Global X MLP & Energy Infrastructure ETF (ticker: MLPX) Global X SuperDividend® Alternatives ETF (ticker: ALTY) Global X U.S. Preferred ETF (ticker: PFFD) Global X S&P 500® Quality Dividend ETF (ticker: QDIV) Global X TargetIncomeTM 5 ETF (ticker: TFIV) Global X TargetIncomeTM Plus 2 ETF (ticker: TFLT) Global X Adaptive U.S. Factor ETF (ticker: AUSF) |

Annual Report

November 30, 2018

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ (defined below) shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary (such as a broker-dealer or bank). Instead, shareholder reports will be available on the Funds’ website (www.globalxfunds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary.

You may elect to receive all future Fund shareholder reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of Fund shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

Table of Contents

| Management Discussion of Fund Performance | 1 |

| Schedules of Investments | |

| Global X MLP & Energy Infrastructure ETF | 15 |

Global X SuperDividend® Alternatives ETF | 18 |

| Global X U.S. Preferred ETF | 21 |

Global X S&P 500® Quality Dividend ETF | 28 |

Global X TargetIncomeTM 5 ETF | 31 |

Global X TargetIncomeTM Plus 2 ETF | 32 |

| Global X Adaptive U.S. Factor ETF | 33 |

| Statements of Assets and Liabilities | 39 |

| Statements of Operations | 41 |

| Statements of Changes in Net Assets | 43 |

| Financial Highlights | 46 |

| Notes to Financial Statements | 47 |

| Report of Independent Registered Public Accounting Firm | 61 |

| Disclosure of Fund Expenses | 63 |

| Approval of Investment Advisory Agreement | 65 |

| Supplemental Information | 73 |

| Trustees and Officers of the Trust | 74 |

| Notice to Shareholders | 77 |

| Shareholder Voting Results | 78 |

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Shares may only be redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

The Funds file their complete schedule of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Funds’ Forms N-Q are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Global X Funds use to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-888-GXFund-1; and (ii) on the Commission’s website at http://www.sec.gov.

| Management Discussion of Fund Performance (unaudited) |

| Global X MLP & Energy Infrastructure ETF |

Global X MLP & Energy Infrastructure ETF

The Global X MLP & Energy Infrastructure ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive MLP & Energy Infrastructure Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index tracks the performance of midstream master limited partnerships (“MLPs”) and energy infrastructure corporations. Midstream energy infrastructure MLPs and corporations principally own and operate assets used in energy logistics, including, but not limited to, pipelines, storage facilities and other assets used in transporting, storing, gathering, and processing natural gas, natural gas liquids, crude oil or refined products.

For the 12-month period ended November 30, 2018 (the “Reporting Period”), the Fund decreased 0.43%, while the Underlying Index increased 0.27%. The Fund had a net asset value of $12.80 per share on November 30, 2017 and ended the Reporting Period with a net asset value of $12.13 on November 30, 2018.

During the Reporting Period, the highest returns came from Energy Transfer Operating and Williams Partners, which returned 40.60% and 34.99%, respectively. The worst performers were Dominion Energy Midstream Partners and TC PipeLines, which returned -52.33% and -36.10%, respectively.

The Fund seeks to provide tax efficient exposure to midstream MLPs, the general partners of midstream MLPs, and energy infrastructure corporations. Midstream MLPs and energy infrastructure companies operate toll road-like business models where they are compensated based on the volumes of natural gas or crude oil that they transport, store, or process. During the Reporting Period, oil prices fell as output around the world increased and demand expectations softened. In addition, a surge in US oil production strained infrastructure systems within the country, with many pipelines operating at full capacity, leaving little room for growth. Broad market selling and a shift away from income-oriented equities as interest rates increased also affected the midstream space.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED NOVEMBER 30, 2018 |

| | One Year Return | Three Year Return | Five Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

| Global X MLP & Energy Infrastructure ETF | -0.43% | -0.43% | 1.62% | 1.62% | -0.77% | -0.76% | -0.01% | -0.07% |

| Solactive MLP & Energy Infrastructure Index | 0.27% | 0.27% | 2.53% | 2.53% | -0.09% | -0.09% | 0.67% | 0.67% |

| S&P 500 Index | 6.27% | 6.27% | 12.16% | 12.16% | 11.12% | 11.12% | 11.87% | 11.87% |

*The Fund commenced investment operations on August 6, 2013.

| Management Discussion of Fund Performance (unaudited) |

| Global X MLP & Energy Infrastructure ETF |

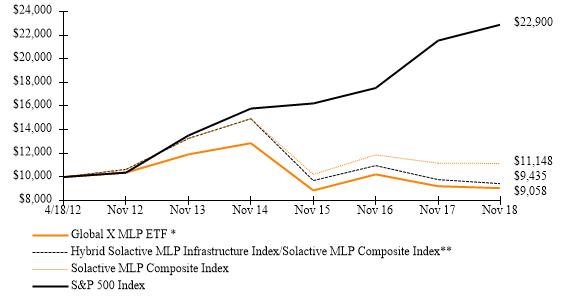

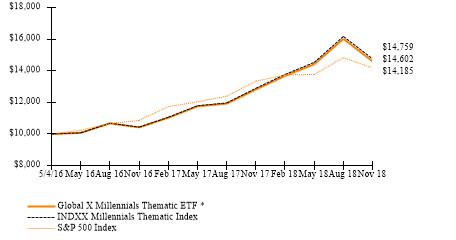

Growth of a $10,000 Investment

(at Net Asset Value)

*The Fund commenced investment operations on August 6, 2013.

The S&P 500 Index is a market capitalization weighted composite index of 500 large capitalization U.S. companies.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on previous page and above.

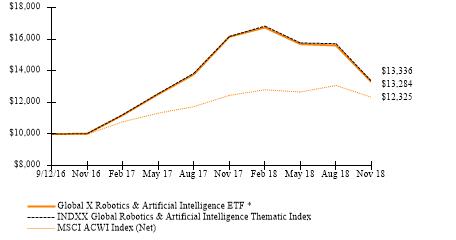

| Management Discussion of Fund Performance (unaudited) |

Global X SuperDividend® Alternatives ETF |

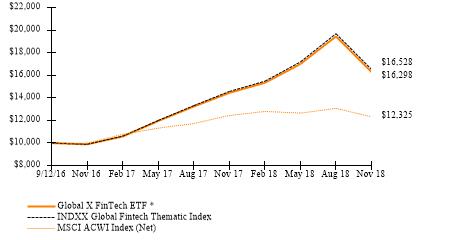

Global X SuperDividend® Alternatives ETF

The Global X SuperDividend® Alternatives ETF (“Fund”) seeks to track, before fees and expenses, the price and yield performance of the INDXX SuperDividend® Alternatives Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is comprised of securities that rank among the highest dividend-yielding securities in each eligible category of alternative income investments, at the time of Underlying Index reconstitution, as defined by the index provider. Alternative income investments that are eligible for inclusion in the Underlying Index fall into one of four classes: Master Limited Partnerships (“MLPs”) and Infrastructure, Real Estate, Institutional Managers, and Fixed Income and Derivative Strategies. The MLPs and Infrastructure categories primarily consist of units of MLPs and shares of infrastructure companies. The Real Estate category provides exposure to global Real Estate Investment Trusts (“REITs”), and gains this exposure through investing directly in the Global X SuperDividend® REIT ETF. The Institutional Managers category primarily consists of shares of Business Development Companies (“BDCs”) and publicly listed private equity companies. The Fixed Income and Derivative Strategies category includes exposure to emerging market debt, mortgage and asset backed securities, and option-writing primarily through the purchase of publicly traded closed-end funds (“CEFs”). Each of the Underlying Index components is selected from a universe of securities that are publicly traded in the U.S. The Underlying Index assigns weights to each of the four categories in a method that seeks to equalize the volatility contribution of each category, which assigns less weight to higher volatility categories and more weight to lower volatility categories. The Underlying Index is reconstituted annually, but may rebalance quarterly if any one category deviates more than 3% from its target weight.

For the 12-month period ended November 30, 2018 (the “Reporting Period”), the Fund increased 1.89%, while the Underlying Index increased 2.72%. The Fund had a net asset value of $15.40 per share on November 30, 2017 and ended the Reporting Period with a net asset value of $14.52 on November 30, 2018.

During the Reporting Period, the highest returns came from Energy Transfer Operating and Icahn Enterprises, which returned 45.78% and 39.03%, respectively. The worst performers were Macquarie Infrastructure Corporation and Buckeye Partners, which returned -24.81% and -14.42%, respectively.

The Fund provides exposure to among the highest yielding securities from various alternative income-generating asset classes including REITs, MLPs and Infrastructure, BDCs, and Fixed Income and Derivative Strategies. During the Reporting Period, the Fund exhibited generally flat performance. As the Federal Reserve raised interest rates and market volatility increased, the Fund’s multi-asset strategy helped mitigate the impact of these events. During the Reporting Period, the Fund had an average approximate exposure of 33% to Fixed Income and Derivative Strategies, 27% to BDCs, 20% to REITs, and 19% to MLPs and Infrastructure.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED NOVEMBER 30, 2018 |

| | One Year Return | Three Year Return | Annualized Inception to Date* |

| | Net Asset Value | Market Price | Net Asset Value | Market Price | Net Asset Value | Market Price |

Global X SuperDividend® Alternatives ETF | 1.89% | 2.02% | 8.61% | 8.64% | 6.96% | 6.96% |

INDXX SuperDividend® Alternatives Index | 2.72% | 2.72% | 9.48% | 9.48% | 7.82% | 7.82% |

| S&P 500 Index | 6.27% | 6.27% | 12.16% | 12.16% | 10.68% | 10.68% |

*The Fund commenced investment operations on July 13, 2015.

| Management Discussion of Fund Performance (unaudited) |

Global X SuperDividend® Alternatives ETF |

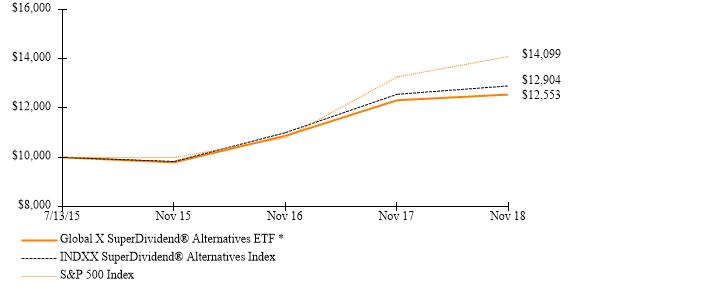

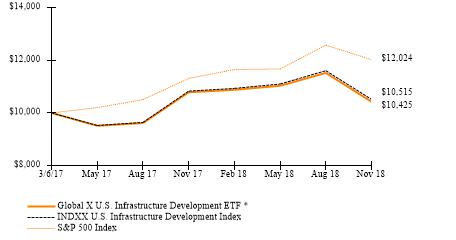

Growth of a $10,000 Investment

(at Net Asset Value)

*The Fund commenced investment operations on July 13, 2015.

The S&P 500 Index is a market capitalization weighted composite index of 500 large capitalization U.S. companies.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on previous page and above.

