UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3462

The Flex-funds Trust

6125 Memorial Drive

Dublin, OH 43017

Bruce McKibben

c/o The Flex-funds Trust

6125 Memorial Drive

Dublin, OH 43017

Registrant’s telephone number, including area code: 800-325-3539

Date of fiscal year end: December 31, 2011

Date of reporting period: June 30, 2011

Item 1. Report to Stockholders.

Semiannual Report

The Money Market Fund The U.S. Government Bond Fund The Total Return Bond Fund The Defensive Balanced Fund The Muirfield Fund® | The Utilities and Infrastructure Fund The Dynamic Growth Fund The Strategic Growth Fund The Aggressive Growth Fund The Quantex FundTM |

TABLE OF CONTENTS

| Letter to Shareholders | 1 |

| The Money Market Fund | 4 |

| The U.S. Government Bond Fund | 5 |

| The Defensive Balanced Fund | 6 |

The Muirfield Fund® | 7 |

| The Utilities and Infrastructure Fund | 8 |

| The Dynamic Growth Fund | 9 |

| The Strategic Growth Fund | 10 |

| The Aggressive Growth Fund | 11 |

The Quantex FundTM | 12 |

| Disclosure | 13 |

| Shareholder Expense Analysis | 14 |

| Fund Holdings & Financial Statements | 16 |

Our Mission Statement

Every day, our mission is to exceed, with integrity, passion, and discipline, the expectations of our shareholders’ and clients’ overall investment experience.

Core Values

The Client/Shareholder Is Our #1 Priority Always remember whom we are serving. Our livelihood depends on providing a superior overall investment experience that exceeds the expectations of our shareholders and clients. Clarity Of Purpose Our organization has a clear, well-defined vision. All of our associates are committed to and understand how they will contribute to that vision. Communication We expect open and effective communication, full reporting, including good and bad news, and constructive feedback. Integrity We insist upon honesty and adhere to the highest ethical standards. Excellence/ Innovation Our associates strive each day for excellence in the work they perform, seek innovative ways to solve problems and introduce new ideas to take advantage of opportunities. We are a “Think Outside The Box” company. Associate Well-Being We value the success and well-being of our associates. We recognize and reward our associates’ contributions. Respect For Others Respect all people, value the differences among them and treat them as you would like to be treated. Seek First To Understand When interacting with others, place curiosity and understanding of their perspective FIRST, setting aside preconceived opinions and quick judgment. Teamwork We are a synergistic organization that works as a team to exceed our objectives. Profit We are profitable. Profitability enhances our services and capabilities, and affords everyone the opportunity to further their financial well-being. |

| 2011 Semiannual Report | June 30, 2011 |

Letter to Shareholders

In the first half of 2011, investor concerns were heightened as the resiliency of the economic recovery was tested, geopolitical unrest emerged in the Middle East, and devastating natural disasters struck Japan. Additionally, ongoing financial instability among several European nations has further contributed to capital market volatility. Despite the presence of many negative catalysts, the domestic stock market has continued to advance, and is up 6.02% year-to-date through June 30, 2011 as measured by the S&P 500 Index. Although the pace of economic growth in the U.S. has tempered in recent months, evidence is not compelling that a return to recession is imminent. Recall that the economy experienced a similar soft patch in 2010, yet it rebounded, and the stock market ended the year at new recovery highs. Additionally, stock valuations continue to appear reasonable, especially as the S&P 500 earnings approach the prior peak set back in 2007, while the Index is trading approximately 15% lower than that time.

The following pages will provide an overview of how we managed our risk exposure and the strategies we employed during the first half of 2011. We will also provide a brief summary of the economic and financial events that took place throughout the first six months of 2011, discuss our expectations for the remainder of the year, and review the performance of The Flex-funds® Mutual Funds.

The First Half of 2011 in Review

As 2011 began, expectations were high for the ongoing recovery of the domestic economy. However, attention was quickly diverted to new concerns, including geopolitical unrest in the Middle East region and the natural disasters in Japan. In the wake of those events, investor attention returned to the sovereign debt problems in Europe and economic indicators in the U.S., such as gross domestic product (GDP) and unemployment. The Federal Reserve maintained its position to wind down scheduled purchases of U.S. Treasury securities, signaling that the economy may be ready to sustain itself with less extensive governmental aid, despite a moderated pace of growth.

Capital market volatility heightened. Following the debt ceiling debate and subsequent downgrade of the U.S. credit rating by Standard & Poor’s, as well as recent evidence of economic weakness and ongoing issues with European sovereign debt, the financial markets have experienced significant declines into the third quarter. While there has been deterioration in the trend and technical aspects of the stock market, valuations remain quite attractive and there is recent evidence that economic activity is stabilizing.

Many economic indicators remain positive. Despite the first quarter GDP report, several economic indicators signal that the ongoing recovery remains intact, and may in fact be accelerating. Orders for durable goods have been positive for the last 16 months and industrial production continues to grow. Additionally, a

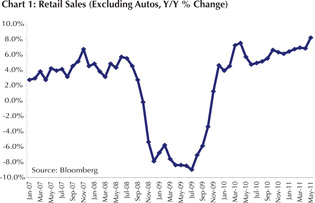

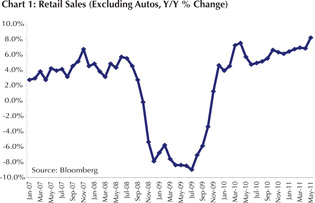

| Retail sales excluding autos increased 8.2% during May |

| 2011 Semiannual Report | June 30, 2011 |

key concern for many economists during the economic recovery has been the consumer’s propensity to spend. Retail sales excluding autos increased 8.2% during May compared to last year, which is faster than the 6.8% pace seen in the previous month (see Chart 1). This provides evidence that personal consumption may be improving, which is crucial since it comprises approximately two thirds of GDP.

Geopolitical unrest engulfs Middle East and North Africa. The Middle East and North Africa (MENA) region is comprised of many countries with authoritarian regimes, including dictatorships. Recently, civilians of many countries in the region have arranged protests to demand government change. The most prominent demonstrations include those in Egypt and Libya. As protests and uprisings continue in the MENA region, investors will examine the effects of these conflicts on oil production and prices. Crude oil has traded near $100 per barrel, which could hinder consumer confidence and dampen consumer demand for other discretionary items. Close attention will be paid to the conflicts in the MENA region and the resulting effects on oil prices and the equity markets.

Natural disasters strike Japan. On March 11, a 9.0 magnitude earthquake struck Japan and triggered a devastating tsunami. To make matters worse, a nuclear plant in Fukishima was destroyed and four out of the six nuclear reactors were damaged. Authorities have worked tirelessly in an attempt to control the radiation seeping from the reactors. Japan is the third largest economy in the world and produces 8.7% of global output. The destructive force of the disaster and nuclear radiation has had a negative effect on the world economy.

European debt problems linger. The European debt crisis continues to weigh heavily on investors as the extent of sovereign debt problems continue to unfold. At the end of June, the Greek parliament accepted an austerity package in order to secure additional rescue funds approved by the European Union (EU) and the International Monetary Fund (IMF). As a result of the severe cutbacks contained in the austerity package, many civilian protests occurred throughout Greece while parliament voted on the package’s approval. Many countries face tough budget decisions to address their fiscal imbalances, and the process of unwinding such budget issues has proven to be a long and arduous task. However, the rescue package pledged by the EU and IMF have served as a safety net for troubled nations.

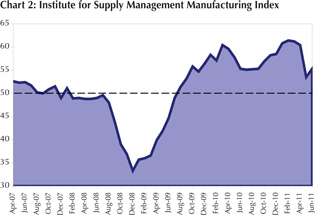

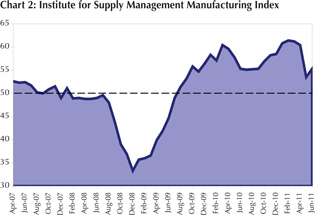

GDP growth slower than expected. The rate of economic growth slowed in the first quarter of 2011 as consumer spending was hampered by rising gas prices and a struggling labor market. First quarter GDP was reported at an annualized growth rate of 1.9%, much lower than the 3.1% seen in the last quarter of 2010. Furthermore, the Federal Reserve revised their growth expectations for 2011 downward from a range of 3.1% to 3.3% to a range of 2.7% to 2.9%. Also, the Institute for Supply Management (ISM) Manufacturing Index fell for 3 consecutive months from 61.4 in February to 53.5 in May. However, the indicator rebounded in June and was reported at 55.3 (see Chart 2), which was much higher than expected. Recall that an ISM reading above 50 is consistent with economic expansion while a reading below 50 is consistent with a shrinking economy, and June’s reading marks the 23rd consecutive month above this important level.

| The ISM indicator rebounded in June to 55.3 |

| 2011 Semiannual Report | June 30, 2011 |

Job growth remains sluggish. Unemployment has been a key drag on the economy since the recession began in 2007. In the first three months of 2011, there were significant improvements in the employment market, yet the jobs report for May and June showed a setback. In May, nonfarm payrolls increased only 25,000, while June posted a gain of only 18,000. In addition, the rate of unemployment has risen from 8.8% in March to 9.2% in June. However, despite the lower than expected gains, there have been positive additions to nonfarm payrolls in each of the last eight months, resulting in approximately 1.2 million jobs. The Obama administration has identified job growth as a major initiative vital to the ongoing growth of the economy. Thus, as the 2012 presidential election campaigns begin, much media attention will be placed on this important barometer of economic health.

