UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3462

The Flex-funds Trust

|

6125 Memorial Drive Dublin, OH 43017 |

Bruce McKibben

c/o The Flex-funds Trust

6125 Memorial Drive

Dublin, OH 43017

Registrant’s telephone number, including area code: 800-325-3539

Date of fiscal year end: December 31, 2008

Date of reporting period: June 30, 2008

| Item 1. | Report to Stockholders. |

The Flex-funds®

2008 Semiannual Report

June 30, 2008

| | |

| | The Flex-funds® Managed by Meeder Asset Management, Inc. 6125 Memorial Drive, Dublin Ohio, 43017 Call Toll Free 800-325-3539 | 614-760-2159 Fax: 614-766-6669 | www.flexfunds.com Email: flexfunds@meederfinancial.com |

Performance Review

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Period & Average Total Returns as of June 30, 2008 | | 3

Months | | | YTD | | | 1

year | | | 3

years | | | 5

years | | | 10

years | | | Since

Inception | | | Net Expense

Ratio** | | | Gross Expense

Ratio*** | |

FUND OF FUNDS | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Dynamic Growth Fund | | 3.05 | % | | -8.55 | % | | -9.04 | % | | 6.33 | % | | 8.43 | % | | — | | | -0.47 | %1 | | 1.32 | % | | 1.86 | % |

The Muirfield Fund® | | 1.67 | % | | -9.14 | % | | -9.75 | % | | 5.08 | % | | 7.24 | % | | 3.58 | % | | 7.93 | %2 | | 1.38 | % | | 1.88 | % |

The Focused Growth Fund | | -0.42 | % | | -10.02 | % | | -11.39 | % | | — | | | — | | | — | | | 0.84 | %3 | | 1.58 | % | | 1.68 | % |

The Aggressive Growth Fund | | -0.52 | % | | -10.24 | % | | -11.08 | % | | 4.85 | % | | 7.60 | % | | — | | | -2.91 | %4 | | 1.70 | % | | 1.83 | % |

The Defensive Growth Fund | | -1.37 | % | | -10.33 | % | | -11.70 | % | | — | | | — | | | — | | | -0.13 | %5 | | 1.56 | % | | 1.66 | % |

EQUITY FUNDS | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Socially Responsible Utilities Fund (formerly The Total Return Utilities Fund) | | 7.01 | % | | -2.51 | % | | 2.27 | % | | 12.56 | % | | 14.97 | % | | 6.54 | % | | 9.79 | %6 | | 1.90 | % | | 2.10 | % |

The Quantex Fund™ | | -4.73 | % | | -13.16 | % | | -26.22 | % | | -0.46 | % | | 4.36 | % | | 0.52 | % | | 6.26 | %7 | | 1.56 | % | | 2.09 | % |

MONEY MARKET FUNDS | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Money Market Fund - Retail* | | 0.61 | % | | 1.53 | % | | 3.98 | % | | 4.29 | % | | 3.09 | % | | 3.54 | % | | 4.98 | %8 | | 0.48 | % | | 0.84 | % |

Current & Effective Yields | | 7-day Compound: 2.21%; 7-day Simple: 2.19% | |

The Money Market Fund - Institutional* | | 0.65 | % | | 1.60 | % | | 4.13 | % | | 4.44 | % | | — | | | — | | | 4.15 | %9 | | 0.34 | % | | 0.67 | % |

Current & Effective Yields | | 7-day Compound: 2.36%; 7-day Simple: 2.33% | |

FIXED INCOME FUND | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The U.S. Government Bond Fund | | -2.01 | % | | 0.64 | % | | 7.38 | % | | 3.76 | % | | 2.06 | % | | 3.49 | % | | 5.57 | %10 | | 1.01 | % | | 1.72 | % |

BENCHMARK INDICES | | | | | | | | | | | | | | | | | | | | | | | | | | | |

S&P 500 Index | | -2.72 | % | | -11.91 | % | | -13.11 | % | | 4.40 | % | | 7.57 | % | | 2.88 | % | | — | | | — | | | — | |

Blended Index**** | | -1.49 | % | | -6.79 | % | | -6.59 | % | | 4.34 | % | | 5.83 | % | | 3.15 | % | | — | | | — | | | — | |

NASDAQ Composite Index | | 0.82 | % | | -13.18 | % | | -11.18 | % | | 4.51 | % | | 7.90 | % | | 2.45 | % | | — | | | — | | | — | |

Russell 2000 Index | | 0.59 | % | | -9.37 | % | | -16.18 | % | | 3.82 | % | | 10.32 | % | | 5.58 | % | | — | | | — | | | — | |

S&P 400 Midcap Index | | 5.43 | % | | -3.90 | % | | -7.34 | % | | 7.44 | % | | 12.59 | % | | 9.82 | % | | — | | | — | | | — | |

Russell 3000 Utilities | | 2.87 | % | | -8.80 | % | | -9.71 | % | | 8.64 | % | | 11.24 | % | | 1.43 | % | | — | | | — | | | — | |

Lehman Brothers Intermediate-Term Gov’t/Credit Index | | -1.53 | % | | 1.43 | % | | 7.37 | % | | 4.27 | % | | 3.49 | % | | 5.55 | % | | — | | | — | | | — | |

iMoneyNet, Inc. Average First-Tier Institutional Money Market Fund | | 0.62 | % | | 1.55 | % | | 4.06 | % | | 4.56 | % | | 3.31 | % | | 4.20 | % | | — | | | — | | | — | |

Lipper Average General-Purpose Money Market Fund | | 0.50 | % | | 1.30 | % | | 3.55 | % | | 3.84 | % | | 2.60 | % | | 3.03 | % | | — | | | — | | | — | |

To obtain a prospectus containing more complete information about The Flex-funds®, including fees and other expenses that apply to a continued investment in the Funds, you may call The Flex-funds® at Toll Free (800)325-3539, visit us online at www.flexfunds.com, or write P.O. Box 7177, Dublin OH 43017. Please read the prospectus carefully for investment objectives, risk & expense information before investing.

Past performance does not guarantee future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2008, and assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees were waived and/or expenses reimbursed in order to reduce the operating expenses of the Funds during all periods shown above. All expense waivers for the Funds are voluntary and may be terminated at any time, except for The Quantex Fund ™. The management fee waiver for The Quantex Fund ™ is contractual and may be terminated annually by the adviser on its renewal date. Source for index data: Bloomberg.

| * | An investment in The Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although The Money Market Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. Yield quotations more closely reflect the current earnings of The Money Market Fund than do total return quotations. The current performance may be lower or higher than the performance data quoted. |

| ** | The Net Expense Ratios are percentages of the Funds’ average net assets as of December 31, 2007. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

| *** | The Gross Expense Ratios are percentages of the Funds’ average net assets as they are shown in the most current Funds’ Prospectus. |

| **** | The Blended Index is comprised of 60% of the S&P 500 Index and 40% of the average 90-day U.S. Treasury bill. |

1 | Inception Date: 2/29/00. |

3 | Inception Date: 1/31/06. |

4 | Inception Date: 2/29/00. |

5 | Inception Date: 1/31/06. |

6 | Inception Date: 6/21/95. |

7 | Inception Date: 3/20/85. |

8 | Inception Date: 3/27/85. |

9 | Inception Date: 12/28/04. |

10 | Inception Date: 5/7/85. |

| | |

| The Flex-funds® | | 2008 Semiannual Report | June 30, 2008 |

Letter to Shareholders

The first half of 2008 has been characterized by volatility and challenging conditions on several fronts among the capital markets and the overall economy. For example, in the first six months of the year we witnessed continued deterioration in the housing market, the collapse of a major Wall Street investment bank, and the threat of escalating inflation in the wake of surging energy and food prices despite a slowing economy.

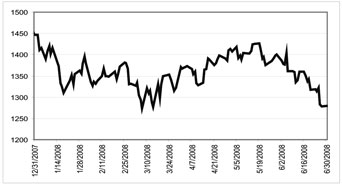

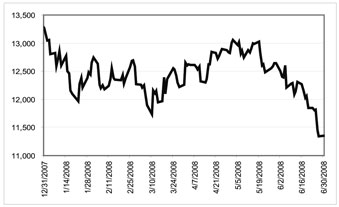

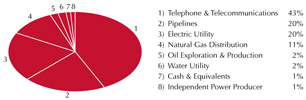

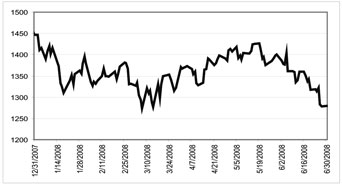

While the equity markets staged a brief rally in early March through mid-May, uncertainty surrounding the aforementioned events drove the markets lower by the end of the second quarter. As of June 30, 2008, the year-to-date return for the Dow Jones Industrial Average was -13.36%, while the S&P 500 returned -11.91% (see Charts 1 and 2).

