UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3462

The Flex-funds Trust

6125 Memorial Drive

Dublin, OH 43017

Bruce McKibben

c/o The Flex-funds Trust

6125 Memorial Drive

Dublin, OH 43017

Registrant’s telephone number, including area code: 800-325-3539

Date of fiscal year end: December 31, 2012

Date of reporting period: June 30, 2012

Item 1. Report to Stockholders.

| Letter to Shareholders | 1 |

| Money Market Fund | 4 |

| Total Return Bond Fund | 5 |

| Balanced Fund | 6 |

Muirfield Fund® | 7 |

| Utilities and Infrastructure Fund | 8 |

| Dynamic Growth Fund | 9 |

| Strategic Growth Fund | 10 |

| Aggressive Growth Fund | 11 |

Quantex FundTM | 12 |

| Shareholder Expense Analysis | 13 |

| Disclosures | 14 |

| Fund Holdings & Financial Statements | 15 |

Our Mission Statement Every day, our mission is to exceed, with integrity, passion, and discipline, the expectations of our shareholders’ and clients’ overall investment experience. Core Values The Client/Shareholder Is Our #1 Priority Always remember whom we are serving. Our livelihood depends on providing a superior overall investment experience that exceeds the expectations of our shareholders and clients. Clarity Of Purpose Our organization has a clear, well-defined vision. All of our associates are committed to and understand how they will contribute to that vision. Communication We expect open and effective communication, full reporting, including good and bad news, and constructive feedback. Integrity We insist upon honesty and adhere to the highest ethical standards. Excellence/ Innovation Our associates strive each day for excellence in the work they perform, seek innovative ways to solve problems and introduce new ideas to take advantage of opportunities. We are a “Think Outside The Box” company. Associate Well-Being We value the success and well-being of our associates. We recognize and reward our associates’ contributions. Respect For Others Respect all people, value the differences among them and treat them as you would like to be treated. Seek First To Understand When interacting with others, place curiosity and understanding of their perspective FIRST, setting aside preconceived opinions and quick judgment. Teamwork We are a synergistic organization that works as a team to exceed our objectives. Profit We are profitable. Profitability enhances our services and capabilities, and affords everyone the opportunity to further their financial well-being. |

| 2012 Semi-Annual Report | June 30, 2012 |

Letter to Shareholders

Following a strong start to the year, stock market declines materialized during the second quarter as Europe once again dominated news headlines. In particular, the recurrence of investor concerns has focused on Spain and the need to recapitalize its banking system, as well as the recent election outcomes in Greece and France. Above all, an expansive solution that creates greater fiscal, political, and financial integration of the euro zone has remained elusive. Softening economic data domestically is also contributing to increased volatility in the stock market. The deceleration in economic growth is reminiscent of the experiences in 2010 and 2011, which were characterized by a strong first quarter followed by a mid-year lull in growth. Currently, a number of gauges are exhibiting signs of fatigue, including the recent payroll figures. For the month of June, only 80,000 jobs were created and the unemployment rate remained elevated at 8.2%. Other gauges of economic activity have also shown signs of deceleration, such as the Institute for Supply Management Manufacturing Index that currently stands at 49.7 in June from a peak 2012 reading of 54.8 in April. Finally, attention is starting to turn toward the federal government spending cuts and tax hikes set to occur in 2013, which likely will not be addressed until after the November elections but could begin to impact consumer confidence much sooner.

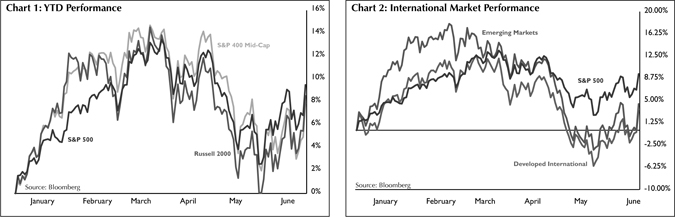

Following strong gains in the first quarter, domestic stock markets posted modest declines during the second quarter. For the year-to-date period through June 30, 2012, the S&P 500 Index has returned 9.48% while the Russell 2000 Index of small capitalization stocks is up 8.53% (see Chart 1). Additionally, international markets have continued to lag the U.S. as many European countries face recession following the implementation of harsh austerity measures and slowing growth in emerging markets. Reflecting these concerns, the MSCI EAFE Index of developed international markets and the MSCI Emerging Markets Index have posted year-to-date gains of 2.96% and 3.94%, respectively, which have trailed the S&P 500 Index for the same period (see Chart 2). Fixed-income markets posted gains amidst the ongoing uncertainty, with the Barclays Aggregate Bond Index up 2.37% through the second quarter.

The following pages will provide an overview of how we managed our risk exposure and the strategies we employed during the first half of 2012. We will also provide a brief summary of the economic and financial events that took place throughout the first six months of 2012, discuss our expectations for the remainder of the year, and review the performance of The Flex-funds® Mutual Funds.

