UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3462

The Flex-funds Trust

6125 Memorial Drive

Dublin, OH 43017

Bruce McKibben

c/o The Flex-funds Trust

6125 Memorial Drive

Dublin, OH 43017

Registrant’s telephone number, including area code: 800-325-3539

Date of fiscal year end: December 31, 2009

Date of reporting period: June 30, 2009

Item 1. Report to Stockholders.

2009 Semiannual Report

June 30, 2009

| ||||

Managed by Meeder Asset Management, Inc. 6125 Memorial Drive, Dublin Ohio, 43017 Call Toll Free 800-325-3539 | 614-760-2159 Fax: 614-766-6669 | www.flexfunds.com Email: flexfunds@meederfinancial.com |

Performance Review

Period & Average Total Returns as of | 3 Months | YTD | 1 year | 3 years | 5 years | 10 years | Since Inception | Net Expense Ratio** | Gross Expense Ratio*** | ||||||||||||||||||

FUND OF FUNDS | |||||||||||||||||||||||||||

The Muirfield Fund® | 9.41 | % | 2.14 | % | -21.39 | % | -5.50 | % | -1.77 | % | -1.94 | % | 6.31 | %1 | 1.39 | % | 1.75 | % | |||||||||

The Defensive Balanced Fund (formerly The Defensive Growth Fund) | 6.63 | % | 2.29 | % | -13.49 | % | -3.75 | % | — | — | -4.25 | %2 | 1.54 | % | 1.70 | % | |||||||||||

The Aggressive Growth Fund | 18.70 | % | 8.86 | % | -25.99 | % | -7.91 | % | -2.31 | % | — | -5.69 | %3 | 1.62 | % | 1.84 | % | ||||||||||

The Dynamic Growth Fund | 17.80 | % | 7.48 | % | -29.21 | % | -8.41 | % | -2.27 | % | — | -4.04 | %4 | 1.34 | % | 1.69 | % | ||||||||||

The Strategic Growth Fund (formerly The Focused Growth Fund) | 20.22 | % | 8.36 | % | -31.36 | % | -10.44 | % | — | — | -9.91 | %5 | 1.57 | % | 1.74 | % | |||||||||||

EQUITY FUNDS | |||||||||||||||||||||||||||

The Total Return Utilities Fund (formerly The Socially Responsible Utilities Fund) | 16.21 | % | 7.86 | % | -30.99 | % | -3.90 | % | 4.64 | % | 1.25 | % | 6.21 | %6 | 1.96 | % | 2.14 | % | |||||||||

The Quantex Fund™ | 34.86 | % | 24.38 | % | -18.54 | % | -9.31 | % | -2.66 | % | -3.49 | % | 5.10 | %7 | 1.73 | % | 2.26 | % | |||||||||

MONEY MARKET FUNDS | |||||||||||||||||||||||||||

The Money Market Fund - Retail* | 0.16 | % | 0.43 | % | 1.54 | % | 3.51 | % | 3.24 | % | 3.19 | % | 4.84 | %8 | 0.49 | % | 0.83 | % | |||||||||

Current & Effective Yields |

| 7-day Compound: 0.52%; 7-day Simple: 0.52% | |||||||||||||||||||||||||

The Money Market Fund - Institutional* | 0.18 | % | 0.50 | % | 1.67 | % | 3.65 | % | — | — | 3.60 | %9 | 0.37 | % | 0.68 | % | |||||||||||

Current & Effective Yields |

| 7-day Compound: 0.63%; 7-day Simple: 0.63% | |||||||||||||||||||||||||

FIXED INCOME FUND | |||||||||||||||||||||||||||

The U.S. Government Bond Fund | -0.84 | % | -0.75 | % | 3.70 | % | 5.20 | % | 3.55 | % | 3.33 | % | 5.49 | %10 | 0.99 | % | 1.58 | % | |||||||||

BENCHMARK INDICES | |||||||||||||||||||||||||||

S&P 500 Index | 15.93 | % | 3.16 | % | -26.21 | % | -8.22 | % | -2.24 | % | -2.22 | % | — | — | — | ||||||||||||

Blended Index**** | 9.44 | % | 2.40 | % | -15.59 | % | -3.46 | % | 0.17 | % | 0.20 | % | — | — | — | ||||||||||||

NASDAQ Composite Index | 20.34 | % | 16.98 | % | -19.13 | % | -4.64 | % | -1.37 | % | -3.17 | % | — | — | — | ||||||||||||

Russell 2000 Index | 20.69 | % | 2.64 | % | -25.01 | % | -9.87 | % | -1.67 | % | 2.43 | % | — | — | — | ||||||||||||

S&P 400 Midcap Index | 18.75 | % | 8.47 | % | -28.02 | % | -7.53 | % | 0.36 | % | 4.60 | % | — | — | — | ||||||||||||

Russell 3000 Utilities | 8.28 | % | -2.09 | % | -23.20 | % | -3.57 | % | 3.93 | % | -4.87 | % | — | — | — | ||||||||||||

Barclays Capital Intermediate Gov’t Credit Index | 1.67 | % | 1.62 | % | 5.27 | % | 6.13 | % | 4.57 | % | 5.66 | % | — | — | — | ||||||||||||

Lipper Average General-Purpose Money Market Fund | 0.04 | % | 0.13 | % | 0.92 | % | 2.98 | % | 2.73 | % | 2.71 | % | — | — | — | ||||||||||||

iMoneyNet, Inc. Average First-Tier Institutional Money Market Fund | 0.09 | % | 0.28 | % | 1.35 | % | 3.48 | % | 3.30 | % | 3.49 | % | — | — | — | ||||||||||||

To obtain a prospectus containing more complete information about The Flex-funds®, including fees and other expenses that apply to a continued investment in the Funds, you may call The Flex-funds® at Toll Free (800)325-3539, visit us online at www.flexfunds.com, or write P.O. Box 7177, Dublin OH 43017. Please read the prospectus carefully for investment objectives, risk & expense information before investing.

Past performance does not guarantee future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2009, and assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees were waived and/or expenses reimbursed in order to reduce the operating expenses of the Funds during all periods shown above. All expense waivers for the Funds are voluntary and may be terminated at any time, except for The Quantex FundTM. The management fee waiver for The Quantex Fund TM is contractual and may be terminated annually by the adviser on its renewal date. Source for index data: Bloomberg.

| * | An investment in The Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although The Money Market Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. Yield quotations more closely reflect the current earnings of The Money Market Fund than do total return quotations. The current performance may be lower or higher than the performance data quoted. |

| ** | The Net Expense Ratios are percentages of the Funds’ average net assets as they are shown in the most current Funds’ Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

| *** | The Gross Expense Ratios are percentages of the Funds’ average net assets as they are shown in the most current Funds’ Prospectus. |

| **** | The Blended Index is comprised of 60% of the S&P 500 Index and 40% of the average 90-day U.S. Treasury bill. |

| 1 | Inception Date: 8/10/88. |

| 2 | Inception Date 1/31/06. |

| 3 | Inception Date: 2/29/00. |

| 4 | Inception Date: 2/29/00. |

| 5 | Inception Date: 1/31/06. |

| 6 | Inception Date: 6/21/95. |

| 7 | Inception Date: 3/20/85. |

| 8 | Inception Date: 3/27/85. |

| 9 | Inception Date: 12/28/04. |

| 10 | Inception Date: 5/8/85. |

| 2009 Semiannual Report | June 30, 2009 |

Letter to Shareholders

Despite the difficulties and declines facing the stock market during the first two months of 2009, a stock market rally that materialized in mid-March continued into the second quarter as better than expected economic data, adequate corporate earnings results and subsiding financial sector fears contributed positively to investor sentiment. Since establishing the low for 2009 on March 9th, the S&P 500 has increased nearly 37% through the end of June. As a result, the stock market gains during the second quarter of 2009 ended a streak that experienced six consecutive negative quarterly returns for the S&P 500 Index. For the first half of the year ending June 30, 2009, the Dow Jones Industrial Average returned –2.01%, the S&P 500 returned 3.16% and the Russell 2000 returned 2.64%. Amidst this volatility, we are pleased to report the majority of our Funds have outperformed their respective benchmarks for the year-to-date period.

