Exhibit (c)(4)

NOTE: A request for confidential treatment has been made with respect to portions of the following document that are marked ***. The redacted portions have been submitted separately with the Securities and Exchange Commission.

Project Pelican Discussion Materials March 27, 2017

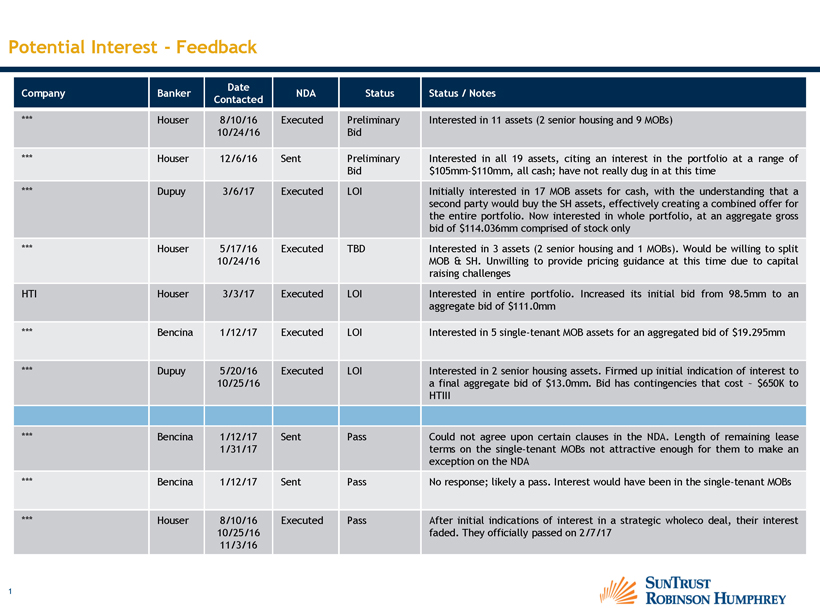

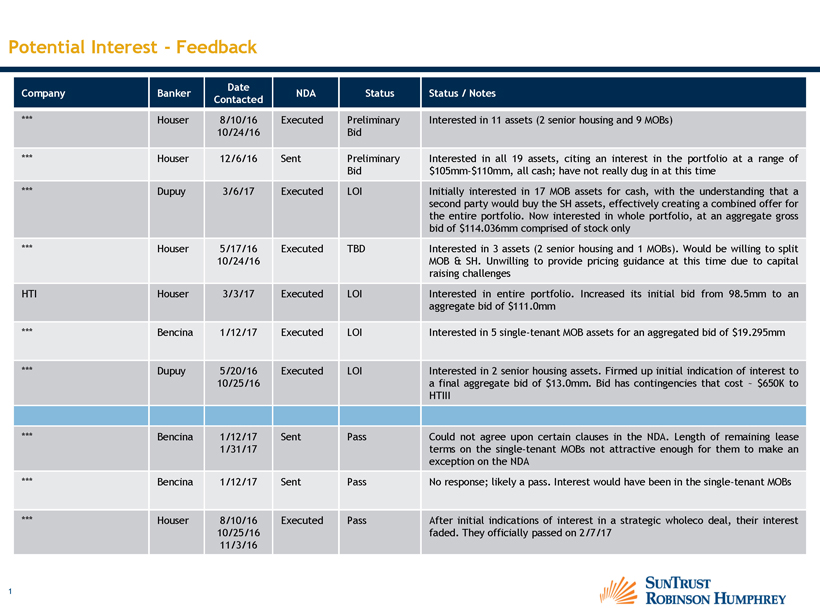

Potential Interest - Feedback Date Company Banker NDA Status Status / Notes Contacted *** Houser 8/10/16 Executed Preliminary Interested in 11 assets (2 senior housing and 9 MOBs) 10/24/16 Bid *** Houser 12/6/16 Sent Preliminary Interested in all 19 assets, citing an interest in the portfolio at a range of Bid $105mm-$110mm, all cash; have not really dug in at this time *** Dupuy 3/6/17 Executed LOI Initially interested in 17 MOB assets for cash, with the understanding that a second party would buy the SH assets, effectively creating a combined offer for the entire portfolio. Now interested in whole portfolio, at an aggregate gross bid of $114.036mm comprised of stock only *** Houser 5/17/16 Executed TBD Interested in 3 assets (2 senior housing and 1 MOBs). Would be willing to split 10/24/16 MOB & SH. Unwilling to provide pricing guidance at this time due to capital raising challenges HTI Houser 3/3/17 Executed LOI Interested in entire portfolio. Increased its initial bid from 98.5mm to an aggregate bid of $111.0mm *** Bencina 1/12/17 Executed LOI Interested in 5 single-tenant MOB assets for an aggregated bid of $19.295mm *** Dupuy 5/20/16 Executed LOI Interested in 2 senior housing assets. Firmed up initial indication of interest to 10/25/16 a final aggregate bid of $13.0mm. Bid has contingencies that cost ~ $650K to HTIII *** Bencina 1/12/17 Sent Pass Could not agree upon certain clauses in the NDA. Length of remaining lease 1/31/17 terms on the single-tenant MOBs not attractive enough for them to make an exception on the NDA *** Bencina 1/12/17 Sent Pass No response; likely a pass. Interest would have been in the single-tenant MOBs *** Houser 8/10/16 Executed Pass After initial indications of interest in a strategic wholeco deal, their interest 10/25/16 faded. They officially passed on 2/7/17 11/3/16

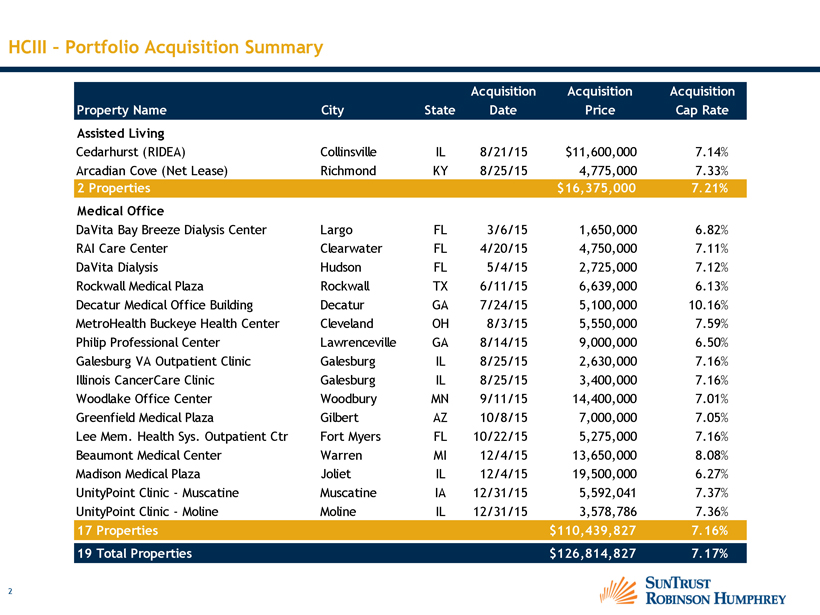

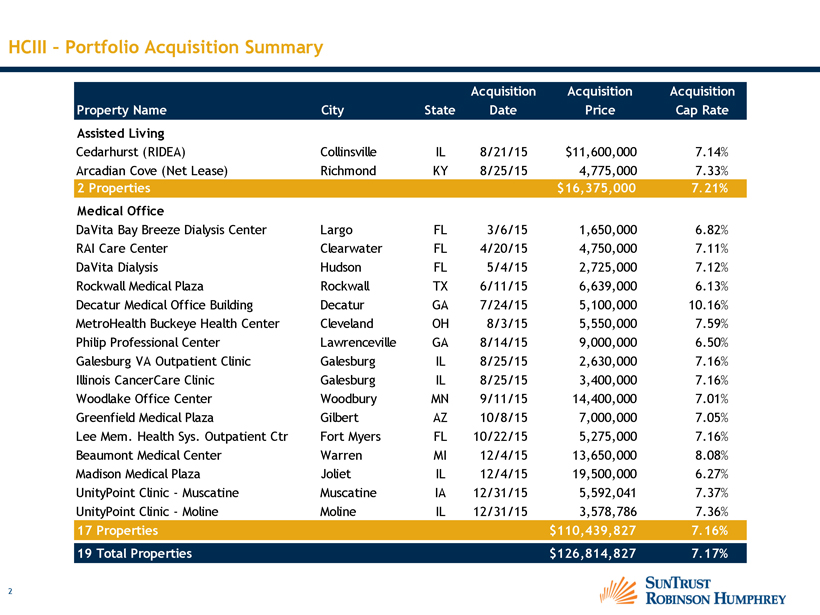

HCIII Portfolio Acquisition Summary Acquisition Acquisition Acquisition Property Name City State Date Price Cap Rate Assisted Living Cedarhurst (RIDEA) Collinsville IL 8/21/15 $11,600,000 7.14% Arcadian Cove (Net Lease) Richmond KY 8/25/15 4,775,000 7.33% 2 Properties $16,375,000 7.21% Medical Office DaVita Bay Breeze Dialysis Center Largo FL 3/6/15 1,650,000 6.82% RAI Care Center Clearwater FL 4/20/15 4,750,000 7.11% DaVita Dialysis Hudson FL 5/4/15 2,725,000 7.12% Rockwall Medical Plaza Rockwall TX 6/11/15 6,639,000 6.13% Decatur Medical Office Building Decatur GA 7/24/15 5,100,000 10.16% MetroHealth Buckeye Health Center Cleveland OH 8/3/15 5,550,000 7.59% Philip Professional Center Lawrenceville GA 8/14/15 9,000,000 6.50% Galesburg VA Outpatient Clinic Galesburg IL 8/25/15 2,630,000 7.16% Illinois CancerCare Clinic Galesburg IL 8/25/15 3,400,000 7.16% Woodlake Office Center Woodbury MN 9/11/15 14,400,000 7.01% Greenfield Medical Plaza Gilbert AZ 10/8/15 7,000,000 7.05% Lee Mem. Health Sys. Outpatient Ctr Fort Myers FL 10/22/15 5,275,000 7.16% Beaumont Medical Center Warren MI 12/4/15 13,650,000 8.08% Madison Medical Plaza Joliet IL 12/4/15 19,500,000 6.27% UnityPoint Clinic - Muscatine Muscatine IA 12/31/15 5,592,041 7.37% UnityPoint Clinic - Moline Moline IL 12/31/15 3,578,786 7.36% 17 Properties $110,439,827 7.16% 19 Total Properties $126,814,827 7.17%

