Annual Report

October 31, 2018

| Management Discussion of Fund Performance | 1 |

| Schedule of Investments | |

| Global X China Consumer ETF | 33 |

| Global X China Energy ETF | 36 |

| Global X China Financials ETF | 38 |

| Global X China Industrials ETF | 40 |

| Global X China Materials ETF | 43 |

| Global X NASDAQ China Technology ETF | 45 |

| Global X FTSE Southeast Asia ETF | 48 |

| Global X MSCI Colombia ETF | 51 |

| Global X MSCI Argentina ETF | 53 |

| Global X MSCI Greece ETF | 56 |

| Global X MSCI Norway ETF | 59 |

| Global X FTSE Nordic Region ETF | 63 |

| Global X MSCI Nigeria ETF | 66 |

| Global X Next Emerging & Frontier ETF | 68 |

| Global X MSCI Portugal ETF | 80 |

| Global X MSCI Pakistan ETF | 83 |

| Statements of Assets and Liabilities | 85 |

| Statements of Operations | 89 |

| Statements of Changes in Net Assets | 93 |

| Financial Highlights | 101 |

| Notes to Financial Statements | 104 |

| Report of Independent Registered Public Accounting Firm | 124 |

| Disclosure of Fund Expenses | 126 |

| Approval of Investment Advisory Agreement | 129 |

| Shareholder Voting Results | 134 |

| Supplemental Information | 138 |

| Trustees and Officers of the Trust | 139 |

| Notice to Shareholders | 141 |

Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Shares may only be redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

The Funds file their complete schedules of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Funds’ Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Global X Funds uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-888-GXFund-1; and (ii) on the Commission’s website at http://www.sec.gov.

Management Discussion of Fund Performance (unaudited) |

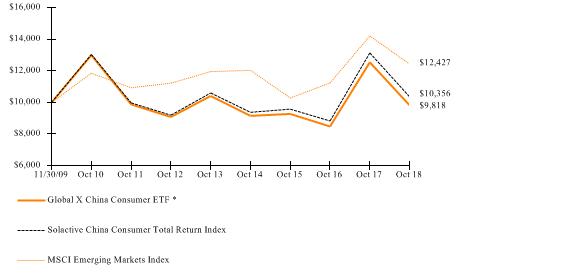

Global X China Consumer ETF

|

Global X China Consumer ETF

The Global X China Consumer ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive China Consumer Total Return Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to measure the equity performance of the investable universe of companies in the consumer sector of the Chinese economy, as defined by the index provider. It is comprised of securities of companies that have their main business operations in the consumer sector and generally includes companies whose businesses involve: general retail, diversified consumer services, food production and retail, beverages, household goods, leisure goods, personal goods, automobiles, auto components and distributors, tobacco, media, and travel and leisure.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund decreased 21.70%, while the Underlying Index decreased 21.16%. The Fund had a net asset value of $17.44 per share on October 31, 2017 and ended the reporting period with a net asset value of $13.57 on October 31, 2018.

During the reporting period, the highest returns came from Shenzhou International Group Holdings and China Resources Beer Holdings, which returned 31.61% and 21.19%, respectively. The worst performers were Brilliance China Automotive Holdings and Li & Fung, which returned -65.11% and -54.70%, respectively.

China’s policies designed to transform the country from a manufacturing and exports-led economy to one driven more by consumption and services are supporting growth of the country’s consumer sectors. During the first half of 2018, the economy expanded by 6.8%. Over that time, retail sales in China grew by 9.4% year-over-year, accelerated in part by robust growth of the country’s e-commerce industry which is now the largest in the world. Yet despite these growth figures, sentiment around consumer stocks in China began to sour as broader concerns about a trade war-induced slowdown in the domestic economy weighed on the outlook for Chinese consumer stocks. Among the stocks most hurt were those from the automobile industry, which depend on both domestic demand and global supply chains for profitability. In addition, the Chinese yuan (CNY) depreciated approximately 5% against the US dollar during the period, hurting overall fund performance.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Five Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X China Consumer ETF | -21.70% | -21.70% | 1.92% | 2.03% | -1.16% | -1.02% | -0.21% | -0.20% |

| Solactive China Consumer Total Return Index | -21.16% | -21.16% | 2.64% | 2.64% | -0.46% | -0.46% | 0.39% | 0.39% |

| MSCI Emerging Markets Index | -12.52% | -12.52% | 6.52% | 6.52% | 0.78% | 0.78% | 2.47% | 2.47% |

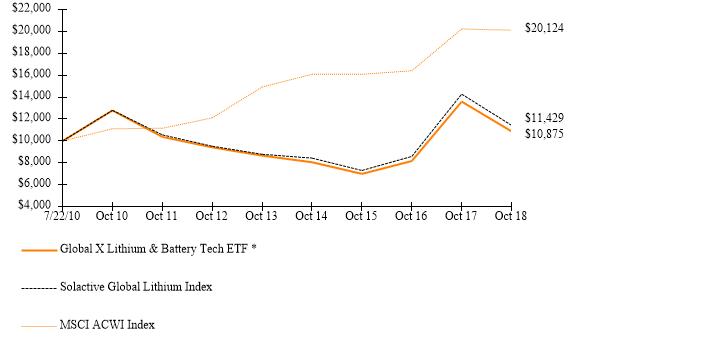

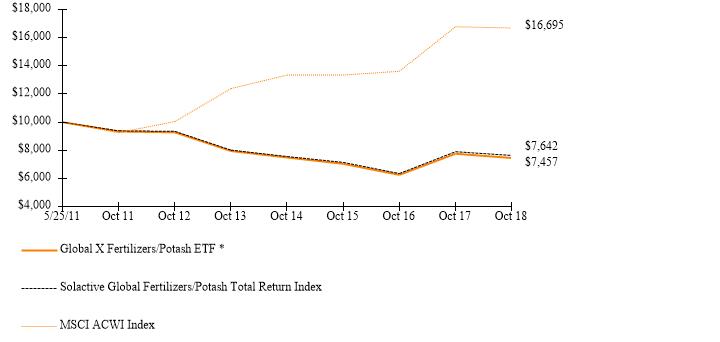

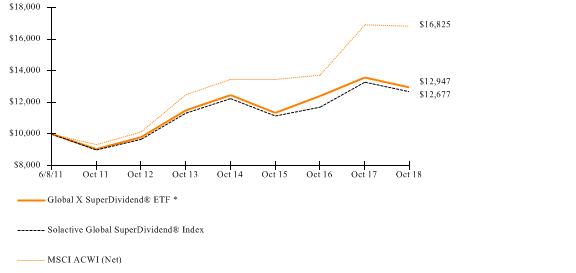

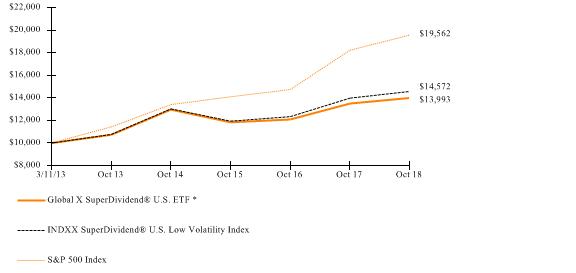

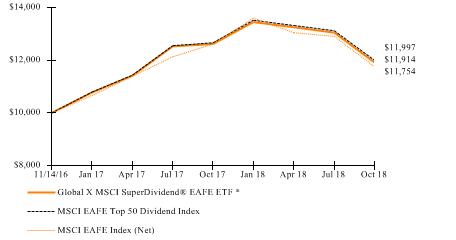

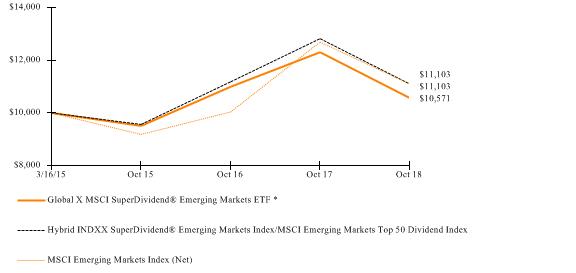

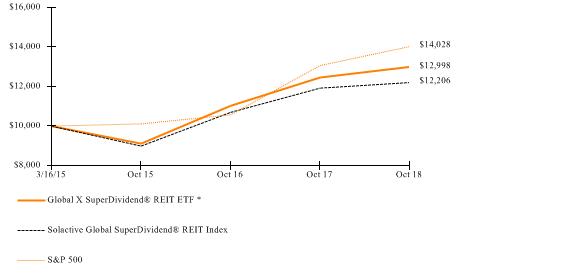

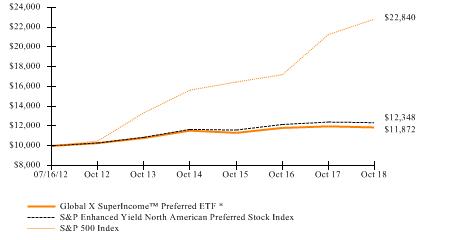

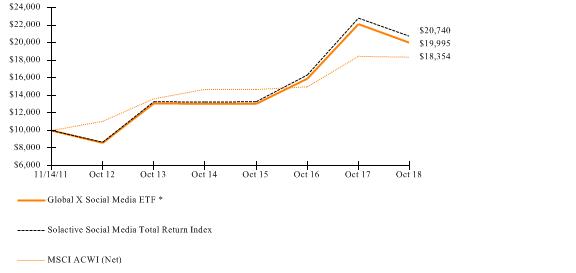

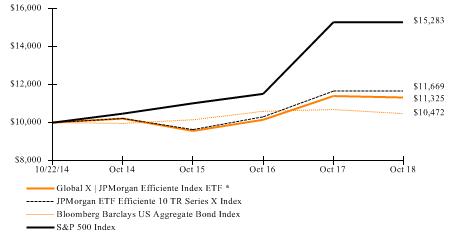

Growth of a $10,000 Investment

(At Net Asset Value)

Management Discussion of Fund Performance (unaudited) |

Global X China Consumer ETF

|

*Fund commenced operations on November 30, 2009.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance

of emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

Management Discussion of Fund Performance (unaudited) |

Global X China Energy ETF |

Global X China Energy ETF

The Global X China Energy ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive China Energy Total Return Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to measure the equity performance of the investable universe of companies in the energy sector of the Chinese economy, as defined by the index provider. It is comprised of securities of companies that have their main business operations in the energy sector and generally includes companies whose businesses involve: oil, gas, consumable fuels, alternative energy and electricity production and distribution, and energy equipment and services.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund increased 4.77%, while the Underlying Index increased 5.50%. The Fund had a net asset value of $ 11.69 per share on October 31, 2017 and ended the reporting period with a net asset value of $11.82 on October 31, 2018.