Europe Concerns Return

Actions by the European Central Bank eased fears regarding the European financial markets in the first quarter; however, the presence of calm was extremely brief. In the second quarter, investor concerns focused on national election outcomes as well as the deterioration of Spain’s banking system. In France, a socialist candidate won the country’s presidency, and campaigned on a platform to unwind austerity measures and pursue a pro-growth agenda. Additionally, Greece nearly saw an anti-austerity party gain control of the government, which could have jeopardized Greece’s financial rescue.

| 2012 Semi-Annual Report | June 30, 2012 |

The results of the aforementioned elections have raised concerns that coordinating actions with Germany could become even more difficult, further hampering efforts to stem the sovereign debt crisis. Attention also turned to Spain’s financial system during the second quarter, and the need to inject capital into Spanish banks as loan losses increase. As a result, Spain was forced to seek up to $125 billion in aid from the European Central Bank. While new developments and volatile market reactions seem to occur daily, one constant has remained: a comprehensive solution to stem Europe’s sovereign debt crisis and ensure the survival of the euro currency has remained elusive.

U.S. Political Uncertainty

While the debt crisis has impeded Europe’s economic recovery, political gridlock and inaction has cast a similar impact on the U.S. economy. The debt ceiling will likely be an issue again at the end of 2012, and over $600 billion of fiscal tightening is set to occur at the start of 2013 as a result of scheduled government spending cuts and a variety of tax increases. Furthermore, the issue will likely not be addressed until after the November elections, leaving only a small window of opportunity for action. While these events are months away, business surveys reveal that the uncertainty over taxes is already weighing heavily, which may lead companies to postpone investment and hiring until a resolution becomes more transparent. For instance, for the first time in nearly four years, taxes emerged as the top problem for small businesses according to a survey conducted by the National Federation of Independent Business.

U.S. Banks Returning to Health

A key driver of the stock market’s progress in 2012 has been alleviation of investor concerns regarding domestic banks. Financial sector stocks were among the best performing segments of the stock market in the first half of 2012. While part of the rally relates to easing concerns over the risks posed by European banks, lending conditions domestically have also improved and stress tests conducted by the Federal Reserve in the first quarter show progress in the health of the U.S. banking sector. The stress tests implemented by the Federal Reserve were rigorous, applying a hypothetical scenario of 13% unemployment, a 50% drop in the stock market, and a 20% drop in housing prices. Even under these conditions, 16 of the largest 19 banks tested had enough capital to meet the Federal Reserve’s minimum requirements. Two of the three that failed only did so marginally. As a result of this outcome, many of the healthiest banks have begun to return capital to their shareholders, a positive sign for the banking sector and the economy as a whole.

Decelerating Economic Data

As we progress through 2012, investors are encountering an economic backdrop eerily similar to 2010 and 2011, which were characterized by strong economic data at the beginning of the year, a mid-year lull in growth, and a subsequent acceleration through year-end. Thus far, 2012 is exhibiting a similar pattern. For instance, the Institute for Supply Management Manufacturing Index, which is a broad gauge of manufacturing activity, fell to 49.7 in June from its 2012 peak of 54.8 in April (see Chart 3). A similar gauge of the service economy fell to 52.1 in June from a peak reading of 57.3 in February. For these measures, a reading above 50 indicates expansion while a reading below 50 indicates contraction. As another key measure of economic activity, job creation has slowed considerably from the first quarter. Nonfarm payrolls for the month of June increased by 80,000

| 2012 Semi-Annual Report | June 30, 2012 |

compared to a monthly average of 225,000 in the first quarter, while the unemployment rate remained steady at 8.2% compared to May.

Housing Market

While it is still too early to be declared a recovery, the U.S. housing market is generating some positive signs. Housing starts, new home sales, and existing home sales have all risen off the extremely low levels experienced during the past three years. Additionally, other indicators that tend to lead changes in the housing sector are posting strong increases. An index of company stocks with strong ties to the housing sector posted substantial gains for the year-to-date period through June 30, increasing 25.72% compared to the S&P 500 Index gain of 9.48%. In June, homebuilder confidence reported by the National Association of Home Builders reached its highest level since May 2007. Finally, as U.S. Treasury yields have continued to decline to record low levels, mortgage rates have followed suit. The average 30-year fixed mortgage rate reported by Freddie Mac fell to 3.66% in the last week of June, which is the lowest level on record (see Chart 4). However, it is important to note that headwinds do remain in place, especially the inventory of homes in foreclosure that could continue to place downward pressure on home prices.

Outlook for the Remainder of 2012

The situation in Europe has remained a key obstacle to the ongoing U.S. economic recovery. Not only have new developments in Europe reinforced this notion, but the prospect of more political gridlock in the U.S. has added another layer of uncertainty. These impediments are inhibiting growth and clouding the outlook. We once again find that the direction of the economy is heavily dependent on the actions of policymakers.

However, if actions by policymakers do succeed in resolving the challenges previously discussed, there are a variety of existing catalysts that could propel the recovery forward. More specifically, the Fed remains extremely accommodative, interest rates are hovering near record low levels, the housing market is showing signs of recovery, and the recent plunge in commodity prices should at least temporarily aid household income.

