Performance Review

June 30, 2010

| | YTD | 1 year | 5 years | 10 years | Since Inception | Current Expense Ratio** | Gross Expense Ratio*** |

The Money Market Fund - Retail*1 | 0.11% | 0.31% | 2.93% | 2.66% | 4.65% | 0.37% | 0.84% |

| Current & Effective Yields | | 7-day Compound: 0.20%; 7-day Simple: 0.20% |

The Money Market Fund - Institutional* 2 | 0.15% | 0.41% | 3.07% | - | 3.01% | 0.29% | 0.67% |

| Current & Effective Yields | | 7-day Compound: 0.28%; 7-day Simple: 0.28% |

The U.S. Government Bond Fund3 | 4.05% | 7.04% | 4.39% | 3.63% | 5.56% | 0.99% | 1.49% |

The Defensive Balanced Fund 4 | -3.01% | 8.71% | - | - | -1.45% | 1.53% | 1.72% |

The Muirfield Fund® 5 | -5.01% | 10.63% | 0.18% | -0.14% | 6.50% | 1.38% | 1.66% |

The Total Return Utilities Fund 6 | -6.14% | 13.68% | 2.27% | 1.42% | 6.69% | 1.94% | 2.20% |

The Dynamic Growth Fund 7 | -6.23% | 12.43% | -0.88% | -1.14% | -2.56% | 1.42% | 1.63% |

The Strategic Growth Fund 8 | -4.80% | 19.29% | - | - | -3.99% | 1.57% | 1.80% |

The Aggressive Growth Fund 9 | -6.24% | 14.34% | -0.50% | -1.83% | -3.92% | 1.60% | 1.82% |

The Quantex Fund™ 10 | -2.54% | 38.98% | 2.23% | -0.72% | 6.27% | 1.62% | 2.39% |

Disclosure

To obtain a prospectus containing more complete information about The Flex-funds®, including fees and other expenses that apply to a continued investment in the Funds, you may call The Flex-funds® at Toll Free (800)325-3539, visit us online at www.flexfunds.com, or write P.O. Box 7177, Dublin OH 43017. Please read the prospectus carefully for investment objectives, risk & expense information before investing. Past performance does not guarantee future results. All performance figures represent total returns and average annual total returns for the periods ended July 30, 2010, and assumes reinvestment of all di vidend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees were waived and/or expenses reimbursed in order to reduce the operating expenses of the Funds during all periods shown above. All expense waivers for the Funds are voluntary and may be terminated at any time, except for The Quantex Fund TM. The management fee waiver for The Quantex Fund TM is contractual and may be terminated annually by the adviser on its renewal date. Source for index data: Bloomberg. *An investment in The Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although The Money Market Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. Yield quotations more closely reflect the current earnings of The Money Market Fund than do total return quotations. The current performance may be lower or higher than the performance data quoted. ** Current expense ratio based on net assets as of 6/30/10. This ratio may increase or decrease depending on fluctuations in fund net assets. *** The Gross Expense Ratios are percentages of the Funds’ average net assets as they are shown in the most current Funds’ Prospectus. ****The Blended Index is comprised of 60% of the S&P 500 Index and 40% of the average 90-day U.S. Treasury bill. 1Inception Date: 3/27/85. 2Inception Date: 12/28/04. 3Inc eption Date: 5/7/85. 4Inception Date 1/31/06. 5Inception Date: 8/10/88. 6Inception Date: 6/21/95. 7Inception Date: 2/29/00. 8Inception Date: 1/31/06. 9Inception Date: 2/29/00. 10Inception Date: 3/20/85.

| 2010 Semiannual Report | June 30, 2010 |

Letter to Shareholders

During the first half of 2010, the economic resurgence in the U.S. led to recovery highs for the major stock market indices through April. However, concerns regarding sovereign debt and the sustainability of the economic recovery following the expiration and fade of numerous stimulus programs weighed heavily on the financial markets during the remainder of the second quarter. As a result, major market indices posted losses during the first half of 2010. The Dow Jones Industrial Average ended the first half of 2010 down 5.00% while the S&P 500 Index declined 6.65%. However, smaller companies performed slightly better as evidenced by the S&P 400 Midcap Index and the Russell 2000 Index which lost 1.36% and 1.94%, respectively. As investor fears returned to the market, tr aditional safe haven assets such as U.S. Treasury securities and gold benefited from the renewed market turbulence. Despite the difficult conditions and volatility encountered in the equity markets, we are pleased with the relative performance of The Flex-funds® through the first half of the year, as the majority of our Funds outperformed their respective benchmarks.

The first half of 2010 witnessed an abundance of events and news headlines which contributed to the stock market volatility. During the first quarter, continued federal government stimulus programs, better than expected corporate profits, and improving employment data provided positive catalysts for the continued advance in the domestic stock market. However, investor anxiety over fiscal deficits and high debt levels in the European region coupled with emerging concerns regarding the sustainability of the economic recovery led to steep and swift market losses. Given the presence of significant challenges, some economists have even concluded that a ‘double-dip’ recession is quite possible. However, despite the numerous negative catalysts, many indicators show that the economic reco very is still intact. Companies have continued to report better than expected profits, which has also been coupled with solid sales growth in recent quarters. Subdued inflation reports should also allow the Federal Reserve to maintain its commitment to keeping interest rates low for an “extended period”.

Because of the recent deterioration of trend and technical factors in our investment models, we believe extra caution is warranted to monitor potential downside risks. Additionally, we believe that the stock market is currently in a cyclical bull market within a long-term secular bear market. As such, we believe an active management approach to risk exposure is critical in this market environment. The following pages will provide an overview of how we managed our risk exposures and the strategies we employed during the first half of 2010. We will also provide a brief summary on the economic and financial events that punctuated the first half of 2010, update our expectations for the balance of the year, and review the performance of our Funds.

The First Half of 2010 in Review

The first half of 2010 brought much uncertainty to the stock market. Following a positive start to the year, the sustainability of the economic recovery was called into question and the European debt crisis escalated as contagion fears gripped investors. In an effort to allay concerns, a bailout loan package was created by eurozone countries in conjunction with the International Monetary Fund (IMF) and the European Central Bank. Domestically, investor fears were stoked by unfavorable economic data in the housing market, renewed weakness on the job front, and the unwinding of various stimulus programs. The following is a brief overview of significant events and developments that influenced investors during the first half of 2010.

* Sovereign debt concerns emerge. The intensifying sovereign debt crisis in Europe has led to stock market declines around the globe. A $1 trillion bailout package was provided by the eurozone members and the International Monetary Fund, but investors remain concerned about the potential for defaults within the European community. Furthermore, as countries implement austerity measures to reign in spending, many economists fear such measures could push some countries back into recession. As European nations work through their debt problems, sovereign debt yields for these countries will likely remain elevated. The efficiency and expediency with which these problems are resolved could affect the progression of the global economi c rebound.

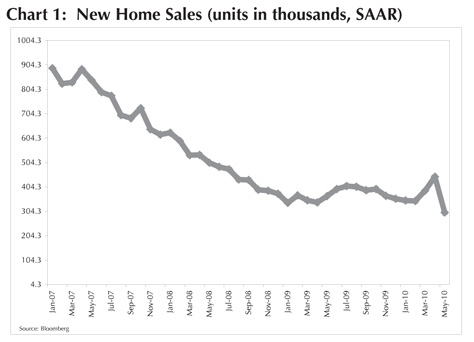

* Home sales stall following tax credit expiration. The expiration of the homebuyer tax credit at the end of April gave way to the lowest level of new home sales on

The Flex-funds® 2010 Semiannual Report | June 30, 2010 | Page 1 |

| 2010 Semiannual Report | June 30, 2010 |

record during the month of May. New home sales declined to an annual rate of 300,000 from the revised April figure of 446,000, a 32.7% decrease (see chart 1). Although the number may be exaggerated due to the expiration of the tax credit, the exceptionally low number of new home sales raises questions whether buying will continue without government incentives. However, mortgage rates recently fell to record low levels, which may help attract buyers into the market. Investors will continue to closely monitor the housing market for signs of recovery, which could be extrapolated to the health of the overall economy.

