Exhibit (c)(9)

Confidential Project Pelican Special Committee Update Real Estate Investment Banking March 7, 2017 KeyBanc Capital Markets

KeyCorp & KeyBanc Capital Markets KeyBanc Capital Markets is a trade name under which the corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., Member NYSE/FINRA/SIPC, and KeyBank National Association (“KeyBank N.A.”), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and by its licensed securities representatives. Banking products and services are offered by KeyBank N.A. A number of our corporate and institutional team members are employed by both KeyBanc Capital Markets Inc. and KeyBank N.A. These “dual employees” are licensed securities representatives of KeyBanc Capital Markets Inc., and they are there to better serve your needs, by making available both securities and banking products and services. Further, in connection with our effort to deliver a comprehensive array of banking and securities products and services to you in a seamless manner, from time to time KeyBank N.A. and KeyBanc Capital Markets Inc. will share with each other certain non-public information that you provide to us. Of course, as always, this information will not be shared or otherwise disclosed outside of the KeyCorp organization without your express permission. Please also be assured that, as with other banks and broker-dealers, KeyBank N.A. and KeyBanc Capital Markets Inc. adhere to established internal procedures to safeguard your corporate information from areas within our organization that trade in or advise clients with respect to the purchase and sale of securities. THE OBLIGATIONS OF KEYBANC CAPITAL MARKETS INC. ARE NOT OBLIGATIONS OF KEYBANK N.A. OR ANY OF ITS AFFILIATE BANKS, AND NONE OF KEYCORP’S BANKS ARE RESPONSIBLE FOR, OR GUARANTEE, THE SECURITIES OR SECURITIES -RELATED PRODUCTS OR SERVICES SOLD, OFFERED OR RECOMMENDED BY KEYBANC CAPITAL MARKETS INC. OR ITS EMPLOYEES. SECURITIES AND OTHER INVESTMENT PRODUCTS SOLD, OFFERED OR RECOMMENDED BY KEYBANC CAPITAL MARKETS INC., IF ANY, ARE NOT BANK DEPOSITS OR OBLIGATIONS AND ARE NOT INSURED BY THE FDIC. KeyBanc Capital Markets 2