Outlook for Remainder of 2011

Despite the negative headwinds from European debt problems and the seemingly slow rate of economic growth, there is strong evidence that suggests the economic recovery remains intact. Corporate profits continue to be strong and retail sales have accelerated despite the ongoing struggles in the labor market. Although the Federal Reserve has lowered its Treasury bond purchases, it has maintained its commitment to keeping interest rates low for “an extended period”. This will provide aid to the struggling housing market, as well as support a source of inexpensive funds for business expansion. The recent decline in oil prices should provide relief to consumers during the peak driving summer months, and allow for further expansion in consumer spending, which is needed to foster an increase in the rate of GDP growth.

As we monitor the stock market and our investment models, we will continuously evaluate our defensive position in The Muirfield Fund® and the equity portion of The Defensive Balanced Fund. We will look for opportunities to adjust portfolio weights among growth and value stocks, large-, mid-, and small-caps, and domestic and international investments in order to enhance returns and manage risk for our clients. We will also continue to proactively manage our sector exposures and will make adjustments as our investment models evolve. On the following pages you will find a review of how The Flex-funds® Mutual Funds have performed. Please read the commentaries to learn more about the investment decisions we made during the first half of 2011.

Finally, we are pleased to announce that The Total Return Bond Fund was added to The Flex-funds® investment offerings on June 30, 2011. The Fund was launched in order to offer shareholders added diversification to their fixed-income allocations, and will be managed in an effort to capitalize on a broader range of sectors in the fixed-income markets.

Although these are challenging times in the financial services industry, we believe opportunities continue to exist. Meeder celebrated its 37th anniversary this March, and we are proud to have assisted investors in meeting their financial goals through many different market environments. On behalf of all of the associates at Meeder Asset Management and The Flex-funds®, I thank you for the continued trust and confidence you have placed in our investment management services.

| | Robert S. Meeder President Meeder Asset Management, Inc. August 15, 2011 |

Please see disclosures on Page 13.

| 2011 Semiannual Report | June 30, 2011 |

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2011 | YTD | 1 Year | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® Money Market Fund (Retail Class) | 0.06% | 0.15% | 2.19% | 2.10% | 4.48% | 3/27/85 |

Current & Effective Yields1 | 7-day Compound: 0.11% 7-day Simple: 0.11% |

Lipper Average General-Purpose Money Market Fund2 | 0.01% | 0.03% | 1.82% | 1.68% | 4.24% | 3/31/85 |

The Flex-funds® Money Market Fund (Institutional Class) | 0.11% | 0.25% | 2.31% | - | 2.58% | 12/28/04 |

Current & Effective Yields1 | 7-day Compound: 0.21% 7-day Simple: 0.21% |

Lipper Average General-Purpose Money Market Fund2 | 0.01% | 0.03% | 1.82% | - | 2.05% | 12/31/04 |

Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of The Money Market Fund during the periods shown above. Investments in The Money Market Fund are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although the Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in The Money Market Fund.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

The retail and institutional classes of The Flex-funds® Money Market Fund ranked among the top general purpose money market funds in the country on June 30, 2011. Based on second quarter 2011 results, the retail class ranked second out of 277 general purpose money market funds that it was measured against according to Lipper. For the year-to-date period ending June 30, 2011, the retail and institutional class reported a return of 0.06% and 0.11%, respectively. The average general purpose money market fund finished the same period with a return of 0.01%, according to Lipper. The retail and institutional classes of The Flex-funds® Money Market Fund closed the quarter with a 7-day simple yield of 0.11% and 0.21%, respectively.

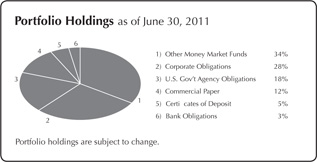

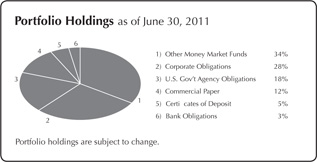

We entered 2011 in a similar market environment which has faced the Fund over the past couple of years. Investors debated the prospects for higher short-term interest rates while the Federal Reserve policy setting committee showed no signs of deviating from its current position. Throughout the first half of 2011, we maintained a weighted average maturity that was in line or slightly below that of our peers. Holdings in the Fund remained allocated toward investments with superior credit quality, as we believed the risk and reward relationship favored this position. Our sector allocation favored an overweight in high quality liquid investments and short-term investment grade corporate debt. We also maintained our exposure to U.S. Government agency securities and products backed by the FDIC. As of June 30, 2011, the Fund’s composition was as follows: 34% in other money market funds, 28% corporate obligations, 18% U.S. Government agency securities, 12% in commercial paper, 5% certificates of deposit, and 3% in bank obligations.

Although we expect available investment options that meet our credit standards may be limited for the next several months, we believe the Fund is positioned to maintain its strong performance during a difficult environment.

| 2011 Semiannual Report | June 30, 2011 |

The U.S. Government Bond Fund

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2011 | YTD | 1 Year | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® U.S. Government Bond Fund | 0.64% | 0.35% | 4.57% | 3.02% | 5.35% | 5/8/85 |

Expense Ratios*: Current Net 0.99% Gross 1.42% | | | | | | |

Barclays Capital Intermediate Government Index3 | 2.10% | 2.64% | 5.84% | 4.98% | 6.90% | 4/30/85 |

Barclays Capital Intermediate-Term Government/Credit Index4 | 2.47% | 3.77% | 6.08% | 5.35% | 7.23% | 4/30/85 |

Management fees and/or expenses were waived and/or reimbursed in The U.S. Government Bond Fund during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Fund are voluntary and may be terminated at any time. *Current expense ratio based on net assets in effect as of 6/30/11. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

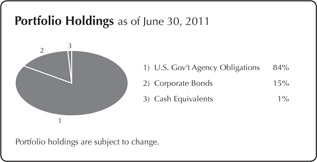

The U.S. Government Bond Fund reported a gain of 0.64% through the first half of the year, and returned 0.35% for the one year period.

In the first quarter, the main driver behind sector performance was the ongoing bearish sentiment toward U.S. Government and agency securities. The negative tone toward the sector coincided with the second round of quantitative easing by the Federal Reserve in the fourth quarter of 2010. Consequently, bonds in the government agency sector realized price declines, which pushed yields higher. However, corporate bonds remained popular during this period as companies with improved financial stability enticed investors seeking higher expected returns. This investment strategy also helped the Fund mitigate some of its underperformance as we maintained an allocation toward investment grade corporate bonds throughout the quarter.

During the second quarter, the Fund benefited from its exposure to U.S. Treasury and government agency securities. U.S. Treasury securities posted strong gains in the quarter as investor sentiment shifted away from equity positions in favor of bonds, which are perceived to carry greater safety. The Fund also obtained gains during the quarter from its allocation in high quality corporate bonds. Corporate bonds continue to advance as investors perceive that historically low default probabilities should remain at or near current levels over the near-term.

Finally, the Fund maintained an average maturity that was equal or below that of the Fund’s benchmark throughout the first half of 2011. Based on our fixed-income models, we anticipated expectations of higher interest rates in the near-term. By adopting this position, the Fund was less sensitive to interest rate movements.

| 2011 Semiannual Report | June 30, 2011 |

The Defensive Balanced Fund

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2011 | YTD | 1 Year | 8/31/08 to 6/30/11† | 5 year | Since Inception | Inception Date |

The Flex-funds® Defensive Balanced Fund† | 2.47% | 15.95% | 3.53% | 2.37% | 1.55% | 1/31/06 |

Expense Ratios*: Current Net 1.49% Gross 1.62% | | | | | | |

Blended Index5 | 3.28% | 13.49% | 3.76% | 3.97% | 3.77% | 1/31/06 |

S&P 500 Index6 | 6.02% | 30.69% | 3.32% | 2.94% | 2.72% | 1/31/06 |

Management fees and/or expenses were waived and/or reimbursed in The Defensive Balanced Fund during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Fund are voluntary and may be terminated at any time. †On August 25, 2008, the name and investment strategy of the Fund was changed. *Current expense ratio based on net assets in effect as of 6/30/11. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

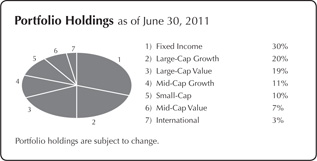

The Flex-funds® Defensive Balanced Fund returned 2.47% for the year-to-date period ended June 30, 2011, and returned 15.95% for the one year period. The Defensive Balanced Fund will always invest at least 30% of its assets in fixed-income securities. The Fund will also hold a minimum 30% allocation in equity securities, with additional investments determined by our defensive equity discipline.