Despite the tough conditions, we employed a variety of strategies that enabled the majority of our Funds to outperform their benchmarks during the first half of 2008. In the following pages, you will find a performance review for each of The Flex-funds® as well as commentary regarding the investment decisions executed in the Funds. We will begin with an economic and financial market review in order to provide a background on the events that influenced our investment strategies.

Economic weakness combined with rising prices

During the first half of 2008, the markets were confronted with a number of challenging developments, including:

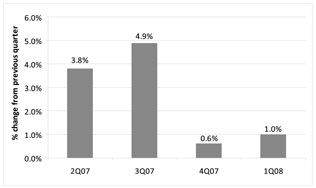

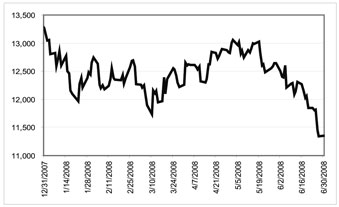

| • | | Sluggish economic growth. Data suggests that the economy grew at a pace of just 1.0% on an annualized basis during the first three months of the year (see Chart 3). Although this was slightly higher than the previous quarter’s growth rate, it shows that the economy is still extremely sluggish. In addition, most of the economic growth during the quarter was driven by exports to foreign countries (not domestic sales). Other indicators provide a more concise assessment, such as industrial production, which fell by 0.1% over the 12 months ended May 31st —the first time since June 2003 industrial output has declined on a year-over-year basis. |

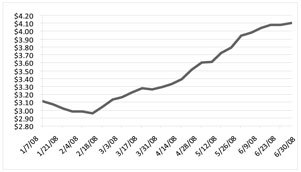

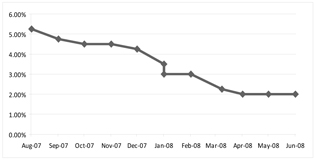

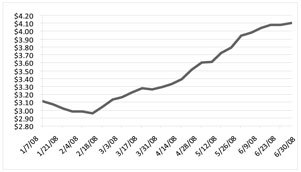

| • | | Soaring energy prices. The first half of 2008 saw the price of oil jump from around $93 a barrel at the beginning of January to more than $140 in late June due to factors such as rising demand for oil from emerging economies, supply constraints and speculation on the part of investors. The spike in oil prices caused gas prices to rise as well. As seen in Chart 4, the average price per gallon of gasoline was $4.10 on June 30th, up from $3.11 in early January. |

Chart 1: S&P 500 Index Year-to-Date Performance

Source: ILX

Chart 2: Dow Jones Industrial Average Year-to-Date Performance

Source: ILX

Chart 3: U.S. Gross Domestic Product (GDP)

Source: U.S. Commerce Department

| | |

| The Flex-funds® 2008 Semiannual Report | June 30, 2008 | | Page 1 |

| | |

| The Flex-funds® | | 2008 Semiannual Report | June 30, 2008 |

Letter to Shareholders

Chart 4: Retail Gasoline Price (per gallon)

Source: Energy Information Administration

| • | | Rising inflation. Rising prices for oil and food are spurring an unwanted increase in inflation. For example, inflation as measured by the Consumer Price Index (CPI) rose at a higher than expected rate in May and was up 4.2% over the previous 12 months. |

So far, higher inflation has not spread throughout the economy as a whole. Consider that core CPI inflation (which excludes the volatile food and energy sectors) was up only 2.3% during the past year through May. Meanwhile, the Core Personal Consumption Expenditures Price Index (Core PCE), the Federal Reserve’s preferred gauge of inflation, rose by 2.1% over the 12 months ending May 31st —just outside of its target range of 1% to 2%. That said, if oil and food prices remain at their highly elevated levels, those costs could eventually be passed on to consumers in the form of higher prices in many areas. We are beginning to see this occur to some extent. For example, Dow Chemical (the nation’s largest chemical company) recently announced two major price increases to offset rising energy costs.

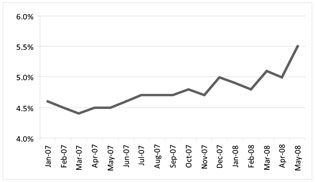

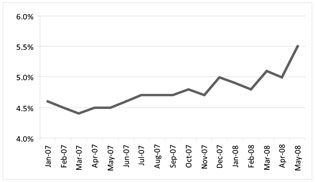

| • | | Rising unemployment. The sluggish economy continued to hurt the job market during the first half of 2008. The unemployment rate jumped significantly, from 5.0% in April to 5.5% in May, as employers cut jobs for the fifth consecutive month (see Chart 5). The 0.5% increase was the largest monthly percentage point rise in unemployment since 1986, and pushed the jobless rate to its highest level since October 2004. In total, some 324,000 jobs were lost from January through May. |

| • | | Housing weakness. Home prices in major U.S. cities plummeted by a record 15.3% during the 12 months through April, bringing prices back down to their 2004 levels. As home values decline further and further, the wealth effect many homeowners feel also diminishes—resulting in less overall spending. Compounding this problem is the fact that the number of homes going into foreclosure soared by 48% on a year-over-year basis in May. |

| • | | Nervous consumers. The powerful combination of rising unemployment, higher prices and weak housing is having an exceptionally negative impact on consumers, whose spending accounts for approximately two-thirds of economic activity. For example, consumer spending rose by just 1.1% from January through March—the slowest pace since the recession of 2001—while consumers’ personal incomes declined by 0.1 % from their peak last December through April. It is not especially surprising, then, that consumer confidence in June fell to its lowest level in 28 years. |

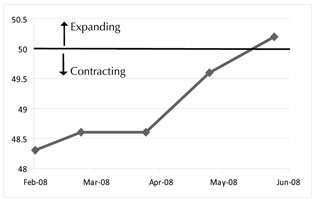

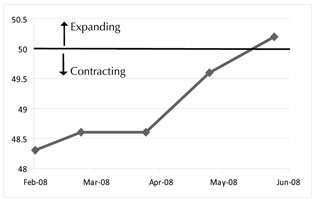

| • | | Weak manufacturing. As seen in Chart 6, manufacturing activity contracted for four consecutive months (a reading above 50 indicates expansion; below 50 indicates contraction). Although the latest reading for June shows a very slight expansion, it is clear manufacturers are facing significant headwinds in the current environment. |

Chart 5: U.S. Unemployment Rate

Source: Bureau of Labor Statistics

Chart 6: U.S. Manufacturing Activity

Source: Institute for Supply Management

| | |

| Page 2 | | The Flex-funds® 2008 Semiannual Report | June 30, 2008 |

| | |

| The Flex-funds® | | 2008 Semiannual Report | June 30, 2008 |

The Fed shifts its focus

The Federal Reserve Board reacted to new data, which emerged during this year, by shifting its primary focus from resparking the flagging economy to containing rising inflationary pressures.

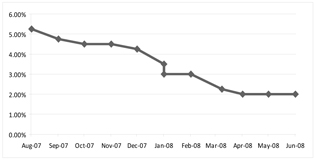

In early April, for example, Fed chairman Ben Bernanke suggested the economy could enter into recession, while notes from a previous Fed meeting showed some Fed members worried about a “prolonged and severe” downturn. Later in April, the Fed cut short-term interest rates for the seventh time since last September (to 2%) in an effort to encourage greater consumer and business spending, and boost economic growth (see Chart 7).

Chart 7: Fed Funds Rate

Source: Federal Reserve

By the end of May, however, the Fed started to indicate further rate cuts were unlikely. Then in June, Bernanke commented that the risk of a substantial economic downturn had diminished, but that inflation—driven by rising energy prices and a weak dollar—was becoming a growing threat the Fed would “strongly resist.” The Fed therefore held rates steady at 2% at its meeting in late June, as further rate cuts could generate an unwanted increase in inflation. It was the first time in more than nine months the Fed did not cut interest rates, while also opening the possibility to future rate hikes to combat inflation. According to the most recent Fed statement, “Although downside risks to growth remain, they appear to have diminished somewhat, and the upside risks to inflation and inflation expectations have increased.”

A somewhat cautious investment approach

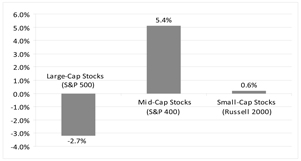

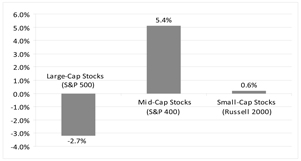

The equity markets have performed poorly during the first half of 2008, driven by the factors explained above and because of the Fed’s rapid shift in focus from stimulating economic growth to fighting inflation. While large-company stocks suffered the largest losses during the time period, mid- and small-cap shares performed well in comparison (see Chart 8).