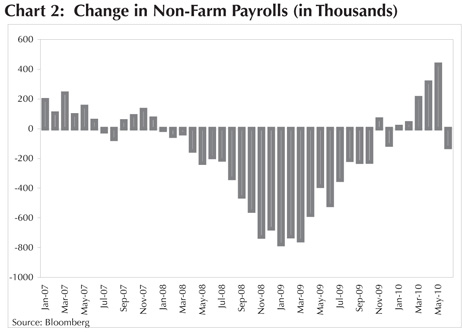

* Mixed employment data. The unemployment rate fell to 9.5% for the month of June from 9.7% during the previous month. Although this is the lowest rate experienced since July of 2009, the reduction was driven by a drop in the labor force participation rate. For the first time since December, nonfarm payrolls declined in June due to the reduction of 225,000 temporary employees hired to conduct the 2010 census (see chart 2). Additionally, private sector payrolls only increased 83,000 while analysts expected a gain of 110,000. Job growth is essential for the economy to maintain the path toward recovery. Without improvement in the labor market, the outlook for consumer spending, which is a primary driver of GDP growth, could becom e uncertain. The strength of the employment market will be continually monitored by investors as a way to gauge the economic recovery.

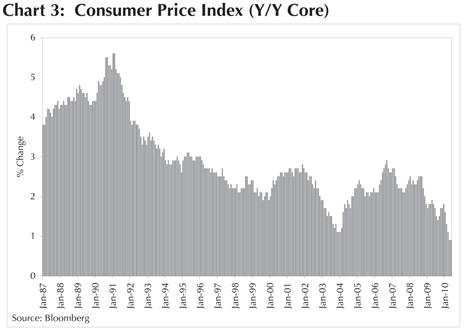

* Inflation remains low. The Consumer Price Index, a broad based gauge of inflation, remains extremely low. The core index reading, which excludes food and energy prices, was reported at 0.9% year-over-year during April and May (see chart 3). This is the lowest year-over-year increase in prices since 1966. As the year began, inflation concerns were elevated as the Federal Reserve maintained a low interest rate policy and economic growth appeared strong. However, given the fragile state of the economy, inflation concerns have become somewhat muted for the immediate future. If the economic recovery persists and employment outlook improves, inflation worries will likely return and scrutiny will surround the Federal Res erve’s interest rate policy.

* Congress approves healthcare overhaul. Congress passed the much debated and controversial healthcare bill that will extend coverage to over 32 million uninsured citizens, with major coverage expansion set to begin in 2014. Despite the marginal passage of The Patient Protection and Affordable Care Act by the House of Representatives, Democrats and Republicans continue to debate over the imminent changes to the healthcare system. Investors initially reacted favorably to the news

| Page 2 | The Flex-funds® 2010 Semiannual Report | June 30, 2010 |

| 2010 Semiannual Report | June 30, 2010 |

as a key source of uncertainty was eliminated. However, the long-term effects of healthcare reform on the financial markets will require time to determine since most of the major policy provisions will not begin to take effect until 2014.

* Largest oil spill ever in U.S. waters. On April 20, an explosion caused a deepwater oil rig to sink in the Gulf of Mexico, and has subsequently led to the largest oil spill in U.S. history. As of the time of this writing, oil continues to leak into the gulf with containment efforts still being developed and debated by scientists and government officials. The full environmental and economic ramifications of this disaster are yet to be completely understood and quantified. As a result, there is great uncertainty surrounding the future of offshore drilling both in the U.S. and abroad, and the potential effects that regulatory changes could have on the supply of oil worldwide.

* Sales growth continues to boost corporate profits. For the first quarter of 2010, companies were able to post strong earnings results due in part to strong sales growth. Over 80% of companies in the S&P 500 reported earnings ahead of analyst expectations. Further, more than 67% of companies reported better than expected growth in sales. Because positive earnings in the first quarter were driven by sales growth, the gains may be more sustainable compared to profits driven by cost-cutting measures, which occurred throughout 2009. Close attention will be levied toward the quality of corporate earnings through the remainder of the year as investors look for evidence of sustained long-term corporate earnings growth.

* Economic indicators remain positive. Numerous indicators signal that the economic rebound remains on track. The Institute for Supply Management Manufacturing Index (ISM) was reported at 56.2 during the month of May and has been reported above 50 for the past eleven consecutive months. An ISM reading above 50 indicates expansion while a reading below 50 indicates contraction. Retail sales have increased 6.1% year-over-year during May, which marks the seventh consecutive monthly increase. Additionally, industrial production increased 8.0% year-over-year during May, which is the largest monthly increase since the economic recovery commenced. Also, capacity utilization rose to 74.7 in May from 73.1 in April, sugg esting that demand is spurring higher production activity.

The events that took place during the first half of 2010 raise questions regarding the continued recovery of the U.S. economy. Sovereign debt concerns in Europe, slow domestic job growth, the struggling housing market, and the subsequent impact on consumer confidence all raise concerns for investors. However, continued low interest rates, rising corporate profits, and increases in industrial production provide evidence that the recovery is on track.

Our Investment Approach

Equity Funds

Following new recovery highs for the major stock market indices during April, concerns regarding sovereign debt and the sustainability of the economic recovery weighed on the financial markets during the second quarter. As market conditions evolved, we employed various tactics and strategies throughout the quarter in response to the uncertain economic and stock market environment. In The Muirfield Fund® and the equity portion of The Defensive Balanced Fund, we began 2010 with an approximate 90% allocation to the stock market and a 10% defensive position in bond funds. As the year progressed and stock market conditions worsened, our investment models indicated a deteriorating risk/reward market environment. More specifically, we noted weakening in many of the trend and technical component s of our investment model. As a result, we began decreasing our stock market exposure and increasing our defensive position. We ended the first half of 2010 approximately 75% invested in the stock market and 25% invested in bond funds in The Muirfield Fund® and the equity portion of The Defensive Balanced Fund.

We also utilize investment models as an integral part of the decision making process regarding our exposure to growth versus value investments and market capitalization in our fund-of-funds based mutual funds. At the beginning of the year, our investment models maintained preference for value investments versus growth investments, which has remained a consistent theme since early 2009. This positioning contributed to positive relative performance during the first half of the year as

The Flex-funds® 2010 Semiannual Report | June 30, 2010 | Page 3 |

| 2010 Semiannual Report | June 30, 2010 |

economically-sensitive value sectors outperformed growth investments and the broader market for the six months ended June 30, 2010. We also entered 2010 with an overweight to small-cap stocks, and subsequently increased our small-cap exposure as the first quarter progressed. However, we pared our small-cap exposure during the second quarter due to indications from our investment models, which occurred as the market conditions deteriorated. Despite the challenges facing the stock market during the second quarter, small-cap stocks delivered favorable performance compared to the broader markets for the first half of 2010, which benefited our relative performance.

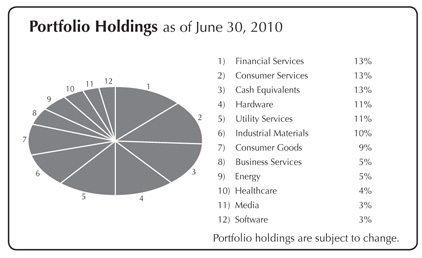

We managed our industry and sector exposure throughout the first half of 2010 and initiated changes in sector allocations as the year progressed. In order to capitalize on the persistence of the stock market rally at the beginning of the year, we started with an overweight position in the industrial materials and energy sectors, as well as a position in emerging market securities. We have continued to avoid direct exposure to the developed international markets since the end of 2009. Additionally, we maintained our overweight positions in the consumer staples and healthcare sectors due to attractive valuations and as a partial hedge against potential market corrections. Our overweight positions were accomplished by underweighting the technology and utilities sectors as also indicated by our models. As the year progressed and market con ditions deteriorated, our models began to indicate preference for domestic securities and conservative sectors with defensive characteristics. As a result, we reduced our emerging markets position, and maintained exposure to the consumer staples and healthcare sectors. We are also maintaining our overweight position in the energy sector, and continue to avoid direct exposure to developed international investments.

Fixed-Income Funds

In the first quarter of 2010, market participants continued their shift into fixed-income investments. Despite the enormous ascent of equities from the March 2009 lows, tightening of yield spreads toward pre-credit crisis levels, global recovery concerns, political overhang, and sovereign debt worries, investors upheld their confidence in fixed-income securities. Discussions surrounding healthcare and financial reform created uncertainty among investors, which provided a boost to fixed-income investments in most sectors. Rumblings in the eurozone over fiscally stressed governments also created ambiguity. Throughout the financial crisis, central banks around the world rushed to aid their domestic financial systems. As a consequence, deficits in some countries have ballooned to uncomfortable levels. Rating agencies, including Moody’ ;s and Standard & Poor’s, would ultimately respond by lowering or downgrading the long-term credit ratings of some sovereign debt.