During the reporting period, the highest returns came from CNOOC and KunLun Energy, which returned 31.82% and 27.08%, respectively. The worst performers were Panda Green Energy Group and JinkoSolar Holding, which returned

-75.12% and -69.73%, respectively.

Despite a broader selloff in Chinese equities, the energy sector delivered positive performance over the reporting period and was among the best performing sectors in the country. In light of higher equity volatility in China and the emerging markets more broadly, many investors shifted towards defensive sectors. China’s energy sector is dominated by State-Owned Enterprises (SOEs), which bulwarks the sector’s defensive status through implicit and explicit support from the government. Also supporting stronger performance in this sector were record crude oil imports, which grew 8.1% from the end of December 2017 to October 2018. Some Chinese energy companies also benefitted from higher oil prices over the period, which increased over 20%. Despite these positive tailwinds, Chinese energy companies had to grapple with concerns around changing US trade rules due to the implementation of tariffs and sanctions on certain oil-exporting nations.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Five Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X China Energy ETF | 4.77% | 5.58% | 3.63% | 3.69% | -2.25% | -2.14% | -0.70% | -0.67% |

| Solactive China Energy Total Return Index | 5.50% | 5.50% | 4.45% | 4.45% | -1.51% | -1.51% | 0.10% | 0.10% |

| MSCI Emerging Markets Index | -12.52% | -12.52% | 6.52% | 6.52% | 0.78% | 0.78% | 2.21% | 2.21% |

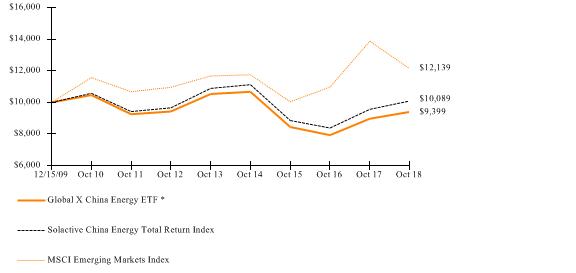

Growth of a $10,000 Investment

(At Net Asset Value)

Management Discussion of Fund Performance (unaudited) |

Global X China Energy ETF |

*Fund commenced operations on December 15, 2009.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance

of emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

Management Discussion of Fund Performance (unaudited) |

| Global X China Financials ETF |

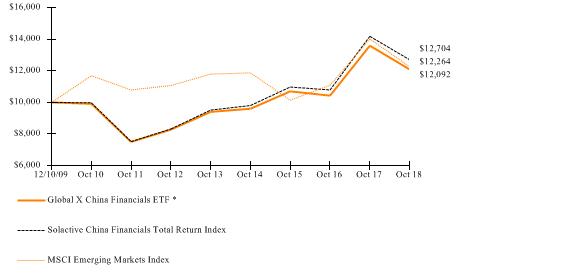

Global X China Financials ETF

The Global X China Financials ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive China Financials Total Return Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to measure the equity performance of the investable universe of companies in the financials sector of the Chinese economy, as defined by the index provider. It is comprised of securities of companies that have their main business operations in the financials sector and generally includes companies whose businesses involve: banking; insurance, real estate, and financial services.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund decreased 11.04%, while the Underlying Index decreased 10.44%. The Fund had a net asset value of $17.63 per share on October 31, 2017 and ended the reporting period with a net asset value of $15.39 on October 31, 2018.

During the reporting period, the highest returns came from Agile Group Holdings and China Resources Land, which returned 36.86% and 17.69%, respectively. The worst performers were Qudian and Sunac China Holdings, which returned -57.88% and -45.59%, respectively.

Chinese financial firms, many of which are state-owned, are often depended on to help stimulate the country’s growth through easing lending policies. At the same time, concerns around the country’s growing public and private debt requires the government to take a cautious approach around relying too heavily on easy access to credit. In the context of China’s structurally decelerating growth after years of rapid expansion, as well as near term headwinds like slowing global growth and increased trade tensions, the government sought to mostly ease credit conditions during the reporting period. The government lowered bank reserve requirements four times from the beginning of 2018 through the end of the reporting period to help facilitate more lending. Despite efforts to broaden access to credit Chinese financial firms still suffered negative performance during the reporting period, caused by slowing domestic growth, a depreciated yuan, and rising concerns around geopolitical tensions.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Five Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X China Financials ETF | -11.04% | -11.27% | 4.15% | 4.21% | 5.16% | 5.25% | 2.16% | 2.14% |

| Solactive China Financials Total Return Index | -10.44% | -10.44% | 4.99% | 4.99% | 5.95% | 5.95% | 2.73% | 2.73% |

| MSCI Emerging Markets Index | -12.52% | -12.52% | 6.52% | 6.52% | 0.78% | 0.78% | 2.32% | 2.32% |

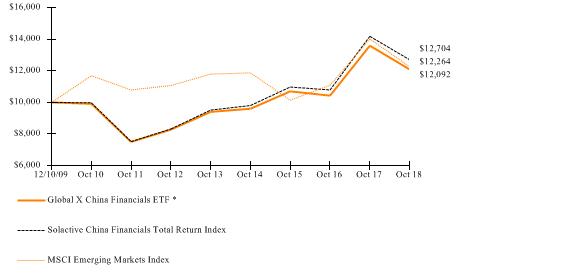

Growth of a $10,000 Investment

(At Net Asset Value)

*Fund commenced operations on December 10, 2009.

Management Discussion of Fund Performance (unaudited) |

Global X China Financials ETF |

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

Management Discussion of Fund Performance (unaudited) |

| Global X China Industrials ETF |

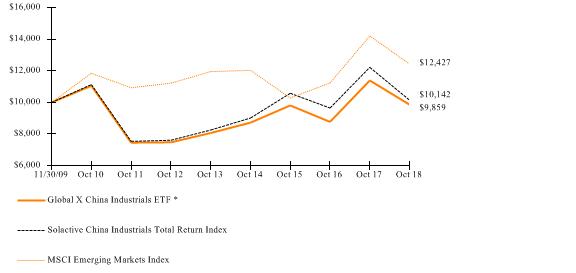

Global X China Industrials ETF

The Global X China Industrials ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive China Industrials Total Return Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to measure the equity performance of the investable universe of companies in the industrials sector of the Chinese economy, as defined by the index provider. It is comprised of securities of companies that have their main business operations in the industrials sector and generally includes companies whose businesses involve: construction and materials, electronic and electrical equipment, industrial engineering, industrial transportation, and support services, and trading companies, shipbuilding and aerospace.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund decreased 13.44%, while the Underlying Index decreased 17.01%. The Fund had a net asset value of $16.06 per share on October 31, 2017 and ended the reporting period with a net asset value of $13.59 on October 31, 2018.

During the reporting period, the highest returns came from China Resources Cement Holdings and Guangdong Investment, which returned 36.86% and 28.11%, respectively. The worst performers were Noble Group and China Shipping Container, which returned -70.55% and -54.50%, respectively.

China’s industrial sector, which accounts for approximately one-third of gross domestic product, performed negatively over the period, but began recovering in response to supportive government policies, increased investment in infrastructure, and a growing trade surplus. Despite rising trade tensions with the US, China’s trade surplus benefitted from a depreciated yuan, which made its goods cheaper abroad. Value-added industrial output increased 6.4% over the period, generally keeping pace with China’s overall GDP growth. Industrials also benefitted from the fact that many of these companies are state-owned, which offers greater implicit and explicit support for these firms during periods of stress.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Five Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X China Industrials ETF | -13.44% | -16.24% | 0.17% | -1.59% | 4.10% | 3.38% | -0.16% | -0.64% |

| Solactive China Industrials Total Return Index | -17.01% | -17.01% | -1.40% | -1.40% | 4.21% | 4.21% | 0.16% | 0.16% |

| MSCI Emerging Markets Index | -12.52% | 12.52% | 6.52% | 6.52% | 0.78% | 0.78% | 2.47% | 2.47% |

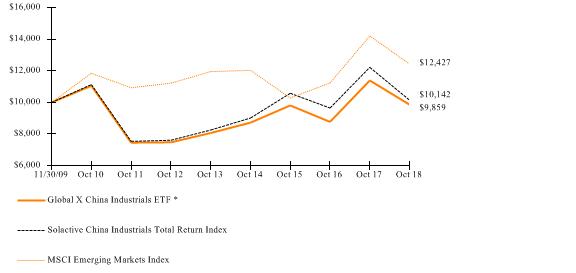

Growth of a $10,000 Investment

(At Net Asset Value)

*Fund commenced operations on November 30, 2009.