Potential Interest Side-by-Side Comparison Three bids for separate sub-portfolios have been received, leaving no remaining assets. Additionally, three whole-portfolio bids have been received Acquisition Property Name City State Date *** *** *** Assisted Living Cedarhurst (RIDEA) Collinsville IL 8/21/15 X X Arcadian Cove (Net Lease) Richmond KY 8/25/15 X X 2 Properties Medical Office: Single-Tenant DaVita Bay Breeze Dialysis Center Largo FL 3/6/15 X X Decatur Medical Office Building Decatur GA 7/24/15 X X MetroHealth Buckeye Health Center Cleveland OH 8/3/15 X X X Galesburg VA Outpatient Clinic Galesburg IL 8/25/15 X X X Illinois CancerCare Clinic Galesburg IL 8/25/15 X X X Woodlake Office Center Woodbury MN 9/11/15 X X X Lee Mem. Health Sys. Outpatient Ctr Fort Myers FL 10/22/15 X X UnityPoint Clinic - Muscatine Muscatine IA 12/31/15 X X UnityPoint Clinic - Moline Moline IL 12/31/15 X X 9 Properties Medical Office: Multi-Tenant RAI Care Center Clearwater FL 4/20/15 X X DaVita Dialysis Hudson FL 5/4/15 X X Rockwall Medical Plaza Rockwall TX 6/11/15 X X X Philip Professional Center Lawrenceville GA 8/14/15 X X Greenfield Medical Plaza Gilbert AZ 10/8/15 X X X Beaumont Medical Center Warren MI 12/4/15 X X X Madison Medical Plaza Joliet IL 12/4/15 X X X 8 Total Properties 17 Properties 19 Total Properties

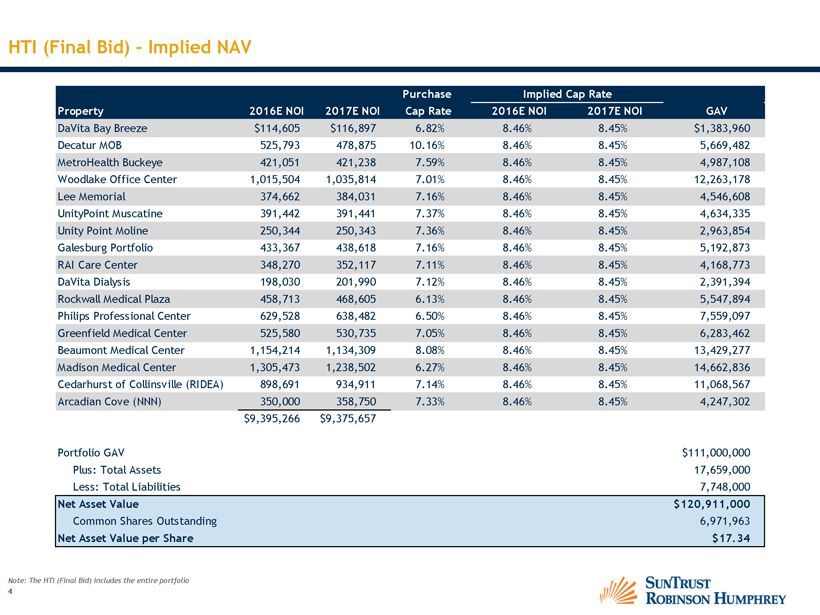

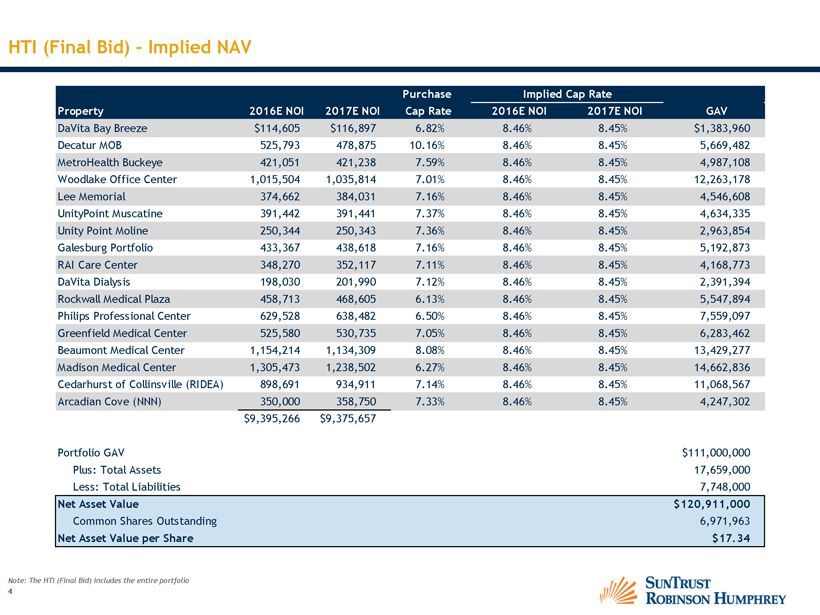

HTI (Final Bid) Implied NAV Purchase Implied Cap Rate Property 2016E NOI 2017E NOI Cap Rate 2016E NOI 2017E NOI GAV DaVita Bay Breeze $114,605 $116,897 6.82% 8.46% 8.45% $1,383,960 Decatur MOB 525,793 478,875 10.16% 8.46% 8.45% 5,669,482 MetroHealth Buckeye 421,051 421,238 7.59% 8.46% 8.45% 4,987,108 Woodlake Office Center 1,015,504 1,035,814 7.01% 8.46% 8.45% 12,263,178 Lee Memorial 374,662 384,031 7.16% 8.46% 8.45% 4,546,608 UnityPoint Muscatine 391,442 391,441 7.37% 8.46% 8.45% 4,634,335 Unity Point Moline 250,344 250,343 7.36% 8.46% 8.45% 2,963,854 Galesburg Portfolio 433,367 438,618 7.16% 8.46% 8.45% 5,192,873 RAI Care Center 348,270 352,117 7.11% 8.46% 8.45% 4,168,773 DaVita Dialysis 198,030 201,990 7.12% 8.46% 8.45% 2,391,394 Rockwall Medical Plaza 458,713 468,605 6.13% 8.46% 8.45% 5,547,894 Philips Professional Center 629,528 638,482 6.50% 8.46% 8.45% 7,559,097 Greenfield Medical Center 525,580 530,735 7.05% 8.46% 8.45% 6,283,462 Beaumont Medical Center 1,154,214 1,134,309 8.08% 8.46% 8.45% 13,429,277 Madison Medical Center 1,305,473 1,238,502 6.27% 8.46% 8.45% 14,662,836 Cedarhurst of Collinsville (RIDEA) 898,691 934,911 7.14% 8.46% 8.45% 11,068,567 Arcadian Cove (NNN) 350,000 358,750 7.33% 8.46% 8.45% 4,247,302 $9,395,266 $9,375,657 Portfolio GAV $111,000,000 Plus: Total Assets 17,659,000 Less: Total Liabilities 7,748,000 Net Asset Value $120,911,000 Common Shares Outstanding 6,971,963 Net Asset Value per Share $17.34 Note: The HTI (Final Bid) includes the entire portfolio 4

*** (Final Bid) Implied NAV Purchase Implied Cap Rate Property 2016E NOI 2017E NOI Cap Rate 2016E NOI 2017E NOI GAV DaVita Bay Breeze $114,605 $116,897 6.82% 8.24% 8.22% $1,421,817 Decatur MOB 525,793 478,875 10.16% 8.24% 8.22% 5,824,563 MetroHealth Buckeye 421,051 421,238 7.59% 8.24% 8.22% 5,123,524 Woodlake Office Center 1,015,504 1,035,814 7.01% 8.24% 8.22% 12,598,620 Lee Memorial 374,662 384,031 7.16% 8.24% 8.22% 4,670,974 UnityPoint Muscatine 391,442 391,441 7.37% 8.24% 8.22% 4,761,100 Unity Point Moline 250,344 250,343 7.36% 8.24% 8.22% 3,044,926 Galesburg Portfolio 433,367 438,618 7.16% 8.24% 8.22% 5,334,917 RAI Care Center 348,270 352,117 7.11% 8.24% 8.22% 4,282,804 DaVita Dialysis 198,030 201,990 7.12% 8.24% 8.22% 2,456,807 Rockwall Medical Plaza 458,713 468,605 6.13% 8.24% 8.22% 5,699,649 Philips Professional Center 629,528 638,482 6.50% 8.24% 8.22% 7,765,865 Greenfield Medical Center 525,580 530,735 7.05% 8.24% 8.22% 6,455,337 Beaumont Medical Center 1,154,214 1,134,309 8.08% 8.24% 8.22% 13,796,616 Madison Medical Center 1,305,473 1,238,502 6.27% 8.24% 8.22% 15,063,917 Cedarhurst of Collinsville (RIDEA) 898,691 934,911 7.14% 8.24% 8.22% 11,371,332 Arcadian Cove (NNN) 350,000 358,750 7.33% 8.24% 8.22% 4,363,481 $9,395,266 $9,375,657 Portfolio GAV $114,036,250 Plus: Total Assets 17,659,000 Less: Total Liabilities 7,748,000 Net Asset Value $123,947,250 Common Shares Outstanding 6,971,963 Net Asset Value per Share $17.78 Note: The *** (Final Bid) includes the entire portfolio 5