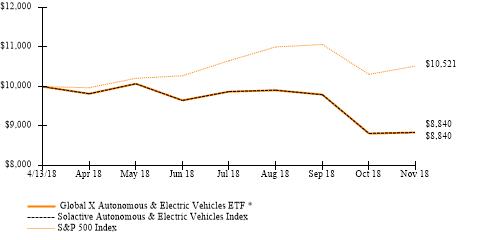

| Management Discussion of Fund Performance (unaudited) |

Global X U.S. Preferred ETF |

Global X U.S. Preferred ETF

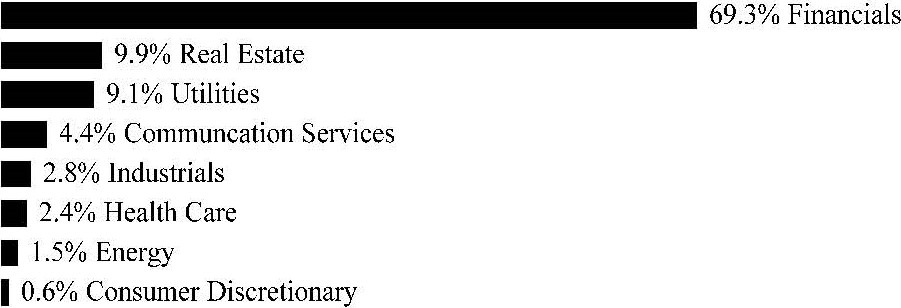

The Global X U.S. Preferred ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the ICE BofAML Diversified Core U.S. Preferred Securities Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to track the broad-based performance of the U.S. preferred securities market. The Underlying Index includes different categories of preferred stock, such as floating, variable and fixed-rate preferreds, cumulative and non-cumulative preferreds, and trust preferreds. Qualifying preferred securities must be listed on a U.S. exchange, denominated in U.S. dollars, and have a minimum amount outstanding of $100 million. Qualifying securities must meet minimum price, liquidity, maturity and other requirements as determined by the index provider.

For the 12-month period ended November 30, 2018 (the “Reporting Period”), the Fund decreased 2.72%, while the Underlying Index decreased 2.48%. The Fund had a net asset value of $25.03 per share on November 30, 2017 and ended the Reporting Period with a net asset value of $22.97 on November 30, 2018.

During the Reporting Period, the highest returns came from Rayonier Advanced Materials and Chesapeake Energy, which returned 20.19% and 13.61%, respectively. The worst performers were Nabors Industries and CBL & Associates Properties, which returned -40.06% and -31.71%, respectively.

The Fund’s holdings consist of broad exposure to U.S. preferred stocks, providing benchmark-like exposure to the asset class. Preferred stocks have historically offered high yield potential given that they are junior in the capital structure to traditional debt instruments. Preferred stocks were negatively affected during the Reporting Period due to rising interest rates, widening credit spreads, and some preferred stocks being called above their par amounts, which reduced total returns. During the Reporting Period, the Fund had an average approximate allocation of 70% to Financials, 10% to Utilities, and 9% to Real Estate.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED NOVEMBER 30, 2018 |

| | One Year Return | Annualized Inception to Date* |

| | Net Asset Value | Net Asset Value | Net Asset Value | Net Asset Value |

| Global X U.S. Preferred ETF | -2.72% | -2.99% | -1.64% | -1.22% |

| ICE BofAML Diversified Core U.S. Preferred Securities Index | -2.48% | -2.48% | -1.40% | -1.40% |

| S&P 500 Index | 6.27% | 6.27% | 13.60% | 13.60% |

*The Fund commenced investment operations on September 11, 2017.

| Management Discussion of Fund Performance (unaudited) |

Global X U.S. Preferred ETF |

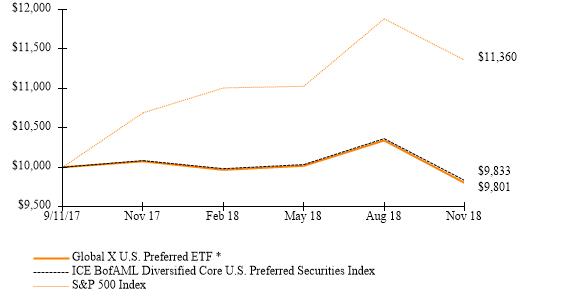

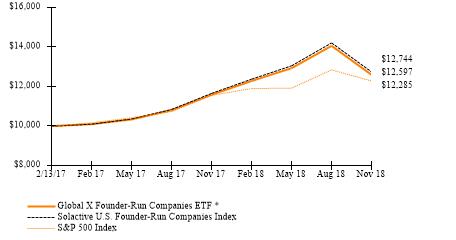

Growth of a $10,000 Investment

(at Net Asset Value)

*The Fund commenced investment operations on September 11, 2017.

The S&P 500 Index is a market capitalization weighted composite index of 500 large capitalization U.S. companies.

The ICE BofAML Diversified U.S. Preferred Securities Index was formerly known as BofA Merrill Lynch Diversified Core U.S. Preferred Securities Index.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on previous page and above.

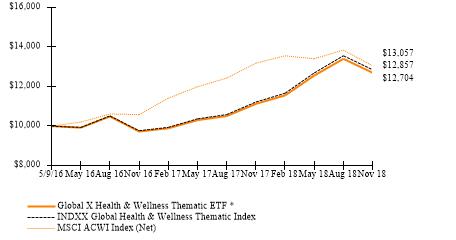

| Management Discussion of Fund Performance (unaudited) |

Global X S&P 500® Quality Dividend ETF |

Global X S&P 500® Quality Dividend ETF

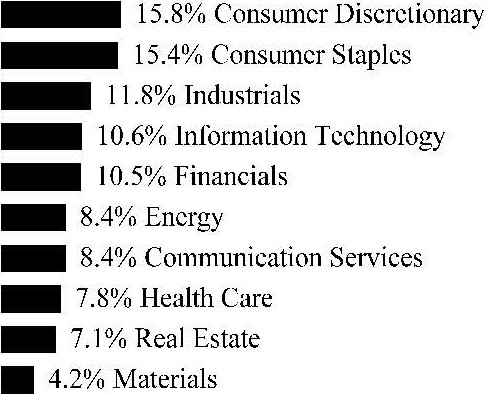

The Global X S&P 500® Quality Dividend ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the S&P 500® Quality High Dividend Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to provide exposure to U.S. equity securities included in the S&P 500® Index that exhibit high quality and dividend yield characteristics, as determined by Standard & Poor’s Financial Services LLC, the provider of the Underlying Index.

For the period from the Fund's commencement date on July 13, 2018 through November 30, 2018 (the “Reporting Period”), the Fund decreased 0.72%, while the Underlying Index decreased 0.60%. The Fund had a net asset value of $25.00 per share on July 13, 2018 and ended the Reporting Period with a net asset value of $24.60 on November 30, 2018.

During the Reporting Period, the highest returns came from Eli Lilly and Company and Walgreens Boots Alliance, which returned 33.66% and 31.44%, respectively. The worst performers were Schlumberger and Seagate Technology, which returned -33.22% and -26.03%, respectively.

The Fund’s quality dividend strategy was adversely affected by rising bond yields and a broader shift away from equity dividend strategies, due to monetary policy tightening. During a rising interest rate period, dividend stocks can become less attractive compared to traditional sources of income, like bonds, resulting in underperformance versus non-dividend payers. In addition, the Fund was negatively impacted by broad market weakness, spurred by concerns around economic growth, and heightened geopolitical risks. As a result of market turbulence, a move away from equities also negatively impacted the Fund.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED NOVEMBER 30, 2018 |

| | Cumulative Inception to Date* |

| | Net Asset Value | Market Price |

Global X S&P 500® Quality Dividend ETF | -0.72% | -0.81% |

S&P 500® Quality High Dividend Index | -0.60% | -0.60% |

| S&P 500 Index | -0.71% | -0.71% |

*The Fund commenced investment operations on July 13, 2018.

| Management Discussion of Fund Performance (unaudited) |

Global X S&P 500® Quality Dividend ETF |

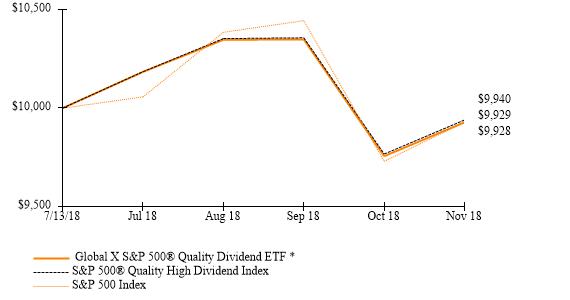

Growth of a $10,000 Investment

(at Net Asset Value)

*The Fund commenced investment operations on July 13, 2018.

The S&P 500 Index is a market capitalization weighted composite index of 500 large capitalization U.S. companies.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on previous page and above.

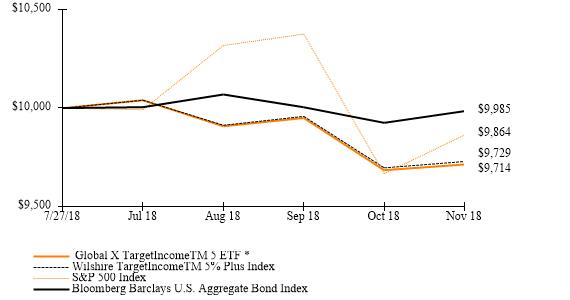

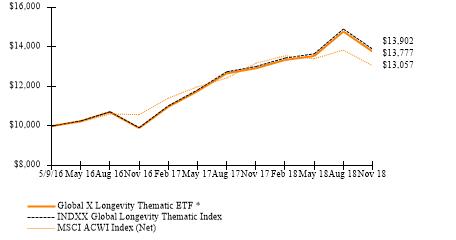

| Management Discussion of Fund Performance (unaudited) |

Global X TargetIncomeTM 5 ETF |

Global X TargetIncomeTM 5 ETF

The Global X TargetIncomeTM 5 ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Wilshire TargetIncomeTM 5% Plus Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally uses a representative sampling with respect to its Underlying Index.

The Underlying Index seeks to provide broad exposure to income-producing asset classes using a portfolio of exchange-traded funds, with the goal, but not the guarantee, of providing exposure that may be sufficient to support an annualized yield of five percent (5.0%) for the Fund, net of fees.

For the period from the Fund's commencement date on July 27, 2018 through November 30, 2018 (the “Reporting Period”), the Fund decreased 2.86%, while the Underlying Index decreased 2.71%. The Fund had a net asset value of $25.00 per share on July 27, 2018 and ended the Reporting Period with a net asset value of $23.95 on November 30, 2018.

During the Reporting Period, the highest returns came from SPDR Blackstone / GSO Senior Loan ETF and Xtrackers USD High Yield Corporate Bond ETF, which returned 0.09% and -0.75%, respectively. The worst performers were Global X SuperDividend ETF and Global X U.S. Preferred ETF, which returned -5.65% and -4.29%, respectively.

The Fund was negatively impacted by its exposure to both equities and bonds during the Reporting Period. Equities and bonds experienced weakness due to lower global growth expectations, earnings contraction, monetary policy tightening, and trade wars. During the Reporting Period, the Fund had an average exposure of 20% to High Yield Bonds, 20% to Emerging Market Bonds, and 20% to Global Equities.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED NOVEMBER 30, 2018 |

| | Cumulative Inception to Date* |

| | Net Asset Value | Market Price |

Global X TargetIncomeTM 5 ETF | -2.86% | -2.78% |

Wilshire TargetIncomeTM 5% Plus Index | -2.71% | -2.71% |

| S&P 500 Index | -1.36% | -1.36% |

| Bloomberg Barclays U.S. Aggregate Bond Index | -0.15% | -0.15% |

*The Fund commenced investment operations on July 27, 2018.

| Management Discussion of Fund Performance (unaudited) |

Global X TargetIncomeTM 5 ETF |

Growth of a $10,000 Investment

(at Net Asset Value)

*The Fund commenced investment operations on July 27, 2018.