Management Discussion of Fund Performance (unaudited) |

Global X China Industrials ETF |

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance

of emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

Management Discussion of Fund Performance (unaudited) |

| Global X China Materials ETF |

Global X China Materials ETF

The Global X China Materials ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive China Materials Total Return Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to measure the equity performance of the investable universe of companies in the materials sector of the Chinese economy, as defined by the index provider. It is comprised of securities of companies that have their main business operations in the basic materials sector and generally includes companies whose businesses involve: chemicals, metals and mining, and forestry and paper products.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund decreased 25.20%, while the Underlying Index decreased 24.70%. The Fund had a net asset value of $21.59 per share on October 31, 2017 and ended the reporting period with a net asset value of $15.97 on October 31, 2018.

During the reporting period, the highest returns came from China Metal Resources Utilization and China Oriental Group, which returned 46.35% and 32.10%, respectively. The worst performers were Mobile Internet (China) Holdings and Munsun Capital Group, which returned -91.11% and -72.39%, respectively.

During the reporting period, China’s Materials sector initially benefitted from an increase in global commodity prices, including Brent Crude oil prices which increased by nearly 24%. As a provider of raw materials for the Industrials sector, Materials firms also benefitted from a rebound in industrial output, which grew by 6.4% in the first three quarters of 2018, spurred by a depreciated yuan. However, Materials began experiencing lower profitability in Q3 2018, as tariffs from the US were imposed on key industrial metals like steel and aluminium, which disrupted supply chains and pressured profitability.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Five Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X China Materials ETF | -25.20% | -25.85% | 9.17% | 9.08% | 3.33% | 3.21% | -5.44% | -5.54% |

| Solactive China Materials Total Return Index | -24.70% | -24.70% | 6.79% | 6.79% | 3.19% | 3.19% | -5.20% | -5.20% |

| MSCI Emerging Markets Index | -12.52% | -12.52% | 6.52% | 6.52% | 0.78% | 0.78% | 1.68% | 1.68% |

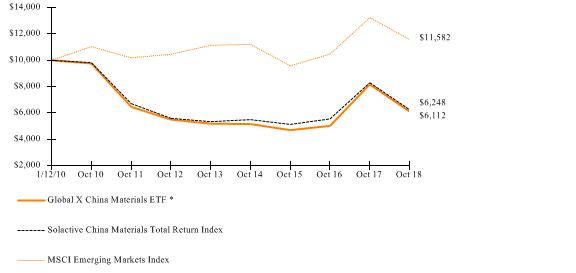

Growth of a $10,000 Investment

(At Net Asset Value)

*Fund commenced operations on January 12, 2010.

Management Discussion of Fund Performance (unaudited) |

| Global X China Materials ETF |

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance

of emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

Management Discussion of Fund Performance (unaudited) |

| Global X NASDAQ China Technology ETF |

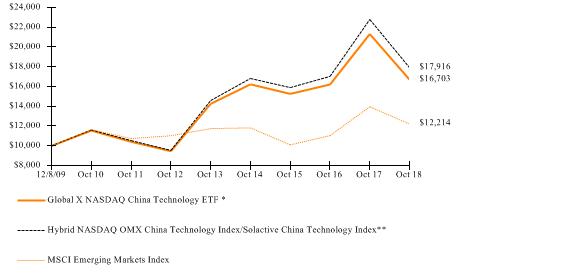

Global X NASDAQ China Technology ETF

The Global X NASDAQ China Technology ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the NASDAQ OMX China Technology Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to track the performance of the technology sector in China as defined by the index provider. It is comprised of securities of companies that have their main business operations in the technology sector and generally includes companies whose businesses involve: computer services, internet, software, computer hardware, electronic office equipment, semiconductors, and telecommunications equipment.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund decreased 21.70%, while the Underlying Index decreased 21.43%. The Fund had a net asset value of $29.24 per share on October 31, 2017 and ended the reporting period with a net asset value of $22.40 on October 31, 2018.

During the reporting period, the highest returns came from HKBN and Kingdee International Software Group, which returned 54.63% and 52.69%, respectively. The worst performers were Link Motion and Green Leader Holdings Group, which returned -85.43% and -84.04%, respectively.

Chinese government policies have long supported the development of a domestic technology industry as a means for modernizing the economy. Despite the strong government support and growing domestic demand, many of China’s technology companies have faced recent challenges from trade tensions affecting key supply chain infrastructure and intense scrutiny driven by the US’s national- and cyber-security concerns. Despite these challenges which particularly affect technology exports, China’s technology sector is becoming increasingly domestic-focused. The country has more than 730 million online users, of which an estimated 90% have access to mobile internet. Increasingly, these internet users purchase items online, use social media, and play interactive mobile games, helping to drive the growth prospects of the country’s technology firms, in spite of geopolitical tensions.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Five Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X NASDAQ China Technology ETF | -21.70% | -21.96% | 3.04% | 3.54% | 3.22% | 3.30% | 5.94% | 6.00% |

| Hybrid NASDAQ OMX China Technology Index/Solactive China Technology Index** | -21.43% | -21.43% | 4.05% | 4.05% | 4.19% | 4.19% | 6.78% | 6.78% |

| MSCI Emerging Markets Index | -12.52% | -12.52% | 6.52% | 6.52% | 0.78% | 0.78% | 2.27% | 2.27% |

Growth of a $10,000 Investment

(At Net Asset Value)

*Fund commenced operations on December 8, 2009.

** Reflects performance of Solactive China Technology Index through December 13, 2011 and NASDAQ OMX China Technology Index thereafter.

Management Discussion of Fund Performance (unaudited) |

| Global X NASDAQ China Technology ETF |

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance

of emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

Management Discussion of Fund Performance (unaudited) |

Global X FTSE Southeast Asia ETF |

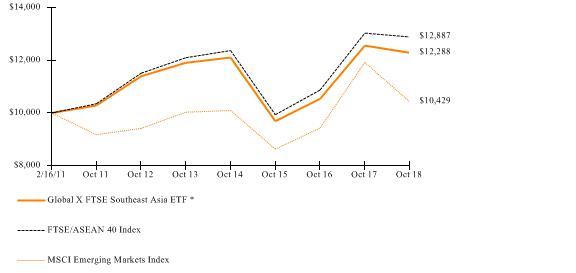

Global X FTSE Southeast Asia ETF

The Global X FTSE Southeast Asia ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the FTSE/ASEAN 40 Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index tracks the equity performance of the 40 largest and most liquid companies in the five Association of Southeast Asian Nations ("ASEAN") regions: Singapore, Malaysia, Indonesia, Thailand and the Philippines, as defined by the index provider.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund decreased 2.15%, while the Underlying Index decreased 1.53%. The Fund had a net asset value of $15.91 per share on October 31, 2017 and ended the reporting period with a net asset value of $15.32 on October 31, 2018.

During the reporting period, the highest returns came from PTT Exploration & Production and Petronas Chemicals Group, which returned 67.98 % and 32.68%, respectively. The worst performers were Axiata Group and PT Bank Negara Indonesia, which returned -34.64% and -28.39%, respectively.

The Southeast Asia region includes many high growth and dynamic economies, such as Singapore, Malaysia, Indonesia, the Philippines, and Thailand. Southeast Asia maintained much of its economic momentum, despite some broader global headwinds, with growth in these economies being driven primarily by domestic demand. Indonesia, the region’s largest economy, grew 5.2% year-over-year in the first half (“H1”) of 2018, backed by a 5.1% year-over-year increase in private consumption and an 8.4% year-over-year rise in investment – the highest growth in investment since 2012. Although broad economic expansion moderated in Malaysia, a 7.4% year-over-year increase in private consumption in H1 2018 helped clock economic growth of 4.9% year-over-year during the period, despite investments and exports weakening. Economic growth in the Philippines eased to 6.3% year-over-year in H1 2018. This growth was driven by investment growth of 16.4% year-over-year, and the nation’s ratio of fixed investment to GDP reached 27.2% in the period – the highest in over two decades. Singapore grew at 4.2% year-over-year on robust exports and domestic demand.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Five Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X FTSE Southeast Asia ETF | -2.15% | -2.48% | 8.24% | 8.36% | 0.63% | 0.63% | 2.71% | 2.66% |

| FTSE/ASEAN 40 Index | -1.53% | -1.53% | 9.02% | 9.02% | 1.27% | 1.27% | 3.35% | 3.35% |

| MSCI Emerging Markets Index | -12.52% | -12.52% | 6.52% | 6.52% | 0.78% | 0.78% | 0.55% | 0.55% |

Growth of a $10,000 Investment

(At Net Asset Value)

*Fund commenced operations on February 16, 2011.