As we monitor the stock market and our investment models, we will continuously evaluate our defensive position in the Muirfield Fund® and the equity portion of the Balanced Fund. We will look for opportunities to adjust portfolio weights among growth and value stocks, large-, mid-, and small-caps, and domestic and international investments in order to enhance returns and manage risk for our clients. We will also continue to proactively manage our sector exposures and will make adjustments as our investment models evolve. On the following pages you will find a review of how The Flex-funds® Mutual Funds have performed. Please read the commentaries to learn more about the investment decisions we made during the first half of 2012.

On behalf of all of the associates at The Flex-funds®, we thank you for the trust and confidence you have placed in our investment management services.

| |  |

| | Robert S. Meeder President Meeder Asset Management, Inc. June 30, 2012 |

Please see diclosures on Page 14.

| 2012 Semi-Annual Report | June 30, 2012 |

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2012 | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® Money Market Fund (Retail Class) | 0.05% | 0.10% | 0.19% | 1.21% | 1.87% | 4.32% | 3/27/85 |

Current & Effective Yields1 | 7-day Compound: 0.11% 7-day Simple: 0.11% |

Lipper Average General-Purpose Money Market Fund2 | 0.01% | 0.01% | 0.03% | 1.00% | 1.65% | 4.04% | 3/31/85 |

The Flex-funds® Money Market Fund (Institutional Class) | 0.08% | 0.17% | 0.27% | 1.31% | - | 2.26% | 12/28/04 |

Current & Effective Yields1 | 7-day Compound: 0.17% 7-day Simple: 0.17% |

Lipper Average General-Purpose Money Market Fund2 | 0.01% | 0.01% | 0.03% | 1.00% | - | 1.93% | 12/31/04 |

Management fees were waived and/or expenses were reimbursed in order to reduce the operating expenses of the Money Market Fund during the periods shown above. Investments in the Money Market Fund are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Money Market Fund.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

The retail and institutional classes of The Flex-funds® Money Market Fund ranked among the top general purpose money market funds in the country on June 30, 2012. Based on second quarter 2012 results, the retail class ranked 5th out of 250 (2nd percentile) general purpose money market funds that it was measured against according to Lipper. The average general purpose money market fund finished the same period with a return of 0.01%, according to Lipper. The retail and institutional classes of The Flex-funds® Money Market Fund closed the quarter with a 7-day simple yield of 0.11% and 0.17%, respectively.

Over the past couple of years, the money market industry has been besieged by historically low interest rates, limited investment options, and the prospect of additional regulatory reform. Short-term interest rates are expected to be little changed over the remainder of the year. Money market investment options will be void of European issuers, as many funds have completely curbed their exposure to the respective region. Finally, various regulatory groups, including some members of the Securities And Exchange Commission, continue to lobby for risk reduction in the money market industry.

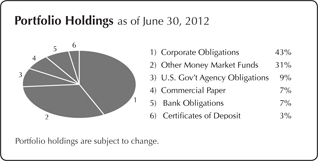

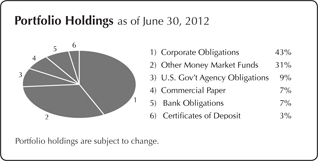

In order to manage around these obstacles, we maintained our focus on providing a high quality portfolio of investments cognizant of maturity and credit risk. Throughout the first half of the year, we maintained a weighted average maturity that was in line or slightly below that of our peers. In this time of uncertainty, we believe positioning the portfolio to take advantage of opportunities is paramount. Holdings in the Fund remained allocated toward investments with superior credit quality, as we believed the risk and reward relationship favored this position. We maintained our exposure to U.S. Government agency securities and products backed by the FDIC. As of June 30, 2012, the Fund’s composition was as follows: 43% corporate obligations, 31% in other money market funds, 9% U.S. Government agency securities, 7% in commercial paper, 7% in bank obligations, and 3% in certificates of deposit. Although we expect available investment options that meet our credit standards may be limited for the next several months, we believe the Fund is positioned to maintain its strong performance during a difficult environment.

| 2012 Semi-Annual Report | June 30, 2012 |

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2012 | YTD | 1 Year | Since Inception | Inception Date |

The Flex-funds® Total Return Bond Fund | 2.85% | 2.27% | 2.27% | 6/30/11 |

Expense Ratios*: Current Net 0.99% Gross 1.36% | | | | |

Barclays Aggregate Bond Index3 | 2.37% | 7.48% | 7.48% | 6/30/11 |

Management fees and/or expenses were waived and/or reimbursed in the Total Return Bond Fund during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Fund are voluntary and may be terminated at any time. *Current expense ratio based on net assets in effect as of 6/30/12. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

As of June 30, 2012, the Flex-funds® Total Return Bond Fund returned 2.27% since the Fund’s inception on June 30, 2011. Also, the Fund returned 2.85% on a year-to-date basis. The Fund’s benchmark, the Barclays Aggregate Bond Index, returned 2.37% over the aforementioned year-to-date period.

