | $ | 2,474 | |

| Loss before other items | | | (2,421 | ) | | (53 | ) | | (2,474 | ) |

| | | | | | | | | | | |

| Other items | | | | | | | | | | |

| Foreign exchange gain (loss) | | | (414 | ) | | | | | (414 | ) |

| Interest income and other income | | | 21 | | | | | | 21 | |

| Unrealized gain on revaluation of derivative liability | | | 440 | | | | | | 440 | |

| Costs relating to gold prepayment | | | (12 | ) | | | | | (12 | ) |

| | | | | | | | | | | |

| Loss before income taxes | | | (2,386 | ) | | (53 | ) | | (2,439 | ) |

| Provision for income taxes | | | (147 | ) | | | | | (147 | ) |

| Net loss for the period | | $ | (2,533 | ) | $ | (53 | ) | $ | (2,586 | ) |

| Translation adjustment | | | 4,331 | | | | | | 4,331 | |

| Comprehensive loss for the period | | $ | 1,798 | | $ | (53 | ) | $ | 1,745 | |

Notes to Reconciliation

| a) | Share-based compensation |

| | |

| | Under Canadian GAAP, stock option grants may be valued as one pool and recognized over the vesting period. IFRS requires a graded approach in valuing and recognizing share-based compensation. The impact on the three months ended February 28, 2011 was $53,000. |

Proposed Transactions

As at the date of this MD&A there are no proposed transactions being considered by the Company.

Events subsequent to March 31, 2012

| a. | After March 31, 2012, the Company received $126,944 on the issuance 204,000 shares pursuant to the exercise of 204,000 options. |

| | |

| b. | After March 31, 2012, the Company delivered 4,949 ounces of gold to RKE in partial settlement of the Gold Prepayment Agreement. This settles all delivery requirements to March 2013. |

Off Balance Sheet Arrangements

The Company has no off balance sheet arrangements.

Outstanding Shares, Warrants and Options

As at the date of this MD&A, the Company has common shares, warrants convertible into common shares and options exercisable into common shares outstanding as follows:

11

| | | |

| Number of common Shares | | | |

| | | |

| December 31, 2011 | | 169,746,352 | |

| Issued upon: | | | |

| Exercise of stock options | | 486,033 | |

| Exercise of warrants | | 1,094,340 | |

| March 31, 2012 | | 171,326,725 | |

| Exercise of stock options | | 204,000 | |

| Exercise of warrants | | 0 | |

| Total as at May 14, 2012 | | 171,530,725 | |

| | | | | | |

| Number of Warrants | | Conversion Price | | | Expiry Date | |

| 1,500,000 | $ | 0.30 | | | June 25, 2012 | |

| 462,990 | $ | 2.05 | | | January 20, 2013 | |

| 1,962,990 | $ | 0.71 | | | | |

| | | | |

| | | Weighted | | |

| | Number of | Average | | |

| Number of | Underlying | Exercise | | |

| Options | Shares | Price (C$) | Grant Date | Date of Expiry |

| 2,112,500 | 2,112,500 | $0.30 | July 24, 2009 | July 24, 2014 |

| 180,000 | 180,000 | $0.70 | March 15, 2010 | March 15, 2015 |

| 814,667 | 814,667 | $1.50 | September 20, 2010 | September 20, 2015 |

| 1,050,000 | 1,050,000 | $1.80 | September 20, 2010 | September 20, 2015 |

| 450,000 | 450,000 | $1.90 | November 5, 2010 | November 5, 2015 |

| 250,000 | 250,000 | $2.00 | December 6, 2010 | December 6, 2015 |

| 385,000 | 385,000 | $2.39 | March 11, 2011 | March 11, 2016 |

| 120,000 | 120,000 | $2.15 | May 11, 2011 | May 11, 2016 |

| 217,800 | 217,800 | $2.29 | August 1, 2011 | August 1, 2016 |

| 2,940,000 | 2,940,000 | $3.08 | November 18, 2011 | November 16, 2016 |

| 1,050,000 | 1,050,000 | $3.22 | November 18, 2011 | November 16, 2016 |

| 200,000 | 200,000 | $3.75 | January 23, 2012 | January 23, 2017 |

| 9,769,967 | 9,769,967 | $2.06 | | |

Disclosure Controls and Procedures

Internal Controls over Financial Reporting and Disclosure Controls and Procedures

The Company's management is responsible for establishing and maintaining internal control over financial reporting. Management has designed and established internal controls over financial reporting and disclosure controls and procedures to ensure information that is disclosed in the Financial Statements and in this MD&A is fairly presented and was properly recorded, processed, summarized and reported.

Any system of internal control over financial reporting and any system of disclosure controls and procedures, no matter how well designed, has inherent limitations. Therefore, even those systems determined to be effective in design and/or operation can provide only reasonable assurance with respect to financial statement preparation and presentation and/or preparation and presentation of information in the MD&A. Management has used the Committee of Sponsoring Organizations of the Treadway Commission framework to evaluate the design of these internal controls over financial reporting and disclosure controls and procedures to the end of the period covered by this report and management has concluded that as at March 31, 2012, the Company’s internal control over financial reporting and disclosure controls and procedures were was effectively designed.