The first half of 2009 witnessed an abundance of events and news headlines which contributed to the stock market decline and subsequent rally. Optimism emerged regarding the recovery and health of the financial sector following bank earnings reports and results of government ‘stress tests.’ There have been instances of better than expected housing data, which has led some economists to speculate the housing market is finally stabilizing. Additionally, several measures of consumer confidence and manufacturing activity have improved since realizing cyclical lows. Despite these positive developments, caution is warranted before declaring an end to the recession. For example, the situation in the employment market is mixed, with the unemployment rate increasing to 9.5% in June. Additionally, two icons of the nation’s manufacturing prowess, General Motors and Chrysler, both filed for bankruptcy protection. There have also been mixed reports regarding retail sales, which has important implications as consumer spending comprises over two-thirds of economic activity.

Given the sharp stock market gains and development of positive investor sentiment, the question has been repeatedly raised: Is this the beginning of a new bull market, or are downside risks still a threat in the market at this time? Based on our investment models, we believe the intermediate-term outlook is favorable; however, we believe long-term risks remain prevalent, which continue to necessitate an active management approach to risk exposure. The following pages will provide an overview of how we managed our risk exposures and the strategies we employed during the first half of 2009. We will also provide a brief summary on the economic and financial events that punctuated the first half of 2009, update our expectations for the balance of 2009 and review the performance of our Funds.

The First Half of 2009 in Review

The first half of 2009 was highlighted by better than expected economic data that evidenced a deceleration in the deterioration of the economy. Extraordinary actions taken to combat the severe recession and stabilize the financial sector have begun to take hold. However, the economic situation remains fragile and tentative, especially in the employment market. The following is a brief overview of significant events that defined the first half of 2009.

* Sense of stability returns to the financial sector. The financial sector, which has been at the epicenter of stock market and economic woes since the recession began, led the markets higher in the second quarter. Investor optimism was driven by bank sector profitability and results of the government stress tests, during which the Federal Reserve and Treasury tested the ability of the nation’s largest banks to withstand further deterioration in the economy. The stress tests, which are a key component in the Treasury’s Financial Stability Plan, revealed that 10 out of the 19 largest banks faced a capital shortage totaling $75 billion should the economy experience further deterioration and lead to more bank losses. However, investor reception was positive and banks that were mandated to raise additional capital generally did not face difficulties raising funds in the secondary market. The liquidity programs introduced by the Federal Reserve and Treasury have also been successful in reducing borrowing costs, although measures of the cost of credit remain above levels experienced before the onset of the credit crisis.

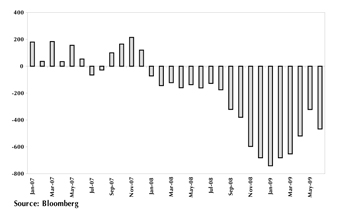

* Continued challenges in the job market. The challenges facing the job market are ongoing despite recent government actions to stimulate the economy, which has led President Obama to recently declare an increased rate in stimulus spending to aid employment. In the most recent report, payrolls were reduced by 467,000 in June, which is the eighteenth straight month of job losses and represents a cumulative loss of over 6 million jobs since January of 2008 (see Chart 1). However, the rate of job losses in the second quarter slowed markedly from prior months. Despite the improvement, the unemployment rate has continued to rise and now stands at 9.5% compared to 7.6% at the beginning of the year. For comparison purposes, the unemployment rate stood at 5.6% at the end of the second quarter in 2008. Additionally, initial jobless claims have been consistently reported above 600k throughout the first half of 2009 with only marginal improvements as the period progressed.

| The Flex-funds® 2009 Semiannual Report | June 30, 2009 | Page 1 |

| 2009 Semiannual Report | June 30, 2009 |

Chart 1: Change in Non-Farm Payrolls (in thousands)

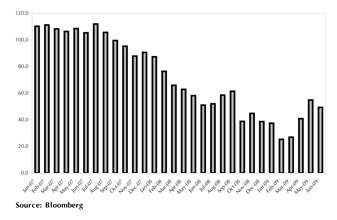

* Improving economic data. Despite the difficulties facing the labor market, several indicators gauging various components of the economy lend support that perhaps the worst has been realized. Consumer confidence has posted solid gains since establishing a low point of 25.3 in February, compared to the most recent reading of 49.3 for June (see Chart 2). Factory orders rose 1.2% from the prior month in May following declines in seven of the nine previous monthly reports. While gauges of the manufacturing and service sector remain indicative of a weak economic situation, the data has improved from prior months. The ISM (Institute for Supply Management) Manufacturing Index was reported at 44.8 during the month of June compared to 42.8 in May. Also, the ISM Non-manufacturing Index (which measures the service sector) was reported at 47.0 in June compared to 44.0 in May. Additionally, both indicators have increased for six consecutive months. For these measures, a reading below 50 indicates contraction while a reading above 50 indicates expansion.

* Inflation debate taking center stage. Despite the most recent reports that show sharp year-over-year price declines at both the producer and consumer levels, a debate regarding the possibility of rising inflation is becoming prominent. In particular, there are fears that the existing federal government deficits, expansion of the Federal Reserve’s balance sheet and massive amounts of spending on the economic stimulus and bailout of various industries will drive inflationary pressure in the future. As a result, there has been much concern regarding the ability of the government and Federal Reserve to reverse spending initiatives in order to remove money from the monetary system. However, pressure to reverse the expansion of the monetary base and negating the stimulus package too soon presents the risk of ending these programs before the economy has returned to full health.

* GDP report reveals weak economy. The most recent available reading on Gross Domestic Product (GDP) during the first quarter of 2009 shows an annualized decline of 5.5%, which follows an annualized decline of 6.3% during the fourth quarter of 2008. The improvement in the rate of decline from the fourth quarter is due to improvement in the personal consumption component, which increased 1.4% during the first quarter and is being monitored closely since it comprises over two-thirds of total GDP. Also, businesses have been keen to reduce inventories during the recession. While this contributed to the decline in GDP during the first quarter, it is also viewed as a positive sign that business production will increase once demand increases. Other GDP components experiencing significant weakness include business investment, exports and residential housing.

Chart 2: Consumer Confidence

* Corporate earnings reports show sequential improvement. The months of April and May provide additional insight into the current and prospective economic environment through the release of corporate earnings results for the three-month period ended March 31, 2009. Following a promising start during the first week of reports, the results were somewhat disappointing with actual earnings about 24% behind estimates and down 51% from last year according to Standard and Poor’s. The only sector that has reported earnings growth from the first quarter of 2008 was healthcare, which is a traditionally defensive sector that benefits from relatively stable demand. However, investors have tended to react favorably to the earnings reports, which has resulted in a cumulative profit as opposed to the cumulative loss realized during the fourth quarter of 2008. As calendar second quarter earnings season is set to begin, investor attention will focus on any improvement in earnings from the first quarter, stabilization in profit margins, and guidance regarding the remainder of 2009.

| Page 2 | The Flex-funds® 2009 Semiannual Report | June 30, 2009 |

| 2009 Semiannual Report | June 30, 2009 |

* Bankrupt automakers. The second quarter of 2009 was witness to the bankruptcy filings of two American manufacturing icons: General Motors and Chrysler. Each company had become heavily reliant on loans from the United States Treasury to continue operations; however, both companies were required to present acceptable restructuring plans to continue securing funds. The Obama administration deemed the restructuring plans unacceptable, which ultimately led to bankruptcy filings in order for General Motors and Chrysler to reorganize operations and emerge as new, leaner organizations. Chrysler was acquired by Italian carmaker Fiat upon emerging from bankruptcy, while General Motors is continuing its reorganization process under bankruptcy protection at the time of this writing.