In the equity portion of The Defensive Balanced Fund we entered the first quarter essentially fully-invested in the stock market. We carefully monitored our investment models during the first half of 2011 for any indications of a deteriorating market environment. However, our models continued to prefer a fully invested position amidst the stock market volatility that has punctuated 2011 thus far. As a result, we ended the first half of 2011 with a fully-invested position in the equity portion of The Defensive Balanced Fund.

In the equity portion of the Fund, we were overweight to growth investments compared to value, and remained overweight to mid- and small-cap investments throughout the first half of 2011. In terms of sector exposure, we were overweight in the industrial materials and energy sector, while being underweight in consumer staples and healthcare during the first quarter. During the second quarter, we remained overweight in the industrial materials and established an overweight to the healthcare sector, while becoming underweight in the energy sector. Finally, throughout the first half of 2011, we maintained a modest position in emerging markets, and have continued to avoid direct exposure to the developed international markets since December of 2009.

In the fixed-income portion of the Fund, the target allocation remained overweight in intermediate-term investment grade bond funds during the first half of 2011. During the first half, the yield on investments in this sector relative to U.S. Treasury securities settled in a range close to average historical levels. We continued to believe there was still value in the sector, and capitalized on favorable investment opportunities during the year. In addition, we believe fundamental data remains supportive of stronger credit quality among issuers in this segment for the rest of the year. Due to indications in our investment models, we expect to maintain an overweight to intermediate-term investment grade credit for the near-term. The average maturity of the fixed-income portion of the Fund was maintained in line or slightly below that of our benchmark.

| 2011 Semiannual Report | June 30, 2011 |

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2011 | YTD | 1 Year | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds Muirfield Fund® | 2.68% | 21.77% | 2.60% | 3.21% | 7.13% | 8/10/88 |

Expense Ratios*: Current Net 1.39% Gross 1.58% | | | | | | |

Blended Index7 | 3.62% | 17.78% | 2.89% | 2.76% | 7.58% | 7/31/88 |

S&P 500 Index6 | 6.02% | 30.69% | 2.94% | 2.72% | 9.54% | 7/31/88 |

Management fees and/or expenses were waived and/or reimbursed in The Muirfield Fund® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Fund are voluntary and may be terminated at any time. *Current expense ratio based on net assets in effect as of 6/30/11. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

The Flex-funds Muirfield Fund® returned 2.68% for the year-to-date period ended June 30, 2011, and returned 21.77% for the one year period.

In The Muirfield Fund®, we entered the first quarter essentially fully-invested in the stock market. We have maintained a fully-invested position since the fourth quarter of 2010 as a result of our investment models, which continue to indicate a favorable risk/reward relationship in the stock market. We carefully monitored our investment models during the first half of 2011 for any indications of a deteriorating market environment, especially as volatility emerged surrounding geopolitical events, the disaster in Japan, and slowing economic activity. However, our models continued to prefer a fully-invested position amidst the stock market volatility that has punctuated 2011 thus far. As a result, we ended the first half of 2011 with a fully-invested position in The Muirfield Fund®.

In addition to the changes in our defensive posture previously discussed, we also managed our exposure to large-, mid-, and small-cap companies, as well as growth versus value investments. During the first quarter, we maintained an overweight allocation to growth investments across the spectrum of market capitalizations. However, we reduced this overweight as the quarter progressed due to indications from our investment models. We also maintained our overweight exposure to mid- and small-cap investments. During the second quarter, we continued to maintain an overweight allocation in growth investments across the spectrum of market capitalizations, as well as our overweight exposure to mid- and small-cap investments.

We also managed our industry and sector exposure in the Fund. During the first quarter, we continued to add to our energy position, which resulted in an overweight exposure to the sector and benefited our performance. We also remained overweight to the industrial materials sector, while being underweight in the consumer staples and healthcare sectors. During the second quarter, we eliminated our energy overweight and subsequently established an overweight to the healthcare sector. Finally, throughout the first half of 2011 we maintained a modest position in emerging markets, and have continued to avoid direct exposure to the developed international markets, including Japan and Europe, since December of 2009.

| 2011 Semiannual Report | June 30, 2011 |

The Utilities and Infrastructure Fund (formerly The Total Return Utilities Fund)

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2011 | YTD | 1 Year | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® Utilities and Infrastructure Fund | 5.83% | 28.66% | 5.35% | 3.24% | 7.95% | 6/21/95 |

Expense Ratios*: Current Net 1.54% Gross 1.79% | | | | | | |

Russell 3000 Utilities Index8 | 8.96% | 31.42% | 4.37% | 1.81% | 4.79% | 6/30/95 |

Management fees and/or expenses were waived and/or reimbursed in The Utilities and Infrastructure Fund during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Fund are voluntary and may be terminated at any time. *Current expense ratio based on net assets in effect as of 6/30/11. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

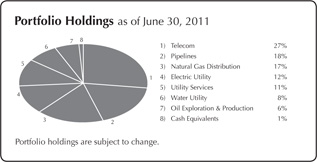

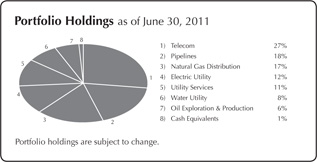

The Flex-funds® Utilities and Infrastructure Fund returned 5.83% for the year-to-date period ended June 30, 2011, and has returned 28.66% for the one year period. In addition, the Fund has outperformed the Russell 3000 Utilities benchmark for the 5-, 10-year, and since inception periods.

We experienced many opportunities across different industries during the first quarter. Natural gas companies with both production and delivery exposure performed well, despite ongoing low natural gas pricing. El Paso led our list, and was joined by Southern Union, National Fuel Gas, ONEOK, and MDU Resources. Battery and power management newcomer EnerSys hit a succession of new highs after beating expectations with a 61% earnings advance. Communications chip maker Qualcomm rose, as its chips have become extremely popular in new cellphones and tablets. Telecommunications companies were among our underperformers, despite big final-week runs in AT&T and Verizon. American Tower was hit by AT&T’s offer for T-Mobile, as investors assumed it would mean less need for towers, and less customers.

During a volatile second quarter for equities, the utilities sector was one of the stronger performing segments of the stock market. Our best performers comprised a mix of various industries. Southern Union rose about 40% following a pair of offers, while American Water Works exceeded earnings expectations once again and raised its dividend by 4.5%. We experienced a gain from Millicom International Cellular on a rally to fair value, and received a boost from dominant Canadian telecom BCE, which beat earnings expectations and raised its financial forecast. On the downside, many of our infrastructure enablers declined as a result of the poor broad market conditions that prevailed during the quarter, and included stocks like American Superconductor, GE, Cisco, driller Ensco, global engineering and construction firm Fluor, battery company EnerSys, and Veolia Environnement.

In our opinion, the stocks in our Fund are inexpensive, and have historically provided income and opportunity. Going forward, we see no reason for that to change.

| 2011 Semiannual Report | June 30, 2011 |

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2011 | YTD | 1 Year | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® Dynamic Growth Fund | 2.83% | 26.70% | 1.82% | 1.92% | -0.27% | 2/29/00 |

Expense Ratios*: Current Net 1.39% Gross 1.57% | | | | | | |

S&P 500 Index6 | 6.02% | 30.69% | 2.94% | 2.72% | 1.54% | 2/29/00 |

Management fees and/or expenses were waived and/or reimbursed in The Dynamic Growth Fund during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Fund are voluntary and may be terminated at any time. * Current expense ratio based on net assets in effect as of 6/30/11. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

The Flex-funds® Dynamic Growth Fund returned 2.83% for the year-to-date period ended June 30, 2011. For the one year period, the Fund has returned 26.70%.

During the first quarter, we maintained our overweight allocation to growth investments versus value; however, we reduced this overweight later in the first quarter as our investment models began to shift toward a neutral position. Additionally, our investment models have continued to maintain preference for mid- and small-cap companies, which has led us to maintain our overweight allocation to these investments. During the second quarter, we maintained the overweight allocation to growth investments versus value due to indications from our investment models. Additionally, our investment models have continued to maintain preference for mid- and small-cap companies, which has led us to maintain our overweight allocation to these investments. On an international basis, we have avoided direct exposure to developed international markets since December of 2009, and have maintained modest exposure to emerging markets during the first half of 2011.