Chart 8: Asset-Class Performance (2nd Quarter 2008)

Source: Standard & Poor’s, WSJ Market Data Group

Since January, our quantitative investment models have indicated a somewhat high-risk stock market environment based on several trend and technical indicators. As a result, we established and have maintained a partially defensive position in The Muirfield Fund® and The Defensive Growth Fund. As of June 30, 2008, these Funds had an approximate 75% equity allocation and 25% allocation to money market securities. This position benefited performance as large-cap stock prices fell.

We also emphasized shares of large- and mid-cap companies in our fund-of-funds based mutual funds. This strategy included an overweight position in mid-cap stocks, which helped us deliver strong returns for the first half compared to the S&P 500 Index, the Dow Jones Industrial Average and the NASDAQ Composite Index. In addition, we continued to focus on growth stocks and underweight value shares. This approach also strongly benefited the Funds’ returns in recent months, especially since growth often performs well on a relative basis during periods of market volatility. Also, the value stock universe consists largely of financial services firms, which performed poorly during the first half and dragged down value shares as a group.

Our international investments dampened performance somewhat, as markets in Europe and elsewhere experienced negative returns. We gradually reduced our exposure to developed international markets during the second quarter. We also established a modest position in emerging markets stocks. Many economies in emerging markets such as Latin America are commodity-based, and therefore offer attractive growth prospects as well as a hedge against rising inflation. As a result of these actions, our total targeted international exposure remained unchanged at 18-20%.

| | |

| The Flex-funds® 2008 Semiannual Report | June 30, 2008 | | Page 3 |

| | |

| The Flex-funds® | | 2008 Semiannual Report | June 30, 2008 |

Letter to Shareholders

The fixed-income markets experienced significant volatility as well during the first half of 2008. During the first quarter, a flight to quality and declining interest rate environment translated to favorable exposure in long duration government Treasury securities. We maintained our position in relatively long weighted average maturities, which allowed us to lock in higher yields on longer-term issues. However, as inflation became the prevalent concern during the second quarter, Treasury bond yields rose (and prices fell), and investors favored corporate and government agency bonds, which offered attractive yields relative to Treasuries. As a result, we reduced the durations of The U.S. Government Bond Fund, which helped protect against some of the losses that occurred in the bond market in the second quarter. The Money Market Fund delivered strong performance and outperformed the average money market fund by maintaining its focus on high-quality money market securities.

Challenges ahead

It appears there will be a number of challenges during the coming months that could negatively affect the economy—including the possibility of higher inflation, reduced consumer spending, high gas prices and continued weakness in the housing market.

Indeed, the Fed now expects the economy to grow by just 0.3% to 1.2% in 2008, down from an earlier prediction of 1.3% to 2.0%. The Fed also raised its core inflation expectations for 2008, from an estimate of 2.0% to 2.2% in January to 2.2% to 2.4%, and expects unemployment to range between 5.5% and 5.7%. Additionally, a report by the Department of Energy predicts gas prices will hover around $4 per gallon and oil prices will remain well above $100 a barrel over the next year. In addition, it seems corporate earnings growth estimates are too high and will likely need to be reduced in the future.

This environment creates a significant challenge for the Federal Reserve. Further rate cuts to boost the economy could push inflation even higher, while raising rates to rein in inflation increases the risk of putting the brakes on the economy before it recovers from its current weakness. Until conditions become more clear, it is likely the Fed will hold interest rates steady.

For now, significant risks remain in the economy and the financial markets. Therefore, we are maintaining our partially defensive position in The Muirfield Fund® and The Defensive Growth Fund. We also continue to favor growth-oriented shares of large- and mid-cap domestic companies, and selective international exposures. Going forward, we will continue to monitor conditions carefully and look for shifts in the relationship between growth and value stocks, large-, mid-, and small-caps, and domestic and international shares that provide opportunities to enhance returns and manage risk for our shareholders.

On the following pages you will find a review of how our Mutual Funds have performed. Please read the commentaries and performance tables to learn more about the investment decisions that were made during the past six months.

On behalf of all of the associates at Meeder Asset Management, Inc. and The Flex-funds®, I thank you for the continued trust and confidence you have placed in our investment management services. We look forward to working with you and helping you achieve your most important financial goals.

Sincerely,

|

|

| Robert S. Meeder, Jr. |

| President |

| Meeder Asset Management, Inc. & The Flex-funds® |

| June 30, 2008 |

| | |

| Page 4 | | The Flex-funds® 2008 Semiannual Report | June 30, 2008 |

| | |

| The Flex-funds® | | 2008 Semiannual Report | June 30, 2008 |

The Muirfield Fund®

The Defensive Growth Fund

Performance Perspective

| | | | | | | | | | | | | | | | | | | | | | | |

Period & Average Annual Total Returns as of June 30, 2008 | | 3

Months | | | YTD | | | 1

Year | | | 3

Years | | | 5

Years | | | 10

Years | | | Since

Inception | | | Inception

Date |

The Muirfield Fund® | | 1.67 | % | | -9.14 | % | | -9.75 | % | | 5.08 | % | | 7.24 | % | | 3.58 | % | | 7.93 | % | | 8/10/88 |

Expense Ratios*: Net 1.38% Gross 1.88% | | | | | | | | | | | | | | | | | | | | | | | |

The Defensive Growth Fund | | -1.37 | % | | -10.33 | % | | -11.70 | % | | — | | | — | | | — | | | -0.13 | % | | 1/31/06 |

Expense Ratios*: Net 1.56% Gross 1.66% | | | | | | | | | | | | | | | | | | | | | | | |

S&P 500 Index1 | | -2.72 | % | | -11.91 | % | | -13.11 | % | | 4.40 | % | | 7.57 | % | | 2.88 | % | | 10.49 | % | | 7/31/88 |

| | | | | | | | | | | | | | | | | | | | 1.97 | % | | 1/31/06 |

Blended Index2 | | -1.49 | % | | -6.79 | % | | -6.59 | % | | 4.34 | % | | 5.83 | % | | 3.15 | % | | 8.12 | % | | 7/31/88 |

| | | | | | | | | | | | | | | | | | | | 2.91 | % | | 1/31/06 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2008. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time.

1 | The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

2 | The Blended Index consists of 60% of the S&P 500 Index and 40% of the average 90-day U.S. Treasury bill. |

| * | The Net Expense Ratios are percentages of the Funds’ net assets as of December 31, 2007. Gross Expense Ratios are percentages of the Funds’ assets as they are shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

Semiannual Market Perspective

The Flex-funds Muirfield Fund® returned -9.14% for the six months ended June 30, 2008 while the The Flex-funds® Defensive Growth Fund returned -10.33% for the same period. By comparison, the S&P 500 Index declined 11.91% for the same period. That said, as conditions warrant, the Funds are sometimes invested “defensively” either partially or fully invested in cash equivalent securities. As a result, we believe another appropriate comparison of performance is a blended index consisting of 60% of the S&P 500 Index and 40% of the 90-day U.S. Treasury Bill. The Muirfield Fund® has outperformed this blended index for the 3 month, 3-, 5- and 10-year periods.

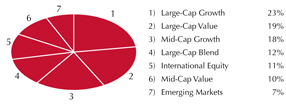

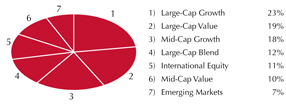

Portfolio Holdings as of June 30, 2008

Portfolio holdings are subject to change.

Since mid-January of this year, The Muirfield Fund® and The Defensive Growth Fund have been invested in a partially defensive position. We initially established a 25% defensive position and have maintained a cash position of approximately 25-45% as a result of deterioration in the trend and technical factors in our quantitative models.

We have also been selective with our equity positions. As was discussed in the President’s letter on pages 1 through 4, the prevailing macroeconomic theme continues to focus on the impact from a slowing economy coupled with the prospect of inflationary pressures, and we believe our view necessitates an allocation to large-and mid-cap shares as opposed to small-cap shares. As such, we continue to believe large-and mid-cap stocks not only provide the best opportunities for superior relative returns over the near-term, but also act as a buffer if the markets continue to stumble.