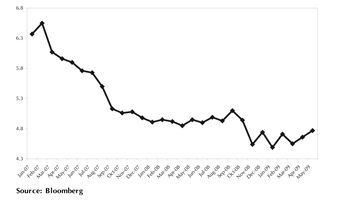

* Housing fundamentals remain depressed, but show recent improvement. While reports remain mixed, there are indications that the housing market may be in a bottoming process. In its most recent reading, new home sales declined by 0.6% in May compared to the previous month, which followed a gain of 2.7% in April. However, existing home sales rose 2.4% in May from the prior month and follows a 2.4% gain in April as well (see Chart 3). Home prices continue to decline as indicated by the S&P/Case-Shiller Price Index, which showed an approximate 18.1% drop in national home prices during April compared to the previous year, although this marks an improvement in the pace of the decline. As a result, several initiatives have been announced and implemented by the government and banks, which are designed to aid struggling homeowners, including loan modification programs that will lower monthly mortgage payments. Also, the government is implementing programs in an effort to reduce mortgage rates in order to aid a rebound in the housing market.

The events that took place during the first half of 2009 highlight the continuing challenges that face the economy and the financial markets. However, stimulative actions being taken by the government, a revamped plan to stabilize the financial sector and unconventional tactics being employed by the Federal Reserve stoked investor optimism that drove the stock market higher.

Our Investment Approach

Equity Funds

The first half of 2009 marked a continuation of the volatile equity markets that materialized during 2008 and presented investors with significant challenges. We employed various tactics and strategies throughout the period in response to the dynamic and uncertain economic and securities market environment. In The Muirfield Fund® and the equity portion of The Defensive Balanced Fund, we began 2009 with an approximate 60% allocation to the stock market and a 40% defensive position in cash equivalent securities. As a point of reference, The Muirfield Fund® and the equity portion of The Defensive Balanced Fund have maintained a partially defensive position of at least 25% since mid-January 2008. We increased our defensive position during the first quarter in response to a deteriorating stock market. However, as the second quarter progressed, we decreased our defensive position and increased exposure to the stock market in response to an improving risk/reward relationship indicated by our investment models. We ended the second quarter approximately 80% invested in the stock market and 20% invested in short-term bond funds in The Muirfield Fund® and the equity portion of The Defensive Balanced Fund.

Chart 3: Existing Home Sales (units in millions, SAAR)

Regarding our stock market exposure, we utilized our investment models to manage our exposure to growth versus value investments and across the range of market capitalization in our fund-of-funds based mutual funds. We began the year with an overweight toward value investments due to indications from our investment models. We also maintained our overweight position in small-cap stocks due to readings from our investment models, as well as attractive relative valuations and favorable historical performance during recessions. As the year progressed, our models indicated a preference for a neutral stance among

| The Flex-funds® 2009 Semiannual Report | June 30, 2009 | Page 3 |

| 2009 Semiannual Report | June 30, 2009 |

growth versus value investments, and we responded accordingly. As a result, we ended the second quarter neutral among growth versus value investments and remained overweight in small-cap stocks in our fund-of-funds based mutual funds.

We also managed our industry and sector exposure throughout the year and initiated changes in sector allocations as 2009 progressed. We began 2009 with an overweight to sectors with defensive characteristics, such as consumer staples, healthcare, and utilities. In addition, we avoided the financials, industrial materials, and energy sectors. However, late in the first quarter we began reducing our exposure to defensive sectors, and simultaneously began increasing our exposure to sectors with greater potential for capital appreciation, such as energy, materials, and financials. We began the second quarter with a neutral weighting toward the financial sector; however, this position evolved to an overweight by the end of the second quarter. We also ended the second quarter with an overweight position in industrial materials and energy. Due to indications from our investment models, we decided to invest in the international markets in the second quarter, which we have avoided since the beginning of the fourth quarter of 2008. Initially, we established a position in emerging markets due to favorable readings from our investment models, which was soon followed by a position in developed international markets as well.

Fixed Income Funds

The fixed-income markets ushered in 2009 clinging to the fears and uncertainties which plagued the markets in 2008. Uncertainty surrounding the banking system persisted and dismal economic news trumped optimism of a new governing administration. As a result, U.S. Treasuries established first quarter lows in yield within the first two weeks of the year. However, the landscape would change quickly. During the second quarter of 2009, fixed-income markets expanded on a theme that favored a “flight from quality” as opposed to a “flight to quality”, which predominantly included any transaction away from U.S. Treasury securities to sectors with greater risk. As with the stock markets, speculation focused on fundamental and economic data that indicated the situation may be less dire than originally anticipated. In addition, investor anxiety began to stir over the expected barrage of supply from U.S. Treasury auctions in the forthcoming months and the impact that additional supply may have on the market environment. The dire scenario presented in previous quarters became less likely, which prompted sector reallocation within fixed-income securities.

While U.S. corporate debt would also come under pressure in the first quarter of 2009, the sectors that outperformed in the second quarter of 2009 were investment grade corporate bonds and high yield bonds. Despite concerns over the uncertainty of future earnings and a steady stream of credit rating downgrades, corporate debt products offered solid value through capital appreciation and attractive yields.

Our strategy at the beginning of the second quarter of 2009 remained unchanged from that of the first quarter. In accordance with our fixed-income models, we maintained an overweight allocation to domestic government agency securities including senior debt and mortgage-backed securities. We believed this sector would continue to offer value as programs instituted by the Federal Reserve to participate in outright purchases of government agency securities would continue to push rates lower, which resulted in higher prices. The average weighted maturity was positioned slightly above that of our benchmark. Short-term interest rates remained at historical lows and inflation was not a near term concern, which influenced our average weighted maturity decision.

As the second quarter progressed, our models began showing signs of a change in leadership and the trend of interest rates. With the yield spread between corporate debt securities and U.S. Treasury securities at above average levels coupled with the steepness of the yield curve stretching beyond historical peaks, our models began to indicate improvement in the potential for corporate debt securities. By the middle of the second quarter our models had shifted to favor the corporate sector of the market and we ultimately shifted our allocations accordingly. Our current allocation favors an overweight of corporate debt with an underweight of both U.S. Treasury and government agency securities. During this time period our models also triggered a change in average maturity to a level below the benchmark due to the rising interest rate environment.

As we look to the second half of 2009, we do not anticipate significant changes in allocation or average weighted maturity strategies. Economic activity is expected to stabilize and below historical interest rate levels should remain intact. These factors should continue to benefit corporate debt while maintaining a conservative average maturity strategy.

Finally, the year-to-date total return of The Flex-funds® Money Market Fund remains in the top 10% of iMoneyNet first-tier retail money market funds. Additionally, as of June 30, 2009, the 7-day simple and 7-day compounded yields of The Flex-funds®

| Page 4 | The Flex-funds® 2009 Semiannual Report | June 30, 2009 |

| 2009 Semiannual Report | June 30, 2009 |

Money Market Fund Retail Class were 0.52% as compared to the median first-tier retail money market fund 7-day simple and compounded yields of 0.03% (according to iMoneyNet. com). Outperforming the average money market fund by nearly 0.50% is an accomplishment we believe is truly remarkable in this market environment. Our investment strategy for this Fund remained unchanged throughout the first half of 2009 and the Fund’s strong performance was accomplished by maintaining its focus on high-quality money market securities and expense controls. At this time, we believe short-term interest rates will remain extremely low for the foreseeable future. Consequently, we maintained our relatively long weighted average maturity and will continue to monitor its effectiveness in our strategy.