The performance of the Fund relative to the S&P 500 during the first quarter was driven by numerous factors. In the Fund, we established an overweight position in the energy sector early in the first quarter, while also maintaining our overweight in the industrial materials sector. We remained underweight in the consumer staples and healthcare sector. Our modest position in emerging market securities detracted from performance during the quarter since these investments underperformed domestic securities. Additionally, our positions in two individual holdings, the Fairholme Fund and the Nuveen Tradewinds Value Opportunities Fund substantially trailed their respective benchmarks. We have responded by reducing and/or eliminating these holdings within the Fund. Our performance during the second quarter was driven by multiple factors as well. In the Fund, we had established an overweight position in the energy sector early in the first quarter while also maintaining our overweight in the industrial materials sector, which detracted from our performance during the second quarter. Our modest position in emerging market securities also negatively impacted performance during the quarter since these investments underperformed domestic securities. Additionally, our overweight position in mid- and small-cap investments detracted from performance in the second quarter. While we have eliminated our direct exposure to the energy sector, we are maintaining our overweight exposure to mid- and small-cap investments due to indications from our investment models.

| 2011 Semiannual Report | June 30, 2011 |

The Strategic Growth Fund

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2011 | YTD | 1 Year | 8/31/08 to 6/30/11† | 5 Year | Since Inception | Inception Date |

The Flex-funds® Strategic Growth Fund† | 3.60% | 30.56% | 2.88% | 2.27% | 1.62% | 1/31/06 |

Expense Ratios*: Current Net 1.42% Gross 1.58% | | | | | | |

S&P 500 Index6 | 6.02% | 30.69% | 3.32% | 2.94% | 2.72% | 1/31/06 |

Blended Index9 | 6.39% | 33.10% | 2.41% | 3.34% | 3.24% | 1/31/06 |

Management fees and/or expenses were waived and/or reimbursed in The Strategic Growth Fund during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Fund are voluntary and may be terminated at any time. * Current expense ratio based on net assets in effect as of 6/30/11. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus. †On August 25, 2008, the name and investment strategy of the Fund was changed.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

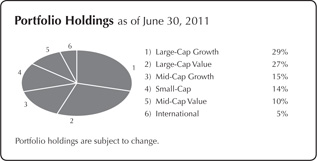

The Flex-funds® Strategic Growth Fund returned 3.60% for the year-to-date period ended June 30, 2011, and has returned 30.56% for the one year period.

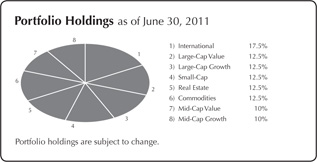

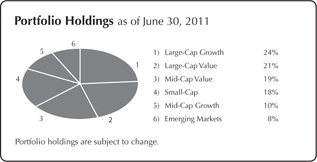

The Strategic Growth Fund is fully invested in the equity market at all times, and holds a fixed allocation across six distinct investment categories. The mix of investments selected to represent each investment category is variable and actively managed by using our strategic fund selection process. The current target allocation is comprised of the following: 25% large-cap, 20% mid-cap, 17.5% international, 12.5% small-cap, 12.5% real estate, and 12.5% commodities.

Within each respective category, we seek to identify funds that we believe will outperform their peers through an evaluation process based on valuation factors, measures of volatility, and risk-adjusted returns. Funds that fall out of favor within our models are sold and replaced with funds ranked higher by our evaluation process.

The Fund underperformed its custom benchmark and the broader market as measured by the S&P 500 Index during the first quarter. This is mostly attributable to unfavorable fund selection in the large-cap, commodity, and international categories. For instance, the Putnam Voyager Fund returned 3.60% during the first quarter compared to the S&P 500 Index return of 5.92%. However, we experienced favorable results among other funds, such as the Wells Fargo Advantage Growth Fund that returned 12.89% in the first quarter.

The Fund also underperformed its custom benchmark and the broader market as measured by the S&P 500 Index during the second quarter, and was primarily attributable to unfavorable fund selection in the mid-cap and international categories. For example, our mid-cap holding of the Ridgeworth Mid-cap Value Fund returned -1.46% during the second quarter versus the S&P 400 Mid-Cap Index return of -0.73%. Several of the asset allocation categories also underperformed the S&P 500 Index during the second quarter, such as the Russell 2000 Index of small-cap stocks that returned -1.61% in the second quarter compared to the S&P 500 Index return of 0.10%.

| 2011 Semiannual Report | June 30, 2011 |

The Aggressive Growth Fund

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2011 | YTD | 1 Year | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® Aggressive Growth Fund | 3.39% | 27.55% | 2.64% | 1.68% | -1.49% | 2/29/00 |

Expense Ratios*: Current Net 1.55% Gross 1.67% | | | | | | |

S&P 500 Index6 | 6.02% | 30.69% | 2.94% | 2.72% | 1.54% | 2/29/00 |

Management fees and/or expenses were waived and/or reimbursed in The Aggressive Growth Fund during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Fund are voluntary and may be terminated at any time. *Current expense ratio based on net assets in effect as of 6/30/11. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

The Flex-funds® Aggressive Growth Fund returned 3.39% for the year-to-date period ended June 30, 2011, and returned 27.55% for the one year period.

The year began with major stock market indices rallying to new recovery highs, with the S&P 500 trading at levels approximately two times greater than the March 2009 lows. However, volatility quickly emerged following heightened geopolitical unrest in the Middle East and the devastating natural disasters in Japan. In the second quarter, investor concerns were heightened as the resiliency of the economic recovery was tested. Financial instability amongst several European nations continued, while some signs of slowing economic growth emerged domestically. Furthermore, a disappointing employment report in May and June emphasized the continuing struggle to add jobs in the U.S.

We entered the first quarter with an overweight position among growth versus value investments, but reduced our growth overweight as the first quarter progressed due to indications from our investment models. We also maintained our overweight in mid- and small-cap stocks, which has been a key component of our investment allocation since the stock market recovery commenced. In the Fund, our sector exposure was concentrated among the energy and industrial materials sector throughout the first quarter, and our growth exposure also resulted in an overweight to the technology sector. We were underweight in the consumer staples and healthcare sector.

During the second quarter, we maintained our overweight position among growth versus value investments, and also maintained our overweight in mid- and small-cap stocks. In the Fund, our sector exposure remained consistent with the first quarter, which was characterized by an overweight position among the energy and industrial materials sector. Additionally, our growth exposure resulted in an overweight to the technology sector, and we were underweight in the consumer staples and healthcare sector during the second quarter.

Throughout the first half of 2011, we maintained a modest direct position in emerging market securities, while we have avoided direct exposure to developed international markets since December 2009.

| 2011 Semiannual Report | June 30, 2011 |

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2011 | YTD | 1 Year | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® Quantex Fund™ | 6.46% | 34.59% | 6.89% | 3.98% | 7.23% | 3/20/85 |

Expense Ratios*: Current Net 1.54% Gross 1.79% | | | | | | |

Russell 2000 Index10 | 6.21% | 37.41% | 4.08% | 6.30% | 9.48% | 3/31/85 |

Blended Index11 | 7.38% | 38.41% | 5.38% | 7.15% | 11.20% | 3/31/85 |

S&P 400 Mid-Cap Index12 | 8.56% | 39.38% | 6.59% | 7.92% | 12.79% | 3/31/85 |

Management fees and/or expenses were waived and/or reimbursed in The Quantex Fund™ during the periods shown in the table above to reduce expenses. The Fund’s management fee waiver is contractual and may be terminated annually by the Advisor on its renewal date. * Current expense ratio based on net assets in effect as of 6/30/11. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

The Flex-funds® Quantex Fund™ returned 6.46% for the year-to-date period ended June 30, 2011. In addition, the Fund has returned 34.59% for the one year time period. The Quantex Fund™ was recently recognized by Lipper as the best mid-cap value fund for the 3-year period ended December 31, 2010.

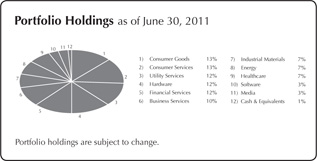

We have consistently employed our quantitative stock selection process since April 30, 2005 for The Quantex Fund™. We utilize rankings from our quantitative financial model to determine which securities are to be held in the Fund on an annual basis. As a result, the Fund is rebalanced annually in January. In the 2011 Fund, there is a strong preference for value holdings, with mid-cap value companies comprising 44% of the Fund, followed by mid-cap core with 26%, and mid-cap growth with 19%. Small-cap holdings of 11% comprise the remainder according to our allocation analysis at the beginning of the year.

Relative to the S&P 400 Mid-Cap Index, stock selection within the energy sector provided the greatest benefit to the Fund. The largest detractor from performance was stock selection within the financial sector, although the Fund’s underweight to the sector partially offset the negative selection impact. Stock selection in the healthcare sector also contributed to performance, while selection in the consumer discretionary sector detracted from returns. The Fund also benefited from other sector allocation decisions, including an overweight to the consumer staples during the first half of 2011.