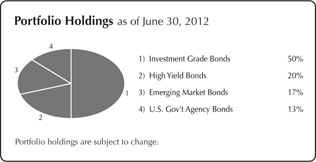

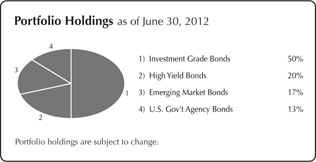

During the first half of 2012, fixed-income investments remained susceptible to the volatility associated with headline risk. Political events, economic sustainability, and banking system risks dominated the news headlines, creating above average volatility across all fixed-income sectors. For the first six months of the year, our models provided consistent output favoring investments in U.S. corporate, high yield, and emerging market bonds. This theme provided excess returns versus our benchmark through March. In the second quarter, a move to more risk aversion became a dominant theme as some of the aforementioned risks began to resurface. As a result, U.S. Treasury securities rallied for a significant portion of the second quarter. This undermined the Fund’s performance for the quarter since we were underweight assets that carry less credit risk due to indications from our investment models.

As of this report, our allocation toward high yield and emerging market bonds has been reduced in favor of investment grade corporate bonds. Risks from Europe and lackluster global growth prospects are our immediate concerns. Our model continues to favor investments in corporate bonds as fundamentals remain relatively strong for participating issuers. We continue to believe current market fundamentals will drive favorable financing for corporate bond issuers and consequently drive adequate supply. We believe demand for corporate bonds will remain steady as default probabilities are expected to remain subdued.

| 2012 Semi-Annual Report | June 30, 2012 |

Balanced Fund

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2012 | YTD | 1 Year | 3 Years | 8/31/08 to 6/30/12† | 5 years | Since Inception | Inception Date |

The Flex-funds® Balanced Fund† | 5.77% | -1.41% | 7.51% | 2.22% | -1.03% | 1.09% | 1/31/06 |

Expense Ratios*: Current Net 1.49% Gross 1.60% | | | | | | | |

Blended Index4 | 4.67% | 4.29% | 8.79% | 3.89% | 2.56% | 3.85% | 1/31/06 |

S&P 500 Index5 | 9.48% | 5.44% | 16.39% | 3.87% | 0.21% | 3.14% | 1/31/06 |

Management fees and/or expenses were waived and/or reimbursed in the Balanced Fund during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Fund are voluntary and may be terminated at any time. †On August 25, 2008, the name and investment strategy of the Fund was changed. *Current expense ratio based on net assets in effect as of 6/30/12. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

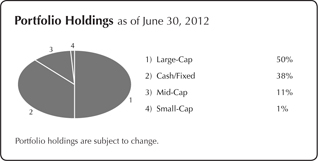

The Flex-funds® Balanced Fund returned 5.77% for the year-to-date period ended June 30, 2012, compared to its blended index return of 4.67%. The Balanced Fund will always invest at least 30% of its assets in fixed-income securities. The Fund will also hold a minimum 30% allocation in equity securities, with additional investments determined by our defensive equity discipline.

In the equity portion of the Fund, we entered the first quarter with a 10% defensive position in fixed-income investments. However, we increased our stock market exposure as the first quarter progressed following improvements in the trend and technical components of our quantitative investment model. During the second quarter, we noticed some deterioration in technical factors that we monitor as stock market declines materialized. As a result, we ended the first half of 2012 90% invested in the stock market and 10% invested in fixed-income investments for the equity portion of the fund.

In the equity portion of the Fund, we were overweight to growth investments compared to value, and maintained exposure to mid- and small-cap investments throughout the first half of 2012. In terms of sector exposure, we were overweight the technology and healthcare sector, while being underweight in financials and utilities during the first and second quarter. Finally, throughout the first half of 2012 we avoided direct exposure to emerging markets, while we held a tactical short-term position in developed international markets at the end of the first quarter. As of June 30, we did not hold direct exposure to any international market.

In the fixed-income portion of the Fund, the target allocation remained overweight in intermediate-term investment grade bond funds during the first half of 2012. During the first half, the yield on investments in this sector relative to U.S. Treasury securities settled in a range close to average historical levels. In addition, we believe fundamental data remains supportive of stronger credit quality among issuers in this segment for the rest of the year. Due to indications in our investment models, we expect to maintain an overweight to intermediate-term investment grade credit for the near-term. The average maturity of the fixed-income portion of the Fund was maintained in line to slightly above that of our benchmark.

| 2012 Semi-Annual Report | June 30, 2012 |

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2012 | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds Muirfield Fund® | 7.35% | -3.34% | 9.20% | -1.57% | 3.71% | 6.67% | 8/10/88 |

Expense Ratios*: Current Net 1.39% Gross 1.58% | | | | | | | |

Blended Index6 | 5.74% | 3.62% | 9.92% | 0.90% | 4.23% | 7.41% | 8/10/88 |

S&P 500 Index5 | 9.48% | 5.44% | 16.39% | 0.21% | 5.33% | 9.36% | 8/10/88 |

Management fees and/or expenses were waived and/or reimbursed in the Muirfield Fund® during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Fund are voluntary and may be terminated at any time. *Current expense ratio based on net assets in effect as of 6/30/12. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

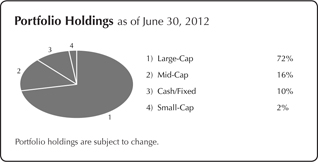

The Flex-funds Muirfield Fund® returned 7.35% for the year-to-date period ended June 30, 2012.