Bid Comparison (HTI vs *** vs ***/*** vs Combination Bid) Implied NAV Gross Asset Value (GAV) Property HTI ***(1) ***(2)+ *** *** + Portfolio GAV $111,000,000 $114,036,250 $110,049,632 $92,495,000 Plus: Total Assets 17,659,000 17,659,000 17,659,000 17,659,000 Less: Total Liabilities 7,748,000 7,748,000 7,748,000 7,748,000 Net Asset Value $120,911,000 $123,947,250 $119,960,632 $102,406,000 Common Shares Outstanding 6,971,963 6,971,963 6,971,963 6,971,963 Net Asset Value per Share $17.34 $17.78 $17.21 $14.69 Potential Brokered Assets Value $14,003,750 Potential Broker Fee 280,075 Adjusted GAV $111,000,000 $114,036,250 $110,049,632 $106,218,675 Adjusted NAV $120,911,000 $123,947,250 $119,960,632 $116,129,675 Adjusted NAV Per Share $17.34 $17.78 $17.21 $16.66 Note: Potential Brokered Assets assume a value of 15% discount to cost, based on other bids. Potential Broker Fee assumes a 2.00% fee charged on the sale of the three remaining assets (1) Reflects ***'s Final Bid of $114,036,250 in stock for all 19 assets (2) Reflects ***'s Initial Bid of $97,049,632 in cash for the 17 MOB assets 6

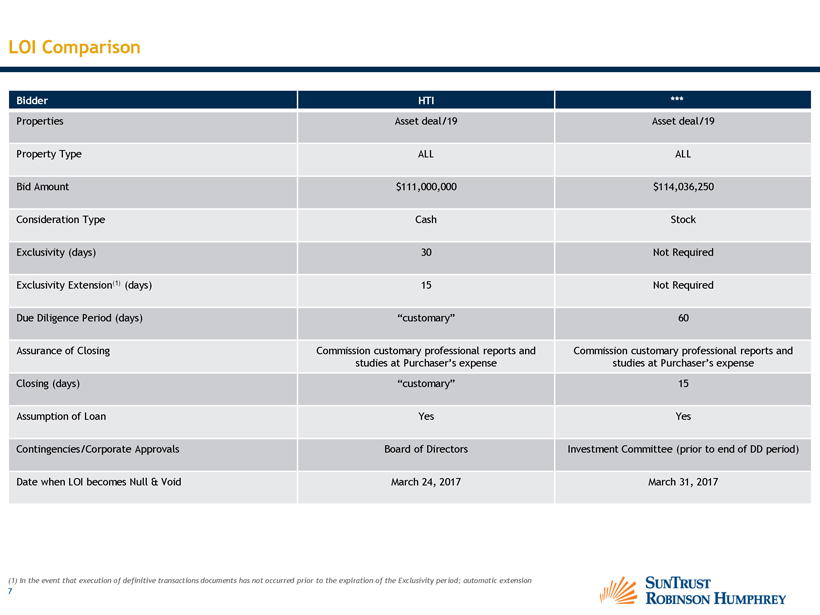

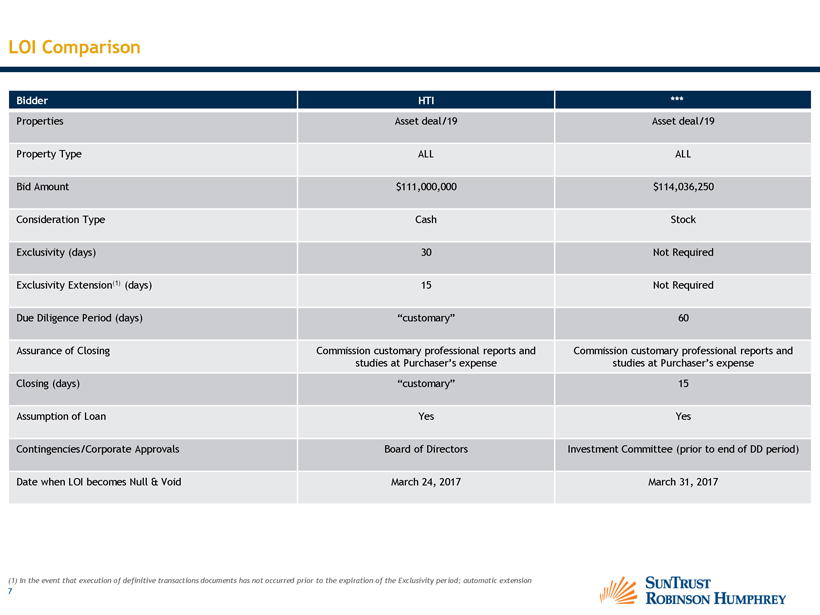

LOI Comparison Bidder HTI *** Properties Asset deal/19 Asset deal/19 Property Type ALL ALL Bid Amount $111,000,000 $114,036,250 Consideration Type Cash Stock Exclusivity (days) 30 Not Required Exclusivity Extension(1) (days) 15 Not Required Due Diligence Period (days) “customary” 60 Assurance of Closing Commission customary professional reports and Commission customary professional reports and studies at Purchaser’s expense studies at Purchaser’s expense Closing (days) “customary” 15 Assumption of Loan Yes Yes Contingencies/Corporate Approvals Board of Directors Investment Committee (prior to end of DD period) Date when LOI becomes Null & Void March 24, 2017 March 31, 2017 (1) In the event that execution of definitive transactions documents has not occurred prior to the expiration of the Exclusivity period; automatic extension 7

Bid Analysis HTI Acquisition Acquisition Property Name Price Cap Rate 2016E NOI 2017E NOI HTI 2016E NOI 2017E NOI Assisted Living Cedarhurst (RIDEA) $11,600,000 7.14% 898,691 934,911 X 898,691 934,911 Arcadian Cove (Net Lease) $4,775,000 7.33% 350,000 358,750 X 350,000 358,750 2 Properties $16,375,000 7.21% $1,248,691 $1,293,661 $1,248,691 $1,293,661 Medical Office: Single-Tenant DaVita Bay Breeze Dialysis Center 1,650,000 6.82% 114,605 116,897 X 114,605 116,897 Decatur Medical Office Building 5, 1 00,000 10.16% 525,793 478,875 X 525,793 478,875 MetroHealth Buckeye Health Center 5,550,000 7.59% 421,051 421,238 X 421,051 421,238 Galesburg VA Outpatient Clinic 2,630,000 7.16% 184,167 184,434 X 184,167 184,434 Illinois CancerCare Clinic 3,400,000 7.16% 249,200 254,184 X 249,200 254,184 Woodlake Office Center 14,400,000 7.01% 1,015,504 1,035,814 X 1,015,504 1,035,814 Lee Mem. Health Sys. Outpatient Ctr 5,275,000 7.16% 374,662 384,031 X 374,662 384,031 UnityPoint Clinic - Muscatine 5,592,041 7.37% 391,441 391,441 X 391,441 391,441 UnityPoint Clinic - Moline 3,578,786 7.36% 250,344 250,343 X 250,344 250,343 9 Properties $47,175,827 7.93% $3,526,766 $3,517,257 $3,526,766 $3,517,257 Medical Office: Multi-Tenant RAI Care Center 4,750,000 7.11% 348,270 352,117 X 348,270 352,117 DaVita Dialysis 2,725,000 7.12% 198,030 201,990 X 198,030 201,990 Rockwall Medical Plaza 6,639,000 6.13% 458,713 468,605 X 458,713 468,605 Philip Professional Center 9,000,000 6.50% 629,528 638,482 X 629,528 638,482 Greenfield Medical Plaza 7,000,000 7.05% 525,580 530,735 X 525,580 530,735 Beaumont Medical Center 13,650,000 8.08% 1,154,214 1,134,309 X 1,154,214 1,134,309 Madison Medical Plaza 19,500,000 6.27% 1,305,473 1,238,502 X 1,305,473 1,238,502 8 Properties $63,264,000 6.81% $4,619,808 $4,564,740 $4,619,808 $4,564,740 17 Properties $110,439,827 7.30% $8,146,574 $8,081,997 $8,146,574 $8,081,997 19 Total Properties $126,814,827 6.08% $9,395,265 $9,375,657 $9,395,265 $9,375,657 $126,814,827 $9,395,265 $9,375,657 $111,000,000 $9,395,265 $9,375,657 Implied Cap 7.41% 7.39% 8.46% 8.45% Comparison of Bid to HCIII Acquistion ($15,814,827) 2.39% 2.37%