The S&P 500 Index is a market capitalization weighted composite index of 500 large capitalization U.S. companies.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices above and on previous page.

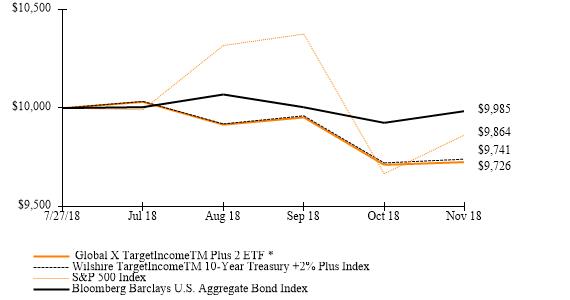

| Management Discussion of Fund Performance (unaudited) |

Global X TargetIncomeTM Plus 2 ETF |

Global X TargetIncomeTM Plus 2 ETF

The Global X TargetIncomeTM Plus 2 ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Wilshire TargetIncomeTM 10-Year Treasury +2% Plus Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally uses a representative sampling with respect to its Underlying Index.

The Underlying Index seeks to provide broad exposure to income-producing asset classes using a portfolio of exchange-traded funds, with the goal, but not the guarantee, of providing exposure that may be sufficient to support an annualized yield of the U.S. 10-Year Treasury yield plus two percent (2.0%) for the Fund, net of fees.

For the period from the Fund's commencement date on July 27, 2018 through November 30, 2018 (the “Reporting Period”), the Fund decreased 2.74%, while the Underlying Index decreased 2.59%. The Fund had a net asset value of $25.00 per share on July 27, 2018 and ended the Reporting Period with a net asset value of $23.98 on November 30, 2018.

During the Reporting Period, the highest returns came from SPDR Blackstone / GSO Senior Loan ETF and Xtrackers USD High Yield Corporate Bond ETF, which returned 0.09% and -0.75%, respectively. The worst performers were Global X SuperDividend ETF and Global X U.S. Preferred ETF, which returned -5.65% and -4.29%, respectively.

The Fund was negatively impacted by its exposure to both equities and bonds during the Reporting Period. Equities and bonds experienced weakness due to lower global growth expectations, earnings contraction, monetary policy tightening, and trade wars. During the Reporting Period, the Fund had an average exposure of 20% to High Yield Bonds, 20% to Emerging Market Bonds, and 18% to Senior Loans.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED NOVEMBER 30, 2018 |

| | Cumulative Inception to Date* |

| | Net Asset Value | Market Price |

Global X TargetIncomeTM Plus 2 ETF | -2.74% | -2.66% |

Wilshire TargetIncome TM10-Year Treasury +2% Plus Index | -2.59% | -2.59% |

| S&P 500 Index | -1.36% | -1.36% |

| Bloomberg Barclays U.S. Aggregate Bond Index | -0.15% | -0.15% |

*The Fund commenced investment operations on July 27, 2018.

| Management Discussion of Fund Performance (unaudited) |

Global X TargetIncomeTM Plus 2 ETF |

Growth of a $10,000 Investment

(at Net Asset Value)

*The Fund commenced investment operations on July 27, 2018.

The S&P 500 Index is a market capitalization weighted composite index of 500 large capitalization U.S. companies.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices above and on previous page.

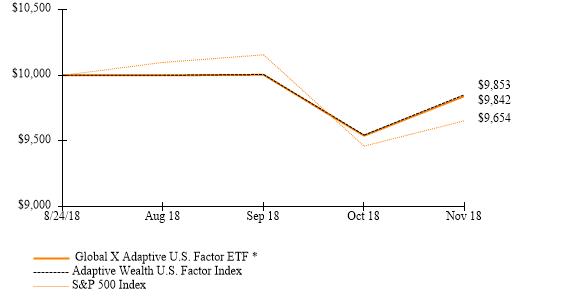

| Management Discussion of Fund Performance (unaudited) |

Global X Adaptive U.S. Factor ETF |

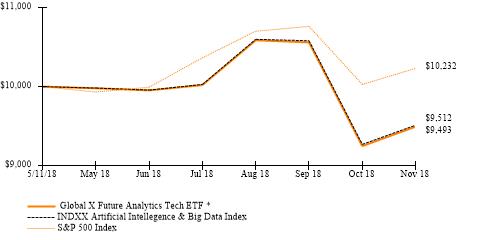

Global X Adaptive U.S. Factor ETF

The Global X Adaptive U.S. Factor ETF (“Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Adaptive Wealth Strategies U.S. Factor Index (“Underlying Index”). The Fund is passively managed, which means the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to dynamically allocate across three sub-indices that provide exposure to U.S. equities that exhibit characteristics of one of three primary factors: value, momentum and low volatility.

For the period from the Fund's commencement date on August 24, 2018 through November 30, 2018 (the “Reporting Period”), the Fund decreased 1.58%, while the Underlying Index decreased 1.48%. The Fund had a net asset value of $25.00 per share on August 24, 2018 and ended the Reporting Period with a net asset value of $24.39 on November 30, 2018.

During the Reporting Period, the highest returns came from Arcosa and McDonald's, which returned 22.88% and 19.75%, respectively. The worst performers were Valero Energy and Olin, which returned -33.06% and -29.20%, respectively.

The Fund employs a dynamic multifactor investment strategy that allocates across three factors: minimum volatility, value, and momentum. The index methodology allocates weight to the three sub-indices based on the relative performance of each sub-index since the last rebalance of the Underlying Index. During the Reporting Period, the Fund had an average approximate allocation of 27% to Financials, 13% to Industrials, and 11% to Real Estate.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE PERIOD ENDED NOVEMBER 30, 2018 |

| | Cumulative Inception to Date* |

| | Net Asset Value | Market Price |

| Global X Adaptive U.S. Factor ETF | -1.58% | -1.50% |

Adaptive Wealth U.S. Factor Index | -1.48% | -1.48% |

| S&P 500 Index | -3.46% | -3.46% |

*The Fund commenced investment operations on August 24, 2018.

| Management Discussion of Fund Performance (unaudited) |

Global X Adaptive U.S. Factor ETF |

Growth of a $10,000 Investment

(at Net Asset Value)

*The Fund commenced investment operations on August 24, 2018.

The S&P 500 Index is a market capitalization weighted composite index of 500 large capitalization U.S. companies.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund's performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund's returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

See definition of comparative indices on previous page and above.

Schedule of Investments | | November 30, 2018 |

| | |

Global X MLP & Energy Infrastructure ETF |

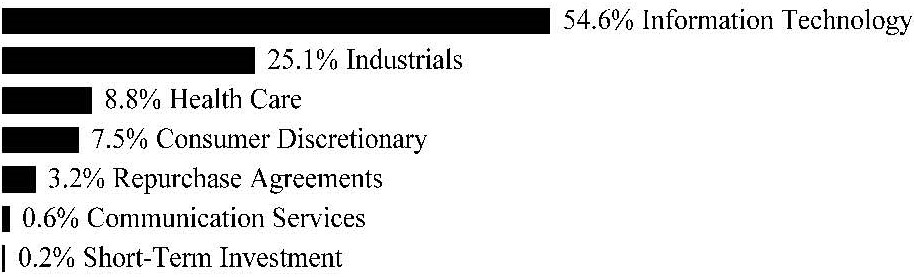

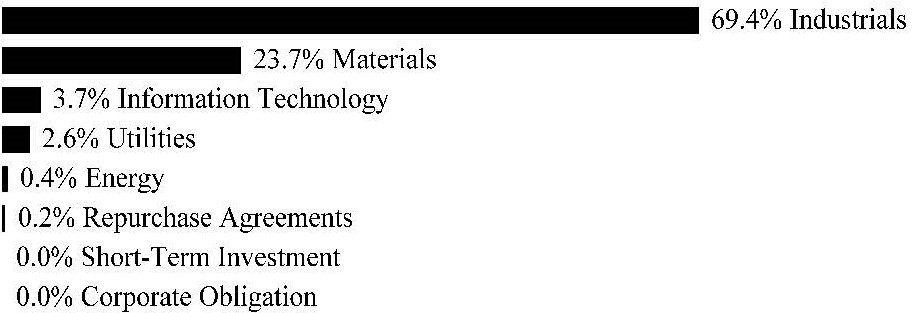

| Sector Weightings (Unaudited)†: |

| † Sector weightings percentages are based on the total market value of investments. Repurchase agreements purchased from cash collateral received for securities lending activity are included in total investments. Please see Notes 2 and 7 in Notes to Financial Statements for more detailed information. |

| | | Shares | | | Value | |

| COMMON STOCK — 76.0% | | | | | | |

| Energy — 76.0% | | | | | | |

Antero Midstream GP (A) | | | 1,076,984 | | | $ | 15,950,133 | |

| Archrock | | | 1,761,537 | | | | 17,967,677 | |

Cheniere Energy * | | | 578,579 | | | | 35,362,749 | |

Enbridge^ (A) | | | 1,508,728 | | | | 49,380,668 | |

Enbridge Energy Management * | | | 1,243,452 | | | | 13,553,627 | |

| EnLink Midstream | | | 842,584 | | | | 9,630,735 | |

| Kinder Morgan | | | 2,835,494 | | | | 48,401,883 | |

| ONEOK | | | 617,023 | | | | 37,903,723 | |

| Plains GP Holdings, Cl A | | | 1,111,317 | | | | 24,593,445 | |

| SemGroup, Cl A | | | 1,086,128 | | | | 17,627,857 | |

| Tallgrass Energy, Cl A | | | 1,101,320 | | | | 23,524,195 | |

| Targa Resources | | | 515,629 | | | | 23,012,522 | |

| TransCanada^ | | | 1,224,513 | | | | 50,107,072 | |

| Williams | | | 1,730,954 | | | | 43,827,755 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $447,213,840) | | | | | | | 410,844,041 | |