In the Muirfield Fund®, we entered the first quarter with a 10% defensive position in fixed-income investments following output from our investment model that indicated some elements of risk in the stock market. However, we increased our stock market exposure as the first quarter progressed following improvements in the trend and technical components of our quantitative investment model, which caused us to end the quarter essentially fully invested in the stock market. During the second quarter, we noticed some deterioration in technical factors that we monitor following declines in the stock market, which led us to adopt a partially defensive position in fixed-income investments. As a result, we ended the second quarter 90% invested in the stock market and 10% invested in fixed-income investments in the Muirfield Fund®.

In addition to the changes in our defensive posture previously discussed, we also managed our exposure to large-, mid-, and small-cap companies, as well as growth versus value investments. During the first quarter, we maintained an overweight allocation to growth investments across the spectrum of market capitalizations. We also maintained our overweight exposure to mid- and small-cap investments. However, we reduced this overweight as the quarter progressed due to indications from our investment models. During the second quarter, we continued to maintain an overweight allocation in growth investments across all market capitalizations, but continued to reduce exposure to mid- and small-cap investments.

We also managed our industry and sector exposure in the Fund. During the first quarter, we were overweight sectors with growth characteristics, such as the technology sector. We were also overweight to the healthcare sector, while being underweight in the financial and utilities sectors. We maintained similar sector exposure throughout the second quarter as well. Finally, throughout the first half of 2012 we avoided direct exposure to emerging markets, while we held a tactical short-term position in developed international markets at the end of the first quarter. As of June 30, we did not hold direct exposure to any international market.

| 2012 Semi-Annual Report | June 30, 2012 |

Utilities and Infrastructure Fund

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2012 | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® Utilities and Infrastructure Fund | -1.61% | -3.39% | 12.21% | -0.06% | 6.55% | 7.25% | 6/21/95 |

Expense Ratios*: Current Net 1.91% Gross 2.02% | | | | | | | |

Russell 3000 Utilities Index7 | 8.54% | 12.01% | 15.67% | 1.41% | 7.15% | 5.20% | 6/30/95 |

Management fees and/or expenses were waived and/or reimbursed in the Utilities and Infrastructure Fund during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Fund are voluntary and may be terminated at any time. *Current expense ratio based on net assets in effect as of 6/30/12. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

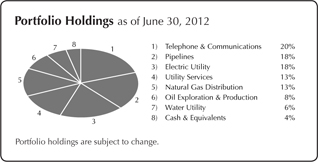

The Flex-funds® Utilities and Infrastructure Fund fell 1.61% for the year-to-date period ended June 30, 2012. The Fund has outperformed the Russell 3000 Utilities benchmark since its inception.

The Utilities and Infrastructure Fund was able to post a gain for the first quarter despite poor performance from large cap utilities and a weakened natural gas market. Veolia Environnement returned 49% in the first quarter, aided by plans to divest assets and reduce debt. EnerSys was up 33% following strong revenue growth and plans for an Indian joint venture. CARBO Ceramics declined 14% in spite of strong revenue for the quarter, after the manufacturer missed earnings targets. NII Holdings fell by 14% in the face of strong competition and lower earnings guidance.

The Fund trailed the broader utilities index during the second quarter due primarily to strong performance among conventional large-cap utilities, which we are underweight. Qualcomm was a detractor from performance with a second quarter decline of 17%, despite the company’s better than expected revenue and net income. Verizon, which gained 18% during the quarter, was a leading contributor to our returns as a result of the company’s strong earnings report stemming from its smartphone business. Finally, we raised our weight in ITC after a complaint about transmission rates prompted nervous investors to exit the stock. We would note that the company projects an increasing compound annual growth rate as a result of its merger with Entergy’s transmission business.

The sharp decline in natural gas prices have hurt many portfolio stocks for a few quarters; however, it appeared that natural gas prices were searching for a bottom during the second quarter. If that obstacle is removed, we believe substantial absolute and relative progress could be experienced in the Fund.

| 2012 Semi-Annual Report | June 30, 2012 |

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2012 | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® Dynamic Growth Fund | 8.20% | -0.72% | 12.25% | -1.86% | 3.69% | -0.31% | 2/29/00 |

Expense Ratios*: Current Net 1.39% Gross 1.57% | | | | | | | |

S&P 500 Index5 | 9.48% | 5.44% | 16.39% | 0.21% | 5.33% | 1.85% | 2/29/00 |

Management fees and/or expenses were waived and/or reimbursed in the Dynamic Growth Fund during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Fund are voluntary and may be terminated at any time. * Current expense ratio based on net assets in effect as of 6/30/12. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

The Flex-funds® Dynamic Growth Fund returned 8.20% for the year-to-date period ended June 30, 2012.