Aside from our emphasis on large-and mid-cap shares, we continued to overweight growth stocks, as our models favored growth over value across all asset size ranges. Our strategic fund selection process identified the potential for gains through the Janus Adviser Forty Fund, which returned–0.31% during the first half. We also experienced success with the Fidelity Independence Growth Fund that returned 6.41% in the first half of 2008. In addition, we maintained our international holdings at approximately 13% as our evaluation continues to favor selective international exposures, including a modest weighting in emerging markets. Our position in the Allianz NFJ International Value Fund returned–4.96%, compared to its benchmark, the MSCI EAFE Index, which returned–10.50% in the first half of 2008.

| | |

| The Flex-funds® 2008 Semiannual Report | June 30, 2008 | | Page 5 |

| | |

| The Flex-funds® | | 2008 Semiannual Report | June 30, 2008 |

The Dynamic Growth Fund

The Focused Growth Fund

Performance Perspective

| | | | | | | | | | | | | | | | | | | | | | |

Period & Average Annual Total Returns as of June 30, 2008 | | 3

Months | | | YTD | | | 1

Year | | | 3

Years | | | 5

Years | | | 10

Years | | Since

Inception | | | Inception

Date |

The Dynamic Growth Fund | | 3.05 | % | | -8.55 | % | | -9.04 | % | | 6.33 | % | | 8.43 | % | | — | | -0.47 | % | | 2/29/00 |

Expense Ratios*: Net 1.32% Gross 1.86% | | | | | | | | | | | | | | | | | | | | | | |

The Focused Growth Fund | | -0.42 | % | | -10.02 | % | | -11.39 | % | | — | | | — | | | — | | 0.84 | % | | 1/31/06 |

Expense Ratios*: Net 1.58% Gross 1.68% | | | | | | | | | | | | | | | | | | | | | | |

S&P 500 Index1 | | -2.72 | % | | -11.91 | % | | -13.11 | % | | 4.40 | % | | 7.57 | % | | — | | 0.91 | % | | 2/29/00 |

| | | | | | | | | | | | | | | | | | | 1.97 | % | | 1/31/06 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2008. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time.

1 | The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| * | The Net Expense Ratios are percentages of the Funds’ net assets as of December 31, 2007. Gross Expense Ratios are percentages of the Funds’ assets as they are shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

Semiannual Market Perspective

The Flex-funds® Dynamic Growth Fund and The Focused Growth Fund returned -8.55% and -10.02%, respectively, for the six months ended June 30, 2008, while the S&P 500 Index returned -11.91% for the same period. The Dynamic Growth Fund has also outperformed its benchmark index for the 3 month, year-to-date, 1-, 3-, and 5-year periods. Similarly, The Focused Growth Fund outperformed its benchmark index for the 3 month, year-to-date and 1-year periods.

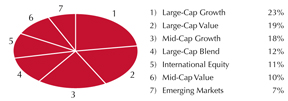

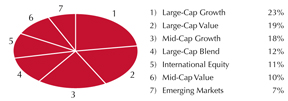

Portfolio Holdings as of June 30, 2008

Portfolio holdings are subject to change.

The economy faced numerous challenges during the first half of 2008 as consumer confidence reached a 28-year low, inflationary pressures persisted from rising energy and food prices, and payrolls continued to decline. The unwinding of the credit bubble continued, as evidenced by the prolonged downturn in the domestic housing market and the struggling financial services sector.

Our emphasis on large-and mid-cap stock funds aided performance in the first half of the year. During the first quarter, we favored the shares of large-cap companies; however, our internal models indicated an attractive risk-return profile for mid-caps in the second quarter. Given our assessment of the economic environment, we believe it remains prudent to be invested in the shares of large-and mid-cap companies as opposed to small-cap shares. Our internal models also began shifting to growth across all market cap ranges in the third quarter of 2007. We made a series of adjustments accordingly throughout the fourth quarter of 2007 and have subsequently maintained those positions.

While value stocks outperformed in the first quarter due to weakness in the technology sector, growth stocks regained their 2007 form and significantly outperformed value stocks in the second quarter, especially as the financial services sector suffered another wave of losses. Additionally, our models continued to favor an international position so we maintained our international exposure at approximately 18-20%. Our international positions of Harbor International and Allianz NFJ International Value Fund outperformed their benchmark the MSCI EAFE Index for the first half of 2008.

As of this writing, our target allocation for the Funds is 54% in large-cap stock funds, 28% in mid-cap stock funds, and 18% in international stock funds.

| | |

| Page 6 | | The Flex-funds® 2008 Semiannual Report | June 30, 2008 |

| | |

| The Flex-funds® | | 2008 Semiannual Report | June 30, 2008 |

The Aggressive Growth Fund

Performance Perspective

| | | | | | | | | | | | | | | | | | | | | | |

Period & Average Annual Total Returns as of June 30, 2008 | | 3

Months | | | YTD | | | 1

Year | | | 3

Years | | | 5

Years | | | 10

Years | | Since

Inception | | | Inception

Date |

The Aggressive Growth Fund | | -0.52 | % | | -10.24 | % | | -11.08 | % | | 4.85 | % | | 7.60 | % | | — | | -2.91 | % | | 2/29/00 |

Expense Ratios*: Net 1.70% Gross 1.83% | | | | | | | | | | | | | | | | | | | | | | |

NASDAQ Composite Index1 | | 0.82 | % | | -13.18 | % | | -11.18 | % | | 4.51 | % | | 7.90 | % | | — | | -7.73 | % | | 2/29/00 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2008. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time.

1 | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ National Market and Small Cap stocks. The NASDAQ Composite Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| * | The Net Expense Ratio is a percentage of the Fund’s net assets as of December 31, 2007. The Gross Expense Ratio is a percentage of the Fund’s assets as it is shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

Semiannual Market Perspective

The Flex-funds® Aggressive Growth Fund returned -10.24% for the six months ended June 30, 2008. In comparison, the NASDAQ Composite Index returned -13.18% for the same period. Even with the market declines over the past nine months, The Aggressive Growth Fund has provided an average annual rate of return of 7.60%, for the 5-year period ending June 30, 2008 while the NASDAQ Composite Index returned 7.90% over the same 5-year period. The Fund exceeded its benchmark for the year-to-date, 1-, 3-and since inception periods.

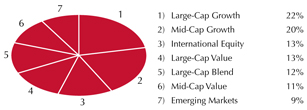

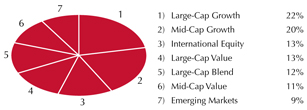

Portfolio Holdings as of June 30, 2008

Portfolio holdings are subject to change.

The economy faced numerous challenges during the first half of 2008 as consumer confidence reached a 28-year low, inflationary pressures persisted from rising energy and food prices, and payrolls continued to decline. Due to the economic environment and a result of our quantitative model, we focused our holdings on large-and mid-cap stock positions, which aided performance in the first half of the year. Given our assessment of the economic environment, we believe it remains prudent to be invested in the shares of large-and mid-cap companies as opposed to small-cap shares. Our internal models also began shifting to growth across all market cap ranges in the third quarter of 2007. We made a series of adjustments accordingly throughout the fourth quarter of 2007 and have subsequently maintained those positions.

In The Flex-funds® Aggressive Growth Fund, our position in the Utilities sector as well as exposure to Latin America benefited the Fund, while geographic exposure to Europe detracted from value. Overall, international exposure ranged from approximately 20% to 30%, including a 9% stake in emerging markets as of the end of the first half. Downward pressure on the U.S. Dollar relative to the Euro continued to aid performance throughout the time period, and widening interest rate differentials between the U.S. and other countries may place more downside pressure on the Dollar in the months ahead.

As of this writing, our target allocation for the Fund is 47% in large-cap stock funds, 31% in mid-cap stock funds, and 22% in international stock funds.

| | |

| The Flex-funds® 2008 Semiannual Report | June 30, 2008 | | Page 7 |

| | |

| The Flex-funds® | | 2008 Semiannual Report | June 30, 2008 |

The Quantex Fund™

Performance Perspective

| | | | | | | | | | | | | | | | | | | | | | | |

Period & Average Annual Total Returns as of June 30, 2008 | | 3

Months | | | YTD | | | 1

Year | | | 3

Years | | | 5

Years | | | 10

Years | | | Since

Inception | | | Inception

Date |

The Quantex Fund™ | | -4.73 | % | | -13.16 | % | | -26.22 | % | | -0.46 | % | | 4.36 | % | | 0.52 | % | | 6.26 | % | | 3/20/85 |

Expense Ratios*: Net 1.56% Gross 2.09% | | | | | | | | | | | | | | | | | | | | | | | |

Russell 2000 Index1 | | 0.59 | % | | -9.37 | % | | -16.18 | % | | 3.82 | % | | 10.32 | % | | 5.58 | % | | 8.00 | % | | 3/31/85 |

S&P 400 Mid-Cap Index2 | | 5.43 | % | | -3.90 | % | | -7.34 | % | | 7.44 | % | | 12.59 | % | | 9.82 | % | | 12.28 | % | | 3/31/85 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2008. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. The Fund’s management fee waiver is contractual and may be terminated annually by the Advisor on its renewal date.

1 | The Russell 2000 Index is a widely recognized unmanaged index of common stock prices of small-sized companies. The Russell 2000 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

2 | The S&P 400 Mid-Cap Index is a widely recognized unmanaged index of common stock prices of mid-sized companies. The S&P 400 Mid-Cap Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| * | The Net Expense Ratio is a percentage of the Fund’s net assets as of December 31, 2007. The Gross Expense Ratio is a percentage of the Fund’s assets as it is shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

Semiannual Market Perspective

The Flex-funds® Quantex Fund™ returned -13.16% for the six months ended June 30, 2008. By comparison, the Russell 2000 Index returned -9.37%, while the S&P 400 Mid-Cap Index returned -3.90% for the same period.