| | | | | | | | | |

| MASTER LIMITED PARTNERSHIPS — 23.7% | | | | | | | | |

| Energy — 23.7% | | | | | | | | |

| Andeavor Logistics | | | 87,448 | | | | 3,263,559 | |

| Antero Midstream Partners | | | 86,318 | | | | 2,387,556 | |

| Buckeye Partners | | | 145,223 | | | | 4,292,792 | |

| Cheniere Energy Partners | | | 39,961 | | | | 1,505,731 | |

| Crestwood Equity Partners | | | 50,549 | | | | 1,501,305 | |

| DCP Midstream | | | 89,585 | | | | 3,053,057 | |

| Dominion Midstream Partners | | | 50,596 | | | | 940,074 | |

| Enable Midstream Partners | | | 90,987 | | | | 1,213,767 | |

| Energy Transfer | | | 1,649,399 | | | | 24,031,743 | |

| EnLink Midstream Partners | | | 164,881 | | | | 2,181,376 | |

| Enterprise Products Partners | | | 912,882 | | | | 23,963,153 | |

| EQM Midstream Partners | | | 119,639 | | | | 5,701,995 | |

| Genesis Energy | | | 105,829 | | | | 2,333,529 | |

| Holly Energy Partners | | | 47,057 | | | | 1,323,713 | |

| Magellan Midstream Partners | | | 227,056 | | | | 13,732,347 | |

| MPLX | | | 286,402 | | | | 9,488,498 | |

| NuStar Energy | | | 86,008 | | | | 2,078,813 | |

Schedule of Investments | | November 30, 2018 |

| | |

Global X MLP & Energy Infrastructure ETF |

| | | Shares/Face Amount | | | Value | |

| MASTER LIMITED PARTNERSHIPS — continued | | | | | | | | |

| Energy — continued | | | | | | | | |

| Phillips 66 Partners | | | 56,454 | | | $ | 2,647,693 | |

| Plains All American Pipeline | | | 438,673 | | | | 10,102,639 | |

| Shell Midstream Partners | | | 122,197 | | | | 2,302,192 | |

| Spectra Energy Partners | | | 80,919 | | | | 2,933,314 | |

| TC PipeLines | | | 56,599 | | | | 1,686,084 | |

| Valero Energy Partners | | | 22,946 | | | | 965,338 | |

| Western Gas Partners | | | 99,678 | | | | 4,429,690 | |

| TOTAL MASTER LIMITED PARTNERSHIPS | | | | | | | | |

| (Cost $129,553,162) | | | | | | | 128,059,958 | |

| | | | | | | | | |

SHORT-TERM INVESTMENT(B)(C) — 0.0% | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Cl Institutional, 2.140% | | | | | | | | |

| (Cost $126,814) | | | 126,814 | | | | 126,814 | |

| | | | | | | | | |

REPURCHASE AGREEMENTS(B) — 0.3% | | | | | | | | |

| BNP Paribas | | | | | | | | |

| 2.280%, dated 11/30/18, to be repurchased on 12/03/18, repurchase price $413,578 (collateralized by U.S. Treasury Obligations, ranging in par value $63,940 - $267,118, 1.500%, 12/31/2018, with a total market value of $422,144) | | $ | 413,499 | | | | 413,499 | |

| | | | | | | | | |

| RBC Capital Markets | | | | | | | | |

| 2.250%, dated 11/30/18, to be repurchased on 12/03/18, repurchase price $1,335,842 (collateralized by U.S. Treasury Obligations, ranging in par value $61,779 - $267,118, 2.000% - 3.125%, 5/15/2021 - 8/15/2025, with a total market value of $1,362,211) | | | 1,335,592 | | | | 1,335,592 | |

| | | | – | | | | — | |

| TOTAL REPURCHASE AGREEMENTS | | | | | | | | |

| (Cost $1,749,091) | | | | | | | 1,749,091 | |

| TOTAL INVESTMENTS — 100.1% | | | | | | | | |

| (Cost $578,642,907) | | | | | | $ | 540,779,904 | |

| Percentages are based on Net Assets of $540,380,572. | | | | | | | | |

| * | Non-income producing security. |

| ^ | Canadian security listed on New York Stock Exchange and Toronto Stock Exchange. |

| (A) | This security or a partial position of this security is on loan at November 30, 2018. The total value of securities on loan at November 30, 2018 was $1,816,695. |

| (B) | Security was purchased with cash collateral held from securities on loan. The total value of such securities as of November 30, 2018, was $1,875,905. |

| (C) | The rate reported on the Schedule of Investments is the 7-day effective yield as of November 30, 2018. |

Schedule of Investments | | November 30, 2018 |

| | |

Global X MLP & Energy Infrastructure ETF |

| The following is a summary of the level of inputs used as of November 30, 2018, in valuing the Fund's investments carried at value: |

| Investments in Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stock | | $ | 410,844,041 | | | $ | — | | | $ | — | | | $ | 410,844,041 | |

| Master Limited Partnerships | | | 128,059,958 | | | | — | | | | — | | | | 128,059,958 | |

| Short-Term Investment | | | 126,814 | | | | — | | | | — | | | | 126,814 | |

| Repurchase Agreements | | | — | | | | 1,749,091 | | | | — | | | | 1,749,091 | |

| Total Investments in Securities | | $ | 539,030,813 | | | $ | 1,749,091 | | | $ | — | | | $ | 540,779,904 | |

For the year ended November 30, 2018, there have been no transfers between Level 1, Level 2 or Level 3 investments.

For the year ended November 30, 2018, there were no Level 3 investments.

Amounts designated as “—” are either $0 or have been rounded to $0.

Schedule of Investments | | November 30, 2018 |

| | |

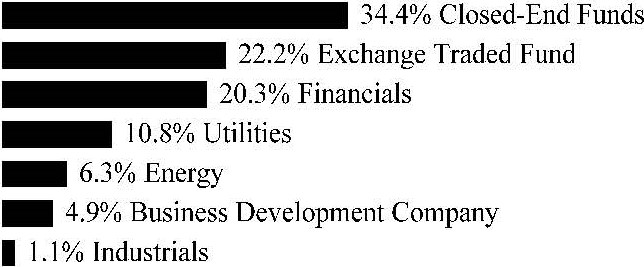

Global X SuperDividend® Alternatives ETF |

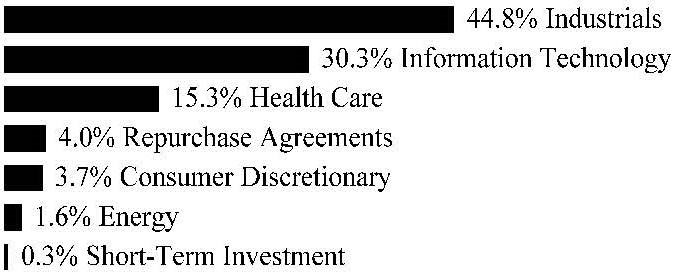

| Sector Weightings (Unaudited)†: |

| † Sector weightings percentages are based on the total market value of investments. |

| | | Shares | | | Value | |

| CLOSED-END FUNDS — 34.3% | | | | | | |

| AllianzGI NFJ Dividend Interest & Premium Strategy Fund | | | 35,625 | | | $ | 433,556 | |

| BlackRock Income Trust | | | 82,766 | | | | 470,110 | |

| Brookfield Real Assets Income Fund | | | 20,419 | | | | 412,260 | |

| Eaton Vance Risk-Managed Diversified Equity Income Fund | | | 47,332 | | | | 442,554 | |

| Eaton Vance Tax Managed Global Buy Write Opportunities Fund | | | 39,148 | | | | 422,015 | |

| Eaton Vance Tax-Managed Buy-Write Opportunities Fund | | | 29,306 | | | | 434,608 | |

| Morgan Stanley Emerging Markets Domestic Debt Fund | | | 69,242 | | | | 440,379 | |

| Nuveen Mortgage Opportunity Term Fund | | | 19,739 | | | | 468,604 | |

| Stone Harbor Emerging Markets Income Fund | | | 36,629 | | | | 441,379 | |

| Templeton Emerging Markets Income Fund | | | 47,410 | | | | 453,714 | |

| Voya Global Equity Dividend and Premium Opportunity Fund | | | 64,877 | | | | 432,730 | |

| Western Asset Emerging Markets Debt Fund | | | 34,985 | | | | 429,966 | |

| Western Asset Mortgage Defined Opportunity Fund | | | 20,476 | | | | 450,882 | |

| TOTAL CLOSED-END FUNDS | | | | | | | | |

| (Cost $6,164,282) | | | | | | | 5,732,757 | |

| | | | | | | | | |

| COMMON STOCK — 29.7% | | | | | | | | |

| Energy — 1.0% | | | | | | | | |

| ONEOK | | | 2,829 | | | | 173,785 | |

| Financials — 20.1% | | | | | | | | |

| Apollo Investment | | | 52,191 | | | | 274,003 | |

| Ares Capital | | | 16,629 | | | | 283,358 | |

| BlackRock Capital Investment | | | 48,128 | | | | 282,030 | |

| BlackRock TCP Capital | | | 20,042 | | | | 288,003 | |

| Hercules Capital | | | 22,014 | | | | 267,690 | |

| Main Street Capital | | | 7,444 | | | | 284,733 | |

| New Mountain Finance | | | 21,032 | | | | 286,246 | |

| PennantPark Floating Rate Capital | | | 21,792 | | | | 280,681 | |

| PennantPark Investment | | | 38,057 | | | | 278,958 | |

| Prospect Capital | | | 38,867 | | | | 266,628 | |

| Solar Capital | | | 13,316 | | | | 282,166 | |

Schedule of Investments | | November 30, 2018 |

| | |

Global X SuperDividend® Alternatives ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Financials — continued | | | | | | | | |

| TPG Specialty Lending | | | 13,926 | | | $ | 282,559 | |

| | | | | | | | 3,357,055 | |

| Utilities — 8.6% | | | | | | | | |

| CenterPoint Energy | | | 6,980 | | | | 195,510 | |

| Dominion Energy | | | 2,759 | | | | 205,545 | |

| Duke Energy | | | 2,429 | | | | 215,137 | |

| Entergy | | | 2,387 | | | | 207,812 | |

| FirstEnergy | | | 5,262 | | | | 199,061 | |

| PPL | | | 6,568 | | | | 200,915 | |

| Southern | | | 4,481 | | | | 212,086 | |

| | | | | | | | 1,436,066 | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $5,041,329) | | | | | | | 4,966,906 | |

| | | | | | | | | |

| EXCHANGE TRADED FUND — 22.1% | | | | | | | | |

Global X SuperDividend® REIT ETF (A) | | | 247,605 | | | | 3,686,838 | |

| TOTAL EXCHANGE TRADED FUNDS | | | | | | | | |

| (Cost $3,690,126) | | | | | | | 3,686,838 | |

| | | | | | | | | |

| MASTER LIMITED PARTNERSHIPS — 8.6% | | | | | | | | |

| Energy — 5.3% | | | | | | | | |

| Alliance Resource Partners | | | 9,493 | | | | 186,537 | |

| Buckeye Partners | | | 5,423 | | | | 160,304 | |

| Holly Energy Partners | | | 6,155 | | | | 173,140 | |

| Sunoco | | | 6,688 | | | | 186,997 | |

| USA Compression Partners | | | 12,002 | | | | 173,549 | |

| | | | | | | | 880,527 | |

| Industrials — 1.1% | | | | | | | | |

| Icahn Enterprises | | | 2,738 | | | | 183,090 | |

| Utilities — 2.2% | | | | | | | | |

| AmeriGas Partners | | | 4,901 | | | | 182,121 | |

| Suburban Propane Partners | | | 8,229 | | | | 192,230 | |

| | | | | | | | 374,351 | |

| TOTAL MASTER LIMITED PARTNERSHIPS | | | | | | | | |

| (Cost $1,437,472) | | | | | | | 1,437,968 | |

| | | | | | | | | |

| BUSINESS DEVELOPMENT COMPANIES — 4.9% | | | | | | | | |

| Goldman Sachs BDC | | | 12,840 | | | | 270,025 | |

| Golub Capital BDC | | | 15,143 | | | | 280,297 | |

| TCG BDC | | | 17,000 | | | | 263,500 | |

Schedule of Investments | | November 30, 2018 |

| | |

Global X SuperDividend® Alternatives ETF |

| | | | | | | Value | |

| BUSINESS DEVELOPMENT COMPANIES — continued | | | | | | | | |

| TOTAL BUSINESS DEVELOPMENT COMPANIES | | | | | | | | |

| (Cost $876,717) | | | | | | $ | 813,822 | |

| | | | | | | | | |

| TOTAL INVESTMENTS — 99.6% | | | | | | | | |

| (Cost $17,209,926) | | | | | | $ | 16,638,291 | |

| Percentages are based on Net Assets of $16,698,169. | | | | | | | | |

| (A) | Affiliated investment. |

BDC — Business Development Companies

ETF — Exchange Traded Fund

REIT — Real Estate Investment Trust

As of November 30, 2018, all of the Fund's investments were considered Level 1, in accordance with authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the year ended November 30, 2018, there have been no transfers between Level 1, Level 2 or Level 3 investments.