Fundamentally, we continued to see an interesting market environment for most of the first quarter. First, the steepness of the U.S. Treasury yield curve (traditionally measured as the difference between the yield of the 2-year and 10-year securities) eclipsed its previous high by reaching more than 2.90% toward the end of February. Conventional wisdom interprets a steep yield curve to mean the economy is expected to improve in the future. Second, yield spreads of investment grade and high-yield debt instruments to U.S. Treasuries have tightened to levels below historical averages. While yield spreads have not realized the low levels of the previous business cycle, it has been a dramatic move to regain these levels. Finally, despite the efforts of the Federal Reserve to make outrig ht purchases of mortgage-backed securities as part of its quantitative easing program, mortgage-backed yield spreads remained elevated compared to historical averages during this time period.

Throughout the second quarter, the market environment remained highly erratic. Volatility continued to be fueled by an array of global news, political interference, unstable sovereign fiscal budgets, economic factors, and technical trends. Despite the instability, many trends remained supportive of corporate debt investments, driven primarily by historically low interest rates. Borrowers from all sectors, including consumers, corporations, and governments, were able to benefit from low interest rates due to the ability to improve financial health, refinance existing debt, and solve liquidity issues. Overall, this is expected to offer additional support to the ongoing recovery.

For the first half of 2010, our fixed-income portfolios remained overweight in investment grade corporate debt securities. Based on economic conditions as well as output from our investment models, we continue to believe this supports our investment allocation. Any changes in

| Page 4 | The Flex-funds® 2010 Semiannual Report | June 30, 2010 |

| 2010 Semiannual Report | June 30, 2010 |

the portfolio were accomplished by maintaining this posture without adding credit or interest rate risk. Investment grade holdings were slanted toward higher quality diversified financial companies. In the agency sector, we maintained positions in high quality senior debt and mortgage-backed securities.

Since equity markets have recovered from March 2009 lows, yield spreads versus U.S. Treasury securities have compressed aggressively. While yield spreads have not achieved previous cycle lows, a reprieve was imminent. During the second quarter, yield spreads have become more attractive, which supports a continued overweight allocation to investment grade corporate bonds. Higher quality corporations with conservative management styles were able to take advantage of favorable market conditions to secure financing and improve productivity. As financial flexibility improved, default prospects among corporate sectors continued to decline. In an effort to balance our investment grade corporate bond position, the remainder of our portfolios were allocated to U.S. Government securities.

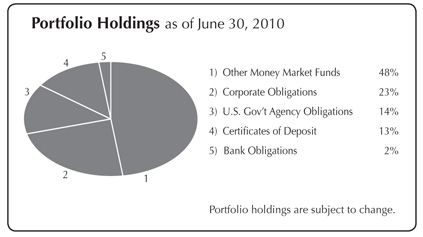

Finally, the retail and institutional classes of The Flex-funds® Money Market Fund remain among the top performers in the iMoneyNet universe of first tier retail and institutional money market funds. Our core investment strategies for this Fund remained unchanged throughout the second quarter and the Fund’s strong performance was accomplished by maintaining its focus on high-quality money market securities and expense controls.

Outlook for the Remainder of 2010

The events that occurred during the first half of 2010 illustrate that the economic recovery in the U.S. has arrived at a crossroads. While the Federal Reserve is able to maintain its accomodative stance with low interest rates, the fade and removal of key sources of economic stimulus will present significant challenges for the durability of the ongoing economic recovery. More specifically, private sources of demand will be necessary to supplant government-induced sources of demand.

Attention will also be dedicated to the progress of European nations regarding the resolution of debt issues and implementation of austerity measures. If austerity programs and the eurozone bailout package restore investor confidence, contagion fears may be quelled and a key source of uncertainty will be removed. Regardless, investors will continue to search for improvement in the employment outlook and other evidence that economic growth is sustainable without government aid.

As we monitor the stock market and our investment models, we will continuously evaluate our defensive position in The Muirfield Fund® and the equity portion of The Defensive Balanced Fund. We will look for opportunities to adjust portfolio weights among growth and value stocks, large-, mid-, and small-caps, and domestic and international investments in order to enhance returns and manage risk for our clients. We will also continue to proactively manage our sector exposures and will make adjustments as we modify our outlook for the economy and financial markets. On the following pages you will find a review of how The Flex-funds® have performed. Please read the commentaries to learn more about the investment decisions we made during the past six months.

These are definitely challenging times in the financial services industry. Since 1974, Meeder Financial has navigated through many periods of difficult market environments. On behalf of all of the associates at Meeder Asset Management and The Flex-funds®, I thank you for the continued trust and confidence you have placed in our investment management services. Be assured we are 100% committed to working with you and helping you achieve your most important financial goals.

Sincerely,

Robert S. Meeder, Jr.

President

The Flex-funds®

June 30, 2010

The Flex-funds® 2010 Semiannual Report | June 30, 2010 | Page 5 |

| 2010 Semiannual Report | June 30, 2010 |

The Money Market Fund

| Period & Average Annual Total Returns as of June 30, 2010 | YTD | 1 Year | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® Money Market Fund (Retail Class) | 0.11% | 0.31% | 2.93% | 2.66% | 4.65% | 3/27/85 |

| | | | | | | |

Current & Effective Yields1 | 7-day Compound: 0.20% 7-day Simple: 0.20% |

| | |

Lipper Average General-Purpose Money Market Fund2 | 0.01% | 0.04% | 2.48% | 2.21% | 4.39% | 3/31/85 |

The Flex-funds® Money Market Fund (Institutional Class) | 0.15% | 0.41% | 3.07% | - | 3.01% | 12/28/04 |

| | | | | | | |

Current & Effective Yields1 | 7-day Compound: 0.28% 7-day Simple: 0.28% |

| | |

iMoneyNet, Inc. Average First-Tier Institutional Money Market Fund2 | 0.03% | 0.09% | 2.87% | - | 2.87% | 12/31/04 |

Past performance does not guarantee future results. Except for the current and effective yields, all performance figures represent average annual total returns for the periods ended June 30, 2010, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Money Market Fund during the periods shown above. Investments in The Money Market Fund are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although the Funds seek to preserve the value of your investment at $1.00 per sh are, it is possible to lose money by investing in The Money Market Fund.1 For the period ended June 30, 2010, yield quotations more closely reflect the current earnings of The Money Market Fund than do total return quotations. 2 An index of funds such as Lipper’s Average General Purpose Money Market Fund Index and iMoneyNet, Inc.’s Average First-Tier Institutional Money Market Fund Index includes a number of mutual funds grouped by investment objective. One cannot invest directly in an index.

Semiannual Market Perspective

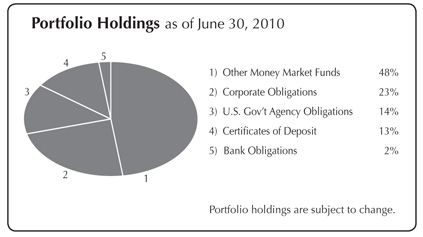

The retail and institutional classes of The Flex-funds® Money Market Fund ranked as the top general purpose money market funds in the country for the six months ended June 30, 2010, according to iMoneyNet, Inc. The retail and institutional classes of The Flex-funds® Money Market Fund closed the first half with a 7-day simple yield of 0.20% and 0.28%, respectively. By comparison, the median first tier retail and institutional money market fund finished the first half with a yield of 0.01% and 0.05%, respectively. As a result, the retail and institutional classes of The Flex-funds® Money Market Fund continue to offer superior yields. Based on year-to-date performance data as of June 30th, the retail class was ranked 1st out of 228 first tier retail funds, and the institutional class was ranked 1st out of 285 first tier institutional funds according to iMoneyNet.