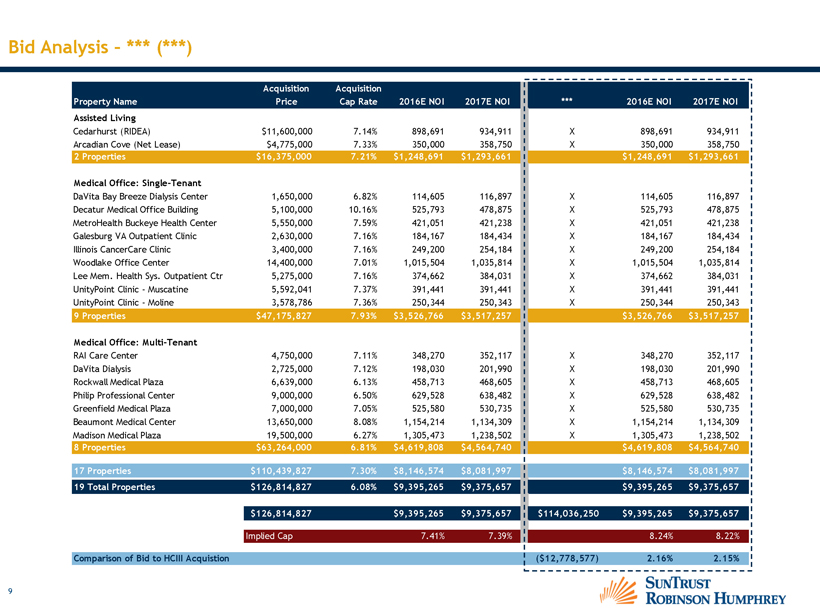

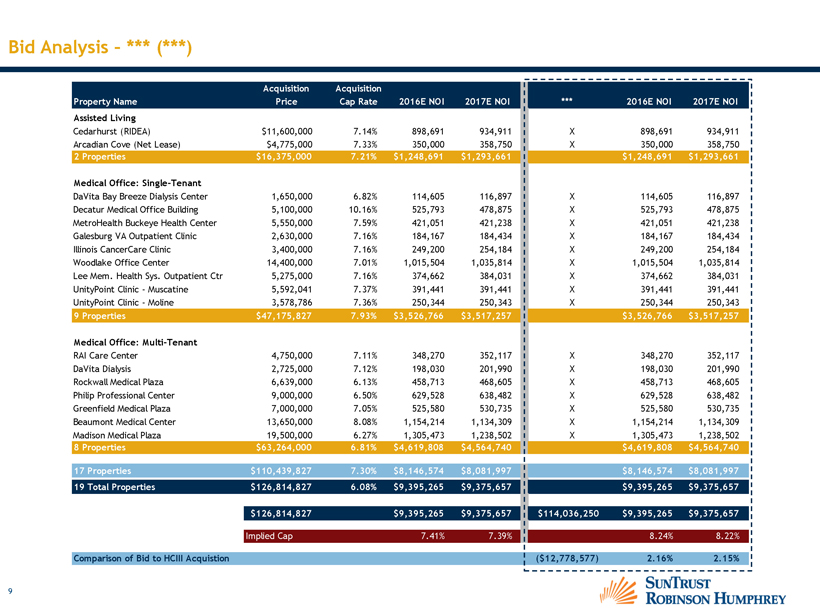

Bid Analysis – *** (***) Property Name Acquisition Price Acquisition Cap Rate 2016E NOI 2017E NOI *** 2016E NOI 2017E NOI Assisted Living Cedarhurst (RIDEA) Arcadian Cove (Net Lease) $11,600,000 $4,775,000 7.14% 7.33% 898,691 350,000 934,911 358,750 898,691 350,000 934,911 358,750 2 Properties $16,375,000 7.21% $1,248,691 $1,293,661 $1,248,691 $1,293,661 Medical Office: Single-Tenant DaVita Bay Breeze Dialysis Center 1,650,000 6.82% 114,605 116,897 X 114,605 116,897 Decatur Medical Office Building 5,100,000 10.16% 525,793 478,875 X 525,793 478,875 MetroHealth Buckeye Health Center 5,550,000 7.59% 421,051 421,238 X 421,051 421,238 Galesburg VA Outpatient Clinic 2,630,000 7.16% 184,167 184,434 X 184,167 184,434 Illinois CancerCare Clinic 3,400,000 7.16% 249,200 254,184 X 249,200 254,184 Woodlake Office Center 14,400,000 7.01% 1,015,504 1,035,814 X 1,015,504 1,035,814 Lee Mem. Health Sys. Outpatient Ctr 5,275,000 7.16% 374,662 384,031 X 374,662 384,031 UnityPoint Clinic - Muscatine 5,592,041 7.37% 391,441 391,441 X 391,441 391,441 UnityPoint Clinic - Moline 3,578,786 7.36% 250,344 250,343 X 250,344 250,343 9 Properties $47,175,827 7.93% $3,526,766 $3,517,257 $3,526,766 $3,517,257 Medical Office: Multi-Tenant RAI Care Center 4,750,000 7.11% 348,270 352,117 X 348,270 352,117 DaVita Dialysis 2,725,000 7.12% 198,030 201,990 X 198,030 201,990 Rockwall Medical Plaza 6,639,000 6.13% 458,713 468,605 X 458,713 468,605 Philip Professional Center 9,000,000 6.50% 629,528 638,482 X 629,528 638,482 Greenfield Medical Plaza 7,000,000 7.05% 525,580 530,735 X 525,580 530,735 Beaumont Medical Center 13,650,000 8.08% 1,154,214 1,134,309 X 1,154,214 1,134,309 Madison Medical Plaza 19,500,000 6.27% 1,305,473 1,238,502 X 1,305,473 1,238,502 8 Properties $63,264,000 6.81% $4,619,808 $4,564,740 $4,619,808 $4,564,740 1 7 Properties $110,439,827 7.30% $8,146,574 $8,081,997 $8,146,574 $8,081,997 19 Total Properties $126,814,827 6.08% $9,395,265 $9,375,657 $9,395,265 $9,375,657 ^ $126,814,827 $9,395,265 $9,375,657 $114,036,250 $9,395,265 $9,375,657 ^ Implied Cap 7.41% 7.39% 8.24% 8.22% Comparison of Bid to HCIII Acquistion ($12,778,577) 2.16% 2.15%

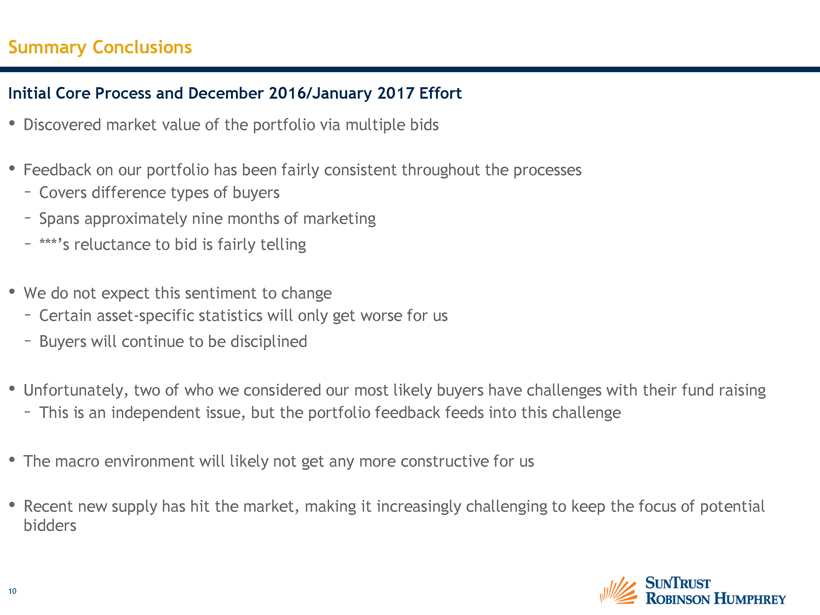

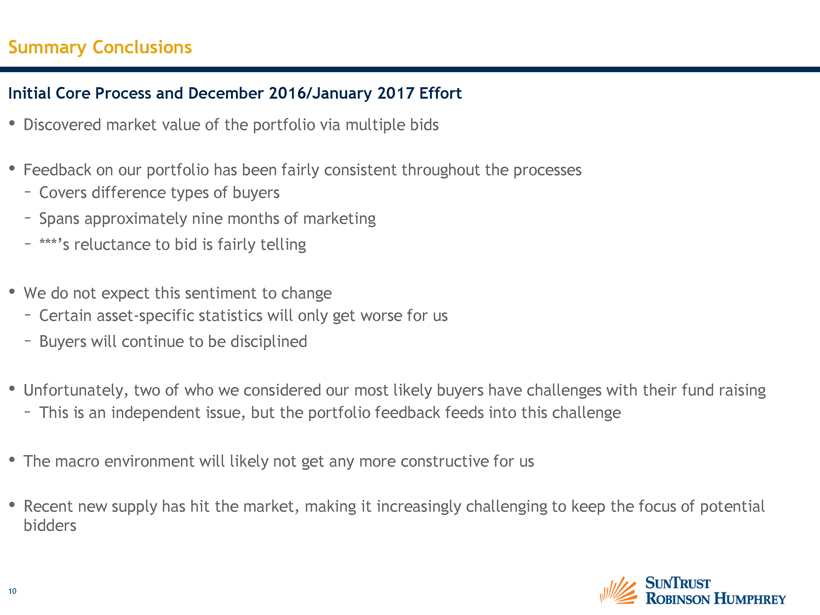

Summary Conclusions Initial Core Process and December 2016/January 2017 Effort Discovered market value of the portfolio via multiple bids Feedback on our portfolio has been fairly consistent throughout the processes Covers difference types of buyers Spans approximately nine months of marketing ***’s reluctance to bid is fairly telling We do not expect this sentiment to change Certain asset-specific statistics will only get worse for us Buyers will continue to be disciplined Unfortunately, two of who we considered our most likely buyers have challenges with their fund raising This is an independent issue, but the portfolio feedback feeds into this challenge The macro environment will likely not get any more constructive for us Recent new supply has hit the market, making it increasingly challenging to keep the focus of potential bidders