The following is a summary of the Fund’s transactions with affiliates for the year ended November 30, 2018:

| Value at 11/30/2017 | | Purchases at Cost | | Proceeds from Sales | | Changes in Unrealized Depreciation | | Realized Gain | | Value at 11/30/2018 | | Dividend Income |

Global X SuperDividend® REIT ETF | | | | | | | | |

| $2,253,799 | | $1,698,944 | | $(153,007) | | $(135,035) | | $22,137 | | $3,686,838 | | $237,818 |

Schedule of Investments | | November 30, 2018 |

| | |

Global X U.S. Preferred ETF |

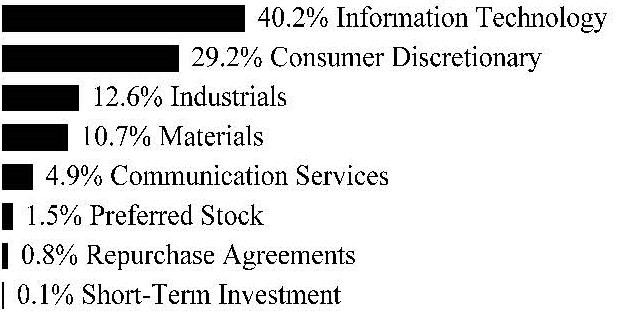

| Sector Weightings (Unaudited)†: |

| † Sector weightings percentages are based on the total market value of investments. |

| | | Shares | | | Value | |

| PREFERRED STOCK — 99.0% | | | | | | |

| BERMUDA— 1.3% | | | | | | |

| Financials — 1.3% | | | | | | |

| Aspen Insurance Holdings, 5.950%, VAR ICE LIBOR USD 3 Month+4.060% | | | 15,796 | | | $ | 381,947 | |

| Aspen Insurance Holdings, 5.625% | | | 14,041 | | | | 306,375 | |

| Enstar Group, 7.000%, VAR ICE LIBOR USD 3 Month+4.015% | | | 22,985 | | | | 571,177 | |

| PartnerRe, 7.250% | | | 16,888 | | | | 434,866 | |

| RenaissanceRe Holdings, 5.750% | | | 14,402 | | | | 328,510 | |

| RenaissanceRe Holdings, 5.375% | | | 15,821 | | | | 347,271 | |

| TOTAL BERMUDA | | | | | | | 2,370,146 | |

| CANADA— 0.4% | | | | | | | | |

| Energy — 0.4% | | | | | | | | |

| Enbridge, 6.375%, VAR ICE LIBOR USD 3 Month+3.593% | | | 34,454 | | | | 801,400 | |

| GERMANY— 1.6% | | | | | | | | |

| Financials — 1.6% | | | | | | | | |

| Deutsche Bank Contingent Capital Trust II, 6.550% | | | 45,917 | | | | 1,051,040 | |

| Deutsche Bank Contingent Capital Trust V, 8.050% | | | 79,456 | | | | 1,958,590 | |

| TOTAL GERMANY | | | | | | | 3,009,630 | |

| NETHERLANDS— 2.6% | | | | | | | | |

| Financials — 2.6% | | | | | | | | |

| Aegon, 6.500% | | | 28,719 | | | | 723,719 | |

| Aegon, 6.375% | | | 57,381 | | | | 1,435,673 | |

| Aegon, 4.000%, VAR ICE LIBOR USD 3 Month+0.875% | | | 14,155 | | | | 293,716 | |

| ING Groep, 6.375% | | | 59,967 | | | | 1,503,373 | |

| ING Groep, 6.125% | | | 40,184 | | | | 1,009,020 | |

| TOTAL NETHERLANDS | | | | | | | 4,965,501 | |

| UNITED KINGDOM— 1.5% | | | | | | | | |

| Financials — 1.5% | | | | | | | | |

| HSBC Holdings, 6.200% | | | 74,870 | | | | 1,902,447 | |

Schedule of Investments | | November 30, 2018 |

| | |

Global X U.S. Preferred ETF |

| | | Shares | | | Value | |

| PREFERRED STOCK — continued | | | | | | | | |

| Financials — continued | | | | | | | | |

| Royal Bank of Scotland Group, Ser S, 6.600% | | | 37,951 | | | $ | 961,299 | |

| TOTAL UNITED KINGDOM | | | | | | | 2,863,746 | |

| UNITED STATES— 91.6% | | | | | | | | |

| Communcation Services — 4.4% | | | | | | | | |

| AT&T, 5.350% | | | 75,875 | | | | 1,708,705 | |

| Iridium Communications, 6.750% | | | 709 | | | | 576,771 | |

| Qwest, 7.000% | | | 13,277 | | | | 325,021 | |

| Qwest, 6.875% | | | 28,723 | | | | 676,427 | |

| Qwest, 6.750% | | | 37,897 | | | | 833,734 | |

| Qwest, 6.625% | | | 22,991 | | | | 518,907 | |

| Qwest, 6.500% | | | 56,096 | | | | 1,164,553 | |

| Qwest, 6.125% | | | 44,488 | | | | 876,414 | |

| United States Cellular, 7.250% | | | 17,237 | | | | 430,925 | |

| United States Cellular, 6.950% | | | 19,670 | | | | 476,407 | |

| Verizon Communications, 5.900% | | | 28,719 | | | | 718,262 | |

| | | | | | | | 8,306,126 | |

| Consumer Discretionary — 0.6% | | | | | | | | |

| eBay, 6.000% | | | 43,062 | | | | 1,082,148 | |

| Energy — 0.9% | | | | | | | | |

| DCP Midstream, 7.875%, VAR ICE LIBOR USD 3 Month+4.919% | | | 9,293 | | | | 210,022 | |

| Nabors Industries, 6.000% | | | 8,272 | | | | 215,072 | |

| NuStar Energy, 9.000%, VAR ICE LIBOR USD 3 Month+6.880% | | | 9,738 | | | | 214,431 | |

| NuStar Energy, 7.625%, VAR ICE LIBOR USD 3 Month+5.643% | | | 22,103 | | | | 428,798 | |

| NuStar Logistics, 9.170%, VAR ICE LIBOR USD 3 Month+6.734% | | | 22,796 | | | | 570,356 | |

| | | | | | | | 1,638,679 | |

| Financials — 61.7% | | | | | | | | |

| Allstate, 6.250% | | | 14,399 | | | | 365,015 | |

| Allstate, 5.625% | | | 33,014 | | | | 798,939 | |

| Allstate, 5.100%, VAR ICE LIBOR USD 3 Month+3.165% | | | 28,720 | | | | 705,651 | |

| Allstate, Ser E, 6.625% | | | 42,915 | | | | 1,087,466 | |

| American Financial Group, 6.000% | | | 8,668 | | | | 219,127 | |

| Apollo Global Management, 6.375% | | | 17,243 | | | | 404,348 | |

| Arch Capital Group, 5.450% | | | 18,961 | | | | 411,454 | |

| Arch Capital Group, 5.250% | | | 25,873 | | | | 546,438 | |

| Ares Management, 7.000% | | | 17,806 | | | | 453,163 | |

| Assurant, 6.500% | | | 4,121 | | | | 432,375 | |

| Axis Capital Holdings, 5.500% | | | 31,602 | | | | 698,088 | |

| Bank of America, 7.250% | | | 4,416 | | | | 5,652,480 | |

| Bank of America, 6.625% | | | 63,112 | | | | 1,596,734 | |

| Bank of America, 6.500% | | | 63,112 | | | | 1,604,307 | |

| Bank of America, 6.200% | | | 63,112 | | | | 1,598,627 | |

| Bank of America, 6.000% | | | 51,649 | | | | 1,291,225 | |

Schedule of Investments | | November 30, 2018 |

| | |

Global X U.S. Preferred ETF |

| | | Shares | | | Value | |

| PREFERRED STOCK — continued | | | | | | | | |

| Financials — continued | | | | | | | | |

| Bank of America, 6.000% | | | 77,456 | | | $ | 1,932,527 | |

| Bank of America, 4.000%, VAR ICE LIBOR USD 3 Month+0.500% | | | 34,640 | | | | 679,983 | |

| Bank of America, 4.000%, VAR ICE LIBOR USD 3 Month+0.750% | | | 22,148 | | | | 451,819 | |

| Bank of America, 4.000%, VAR ICE LIBOR USD 3 Month+0.350% | | | 18,185 | | | | 362,609 | |

| Bank of America, 3.357%, VAR ICE LIBOR USD 3 Month+0.650% | | | 30,238 | | | | 597,200 | |

| Bank of New York Mellon, 5.200% | | | 32,625 | | | | 738,304 | |

| BB&T, 5.850% | | | 33,013 | | | | 815,421 | |

| BB&T, 5.625% | | | 65,994 | | | | 1,568,017 | |

| BB&T, 5.625% | | | 26,719 | | | | 651,944 | |

| BB&T, 5.200% | | | 28,723 | | | | 638,225 | |

| BB&T, 5.200% | | | 25,868 | | | | 574,270 | |

| Capital One Financial, 6.200% | | | 28,720 | | | | 718,574 | |

| Capital One Financial, 6.000% | | | 28,720 | | | | 710,533 | |

| Capital One Financial, 5.200% | | | 34,458 | | | | 749,462 | |

| Capital One Financial, Ser B, 6.000% | | | 50,210 | | | | 1,236,170 | |

| Capital One Financial, Ser C, 6.250% | | | 28,720 | | | | 713,692 | |

| Capital One Financial, Ser D, 6.700% | | | 28,719 | | | | 725,729 | |

| Carlyle Group, 5.875% | | | 22,994 | | | | 479,885 | |

| Charles Schwab, 6.000% | | | 34,451 | | | | 869,543 | |

| Charles Schwab, 5.950% | | | 43,060 | | | | 1,084,251 | |

| Citigroup, 6.875%, VAR ICE LIBOR USD 3 Month+4.130% | | | 85,747 | | | | 2,233,709 | |

| Citigroup, 6.300% | | | 51,648 | | | | 1,304,628 | |

| Citigroup, Ser J, 7.125%, VAR ICE LIBOR USD 3 Month+4.040% | | | 54,524 | | | | 1,458,517 | |

| Citigroup, Ser L, 6.875% | | | 27,573 | | | | 694,840 | |

| Citigroup Capital XIII, 8.890%, VAR ICE LIBOR USD 3 Month+6.370% | | | 128,803 | | | | 3,393,959 | |

| Fifth Third Bancorp, 6.625%, VAR ICE LIBOR USD 3 Month+3.710% | | | 25,861 | | | | 682,213 | |

| First Republic Bank, 5.500% | | | 17,257 | | | | 392,597 | |

| First Republic Bank, 5.500% | | | 10,768 | | | | 250,571 | |

| GMAC Capital Trust I, Ser 2, 8.401%, VAR ICE LIBOR USD 3 Month+5.785% | | | 156,490 | | | | 3,990,495 | |