We entered 2010 with the cautious stance we have employed for a majority of the past year. Investors debating the prospects for movements in interest rates and the growth trajectory of the economy contributed to a volatile market environment. Despite the unstable backdrop, corporate financial positions continued to improve throughout the first half of the year, which created more opportunities within the money market arena. Yield spread differentials are returning to historical average spread comparisons versus U.S. Treasury bill or Government agency securities. In order to take advantage of the improving environment, we increased our allocation to investments with above average credit quality and maintained a high liquidity position.Throughout the first half of 2010, we maintained a weighted average maturity (WAM) which was greater than the average or our peers. Currently, we are adjusting our WAM lower to comply with new money market regulations and to be more in line with the category average.

| Page 6 | The Flex-funds® 2010 Semiannual Report | June 30, 2010 |

| 2010 Semiannual Report | June 30, 2010 |

The U.S. Government Bond Fund

| Period & Average Annual Total Returns as of June 30, 2010 | YTD | 1 Year | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® U.S. Government Bond Fund | 4.05% | 7.04% | 4.39% | 3.63% | 5.56% | 5/7/85 |

| | | | | | | |

Expense Ratios*: Current 0.99% Gross 1.49% | | | | | | |

| | | | | | | |

Barclays Capital Intermediate Government Index1 | 4.41% | 5.67% | 5.31% | 5.74% | 7.16% | 4/30/85 |

| | | | | | | |

Barclays Capital Intermediate-Term Government/Credit Index2 | 4.55% | 8.28% | 5.26% | 6.06% | 7.36% | 4/30/85 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2010. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time. 1 The Barclays Capital Intermediate Government Index is an unmanaged index of dollar-denominated non-convertible fixed-rate bonds issued by the U.S. Government that are rated investment-grade or higher, have a maturity of one to ten years, and at least $250 million outstanding. The Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. 2Barclays Capital Intermediate-Term Government/Credit Index is an unmanaged index of fixed-rate bonds issued by the U.S. Government and its agencies that are rated investment grade or higher, have one to ten years remaining until maturity, and at least $100 million outstanding. Barclays Capital Intermediate-Term Government/Credit Index does not take int o account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. *Current expense ratio based on net assets in effect as of 6/30/10. This ratio may increase or decrease depending on fluctuations in fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

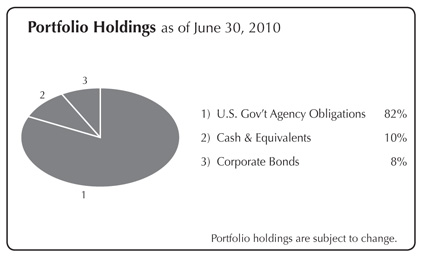

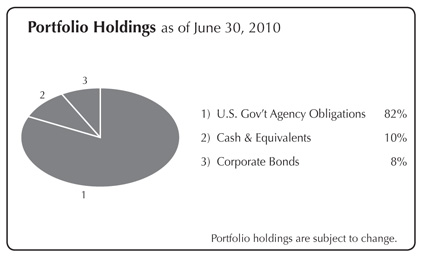

Semiannual Market Perspective

The Flex-funds® U.S. Government Bond Fund returned 4.05% year-to-date through June 30, 2010. The Fund is currently positioned with a mix of holdings issued by U.S. Government agencies and investment grade corporations. We believe both sectors should continue to benefit as investors attempt to diversify their portfolios into fixed-income investments. Currently, our models favor investment grade corporate holdings. As opportunities become present within economic cycles which support this sector, we may invest in high quality corporate obligations. The Fund’s current allocation in investment grade corporate bonds is approximately 8%. The fund is permitted to invest to a maximum allocation of 20% in investment grade corporate bonds.

Throughout the first half of the year, interest rate projections based on our models and investor sentiment in the fixed-income markets offered mixed signals. Traditionally, the current environment of historically low interest rate policy would promote a portfolio strategy incorporating shorter average maturity. However, uncertainty of economic stability has generated above average interest for fixed-income obligations. This would suggest a greater need for a portfolio adopting a longer average maturity. To combat the variability of this environment, we positioned the Fund with an average maturity level less than that of the benchmark.

The Flex-funds® 2010 Semiannual Report | June 30, 2010 | Page 7 |

| 2010 Semiannual Report | June 30, 2010 |

The Defensive Balanced Fund

| Period & Average Annual Total Returns as of June 30, 2010 | YTD | 1 Year | 8/31/08 to 6/30/103 | Since Inception | Inception Date |

The Flex-funds® Defensive Balanced Fund | -3.01% | 8.71% | -2.67% | -1.45% | 1/31/06 |

| | | | | | |

Expense Ratios*: Current 1.53% Gross 1.72% | | | | | |

| | | | | | |

S&P 500 Index1 | -6.65% | 14.43% | -9.10% | -2.72% | 1/31/06 |

| | | | | | |

Blended Index2 | -1.32% | 8.79% | -1.21% | 1.69% | 1/31/06 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2010. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time. 1The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. 2 The Blended Index consists of 42% of the S&P 500 Index, 28% of the average 90-day U.S. Treasury bill and 30% Barclays Intermediate-Term Government/Credit Index. 3 On August 25, 2008, the name and investment strategy of the Fund was changed. *Current expense ratio based on net assets in effect as of 6/30/10. This ratio may increase or decrease depending on fluctuations in fund net assets. The Gross Expense R atio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

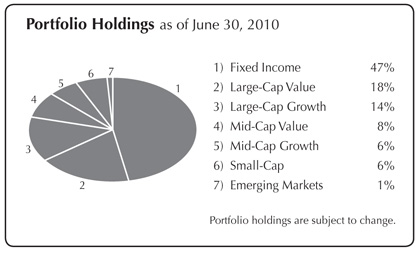

Semiannual Market Perspective

The Defensive Balanced Fund will always invest at least 30%, and up to 70%, of its assets in the stock market. The Fund will also invest at least 30%, and up to 70%, of its assets in fixed-income securities. We began 2010 with an approximate 60% allocation to the stock market. As the year progressed and stock market conditions worsened, our investment models indicated a deteriorating risk/reward market environment. As a result, we began decreasing our stock market exposure and increasing our defensive position during the second quarter. As a result, we ended the first half of 2010 approximately 55% invested in the stock market in The Defensive Balanced Fund.

Regarding equity exposure, we entered 2010 with an overweight to value investments versus growth investments. We have also remained overweight in small-cap stocks to a varying degree throughout the first half of 2010 due to indications from our investment models. Overall, our positioning contributed to positive relative performance during the first half of the year as economically-sensitive small-cap and value sectors outperformed the broader market for the six months ended June 30, 2010. Regarding industry and sector exposure, we began the year with an overweight position in the healthcare, consumer staples, energy, and industrial materials sectors. We also maintained a position in emerging market securities, while continuing to avoid direct exposure to developed international markets. As the year progressed and market conditions dete riorated, our models began to indicate incremental preference for domestic securities and conservative sectors with defensive characteristics. As a result, we reduced our emerging markets position, and maintained exposure to the consumer staples and healthcare sectors. We also ended the first half of 2010 with an overweight to the energy sector.

In the fixed-income portion of the Fund, the target allocation has been overweight in the investment grade bond sector during the first half of 2010. While our positioning benefited performance during the first quarter, the corporate sector underperformed U.S. Treasury securities during the second quarter. Overall, our overweight to the corporate sector has benefited fixed-income returns for the first half of 2010. Additionally, the duration of the fixed-income portion of the Fund was maintained slightly below that of our benchmark during the first half, which is consistent with readings from our fixed-income models.

| Page 8 | The Flex-funds® 2010 Semiannual Report | June 30, 2010 |

| 2010 Semiannual Report | June 30, 2010 |

The Muirfield Fund®

| Period & Average Annual Total Returns as of June 30, 2010 | YTD | 1 Year | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds Muirfield Fund® | -5.01% | 10.63% | 0.18% | -0.14% | 6.50% | 8/10/88 |

| | | | | | | |

Expense Ratios*: Current 1.38% Gross 1.66% | | | | | | |

| | | | | | | |

S&P 500 Index1 | -6.65% | 14.43% | -0.79% | -1.59% | 8.65% | 7/31/88 |

| | | | | | | |

Blended Index2 | -3.85% | 8.83% | 0.93% | 0.38% | 7.13% | 7/31/88 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2010. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time.� 0; 1The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. 2 The Blended Index consists of 60% of the S&P 500 Index and 40% of the average 90-day U.S. Treasury bill. *Current expense ratio based on net assets in effect as of 6/30/10. This ratio may increase or decrease depending on fluctuations in fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

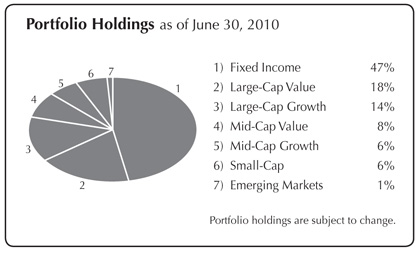

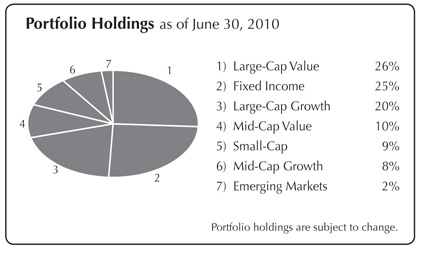

Semiannual Market Perspective

The Muirfield Fund® began 2010 with an approximate 90% allocation to the stock market and a 10% defensive position in bond funds. As the year progressed and stock market conditions worsened, our investment models indicated a deteriorating risk/reward market environment. More specifically, we noted weakening in many of the trend and technical components of our investment model. As a result, we began decreasing our stock market exposure and increasing our defensive position. We ended the first half of 2010 approximately 75% invested in the stock market and 25% invested in bond funds in The Muirfield Fund®. While the Fund’s invested position benefited performance during the first quarter, the stock market decline during the second quarter detracted from performance relative to the blended index. However, the Fund’s defensive position contributed to relative outperformance of the broader market as measured by the S&P 500 Index.