We have employed our quantitative stock selection process for The Quantex Fund™ since April 30, 2005. We utilize rankings from our financial model to determine which 100 securities are to be held in the Fund on an annual basis, which focuses on small-and mid-cap stocks. These stocks are typically those of large companies that have declined in price prior to being included in the Fund (referred to as “fallen angels”) or stocks of small, up-and-coming companies (“rising stars”).

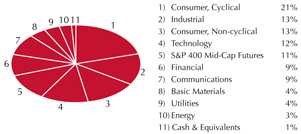

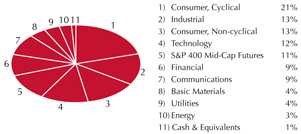

Sector Weightings as of June 30, 2008

Sector weightings are subject to change.

The Fund is rebalanced once each year in January, and for 2008 the composition of the Fund is once again overweighted in Consumer Goods and underweighted in Energy, with an overall tilt to value. For the first half of 2008, the single best performing stock was Big Lots (up 95%). Energy stocks benefited performance as Teco Energy gained nearly 28% and Dynegy gained approximately 20% during the first half. The Fund also benefited from chemical companies, with Eastman Chemical Company gaining 14% during the first half of the year. The Fund experienced mixed performance with consumer-oriented companies, as evidenced by a 17% increase with Darden Restaurants compared to a 27% decrease in Radioshack. As expected, financial stocks were the worst performers, including Ambac Financial Group, Inc and MBIA.

The Fund has encountered similar rough patches in the past, particularly during transitional periods in the market. For example, in the fourth quarter of 1999 and the first quarter of 2000, the Fund returned 13.46% and 3.80%, respectively, while the S&P 400 Mid-Cap Index returned 17.20% and 12.70%.

| | |

| Page 8 | | The Flex-funds® 2008 Semiannual Report | June 30, 2008 |

| | |

| The Flex-funds® | | 2008 Semiannual Report | June 30, 2008 |

The Socially Responsible Utilities Fund

(Formerly known as The Total Return Utilities Fund)3

Performance Perspective

| | | | | | | | | | | | | | | | | | | | | | | |

Period & Average Annual Total Returns as of June 30, 2008 | | 3

Months | | | YTD | | | 1

Year | | | 3

Years | | | 5

Years | | | 10

Years | | | Since

Inception | | | Inception

Date |

The Socially Responsible Utilities Fund | | 7.01 | % | | - 2.51 | % | | 2.27 | % | | 12.56 | % | | 14.97 | % | | 6.54 | % | | 9.79 | % | | 6/21/95 |

Expense Ratios*: Net 1.90% Gross 2.10% | | | | | | | | | | | | | | | | | | | | | | | |

Russell 3000 Utilities Index1 | | 2.87 | % | | -8.80 | % | | -9.71 | % | | 8.64 | % | | 11.24 | % | | 1.43 | % | | 5.43 | % | | 6/30/95 |

Blended Index2 | | 1.48 | % | | -6.33 | % | | -5.15 | % | | 5.52 | % | | 8.11 | % | | 3.18 | % | | 5.96 | % | | 6/30/95 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2008. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time.

1 | The Russell 3000 Utilities Index is a market capitalization-weighted index that is comprised of utility stocks that are included in the Russell 3000 Index. This index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

2 | The Blended Index consists of 60% of the Russell 3000 Utilities Index and 40% of the Lehman Brothers Long Credit Index. |

3 | While the name of the fund has changed, the investment objective has remained the same. |

| * | The Net Expense Ratio is a percentage of the Fund’s net assets as of December 31, 2007. The Gross Expense Ratio is a percentage of the Fund’s assets as it is shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

Semiannual Market Perspective

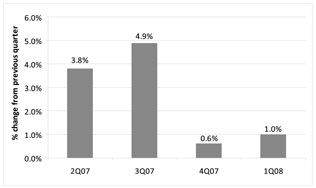

For the six months ended June 30, 2008, The Flex-funds® Socially Responsible Utilities Fund returned -2.51%, while the Russell 3000 Utilities Index returned -8.80%, and a blended index consisting of 60% of the Russell 3000 Utilities Index and 40% of The Lehman Brothers Long Credit Index returned -6.33%. We are very pleased the Fund has outperformed both of these benchmarks for the 3 month, year-to-date, 1-, 3-, 5-, 10-year and since inception periods.

Absent the problems plaguing the financial sector, utilities generally had favorable first half performance, and so did the Fund. Lower performance in the Russell 3000 Utilities generally indicates poor telecom performance, since the index is over half telecom; however, our representatives in the group had mixed performance, with some doing quite well.

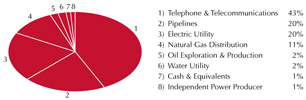

Sector Weightings as of June 30, 2008

Sector weightings are subject to change.

Telecom shares proved volatile and produced mixed returns throughout the first half. A well-timed entry into the very cheap Brazilian phone company Tele Norte Leste helped the Fund in the first quarter while AT&T negatively impacted performance. During the second quarter, we took profits of about 100% in Brasil Telecom as it had fully priced its impending deal, and took profits of 65% in Leap Wireless, a fourth quarter trading purchase, replacing it with deal speculation Telephone & Data Systems. Canadian telecom TELUS, China Mobile, AT&T, America Movil and Philippine Long Distance were the weaker performers in the Fund during the second quarter.

During the first quarter we thought there had been “enough correction” in share prices. Right now we do not see excesses that need correction in this sector. Some of the weak will become strong, some of the strong will become booked profits, and there are ample new opportunities presenting themselves in many corners. We continue to like what we see, both short-term and long-term, and in this sector the term “write-down” is rarely if ever heard.

| | |

| The Flex-funds® 2008 Semiannual Report | June 30, 2008 | | Page 9 |

| | |

| The Flex-funds® | | 2008 Semiannual Report | June 30, 2008 |

The U.S. Government Bond Fund

Performance Perspective

| | | | | | | | | | | | | | | | | | | | | | | |

Period & Average Annual Total Returns as of June 30, 2008 | | 3

Months | | | YTD | | | 1

Year | | | 3

Years | | | 5

Years | | | 10

Years | | | Since

Inception | | | Inception

Date |

The U.S. Government Bond Fund | | -2.01 | % | | 0.64 | % | | 7.38 | % | | 3.76 | % | | 2.06 | % | | 3.49 | % | | 5.57 | % | | 5/7/85 |

Expense Ratios*: Net 1.01% Gross 1.72% | | | | | | | | | | | | | | | | | | | | | | | |

Lehman Brothers Intermediate-Term Government/Credit Index1 | | -1.53 | % | | 1.43 | % | | 7.37 | % | | 4.27 | % | | 3.49 | % | | 5.55 | % | | 7.43 | % | | 4/30/85 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2008. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time.

1 | The Lehman Brothers Intermediate-Term Government/Credit Index is an unmanaged index of fixed-rate bonds issued by the U.S. Government and its agencies that are rated investment grade or higher, have one to ten years remaining until maturity, and at least $100 million outstanding. The Lehman Brothers Intermediate-Term Government/Credit Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| * | The Net Expense Ratio is a percentage of the Fund’s net assets as of December 31, 2007. The Gross Expense Ratio is a percentages of the Fund’s assets as it is shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

Semiannual Market Perspective

The Flex-funds® U.S. Government Bond Fund returned 0.64% year-to-date through June 30, 2008. After a positive first quarter when bond prices consistently rallied and yields declined, the second quarter realized the opposite with bond prices declining and yields increasing. The average yield on a 2-year U.S. Treasury security increased approximately 1.45% during the second quarter. This was due to the anticipation the Fed would move away from cutting its benchmark interest rate and focus more on inflation expectations. Throughout the first half of the year inflation expectations elevated with accelerated increases in many commodity and food prices. As these data sets changed our fixed-income model inputs also changed to indicate we should move our average duration lower. As a result, our target average duration moved lower from approximately 5 to 3.75.

Portfolio Holdings as of June 30, 2008

Portfolio holdings are subject to change.

As yields in the fixed-income markets started pricing in the changes in the market environment, opportunities were generated to purchase higher yielding products. Recognizing this opportunity, we invested a portion of the Fund in callable government agency bonds. This offered the opportunity for additional yield pick-up over other more traditional non-callable government investments.