During the year-to-date period of 2011, many stocks contributed positively to the performance of the Fund. The top performing stock for the period was National Semiconductor Corporation, which was up 80%. Other top performers for the period include Cabot Oil and Gas Corporation (up 75%) and Goodyear Tire & Rubber (up 42%). The largest detractors from performance during the period were Monster Worldwide Incorporated (down 38%) and Tellabs Incorporated (down 31%).

| 2011 Semiannual Report | June 30, 2011 |

Disclosures

Investors are advised to consider the investment objectives, risks, charges and expenses of The Flex-funds® carefully before investing. The Flex-funds® prospectus contains this and other information about the Funds and should be read carefully before investing. To request or receive a copy of The Flex-funds® prospectus, contact Shareholder Services at 800.325.3539 or visit www.flexfunds.com.

To obtain a prospectus containing more information about The Flex-funds®, including other fees and expenses that apply to a continued investment in the Funds, you may call (800)325-3539, or write to P.O. Box 7177, Dublin, OH 43017. Please read the prospectus carefully before investing.

Opinions and forecasts regarding sectors, industries, companies, countries and/or themes, and portfolio composition and holdings, are all subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security, industry, or sector.

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns or current and effective yields for the periods ended June 30, 2011. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so an investor’s shares or units, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in these tables to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time, except for The Quantex Fund TM. The Quantex Fund TM management fee waiver is contractual and can be terminated annually by the Adviser on its renewal date, April 29, 2012.

1For the period ended June 30, 2011, yield quotations more closely reflect the current earnings of The Money Market Fund than do total return quotations.

2An index of funds such as Lipper’s Average General Purpose Money Market Fund Index includes a number of mutual funds grouped by investment objective. One cannot invest directly in an index.

3The Barclays Capital Intermediate Government Index is an unmanaged index of dollar-denominated non-convertible fixed-rate bonds issued by the U.S. Government that are rated investment-grade or higher, have a maturity of one to ten years, and at least $250 million outstanding. The Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

4Barclays Capital Intermediate-Term Government/Credit Index is an unmanaged index of fixed-rate bonds issued by the U.S. Government and its agencies that are rated investment grade or higher, have one to ten years remaining until maturity, and at least $100 million outstanding. Barclays Capital Intermediate-Term Government/Credit Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

5The Blended Index consists of 42% of the S&P 500 Index, 28% of the average 90-day U.S. Treasury bill and 30% Barclays Intermediate-Term Government/Credit Index.

6The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

7The Blended Index consists of 60% of the S&P 500 Index and 40% of the average 90-day U.S. Treasury bill.

8The Russell 3000 Utilities Index is a market capitalization-weighted index that is comprised of utility stocks that are included in the Russell 3000 Index. This index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

9The Blended Index is comprised of 25% S&P 500, 20% S&P Midcap 400, 12.5% Russell 2000, 12.5% Dow Jones Wilshire Real Estate Investment Trust, 12.5% Goldman Sachs Commodity Index, 12% Morgan Stanley Capital International Europe, Australasia, and Far East, and 5.5% Morgan Stanley Capital International Europe Emerging Markets Index. These indices do not take into account the deduction of expenses associated with a mutual fund such as investment management and accounting fees. An investor cannot invest directly in an index.

10The Russell 2000 Index is a widely recognized unmanaged index of common stock prices of small-sized companies. The Russell 2000 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

11The Blended Index consists of 50% Russell 2000 Index and 50% S&P 400 Mid-Cap Index.

12The S&P 400 Mid-Cap Index is a widely recognized unmanaged index of common stock prices of mid-sized companies. The S&P 400 Mid-Cap Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index.

| 2011 Semiannual Report | June 30, 2011 |

Shareholder Expense Analysis (Unaudited)

Shareholders of mutual funds pay ongoing expenses, such as advisory fees, distribution and service fees (12b-1 fees) and other fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The following examples are based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from December 31, 2010 to June 30, 2011.

ACTUAL EXPENSES: The first table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g.: an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

| ACTUAL EXPENSES | Beginning Account Value (12/31/2010) | Ending Account Value (6/30/2011) | Expenses Paid During Period1 (12/31/2010 - 6/30/2011) | Expense Ratio (Annualized) |

| The Money Market Fund - Institutional Class | $1,000.00 | $1,001.10 | $1.09 | 0.22% |

| The Money Market Fund - Retail Class | $1,000.00 | $1,000.60 | $1.59 | 0.32% |

| The U.S. Government Bond Fund | $1,000.00 | $1,006.40 | $4.93 | 0.99% |

The Muirfield Fund® | $1,000.00 | $1,026.80 | $6.99 | 1.39% |

| The Dynamic Growth Fund | $1,000.00 | $1,028.30 | $6.99 | 1.39% |

| The Strategic Growth Fund | $1,000.00 | $1,036.00 | $7.17 | 1.42% |

| The Defensive Balanced Fund | $1,000.00 | $1,024.70 | $7.48 | 1.49% |

The Quantex Fund™ | $1,000.00 | $1,064.60 | $7.88 | 1.54% |

| The Aggressive Growth Fund | $1,000.00 | $1,033.90 | $7.82 | 1.55% |

| The Utilities and Infrastructure Fund | $1,000.00 | $1,058.30 | $9.54 | 1.87% |

| 2011 Semiannual Report | June 30, 2011 |

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES: The second table provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds to other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

HYPOTHETICAL EXAMPLE (5% return before expenses) | Beginning Account Value (12/31/2010) | Ending Account Value (6/30/2011) | Expenses Paid During Period1 (12/31/2010 - 6/30/2011) | Expense Ratio (Annualized) |

| The Money Market Fund - Institutional Class | $1,000.00 | $1,023.70 | $1.10 | 0.22% |

| The Money Market Fund - Retail Class | $1,000.00 | $1,023.21 | $1.61 | 0.32% |

| The U.S. Government Bond Fund | $1,000.00 | $1,019.89 | $4.96 | 0.99% |

The Muirfield Fund® | $1,000.00 | $1,017.90 | $6.95 | 1.39% |

| The Dynamic Growth Fund | $1,000.00 | $1,017.90 | $6.95 | 1.39% |

| The Strategic Growth Fund | $1,000.00 | $1,017.75 | $7.10 | 1.42% |

| The Defensive Balanced Fund | $1,000.00 | $1,017.41 | $7.45 | 1.49% |

The Quantex Fund™ | $1,000.00 | $1,017.16 | $7.70 | 1.54% |

| The Aggressive Growth Fund | $1,000.00 | $1,017.11 | $7.75 | 1.55% |

| The Utilities and Infrastructure Fund | $1,000.00 | $1,015.52 | $9.35 | 1.87% |

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if any transactional costs were included, your costs would have been higher.

| 1 | Expenses are equal to the Funds’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the total number of days in the six-month period). |

| 2011 Semiannual Report | June 30, 2011 |

Schedule of Investments

June 30, 2011 (unaudited)

| The Muirfield Fund | |

| | Shares or Principal Amount ($) | | | | |

| Registered Investment Companies — 95.3% | |

| Allianz NFJ Dividend Value Fund | | | 969,674 | | | | 11,723,358 | |

| Delaware Emerging Markets Fund | | | 302,516 | | | | 4,846,305 | |

| Health Care Select Sector SPDR Fund | | | 148,400 | | | | 5,272,652 | |

| iShares MSCI Emerging Markets Index Fund | | | 55,625 | | | | 2,647,750 | |

iShares Russell 2000 Index Fund | | | 87,525 | | | | 7,247,070 | |

Ivy Mid Cap Growth Fund # | | | 211,699 | | | | 4,047,680 | |

| Lord Abbett Fundamental Equity Fund | | | 810,578 | | | | 11,104,919 | |

| Nuveen Tradewinds Value Opportunities Fund | | | 219,406 | | | | 7,806,482 | |

PowerShares QQQ Trust | | | 97,830 | | | | 5,581,201 | |

Putnam Voyager Fund | | | 266,709 | | | | 6,526,360 | |

| RidgeWorth Mid Cap Value Equity Fund | | | 656,034 | | | | 8,180,747 | |

| RidgeWorth Small Cap Value Equity Fund | | | 519,247 | | | | 7,643,316 | |

| T. Rowe Price Mid-Cap Growth Fund | | | 64,635 | | | | 4,062,956 | |

T. Rowe Price Value Fund | | | 447,911 | | | | 11,041,000 | |

| Wells Fargo Advantage Growth Fund # | | | 359,538 | | | | 13,177,049 | |

| Total Registered Investment Companies (Cost $102,286,476) | | | | | | | 110,908,845 | |

| Money Market Registered Investment Companies — 1.7% | |

| The Flex-funds Money Market Fund - Institutional Class, 0.21%* | | | 1,964,199 | | | | 1,964,199 | |

Total Money Market Registered Investment Companies (Cost $1,964,199) | | | | | | | 1,964,199 | |

| Floating Rate Demand Notes — 2.3% | |

Caterpillar Financial Power Investment Floating Rate Demand Note, 0.65%, 7/1/2011** | | | 2,632,955 | | | | 2,632,955 | |