| Goldman Sachs Group, 6.375%, VAR ICE LIBOR USD 3 Month+3.550% | | | 40,182 | | | | 1,016,605 | |

| Goldman Sachs Group, 6.300% | | | 38,744 | | | | 981,386 | |

| Goldman Sachs Group, 5.500%, VAR ICE LIBOR USD 3 Month+3.640% | | | 57,381 | | | | 1,384,030 | |

| Goldman Sachs Group, 4.000%, VAR ICE LIBOR USD 3 Month+0.670% | | | 42,412 | | | | 822,793 | |

| Goldman Sachs Group, 3.750%, VAR ICE LIBOR USD 3 Month+0.750% | | | 42,365 | | | | 813,408 | |

| Hartford Financial Services Group, 7.875%, VAR ICE LIBOR USD 3 Month+5.596% | | | 34,447 | | | | 945,570 | |

| Huntington Bancshares, 6.250% | | | 34,451 | | | | 871,266 | |

| JPMorgan Chase, 6.300% | | | 50,501 | | | | 1,279,695 | |

| JPMorgan Chase, 6.150% | | | 65,991 | | | | 1,666,273 | |

| JPMorgan Chase, 6.125% | | | 82,042 | | | | 2,062,536 | |

| JPMorgan Chase, 6.100% | | | 81,748 | | | | 2,073,129 | |

| JPMorgan Chase, 5.450% | | | 51,649 | | | | 1,259,203 | |

| JPMorgan Chase, Ser T, 6.700% | | | 53,087 | | | | 1,345,225 | |

Schedule of Investments | | November 30, 2018 |

| | |

Global X U.S. Preferred ETF |

| | | Shares | | | Value | |

| PREFERRED STOCK — continued | | | | | | | | |

| Financials — continued | | | | | | | | |

| KeyCorp, 6.125%, VAR ICE LIBOR USD 3 Month+3.892% | | | 28,718 | | | $ | 721,683 | |

| KKR, 6.750% | | | 19,837 | | | | 508,224 | |

| Legg Mason, 5.450% | | | 28,725 | | | | 632,237 | |

| MB Financial, 6.000% | | | 11,291 | | | | 273,129 | |

| MetLife, 5.625% | | | 46,211 | | | | 1,114,609 | |

| MetLife, 4.000%, VAR ICE LIBOR USD 3 Month+1.000% | | | 34,456 | | | | 756,998 | |

| Morgan Stanley, 6.375%, VAR ICE LIBOR USD 3 Month+3.708% | | | 57,379 | | | | 1,463,738 | |

| Morgan Stanley, 5.850%, VAR ICE LIBOR USD 3 Month+3.491% | | | 57,381 | | | | 1,415,589 | |

| Morgan Stanley, 4.000%, VAR ICE LIBOR USD 3 Month+0.700% | | | 63,123 | | | | 1,259,935 | |

| Morgan Stanley, Ser E, 7.125%, VAR ICE LIBOR USD 3 Month+4.320% | | | 49,498 | | | | 1,331,496 | |

| Morgan Stanley, Ser F, 6.875%, VAR ICE LIBOR USD 3 Month+3.940% | | | 48,790 | | | | 1,276,346 | |

| Morgan Stanley, Ser G, 6.625% | | | 28,719 | | | | 732,909 | |

| New York Community Bancorp, 6.375%, VAR ICE LIBOR USD 3 Month+3.821% | | | 29,573 | | | | 719,511 | |

| New York Community Capital Trust V, 6.000% | | | 4,073 | | | | 189,476 | |

| Northern Trust, 5.850% | | | 22,985 | | | | 578,073 | |

| Oaktree Capital Group, 6.625% | | | 10,376 | | | | 252,033 | |

| People's United Financial, 5.625%, VAR ICE LIBOR USD 3 Month+4.020% | | | 14,041 | | | | 336,422 | |

| PNC Financial Services Group, 6.125%, VAR ICE LIBOR USD 3 Month+4.067% | | | 86,042 | | | | 2,240,534 | |

| PNC Financial Services Group, 5.375% | | | 25,866 | | | | 606,558 | |

| Prospect Capital, 6.250% | | | 11,487 | | | | 283,499 | |

| Prudential Financial, 5.750% | | | 33,013 | | | | 788,681 | |

| Prudential Financial, 5.700% | | | 40,770 | | | | 966,249 | |

Ready Capital, 7.000%‡ | | | 6,503 | | | | 163,128 | |

| Regions Financial, Ser A, 6.375% | | | 28,720 | | | | 714,841 | |

| Regions Financial, Ser B, 6.375%, VAR ICE LIBOR USD 3 Month+3.536% | | | 28,717 | | | | 726,540 | |

| Reinsurance Group of America, 6.200%, VAR ICE LIBOR USD 3 Month+4.370% | | | 22,983 | | | | 582,159 | |

| Reinsurance Group of America, 5.750%, VAR ICE LIBOR USD 3 Month+4.040% | | | 22,986 | | | | 556,031 | |

| SLM, 4.034%, VAR ICE LIBOR USD 3 Month+1.700% | | | 5,615 | | | | 369,467 | |

| State Street, 6.000% | | | 43,061 | | | | 1,070,066 | |

| State Street, 5.900%, VAR ICE LIBOR USD 3 Month+3.108% | | | 43,060 | | | | 1,095,877 | |

| State Street, 5.350%, VAR ICE LIBOR USD 3 Month+3.709% | | | 28,720 | | | | 697,896 | |

| State Street, 5.250% | | | 28,724 | | | | 646,865 | |

| Stifel Financial, 5.200% | | | 12,684 | | | | 266,871 | |

| SunTrust Banks, 4.000%, VAR ICE LIBOR USD 3 Month+0.530% | | | 9,944 | | | | 199,874 | |

| Synovus Financial, 6.300%, VAR ICE LIBOR USD 3 Month+3.352% | | | 11,521 | | | | 287,449 | |

| TCF Financial, 5.700% | | | 9,897 | | | | 224,761 | |

| Torchmark, 6.125% | | | 17,239 | | | | 430,975 | |

| Unum Group, 6.250% | | | 17,254 | | | | 412,543 | |

| US Bancorp, 6.500%, VAR ICE LIBOR USD 3 Month+4.468% | | | 63,110 | | | | 1,662,948 | |

Schedule of Investments | | November 30, 2018 |

| | |

Global X U.S. Preferred ETF |

| | | Shares | | | Value | |

| PREFERRED STOCK — continued | | | | | | | | |

| Financials — continued | | | | | | | | |

| US Bancorp, 4.500% | | | 28,724 | | | $ | 641,981 | |

| US Bancorp, 3.500%, VAR ICE LIBOR USD 3 Month+0.600% | | | 57,393 | | | | 1,117,442 | |

| Webster Financial, 5.250% | | | 8,462 | | | | 182,356 | |

| Wells Fargo, 7.500% | | | 5,429 | | | | 6,860,899 | |

| Wells Fargo, 6.625%, VAR ICE LIBOR USD 3 Month+3.690% | | | 46,061 | | | | 1,202,653 | |

| Wells Fargo, 6.000% | | | 43,882 | | | | 1,093,539 | |

| Wells Fargo, 6.000% | | | 54,814 | | | | 1,368,157 | |

| Wells Fargo, 5.850%, VAR ICE LIBOR USD 3 Month+3.090% | | | 94,536 | | | | 2,346,384 | |