Outlook for the Remainder of 2009

As discussed earlier in this report, the stock market rally since mid-March can be at least partially attributed to better than expected economic data. However, in many instances the ‘better than expected’ description was explained by a less severe decline, which is commonly referred to by economists as the improvement in the second derivative. In other words, the rate of decline has experienced improvement (i.e. first quarter 2009 GDP declined at an annualized rate of 5.5% compared to 6.3% in the fourth quarter of 2008). Such improvement also led to frequent discussion of ‘green shoots,’ which refers to positive signs of economic activity. In order for the stock market to sustain these gains and continue increasing, we believe a transition in economic indicators is necessary to display more than an improvement in the rate of decline. We believe economic indicators need to demonstrate gains in economic activity and provide support indicating the worst of the recession has been realized and economic growth is just around the corner.

As a result of these factors, we believe intense scrutiny will surround economic data releases and events, which we believe will likely lead to persistence in volatility that has been prevalent in the stock market throughout 2009. In turn, this belief is directly related to our discussion in the introductory paragraphs of this report, which express concern over the future direction of the stock market. In that discussion, we state our belief that the intermediate-term outlook is favorable, but that long-term risks remain present.

Since we continue to believe many uncertainties remain in the economy and the financial markets, we are maintaining a partially defensive position in The Muirfield Fund® and the equity portion of The Defensive Balanced Fund. In addition, we are examining and actively managing our mix among large-, mid-, and small-cap companies. Going forward, we will continue to monitor conditions carefully and look for opportunities to adjust allocation weights among growth and value stocks, large-, mid- and small-caps, and domestic and international investments in order to enhance returns and manage risk for our clients. We will also continue to proactively manage our sector exposures and will make adjustments as we modify our outlook for the economy and financial markets. On the following pages you will find a review of how our mutual funds have performed. Please read the commentaries to learn more about the investment decisions that were made during the first six months of 2009.

Finally, we would like to remind investors that the stock market is forward-looking in nature and tends to anticipate future economic activity. As painful and deep as this recession has been, it is quite possible that the gains in the stock market since mid-March are reflecting an anticipated economic recovery in the second half of the year.

These are trying times in the financial services industry. Since 1974, Meeder Financial has navigated through periods of extremely difficult market environments. On behalf of all of the associates at Meeder Asset Management and The Flex-funds®, I thank you for the continued trust and confidence you have placed in our investment management services. Be assured we are 100% committed to working with you and helping you achieve your most important financial goals.

| Sincerely, |

|

Robert S. Meeder, Jr. President |

Meeder Financial & The Flex-funds® June 30, 2009 |

| The Flex-funds® 2009 Semiannual Report | June 30, 2009 | Page 5 |

| 2009 Semiannual Report | June 30, 2009 |

The Muirfield Fund®

Performance Perspective

Period & Average Annual Total Returns as of June 30, 2009 | 3 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date | |||||||||||||||

The Muirfield Fund® Expense Ratios*: Net 1.39% Gross 1.75% | 9.41 | % | 2.14 | % | -21.39 | % | -5.50 | % | -1.77 | % | -1.94 | % | 6.31 | % | 8/10/88 | ||||||||

Blended Index1 | 9.44 | % | 2.40 | % | -15.59 | % | -3.46 | % | 0.17 | % | 0.20 | % | 7.05 | % | 7/31/88 | ||||||||

S&P 500 Index2 | 15.93 | % | 3.16 | % | -26.21 | % | -8.22 | % | -2.24 | % | -2.22 | % | 8.38 | % | 7/31/88 | ||||||||

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2009. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time.

| 1 | The Blended Index consists of 60% of the S&P 500 Index and 40% of the average 90-day U.S. Treasury bill. |

| 2 | The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| * | The Net Expense Ratio is a percentage of the Fund’s net assets as of December 31, 2008. The Gross Expense Ratio is a percentage of the Fund’s assets as it is shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

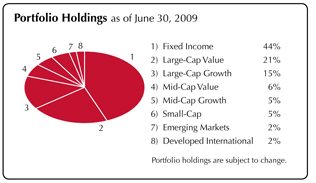

Semiannual Market Perspective

In The Muirfield Fund®, we began 2009 with an approximate 60% allocation to the stock market and a 40% defensive position in cash equivalent securities. As a point of reference, The Muirfield Fund® has maintained a partially defensive position of at least 25% since mid-January 2008. We increased our defensive position during the first quarter in response to a deteriorating stock market. However, as the second quarter progressed, we decreased our defensive position and increased exposure to the stock market in response to an improving risk/reward relationship indicated by our investment models. We ended the second quarter approximately 80% invested in the stock market and 20% invested in short-term bond funds in The Muirfield Fund® . For both the second quarter and the first six months of 2009, The Muirfield Fund® performed essentially in line with its Blended Index of 60% of the S&P 500 Index and 40% of the average 90-day U.S. Treasury bill.

Regarding our stock market exposure, we utilized our investment models to manage our exposure to growth versus value investments and across the range of market capitalization. We began the year with an overweight toward value investments due to indications from our investment models. We also maintained our overweight position in small-cap stocks due to readings from our investment models, as well as attractive relative valuations and favorable historical performance during recessions. As the year progressed, our models indicated a preference for a neutral stance among growth versus value investments, and we responded accordingly. As a result, we ended the second quarter neutral among growth versus value investments and remained overweight in small-cap stocks.

We also managed our industry and sector exposure throughout the year and initiated changes in sector allocations as 2009 progressed. We began 2009 with an overweight to sectors with defensive characteristics, such as consumer staples, healthcare, and utilities. In addition, we avoided the financials, industrial materials, and energy sectors. However, late in the first quarter we began reducing our exposure to defensive sectors, and simultaneously began increasing our exposure to sectors with greater potential for capital appreciation, such as energy, materials, and financials. We began the second quarter with a neutral weighting toward the financial sector; however, this position evolved to an overweight by the end of the second quarter. We also ended the second quarter with an overweight position in industrial materials and energy. We also decided to invest in the international markets in the second quarter, which we have avoided since the beginning of the fourth quarter of 2008.

| Page 6 | The Flex-funds® 2009 Semiannual Report | June 30, 2009 |

| 2009 Semiannual Report | June 30, 2009 |

The Defensive Balanced Fund

(Formerly known as The Defensive Growth Fund)3

Performance Perspective

Period & Average Annual Total Returns as of June 30, 2009 | 3 Months | YTD | 1 Year | 3 Years | Since Inception | Inception Date | |||||||||||

The Defensive Balanced Fund Expense Ratios*: Net 1.54% Gross 1.70% | 6.63 | % | 2.29 | % | -13.49 | % | -3.75 | % | -4.25 | % | 1/31/06 | ||||||

Blended Index1 | 7.08 | % | 2.28 | % | -9.55 | % | -0.53 | % | -0.31 | % | 1/31/06 | ||||||

S&P 500 Index2 | 15.93 | % | 3.16 | % | -26.21 | % | -8.22 | % | -7.25 | % | 1/31/06 | ||||||

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2009. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time.

| 1 | The Blended Index consists of 42% of the S&P 500 Index, 28% of the average 90-day U.S. Treasury bill and 30% Barclays Intermediate-Term Government/Credit Index. |

| 2 | The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| 3 | On August 25, 2008, The Defensive Growth Fund became known as The Defensive Balanced Fund and its investment strategy changed. This Fund will always invest at least 30% and may invest up to 70% of its assets primarily in equity mutual funds. In addition, this Fund will always invest at least 30% and may invest up to 70% of its assets primarily in investment grade bonds, money market instruments, or exchange traded funds. |

| * | The Net Expense Ratio is a percentage of the Fund’s net assets as of December 31, 2008. The Gross Expense Ratio is a percentage of the Fund’s assets as it is shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

Semiannual Market Perspective

The Defensive Balanced Fund will always have at least 30%, and up to 70%, of assets invested in the stock market. The Fund will also have at least 30%, and up to 70%, of assets in investment grade bonds, money market instruments, or exchange traded funds that invest in fixed-income securities as a defensive tactic. In the fixed-income portion of the Fund, we began 2009 with a large allocation to government agency securities. Due to indications from our investment models, we began adding exposure to investment grade corporate bonds during the second quarter.