In addition to altering our defensive position in order to protect against downside market risk, we also managed our industry and sector exposure in the Fund. We began 2010 with an overweight position in the industrial materials, energy, consumer staples, and healthcare sectors due to indications from our investment models. Our overweight positions were accomplished by underweighting the technology and utilities sectors. As the year progressed and market conditions deteriorated, our models began to indicate incremental preference for domestic securities and conservative sectors with defensive characteristics. As a result, we reduced our emerging markets position, and maintained exposure to the consumer staples and healthcare sectors. We are also maintaining our overweight pos ition in the energy sector, and continue to avoid direct exposure to developed international investments.

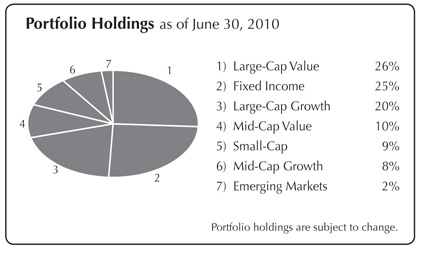

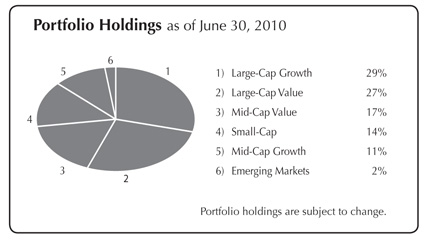

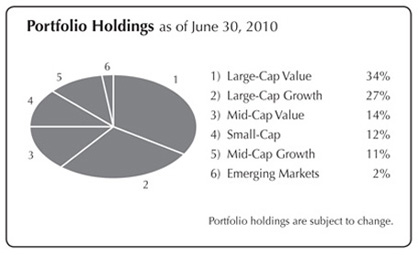

Regarding our stock market exposure, we utilized our investment models to manage our exposure to growth versus value investments and across the range of market capitalization. We began the year with an overweight toward value investments due to indications from our investment models. We also maintained our overweight position in small-cap stocks; however, we pared our small-cap exposure during the second quarter due to indications from our investment models which followed deterioration of market conditions. Despite the challenges facing the stock market during the second quarter, small-cap stocks delivered favorable performance compared to the broader markets for the first half of 2010, which benefited our relative performance.

The Flex-funds® 2010 Semiannual Report | June 30, 2010 | Page 9 |

| 2010 Semiannual Report | June 30, 2010 |

The Total Return Utilities Fund

| Period & Average Annual Total Returns as of June 30, 2010 | YTD | 1 Year | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® Total Return Utilities Fund | -6.14% | 13.68% | 2.27% | 1.42% | 6.69% | 6/21/95 |

| | | | | | | |

Expense Ratios*: Current 1.94% Gross 2.20% | | | | | | |

| | | | | | | |

Russell 3000 Utilities Index1 | -7.36% | 5.13% | -2.93% | -3.39% | 3.22% | 6/30/95 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2010. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time. 1The Russell 3000 Utilities Index is a market capitalization-weighted index that is comprised of utility stocks that are included in the Russell 3000 Index. This index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. *Current expense ratio based on net assets in effect as of 6/30/10. This ratio may increase or decrease depending on fluctuations in fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

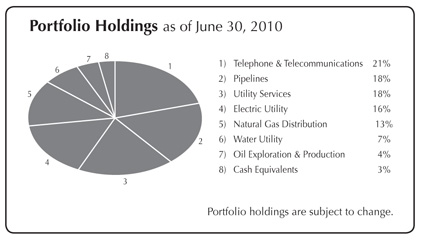

Semiannual Market Perspective

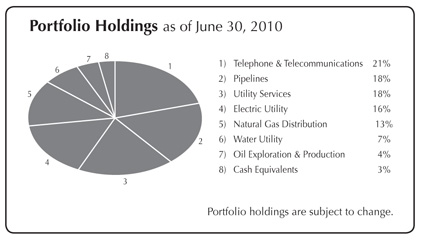

The Flex-funds® Total Return Utilities Fund returned -6.14% for the six months ended June 30, 2010, compared to the benchmark Russell 3000 Utilities Index return of -7.36%. On a year-to-date basis, the Fund is also outperforming the broader market as measured by the S&P 500 Index, while the aforementioned utility index is lagging the broader market.

During the first quarter, we bought and sold Telmex with little result in terms of performance. We anticipated more upside for the stock as a player in Carlos Slim’s Helu’s consolidation and restructuring, but as the story unfolded we decided that gains were limited. We trimmed NII Holdings for cash needs, though it remains our largest position by virtue of its persistent and outstanding gains. We added American Tower, which is a major beneficiary of the wireless infrastructure build-out, and additional infrastructure appears necessary since smart phones use a multiple of the bandwidth used by regular voice phones. As a result, that translates to more antennas on AMT’s towers and more revenue per tower.

During the second quarter, our best performers included a mix of infrastructure companies and master limited partnerships. Akamai, whose technology and services make high speed delivery of information on the internet possible, increased nearly 30% during the second quarter. The company reported results that were much better than expected, increased its share buy-back program, and raised future guidance. Questar was strong following the company’s announcement that it would split their E&P operations from the utility and pipeline operations. On the downside, NIHD Holdings was the worst performer, but this was primarily a result of market volatility, which we believe is tolerable since the stock has been a portfolio leader over the past year. Veolia lost ground, though we continue to t hink this diversified water and infrastructure company is a long-term winner, which is a view that other investors may come to embrace as the company decreases debt through asset sales.

We believe that our stocks do not depend on the same kind of economic shifts that analysts often employ in determining which stocks will outperform or underperform. Our companies provide the essential services and infrastructure that enable the pursuit of our daily lives. We believe that investor interest in stability versus strong near-term growth tends to favor our group, although that generalization is subject to contradiction at various periods in past history. We will continue to seek holdings that can benefit from economic tailwinds and in service-provision, while being mindful of valuations.

| Page 10 | The Flex-funds® 2010 Semiannual Report | June 30, 2010 |

| 2010 Semiannual Report | June 30, 2010 |

The Dynamic Growth Fund

| Period & Average Annual Total Returnsas of June 30, 2010 | YTD | 1 Year | 5 Years | 10 Years | Inception Date |

The Flex-funds® Dynamic Growth Fund | -6.23% | 12.43% | -0.88% | -1.14% | 2/29/00 |

| | | | | | |

Expense Ratios*: Current 1.42% Gross 1.63% | | | | | |

| | | | | | |

S&P 500 Index1 | -6.65% | 14.43% | -0.79% | -1.59% | 2/29/00 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2010. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time. 1The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. * Current expense ratio based on net assets in effect as of 6/30/10. This ratio may increase or decrease depending on fluctuations in fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Semiannual Market Perspective

The Flex-funds® Dynamic Growth Fund returned -6.23% during the first half of 2010 compared to the S&P 500 Index return of -6.65% for the same time period. The second quarter of 2010 encountered significant challenges presented by a slowing economic recovery and concerns regarding heightened government debt levels and deficits. Following an 84% rally from the March 2009 low, the stock market succumbed to selling pressure and posted its first quarterly decline since the first quarter of 2009, as measured by the S&P 500 Index. However, many economic indicators show that the economic recovery is still intact.

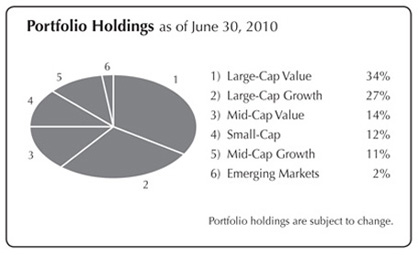

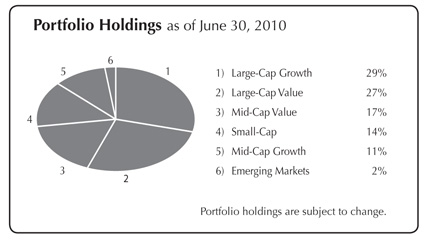

In The Flex-funds® Dynamic Growth Fund, we utilize investment models as an integral part of the decision making process regarding our exposure to growth versus value investments and market capitalization. At the beginning of the year, our investment models maintained preference for value investments versus growth investments, which has remained a consistent theme since early 2009. This positioning contributed to positive relative performance during the first half of the year as economically-sensitive value sectors outperformed growth investments and the broader market for the six months ended June 30, 2010. We also entered 2010 with an overweight to small-cap stocks, and subsequently increased our sma ll-cap exposure as the first quarter progressed. However, we pared our small-cap exposure during the second quarter due to indications from our investment models, which followed deterioration of market conditions. Despite the challenges facing the stock market during the second quarter, small-cap stocks delivered favorable performance compared to the broader markets for the first half of 2010, which benefited our relative performance.