As we move into the third quarter of 2008, we anticipate interest rates to rise slightly. With no relief from inflated commodity and food prices in sight, we believe our model will remain in favor of a lower average duration. Depending on the economic environment, we may continue to lower the average duration of the Fund. Investments in the Fund remain in U.S. Government Agency securities as we believe they offer an attractive spread over U.S. Treasury Securities. As the third quarter evolves we will remain vigilant to anticipate changes in the market and alter investments accordingly. At this time we believe the Fund structure is consistent with our philosophy and fixed-income model.

| | |

| Page 10 | | The Flex-funds® 2008 Semiannual Report | June 30, 2008 |

| | |

| The Flex-funds® | | 2008 Semiannual Report | June 30, 2008 |

The Money Market Fund

Performance Perspective

| | | | | | | | | | | | | | | | | | | | | | | |

Period & Average Annual Total Returns as of June 30, 2008 | | 3

Months | | | YTD | | | 1

Year | | | 3

Years | | | 5

Years | | | 10

Years | | | Since

Inception | | | Inception

Date |

The Flex-funds® Money Market Fund (Retail Class) | | 0.61 | % | | 1.53 | % | | 3.98 | % | | 4.29 | % | | 3.09 | % | | 3.54 | % | | 4.98 | % | | 3/27/85 |

Expense Ratios*: Net 0.48% Gross 0.84% | | | | | | | | | | | | | | | | | | | | | | | |

Current & Effective Yields1 | | 7-day Compound: 2.21% | | | 7-day Simple: 2.19% |

Lipper Average General-Purpose | | 0.50 | % | | 1.30 | % | | 3.55 | % | | 3.84 | % | | 2.60 | % | | 3.03 | % | | 4.45 | % | | 3/31/85 |

Money Market Fund2 | | | | | | | | | | | | | | | | | | | | | | | |

The Flex-funds® Money Market Fund (Institutional Class) | | 0.65 | % | | 1.60 | % | | 4.13 | % | | 4.44 | % | | — | | | — | | | 4.15 | % | | 12/28/04 |

Expense Ratios*: Net 0.34% Gross 0.67% | | | | | | | | | | | | | | | | | | | | | | | |

Current & Effective Yields1 | | 7-day Compound: 2.36% | | | 7-day Simple: 2.33% |

iMoneyNet, Inc. Average First-Tier | | 0.62 | % | | 1.55 | % | | 4.06 | % | | 4.56 | % | | — | | | — | | | 4.09 | % | | 12/31/04 |

Institutional Money Market Fund2 | | | | | | | | | | | | | | | | | | | | | | | |

Past performance does not guarantee future results. Except for the current and effective yields, all performance figures represent average annual total returns for the periods ended June 30, 2008, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Money Market Fund during the periods shown above. Investments in The Money Market Fund are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although the Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in The Money Market Fund.

1 | For the period ended June 30, 2008, yield quotations more closely reflect the current earnings of The Money Market Fund than do total return quotations. |

2 | An index of funds such as Lipper’s Average General Purpose Money Market Fund Index and iMoneyNet, Inc.’s Average First-Tier Institutional Money Market Fund Index includes a number of mutual funds grouped by investment objective. |

| * | The Net Expense Ratios are percentages of the Funds’ net assets as of December 31, 2007. Gross Expense Ratios are percentages of the Funds’ assets as they are shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

Semiannual Market Perspective

The Retail Class of The Flex-funds® Money Market Fund continues to rank among the top general-purpose money market funds in the country as of June 30, 2008, according to iMoneyNet, Inc. The Retail Class of the Fund closed the first half of 2008 with a 2.21% 7-day compound yield. The average general-purpose money market fund finished the quarter with a 1.89% 7-day compound yield.

Portfolio Holdings as of June 30, 2008

Portfolio holdings are subject to change.

The first quarter was characterized by volatility as the Fed cut the federal funds rate from 4.25% to 2.25% in response to disruptions in the credit markets. Fixed-income securities across all money market sectors rallied in price and reached a peak near the end of March. In the second quarter, investors seemed to shift focus to the potential onset of inflation despite lingering credit concerns. However, debt of financial intermediaries continued to be priced for higher yields as risk associated with these investments remained elevated. With events in place, the second quarter also realized a steeper yield curve. Traditional commercial paper with the highest credit ratings maturing in 90 days increased only 0.14% while yields at the maximum maturity for commercial paper (270 days) increased nearly 0.50%.

Corporate debt issued by financial institutions (including asset-backed commercial paper) traded at a greater spread over U.S Treasury securities compared to other money market instruments. Asset-backed commercial paper also maintained an above average spread over traditional commercial paper by approximately 0.50%. This is mainly due to higher risk associated with these investments. We continue to avoid holding any asset-backed commercial paper due to the ongoing concerns over the creditworthiness of these investments.

As we move into the third quarter of 2008, we continue to watch the developments taking place in the credit markets closely. Credit markets still show signs of instability, which is apparent in excessive spreads in certain areas of the money market arena. With the possibility of prolonged economic weakness coupled with the credit crisis it is important to remain patient at this juncture. As for the weighted average maturity (WAM) of the fund, we will move to position ourselves for flat to increasing interest rates. With this in mind, our strategy over the next quarter will be to lower our WAM closer to the industry average. We believe this philosophy will be suitable to position ourselves for the potential increase in interest rates over the next several quarters.

| | |

| The Flex-funds® 2008 Semiannual Report | June 30, 2008 | | Page 11 |

| | |

| The Flex-funds® | | 2008 Semiannual Report | June 30, 2008 |

Shareholder Expense Analysis (Unaudited)

Shareholders of mutual funds pay ongoing expenses, such as advisory fees, distribution and service fees (12b-1 fees) and other fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples below are based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from December 31, 2007 to June 30, 2008.

ACTUAL EXPENSES: The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g.: an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

| | | | | | | | | | | | |

ACTUAL EXPENSES | | Beginning

Account Value

(12/31/2007) | | Ending

Account Value

(6/30/08) | | Expenses Paid

During Period1

(12/31/2007-

6/30/08) | | Expense Ratio

(Annualized) | |

The Muirfield Fund® | | $ | 1,000.00 | | $ | 908.60 | | $ | 6.64 | | 1.40 | % |

The Socially Responsible Utilities Fund | | | 1,000.00 | | | 974.90 | | | 9.33 | | 1.90 | % |

The Quantex Fund™ | | | 1,000.00 | | | 868.40 | | | 7.67 | | 1.65 | % |

The Dynamic Growth Fund | | | 1,000.00 | | | 914.50 | | | 6.28 | | 1.32 | % |

The Aggressive Growth Fund | | | 1,000.00 | | | 897.60 | | | 8.02 | | 1.70 | % |

The Defensive Growth Fund | | | 1,000.00 | | | 896.70 | | | 7.31 | | 1.55 | % |

The Focused Growth Fund | | | 1,000.00 | | | 899.80 | | | 7.42 | | 1.57 | % |

The U.S. Government Bond Fund | | | 1,000.00 | | | 1,006.40 | | | 4.94 | | 0.99 | % |

The Money Market Fund - Retail Class | | | 1,000.00 | | | 1,015.30 | | | 2.41 | | 0.48 | % |

The Money Market Fund - Institutional Class | | | 1,000.00 | | | 1,016.00 | | | 1.70 | | 0.34 | % |

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES: The second table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | | | | | | | | | | |

HYPOTHETICAL EXAMPLE (5% return before expenses) | | Beginning

Account Value

(12/31/2007) | | Ending

Account Value

(6/30/08) | | Expenses Paid

During Period1

(12/31/2007-

6/30/08) | | Expense Ratio

(Annualized) | |

The Muirfield Fund® | | $ | 1,000.00 | | $ | 1,017.90 | | $ | 7.02 | | 1.40 | % |

The Socially Responsible Utilities Fund | | | 1,000.00 | | | 1,015.42 | | | 9.52 | | 1.90 | % |

The Quantex Fund™ | | | 1,000.00 | | | 1,016.66 | | | 8.27 | | 1.65 | % |

The Dynamic Growth Fund | | | 1,000.00 | | | 1,018.30 | | | 6.62 | | 1.32 | % |

The Aggressive Growth Fund | | | 1,000.00 | | | 1,016.41 | | | 8.52 | | 1.70 | % |

The Defensive Growth Fund | | | 1,000.00 | | | 1,017.16 | | | 7.77 | | 1.55 | % |

The Focused Growth Fund | | | 1,000.00 | | | 1,017.06 | | | 7.87 | | 1.57 | % |

The U.S. Government Bond Fund | | | 1,000.00 | | | 1,019.94 | | | 4.97 | | 0.99 | % |

The Money Market Fund - Retail Class | | | 1,000.00 | | | 1,022.48 | | | 2.41 | | 0.48 | % |

The Money Market Fund - Institutional Class | | | 1,000.00 | | | 1,023.17 | | | 1.71 | | 0.34 | % |

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if any transactional costs were included, your costs would have been higher.