During the first quarter, we maintained our overweight allocation to growth investments versus value following indications from our investment models. Additionally, our investment models have continued to maintain preference for mid- and small-cap companies, although to a lesser extent relative to the end of 2011. As a result, we reduced our exposure to these capitalization ranges. During the second quarter, we continued to maintain an overweight allocation to growth investments versus value, while our investment models continued to pare preference for mid- and small-cap companies, which led us to further reduce our allocation to these investments. Finally, throughout the first half of 2012, we were overweight the technology and healthcare sectors, while being underweight the financial and utilities sector. Throughout the first half of 2012, we avoided direct exposure to emerging markets, while we held a tactical short-term position in developed international markets at the end of the first quarter. As of June 30, we did not hold direct exposure to any international market.

The performance of the Fund was in line with the S&P 500 during the first quarter, and was driven by numerous factors. In the Fund, our overweight to growth investments benefited performance, while our modest position among mid- and small-cap investments benefited performance overall. Additionally, our underlying fund holdings also benefited performance, which was mostly driven by the Wells Fargo Advantage Growth Fund. However, our sector positions detracted from performance, with our overweight position in technology benefiting the Fund while the overweight to healthcare and underweight to financials detracted from returns. Our performance during the second quarter lagged the S&P 500 Index, which was driven by multiple factors as well. Our overweight to growth investments detracted from the Fund’s return, while our exposure to mid- and small-cap companies also detracted from performance. In the Fund, our overweight to technology detracted from performance, while our overweight to healthcare and underweight to financials provided a benefit. Finally, our underlying fund holdings generally underperformed their respective benchmarks.

| 2012 Semi-Annual Report | June 30, 2012 |

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2012 | YTD | 1 Year | 3 Years | 8/31/08 to 6/30/12† | 5 Year | Since Inception | Inception Date |

The Flex-funds® Strategic Growth Fund† | 5.51% | -6.66% | 13.28% | 0.30% | -2.43% | 0.28% | 1/31/06 |

Expense Ratios*: Current Net 1.39% Gross 1.58% | | | | | | | |

S&P 500 Index5 | 9.48% | 5.44% | 16.39% | 3.87% | 0.21% | 3.14% | 1/31/06 |

Blended Index8 | 6.52% | -1.76% | 15.80% | 1.29% | -0.02% | 2.43% | 1/31/06 |

Management fees and/or expenses were waived and/or reimbursed in the Strategic Growth Fund during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Fund are voluntary and may be terminated at any time. * Current expense ratio based on net assets in effect as of 6/30/12. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus. †On August 25, 2008, the name and investment strategy of the Fund was changed.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

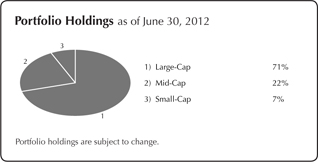

The Flex-funds® Strategic Growth Fund returned 5.51% for the year-to-date period ended June 30, 2012.

The Strategic Growth Fund is fully invested in the equity market at all times, and holds a fixed allocation across six distinct investment categories. The mix of investments selected to represent each investment category is variable and actively managed by using our strategic fund selection process. The current target allocation is comprised of the following: 25% large-cap, 20% mid-cap, 17.5% international, 12.5% small-cap, 12.5% real estate, and 12.5% commodities.

Within each respective category, we seek to identify investments that we believe will outperform the index or peers through an evaluation process based on valuation factors, measures of volatility, and risk-adjusted returns. Investments that fall out of favor within our models are sold and replaced with investments ranked higher by our evaluation process.

The Fund slightly underperformed its custom benchmark, and also underperformed the broader market as measured by the S&P 500 Index during the first quarter. We experienced unfavorable fund selection in the small-cap, emerging market, and commodities categories, while fund selection in the large-cap and developed international categories outperformed their respective benchmarks. Relative to the S&P 500 Index, the Fund’s allocation to real estate, developed international, and commodities detracted from performance while emerging market and mid-cap benefited performance.

The Fund also underperformed its custom benchmark and the broader market as measured by the S&P 500 Index during the second quarter. Fund selection in the large-cap, mid-cap, and small-cap categories detracted from performance, while selections in the commodity and developed international categories outperformed their respective benchmarks. The Fund’s allocation to real estate investments benefited performance relative to the S&P 500, but all other asset allocation categories detracted from performance.

| 2012 Semi-Annual Report | June 30, 2012 |

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2012 | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® Aggressive Growth Fund | 7.30% | -3.64% | 12.01% | -1.55% | 3.52% | -1.66% | 2/29/00 |

Expense Ratios*: Current Net 1.70% Gross 1.70% | | | | | | | |

S&P 500 Index5 | 9.48% | 5.44% | 16.39% | 0.21% | 5.33% | 1.85% | 2/29/00 |

Management fees and/or expenses were waived and/or reimbursed in the Aggressive Growth Fund during the periods shown in the table above to reduce expenses. All expenses, management fees, reimbursements or waivers for the Fund are voluntary and may be terminated at any time. *Current expense ratio based on net assets in effect as of 6/30/12. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

The Flex-funds® Aggressive Growth Fund returned 7.30% for the year-to-date period ended June 30, 2012.