In the equity portion of The Defensive Balanced Fund, we began 2009 with an approximate 60% allocation to the stock market and a 40% defensive position in cash equivalent securities. We increased our defensive position during the first quarter in response to a deteriorating stock market. However, as the second quarter progressed, we decreased our defensive position and increased exposure to the stock market in response to an improving risk/reward relationship indicated by our investment models. We ended the second quarter approximately 80% invested in the stock market and 20% invested in short-term bond funds in the equity portion of The Defensive Balanced Fund. For both the second quarter and the first six months of 2009, The Defensive Balanced Fund performed essentially in line with its primary Blended Index of 42% of the S&P 500 Index, 28% of the Average 90-day U.S. Treasury bill and 30% of Barclays Intermediate-Term Government/Credit Index.

Regarding our stock market exposure, we began the year with an overweight toward value investments, and maintained our overweight position in small-cap stocks due to readings from our investment models. As the year progressed, our models indicated a preference for a neutral stance among growth versus value investments, and we ended the second quarter neutral among growth versus value investments and remained overweight in small-cap stocks. We also managed our industry and sector exposure throughout the year. We began 2009 with an overweight to sectors with defensive characteristics, such as consumer staples, healthcare, and utilities. However, late in the first quarter we began reducing our exposure to defensive sectors, and simultaneously began increasing our exposure to sectors with greater potential for capital appreciation, such as energy, materials, and financials. We ended the second quarter with an overweight position in industrial materials and energy. We also decided to invest in the international markets in the second quarter, which we have avoided since the beginning of the fourth quarter of 2008.

| The Flex-funds® 2009 Semiannual Report | June 30, 2009 | Page 7 |

| 2009 Semiannual Report | June 30, 2009 |

The Strategic Growth Fund

(Formerly known as The Focused Growth Fund)3

Performance Perspective

Period & Average Annual Total Returns as of June 30, 2009 | 3 Months | YTD | 1 Year | 3 Years | Since Inception | Inception Date | |||||||||||

The Strategic Growth Fund Expense Ratios*: Net 1.57% Gross 1.74% | 20.22 | % | 8.36 | % | -31.36 | % | -10.44 | % | -9.91 | % | 1/31/06 | ||||||

Custom Blended Index1 | 21.98 | % | 5.12 | % | -33.89 | % | -9.33 | % | -8.03 | % | 1/31/06 | ||||||

S&P 500 Index2 | 15.93 | % | 3.16 | % | -26.21 | % | -8.22 | % | -7.25 | % | 1/31/06 | ||||||

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2009. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time.

| 1 | The Custom Blended Index is comprised of 25% S&P 500, 20% S&P Midcap 400, 12.5% Russell 2000, 12.5% Dow Jones Wilshire Real Estate Investment Trust, 12.5% Goldman Sachs Commodity Index, 12% Morgan Stanley Capital International Europe, Australasia, and Far East, and 5.5% Morgan Stanley Capital International Europe Emerging Markets Index. These indices do not take into account the deduction of expenses associated with a mutual fund such as investment management and accounting fees. An investor cannot invest directly in an index. |

| 2 | The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| 3 | On August 25, 2008, The Focused Growth Fund became known as The Strategic Growth Fund and its investment strategy changed. This Fund will pursue its goal by investing primarily in open-end or closed-end investment companies that seek capital growth or appreciation without regard to current income. In addition, this fund will always have set allocations to U.S. large-cap equities, U.S. mid-cap equities, U.S. small-cap equities, non-U.S./International (including emerging markets) equities, real estate equities and commodity based equities. |

| * | The Net Expense Ratio is a percentage of the Fund’s net assets as of December 31, 2008. The Gross Expense Ratio is a percentage of the Fund’s assets as it is shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

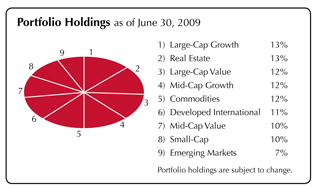

Semiannual Market Perspective

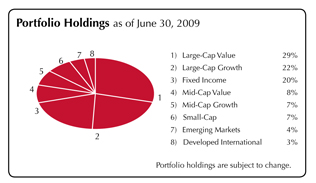

For the six months ended June 30, 2009, The Strategic Growth Fund outperformed both the S&P 500 Index and its Custom Benchmark. The Strategic Growth Fund is designed to hold fixed allocations across six distinct investment categories, although the mix of investments selected to represent the investment category is variable and actively managed. The fixed allocations were determined by examining an optimal asset allocation strategy that maximized return while minimizing risk during a specified time period. The current target allocation mix is comprised of the following: 17.5% international holdings, 25% large-cap holdings, 20% mid-cap holdings, 12.5% small-cap holdings, 12.5% real estate holdings, and 12.5% commodities holdings.

The Fund’s performance is compared against a custom benchmark that reflects the target allocations previously specified. For the year-to-date period through June 30, 2009, the Fund has outperformed the benchmark as a result of favorable fund selection in various categories. For instance, the Allianz NFJ International Value Fund outperformed its benchmark during the first half of 2009. We also experienced favorable results among several large-cap holdings, including the Fairholme Fund, the Hartford Capital Appreciation Fund, and the Ivy Large Cap Growth Fund. The Van Eck Global Hard Assets Fund contributed positively to our holdings of commodity-related stocks, and our real estate holding of the First American Real Estate Fund proved beneficial.

| Page 8 | The Flex-funds® 2009 Semiannual Report | June 30, 2009 |

| 2009 Semiannual Report | June 30, 2009 |

The Dynamic Growth Fund

Performance Perspective

Period & Average Annual Total Returns as of June 30, 2009 | 3 Months | YTD | 1 Year | 3 Years | 5 Years | Since Inception | Inception Date | |||||||||||||

The Dynamic Growth Fund Expense Ratios*: Net 1.34% Gross 1.69% | 17.80 | % | 7.48 | % | -29.21 | % | -8.41 | % | -2.27 | % | -4.04 | % | 2/29/00 | |||||||

S&P 500 Index1 | 15.93 | % | 3.16 | % | -26.21 | % | -8.22 | % | -2.24 | % | -2.41 | % | 2/29/00 | |||||||

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2009. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time.

| 1 | The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| * | The Net Expense Ratio is a percentage of the Fund’s net assets as of December 31, 2008. The Gross Expense Ratio is a percentage of the Fund’s assets as it is shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

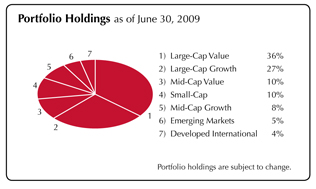

Semiannual Market Perspective

Despite the difficulties and declines facing the stock market during the first two months of 2009, a stock market rally that materialized in mid-March continued into the second quarter as better than expected economic data, adequate corporate earnings results and subsiding financial sector fears contributed positively to investor sentiment. Since establishing the low for 2009 on March 9th, the S&P 500 has increased nearly 37% through the end of June. As a result, the stock market ended a streak that experienced six consecutive negative quarterly returns for the S&P 500 Index.

We utilized our investment models to manage our exposure to growth versus value investments and across the range of market capitalization. We began the year with an overweight toward value investments due to indications from our investment models. We also maintained our overweight position in small-cap stocks due to readings from our investment models, as well as a attractive relative valuations and favorable historical performance during recessions. As the year progressed, our models indicated a preference for a neutral stance among growth versus value investments, and we responded accordingly. As a result, we ended the second quarter neutral among growth versus value investments and remained overweight in small-cap stocks. For both the second quarter and year-to-date periods, The Dynamic Growth Fund outperformed its benchmark, the S&P 500 Index.