Total Floating Rate Demand Notes (Cost $2,632,955) | | | | | | | 2,632,955 | |

| U.S. Government Obligations — 0.7% | |

U.S. Treasury Bill, 0.102%, due 3/8/2012*** | | | 800,000 | | | | 799,470 | |

| Total U.S. Government Obligations (Cost $799,442) | | | | | | | 799,470 | |

Total Investments — 100.0% (Cost $107,683,072)(a) | | | | | | | 116,305,469 | |

| Liabilities less Other Assets — (0.0%) | | | | | | | (36,380 | ) |

Total Net Assets — 100.0% | | | | | | | 116,269,089 | |

| The Muirfield Fund | |

| | Shares or Principal Amount ($) | | | | |

| Trustee Deferred Compensation**** | |

| The Flex-funds Aggressive Growth Fund | | | 2,082 | | | | 17,156 | |

| The Flex-funds Defensive Balanced Fund | | | 1,063 | | | | 10,587 | |

| The Flex-funds Dynamic Growth Fund | | | 660 | | | | 5,524 | |

The Flex-funds Muirfield Fund | | | 3,698 | | | | 21,264 | |

The Flex-funds Quantex Fund | | | 2,504 | | | | 60,697 | |

| The Flex-funds Utilities and Infrastructure Fund | | | 234 | | | | 5,806 | |

Total Trustee Deferred Compensation (Cost $90,845) | | | | | | | 121,034 | |

| | | | | | Unrealized Appreciation (Depreciation) ($) | |

| Futures Contracts | |

| Standard & Poors 500 expiring September 2011, notional value $5,262,000 | | | 16 | | | | 108,230 | |

Total Futures Contracts | | | | | | | 108,230 | |

| (a) | Represents cost for financial reporting purposes and differs for federal income tax purposes by the amount of losses deferred for federal income tax reporting in the amount of $312,180. Cost for federal income tax purposes of $107,995,252 differs from value by net unrealized appreciation (depreciation) of securities as follows: |

Unrealized appreciation | | $ | 8,525,900 | |

Unrealized depreciation | | | (215,683 | ) |

| Net unrealized appreciation (depreciation) | | $ | 8,310,217 | |

| # | Represents non-income producing securities. |

| * | Investment in affiliate. The yield shown represents the 7-day yield in effect at June 30, 2011. |

| ** | Floating rate security. The rate shown represents the rate in effect at June 30, 2011. |

| *** | Pledged as collateral on futures contracts. |

| **** | Assets of affiliates to The Muirfield Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

| The accompanying notes are an integral part of these financial statements. |

| 2011 Semiannual Report | June 30, 2011 |

Schedule of Investments

June 30, 2011 (unaudited)

| The Dynamic Growth Fund | |

| | Shares or Principal Amount ($) | | | | |

| Registered Investment Companies — 96.0% | |

| Allianz NFJ Dividend Value Fund | | | 848,275 | | | | 10,255,648 | |

| Delaware Emerging Markets Fund | | | 266,869 | | | | 4,275,243 | |

| Health Care Select Sector SPDR Fund | | | 134,725 | | | | 4,786,779 | |

| iShares MSCI Emerging Markets Index Fund | | | 49,800 | | | | 2,370,480 | |

iShares Russell 2000 Index Fund | | | 76,900 | | | | 6,367,320 | |

Ivy Mid Cap Growth Fund # | | | 158,774 | | | | 3,035,760 | |

| Lord Abbett Fundamental Equity Fund | | | 704,109 | | | | 9,646,292 | |

| Nuveen Tradewinds Value Opportunities Fund | | | 179,898 | | | | 6,400,785 | |

PowerShares QQQ Trust | | | 84,700 | | | | 4,832,135 | |

Putnam Voyager Fund | | | 229,598 | | | | 5,618,264 | |

| RidgeWorth Mid Cap Value Equity Fund | | | 582,632 | | | | 7,265,420 | |

| RidgeWorth Small Cap Value Equity Fund | | | 453,749 | | | | 6,679,184 | |

| T. Rowe Price Mid-Cap Growth Fund | | | 65,637 | | | | 4,125,918 | |

T. Rowe Price Value Fund | | | 388,211 | | | | 9,569,407 | |

| Wells Fargo Advantage Growth Fund # | | | 312,659 | | | | 11,458,963 | |

| Total Registered Investment Companies (Cost $87,731,925) | | | | | | | 96,687,598 | |

| Money Market Registered Investment Companies — 2.5% | |

| The Flex-funds Money Market Fund - Institutional Class, 0.21%* | | | 2,508,027 | | | | 2,508,027 | |

Total Money Market Registered Investment Companies (Cost $2,508,027) | | | | | | | 2,508,027 | |

| Floating Rate Demand Notes — 0.7% | |

Caterpillar Financial Power Investment Floating Rate Demand Note, 0.65%, 7/1/2011** | | | 752,888 | | | | 752,888 | |

| Total Floating Rate Demand Notes (Cost $752,888) | | | | | | | 752,888 | |

| U.S. Government Obligations — 0.8% | |

U.S. Treasury Bill, 0.102%, due 3/8/2012*** | | | 800,000 | | | | 799,470 | |

| Total U.S. Government Obligations (Cost $799,442) | | | | | | | 799,470 | |

Total Investments — 100.0% (Cost $91,792,282)(a) | | | | | | | 100,747,983 | |

| Liabilities less Other Assets — (0.0%) | | | | | | | (34,375 | ) |

Total Net Assets — 100.0% | | | | | | | 100,713,608 | |

| The Dynamic Growth Fund | |

| | Shares or Principal Amount ($) | | | | |

| Trustee Deferred Compensation**** | |

| The Flex-funds Aggressive Growth Fund | | | 1,495 | | | | 12,319 | |

| The Flex-funds Defensive Balanced Fund | | | 755 | | | | 7,520 | |

| The Flex-funds Dynamic Growth Fund | | | 475 | | | | 3,976 | |

The Flex-funds Muirfield Fund | | | 1,788 | | | | 10,281 | |

The Flex-funds Quantex Fund | | | 1,012 | | | | 24,531 | |

| The Flex-funds Utilities and Infrastructure Fund | | | 168 | | | | 4,168 | |

Total Trustee Deferred Compensation (Cost $39,474) | | | | | | | 62,795 | |

| | | | | | Unrealized Appreciation (Depreciation) ($) | |

| Futures Contracts | |

| Standard & Poors 500 expiring September 2011, notional value $3,946,500 | | | 12 | | | | 91,860 | |

Total Futures Contracts | | | | | | | 91,860 | |

| (a) | Represents cost for financial reporting purposes and differs for federal income tax purposes by the amount of losses deferred for federal income tax reporting in the amount of $104,957. Cost for federal income tax purposes of $91,897,239 differs from value by net unrealized appreciation (depreciation) of securities as follows: |

Unrealized appreciation | | $ | 9,047,012 | |

Unrealized depreciation | | | (196,268 | ) |

| Net unrealized appreciation (depreciation) | | $ | 8,850,744 | |

| # | Represents non-income producing securities. |

| * | Investment in affiliate. The yield shown represents the 7-day yield in effect at June 30, 2011. |

| ** | Floating rate security. The rate shown represents the rate in effect at June 30, 2011. |

| *** | Pledged as collateral on futures contracts. |

| **** | Assets of affiliates to The Dynamic Growth Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

| The accompanying notes are an integral part of these financial statements. |

| 2011 Semiannual Report | June 30, 2011 |

Schedule of Investments

June 30, 2011 (unaudited)

| The Aggressive Growth Fund | |

| | Shares or Principal Amount ($) | | | | |

| Registered Investment Companies — 96.9% | |

| Allianz NFJ Dividend Value Fund | | | 259,122 | | | | 3,132,783 | |

| BlackRock Energy & Resources Portfolio | | | 41,279 | | | | 1,883,568 | |

| Delaware Emerging Markets Fund | | | 111,609 | | | | 1,787,982 | |

| iShares MSCI Emerging Markets Index Fund | | | 32,425 | | | | 1,543,430 | |

iShares Russell 2000 Index Fund | | | 35,100 | | | | 2,906,280 | |

Ivy Mid Cap Growth Fund # | | | 52,925 | | | | 1,011,920 | |

| Lord Abbett Developing Growth Fund, Inc. # | | | 86,735 | | | | 2,195,272 | |

| Lord Abbett Fundamental Equity Fund | | | 275,126 | | | | 3,769,229 | |

Putnam Voyager Fund | | | 96,250 | | | | 2,355,231 | |

| RidgeWorth Mid Cap Value Equity Fund | | | 224,485 | | | | 2,799,325 | |

| RidgeWorth Small Cap Value Equity Fund | | | 133,349 | | | | 1,962,899 | |

RS Technology Fund | | | 100,611 | | | | 2,117,870 | |

| T. Rowe Price Mid-Cap Growth Fund | | | 24,516 | | | | 1,541,048 | |

T. Rowe Price Value Fund | | | 138,920 | | | | 3,424,385 | |

| Wells Fargo Advantage Growth Fund # | | | 143,407 | | | | 5,255,883 | |

| Total Registered Investment Companies (Cost $36,587,199) | | | | | | | 37,687,105 | |

| Money Market Registered Investment Companies — 2.3% | |

| The Flex-funds Money Market Fund - Institutional Class, 0.21%* | | | 890,714 | | | | 890,714 | |