Appendix

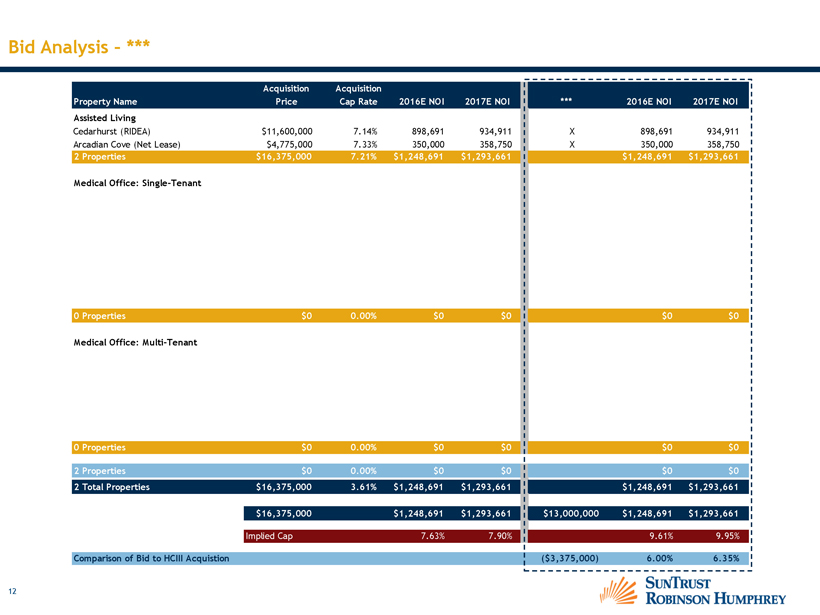

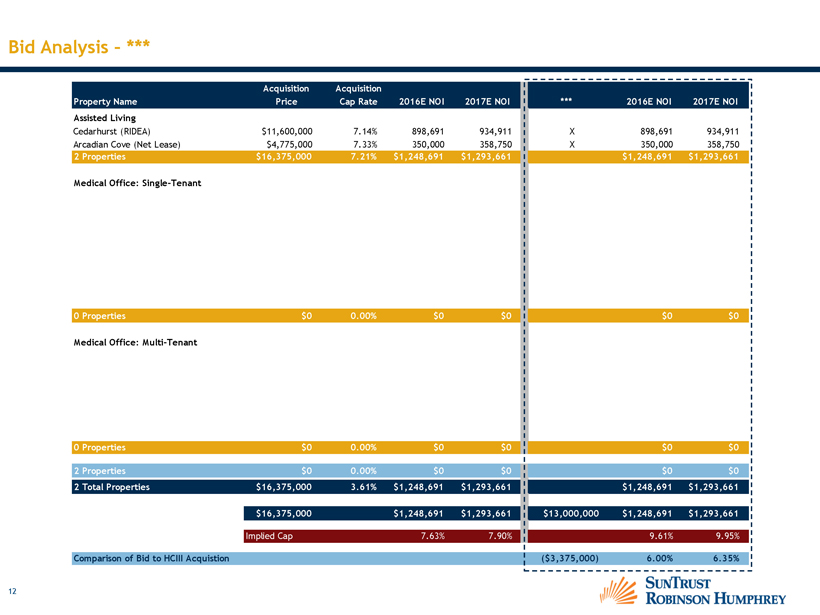

Bid Analysis – *** Property Name Acquisition Price Acquisition Cap Rate 2016E NOI 2017E NOI *** 2016E NOI 2017E NOI Assisted Living Cedarhurst (RIDEA) Arcadian Cove (Net Lease) $11,600,000 $4,775,000 7.14% 7.33% 898,691 350,000 934,911 358,750 X X 898,691 350,000 934,911 358,750 $16,375,000 7.21% $1,248,691 $1,293,661 $1,248,691 $1,293,661 Medical Office: Single-Tenant 0 Properties $0 0.00% $0 $0 $0 $0 Medical Office: Multi-Tenant 0 Properties $0 0.00% $0 $0 $0 $0 2 Properties $0 0.00% $0 $0 $0 $0 2 Total Properties $16,375,000 3.61% $1,248,691 $1,293,661 $1,248,691 $1,293,661 $16,375,000 $1,248,691 $1,293,661 $13,000,000 $1,248,691 $1,293,661 Implied Cap 7.63% 7.90% 9.61% 9.95% i Comparison of Bid to HCIII Acquistion ($3,375,000) 6.00% 6.35% ^

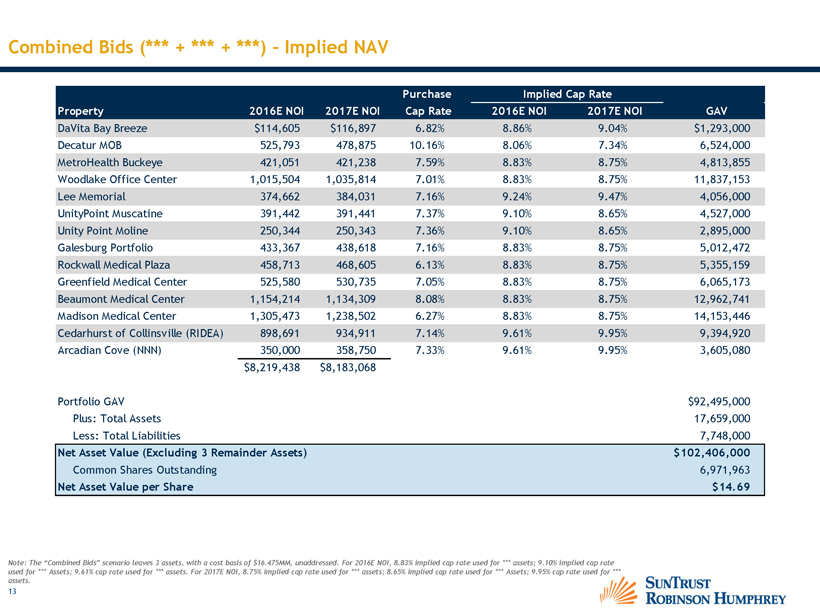

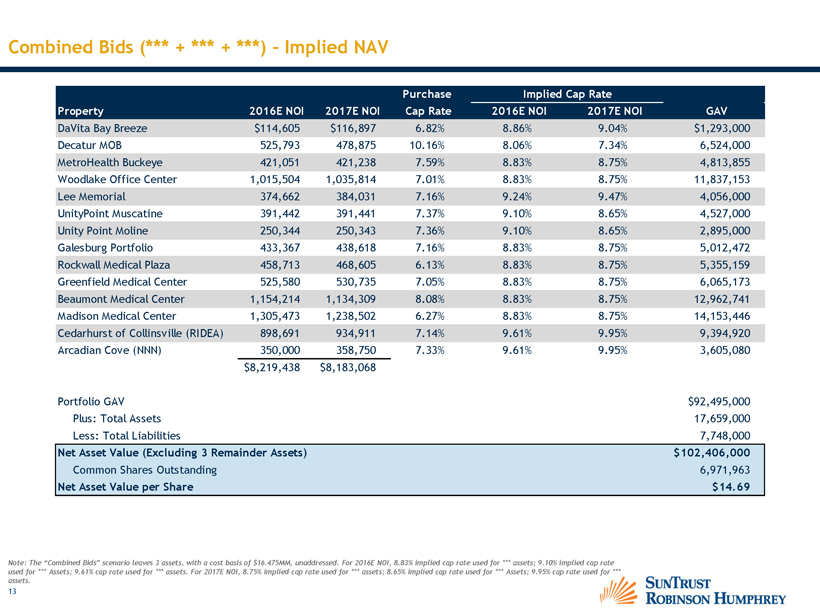

Combined Bids (*** + *** + ***) Implied NAV Purchase Implied Cap Rate GAV Property 2016E NOI 2017E NOI Cap Rate 2016E NOI 2017E NOI GAV DaVita Bay Breeze $114,605 $116,897 6.82% 8.86% 9.04% $1,293,000 Decatur MOB 525,793 478,875 10.16% 8.06% 7.34% 6,524,000 MetroHealth Buckeye 421,051 421,238 7.59% 8.83% 8.75% 4,813,855 Woodlake Office Center 1,015,504 1,035,814 7.01% 8.83% 8.75% 11,837,153 Lee Memorial 374,662 384,031 7.16% 9.24% 9.47% 4,056,000 UnityPoint Muscatine 391,442 391,441 7.37% 9.10% 8.65% 4,527,000 Unity Point Moline 250,344 250,343 7.36% 9.10% 8.65% 2,895,000 Galesburg Portfolio 433,367 438,618 7.16% 8.83% 8.75% 5,012,472 Rockwall Medical Plaza 458,713 468,605 6.13% 8.83% 8.75% 5,355,159 Greenfield Medical Center 525,580 530,735 7.05% 8.83% 8.75% 6,065,173 Beaumont Medical Center 1,154,214 1,134,309 8.08% 8.83% 8.75% 12,962,741 Madison Medical Center 1,305,473 1,238,502 6.27% 8.83% 8.75% 14,153,446 Cedarhurst of Collinsville (RIDEA) 898,691 934,911 7.14% 9.61% 9.95% 9,394,920 Arcadian Cove (NNN) 350,000 358,750 7.33% 9.61% 9.95% 3,605,080 $8,219,438 $8,183,068 Portfolio GAV $92,495,000 Plus: Total Assets 17,659,000 Less: Total Liabilities 7,748,000 Net Asset Value (Excluding 3 Remainder Assets) $102,406,000 Common Shares Outstanding 6,971,963 Net Asset Value per Share $14.69 Note: The “Combined Bids” scenario leaves 3 assets, with a cost basis of $16.475MM, unaddressed. For 2016E NOI, 8.83% implied cap rate used for *** assets; 9.10% implied cap rate used for *** Assets; 9.61% cap rate used for *** assets. For 2017E NOI, 8.75% implied cap rate used for *** assets; 8.65% implied cap rate used for *** Assets; 9.95% cap rate used for *** assets. 13