Following a strong start to the year, stock market declines materialized during the second quarter as Europe once again dominated news headlines. Softening economic data domestically is also contributing to increased volatility in the stock market. The deceleration in economic growth is reminiscent of the experiences in 2010 and 2011, which were characterized by a strong first quarter followed by a mid-year lull in growth. Finally, attention is starting to turn toward the federal government spending cuts and tax hikes set to occur in 2013, which likely will not be addressed until after the November elections but could begin to impact consumer confidence much sooner.

We entered the first quarter with an overweight position among growth versus value investments due to indications from our investment models. We also maintained our overweight in mid- and small-cap stocks, which has been a key component of our investment allocation since the stock market recovery commenced. In the Fund, our sector exposure was concentrated among the technology and healthcare sector throughout the first quarter, and our growth exposure also resulted in an overweight to the consumer discretionary sector. We were underweight in the financial and utilities sector.

During the second quarter, we maintained our overweight position among growth versus value investments, and also maintained our overweight in mid- and small-cap stocks. In the Fund, our sector exposure remained mostly consistent with the first quarter, which was characterized by an overweight position among the technology and healthcare sector. Additionally, our growth exposure resulted in an overweight to the consumer discretionary sector, and we were underweight in the financial and utilities sector during the second quarter.

Throughout the first half of 2012, we avoided direct exposure to emerging markets, while we held a tactical short-term position in developed international markets at the end of the first quarter. As of June 30, we did not hold direct exposure to any international market.

| 2012 Semi-Annual Report | June 30, 2012 |

Performance Perspective

| Period & Average Annual Total Returns as of June 30, 2012 | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | Inception Date |

The Flex-funds® Quantex Fund™ | 3.94% | -6.32% | 20.56% | 1.04% | 5.60% | 6.70% | 3/20/85 |

Expense Ratios*: Current Net 1.61% Gross 1.81% | | | | | | | |

Russell 2000 Index9 | 8.53% | -2.06% | 17.80% | 0.54% | 7.00% | 9.03% | 3/31/85 |

Blended Index10 | 8.24% | -2.16% | 18.61% | 1.59% | 7.65% | 10.68% | 3/31/85 |

S&P 400 Mid-Cap Index11 | 7.90% | -2.32% | 19.37% | 2.56% | 8.21% | 12.19% | 3/31/85 |

Management fees and/or expenses were waived and/or reimbursed in the Quantex Fund™ during the periods shown in the table above to reduce expenses. The Fund’s management fee waiver is contractual and may be terminated annually by the Advisor on its renewal date. * Current expense ratio based on net assets in effect as of 6/30/12. This ratio may increase or decrease depending on fluctuations in Fund net assets. The Gross Expense Ratio is a percentage of the Fund’s assets as shown in the most recent Prospectus.

Please see Page 13 for additional disclosures.

Semiannual Market Perspective

The Flex-funds® Quantex Fund™ returned 3.94% for the year-to-date period ended June 30, 2012. Also, the Quantex Fund™ was recently recognized by Lipper as the best mid-cap value fund for the 3-year period ended December 31, 2011.

We have consistently employed our quantitative stock selection process since April 30, 2005 for the Quantex Fund™. We utilize rankings from our quantitative financial model to determine which securities are to be held in the Fund on an annual basis. As a result, the Fund is rebalanced annually in January. In the 2012 Fund, there is a strong preference for value holdings, with mid-cap value companies comprising 45% of the Fund, followed by mid-cap core with 27%, and mid-cap growth with 12%. Small-cap holdings of 16% comprise the remainder according to our allocation analysis at the beginning of the year.

Relative to the S&P 400 Mid-Cap Index, stock selection within the energy and consumer staples sector provided the greatest benefit to the Fund. The largest detractor from performance was stock selection within the materials and technology sector. Additionally, the Fund’s underweight to the healthcare and financial sector detracted from performance. However, other sector allocations benefited performance, such as the Fund’s overweight to the consumer discretionary sector and underweight to the industrial sector during the first half of 2012.

During the year-to-date period of 2012, many stocks contributed positively to the performance of the Fund. The top performing stock for the period was Sears Holdings, which was up 88%. Other top performers for the period include TripAdvisor (up 77%) and Pulte Homes (up 70%). The largest detractors from performance during the period were Alpha Natural Resources (down 57%) and First Solar (down 55%).

| 2012 Semi-Annual Report | June 30, 2012 |

Shareholder Expense Analysis (Unaudited)

Shareholders of mutual funds pay ongoing expenses, such as advisory fees, distribution and service fees (12b-1 fees) and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The following example is based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from December 31, 2011 to June 30, 2012.