Management Discussion of Fund Performance (unaudited) |

Global X FTSE Southeast Asia ETF |

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance

of emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

Management Discussion of Fund Performance (unaudited) |

Global X MSCI Colombia ETF |

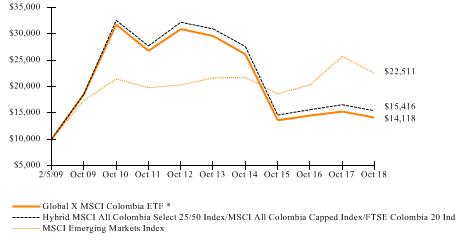

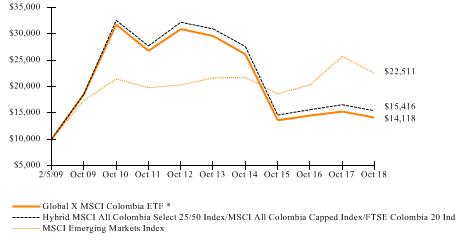

Global X MSCI Colombia ETF

The Global X MSCI Colombia ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI All Colombia Select 25/50 Index (the “Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to represent the performance of the broad Colombia equity universe, as defined by the index provider.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund decreased 7.55%, while the Underlying Index decreased 6.92%. The Fund had a net asset value of $9.56 per share on October 31, 2017 and ended the reporting period with a net asset value of $8.68 on October 31, 2018.

During the reporting period, the highest returns came from Ecopetrol and Grupo Aval Acciones y Valores, which returned 118.59% and 5.18%, respectively. The worst performers were Cemex Latam Holdings and Cementos Argos, which returned -56.19% and -42.12%, respectively.

Despite efforts to diversify, Colombia’s economy, currency, and equity markets still remain affected by changing oil prices, as it is the country’s main export. During the reporting period, oil prices improved over 20%, helping the economy to grow 2.7% year-over-year in Q3 2018, after growing 2.2% and 2.8% year-over-year in Q1 2018 and Q2 2018, respectively. Private consumption picked up significantly, with increased consumer confidence and declining inflation boosting the real income of consumers. Investments also received some support from policy rate cuts and higher oil prices. Export earnings, particularly from oil and coal, had increased as a result of improved terms of trade, facilitating a reduction in the current account deficit. Further, the fiscal policy remained prudent, striking a balance between the fiscal rule to reduce the central government deficit to 1% of GDP by 2022 and the spending needs to stimulate economic growth.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Five Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X MSCI Colombia ETF | -7.55% | -7.98% | 1.21% | 1.25% | -13.78% | -13.87% | 3.61% | 3.55% |

| Hybrid MSCI All Colombia Select 25/50 Index/MSCI All Colombia Capped Index/FTSE Colombia 20 Index** | -6.92% | -6.92% | 1.81% | 1.81% | -13.02% | -13.02% | 4.55% | 4.55% |

| MSCI Emerging Markets Index | -12.52% | -12.52% | 6.52% | 6.52% | 0.78% | 0.78% | 8.69% | 8.69% |

Growth of a $10,000 Investment

(At Net Asset Value)

*Fund commenced operations on February 5, 2009.

Management Discussion of Fund Performance (unaudited) |

Global X MSCI Colombia ETF |

**Reflects performance of the FTSE Colombia 20 Index through July 14, 2014, the MSCI All Colombia Capped Index through August 30, 2016 and the MSCI All Colombia Select 25/50 Index, thereafter. The inception of the MSCI All Colombia Select 25/50 Index (“New Index”) was on July 15, 2016. Effective on or around August 31, 2016, the Fund began to track the New Index. This change was due to the planned migration to the New Index, potentially improving the trading characteristics of the Fund.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance

of emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. The Fund’s performace reflects contractual fee waivers in effect until March 1, 2018. Absent these waivers performance would have been lower. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

Management Discussion of Fund Performance (unaudited) |

| Global X MSCI Argentina ETF |

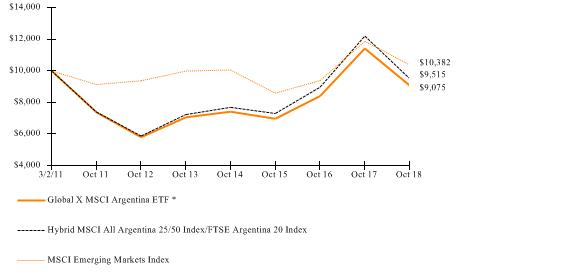

Global X MSCI Argentina ETF

The Global X MSCI Argentina ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI All Argentina 25/50 Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to represent the performance of the broad Argentina equity universe, while including a minimum number of constituents, as defined by the index provider. The broad Argentina equity universe includes securities that are classified in Argentina according to the MSCI Global Investable Market Index Methodology, together with companies that are headquartered or listed in Argentina and carry out the majority of their operations in Argentina.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund decreased 20.48%, while the Underlying Index decreased 22.02%. The Fund had a net asset value of $32.05 per share on October 31, 2017 and ended the reporting period with a net asset value of $25.36 on October 31, 2018.

During the reporting period, the highest returns came from Globant and MercadoLibre, which returned 36.48% and 35.10%, respectively. The worst performers were Grupo Supervielle and Phoenix Global Resources, which returned

-68.73% and -63.98%, respectively.

After a few quarters of economic recovery, assisted by a series of ambitious reforms by the government led by Mauricio Macri, Argentina’s economy again slipped into a phase of negative growth. The economy contracted 4.2% year-over-year in Q2 2018 after expanding 3.9% year-over-year in Q1 2018. The nation’s pro-market policies even prompted MSCI to announce an upgrade of Argentina to emerging market status from frontier market status beginning June 2019. However, rising US interest rates, a broader emerging market selloff, and a severe drought, together with existing economic imbalances of double-digit inflation and large fiscal and current account deficits, led to a steep fall in the country’s currency and economic outlook. The government’s decision to increase interest rates to support the currency led to a slide in investment and rising unemployment that negatively impacted consumption and growth. Exports were impacted by the drought, worsening the current account further. As it was difficult to finance the twin deficits, the country entered into a US$57 billion financing agreement with the International Monetary Fund to help provide stabilization to its currency. However, tight fiscal and monetary policies are expected to likely to keep the economy in recession in the near term.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Five Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X MSCI Argentina ETF | -20.48% | -20.60% | 9.21% | 8.95% | 5.15% | 5.02% | -1.26% | -1.29% |

| Hybrid FTSE Argentina 20 Index/MSCI All Argentina 25/50 Index** | -22.02% | -22.02% | 9.23% | 9.23% | 5.64% | 5.64% | -0.65% | -0.65% |

| MSCI Emerging Markets Index | -12.52% | -12.52% | 6.52% | 6.52% | 0.78% | 0.78% | 0.49% | 0.49% |

Growth of a $10,000 Investment

(At Net Asset Value)

Management Discussion of Fund Performance (unaudited) |

| Global X MSCI Argentina ETF |

*Fund commenced operations on March 2, 2011.

**Reflects performance of the FTSE Argentina 20 Index through August 14, 2014 and the MSCI All Argentina 25/50 Index (“New Index”) thereafter.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance

of emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

Management Discussion of Fund Performance (unaudited) |

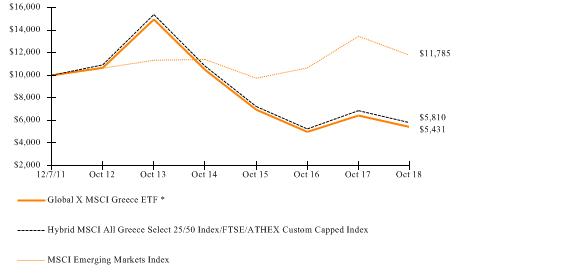

Global X MSCI Greece ETF |

Global X MSCI Greece ETF

The Global X MSCI Greece ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI All Greece Select 25/50 Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to represent the performance of the broad Greece equity universe, as defined by the index provider.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund decreased 15.63%, while the Underlying Index decreased 15.46%. The Fund had a net asset value of $9.30 per share on October 31, 2017 and ended the reporting period with a net asset value of $7.68 on October 31, 2018.

During the reporting period, the highest returns came from Terna Energy and GasLog, which returned 50.40% and 22.57%, respectively. The worst performers were Folli Follie and Aegean Marine Petroleum Network, which returned -65.53% and -60.31%, respectively.

After more than eight years into the debt-driven crisis, Greece exited its economic bailout program in August 2018. Reforms undertaken by the country, including significant austerity measures and asset sales, have stimulated an economic recovery that is gaining traction. Q2 2018 marked the sixth consecutive quarter of positive growth, with the GDP expanding 1.8% year-over-year. The country also successfully reversed its extraordinary fiscal deficit, which stood at 15% of GDP in 2009, and has turned into a surplus of approximately 3.5% as of April 2018. Economic growth has been primarily driven by exports. Industrial production is also picking up with improved confidence. Private consumption, which had been stagnant, is growing as wages have started to rise with strong growth in employment. A public debt of around 180% of GDP and high level of bad loans in the banking system remain concerns, making the economy vulnerable to external shocks.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Five Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X MSCI Greece ETF | -15.63% | -15.43% | -7.94% | -8.08% | -18.33% | -18.41% | -8.47% | -8.44% |

| Hybrid MSCI All Greece Select 25/50 Index/ FTSE/ATHEX Custom Capped Index** | -15.46% | -15.46% | -7.09% | -7.09% | -17.70% | -17.70% | -7.57% | -7.57% |

| MSCI Emerging Markets Index | -12.52% | -12.52% | 6.52% | 6.52% | 0.78% | 0.78% | 2.41% | 2.41% |

Growth of a $10,000 Investment

(At Net Asset Value)

*Fund commenced operations on December 7, 2011.