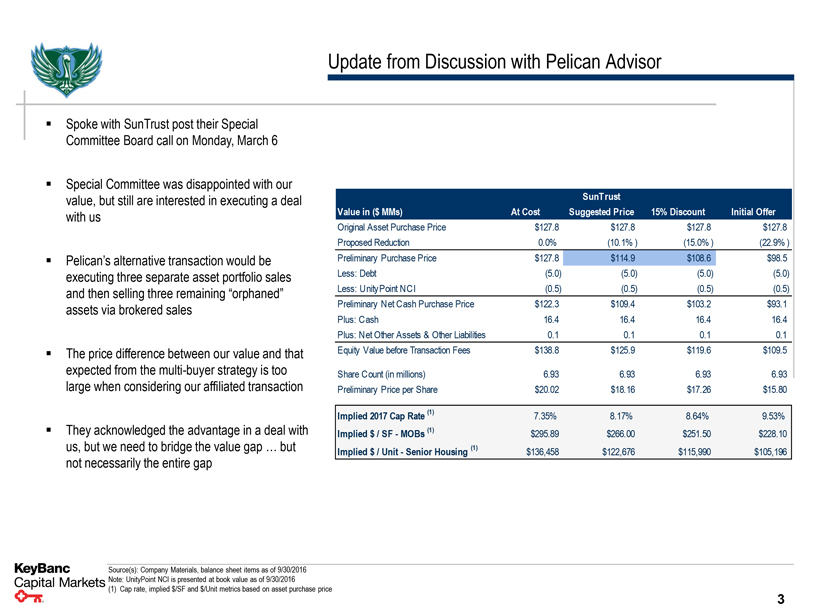

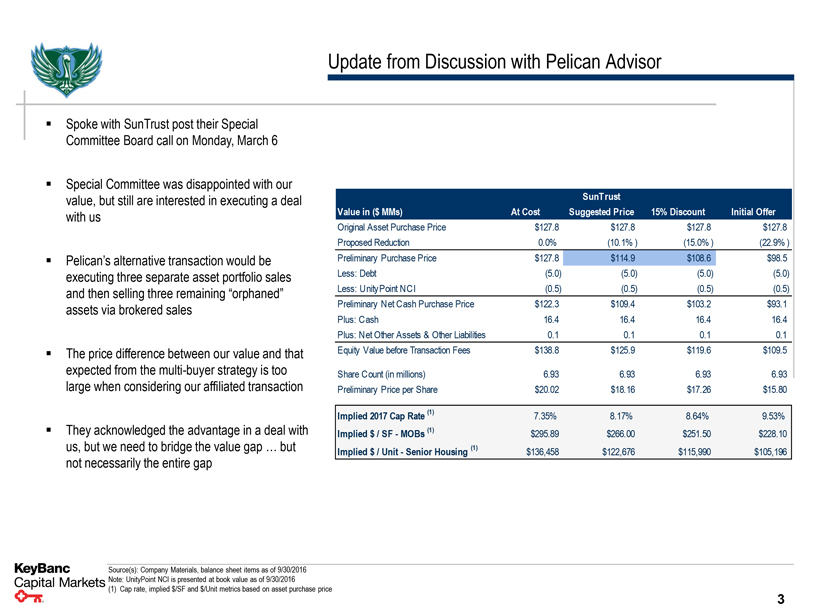

Update from Discussion with Pelican Advisor ▪ Spoke with SunTrust post their Special Committee Board call on Monday, March 6 ▪ Special Committee was disappointed with our value, but still are interested in executing a deal with us ▪ Pelican’s alternative transaction would be executing three separate asset portfolio sales and then selling three remaining “orphaned” assets via brokered sales ▪ The price difference between our value and that expected from the multi-buyer strategy is too large when considering our affiliated transaction ▪ They acknowledged the advantage in a deal with us, but we need to bridge the value gap … but not necessarily the entire gap SunTrust Value in ($MMs) At Cost Suggested Price 15% Discount Initial Offer Original Asset Purchase Price $127.8 $127.8 $127.8 $127.8 Proposed Reduction 0.0% (10.1%) (15.0%) (22.9%) Preliminary Purchase Price $127.8 $114.9 $108.6 $98.5 Less: Debt (5.0) (5.0) (5.0) (5.0) Less: UnityPoint NCI (0.5) (0.5) (0.5) (0.5) Preliminary Net Cash Purchase Price $122.3 $109.4 $103.2 $93.1 Plus: Cash 16.4 16.4 16.4 16.4 Plus: Net Other Assets & Other Liabilities 0.1 0.1 0.1 0.1 Equity Value before Transaction Fees $138.8 $125.9 $119.6 $109.5 Share Count (in millions) 6.93 6.93 6.93 6.93 Preliminary Price per Share $20.02 $18.16 $17.26 $15.80 Implied 2017 Cap Rate (1) 7.35% 8.17% 8.64% 9.53% Implied $/ SF - MOBs (1) $295.89 $266.00 $251.50 $228.10 Implied $/ Unit - Senior Housing (1) $136,458 $122,676 $115,990 $105,196 Source(s): Company Materials, balance sheet items as of 9/30/2016 Note: UnityPoint NCI is presented at book value as of 9/30/2016 (1) Cap rate, implied $/SF and $/Unit metrics based on asset purchase price KeyBanc Capital Markets 3