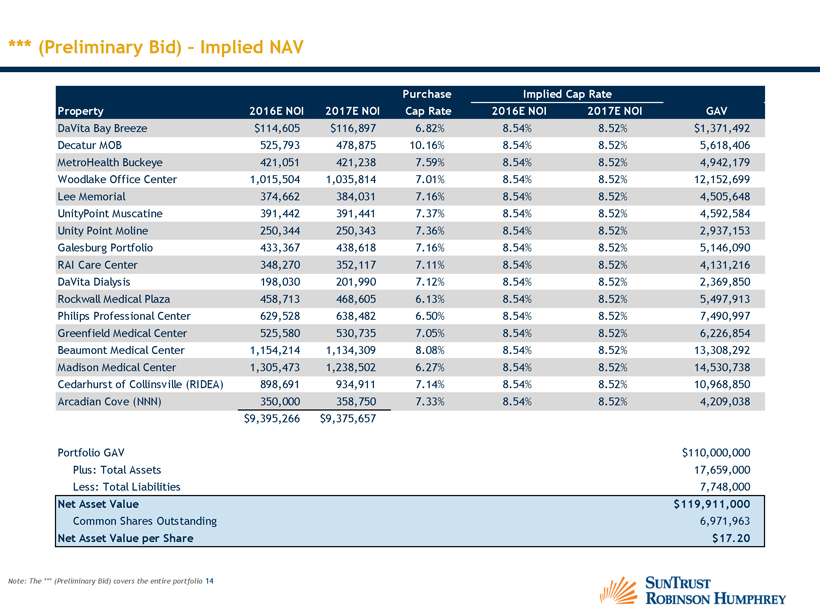

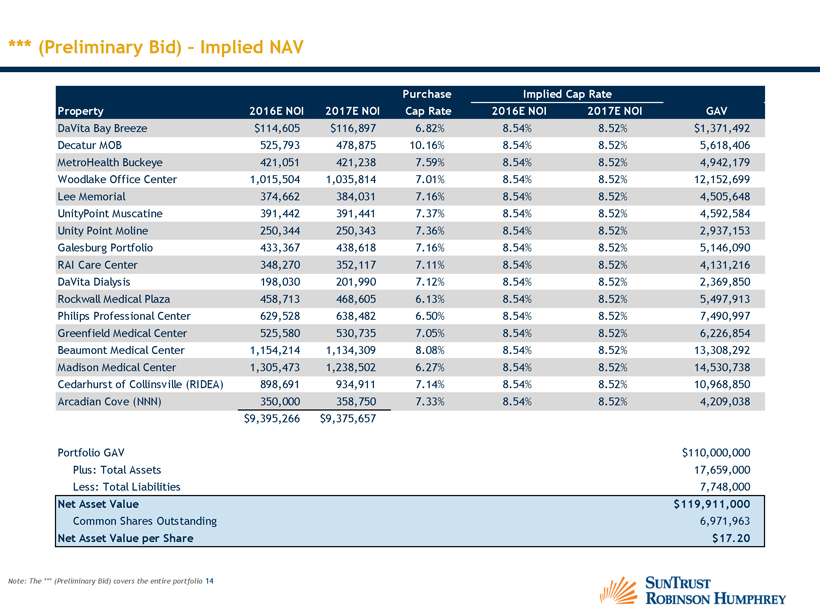

*** (Preliminary Bid) Implied NAV Purchase Implied Cap Rate Property 2016E NOI 2017E NOI Cap Rate 2016E NOI 2017E NOI GAV DaVita Bay Breeze $114,605 $116,897 6.82% 8.54% 8.52% $1,371,492 Decatur MOB 525,793 478,875 10.16% 8.54% 8.52% 5,618,406 MetroHealth Buckeye 421,051 421,238 7.59% 8.54% 8.52% 4,942,179 Woodlake Office Center 1,015,504 1,035,814 7.01% 8.54% 8.52% 12,152,699 Lee Memorial 374,662 384,031 7.16% 8.54% 8.52% 4,505,648 UnityPoint Muscatine 391,442 391,441 7.37% 8.54% 8.52% 4,592,584 Unity Point Moline 250,344 250,343 7.36% 8.54% 8.52% 2,937,153 Galesburg Portfolio 433,367 438,618 7.16% 8.54% 8.52% 5,146,090 RAI Care Center 348,270 352,117 7.11% 8.54% 8.52% 4,131,216 DaVita Dialysis 198,030 201,990 7.12% 8.54% 8.52% 2,369,850 Rockwall Medical Plaza 458,713 468,605 6.13% 8.54% 8.52% 5,497,913 Philips Professional Center 629,528 638,482 6.50% 8.54% 8.52% 7,490,997 Greenfield Medical Center 525,580 530,735 7.05% 8.54% 8.52% 6,226,854 Beaumont Medical Center 1,154,214 1,134,309 8.08% 8.54% 8.52% 13,308,292 Madison Medical Center 1,305,473 1,238,502 6.27% 8.54% 8.52% 14,530,738 Cedarhurst of Collinsville (RIDEA) 898,691 934,911 7.14% 8.54% 8.52% 10,968,850 Arcadian Cove (NNN) 350,000 358,750 7.33% 8.54% 8.52% 4,209,038 $9,395,266 $9,375,657 Portfolio GAV $110,000,000 Plus: Total Assets 17,659,000 Less: Total Liabilities 7,748,000 Net Asset Value $119,911,000 Common Shares Outstanding 6,971,963 Net Asset Value per Share $17.20 Note: The *** (Preliminary Bid) covers the entire portfolio 14

Bid Analysis – *** Property Name Acquisition Price Acquisition Cap Rate 2016E NOI 2017E NOI *** 2016E NOI 2017E NOI Assisted Living 0 Properties $0 0.00% $0 $0 $0 $0 Medical Office: Single-Tenant MetroHealth Buckeye Health Center Galesburg VA Outpatient Clinic Illinois CancerCare Clinic Woodlake Office Center 5.550.000 2.630.000 3.400.0 14,400,000 7.59% 7.16% 7.16% 7.01% 421,051 184,167 249,200 1,015,504 421,238 184,434 254,184 1,035,814 ^ ^ ^ ^ 421,051 184,167 249,200 1,015,504 421,238 184,434 254,184 1,035,814 4 Properties $25,980,000 7.22% $1,869,922 $1,895,670 $1,869,922 $1,895,670 Medical Office: Multi-Tenant Rockwall Medical Plaza 6,639,000 6.13% 458,713 468,605 X 458,713 468,605 Greenfield Medical Plaza Beaumont Medical Center Madison Medical Plaza 7,000,000 13.650.000 19.500.000 7.05% 8.08% 6.27% 525,580 1,154,214 1,305,473 530,735 1,134,309 1,238,502 X X X 525,580 1,154,214 1,305,473 530,735 1,134,309 1,238,502 4 Properties $46,789,000 6.82% $3,443,980 $3,372,151 $3,443,980 $3,372,151 8 Properties $72,769,000 6.96% $5,313,902 $5,267,821 $5,313,902 $5,267,821 8 Total Properties $72,769,000 6.96% $5,313,902 $5,267,821 $5,313,902 $5,267,821 $72,769,000 $5,313,902 $5,267,821 $60,200,000 $5,313,902 $5,267,821 Implied Cap 7.30% 7.24% 8.83% 8.75% Comparison of Bid to HCIII Acquistion ($12,569,000) 1.87% 1.79% 15