We also managed our industry and sector exposure throughout the year and initiated changes in sector allocations as 2009 progressed. We began 2009 with an overweight to sectors with defensive characteristics, such as consumer staples, healthcare, and utilities. In addition, we avoided the financials, industrial materials, and energy sectors. However, late in the first quarter we began reducing our exposure to defensive sectors, and simultaneously began increasing our exposure to sectors with greater potential for capital appreciation, such as energy, materials, and financials. We began the second quarter with a neutral weighting toward the financial sector; however, this position evolved to an overweight by the end of the second quarter. We also ended the second quarter with an overweight position in industrial materials and energy. Due to indications from our investment models, we decided to invest in the international markets in the second quarter, which we have avoided since the beginning of the fourth quarter of 2008. Initially, we established a position in emerging markets due to favorable readings from our investment models, which was soon followed by a position in developed international markets as well.

| The Flex-funds® 2009 Semiannual Report | June 30, 2009 | Page 9 |

| 2009 Semiannual Report | June 30, 2009 |

The Aggressive Growth Fund

Performance Perspective

Period & Average Annual Total Returns as of June 30, 2009 | 3 Months | YTD | 1 Year | 3 Years | 5 Years | Since Inception | Inception Date | |||||||||||||

The Aggressive Growth Fund Expense Ratios*: Net 1.62% Gross 1.84% | 18.70 | % | 8.86 | % | -25.99 | % | -7.91 | % | -2.31 | % | -5.69 | % | 2/29/00 | |||||||

NASDAQ Composite Index1 | 20.34 | % | 16.98 | % | -19.13 | % | -4.64 | % | -1.37 | % | -9.02 | % | 2/29/00 | |||||||

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2009. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time.

| 1 | The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ National Market and Small Cap stocks. The NASDAQ Composite Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| * | The Net Expense Ratio is a percentage of the Fund’s net assets as of December 31, 2008. The Gross Expense Ratio is a percentage of the Fund’s assets as it is shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

Semiannual Market Perspective

The first half of 2009 witnessed an abundance of events and news headlines which contributed to the stock market decline and subsequent rally. Optimism emerged regarding the recovery and health of the financial sector following bank earnings reports and results of government ‘stress tests.’ There have been instances of better than expected housing data, which has led some economists to speculate the housing market is finally stabilizing. Additionally, several measures of consumer confidence and manufacturing activity have improved since realizing cyclical lows during the first quarter.

Regarding our stock market exposure, we utilized our investment models to manage our exposure to growth versus value investments and across the range of market capitalization. We began the year with an overweight toward value investments due to indications from our investment models. We also maintained our overweight position in small-cap stocks due to readings from our investment models, as well as a attractive relative valuations and favorable historical performance during recessions. As the year progressed, our models indicated a preference for a neutral stance among growth versus value investments, and we responded accordingly. Also, we continued to add to our overweight position in small-cap stocks as the year progressed due to consistently favorable indications from our investment models. Additionally, we maintained an overweight to mid-cap stocks throughout the year.

We also managed our industry and sector exposure throughout the year and initiated changes in sector allocations as 2009 progressed. We began 2009 with an overweight to sectors with defensive characteristics, such as consumer staples, healthcare, and utilities; while simultaneously avoiding the financials, industrial materials, and energy sectors. However, late in the first quarter we began reducing our exposure to defensive sectors, and began increasing our exposure to sectors with greater potential for capital appreciation, such as energy, materials, and financials. Throughout the second quarter we maintained an overweight to the energy, industrial materials, and financial sector. Finally, we made the decision to directly establish a position in international markets due to indications from our investment models. Initially, we established a position in emerging markets due to favorable readings from our investment models, which was soon followed by a position in developed international markets as well.

| Page 10 | The Flex-funds® 2009 Semiannual Report | June 30, 2009 |

| 2009 Semiannual Report | June 30, 2009 |

The Quantex Fund™

Performance Perspective

Period & Average Annual Total Returns as of June 30, 2009 | 3 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date | |||||||||||||||

The Quantex Fund™ Expense Ratios*: Net 1.73% Gross 2.26% | 34.86 | % | 24.38 | % | -18.54 | % | -9.31 | % | -2.66 | % | -3.49 | % | 5.10 | % | 3/20/85 | ||||||||

Blended Index1 | 19.71 | % | 5.55 | % | -26.47 | % | -8.68 | % | -0.61 | % | 3.63 | % | — | 3/31/85 | |||||||||

Russell 2000 Index2 | 20.69 | % | 2.64 | % | -25.01 | % | -9.87 | % | -1.67 | % | 2.43 | % | 6.32 | % | 3/31/85 | ||||||||

S&P 400 Mid-Cap Index3 | 18.75 | % | 8.47 | % | -28.02 | % | -7.53 | % | 0.36 | % | 4.60 | % | — | 3/31/85 | |||||||||

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2009. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. The Fund’s management fee waiver is contractual and may be terminated annually by the Advisor on its renewal date.

| 1 | The Blended Index consists of 50% Russell 2000 Index and 50% S&P 400 Mid-Cap Index. |

| 2 | The Russell 2000 Index is a widely recognized unmanaged index of common stock prices of small-sized companies. The Russell 2000 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| 3 | The S&P 400 Mid-Cap Index is a widely recognized unmanaged index of common stock prices of mid-sized companies. The S&P 400 Mid-Cap Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| * | The Net Expense Ratio is a percentage of the Fund’s net assets as of December 31, 2008. The Gross Expense Ratio is a percentage of the Fund’s assets as it is shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

Semiannual Market Perspective

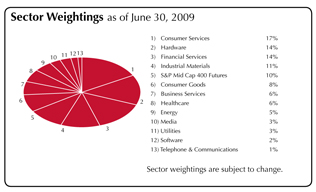

As the first half of the year has demonstrated, The Quantex Fund™ has a tendency to encounter headwinds during turbulent markets, as well as the ability to lead the market higher on the upside. The Quantex Fund™ appreciated 34.86% in the second quarter and has returned a total of 24.38% for the first half of 2009. In contrast, its Blended Index of 50% of the Russell 2000 Index and 50% of the S&P 400 Mid-Cap Index only returned 19.71% and 5.55% respectively for the second quarter and year-to-date periods.

We have consistently employed our quantitative stock selection process since April 30, 2005 for The Quantex Fund™. We utilize rankings from our financial model to determine which 100 securities are to be held in the Fund on an annual basis. As a result, the Fund is rebalanced once each year in January. For 2009, the updated composition of the Fund displays large overweights in hardware (a technology sub-sector) and consumer services and underweights in healthcare and energy. From a broader standpoint, at the beginning of the year the Fund had a 45% allocation to the service sector, 31% to the manufacturing sector and a 24% allocation to information technology. Additionally, there is a strong preference for value holdings in the 2009 composition, with mid-cap value companies comprising 36% of the Fund, followed by small-cap value with 23% and mid-cap core with 22% of the composition according to our allocation analysis in January.