We also managed our industry and sector exposure throughout the first half of 2010. In order to capitalize on the persistence of the stock market rally at the beginning of the year, we started with an overweight position in the industrial materials and energy sector, as well as a position in emerging market securities. Additionally, we maintained our overweight positions in the consumer staples and healthcare sectors due to attractive valuations and as a partial hedge against potential market corrections. Our overweight positions were accomplished by underweighting the technology and utilities sectors as also indicated by our models. As the year progressed and market conditions deteriorated, our models began to indicate incremental preference for domestic securities and conservative sectors w ith defensive characteristics. As a result, we reduced our emerging markets position, and maintained exposure to the consumer staples and healthcare sectors. We are also maintaining our overweight position in the energy sector, and continue to avoid direct exposure to developed international investments.

The Flex-funds® 2010 Semiannual Report | June 30, 2010 | Page 11 |

| 2010 Semiannual Report | June 30, 2010 |

The Strategic Growth Fund

| Period & Average Annual Total Returns as of June 30, 2010 | YTD | 1 Year | 8/31/08 to 6/30/103 | Since Inception | Inception Date |

The Flex-funds® Strategic Growth Fund | -4.80% | 19.29% | -9.65% | -3.99% | 1/31/06 |

| | | | | | |

Expense Ratios*: Current 1.57% Gross 1.80% | | | | | |

| | | | | | |

S&P 500 Index1 | -6.65% | 14.43% | -9.10% | -2.72% | 1/31/06 |

| | | | | | |

Blended Index2 | -5.11% | 18.57% | -11.35% | -2.58% | 1/31/06 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2010. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time. 1The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. 2The Custom Blended Index is comprised of 25% S&P 500, 20% S&P Midcap 400, 12.5% Russell 2000, 12.5% Dow Jones Wilshire Real Estate Investment Trust, 12.5% Goldman Sachs Commodity Index, 12% Morgan Stanley Capital International Europe, Australasia, and Far East, and 5.5% Morgan Stanley Capital International Europe Emerging Markets Index. These indices do not take into account the deduction of expenses associated with a mutual fund such as investment management and accounting fees. An investor cannot invest directly in an index. 3 On August 25, 2008, the name and investment strategy of the Fund was changed.* Current expense ratio based on net assets in effect as of 6/30/10. This ratio may increase or decrease depending on fluctuations in fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Semiannual Market Perspective

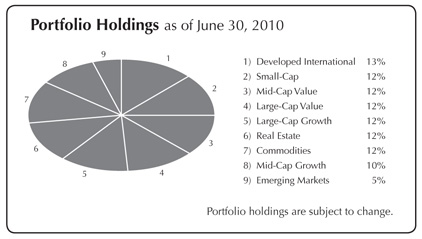

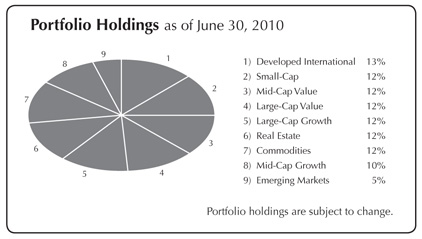

For the six months ended June 30, 2010, The Strategic Growth Fund returned -4.80%, compared to the S&P 500 Index return of -6.65% and the custom benchmark return of -5.11%. The Strategic Growth Fund is fully invested in the equity market at all times and holds a fixed allocation across six distinct investment categories. The mix of investments selected to represent each investment category is variable and actively managed by using our strategic fund selection process. The current target allocation is comprised of the following: 25% large-cap holdings, 20% mid-cap holdings, 17.5% international holdings, 12.5% small-cap holdings, 12.5% real estate holdings, and 12.5% commodities holdings. Within each respective category, we seek to identify funds that will outperform their peers through an evaluation process based on valuation factors, measures of volatility, and risk-adjusted returns. Funds that fall out of favor within our models are sold and replaced with higher ranking funds. Due to this allocation, we believe it is most appropriate to compare the Fund’s performance to a custom benchmark that reflects the target allocations previously specified. For the first half of 2010, the Fund outperformed the custom benchmark, which is attributable to favorable fund selection in various categories, particularly in our small-cap and real-estate holdings. Fund selection detracted from our performance in the commodity category through our holding of Van Eck Global Hard Assets.

The Fund’s favorable performance during the first half of 2010 versus the S&P 500 can be directly attributed to several of the asset allocation categories. While the S&P 500 declined by 6.65% during the first half of 2010, the Russell 2000 Index of small-cap stocks decreased by 1.94% and the S&P 400 Index of mid-cap stocks decreased by 1.36% during the same time period (be advised one cannot invest directly in an index). Additionally, an index tracking real estate-related stocks increased by 5.28% during the six months ended June 30, 2010. Market segments that detracted from performance for the first half include developed international and emerging market holdings.

The custom benchmark for the Strategic Growth Fund is comprised of 25% of the S&P 500 Index, 20% of the S&P 400 Index, 12.5% of the Russell 2000 Index, 12.5% of the Dow Jones US Select REIT Index, 12.5% of the S&P GSCI Index, 12% of the MSCI EAFE Index, and 5.5% of the MSCI Emerging Markets Index.

| Page 12 | The Flex-funds® 2010 Semiannual Report | June 30, 2010 |

| 2010 Semiannual Report | June 30, 2010 |

The Aggressive Growth Fund

| Period & Average Annual Total Returns as of June 30, 2010 | YTD | 1 Year | 5 Years | 10 Years | Inception Date |

The Flex-funds® Aggressive Growth Fund | -6.24% | 14.34% | -0.50% | -1.83% | 2/29/00 |

| | | | | | |

Expense Ratios*: Current 1.60% Gross 1.82% | | | | | |

| | | | | | |

S&P 500 Index1 | -6.65% | 14.43% | -0.79% | -1.59% | 2/29/00 |

| | | | | | |

NASDAQ Composite Index2 | -6.62% | 16.04% | 1.38% | -5.50% | 2/29/00 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2010. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time. 1The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. 2The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ National Market and Small Cap stocks. The NASDAQ Composite Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. *Current expense ratio based on net assets in effect as of 6/30/10. This ratio may increase or decrease d epending on fluctuations in fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Semiannual Market Perspective

The Flex-funds® Aggressive Growth Fund returned -6.24% for the first half of 2010 compared to the NASDAQ Composite Index return of -6.62% and the S&P 500 Index return of -6.65%. During the first quarter, continued federal government stimulus programs, better than expected corporate profits, and improving employment data provided positive catalysts for the continued advance in the domestic stock market. However, the stock market succumbed to pressures in the second quarter as a result of decelerating economic activity and sovereign debt woes.

In The Aggressive Growth Fund, we entered 2010 with an overweight to value investments, mid-cap stocks, and small-cap stocks. Regarding small-cap stocks, we have maintained an overweight to a varying degree for over a year due to favorable readings from our investment models and favorable historical performance surrounding economic troughs. Following an incremental allocation to small-cap investments during the first quarter, our investment models pared preference for small-cap stocks during the second quarter as market declines intensified, which led us to decrease our position. Despite the adjustment, we remained overweight to small-cap stocks, which benefited our performance. As of the end of the first half of 2010, we are also maintaining our overweight to value investments and mid-cap st ocks.

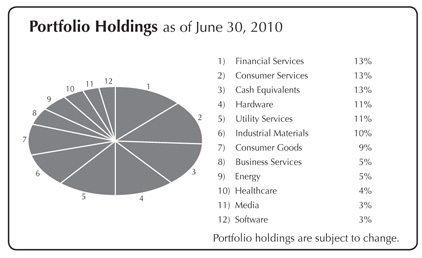

We also managed our industry and sector exposure in the Fund, and began the year with an overweight position in the energy and industrial materials sectors, as well as a position in emerging market stocks. Given the ongoing stock market rally and economic recovery, we believed these sectors offered greater potential for capital appreciation. As the first quarter progressed our investment models increased preference for domestic securities, which led us to reduce our emerging market position while continuing to avoid direct exposure to developed international markets. We also increased our exposure to the healthcare sector due to indications from our investment models, which was largely driven by attractive valuations. We achieved our overweight positions by being underweight the technology an d utilities sectors. As the year progressed and stock market declines materialized, our investment models increased preference for defensive sectors, which led us to increase our healthcare position and establish an overweight position in the consumer staples sector. We ended the first half with an overweight position in the healthcare, consumer staples, and energy sectors.