| Wells Fargo, 5.700% | | | 54,815 | | | | 1,334,745 | |

| Wells Fargo, 5.625% | | | 37,854 | | | | 914,553 | |

| Wells Fargo, 5.500% | | | 63,053 | | | | 1,491,834 | |

| Wells Fargo, 5.250% | | | 34,292 | | | | 769,855 | |

| Wells Fargo, 5.200% | | | 41,144 | | | | 911,340 | |

| Wells Fargo, 5.125% | | | 35,653 | | | | 785,436 | |

Wells Fargo Real Estate Investment, 6.375%‡ | | | 15,119 | | | | 380,394 | |

| WR Berkley, 5.750% | | | 16,686 | | | | 374,601 | |

| WR Berkley, 5.700% | | | 10,673 | | | | 238,648 | |

| WR Berkley, 5.625% | | | 20,138 | | | | 446,862 | |

| | | | | | | | 116,104,142 | |

| Health Care — 2.4% | | | | | | | | |

| Becton Dickinson, 6.125% | | | 70,962 | | | | 4,482,669 | |

| Industrials — 2.8% | | | | | | | | |

| Fortive, 5.000% | | | 1,977 | | | | 1,940,920 | |

| Pitney Bowes, 6.700% | | | 24,432 | | | | 536,771 | |

| Rexnord, 5.750% | | | 11,554 | | | | 688,965 | |

| Stanley Black & Decker, 5.750% | | | 43,062 | | | | 1,051,574 | |

| Stanley Black & Decker, 5.375% | | | 10,773 | | | | 1,055,754 | |

| | | | | | | | 5,273,984 | |

| Real Estate — 9.8% | | | | | | | | |

American Homes 4 Rent, 5.875%‡ | | | 6,520 | | | | 140,180 | |

CBL & Associates Properties, 6.625%‡ | | | 9,733 | | | | 127,308 | |

CBL & Associates Properties, Ser D, 7.375%‡ | | | 26,060 | | | | 370,573 | |

Crown Castle International, 6.875%‡ | | | 2,880 | | | | 3,116,782 | |

Digital Realty Trust, 6.350%‡ | | | 14,042 | | | | 373,798 | |

Digital Realty Trust, 5.875%‡ | | | 14,156 | | | | 343,283 | |

Digital Realty Trust, 5.250%‡ | | | 11,311 | | | | 240,698 | |

Digital Realty Trust, Ser H, 7.375%‡ | | | 20,985 | | | | 534,908 | |

EPR Properties, 5.750%‡ | | | 8,461 | | | | 180,219 | |

Federal Realty Investment Trust, 5.000%‡ | | | 8,479 | | | | 176,278 | |

Government Properties Income Trust, 5.875%‡ | | | 17,813 | | | | 371,757 | |

Kimco Realty, 5.625%‡ | | | 9,807 | | | | 209,772 | |

Kimco Realty, 5.250%‡ | | | 14,945 | | | | 295,164 | |

Kimco Realty, 5.125%‡ | | | 12,707 | | | | 247,278 | |

Schedule of Investments | | November 30, 2018 |

| | |

Global X U.S. Preferred ETF |

| | | Shares | | | Value | |

| PREFERRED STOCK — continued | | | | | | | | |

| Real Estate — continued | | | | | | | | |

National Retail Properties, 5.700%‡ | | | 16,539 | | | $ | 378,909 | |

National Retail Properties, 5.200%‡ | | | 19,813 | | | | 421,621 | |

PS Business Parks, 5.250%‡ | | | 12,916 | | | | 270,203 | |

PS Business Parks, 5.200%‡ | | | 11,290 | | | | 234,493 | |

Public Storage, 6.375%‡ | | | 16,385 | | | | 414,541 | |

Public Storage, 6.000%‡ | | | 16,534 | | | | 416,657 | |

Public Storage, 5.875%‡ | | | 10,768 | | | | 269,846 | |

Public Storage, 5.400%�� | | | 17,240 | | | | 394,106 | |

Public Storage, 5.375%‡ | | | 28,432 | | | | 638,583 | |

Public Storage, 5.200%‡ | | | 28,726 | | | | 627,089 | |

Public Storage, 5.150%‡ | | | 16,098 | | | | 348,844 | |

Public Storage, 5.125%‡ | | | 11,291 | | | | 246,144 | |

Public Storage, 5.050%‡ | | | 17,243 | | | | 376,760 | |

Public Storage, 4.950%‡ | | | 18,666 | | | | 390,866 | |

Public Storage, 4.900%‡ | | | 20,108 | | | | 417,040 | |

QTS Realty Trust, 7.125%‡ | | | 5,975 | | | | 147,762 | |

QTS Realty Trust, 6.500%‡ | | | 4,556 | | | | 462,388 | |

RLJ Lodging Trust, 1.950%‡ | | | 18,521 | | | | 469,507 | |

Senior Housing Properties Trust, 5.625%‡ | | | 20,139 | | | | 405,398 | |

SITE Centers, 6.500%‡ | | | 11,526 | | | | 265,098 | |

Spirit Realty Capital, 6.000%‡ | | | 9,737 | | | | 214,311 | |

VEREIT, Ser F, 6.700%‡ | | | 61,449 | | | | 1,482,764 | |

Vornado Realty Trust, 5.700%‡ | | | 17,241 | | | | 385,681 | |

Vornado Realty Trust, 5.400%‡ | | | 17,245 | | | | 375,596 | |

Vornado Realty Trust, 5.250%‡ | | | 18,369 | | | | 378,952 | |

Welltower, 6.500%‡ | | | 20,623 | | | | 1,345,651 | |

| | | | | | | | 18,506,808 | |

| Utilities — 9.0% | | | | | | | | |

| Alabama Power, 5.000% | | | 14,156 | | | | 347,530 | |

| CMS Energy, 5.625% | | | 11,225 | | | | 256,267 | |

| Dominion Energy, 5.250% | | | 45,922 | | | | 998,344 | |

| DTE Energy, 6.500% | | | 19,372 | | | | 1,061,779 | |

| DTE Energy, 5.375% | | | 17,245 | | | | 380,080 | |

| DTE Energy, 5.250% | | | 22,992 | | | | 490,879 | |

| Duke Energy, 5.125% | | | 28,725 | | | | 651,770 | |

| Energy Transfer Operating, 7.375%, VAR ICE LIBOR USD 3 Month+4.530% | | | 25,865 | | | | 581,962 | |

| Entergy Arkansas, 4.875% | | | 23,581 | | | | 519,254 | |

| Entergy Louisiana, 4.875% | | | 15,171 | | | | 327,845 | |

| Entergy Mississippi, 4.900% | | | 14,971 | | | | 325,619 | |

| Entergy New Orleans, 5.500% | | | 6,216 | | | | 156,643 | |

| Georgia Power, 5.000% | | | 15,171 | | | | 318,591 | |

| NextEra Energy Capital Holdings, 5.250% | | | 32,748 | | | | 745,344 | |

Schedule of Investments | | November 30, 2018 |

| | |

Global X U.S. Preferred ETF |

| | | Shares | | | Value | |

| PREFERRED STOCK — continued | | | | | | | | |

| Utilities — continued | | | | | | | | |

| NextEra Energy Capital Holdings, 5.125% | | | 28,726 | | | $ | 628,238 | |

| NextEra Energy Capital Holdings, 5.000% | | | 25,873 | | | | 550,577 | |

Pacific Gas & Electric, 6.000%* | | | 5,939 | | | | 128,342 | |

| PPL Capital Funding, Ser B, 5.900% | | | 25,866 | | | | 633,717 | |

| SCE Trust II, 5.100% | | | 22,996 | | | | 439,224 | |

| SCE Trust IV, 5.375%, VAR ICE LIBOR USD 3 Month+3.132% | | | 18,661 | | | | 386,656 | |

| SCE Trust V, 5.450%, VAR ICE LIBOR USD 3 Month+3.790% | | | 17,240 | | | | 378,935 | |

| SCE Trust VI, 5.000% | | | 27,291 | | | | 506,794 | |

| Sempra Energy, 6.000% | | | 24,736 | | | | 2,508,973 | |

| Southern, 6.250% | | | 57,380 | | | | 1,448,845 | |

| Southern, 5.250% | | | 25,871 | | | | 554,416 | |

| Southern, 5.250% | | | 45,923 | | | | 990,559 | |

| Tennessee Valley Authority, 3.550%, VAR US Treas Yield Curve Rate T Note Const Mat 30 Yr+0.940% | | | 15,111 | | | | 375,508 | |

| Tennessee Valley Authority, 3.360%, VAR US Treas Yield Curve Rate T Note Const Mat 30 Yr+0.840% | | | 13,040 | | | | 317,394 | |

| | | | | | | | 17,010,085 | |

| TOTAL UNITED STATES | | | | | | | 172,404,641 | |

| TOTAL PREFERRED STOCK | | | | | | | | |

| (Cost $195,725,768) | | | | | | | 186,415,064 | |

| | | | | | | | | |

| MASTER LIMITED PARTNERSHIPS — 0.3% | | | | | | | | |

| Energy — 0.1% | | | | | | | | |

| NuStar Energy, 8.500% | | | 12,808 | | | | 275,756 | |

| Financials — 0.2% | | | | | | | | |

| Apollo Global Management, 6.375% | | | 15,797 | | | | 366,017 | |

| TOTAL MASTER LIMITED PARTNERSHIP | | | | | | | | |

| (Cost $648,207) | | | | | | | 641,773 | |

| TOTAL INVESTMENTS — 99.3% | | | | | | | | |

| (Cost $196,373,975) | | | | | | $ | 187,056,837 | |

| Percentages are based on Net Assets of $188,314,440 | | | | | |

| * | Non-income producing security. |

| ‡ | Real Estate Investment Trust |

ICE — Intercontinental Exchange

LIBOR — London Interbank Offered Rate

Ser — Series

USD — U.S. DollarVAR – Variable Rate

As of November 30, 2018, all of the Fund's investments were considered Level 1, in accordance with authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the year ended November 30, 2018, there have been no transfers between Level 1, Level 2 or Level 3 investments.

Schedule of Investments | | November 30, 2018 |

| | |

Global X S&P 500® Quality Dividend ETF |

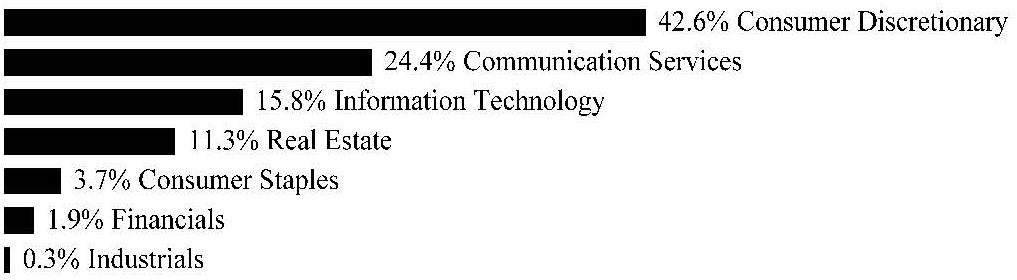

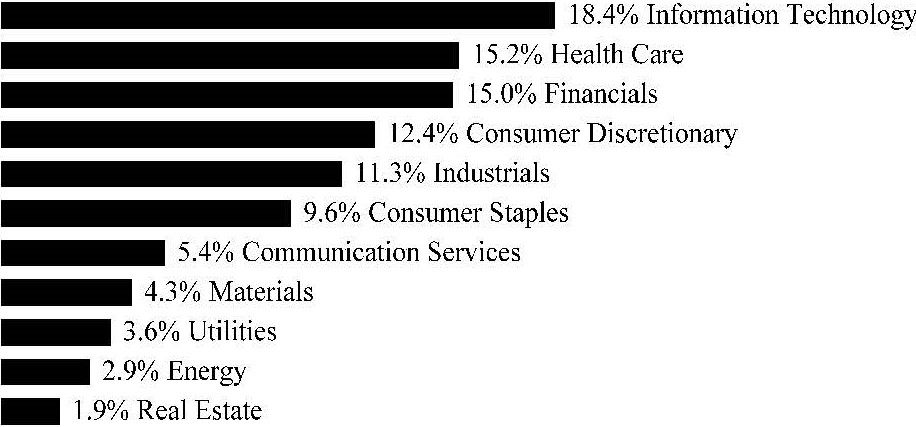

| Sector Weightings (Unaudited)†: |

| † Sector weightings percentages are based on the total market value of investments. |

| | | Shares | | | Value | |

| COMMON STOCK — 99.6% | | | | | | |

| Communication Services — 8.4% | | | | | | |

| AT&T | | | 931 | | | $ | 29,084 | |

| Comcast, Cl A | | | 981 | | | | 38,270 | |

| Interpublic Group | | | 1,362 | | | | 32,007 | |

| Omnicom Group | | | 426 | | | | 32,789 | |

| Verizon Communications | | | 640 | | | | 38,592 | |

| Viacom, Cl B | | | 1,128 | | | | 34,810 | |

| | | | | | | | 205,552 | |

| Consumer Discretionary — 15.7% | | | | | | | | |

| Best Buy | | | 436 | | | | 28,161 | |

| Carnival | | | 517 | | | | 31,170 | |

| Foot Locker | | | 526 | | | | 29,667 | |

| Gap | | | 993 | | | | 27,099 | |

| Garmin | | | 509 | | | | 33,930 | |

| Hasbro | | | 349 | | | | 31,759 | |

| Kohl's | | | 405 | | | | 27,204 | |

| Macy's | | | 778 | | | | 26,623 | |

| Nordstrom | | | 600 | | | | 31,721 | |

| Royal Caribbean Cruises | | | 304 | | | | 34,373 | |

| Tapestry | | | 681 | | | | 26,511 | |

| Target | | | 404 | | | | 28,668 | |

| VF | | | 376 | | | | 30,565 | |

| | | | | | | | 387,451 | |

| Consumer Staples — 15.4% | | | | | | | | |

| Altria Group | | | 546 | | | | 29,937 | |

| Campbell Soup | | | 925 | | | | 36,260 | |

| Clorox | | | 248 | | | | 41,074 | |

| Conagra Brands | | | 822 | | | | 26,583 | |

| General Mills | | | 734 | | | | 31,056 | |

Schedule of Investments | | November 30, 2018 |

| | |

Global X S&P 500® Quality Dividend ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Consumer Staples — continued | | | | | | | | |