Management Discussion of Fund Performance (unaudited) |

Global X MSCI Greece ETF |

** Reflects performance of the FTSE/ATHEX Custom Capped Index through February 29, 2016 and MSCI All Greece Select 25/50 Index, thereafter. The inception of the MSCI All Greece Select 25/50 Index (“New Index”) was on December 23, 2015. Effective on or around March 1, 2016, the Fund began to track the New Index. The change was due to the planned migration to the New Index, potentially allowing for broader exposure to the local market.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

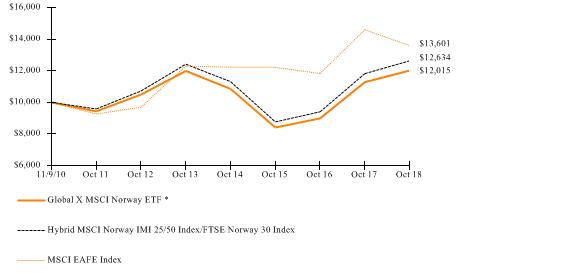

Management Discussion of Fund Performance (unaudited) |

| Global X MSCI Norway ETF |

Global X MSCI Norway ETF

The Global X MSCI Norway ETF (“Fund”) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Norway IMI 25/50 Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to represent the performance of the broad Norway equity universe, as defined by the index provider. The Underlying Index may include large-, mid- or small-capitalization companies.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund increased 6.47%, while the Underlying Index increased 6.86%. The Fund had a net asset value of $13.50 per share on October 31, 2017 and ended the reporting period with a net asset value of $13.97 on October 31, 2018.

During the reporting period, the highest returns came from BW Offshore and Petroleum Geo-Services, which returned 96.51% and 91.78%, respectively. The worst performers were Protector Forsikring and XXL, which returned -57.34% and

-50.67%, respectively.

Norway’s economy continued to benefit from its pivot away from reliance on oil revenues to fund its expenditure. This includes a more diversified energy export portfolio, as Norway is now the third largest natural gas exporter and quickly becoming a hydropower exporter with its subsea cables connecting Norway to Germany and the UK. Efforts to diversify exports are complemented by policy reform that reduce corporate tax rates, simplify business regulation, improve education and skill development programs, and increase labor force participation. Although the government has worked to reduce its reliance on oil-related income, Norway still largely benefitted from higher Brent Crude oil prices, which increased nearly 24% over the reporting period.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Five Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X MSCI Norway ETF | 6.47% | 5.02% | 12.61% | 12.23% | 0.04% | -0.17% | 2.33% | 2.20% |

| Hybrid MSCI Norway IMI 25/50 Index/FTSE Norway 30 Index** | 6.86% | 6.86% | 12.94% | 12.94% | 0.34% | 0.34% | 2.97% | 2.97% |

| MSCI EAFE Index | -6.85% | -6.85% | 3.62% | 3.62% | 2.02% | 2.02% | 3.93% | 3.93% |

Growth of a $10,000 Investment

(At Net Asset Value)

*Fund commenced operations on November 9, 2010.

**Reflects performance of the FTSE Norway 30 Index through July 14, 2014 and the MSCI Norway IMI 25/50 Index thereafter.

Management Discussion of Fund Performance (unaudited) |

| Global X MSCI Norway ETF |

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

Management Discussion of Fund Performance (unaudited) |

Global X FTSE Nordic Region ETF |

Global X FTSE Nordic Region ETF

The Global X FTSE Nordic Region ETF (“Fund”) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the FTSE Nordic 30 Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund decreased 9.67%, while the Underlying Index decreased 9.52%. The Fund had a net asset value of $23.89 per share on October 31, 2017 and ended the reporting period with a net asset value of $20.82 on October 31, 2018.

During the reporting period, the highest returns came from Telefonaktiebolaget LM Ericsson and Equinor, which returned 41.29% and 34.06%, respectively. The worst performers were Danske Bank and A.P. Moller - Maersk, which returned

-47.56% and -32.81%, respectively.

Growth in the Nordic region was robust, supported by both domestic and external factors. Sweden’s economy grew at a strong pace, bolstered by exports and domestic demand. Exports were supported by a weaker currency and growth in the country’s key trading partners. Denmark’s economy experienced a steady upturn, supported by private consumption and business investments. Rising income, led by employment growth, boosted overall consumption. Finland’s economy benefitted from employment gains and income growth, which boosted private consumption and residential investment. Business investment was supported by high capacity utilization and growing exports. Norway’s economy strengthened on increases in oil prices and an associated pick-up in investment, and rising income from employment growth.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Five Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X FTSE Nordic Region ETF | -9.67% | -10.15% | 1.13% | 1.09% | 0.67% | 0.54% | 6.71% | 6.66% |

| FTSE Nordic 30 Index | -9.52% | -9.52% | 1.06% | 1.06% | 0.59% | 0.59% | 6.66% | 6.66% |

| MSCI EAFE Index | -6.85% | -6.85% | 3.62% | 3.62% | 2.02% | 2.02% | 5.64% | 5.64% |

Growth of a $10,000 Investment

(At Net Asset Value)

*Fund commenced operations on August 17, 2009.

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada.

Management Discussion of Fund Performance (unaudited) |

Global X FTSE Nordic Region ETF |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous page.

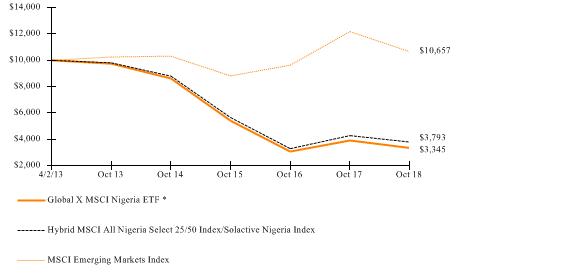

Management Discussion of Fund Performance (unaudited) |

Global X MSCI Nigeria ETF |

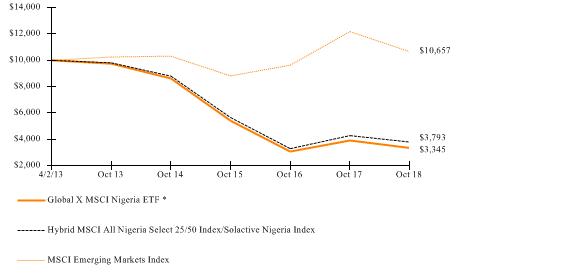

Global X MSCI Nigeria ETF

The Global X MSCI Nigeria ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI All Nigeria Select 25/50 Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to represent the performance of the broad Nigeria equity universe, while including a minimum number of constituents, as defined by the index provider.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund decreased 14.46%, while the Underlying Index decreased 11.43%. The Fund had a net asset value of $21.43 per share on October 31, 2017 and ended the reporting period with a net asset value of $17.98 on October 31, 2018.

During the reporting period, the highest returns came from Diamond Bank and Seplat Petroleum Development Co., which returned 38.45% and 33.25%, respectively. The worst performers were Lafarge Africa and Nigerian Breweries, which returned -62.02% and -43.76%, respectively.

Nigeria’s economy continued its recovery from a deep recession that was originally caused by the selloff in oil prices from 2014-2016. In Q2 2018, the economy registered growth of 1.5%, its fifth consecutive quarter of positive economic growth. However, the pace of overall economic growth remains slow compared to previous levels in the early 2010’s. Higher oil prices as well as growth in non-oil sectors supported economic expansion during the review period. The non-oil sector was the major growth driver in Q2 2018, with services growing the fastest since 2016. Activity in non-oil non-agriculture remains weak as low purchasing power due to a weakened currency is affecting consumer demand, and as private sector lending remains low. Reforms are under way to improve the business environment, increase private investment, raise spending in priority sectors, such as agriculture and infrastructure, create jobs, improve healthcare for the growing population, and provide macroeconomic stability and economic diversification.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Five Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X MSCI Nigeria ETF | -14.46% | -11.77% | -14.80% | -14.49% | -19.25% | -19.34% | -17.82% | -17.39% |

| Hybrid MSCI All Nigeria Select 25/50 Index/Solactive Nigeria Index** | -11.43% | -11.43% | -12.45% | -12.45% | -17.31% | -17.31% | -15.95% | -15.95% |

| MSCI Emerging Markets Index | -12.52% | -12.52% | 6.52% | 6.52% | 0.78% | 0.78% | 1.15% | 1.15% |

Growth of a $10,000 Investment

(At Net Asset Value)

Management Discussion of Fund Performance (unaudited) |

Global X MSCI Nigeria ETF |

*Fund commenced operations on April 2, 2013.