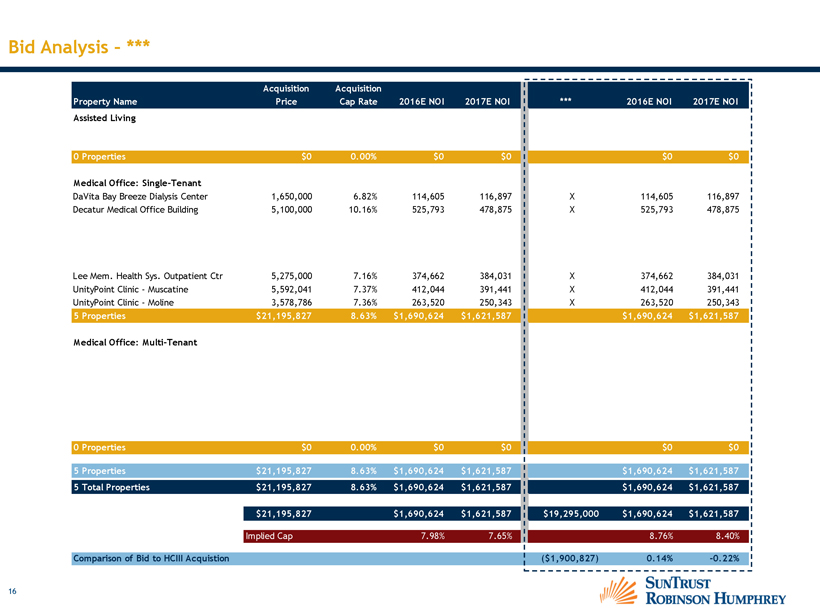

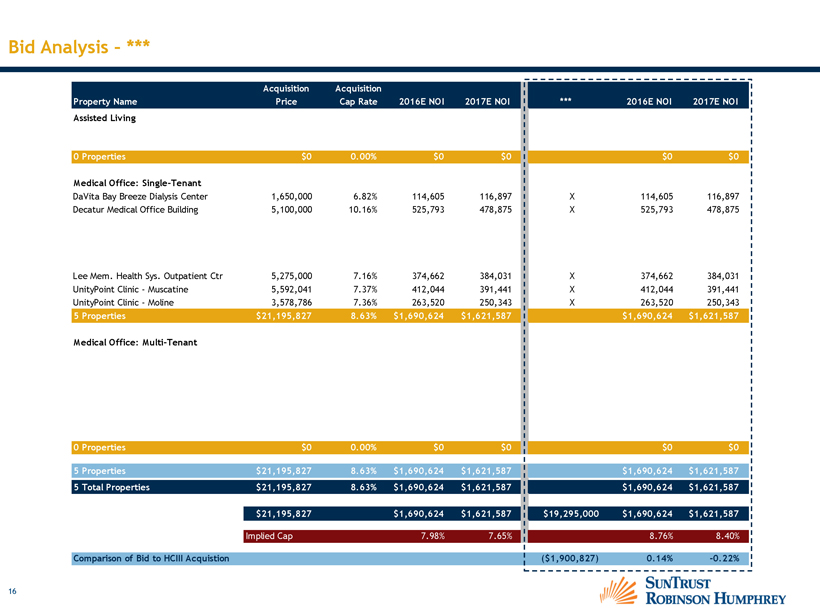

Bid Analysis – *** Property Name Acquisition Price Acquisition Cap Rate 2016E NOI 2017E NOI *** 2016E NOI 2017E NOI Assisted Living 0 Properties $0 0.00% $0 $0 $0 $0 Medical Office: Single-Tenant DaVita Bay Breeze Dialysis Center Decatur Medical Office Building 1.650.000 5.100.000 6.82% 10.16% 114,605 525,793 116,897 478,875 X X 114,605 525,793 116,897 478,875 Lee Mem. Health Sys. Outpatient Ctr UnityPoint Clinic - Muscatine UnityPoint Clinic - Moline 5,275,000 5,592,041 3,578,786 7.16% 7.37% 7.36% 374,662 412,044 263,520 384,031 391,441 250,343 X X X 374,662 412,044 263,520 384,031 391,441 250,343 5 Properties $21,195,827 8.63% $1,690,624 $1,621,587 $1,690,624 $1,621,587 Medical Office: Multi-Tenant 0 Properties $0 0.00% $0 $0 $0 $0 5 Properties $21,195,827 8.63% $1,690,624 $1,621,587 $1,690,624 $1,621,587 5 Total Properties $21,195,827 8.63% $1,690,624 $1,621,587 $1,690,624 $1,621,587 $21,195,827 $1,690,624 $1,621,587 $19,295,000 $1,690,624 $1,621,587 Implied Cap 7.98% 7.65% 8.76% 8.40% Comparison of Bid to HCIII Acquistion ($1,900,827) 0.14% -0.22% 16

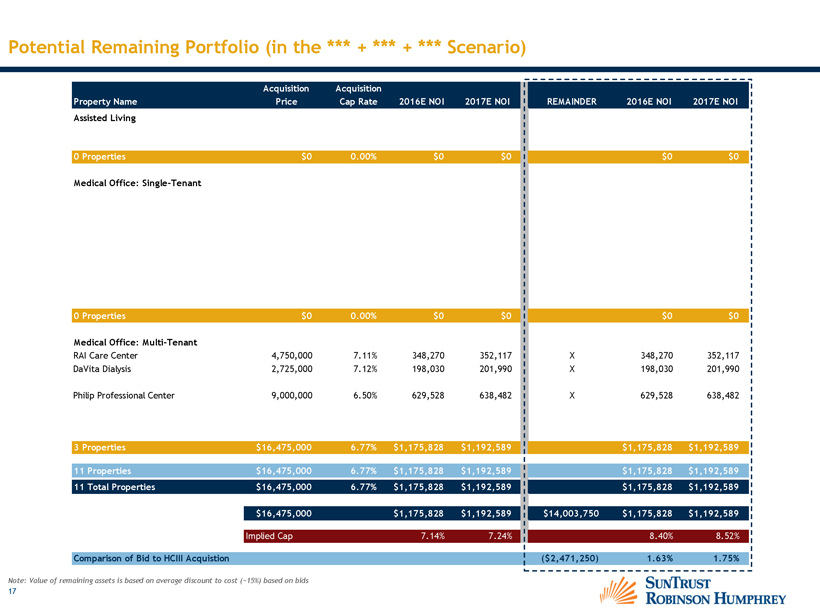

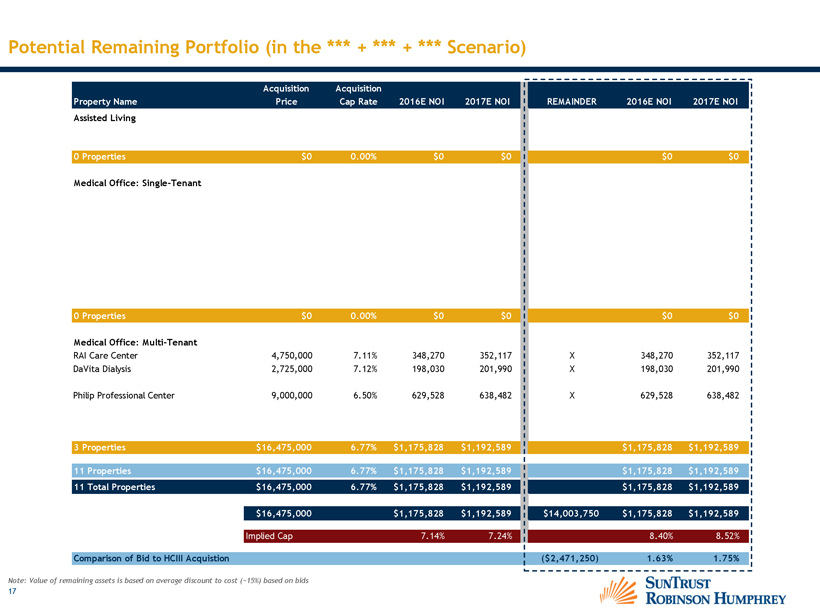

Potential Remaining Portfolio (in the *** + *** + *** Scenario) Property Name Acquisition Price Acquisition Cap Rate 2016E NOI 2017E NOI REMAINDER 2016E NOI 2017E NOI Assisted Living 0 Properties $0 0.00% $0 $0 $0 $0 Medical Office: Single-Tenant 0 Properties $0 0.00% $0 $0 $0 $0 Medical Office: Multi-Tenant RAI Care Center DaVita Dialysis 4.750.000 2.725.000 7.11% 7.12% 348,270 198,030 352,117 201,990 X X 348,270 198,030 352,117 201,990 Philip Professional Center 9,000,000 6.50% 629,528 638,482 X 629,528 638,482 3 Properties $16,475,000 6.77% $1,175,828 $1,192,589 $1,175,828 $1,192,589 11 Properties $16,475,000 6.77% $1,175,828 $1,192,589 $1,175,828 $1,192,589 1 1 Total Properties $16,475,000 6.77% $1,175,828 $1,192,589 $1,175,828 $1,192,589 $16,475,000 $1,175,828 $1,192,589 $14,003,750 $1,175,828 $1,192,589 Implied Cap 7.14% 7.24% 8.40% 8.52% Comparison of Bid to HCIII Acquistion ($2,471,250) 1.63% 1.75% ^ Note: Value of remaining assets is based on average discount to cost (~15%) based on bids 17