1 | Expenses are equal to the Funds’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the total number of days in the six-month period). |

| | |

| Page 12 | | The Flex-funds® 2008 Semiannual Report | June 30, 2008 |

| | |

| The Flex-funds® | | 2008 Semiannual Report | June 30, 2008 |

2008 Semiannual Report

Portfolio Holdings & Financial Statements

| | |

| The Flex-funds® 2008 Semiannual Report | June 30, 2008 | | Page 13 |

Schedule of Investments

June 30, 2008 (unaudited)

The Muirfield Fund

| | | | | |

Security Description | | Shares or

Principal

Amount ($) | | Value ($)(a) | |

Registered Investment Companies — 70.9% | | | |

Allianz NFJ Dividend Value Fund — Class D | | 203,321 | | 2,980,679 | |

Allianz NFJ International Value Fund —Class A | | 156,343 | | 3,878,882 | |

CGM Focus Fund | | 54,832 | | 3,369,990 | |

DWS Large Cap Value Fund — Class A | | 69,478 | | 1,381,224 | |

Fairholme Fund | | 76,614 | | 2,296,902 | |

Fidelity Advisor Leveraged Company Stock Fund — A | | 134,409 | | 5,438,183 | |

Fidelity Independence Fund | | 144,510 | | 4,252,943 | |

Harbor International Fund — Inst. Class | | 58,263 | | 3,852,349 | |

Hartford Capital Appreciation Fund —Class A | | 176,105 | | 6,487,709 | |

iShares S&P Latin American 40 Index Fund | | 2,150 | | 591,250 | |

iShares S&P Midcap 400 Index Fund | | 25,200 | | 2,055,816 | |

Janus Adviser Forty Fund — Class S | | 160,516 | | 6,634,119 | |

Janus Adviser Mid Cap Growth Fund —Class S# | | 82,401 | | 2,974,676 | |

Janus Adviser Mid Cap Value Fund —Class S | | 215,069 | | 3,811,022 | |

Janus Enterprise Fund# | | 96,377 | | 5,264,102 | |

Lazard Emerging Markets Portfolio | | 124,939 | | 2,776,152 | |

MFS Value Fund — Class A | | 132,101 | | 3,108,344 | |

Nuveen Tradewinds Value Opportunities Fund — Class A | | 127,273 | | 3,767,295 | |

Pioneer Cullen Value Fund — Class A | | 67,034 | | 1,271,637 | |

PowerShares QQQ | | 38,250 | | 1,727,752 | |

| | | | | |

Total Registered Investment Companies (Cost $70,702,592) | | | | 67,921,026 | |

| | | | | |

Money Market Registered Investment Companies — 4.1% | |

Federated Prime Obligations Fund —Class I | | 3,891,672 | | 3,891,672 | |

| | | | | |

Total Money Market Registered Investment Companies

(Cost $3,891,672) | | | | 3,891,672 | |

| | | | | |

U.S. Government Obligations — 0.4% | | | |

U.S. Treasury Bill, 1.61%, due 08/07/2008* | | 100,000 | | 99,822 | |

U.S. Treasury Bill, 1.79%, due 09/04/2008* | | 300,000 | | 299,054 | |

| | | | | |

Total U.S. Government Obligations

(Cost $398,854) | | | | 398,876 | |

| | | | | |

Repurchase Agreements — 25.0% | | | | | |

Morgan Stanley DW, Inc., 2.56%, 07/01/2008, (Collateralized by $24,991,548 various Government Agencies, Agency Strips, Treasury Notes, and Treasury Strips at 5.125% — 8.625%, due 07/15/2008 —04/15/2030, value — $24,477,015) purchase date 06/30/2008 | | 23,997,000 | | 23,997,000 | |

| | | | | |

Total Repurchase Agreements

(Cost $23,997,000) | | | | 23,997,000 | |

| | | | | |

Total Investments — 100.4%

(Cost $98,990,118)(b) | | | | 96,208,574 | |

| | | | | |

Liabilities less Other Assets — (0.4%) | | (392,284 | ) |

| | | | | |

Total Net Assets — 100.0% | | | | 95,816,290 | |

| | | | | |

The Muirfield Fund

| | | | | |

Security Description | | Shares or

Principal

Amount ($) | | Value ($)(a) | |

Trustee Deferred Compensation** | | | |

The Flex-funds Aggressive Growth Fund | | 528 | | 4,071 | |

The Flex-funds Defensive Growth Fund | | 303 | | 2,842 | |

The Flex-funds Dynamic Growth Fund | | 1,490 | | 12,591 | |

The Flex-funds Muirfield Fund | | 4,349 | | 23,789 | |

The Flex-funds Quantex Fund | | 1,959 | | 31,168 | |

The Flex-funds Socially Responsible Utilities Fund | | 280 | | 7,123 | |

| | | | | |

Total Trustee Deferred Compensation

(Cost $74,579) | | 81,584 | |

| | | | | |

| | | Long

Contracts | | Unrealized

Appreciation

(Depreciation) ($) | |

Futures Contracts | | | | | |

Standard & Poors MidCap 400 expiring September 2008, notional value $1,642,400 | | 4 | | (105,600 | ) |

| | | | | |

Total Futures Contracts | | | | (105,600 | ) |

| | | | | |

| (a) | Statement on Financial Accounting Standard No. 157 “Fair Value Measurements” — Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below. |

| | • | | Level 1 — quoted prices in active markets for identical securities |

| | • | | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The following is a summary of the inputs used as of June 30, 2008 in valuing the Fund’s assets carried at fair value:

| | | | | | | |

Valuation Inputs | | Investments in

Securities | | Other Financial

Instruments*** | |

Level 1 — Quoted Prices | | $ | 72,111,752 | | $ | (105,600 | ) |

Level 2 — Other Significant Observable Inputs | | | 24,096,822 | | | — | |

Level 3 — Significant Unobservable Inputs | | | — | | | — | |

| | | | | | | |

Total | | $ | 96,208,574 | | $ | (105,600 | ) |

| | | | | | | |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, short-term debt instruments and repurchase agreements with a maturity of less than 60 days are valued using amortized cost, in accordance with rules under the Investment Company Act of 1940. Generally, amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as Level 2.

The accompanying notes are an integral part of these financial statements.

Schedule of Investments

June 30, 2008 (unaudited)

The Muirfield Fund

| (b) | Cost for financial reporting purposes and federal income tax purposes are the same. Cost for federal income tax purposes differs from value by net unrealized appreciation (depreciation) of securities as follows: |

| | | | |

Unrealized appreciation | | $ | 588,651 | |

Unrealized depreciation | | | (3,370,195 | ) |

| | | | |

Net unrealized appreciation (depreciation) | | $ | (2,781,544 | ) |

| | | | |

| # | Represents non-income producing securities. |

| * | Pledged as collateral on futures contracts. |

| ** | Assets of affiliates to The Muirfield Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures contracts, which are valued at the unrealized appreciation/depreciation on the instrument. |

The accompanying notes are an integral part of these financial statements.

Schedule of Investments

June 30, 2008 (unaudited)

The Dynamic Growth Fund

| | | | | |

Security Description | | Shares or

Principal

Amount ($) | | Value ($)(a) | |

Registered Investment Companies — 92.8% | | | |

Allegiant Mid Cap Value Fund — Class A | | 27,512 | | 330,696 | |

Allianz NFJ Dividend Value Fund — Class D | | 143,363 | | 2,101,700 | |

Allianz NFJ International Value Fund — Class A | | 140,873 | | 3,495,067 | |

CGM Focus Fund | | 46,260 | | 2,843,117 | |

DWS Large Cap Value Fund — Class A | | 69,144 | | 1,374,588 | |

Fairholme Fund | | 73,126 | | 2,192,305 | |

Fidelity Advisor Leveraged Company Stock Fund — A | | 101,018 | | 4,087,190 | |

Fidelity Independence Fund | | 131,980 | | 3,884,159 | |

Harbor International Fund — Inst. Class | | 52,261 | | 3,455,465 | |

Hartford Capital Appreciation Fund — Class A | | 132,713 | | 4,889,159 | |

iShares S&P Midcap 400 Index Fund | | 23,000 | | 1,876,340 | |

Ivy Large Cap Growth Fund — Class A | | 82,775 | | 1,086,838 | |

Janus Adviser Forty Fund — Class S | | 120,948 | | 4,998,774 | |

Janus Adviser Mid Cap Growth Fund — Class S# | | 64,607 | | 2,332,314 | |

Janus Adviser Mid Cap Value Fund — Class S | | 131,526 | | 2,330,624 | |

Janus Enterprise Fund | | 71,028 | | 3,879,554 | |

Lazard Emerging Markets Portfolio | | 140,925 | | 3,131,352 | |

MFS Value Fund — Class A | | 68,016 | | 1,600,408 | |

Nuveen Tradewinds Value Opportunities Fund — Class A | | 104,558 | | 3,094,923 | |