**Reflects performance of the Solactive Nigeria Index through August 14, 2014 and the MSCI All Nigeria Select 25/50 Index thereafter.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance

of emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. The Fund’s performance reflects contractual fee waivers in effect from its inception through February 29, 2016. Absent these waivers performance would have been lower. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

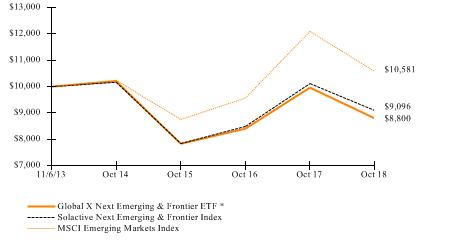

Management Discussion of Fund Performance (unaudited) |

Global X Next Emerging & Frontier ETF |

Global X Next Emerging & Frontier ETF

The Global X Next Emerging & Frontier ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Next Emerging & Frontier Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to reflect equity performance of next emerging markets and frontier markets companies, as defined by the index provider. Next Emerging markets are defined as emerging market countries, excluding the BRICs (Brazil, Russia, India and China) and excluding the most developed tier of emerging markets (South Korea and Taiwan). Frontier markets are those emerging market countries that generally have smaller economies or less developed capital markets.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund decreased 11.66%, while the Underlying Index decreased 11.15%. The Fund had a net asset value of $23.28 per share on October 31, 2017 and ended the reporting period with a net asset value of $20.22 on October 31, 2018.

During the reporting period, the highest returns came from Ecopetrol and Qatar National Bank, which returned 118.27% and 68.10%, respectively. The worst performers were Turk Telekomunikasyon and Banco Macro, which returned -66.38% and -63.56%, respectively.

While demonstrating high growth potential, many emerging and frontier market equities depend on high commodity prices and a weak dollar to fuel their expansions. During the reporting period, oil, a key export for many emerging & frontier markets appreciated by approximately 24%. Yet other export prices were mixed, with copper and soybean prices falling and corn rising. In addition, slowing growth in China hurt many emerging and frontier countries that depend on China as a major trade partner. Further, rising interest rates in the US caused the US dollar to appreciate, which increased the borrowing costs for many companies in the developing world while reducing the value of their stock prices in dollar-terms.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X Next Emerging & Frontier ETF | -11.66% | -11.99% | 3.97% | 4.23% | -2.53% | -2.64% |

| Solactive Next Emerging & Frontier Index | -11.15% | -11.15% | 4.67% | 4.67% | -1.88% | -1.88% |

| MSCI Emerging Markets Index | -12.52% | -12.52% | 6.52% | 6.52% | 1.14% | 1.14% |

Growth of a $10,000 Investment

(At Net Asset Value)

*Fund commenced operations on November 6, 2013.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

Management Discussion of Fund Performance (unaudited) |

Global X Next Emerging & Frontier ETF |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

Management Discussion of Fund Performance (unaudited) |

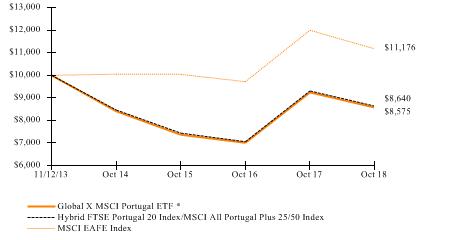

Global X MSCI Portugal ETF |

Global X MSCI Portugal ETF

The Global X MSCI Portugal ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI All Portugal Plus 25/50 Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to represent the performance of the broad Portugal equity universe, while including a minimum number of constituents, as defined by the index provider.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund decreased 7.26%, while the Underlying Index decreased 7.18%. The Fund had a net asset value of $12.49 per share on October 31, 2017 and ended the reporting period with a net asset value of $11.24 on October 31, 2018.

During the reporting period, the highest returns came from Altri and Banco Espirito Santo, which returned 42.96% and 12.50%, respectively. The worst performers were Pharol and Altice Europe, which returned -64.57% and

-50.78 %, respectively.

The Portuguese economy grew at by 2.1% year-over-year in Q3 2018, which is significantly higher than the European Union’s broad growth rate of 0.3%. The growth was supported by strong domestic demand, mainly private consumption, as the labor market continued to improve, pulling the unemployment rate further down. In September 2018, the unemployment rate fell to a 14-year low of 6.6%. Private investment growth continued with increasing capacity utilization, while rising housing prices drove additional residential investments. Fiscal policy was expansionary during the reporting period, but efforts are underway to move towards a balanced budget and reducing the ratio of public debt to GDP further. In Q2 2018, the debt-to-GDP ratio stood at approximately 125%, down from almost 130% in Q3 2017. The government targets to reduce the ratio to around 122% by end 2018 to further ease the country’s debt load.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X MSCI Portugal ETF | -7.26% | -8.24% | 5.18% | 5.10% | -3.05% | -3.24% |

| Hybrid FTSE Portugal 20 Index/MSCI All Portugal Plus 25/50 Index** | -7.18% | -7.18% | 5.10% | 5.10% | -2.90% | -2.90% |

| MSCI EAFE Index | -6.85% | -6.85% | 3.62% | 3.62% | 2.26% | 2.26% |

Growth of a $10,000 Investment

(At Net Asset Value)

*Fund commenced operations on November 12, 2013.

** Hybrid index performance reflects the performance of the FTSE Portugal 20 Index through December 5, 2016, and the MSCI All Portugal Plus 25/50 Index thereafter.

Management Discussion of Fund Performance (unaudited) |

Global X MSCI Portugal ETF |

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above and on previous page.

Management Discussion of Fund Performance (unaudited) |

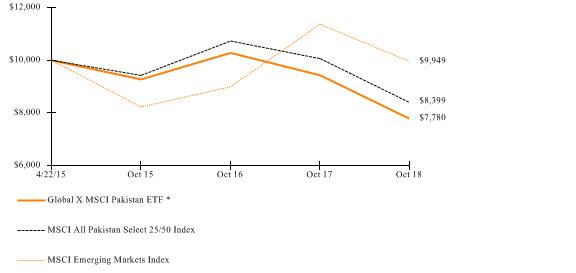

Global X MSCI Pakistan ETF |

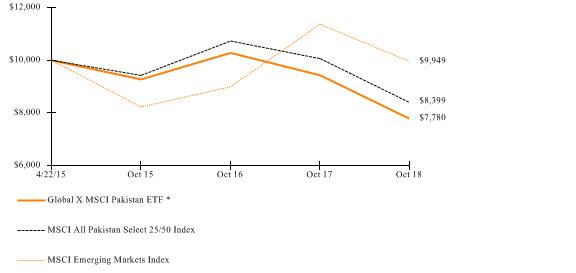

Global X MSCI Pakistan ETF

The Global X MSCI Pakistan ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI All Pakistan Select 25/50 Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to represent the performance of the broad Pakistan equity universe, while including a minimum number of constituents, as defined by the index provider. The broad Pakistan equity universe includes securities that are classified in Pakistan according to the MSCI Global Investable Market Index Methodology, together with companies that are headquartered or listed in Pakistan and carry out the majority of their operations in Pakistan.

For the 12-month period ended October 31, 2018 (the “reporting period”), the Fund decreased 17.53%, while the Underlying Index decreased 16.54%. The Fund had a net asset value of $13.56 per share on October 31, 2017 and ended the reporting period with a net asset value of $10.26 on October 31, 2018.

During the reporting period, the highest returns came from Pakistan International Bulk Terminal and Bank Alfalah, which returned 25.50% and 20.18 %, respectively. The worst performers were Honda Atlas Cars (Pakistan) and National Refinery, which returned -61.52% and -60.29%, respectively.

Pakistan’s economy gained momentum during the reporting period, growing at its highest rate in 13 years in the financial year (FY) ending June 2018, clocking growth of 5.8% year-over-year. This growth was supported by higher agricultural growth, which nearly doubled year-over-year to 3.8% during the year, and robust growth in the services sector. Private consumption slowed slightly to 6.3%, but remained the largest contributor to GDP growth with an 81% share as of June 2018. However, the rising budget deficit, swelling current account deficit, rising debt obligations, and falling foreign exchange reserves remain concerns that battered the country’s currency. The newly formed government is taking measures, such as imposing import tariffs and raising the policy rate, to deal with the current macroeconomic imbalances, but the efficacy of such policies remain uncertain.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED OCTOBER 31, 2018 |

| | One Year Return | Three Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X MSCI Pakistan ETF* | -17.53% | -19.15% | -5.69% | -6.77% | -6.88% | -7.55% |

| MSCI All Pakistan Select 25/50 Index | -16.54% | -16.54% | -3.78% | -3.78% | -4.83% | -4.83% |

| MSCI Emerging Markets Index | -12.52% | -12.52% | 6.52% | 6.52% | -0.15% | -0.15% |

Growth of a $10,000 Investment

(At Net Asset Value)

Management Discussion of Fund Performance (unaudited) |

Global X MSCI Pakistan ETF |

*Fund commenced operations on April 22, 2015.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when redeemed, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices above.

The accompanying notes are an integral part of the financial statements.

The accompanying notes are an integral part of the financial statements.

The accompanying notes are an integral part of the financial statements.