The Flex-funds® 2010 Semiannual Report | June 30, 2010 | Page 13 |

| 2010 Semiannual Report | June 30, 2010 |

The Quantex Fund™

| Period & Average Annual Total Returns as of June 30, 2010 | YTD | 1 Year | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® Quantex Fund™ | -2.54% | 38.98% | 2.23% | -0.72% | 6.27% | 3/20/85 |

| | | | | | | |

Expense Ratios*: Current 1.62% Gross 2.39% | | | | | | |

| | | | | | | |

Russell 2000 Index1 | -1.94% | 21.49% | 0.39% | 3.04% | 6.82% | 3/31/85 |

| | | | | | | |

Blended Index2 | -1.65% | 23.22% | 1.33% | 4.22% | 9.77% | 3/31/85 |

| | | | | | | |

S&P 400 Mid-cap Index3 | -1.36% | 24.92% | 2.21% | 5.30% | 11.71% | 3/31/85 |

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2010. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. The Fund’s management fee waiver is contractual and may be terminated annually by the Advisor on its renewal date. 1The Russell 2000 Index is a widely recognized unmanaged index of common stock prices of small-sized companies. The Russell 2000 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. 2The Blended Index consists of 50% Russell 2000 Index and 50% S&P 400 Mid-Cap Index. 3The S&P 400 Mid-Cap Index is a widely recognized unmanaged index of common stock prices of mid-sized companies. The S&P 400 Mid-Cap Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. * Current expense ratio based on net assets in effect as of 6/30/10. This ratio may increase or decrease depending on fluctuations in fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Semiannual Market Perspective

The Quantex Fund™ returned -2.54% for the six months ended June 30, 2010 compared to the Russell 2000 Index return of -1.94% and the S&P 400 Mid-Cap Index return of -1.36% for the same period. For the one-year period ended June 30, 2010, The Quantex Fund™ returned 38.98% compared to the Russell 2000 Index return of 21.49% and the S&P 400 Mid-Cap Index return of 24.92% for the same time period. As a result of its impressive one-year performance, the Wall Street Journal recently recognized The Quantex Fund™ as the 3rd best performing mid-cap value fund (out of 190 funds) in the country for the year ended June 30, 2010.

We have consistently employed our quantitative stock selection process since April 30, 2005 for The Quantex Fund™. We utilize rankings from our quantitative financial model to determine which securities are to be held in the Fund on an annual basis. As a result, the Fund is restructured once each year in January. From a broad standpoint for 2010, the Fund began the year with a 37% allocation to the service sector, 40% to the manufacturing sector and a 23% allocation to information technology. In the Fund’s composition for 2010 there is a strong preference for value holdings, with mid-cap value companies comprising 39% of the Fund, followed by mid-cap core with 35%, and mid-cap growth with 14%. Small-cap holdings of 12% comprise the remainder of the Fund.

For the first half of the year, Zions Bancorporation was the best performing stock in the Fund, with an increase of 68%. Akamai Technologies, Inc. also experienced significant returns through the first half of 2010 with an increase of approximately 60%. The worst performing stocks during the first half include Dean Foods Company, which is down 44%, and AK Steel Holding Corporation, which also declined by approximately 44%.

| Page 14 | The Flex-funds® 2010 Semiannual Report | June 30, 2010 |

| 2010 Semiannual Report | June 30, 2010 |

Shareholder Expense Analysis (Unaudited)

Shareholders of mutual funds pay ongoing expenses, such as advisory fees, distribution and service fees (12b-1 fees) and other fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples below are based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from December 31, 2009 to June 30, 2010.

ACTUAL EXPENSES: The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g.: an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

| ACTUAL EXPENSES | Beginning Account Value (12/31/2009) | Ending Account Value (6/30/2010) | Expenses Paid During Period1 (12/31/2009 - 6/30/2010) | Expense Ratio (Annualized) |

| The Money Market Fund - Retail Class | $1,000.00 | $1,001.10 | $2.08 | 0.42% |

| The Money Market Fund - Institutional Class | 1,000.00 | 1,001.50 | 1.69 | 0.34% |

| The U.S. Government Bond Fund | 1,000.00 | 1,040.50 | 5.01 | 0.99% |

| The Defensive Balanced Fund | 1,000.00 | 969.90 | 7.38 | 1.51% |

The Muirfield Fund® | 1,000.00 | 949.90 | 6.67 | 1.38% |

| The Total Return Utilities Fund | 1,000.00 | 938.60 | 9.13 | 1.90% |

| The Dynamic Growth Fund | 1,000.00 | 937.70 | 6.68 | 1.39% |

| The Strategic Growth Fund | 1,000.00 | 952.00 | 7.21 | 1.49% |

| The Aggressive Growth Fund | 1,000.00 | 937.60 | 7.64 | 1.59% |

The Quantex Fund™ | 1,000.00 | 974.60 | 7.59 | 1.55% |

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES: The second table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

HYPOTHETICAL EXAMPLE (5% return before expenses) | Beginning Account Value (12/31/2009) | Ending Account Value (6/30/2010) | Expenses Paid During Period1 (12/31/2009 - 6/30/2010) | Expense Ratio (Annualized) |

| The Money Market Fund - Retail Class | $1,000.00 | $1,022.71 | $2.11 | 0.42% |

| The Money Market Fund - Institutional Class | 1,000.00 | 1,023.11 | 1.71 | 0.34% |

| The U.S. Government Bond Fund | 1,000.00 | 1,019.89 | 4.96 | 0.99% |

| The Defensive Balanced Fund | 1,000.00 | 1,017.31 | 7.55 | 1.51% |

The Muirfield Fund® | 1,000.00 | 1,017.95 | 6.90 | 1.38% |

| The Total Return Utilities Fund | 1,000.00 | 1,015.37 | 9.49 | 1.90% |

| The Dynamic Growth Fund | 1,000.00 | 1,017.90 | 6.95 | 1.39% |

| The Strategic Growth Fund | 1,000.00 | 1,017.41 | 7.45 | 1.49% |

| The Aggressive Growth Fund | 1,000.00 | 1,016.91 | 7.95 | 1.59% |

The Quantex Fund™ | 1,000.00 | 1,017.11 | 7.75 | 1.55% |

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if any transactional costs were included, your costs would have been higher.

| 1 | Expenses are equal to the Funds’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the total number of days in the six-month period). |

The Flex-funds® 2010 Semiannual Report | June 30, 2010 | Page 15 |

| 2010 Semiannual Report | June 30, 2010 |

2010 Semiannual Report

Portfolio Holdings & Financial Statements

| Page 16 | The Flex-funds® 2010 Semiannual Report | June 30, 2010 |

| 2010 Semiannual Report | June 30, 2010 |

Schedule of Investments

June 30, 2010 (unaudited)

| The Muirfield Fund | |

| | Shares or Principal Amount ($) | | | | |

| Registered Investment Companies — 96.0% | |

BB&T Equity Income Fund | | | 182,117 | | | | 2,118,021 | |

| Calvert Short Duration Income Fund | | | 87,063 | | | | 1,430,442 | |

| Consumer Staples Select Sector SPDR Fund | | | 224,800 | | | | 5,732,400 | |

| Delaware Diversified Income Fund | | | 381,857 | | | | 3,612,366 | |

Energy Select Sector SPDR Fund | | | 88,325 | | | | 4,387,986 | |

Fairholme Fund | | | 320,099 | | | | 9,698,989 | |

| Fidelity Advisor Leveraged Company Stock Fund | | | 162,734 | | | | 4,356,392 | |

Harbor Bond Fund | | | 284,564 | | | | 3,613,966 | |

| Hartford Capital Appreciation Fund | | | 153,485 | | | | 4,240,803 | |

| Health Care Select Sector SPDR Fund | | | 161,325 | | | | 4,549,365 | |

Heartland Value Plus Fund | | | 127,721 | | | | 3,034,655 | |

| Invesco Diversified Dividend Fund | | | 508,823 | | | | 5,291,754 | |

| iShares Russell 2000 Value Index Fund | | | 31,400 | | | | 1,791,056 | |

Janus Short-Term Bond Fund | | | 464,031 | | | | 1,433,855 | |

| Natixis Loomis Sayles Investment Grade Bond Fund | | | 119,604 | | | | 1,437,635 | |

| Nuveen Tradewinds Value Opportunities Fund # | | | 266,822 | | | | 7,940,620 | |