| Hershey | | | 343 | | | $ | 37,147 | |

| JM Smucker | | | 307 | | | | 32,085 | |

| Kraft Heinz | | | 530 | | | | 27,094 | |

| Procter & Gamble | | | 408 | | | | 38,560 | |

| Walgreens Boots Alliance | | | 497 | | | | 42,081 | |

| Walmart | | | 373 | | | | 36,423 | |

| | | | | | | | 378,300 | |

| Energy — 8.4% | | | | | | | | |

| Chevron | | | 246 | | | | 29,259 | |

| Exxon Mobil | | | 377 | | | | 29,971 | |

| Helmerich & Payne | | | 482 | | | | 29,209 | |

| Marathon Petroleum | | | 399 | | | | 25,999 | |

| Occidental Petroleum | | | 369 | | | | 25,930 | |

| Phillips 66 | | | 266 | | | | 24,876 | |

| Schlumberger | | | 446 | | | | 20,115 | |

| Valero Energy | | | 263 | | | | 21,014 | |

| | | | | | | | 206,373 | |

| Financials — 10.5% | | | | | | | | |

| Ameriprise Financial | | | 218 | | | | 28,285 | |

| Assurant | | | 316 | | | | 30,728 | |

| BlackRock, Cl A | | | 57 | | | | 24,397 | |

| Chubb | | | 236 | | | | 31,562 | |

| Everest Re Group | | | 137 | | | | 30,425 | |

| SunTrust Banks | | | 440 | | | | 27,584 | |

| T Rowe Price Group | | | 246 | | | | 24,443 | |

| Travelers | | | 240 | | | | 31,288 | |

| Unum Group | | | 801 | | | | 28,764 | |

| | | | | | | | 257,476 | |

| Health Care — 7.8% | | | | | | | | |

| Bristol-Myers Squibb | | | 584 | | | | 31,221 | |

| Eli Lilly | | | 366 | | | | 43,421 | |

| Johnson & Johnson | | | 254 | | | | 37,313 | |

| Merck | | | 503 | | | | 39,908 | |

| Pfizer | | | 859 | | | | 39,712 | |

| | | | | | | | 191,575 | |

| Industrials — 11.7% | | | | | | | | |

| 3M | | | 153 | | | | 31,812 | |

| Dover | | | 399 | | | | 33,870 | |

| Eaton | | | 386 | | | | 29,699 | |

| Emerson Electric | | | 431 | | | | 29,101 | |

| Fastenal | | | 596 | | | | 35,319 | |

| Illinois Tool Works | | | 210 | | | | 29,201 | |

Schedule of Investments | | November 30, 2018 |

| | |

Global X S&P 500® Quality Dividend ETF |

| | | Shares | | | Value | |

| COMMON STOCK — continued | | | | | | | | |

| Industrials — continued | | | | | | | | |

| Johnson Controls International | | | 897 | | | $ | 31,198 | |

| Snap-On | | | 198 | | | | 32,915 | |

| Waste Management | | | 377 | | | | 35,344 | |

| | | | | | | | 288,459 | |

| Information Technology — 10.5% | | | | | | | | |

| Broadcom | | | 122 | | | | 28,964 | |

| Hewlett Packard Enterprise | | | 1,968 | | | | 29,520 | |

| Intel | | | 564 | | | | 27,811 | |

| Juniper Networks | | | 1,128 | | | | 32,385 | |

| KLA-Tencor | | | 272 | | | | 26,808 | |

| Paychex | | | 462 | | | | 32,691 | |

| QUALCOMM | | | 523 | | | | 30,470 | |

| Seagate Technology | | | 554 | | | | 23,872 | |

| Texas Instruments | | | 268 | | | | 26,760 | |

| | | | | | | | 259,281 | |

| Materials — 4.2% | | | | | | | | |

| Air Products & Chemicals | | | 187 | | | | 30,083 | |

| International Paper | | | 528 | | | | 24,388 | |

| LyondellBasell Industries, Cl A | | | 267 | | | | 24,914 | |

| Westrock | | | 508 | | | | 23,932 | |

| | | | | | | | 103,317 | |

| Real Estate — 7.0% | | | | | | | | |

Duke Realty ‡ | | | 1,097 | | | | 31,221 | |

Host Hotels & Resorts ‡ | | | 1,404 | | | | 26,676 | |

ProLogis ‡ | | | 478 | | | | 32,189 | |

Public Storage ‡ | | | 144 | | | | 30,709 | |

SL Green Realty ‡ | | | 320 | | | | 30,854 | |

Weyerhaeuser ‡ | | | 814 | | | | 21,498 | |

| | | | | | | | 173,147 | |

| | | | | | | | | |

| TOTAL COMMON STOCK | | | | | | | | |

| (Cost $2,494,800) | | | | | | | 2,450,931 | |

| TOTAL INVESTMENTS — 99.6% | | | | | | | | |

| (Cost $2,494,800) | | | | | | $ | 2,450,931 | |

| Percentages are based on Net Assets of $2,459,691 | | | | | | | | |

| ‡ | Real Estate Investment Trust |

As of November 30, 2018, all of the Fund's investments were considered Level 1, in accordance with authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the year ended November 30, 2018, there have been no transfers between Level 1, Level 2 or Level 3 investments.

Schedule of Investments | | November 30, 2018 |

| | |

Global X TargetIncomeTM 5 ETF |

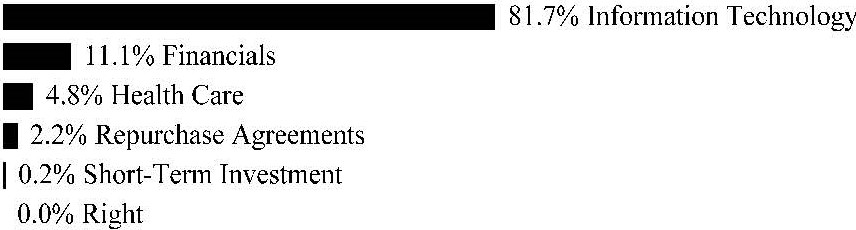

| Sector Weightings (Unaudited)†: |

| † Sector weightings percentages are based on the total market value of investments. |

| | | Shares | | | Value | |

| EXCHANGE TRADED FUNDS — 99.8% | | | | | | |

Global X SuperDividend® ETF (A) | | | 23,969 | | | $ | 459,486 | |

Global X SuperDividend® U.S. ETF (A) | | | 14,739 | | | | 360,810 | |

Global X U.S. Preferred ETF (A) | | | 20,120 | | | | 462,559 | |

| SPDR Blackstone | | | 2,618 | | | | 121,580 | |

| VanEck Vectors J.P. Morgan EM Local Currency Bond ETF | | | 15,352 | | | | 505,848 | |

| Xtrackers USD High Yield Corporate Bond ETF | | | 9,965 | | | | 481,210 | |

| | | | | | | | | |

| TOTAL EXCHANGE TRADED FUNDS | | | | | | | | |

| (Cost $2,510,151) | | | | | | | 2,391,493 | |

| TOTAL INVESTMENTS — 99.8% | | | | | | | | |

| (Cost $2,510,151) | | | | | | $ | 2,391,493 | |

| Percentages are based on Net Assets of $2,395,433 | | | | | | | | |

| (A) | Affiliated investment. |

| ETF — Exchange Traded Fund |

| SPDR — Standard & Poor’s Depositary Receipts |

| USD — U.S. Dollar |

As of November 30, 2018, all of the Fund's investments were considered Level 1, in accordance with authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the period ended November 30, 2018, there have been no transfers between Level 1, Level 2 or Level 3 investments.

The following is a summary of the transactions with affiliates for the period ended November 30, 2018:

| Value at 11/30/2017 | | Purchases at Cost | | Proceeds from Sales | | Changes in Unrealized Depreciation | | Realized Loss | | Value at 11/30/2018 | | Dividend Income |

Global X SuperDividend® ETF | | | | | | | | |

| $- | | $500,882 | | $ (1,571) | | $ (39,789) | | $ (36) | | $459,486 | | $12,030 |

Global X SuperDividend® U.S. ETF | | | | | | | | |

| - | | 371,309 | | - | | (10,499) | | - | | 360,810 | | 5,922 |

| Global X U.S. Preferred ETF | | | | | | | | |

| - | | 489,749 | | - | | (27,190) | | - | | 462,559 | | 7,064 |

| Totals: | | | | | | | | |

| $- | | $1,361,940 | | $(1,571) | | $(77,478) | | $(36) | | $1,282,855 | | $25,016 |

Schedule of Investments | | November 30, 2018 |

| | |

Global X TargetIncomeTM Plus 2 ETF |

| Sector Weightings (Unaudited)†: |

| † Sector weightings percentages are based on the total market value of investments. |

| | | Shares | | | Value | |

| EXCHANGE TRADED FUNDS — 99.9% | | | | | | |

Global X SuperDividend® ETF (A) | | | 23,976 | | | $ | 459,620 | |

Global X SuperDividend® U.S. ETF (A) | | | 4,904 | | | | 120,050 | |

Global X U.S. Preferred ETF (A) | | | 20,126 | | | | 462,697 | |

| SPDR Blackstone | | | 7,874 | | | | 365,668 | |

| VanEck Vectors J.P. Morgan EM Local Currency Bond ETF | | | 15,356 | | | | 505,980 | |

| Xtrackers USD High Yield Corporate Bond ETF | | | 9,968 | | | | 481,355 | |

| | | | | | | | | |

| TOTAL EXCHANGE TRADED FUND | | | | | | | | |

| (Cost $2,509,493) | | | | | | | 2,395,370 | |

| TOTAL INVESTMENTS — 99.9% | | | | | | | | |

| (Cost $2,509,493) | | | | | | $ | 2,395,370 | |

| Percentages are based on Net Assets of $2,398,545 | | | | | | | | |

| (A) | Affiliated investment. |

| ETF — Exchange Traded Fund |

| SPDR — Standard & Poor’s Depositary Receipts |

| USD — U.S. Dollar |

As of November 30, 2018, all of the Fund's investments were considered Level 1, in accordance with authoritative guidance on fair value measurements and disclosure under U.S. GAAP.

For the period ended November 30, 2018, there have been no transfers between Level 1, Level 2 or Level 3 investments.

The following is a summary of the transactions with affiliates for the period ended November 30, 2018:

| Value at 11/30/2017 | | Purchases at Cost | | Proceeds from Sales | | Changes in Unrealized Depreciation | | Realized Gain | | Value at 11/30/2018 | | Dividend Income |

Global X SuperDividend® ETF | | | | | | | | |

| $- | | $496,902 | | $- | | $(37,282) | | $- | | $459,620 | | $10,563 |

Global X SuperDividend® U.S. ETF | | | | | | | | |

| - | | 255,101 | | (131,980) | | (3,121) | | 50 | | 120,050 | | 3,482 |

| Global X U.S. Preferred ETF | | | | | | | | |

| - | | 491,471 | | - | | (28,774) | | - | | 462,697 | | 8,268 |

| Totals: | | | | | | | | |

| $- | | $1,243,474 | | $(131,980) | | $(69,177) | | $50 | | $1,042,367 | | $22,313 |

Schedule of Investments | | November 30, 2018 |

| | |

Global X Adaptive U.S. Factor ETF |

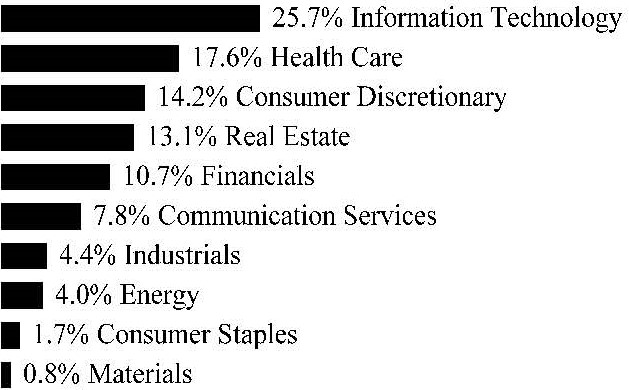

| Sector Weightings (Unaudited)†: |

| † Sector weightings percentages are based on the total market value of investments. |

| | | Shares | | | Value | |

| COMMON STOCK — 99.8% | | | | | | |

| Communication Services — 6.1% | | | | | | |