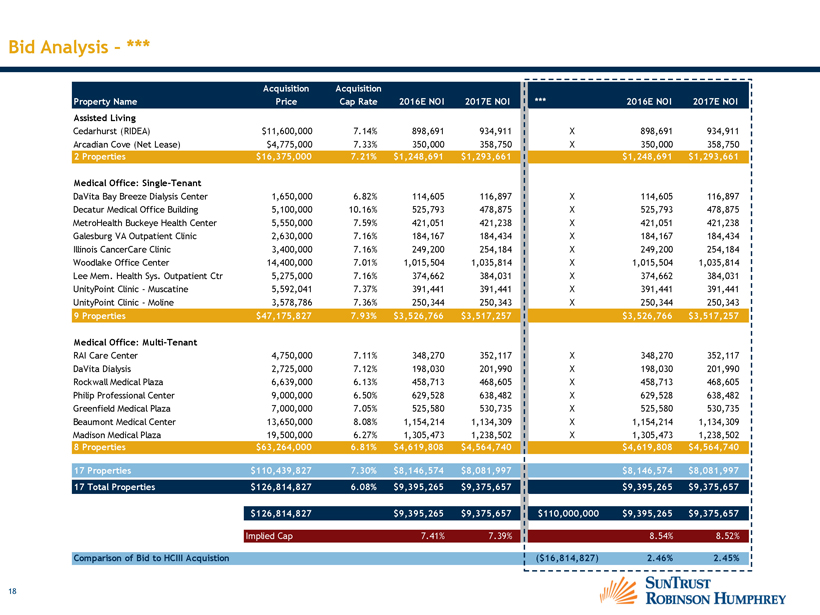

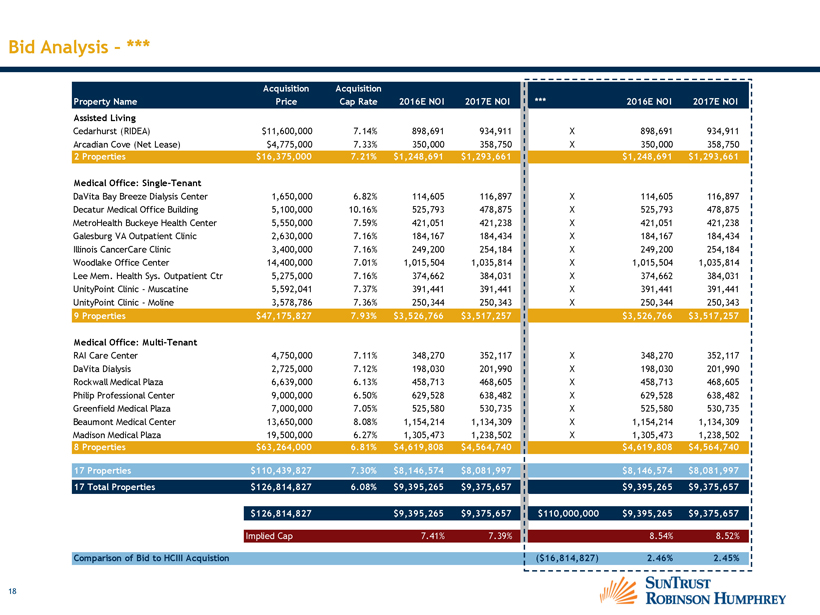

Bid Analysis – *** Acquisition Acquisition Property Name Price Cap Rate 2016E NOI 2017E NOI *** 2016E NOI 2017E NOI Assisted Living Cedarhurst (RIDEA) $11,600,000 7.14% 898,691 934,911 X 898,691 934,911 Arcadian Cove (Net Lease) $4,775,000 7.33% 350,000 358,750 X 350,000 358,750 2 Properties $16,375,000 7.21% $1,248,691 $1,293,661 $1,248,691 $1,293,661 Medical Office: Single-Tenant DaVita Bay Breeze Dialysis Center 1,650,000 6.82% 114,605 116,897 X 114,605 116,897 Decatur Medical Office Building 5, 1 00,000 10.16% 525,793 478,875 X 525,793 478,875 MetroHealth Buckeye Health Center 5,550,000 7.59% 421,051 421,238 X 421,051 421,238 Galesburg VA Outpatient Clinic 2,630,000 7.16% 184,167 184,434 X 184,167 184,434 Illinois CancerCare Clinic 3,400,000 7.16% 249,200 254,184 X 249,200 254,184 Woodlake Office Center 14,400,000 7.01% 1,015,504 1,035,814 X 1,015,504 1,035,814 Lee Mem. Health Sys. Outpatient Ctr 5,275,000 7.16% 374,662 384,031 X 374,662 384,031 UnityPoint Clinic - Muscatine 5,592,041 7.37% 391,441 391,441 X 391,441 391,441 UnityPoint Clinic - Moline 3,578,786 7.36% 250,344 250,343 X 250,344 250,343 9 Properties $47,175,827 7.93% $3,526,766 $3,517,257 $3,526,766 $3,517,257 Medical Office: Multi-Tenant RAI Care Center 4,750,000 7.11% 348,270 352,117 X 348,270 352,117 DaVita Dialysis 2,725,000 7.12% 198,030 201,990 X 198,030 201,990 Rockwall Medical Plaza 6,639,000 6.13% 458,713 468,605 X 458,713 468,605 Philip Professional Center 9,000,000 6.50% 629,528 638,482 X 629,528 638,482 Greenfield Medical Plaza 7,000,000 7.05% 525,580 530,735 X 525,580 530,735 Beaumont Medical Center 13,650,000 8.08% 1,154,214 1,134,309 X 1,154,214 1,134,309 Madison Medical Plaza 19,500,000 6.27% 1,305,473 1,238,502 X 1,305,473 1,238,502 8 Properties $63,264,000 6.81% $4,619,808 $4,564,740 $4,619,808 $4,564,740 17 Properties $110,439,827 7.30% $8,146,574 $8,081,997 $8,146,574 $8,081,997 17 Total Properties $126,814,827 6.08% $9,395,265 $9,375,657 $9,395,265 $9,375,657 $126,814,827 $9,395,265 $9,375,657 $110,000,000 $9,395,265 $9,375,657 Implied Cap 7.41% 7.39% 8.54% 8.52% Comparison of Bid to HCIII Acquistion ($16,814,827) 2.46% 2.45% ^ ^ ^ ^ ^ 18

Indication of Interest Analysis – *** Property Name Acquisition Price Acquisition Cap Rate 2016E NOI 2017E NOI *** 2016E NOI 2017E NOI Assisted Living Cedarhurst (RIDEA) Arcadian Cove (Net Lease) $11,600,000 $4,775,000 7.14% 7.33% 898,691 350,000 934,911 358,750 X X 898,691 350,000 934,911 358,750 2 Properties $16,375,000 7.21% $1,248,691 $1,293,661 $1,248,691 $1,293,661 Medical Office: Single-Tenant 0 Properties $0 0.00% $0 $0 $0 $0 Medical Office: Multi-Tenant Madison Medical Plaza 19,500,000 6.27% 1,305,473 1,238,502 X 1,305,473 1,238,502 1 Properties $19,500,000 6.27% $1,305,473 $1,238,502 $1,305,473 $1,238,502 3 Properties $19,500,000 6.27% $1,305,473 $1,238,502 $1,305,473 $1,238,502 3 Total Properties $35,875,000 4.34% $2,554,164 $2,532,163 $2,554,164 $2,532,163 $35,875,000 $2,554,164 $2,532,163 N/A $2,554,164 $2,532,163 Implied Cap 7.12% 7.06% N/A N/A Comparison of Bid to HCIII Acquistion N/A N/A N/A ^ 19

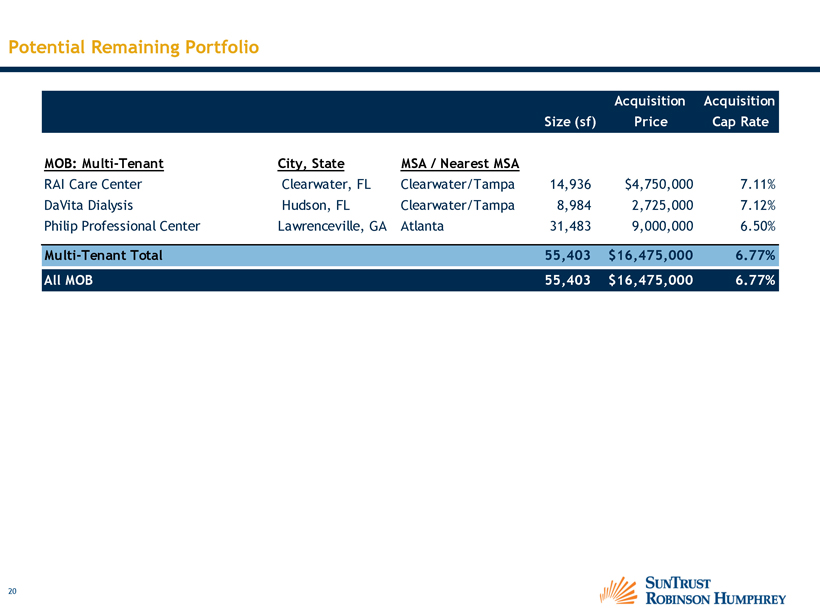

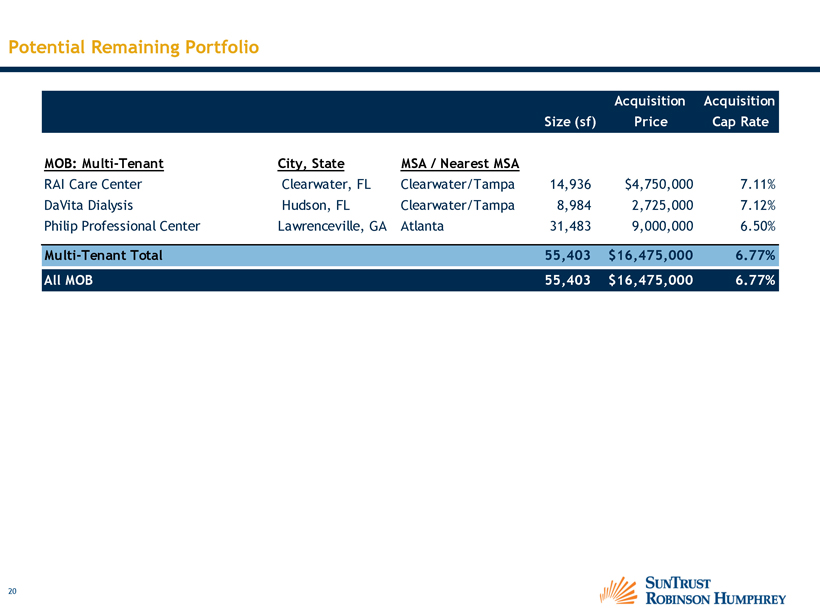

Potential Remaining Portfolio Acquisition Acquisition Size (sf) Price Cap Rate MOB: Multi-Tenant City, State MSA / Nearest MSA RAI Care Center Clearwater, FL Clearwater/Tampa 14,936 $4,750,000 7.11% DaVita Dialysis Hudson, FL Clearwater/Tampa 8,984 2,725,000 7.12% Philip Professional Center Lawrenceville, GA Atlanta 31,483 9,000,000 6.50% Multi-Tenant Total 55,403 $16,475,000 6.77% All MOB 55,403 $16,475,000 6.77%

Important Disclosures This presentation is for informational purposes only and is being furnished on a confidential basis. By accepting this information, the recipient agrees that it will use the information only to evaluate its potential interest in the strategies described herein and for no other purpose and will not divulge any such information to any other party. This presentation does not constitute a commitment to lend money, underwrite any proposed transaction, purchase securities or other assets, provide financing, arrange financing, or provide any other services. SunTrust Robinson Humphrey, Inc. and its representatives and affiliates make no representation and have given you no advice concerning the appropriate regulatory treatment, accounting treatment, or possible tax consequences of the proposed transactions described herein. Prior to entering into any proposed transaction, you should determine, without reliance upon SunTrust Robinson Humphrey, Inc. or its representatives or affiliates, the economic risks and merits, as well as the legal, tax and accounting characteristics and consequences, of the transaction and that you are able to assume these risks. These materials should not be relied upon for the maintenance of your books and records or for any tax, accounting, legal or other purposes. All materials, including proposed terms and conditions, are indicative and for discussion purposes only. Finalized terms and conditions are subject to further discussion and negotiation and will be evidenced by a formal written agreement. Except as required by applicable law, we make no representation or warranty, express or implied, to you or to any person as to the content of the information contained herein. Opinions expressed herein are current opinions only as of the date indicated. Any historical price(s) or value(s) are also only as of the date indicated. We are under no obligation to update opinions or other information. In connection with Treasury Regulation Section 1.6011-4, it is our mutual intent that the tax structure and tax treatment of the transactions contemplated by this presentation are not confidential and that notwithstanding anything herein to the contrary that each of us (and our employees, representatives and agents) may disclose to any and all persons, without limitation of any kind, the tax structure and tax treatment of the transactions contemplated herein. SunTrust Robinson Humphrey is the trade name for the corporate and investment banking services of SunTrust Banks, Inc. and its subsidiaries. Securities underwriting and M&A advisory services are provided by SunTrust Robinson Humphrey, Inc., member FINRA and SIPC. │ Lending, financial risk management, and treasury and payment solutions are offered by SunTrust Bank. │ Deposit products are offered by SunTrust Bank, Member FDIC. © SunTrust Banks, Inc. All rights reserved.