For the first half of the year, XL Capital LTD was the best performing stock in the Fund, with an increase of 221%. Genworth Financial, Inc. also experienced significant returns through the first half of 2009 with an increase of nearly 147%. Overall, six of our holdings experienced returns of over 100% through the first half of 2009. The worst performing stocks during the first half include Eastman Kodak Co, which is down 55%, and media company Gannett Company Inc., which is down 54%. While financial companies were among our best performers, there were several financial sector stocks that were among the worst performers as well, including CIT Group and Huntington Bancshares Inc.

| The Flex-funds® 2009 Semiannual Report | June 30, 2009 | Page 11 |

| 2009 Semiannual Report | June 30, 2009 |

The Total Return Utilities Fund

(Formerly known as The Socially Responsible Utilities Fund)3

Performance Perspective

Period & Average Annual Total Returns as of June 30, 2009 | 3 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date | |||||||||||||||

The Socially Responsible Utilities Fund Expense Ratios*: Net 1.96% Gross 2.14% | 16.21 | % | 7.86 | % | -30.99 | % | -3.90 | % | 4.64 | % | 1.25 | % | 6.21 | % | 6/21/95 | ||||||||

Blended Index1 | 10.13 | % | 0.84 | % | -13.11 | % | -0.19 | % | 4.31 | % | -0.20 | % | 4.78 | % | 6/30/95 | ||||||||

Russell 3000 Utilities Index2 | 8.28 | % | -2.09 | % | -23.20 | % | -3.57 | % | 3.93 | % | -4.87 | % | 3.08 | % | 6/30/95 | ||||||||

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2009. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time.

| 1 | The Blended Index consists of 60% of the Russell 3000 Utilities Index and 40% of Barclays Capital Long Credit Index. |

| 2 | The Russell 3000 Utilities Index is a market capitalization-weighted index that is comprised of utility stocks that are included in the Russell 3000 Index. This index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| 3 | While the name of the fund has changed, the investment objective has remained the same. |

| * | The Net Expense Ratio is a percentage of the Fund’s net assets as of December 31, 2008. The Gross Expense Ratio is a percentage of the Fund’s assets as it is shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

Semiannual Market Perspective

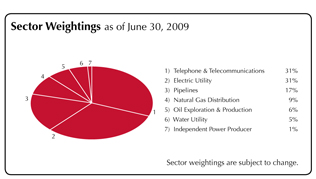

Concerns regarding the large-cap utility indices have significantly dissipated as attractive valuations within the sector have made stocks broadly appealing. Although lagging the broader market since the stock market rally materialized, the utility indices provided favorable returns, and the Fund’s performance relative to the peer group has been impressive during the first half of the year. The Total Return Utilities Fund returned 16.21% for the second quarter and 7.86% for the first half of 2009. The Total Return Utilities Fund outperformed both of its benchmarks for each of these periods. The strongest portion of the gains in the stock market rally was generally experienced in lower-quality stocks; however, we have been able to obtain similar results with a portfolio of quality names characterized by strong continuing operations, healthy balance sheets, and stable or increasing dividends. Given our preference for quality, our investment strategy does not emphasize the pursuit of short-term returns; alternatively, we prefer the sustainability of gains that have been achieved.

Investor attention toward utilities and related stocks has increased significantly as Congress debates energy legislation which impacts pollution, renewable energy standards, energy efficiency standards, new nuclear energy, and the renovation of the electrical transmission grid. Similar to the movement toward deregulation at the state level in the 1980s and 1990s, change in government rules will positively impact some companies while detracting from others. For now, companies enjoying positive investor sentiment are involved in rebuilding, expanding, and adding technology to the electric grid. Approximately 20% of the Fund is focused on aspects of the electrical grid, which we believe will continue to present favorable opportunities.

Over the near term, both our holdings and the utility indices should appeal to investors seeking to build equity positions but are concerned about the uncertainties facing the economy. As noted earlier, headline risk is present, but we do not believe that the debate will inhibit our holdings thus far. Additionally, there is potential for our holdings to benefit from stimulus projects and what appears to be a much easier carbon cap-and-trade regime than many had feared. There is significant work to be done regarding the renovation and expansion of enabling facilities in this country, and we hold stocks that build and operate all the conduits we need today and for the eventual recovery.

| Page 12 | The Flex-funds® 2009 Semiannual Report | June 30, 2009 |

| 2009 Semiannual Report | June 30, 2009 |

The U.S. Government Bond Fund

Performance Perspective

Period & Average Annual Total Returns as of June 30, 2009 | 3 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date | |||||||||||||||

The U.S. Government Bond Fund Expense Ratios*: Net 0.99% Gross 1.58% | -0.84 | % | -0.75 | % | 3.70 | % | 5.20 | % | 3.55 | % | 3.33 | % | 5.49 | % | 5/7/85 | ||||||||

Barclays Capital Intermediate-Term Government/Credit Index1 | 1.67 | % | 1.62 | % | 5.27 | % | 6.13 | % | 4.57 | % | 5.66 | % | 7.33 | % | 4/30/85 | ||||||||

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns for the periods ended June 30, 2009. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time.

| 1 | Barclays Capital Intermediate-Term Government/Credit Index is an unmanaged index of fixed-rate bonds issued by the U.S. Government and its agencies that are rated investment grade or higher, have one to ten years remaining until maturity, and at least $100 million outstanding. Barclays Capital Intermediate-Term Government/Credit Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| * | The Net Expense Ratio is a percentage of the Fund’s net assets as of December 31, 2008. The Gross Expense Ratio is a percentage of the Fund’s assets as it is shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

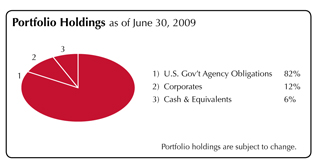

Semiannual Market Perspective

The Flex-funds® U.S. Government Bond Fund’s sector allocation continues to be positioned away from U.S. Treasury securities, and towards U.S. Government agency securities. In the second quarter we also added to our position in investment grade debt as this sector continues to offer value. U.S. Treasury securities dramatically underperformed year-to-date, and it appears the rally in this sector may have peaked. However, as its name implies, The U.S. Government Bond Fund is limited to a 20% weighting in corporate debt securities and this limitation led to its underperformance relative to the Barclays Capital Intermediate-Term Government/Credit Index.

The yield spread of government agency securities over U.S. Treasuries continues to be attractive versus the historical average. This, in conjunction with current Federal Reserve policies, should continue to benefit the government agency and investment grade sectors. Intervention by Federal Reserve on short-term interest rates has kept yields on the U.S. Treasury curve in check and trading within a range for the last months.

We began the year with an average weighted maturity in line with the benchmark; however, in the second quarter the Fund moved to alter average weighted maturity stance. Interest rate projections based on our models indicate intermediate-term interest rates may move higher in the coming quarters. With this in mind coupled with signs of improving economic data, we believed it was optimal to slightly underweight our average weighted maturity compared to the benchmark.

| The Flex-funds® 2009 Semiannual Report | June 30, 2009 | Page 13 |

| 2009 Semiannual Report | June 30, 2009 |

The Money Market Fund

Performance Perspective

Period & Average Annual Total Returns as of June 30, 2009 | 3 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date | |||||||||||||||

The Flex-funds® Money Market Fund (Retail Class) Expense Ratios*: Net 0.49% Gross 0.83% | 0.16 | % | 0.43 | % | 1.54 | % | 3.51 | % | 3.24 | % | 3.19 | % | 4.84 | % | 3/27/85 | ||||||||

Current & Effective Yields1 | 7-day Compound: 0.52% | 7-day Simple: 0.52% | |||||||||||||||||||||

Lipper Average General-Purpose Money Market Fund2 | 0.04 | % | 0.13 | % | 0.92 | % | 2.98 | % | 2.73 | % | 2.71 | % | 4.54 | % | 3/31/85 | ||||||||

The Flex-funds® Money Market Fund (Institutional Class) Expense Ratios*: Net 0.37% Gross 0.68% | 0.18 | % | 0.50 | % | 1.67 | % | 3.65 | % | — | — | 3.60 | % | 12/28/04 | ||||||||||

Current & Effective Yields1 | 7-day Compound: 0.63% | 7-day Simple: 0.63% | |||||||||||||||||||||

iMoneyNet, Inc. Average First-Tier Institutional Money Market Fund2 | 0.09 | % | 0.28 | % | 1.35 | % | 3.48 | % | — | — | 3.53 | % | 12/31/04 | ||||||||||