Schedule of Investments | | October 31, 2018 |

Global X China Financials ETF

___________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

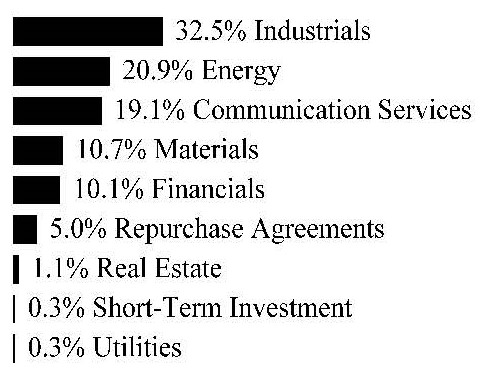

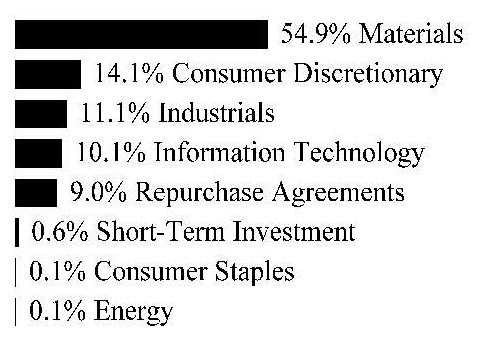

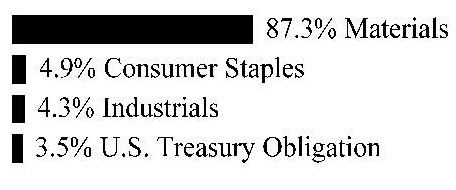

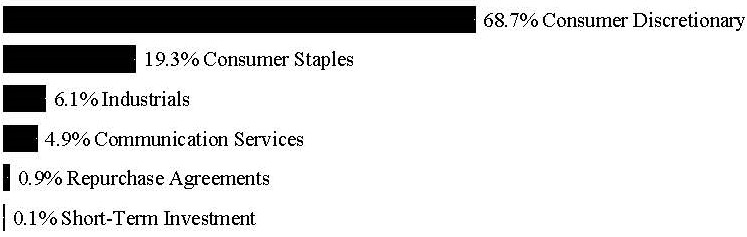

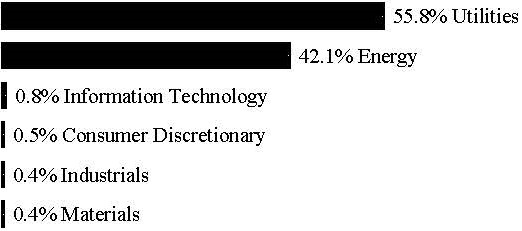

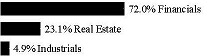

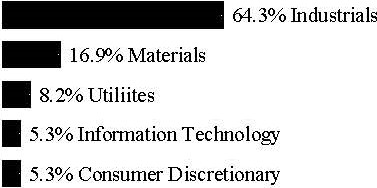

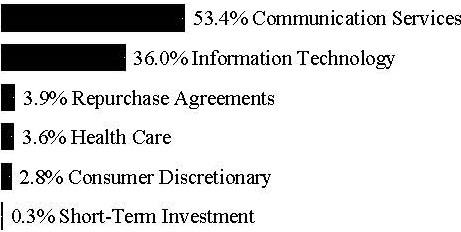

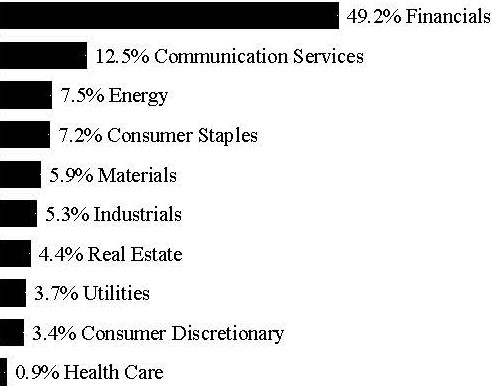

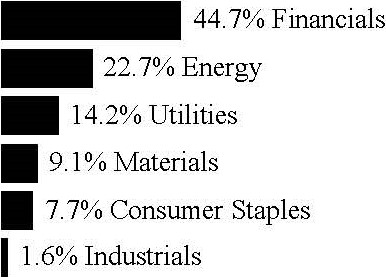

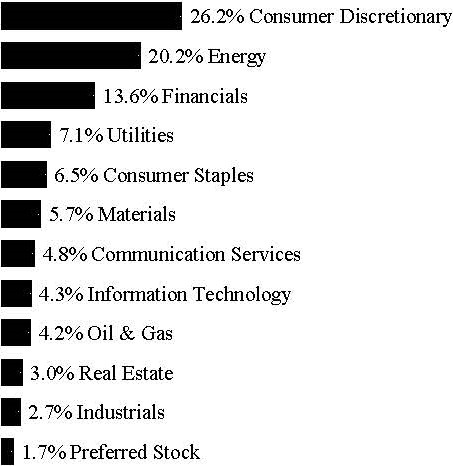

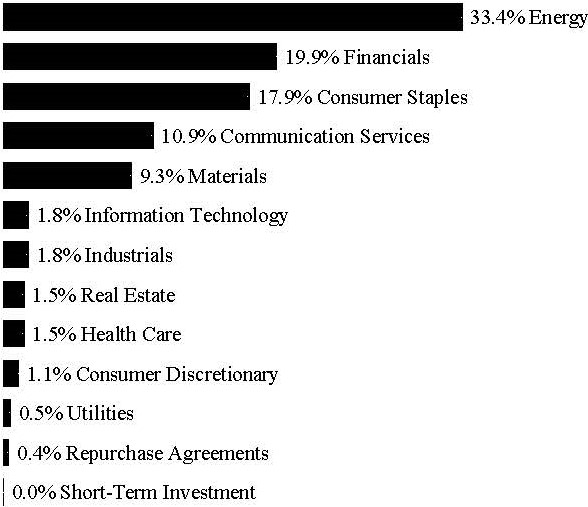

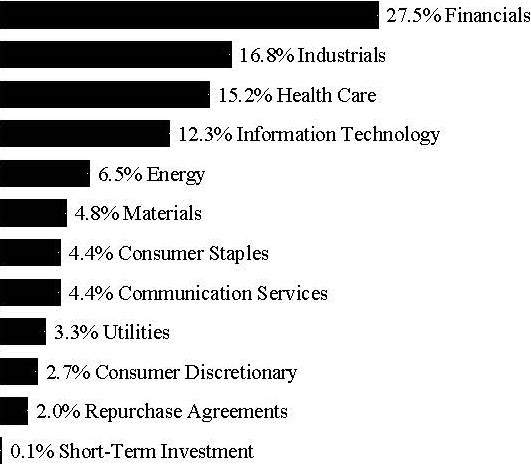

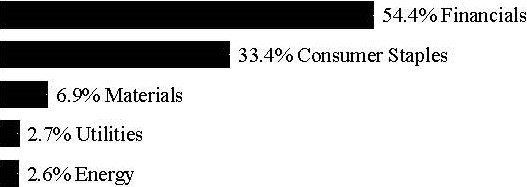

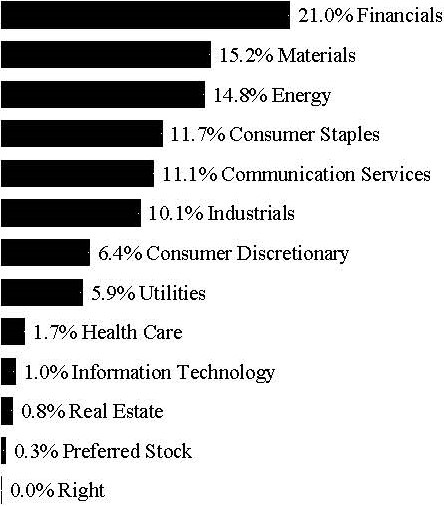

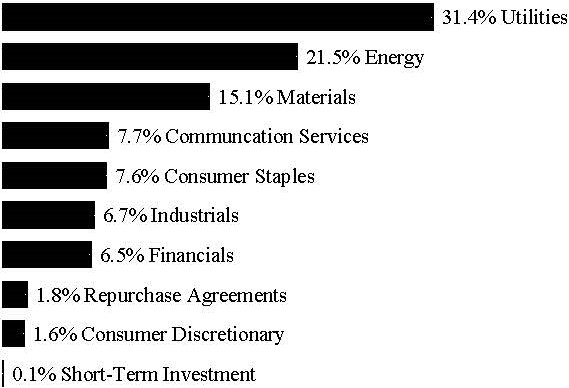

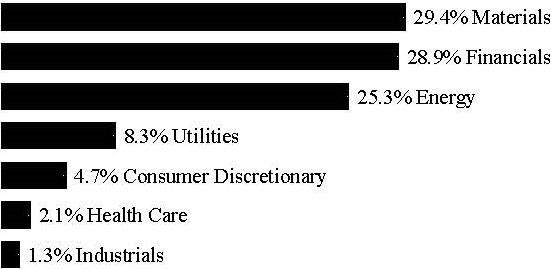

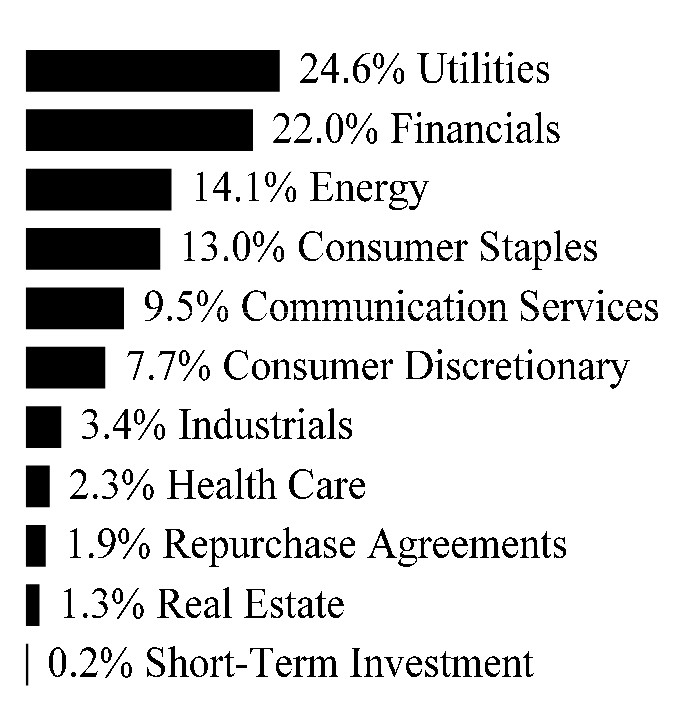

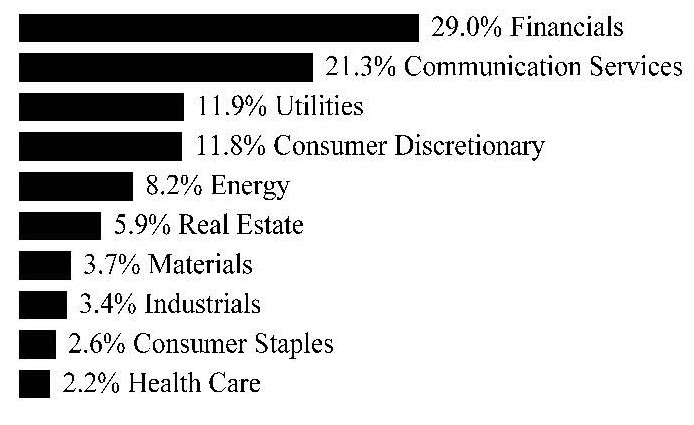

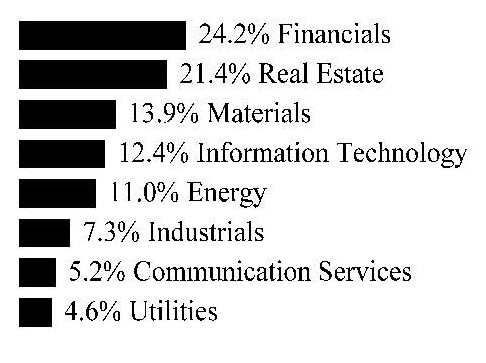

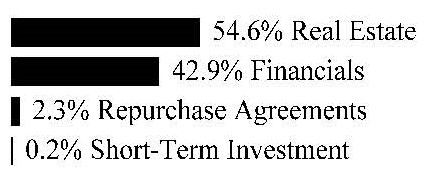

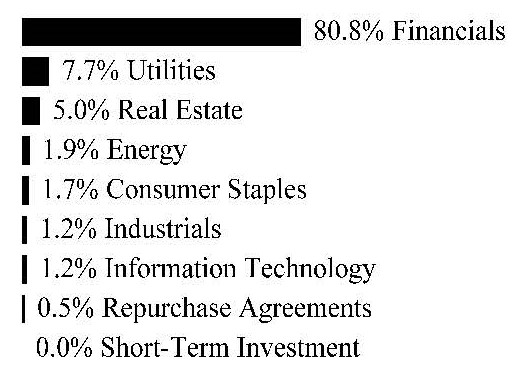

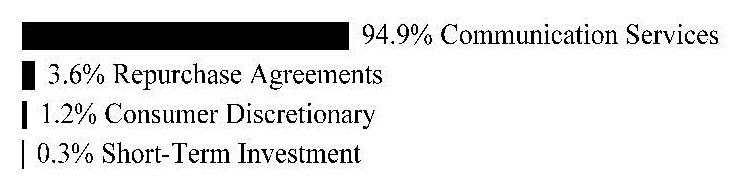

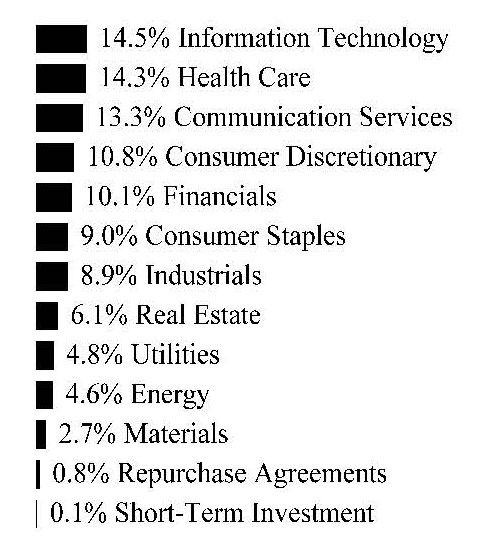

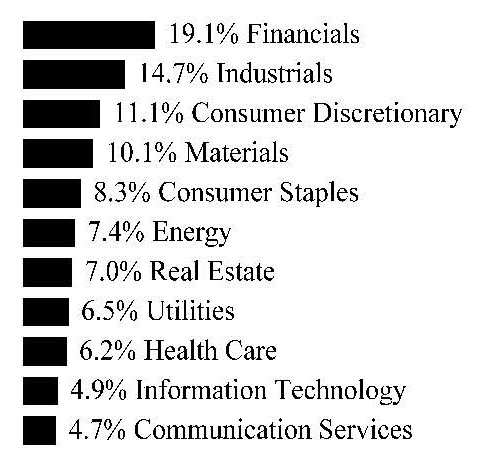