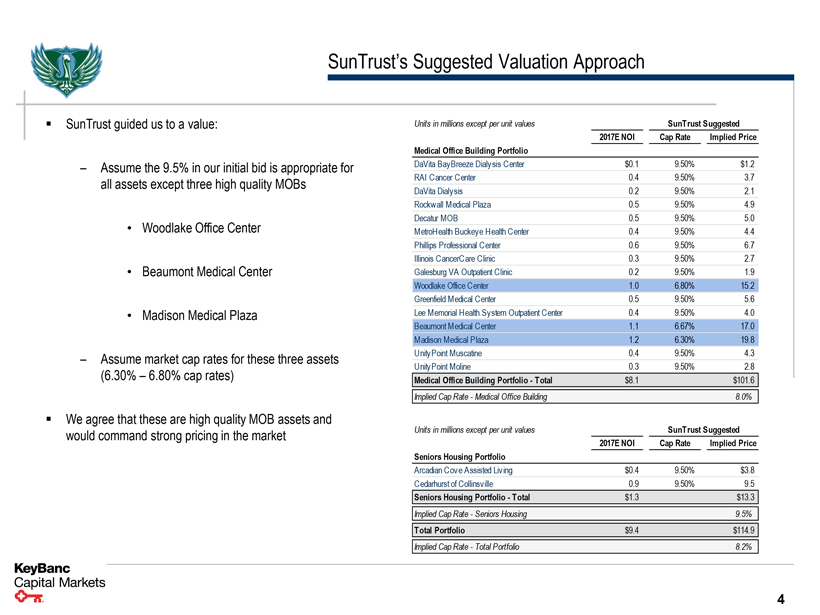

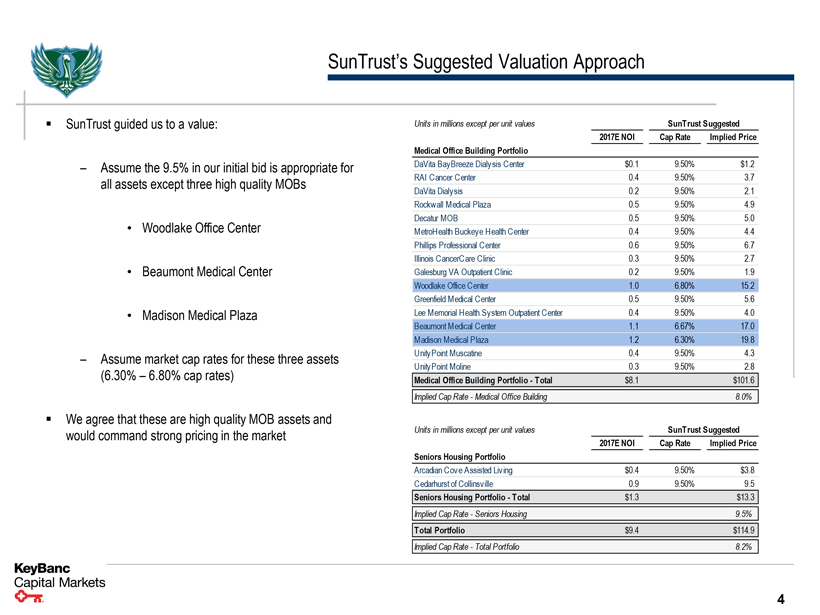

SunTrust’s Suggested Valuation Approach ▪ SunTrust guided us to a value: – Assume the 9.5% in our initial bid is appropriate for all assets except three high quality MOBs • Woodlake Office Center • Beaumont Medical Center • Madison Medical Plaza – Assume market cap rates for these three assets (6.30% – 6.80% cap rates) ▪ We agree that these are high quality MOB assets and would command strong pricing in the market Units in millions except per unit values SunTrust Suggested 2017E NOI Cap Rate Implied Price Medical Office Building Portfolio DaVita BayBreeze Dialysis Center $0.1 9.50% $1.2 RAI Cancer Center 0.4 9.50% 3.7 DaVita Dialysis 0.2 9.50% 2.1 Rockwall Medical Plaza 0.5 9.50% 4.9 Decatur MOB 0.5 9.50% 5.0 MetroHealth Buckeye Health Center 0.4 9.50% 4.4 Phillips Professional Center 0.6 9.50% 6.7 Illinois CancerCare Clinic 0.3 9.50% 2.7 Galesburg VA Outpatient Clinic 0.2 9.50% 1.9 Woodlake Office Center 1.0 6.80% 15.2 Greenfield Medical Center 0.5 9.50% 5.6 Lee Memorial Health System Outpatient Center 0.4 9.50% 4.0 Beaumont Medical Center 1.1 6.67% 17.0 Madison Medical Plaza 1.2 6.30% 19.8 UnityPoint Muscatine 0.4 9.50% 4.3 UnityPoint Moline 0.3 9.50% 2.8 Medical Office Building Portfolio - Total $8.1 $101.6 Implied Cap Rate - Medical Office Building 8.0% Units in millions except per unit values SunTrust Suggested 2017E NOI Cap Rate Implied Price Seniors Housing Portfolio Arcadian Cove Assisted Living $0.4 9.50% $3.8 Cedarhurst of Collinsville 0.9 9.50% 9.5 Seniors Housing Portfolio - Total $1.3 $13.3 Implied Cap Rate - Seniors Housing 9.5% Total Portfolio $9.4 $114.9 Implied Cap Rate - Total Portfolio 8.2% KeyBanc Capital Markets 4