Business Risk Factors

Natural resources exploration, development, production and processing involve a number of risks, many of which are beyond the Company's control. Without limiting the foregoing, such risks include:

12

Changes in the market price for mineral products, which have fluctuated widely in the past, will affect the future profitability of the Company’s operations and financial condition.

The Company has limited operating history and there can be no assurance of its continued ability to operate its projects profitably.

Mining is inherently dangerous and subject to conditions or elements beyond the Company’s control, which could have a material adverse effect on the Company’s business.

Actual exploration, development, construction and other costs and economic returns may differ significantly from those the Company has anticipated and there are no assurances that any future development activities will result in profitable mining operations.

Increased competition could adversely affect the Company’s ability to attract necessary capital funding or acquire suitable producing properties or prospects for mineral exploration and development in the future.

The Company’s insurance coverage does not cover all of its potential losses, liabilities and damage related to its business and certain risks are uninsured or uninsurable.

The Company depends heavily on limited mineral properties, and there can be no guarantee that the Company will successfully acquire other commercially mineable properties.

The Company’s activities are subject to environmental laws and regulations that may increase the cost of doing business or restrict operations.

The Company requires numerous permits in order to conduct exploration, development or mining activities and delays in obtaining, or a failure to obtain, such permits or failure to comply with the terms of any such permits that have been obtained could have a material adverse impact on the Company.

Exploration, development and mining activities on land within Peru generally require both ownership of mining concessions and ownership of or a leasehold interest over surface lands (“surface rights”). The Company constantly seeks to expand its activities and may experience delays in obtaining surface rights or may not be able to acquire surface rights because of an unwillingness by the owner of such rights to transfer ownership at a reasonable cost or in a timely manner.

The Company may experience difficulty in attracting and retaining qualified management to meet the needs of its anticipated growth, and the failure to manage the Company’s growth effectively could have a material adverse effect on its business and financial condition.

Insofar as certain directors and officers of the Company hold similar positions with other mineral resource companies, conflicts may arise between the obligations of these directors and officers to the Company and to such other mineral resource companies.

Title to the Company’s mineral properties cannot be guaranteed and may be subject to prior unregistered agreements, transfers or claims or defects.

The Company’s business is subject to potential political, social and economic instability in the countries in which it operates.

Changes in taxation legislation or regulations in the countries in which the Company operates could have a material adverse effect on the Company’s business and financial condition.

Currency exchange rate fluctuations may affect the cost of the Company’s operations and exploration and development activities.

The Company has no dividend payment policy and does not intend to pay any dividends in the foreseeable future.

Readers should also refer to other risk factors outlined in the Company’s Annual Information Form dated March 29, 2012 as filed on SEDAR.

Social and Community Issues

In recent years communities and non-governmental organizations ("NGO's") have become more vocal and active with respect to mining activities at or near their communities. These communities and NGO's have taken such actions as road closures, work stoppages, and law suits for damages. These actions relate not only to current activities, but often in respect of decades old mining activities by prior owners of mining properties. Actions by communities and NGO's may have a material adverse effect on the Company's financial position, cash flow and results of operations.

13

Cautionary Statement on Forward-Looking Information

Certain information in this MD&A, including information about the Company’s financial or operating performance and other statements expressing management’s expectations or estimates of future performance and exploration and development programs or plans constitute “forward-looking statements”. Words such as “expect”, “will”, “intend”, “estimate”, “anticipate”, “plan” and similar expressions of a conditional or future oriented nature identify forward-looking statements. Forward-looking statements are, necessarily, based upon a number of estimates and assumptions. While considered by management to be reasonable in the context in which they are made, forward-looking statements are inherently subject to business risks and economic and competitive uncertainties and contingencies. The Company cautions readers that forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Rio Alto’s actual financial results, future performance and results of exploration and development programs and plans to be materially different than those estimated future results, performance or achievements and that forward-looking statements are not guarantees of future performance, results or achievements.

Risks, uncertainties and contingencies and other factors that might cause actual performance to differ from forward-looking statements include, but are not limited to, changes in the worldwide price of precious metals and commodities, changes in the relative exchange rates for the dollar, the Canadian dollar, and the Peruvian Nuevo sol, interest rates, legislative, political, social or economic developments both within the countries in which the Company operates and in general, contests over title to property, the speculative nature of mineral exploration and development, operating or technical difficulties in connection with the Company’s operating, development or exploration programs, increasing costs as a result of inflation or scarcity of human resources and input materials or equipment. Known and unknown risks inherent in the mining business include potential uncertainties related to title to mineral claims, the accuracy of mineral reserve and resource estimates, metallurgical recoveries, capital and operating costs and the future demand for minerals. Please see Business Risk Factors, elsewhere herein.

Management continuously reviews its development plans and business running costs and, if necessary, revises them as business risk factors, uncertainties, contingencies and other factors change.

Qualified Person Review

The disclosure in this MD&A of scientific and technical information regarding the La Arena Project has been reviewed and verified by Enrique Garay, M Sc. P. Geo (AIG Member) Vice President Geology, Rio Alto Mr. Garay is a Qualified Person for the purposes of National Instrument 43-101.

Approval

The Board of Directors has approved the disclosure in this MD&A.

A copy of this MD&A, the Financial Statements and previously published financial statements, management discussions and analysis as well as other information is available on the SEDAR website at www.sedar.com.

14