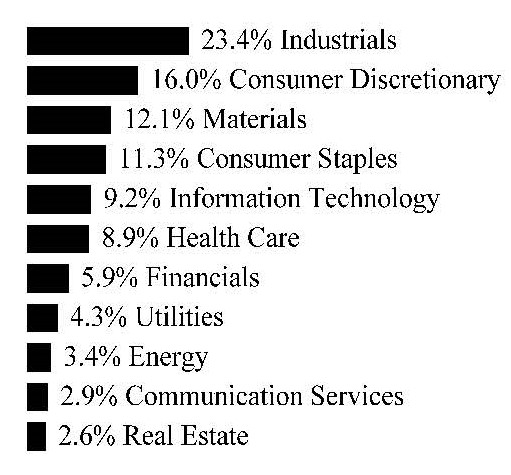

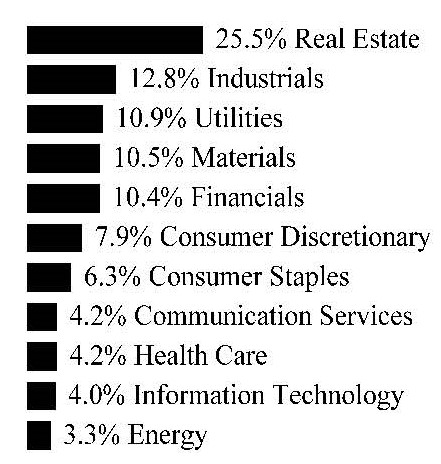

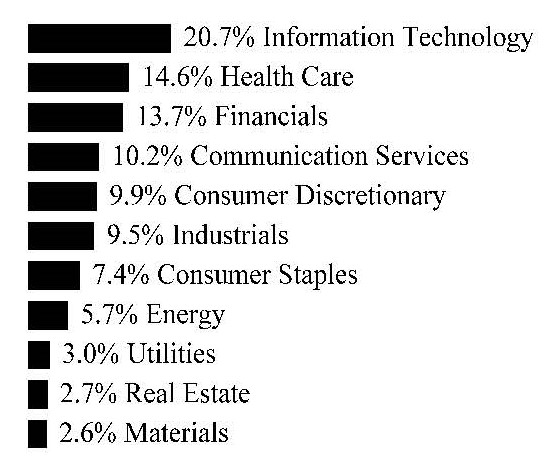

| Sector Weightings (unaudited)†: |

† Sector weightings percentages are based on the total market value of investments.

|

| | Shares | | Value | |

| COMMON STOCK — 99.9% | | | | | | |

| CHINA— 46.2% | | | | | | |

| Financials — 45.1% | | | | | | |

| Agricultural Bank of China, Cl H | | | 1,992,788 | | | $ | 874,454 | |

| Bank of China, Cl H | | | 3,536,234 | | | | 1,506,623 | |

| Bank of Communications, Cl H | | | 528,671 | | | | 396,534 | |

| China Citic Bank, Cl H | | | 655,022 | | | | 405,242 | |

| China Construction Bank, Cl H | | | 3,974,626 | | | | 3,153,580 | |

| China Life Insurance, Cl H | | | 524,340 | | | | 1,044,747 | |

| China Merchants Bank, Cl H | | | 273,734 | | | | 1,054,515 | |

| China Minsheng Banking, Cl H | | | 472,826 | | | | 348,615 | |

| China Pacific Insurance Group, Cl H | | | 195,412 | | | | 727,866 | |

| CITIC Securities, Cl H | | | 156,496 | | | | 275,486 | |

| Country Garden Holdings | | | 539,897 | | | | 577,817 | |

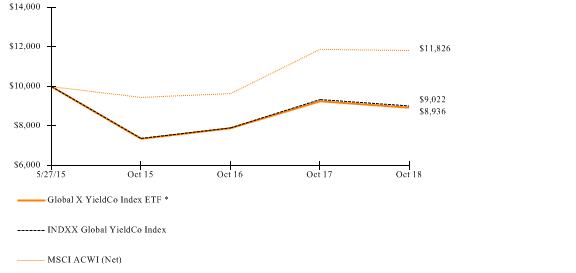

| Industrial & Commercial Bank of China, Cl H | | | 2,218,737 | | | | 1,500,026 | |