PowerShares QQQ | | | 127,955 | | | | 5,464,958 | |

Putnam Equity Income Fund | | | 177,063 | | | | 2,170,793 | |

Putnam Voyager Fund | | | 262,812 | | | | 5,014,453 | |

| RidgeWorth Mid Cap Value Equity Fund | | | 594,410 | | | | 5,890,603 | |

| RidgeWorth Small Cap Value Equity Fund | | | 378,988 | | | | 4,115,809 | |

RS Emerging Markets Fund | | | 81,310 | | | | 1,756,300 | |

| Sentinel Government Securities Fund | | | 130,682 | | | | 1,446,646 | |

| Sentinel Short Maturity Government Fund | | | 153,456 | | | | 1,431,740 | |

| T. Rowe Price Equity Income Fund | | | 200,828 | | | | 3,940,248 | |

| Wells Fargo Advantage Growth Fund # | | | 222,656 | | | | 5,508,497 | |

| Total Registered Investment Companies (Cost $101,904,813) | | | | | | | 101,410,352 | |

| | | | | | | | | |

| Money Market Registered Investment Companies — 2.1% | |

| The Flex-funds Money Market Fund — Institutional Class, 0.276%* | | | 2,164,956 | | | | 2,164,956 | |

Total Money Market Registered Investment Companies (Cost $2,164,956) | | | | | | | 2,164,956 | |

| | | | | | | | | |

| Floating Rate Demand Notes — 1.2% | |

Caterpillar Financial Power Investment Floating Rate Demand Note, 1.30%, 7/1/2010** | | | 1,226,056 | | | | 1,226,056 | |

Total Floating Rate Demand Notes (Cost $1,226,056) | | | | | | | 1,226,056 | |

| | | | | | | | | |

| U.S. Government Obligations — 0.8% | |

U.S. Treasury Bill, 0.132%, due 9/23/2010*** | | | 800,000 | | | | 799,692 | |

Total U.S. Government Obligations (Cost $799,757) | | | | | | | 799,692 | |

Total Investments — 100.1% (Cost $106,095,582)(a) | | | | | | | 105,601,056 | |

| Liabilities less Other Assets - (0.1%) | | | | | | | (76,875 | ) |

Total Net Assets — 100.0% | | | | | | | 105,524,181 | |

| The Muirfield Fund | |

| | Shares or Principal Amount ($) | | | | |

| | | | | | | |

| Trustee Deferred Compensation**** | |

| The Flex-funds Aggressive Growth Fund | | | 1,660 | | | | 10,724 | |

| The Flex-funds Defensive Balanced Fund | | | 829 | | | | 7,221 | |

| The Flex-funds Dynamic Growth Fund | | | 515 | | | | 3,409 | |

The Flex-funds Muirfield Fund | | | 3,308 | | | | 15,680 | |

The Flex-funds Quantex Fund | | | 2,379 | | | | 42,846 | |

| The Flex-funds Total Return Utilities Fund | | | 184 | | | | 3,573 | |

Total Trustee Deferred Compensation (Cost $78,103) | | | | | | | 83,453 | |

| | | | | | | |

| | | | | | Unrealized Appreciation (Depreciation) ($) | |

| | | | | | | |

| Futures Contracts | |

| Standard & Poors 500 expiring September 2010, notional value $7,956,150 | | | (31 | ) | | | 104,568 | |

Total Futures Contracts | | | | | | | 104,568 | |

| (a) | Represents cost for financial reporting purposes and differs for federal income tax purposes by the amount of losses deferred for federal income tax reporting in the amount of $1,001,685. Cost for federal income tax purposes of $107,097,267 differs from value by net unrealized appreciation (depreciation) of securities as follows: |

| | | | | |

Unrealized appreciation | | $ | 3,860,923 | |

| | | | | |

Unrealized depreciation | | | (5,357,134 | ) |

| | | | | |

| Net unrealized appreciation (depreciation) | | $ | (1,496,211 | ) |

| # | Represents non-income producing securities. |

| * | Investment in affiliate. The yield shown represents the 7-day yield in effect at June 30, 2010. |

| ** | Floating rate security. The rate shown represents the rate in effect at June 30, 2010. |

| *** | Pledged as collateral on futures contracts. |

| **** | Assets of affiliates to The Muirfield Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

| The accompanying notes are an integral part of these financial statements. |

The Flex-funds® 2010 Semiannual Report | June 30, 2010 | Page 17 |

| 2010 Semiannual Report | June 30, 2010 |

Schedule of Investments

June 30, 2010 (unaudited)

| The Dynamic Growth Fund | |

| | Shares or Principal Amount ($) | | | | |

| | | | | | | |

| Registered Investment Companies — 95.2% | |

BB&T Equity Income Fund | | | 146,248 | | | | 1,700,868 | |

| Consumer Staples Select Sector SPDR Fund | | | 171,525 | | | | 4,373,887 | |

Energy Select Sector SPDR Fund | | | 79,950 | | | | 3,971,916 | |

Fairholme Fund | | | 290,329 | | | | 8,796,957 | |

| Fidelity Advisor Leveraged Company Stock Fund | | | 143,510 | | | | 3,841,765 | |

| Hartford Capital Appreciation Fund | | | 118,690 | | | | 3,279,416 | |

| Health Care Select Sector SPDR Fund | | | 140,475 | | | | 3,961,395 | |

Heartland Value Plus Fund | | | 110,473 | | | | 2,624,839 | |

| Invesco Diversified Dividend Fund | | | 520,110 | | | | 5,409,139 | |

| iShares Russell 2000 Value Index Fund | | | 25,890 | | | | 1,476,766 | |

| Nuveen Tradewinds Value Opportunities Fund # | | | 213,501 | | | | 6,353,778 | |

PowerShares QQQ | | | 109,225 | | | | 4,665,000 | |

Putnam Equity Income Fund | | | 140,906 | | | | 1,727,510 | |

Putnam Voyager Fund | | | 229,216 | | | | 4,373,445 | |

| RidgeWorth Mid Cap Value Equity Fund | | | 568,694 | | | | 5,635,755 | |

| RidgeWorth Small Cap Value Equity Fund | | | 380,304 | | | | 4,130,106 | |

RS Emerging Markets Fund | | | 72,814 | | | | 1,572,784 | |

| T. Rowe Price Equity Income Fund | | | 210,675 | | | | 4,133,442 | |

| Wells Fargo Advantage Growth Fund # | | | 216,326 | | | | 5,351,907 | |

| Total Registered Investment Companies (Cost $78,413,329) | | | | | | | 77,380,675 | |

| | | | | | | | | |

| Money Market Registered Investment Companies — 4.0% | |

| The Flex-funds Money Market Fund — Institutional Class, 0.276%* | | | 3,276,351 | | | | 3,276,351 | |

Total Money Market Registered Investment Companies (Cost $3,276,351) | | | | | | | 3,276,351 | |

| | | | | | | | | |

| U.S. Government Obligations — 1.0% | |

U.S. Treasury Bill, 0.132%, due 9/23/2010** | | | 800,000 | | | | 799,692 | |

| Total U.S. Government Obligations (Cost $799,757) | | | | | | | 799,692 | |

Total Investments — 100.2% (Cost $82,489,437)(a) | | | | | | | 81,456,718 | |

| Liabilities less Other Assets - (0.2%) | | | | | | | (125,417 | ) |

Total Net Assets — 100.0% | | | | | | | 81,331,301 | |

| The Dynamic Growth Fund | |

| | Shares or Principal Amount ($) | | | | |

| Trustee Deferred Compensation*** | |

| The Flex-funds Aggressive Growth Fund | | | 1,161 | | | | 7,500 | |

| The Flex-funds Defensive Balanced Fund | | | 570 | | | | 4,965 | |

| The Flex-funds Dynamic Growth Fund | | | 362 | | | | 2,396 | |

The Flex-funds Muirfield Fund | | | 1,490 | | | | 7,063 | |

The Flex-funds Quantex Fund | | | 916 | | | | 16,497 | |

| The Flex-funds Total Return Utilities Fund | | | 128 | | | | 2,486 | |

Total Trustee Deferred Compensation (Cost $38,516) | | | | | | | 40,907 | |

| | | | | | Unrealized Appreciation (Depreciation) ($) | |

| Futures Contracts | |

| Standard & Poors 500 expiring September 2010, notional value $4,363,050 | | | 17 | | | | (205,628 | ) |

| Total Futures Contracts | | | | | | | (205,628 | ) |