Total Money Market Registered Investment Companies (Cost $890,714) | | | | | | | 890,714 | |

| U.S. Government Obligations — 0.8% | |

U.S. Treasury Bill, 0.102%, due 3/8/2012** | | | 300,000 | | | | 299,801 | |

| Total U.S. Government Obligations (Cost $299,791) | | | | | | | 299,801 | |

Total Investments — 100.0% (Cost $37,777,704)(a) | | | | | | | 38,877,620 | |

| Liabilities less Other Assets — (0.0%) | | | | | | | (8,453 | ) |

Total Net Assets — 100.0% | | | | | | | 38,869,167 | |

| The Aggressive Growth Fund | |

| | Shares or Principal Amount ($) | | | | |

| Trustee Deferred Compensation*** | |

| The Flex-funds Aggressive Growth Fund | | | 844 | | | | 6,955 | |

| The Flex-funds Defensive Balanced Fund | | | 439 | | | | 4,372 | |

| The Flex-funds Dynamic Growth Fund | | | 265 | | | | 2,218 | |

The Flex-funds Muirfield Fund | | | 1,137 | | | | 6,538 | |

The Flex-funds Quantex Fund | | | 676 | | | | 16,386 | |

| The Flex-funds Utilities and Infrastructure Fund | | | 95 | | | | 2,357 | |

Total Trustee Deferred Compensation (Cost $30,776) | | | | | | | 38,826 | |

| | | | | | Unrealized Appreciation (Depreciation) ($) | |

| Futures Contracts | |

| Standard & Poors 500 expiring September 2011, notional value $1,315,500 | | | 4 | | | | 55,770 | |

Total Futures Contracts | | | | | | | 55,770 | |

| (a) | Represents cost for financial reporting purposes and income tax purposes. Net unrealized appreciation (depreciation) of securities is as follows: |

Unrealized appreciation | | $ | 1,394,614 | |

Unrealized depreciation | | | (294,698 | ) |

| Net unrealized appreciation (depreciation) | | $ | 1,099,916 | |

| # | Represents non-income producing securities. |

| * | Investment in affiliate. The yield shown represents the 7-day yield in effect at June 30, 2011. |

| ** | Pledged as collateral on futures contracts. |

| *** | Assets of affiliates to The Aggressive Growth Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

| The accompanying notes are an integral part of these financial statements. |

| 2011 Semiannual Report | June 30, 2011 |

Schedule of Investments

June 30, 2011 (unaudited)

| The Defensive Balanced Fund | |

| | Shares or Principal Amount ($) | | | | |

| Registered Investment Companies — 95.0% | |

| Alliance Bernstein High Income Fund | | | 233,882 | | | | 2,140,024 | |

| Allianz NFJ Dividend Value Fund | | | 455,119 | | | | 5,502,386 | |

| Delaware Emerging Markets Fund | | | 139,516 | | | | 2,235,047 | |

| Eaton Vance Floating-Rate Advantage Fund | | | 194,942 | | | | 2,132,669 | |

Federated Bond Fund | | | 464,201 | | | | 4,279,934 | |

| Health Care Select Sector SPDR Fund | | | 49,575 | | | | 1,761,400 | |

| iShares MSCI Emerging Markets Index Fund | | | 24,750 | | | | 1,178,100 | |

iShares Russell 2000 Index Fund | | | 39,800 | | | | 3,295,440 | |

Ivy Mid Cap Growth Fund # | | | 105,849 | | | | 2,023,840 | |

| Legg Mason Western Asset Government Securities Fund | | | 338,688 | | | | 3,607,022 | |

| Lord Abbett Fundamental Equity Fund | | | 360,154 | | | | 4,934,115 | |

| Nuveen Tradewinds Value Opportunities Fund | | | 75,278 | | | | 2,678,375 | |

PowerShares QQQ Trust | | | 40,250 | | | | 2,296,263 | |

| Prudential Total Return Bond Fund | | | 305,907 | | | | 4,319,409 | |

Putnam Income Fund | | | 623,298 | | | | 4,319,456 | |

Putnam Voyager Fund | | | 114,569 | | | | 2,803,493 | |

| RidgeWorth Mid Cap Value Equity Fund | | | 299,618 | | | | 3,736,235 | |

| RidgeWorth Small Cap Value Equity Fund | | | 233,536 | | | | 3,437,649 | |

| T. Rowe Price Mid-Cap Growth Fund | | | 26,697 | | | | 1,678,175 | |

T. Rowe Price Value Fund | | | 195,667 | | | | 4,823,193 | |

| Wells Fargo Advantage Growth Fund # | | | 171,151 | | | | 6,272,688 | |

| Total Registered Investment Companies (Cost $66,267,542) | | | | | | | 69,454,913 | |

| Money Market Registered Investment Companies — 0.9% | |

| The Flex-funds Money Market Fund - Institutional Class, 0.21%* | | | 662,574 | | | | 662,574 | |

Total Money Market Registered Investment Companies (Cost $662,574) | | | | | | | 662,574 | |

| Floating Rate Demand Notes — 2.4% | |

Caterpillar Financial Power Investment Floating Rate Demand Note, 0.65%, 7/1/2011** | | | 1,759,244 | | | | 1,759,244 | |

| Total Floating Rate Demand Notes (Cost $1,759,244) | | | | | | | 1,759,244 | |

| U.S. Government Obligations — 1.8% | |

| Federal Home Loan Mortgage Corporation, 4.00%, due 12/15/2022 | | | 1,000,000 | | | | 1,001,532 | |

| U.S. Treasury Bill, 0.102%, due 3/8/2012*** | | | 300,000 | | | | 299,801 | |

| Total U.S. Government Obligations (Cost $1,293,391) | | | | | | | 1,301,333 | |

Total Investments — 100.1% (Cost $69,982,751)(a) | | | | | | | 73,178,064 | |

| Liabilities less Other Assets — (0.1%) | | | | | | | (89,170 | ) |

Total Net Assets — 100.0% | | | | | | | 73,088,894 | |

| The Defensive Balanced Fund | |

| | Shares or Principal Amount ($) | | | | |

| Trustee Deferred Compensation**** | |

| The Flex-funds Aggressive Growth Fund | | | 1,300 | | | | 10,712 | |

| The Flex-funds Defensive Balanced Fund | | | 682 | | | | 6,793 | |

| The Flex-funds Dynamic Growth Fund | | | 406 | | | | 3,398 | |

The Flex-funds Muirfield Fund | | | 1,129 | | | | 6,492 | |

The Flex-funds Quantex Fund | | | 498 | | | | 12,072 | |

| The Flex-funds Utilities and Infrastructure Fund | | | 145 | | | | 3,597 | |

Total Trustee Deferred Compensation (Cost $36,621) | | | | | | | 43,064 | |

| | | | | | Unrealized Appreciation (Depreciation) ($) | |

| Futures Contracts | |

| Standard & Poors 500 expiring September 2011, notional value $2,302,125 | | | 7 | | | | 58,573 | |

Total Futures Contracts | | | | | | | 58,573 | |

| (a) | Represents cost for financial reporting purposes and differs for federal income tax purposes by the amount of losses deferred for federal income tax reporting in the amount of $15,532. Cost for federal income tax purposes of $69,998,283 differs from value by net unrealized appreciation (depreciation) of securities as follows: |