Pioneer Cullen Value Fund — Class A | | 113,652 | | 2,155,975 | |

PowerShares QQQ | | 42,450 | | 1,917,466 | |

| | | | | |

Total Registered Investment Companies

(Cost $59,632,202) | | | | 57,058,014 | |

| | | | | |

U.S. Government Obligations — 0.6% | |

U.S. Treasury Bill,

1.79%, due 09/04/2008* | | 400,000 | | 398,739 | |

| | | | | |

Total U.S. Government Obligations

(Cost $398,693) | | | | 398,739 | |

| | | | | |

Repurchase Agreements — 7.0% | |

Morgan Stanley DW, Inc., 2.56%, 07/01/2008, (Collateralized by $4,471,963 various Government Agencies, Agency Strips, Treasury Notes, and Treasury Strips at 5.125% — 8.625%, due 07/15/2008 — 04/15/2030, value — $4,379,893) purchase date 06/30/2008 | | 4,294,000 | | 4,294,000 | |

| | | | | |

Total Repurchase Agreements

(Cost $4,294,000) | | | | 4,294,000 | |

| | | | | |

Total Investments — 100.4%

(Cost $64,324,895)(b) | | | | 61,750,753 | |

| | | | | |

Liabilities less Other Assets — (0.4%) | | | | (251,019 | ) |

| | | | | |

Total Net Assets — 100.0% | | | | 61,499,734 | |

| | | | | |

The Dynamic Growth Fund

| | | | | |

Security Description | | Shares or

Principal

Amount ($) | | Value ($)(a) | |

Trustee Deferred Compensation** | |

The Flex-funds Aggressive Growth Fund | | 266 | | 2,051 | |

The Flex-funds Defensive Growth Fund | | 155 | | 1,454 | |

The Flex-funds Dynamic Growth Fund | | 400 | | 3,380 | |

The Flex-funds Muirfield Fund | | 1,240 | | 6,783 | |

The Flex-funds Quantex Fund | | 580 | | 9,228 | |

The Flex-funds Socially Responsible Utilities Fund | | 69 | | 1,755 | |

| | | | | |

Total Trustee Deferred Compensation

(Cost $24,018) | | 24,651 | |

| | | | | |

| | | Long

Contracts | | Unrealized

Appreciation

(Depreciation) ($) | |

Futures Contracts | | | | | |

Standard & Poors Mid Cap 400 expiring September 2008, notional value $4,516,600 | | 11 | | (287,400 | ) |

| | | | | |

Total Futures Contracts | | | | (287,400 | ) |

| | | | | |

| (a) | Statement on Financial Accounting Standard No. 157 “Fair Value Measurements” — Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below. |

| | • | | Level 1 — quoted prices in active markets for identical securities |

| | • | | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The following is a summary of the inputs used as of June 30, 2008 in valuing the Fund’s assets carried at fair value:

| | | | | | | |

Valuation Inputs | | Investments in

Securities | | Other Financial

Instruments*** | |

Level 1 — Quoted Prices | | $ | 57,456,753 | | $ | (287,400 | ) |

Level 2 — Other Significant Observable Inputs | | | 4,294,000 | | | — | |

Level 3 — Significant Unobservable Inputs | | | — | | | — | |

| | | | | | | |

Total | | $ | 61,750,753 | | $ | (287,400 | ) |

| | | | | | | |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. For example, short-term debt instruments and repurchase agreements with a maturity of less than 60 days are valued using amortized cost, in accordance with rules under the Investment Company Act of 1940. Generally, amortized cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market, such securities are reflected as Level 2.

The accompanying notes are an integral part of these financial statements.

Schedule of Investments

June 30, 2008 (unaudited)

The Dynamic Growth Fund

| (b) | Cost for financial reporting purposes and federal income tax purposes are the same. Cost for federal income tax purposes differs from value by net unrealized appreciation (depreciation) of securities as follows: |

| | | | |

Unrealized appreciation | | $ | 562,513 | |

Unrealized depreciation | | | (3,136,655 | ) |

| | | | |

Net unrealized appreciation (depreciation) | | $ | (2,574,142 | ) |

| | | | |

| # | Represents non-income producing securities. |

| * | Pledged as collateral on futures contracts. |

| ** | Assets of affiliates to The Dynamic Growth Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures contracts, which are valued at the unrealized appreciation/depreciation on the instrument. |

The accompanying notes are an integral part of these financial statements.

Schedule of Investments

June 30, 2008 (unaudited)

The Aggressive Growth Fund

| | | | | |

Security Description | | Shares or

Principal

Amount ($) | | Value ($)(a) | |

Registered Investment Companies — 93.0% | | | |

Consumer Staples Select Sector SPDR Fund | | 35,675 | | 954,306 | |

DIAMONDS Trust, Series I | | 32,750 | | 3,714,505 | |

iShares Dow Jones U.S Industrial Sector Index Fund | | 13,850 | | 892,771 | |

iShares MSCI EAFE Growth Index Fund | | 14,700 | | 1,038,114 | |

iShares MSCI EAFE Index Fund | | 20,790 | | 1,427,649 | |

iShares MSCI Emerging Markets Index Fund | | 4,250 | | 576,810 | |

iShares MSCI EMU Index Fund | | 8,855 | | 867,702 | |

iShares MSCI Singapore Index Fund | | 36,900 | | 457,929 | |

iShares MSCI Taiwan Index Fund | | 29,400 | | 415,422 | |

iShares Russell Midcap Growth Index Fund | | 20,325 | | 2,151,198 | |

iShares Russell Midcap Value Index Fund | | 17,650 | | 2,270,496 | |

iShares S&P 500 Growth Index Fund | | 10,250 | | 654,258 | |

iShares S&P Latin American 40 Index Fund | | 10,450 | | 2,873,750 | |

iShares S&P MidCap 400 Growth Index Fund | | 14,800 | | 1,309,948 | |

iShares S&P MidCap 400 Index Fund | | 27,350 | | 2,231,213 | |

PowerShares Dynamic Mid Cap Growth Portfolio | | 126,275 | | 2,752,795 | |

PowerShares QQQ | | 80,760 | | 3,647,929 | |

Utilities Select Sector SPDR Fund | | 20,750 | | 844,525 | |

| | | | | |

Total Registered Investment Companies (Cost $31,362,782) | | | | 29,081,320 | |

| | | | | |

U.S. Government Obligations — 0.9% | | | |

U.S. Treasury Bill, 1.79%, due 09/04/08* | | 300,000 | | 299,054 | |

| | | | | |

Total U.S. Government Obligations

(Cost $299,020) | | | | 299,054 | |

| | | | | |

Repurchase Agreements — 6.3% | | | |

Morgan Stanley DW, Inc., 2.56%, 07/01/2008, (Collateralized by $2,064,143 various Government Agencies, Agency Strips, Treasury Notes, and Treasury Strips at 5.125% — 8.625%, due 07/15/2008 —04/15/2030, value — $2,021,646) purchase date 06/30/2008 | | 1,982,000 | | 1,982,000 | |

| | | | | |

Total Repurchase Agreements

(Cost $1,982,000) | | | | 1,982,000 | |

| | | | | |

Total Investments — 100.2%

(Cost $33,643,802)(b) | | | | 31,362,374 | |

| | | | | |

Liabilities less Other Assets — (0.2%) | | | | (75,785 | ) |

| | | | | |

Total Net Assets — 100.0% | | | | 31,286,589 | |

| | | | | |

Trustee Deferred Compensation** | | | |

The Flex-funds Aggressive Growth Fund | | 294 | | 2,267 | |

The Flex-funds Defensive Growth Fund | | 169 | | 1,585 | |

The Flex-funds Dynamic Growth Fund | | 362 | | 3,059 | |

The Flex-funds Muirfield Fund | | 1,086 | | 5,940 | |

The Flex-funds Quantex Fund | | 491 | | 7,812 | |

The Flex-funds Socially Responsible Utilities Fund | | 67 | | 1,704 | |

| | | | | |

Total Trustee Deferred Compensation (Cost $22,003) | | | | 22,367 | |

| | | | | |

The Aggressive Growth Fund

| | | | | |

Security Description | | Long

Contracts | | Unrealized

Appreciation

(Depreciation) ($) | |

Futures Contracts | | | |

Standard & Poors Mid Cap 400 expiring September 2008, notional value $2,053,000 | | 5 | | (120,900 | ) |

| | | | | |

Total Futures Contracts | | | | (120,900 | ) |

| | | | | |

| (a) | Statement on Financial Accounting Standard No. 157 “Fair Value Measurements” — Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below. |

| | • | | Level 1 — quoted prices in active markets for identical securities |

| | • | | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | • | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The following is a summary of the inputs used as of June 30, 2008 in valuing the Fund’s assets carried at fair value:

| | | | | | | |

Valuation Inputs | | Investments in

Securities | | Other Financial

Instruments*** | |

Level 1 — Quoted Prices | | $ | 29,380,374 | | $ | (120,900 | ) |

Level 2 — Other Significant Observable Inputs | | | 1,982,000 | | | — | |

Level 3 — Significant Unobservable Inputs | | | — | | | — | |

| | | | | | | |

Total | | $ | 31,362,374 | | $ | (120,900 | ) |

| | | | | | | |