Past performance does not guarantee future results. Except for the current and effective yields, all performance figures represent average annual total returns for the periods ended June 30, 2009, and assume reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Money Market Fund during the periods shown above. Investments in The Money Market Fund are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although the Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in The Money Market Fund.

| 1 | For the period ended June 30, 2009, yield quotations more closely reflect the current earnings of The Money Market Fund than do total return quotations. |

| 2 | An index of funds such as Lipper’s Average General Purpose Money Market Fund Index and iMoneyNet, Inc.’s Average First-Tier Institutional Money Market Fund Index includes a number of mutual funds grouped by investment objective. |

| * | The Net Expense Ratios are percentages of the Funds’ net assets as of December 31, 2008. Gross Expense Ratios are percentages of the Funds’ assets as they are shown in the most recent Prospectus. The Net Expense Ratio includes all waivers, reimbursements and expenses paid indirectly. |

Semiannual Market Perspective

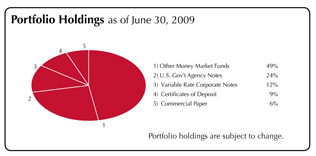

The Retail Class of The Flex-funds® Money Market Fund continued to rank among the top first tier retail and institutional money market funds in the country during the six month period ended June 30, 2009, according to iMoneyNet, Inc. Further, The Retail Class of The Flex-funds® Money Market Fund closed the period with a 0.52% 7-day compound yield and a 0.52% 7-day simple yield, while the median first-tier retail money market fund finished the quarter with yields of 0.04% and 0.04%, respectively.

Throughout the first half of 2009, we continued to focus on high quality investments and supported a relatively long weighted average maturity. As the year progressed, we continued to overweight U.S. Government agency securities while we reduced our holdings in commercial paper. We added FDIC backed securities to the portfolio, which allowed us to add yield to the Fund without increasing our risk profile. As of June 30, 2009 the portfolio composition was as follows: 24% U.S. Government agency securities, 18% corporate debt securities (including commercial paper), 9% in certificates of deposit and 49% in other money market funds. The strategy served the Fund well as the retail class finished the first half in the 5th percentile for the 1-year period ending June 30, 2009 (10th out of 217 funds) based on preliminary results versus its peers according to iMoneyNet, Inc.

As we enter the second half of 2009 we believe the Fund is positioned properly to maintain its outperformance. We will continue to face challenges with short-term investment options since we expect supply of available investment options and credit quality to be depressed for the next several months. The quality of the Fund’s investments will remain top priority as we navigate through this turbulent time period. However, we believe actions taken by the U.S. Government to rescue the sluggish economy should prove successful over time, and ultimately enable a return to normal market conditions. We believe short-term interest rates should remain depressed in the upcoming quarter. We believe a relatively long weighted average maturity should continue to prove beneficial. Throughout the remainder of the year, we will monitor the markets and our strategy, while constantly keeping in mind the best interest of our shareholders.

| Page 14 | The Flex-funds® 2009 Semiannual Report | June 30, 2009 |

| 2009 Semiannual Report | June 30, 2009 |

Shareholder Expense Analysis (Unaudited)

Shareholders of mutual funds pay ongoing expenses, such as advisory fees, distribution and service fees (12b-1 fees) and other fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples below are based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from December 31, 2008 to June 30, 2009.

ACTUAL EXPENSES: The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g.: an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

ACTUAL EXPENSES | Beginning Account Value (12/31/2008) | Ending Account Value (6/30/2009) | Expenses Paid During Period1 (12/31/2008 - 6/30/2009) | Expense Ratio (Annualized) | ||||||||

The Muirfield Fund® | $ | 1,000.00 | $ | 1,021.40 | $ | 7.67 | 1.53 | % | ||||

The Total Return Utilities Fund | 1,000.00 | 1,078.60 | 11.29 | 2.19 | % | |||||||

The Quantex Fund™ | 1,000.00 | 1,243.80 | 12.07 | 2.17 | % | |||||||

The Dynamic Growth Fund | 1,000.00 | 1,074.80 | 7.56 | 1.47 | % | |||||||

The Aggressive Growth Fund | 1,000.00 | 1,088.60 | 8.29 | 1.60 | % | |||||||

The Defensive Balanced Fund | 1,000.00 | 1,022.90 | 8.03 | 1.60 | % | |||||||

The Strategic Growth Fund | 1,000.00 | 1,083.60 | 8.27 | 1.60 | % | |||||||

The U.S. Government Bond Fund | 1,000.00 | 992.50 | 4.89 | 0.99 | % | |||||||

The Money Market Fund - Retail Class | 1,000.00 | 1,004.30 | 2.93 | 0.59 | % | |||||||

The Money Market Fund - Institutional Class | 1,000.00 | 1,005.00 | 2.29 | 0.46 | % | |||||||

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES: The second table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

HYPOTHETICAL EXAMPLE (5% return before expenses) | Beginning Account Value (12/31/2008) | Ending Account Value (6/30/2009) | Expenses Paid During Period1 (12/31/2008 - 6/30/2009) | Expense Ratio (Annualized) | ||||||||

The Muirfield Fund® | $ | 1,000.00 | $ | 1,017.21 | $ | 7.65 | 1.53 | % | ||||

The Total Return Utilities Fund | 1,000.00 | 1,013.93 | 10.94 | 2.19 | % | |||||||

The Quantex Fund™ | 1,000.00 | 1,014.03 | 10.84 | 2.17 | % | |||||||

The Dynamic Growth Fund | 1,000.00 | 1,017.50 | 7.35 | 1.47 | % | |||||||

The Aggressive Growth Fund | 1,000.00 | 1,016.86 | 8.00 | 1.60 | % | |||||||

The Defensive Balanced Fund | 1,000.00 | 1,016.86 | 8.00 | 1.60 | % | |||||||

The Strategic Growth Fund | 1,000.00 | 1,016.86 | 8.00 | 1.60 | % | |||||||

The U.S. Government Bond Fund | 1,000.00 | 1,019.89 | 4.96 | 0.99 | % | |||||||

The Money Market Fund - Retail Class | 1,000.00 | 1,021.87 | 2.96 | 0.59 | % | |||||||

The Money Market Fund - Institutional Class | 1,000.00 | 1,022.51 | 2.31 | 0.46 | % | |||||||

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if any transactional costs were included, your costs would have been higher.

| 1 | Expenses are equal to the Funds’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the total number of days in the six-month period). |

| The Flex-funds® 2009 Semiannual Report | June 30, 2009 | Page 15 |

| 2009 Semiannual Report | June 30, 2009 |

2009 Semiannual Report

Portfolio Holdings & Financial Statements

| Page 16 | The Flex-funds® 2009 Semiannual Report | June 30, 2009 |

Schedule of Investments

June 30, 2009 (unaudited)

The Muirfield Fund

Security Description | Shares or Principal Amount ($) | Value ($)(a) | ||

Registered Investment Companies — 89.9% | ||||

AIM Diversified Dividend Fund | 310,437 | 2,775,310 | ||

Allianz NFJ Dividend Value Fund | 288,779 | 2,486,388 | ||

American Century Equity Income Fund | 128,866 | 744,845 | ||

BB&T Equity Income Fund | 307,236 | 3,192,185 | ||

BlackRock Equity Dividend Fund | 137,828 | 1,831,740 | ||

Columbia Dividend Income Fund | 176,254 | 1,771,348 | ||

Consumer Staples Select Sector SPDR Fund | 43,900 | 1,009,261 | ||

Energy Select Sector SPDR Fund | 53,950 | 2,592,298 | ||

Fairholme Fund | 240,722 | 6,109,520 | ||

Fidelity Advisor Leveraged Company Stock Fund | 194,576 | 4,187,283 | ||

Fidelity Ginnie Mae Fund | 245,913 | 2,773,901 | ||

Financial Select Sector SPDR Fund | 146,900 | 1,755,455 | ||