Unrealized appreciation | | $ | 3,381,633 | |

Unrealized depreciation | | | (201,852 | ) |

| Net unrealized appreciation (depreciation) | | $ | 3,179,781 | |

| # | Represents non-income producing securities. |

| * | Investment in affiliate. The yield shown represents the 7-day yield in effect at June 30, 2011. |

| ** | Floating rate security. The rate shown represents the rate in effect at June 30, 2011. |

| *** | Pledged as collateral on futures contracts. |

| **** | Assets of affiliates to The Defensive Balanced Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

| The accompanying notes are an integral part of these financial statements. |

| 2011 Semiannual Report | June 30, 2011 |

Schedule of Investments

June 30, 2011 (unaudited)

| The Strategic Growth Fund | |

| | Shares or Principal Amount ($) | | | | |

| Registered Investment Companies — 96.4% | |

| Allianz NFJ Dividend Value Fund | | | 396,110 | | | | 4,788,965 | |

| Delaware Emerging Markets Fund | | | 443,982 | | | | 7,112,597 | |

| Dodge and Cox International Stock Fund | | | 33,544 | | | | 1,233,765 | |

Invesco Energy Fund | | | 98,718 | | | | 4,407,774 | |

Ivy Mid Cap Growth Fund # | | | 211,699 | | | | 4,047,680 | |

| Lord Abbett Developing Growth Fund, Inc. # | | | 216,628 | | | | 5,482,844 | |

| Nuveen Real Estate Securities Fund | | | 509,584 | | | | 10,173,388 | |

Oakmark International Fund | | | 297,011 | | | | 6,020,416 | |

| RidgeWorth Mid Cap Value Equity Fund | | | 633,060 | | | | 7,894,252 | |

Royce Low-Priced Stock Fund | | | 276,264 | | | | 5,235,203 | |

| T. Rowe Price Mid-Cap Growth Fund | | | 56,701 | | | | 3,564,233 | |

T. Rowe Price Value Fund | | | 205,355 | | | | 5,061,990 | |

| Van Eck Global Hard Assets Fund | | | 118,060 | | | | 6,274,875 | |

| Wells Fargo Advantage Growth Fund # | | | 309,515 | | | | 11,343,728 | |

| Total Registered Investment Companies (Cost $80,570,755) | | | | | | | 82,641,710 | |

| Money Market Registered Investment Companies — 2.7% | |

| The Flex-funds Money Market Fund - Institutional Class, 0.21%* | | | 2,350,887 | | | | 2,350,887 | |

Total Money Market Registered Investment Companies (Cost $2,350,887) | | | | | | | 2,350,887 | |

| Floating Rate Demand Notes — 0.6% | |

Caterpillar Financial Power Investment Floating Rate Demand Note, 0.65%, 7/1/2011** | | | 502,104 | | | | 502,104 | |

| Total Floating Rate Demand Notes (Cost $502,104) | | | | | | | 502,104 | |

| U.S. Government Obligations — 0.4% | |

| U.S. Treasury Bill, 0.102%, due 3/8/2012*** | | | 300,000 | | | | 299,801 | |

| Total U.S. Government Obligations (Cost $299,791) | | | | | | | 299,801 | |

Total Investments — 100.1% (Cost $83,723,537)(a) | | | | | | | 85,794,502 | |

| Liabilities less Other Assets — (0.1%) | | | | | | | (56,288 | ) |

Total Net Assets — 100.0% | | | | | | | 85,738,214 | |

| The Strategic Growth Fund | |

| | Shares or Principal Amount ($) | | | | |

| Trustee Deferred Compensation**** | |

| The Flex-funds Aggressive Growth Fund | | | 1,104 | | | | 9,097 | |

| The Flex-funds Defensive Balanced Fund | | | 583 | | | | 5,807 | |

| The Flex-funds Dynamic Growth Fund | | | 346 | | | | 2,896 | |

The Flex-funds Muirfield Fund | | | 960 | | | | 5,520 | |

The Flex-funds Quantex Fund | | | 415 | | | | 10,060 | |

| The Flex-funds Utilities and Infrastructure Fund | | | 124 | | | | 3,076 | |

Total Trustee Deferred Compensation (Cost $31,590) | | | | | | | 36,456 | |

| | | | | | Unrealized Appreciation (Depreciation) ($) | |

| Futures Contracts | |

| Standard & Poors Mid Cap 400 expiring September 2011, notional value $2,929,500 | | | 6 | | | | 74,255 | |

Total Futures Contracts | | | | | | | 74,255 | |

| (a) | Represents cost for financial reporting purposes and differs for federal income tax purposes by the amount of losses deferred for federal income tax reporting in the amount of $87,322. Cost for federal income tax purposes of $83,810,859 differs from value by net unrealized appreciation (depreciation) of securities as follows: |

Unrealized appreciation | | $ | 2,516,428 | |

Unrealized depreciation | | | (532,785 | ) |

| Net unrealized appreciation (depreciation) | | $ | 1,983,643 | |

| # | Represents non-income producing securities. |

| * | Investment in affiliate. The yield shown represents the 7-day yield in effect at June 30, 2011. |

| ** | Floating rate security. The rate shown represents the rate in effect at June 30, 2011. |

| *** | Pledged as collateral on futures contracts. |

| **** | Assets of affiliates to The Strategic Growth Fund held for the benefit of the Fund’s Trustees in connection with the Trustee Deferred Compensation Plan. |

| The accompanying notes are an integral part of these financial statements. |

| 2011 Semiannual Report | June 30, 2011 |

Schedule of Investments

June 30, 2011 (unaudited)

| The Quantex Fund | |

| | Shares or Principal Amount ($) | | | | |

| Common Stocks — 97.7% | |

| Business Services — 10.2% | | | | | | |

Apollo Group, Inc. # | | | 6,050 | | | | 264,264 | |

Cintas Corporation | | | 8,550 | | | | 282,407 | |

DeVry, Inc. | | | 4,970 | | | | 293,876 | |

H&R Block, Inc. | | | 20,090 | | | | 322,244 | |

| Interpublic Group of Companies, Inc./The | | | 22,535 | | | | 281,687 | |

Monster Worldwide, Inc. # | | | 10,130 | | | | 148,506 | |

Robert Half International, Inc. | | | 7,810 | | | | 211,104 | |

R.R. Donnelly & Sons Company | | | 13,700 | | | | 268,657 | |

Ryder System, Inc. | | | 4,550 | | | | 258,667 | |

Total System Services, Inc. | | | 15,540 | | | | 288,733 | |

(Cost $2,371,392) | | | | | | | 2,620,145 | |

| Consumer Goods — 12.7% | | | | | | | | |

Avery Dennison Corp. | | | 5,640 | | | | 217,873 | |

Bemis Company, Inc. | | | 7,320 | | | | 247,270 | |

Constellation Brands, Inc. # | | | 10,810 | | | | 225,064 | |

Dean Foods Company # | | | 27,060 | | | | 332,026 | |

| Harman International Industries, Inc. | | | 5,170 | | | | 235,597 | |

Hormel Food Corp. | | | 9,330 | | | | 278,127 | |

| International Flavors & Fragrances, Inc. | | | 4,305 | | | | 276,553 | |

Masco Corp. | | | 18,890 | | | | 227,247 | |

MeadWestvaco Corp. | | | 9,150 | | | | 304,786 | |

Owens-Illinois, Inc. # | | | 7,790 | | | | 201,060 | |

Pitney Bowes, Inc. | | | 9,890 | | | | 227,371 | |

Sealed Air Corp. | | | 9,395 | | | | 223,507 | |

Tyson Foods, Inc. | | | 13,890 | | | | 269,744 | |

(Cost $3,087,286) | | | | | | | 3,266,225 | |

| Consumer Services — 12.4% | | | | | | | | |

Abercrombie and Fitch Co. | | | 4,150 | | | | 277,718 | |

Airgas, Inc. | | | 3,820 | | | | 267,553 | |

AutoNation, Inc. # | | | 8,485 | | | | 310,636 | |

Big Lots, Inc. # | | | 7,845 | | | | 260,062 | |

D.R. Horton, Inc. | | | 20,050 | | | | 230,976 | |

Expedia, Inc. | | | 9,540 | | | | 276,565 | |

GameStop Corp. # | | | 10,450 | | | | 278,701 | |

Lennar Corp. | | | 12,750 | | | | 231,412 | |

PulteGroup, Inc. # | | | 31,803 | | | | 243,611 | |

RadioShack Corp. | | | 12,935 | | | | 172,165 | |

Sears Holding Corp. # | | | 3,250 | | | | 232,180 | |

SUPERVALU, Inc. | | | 24,830 | | | | 233,650 | |

Urban Outfitters, Inc. # | | | 6,690 | | | | 188,323 | |

(Cost $3,072,062) | | | | | | | 3,203,552 | |

| Energy — 7.0% | | | | | | | | |

Cabot Oil & Gas Corp. | | | 6,320 | | | | 419,079 | |

Diamond Offshore Drilling, Inc. | | | 3,570 | | | | 251,364 | |

Helmerich & Payne, Inc. | | | 4,930 | | | | 325,972 | |

Rowan Companies, Inc. # | | | 6,850 | | | | 265,848 | |

Sunoco, Inc. | | | 5,930 | | | | 247,340 | |

Tesoro Corp. # | | | 12,900 | | | | 295,539 | |

(Cost $1,458,328) | | | | | | | 1,805,142 | |

| Financial Services — 11.5% | | | | | | | | |

| Apartment Investment & Management Company @ | | | 9,265 | | | | 236,535 | |

Assurant, Inc. | | | 6,210 | | | | 225,237 | |

Cincinnati Financial Corporation | | | 7,540 | | | | 220,017 | |

| The Quantex Fund | |

| | Shares or Principal Amount ($) | | | | |

| Common Stocks — continued | |