ACTUAL EXPENSES: The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g.: an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES: The second line provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds with the ongoing costs of investing in other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | Beginning Account Value (12/31/2011) | Ending Account Value (6/30/2012) | Expenses Paid During Period1 (12/31/2011 - 6/30/2012) | Expense Ratio (Annualized) |

| The Muirfield Fund | Actual | $1,000.00 | $1,073.50 | $7.21 | 1.39% |

| | Hypothetical* | $1,000.00 | $1,018.05 | $7.01 | 1.39% |

| The Utilities & Infrastructure Fund | Actual | $1,000.00 | $983.90 | $9.47 | 1.91% |

| | Hypothetical* | $1,000.00 | $1,015.45 | $9.62 | 1.91% |

The Quantex FundTM | Actual | $1,000.00 | $1,039.40 | $8.21 | 1.61% |

| | Hypothetical* | $1,000.00 | $1,016.95 | $8.12 | 1.61% |

| The Dynamic Growth Fund | Actual | $1,000.00 | $1,082.00 | $7.23 | 1.39% |

| | Hypothetical* | $1,000.00 | $1,018.05 | $7.01 | 1.39% |

| The Aggressive Growth Fund | Actual | $1,000.00 | $1,073.00 | $8.24 | 1.59% |

| | Hypothetical* | $1,000.00 | $1,017.05 | $8.02 | 1.59% |

| The Balanced Fund | Actual | $1,000.00 | $1,057.70 | $7.66 | 1.49% |

| | Hypothetical* | $1,000.00 | $1,017.55 | $7.52 | 1.49% |

| The Strategic Growth Fund | Actual | $1,000.00 | $1,055.10 | $7.14 | 1.39% |

| | Hypothetical* | $1,000.00 | $1,018.05 | $7.01 | 1.39% |

| The Total Return Bond Fund | Actual | $1,000.00 | $1,028.50 | $5.02 | 0.99% |

| | Hypothetical* | $1,000.00 | $1,020.05 | $5.00 | 0.99% |

| The Money Market Fund - Retail Class | Actual | $1,000.00 | $1,000.50 | $1.45 | 0.29% |

| | Hypothetical* | $1,000.00 | $1,023.55 | $1.47 | 0.29% |

| The Money Market Fund - Institutional Class | Actual | $1,000.00 | $1,000.80 | $1.10 | 0.22% |

| | Hypothetical* | $1,000.00 | $1,023.90 | $1.11 | 0.22% |

| * | Represents the hypothetical 5% return before expenses. |

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if any transactional costs were included, your costs would have been higher.

| 1 | Expenses are equal to the Funds’ annualized expense ratios, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the total number of days in the six-month period). |

| 2012 Semi-Annual Report | June 30, 2012 |

Disclosures

Investors are advised to consider the investment objectives, risks, charges and expenses of The Flex-funds® carefully before investing. The Flex-funds® prospectus contains this and other information about the Funds and should be read carefully before investing. To request or receive a copy of The Flex-funds® prospectus, contact Shareholder Services at 800.325.3539 or visit www.flexfunds.com.

To obtain a prospectus containing more information about The Flex-funds®, including other fees and expenses that apply to a continued investment in the Funds, you may call (800)325-3539, or write to P.O. Box 7177, Dublin, OH 43017. Please read the prospectus carefully before investing.

Opinions and forecasts regarding sectors, industries, companies, countries and/or themes, and portfolio composition and holdings, are all subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security, industry, or sector.

Past performance is not a guarantee of future results. All performance figures represent total returns and average annual total returns or current and effective yields for the periods ended June 30, 2012. Investment performance assumes reinvestment of all dividend and capital gain distributions. The investment return and principal value of an investment will fluctuate so an investor’s shares or units, when redeemed, may be worth more or less than their original cost. Management fees and/or expenses were waived and/or reimbursed in The Flex-funds® during the periods shown in these tables to reduce expenses. All expenses, management fees, reimbursements or waivers for the Funds are voluntary and may be terminated at any time, except for the Quantex Fund TM. The Quantex Fund TM management fee waiver is contractual and can be terminated annually by the Adviser on its renewal date, April 30, 2013.

| 1 | For the period ended June 30, 2012, yield quotations more closely reflect the current earnings of The Money Market Fund than do total return quotations. |

| 2 | An index of funds such as Lipper’s Average General Purpose Money Market Fund Index includes a number of mutual funds grouped by investment objective. One cannot invest directly in an index. |

| 3 | The Barclays Aggregate Bond Index provides a measure of the performance of the U.S. investment grade bond market, which includes investment grade U.S. Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities index must have at least 1 year remaining to maturity. In addition, the securities must be denominated in US dollars and must be fixed rate, non convertible and taxable. |

| 4 | The Blended Index consists of 42% of the S&P 500 Index, 28% of the average 90-day U.S. Treasury bill and 30% Barclays Intermediate-Term Government/Credit Index. |

| 5 | The S&P 500 Index is a widely recognized unmanaged index of common stock prices. The S&P 500 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| 6 | The Blended Index consists of 60% of the S&P 500 Index and 40% of the average 90-day U.S. Treasury bill. |

| 7 | The Russell 3000 Utilities Index is a market capitalization-weighted index that is comprised of utility stocks that are included in the Russell 3000 Index. This index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| 8 | The Blended Index is comprised of 25% S&P 500, 20% S&P Midcap 400, 12.5% Russell 2000, 12.5% Dow Jones Wilshire Real Estate Investment Trust, 12.5% Goldman Sachs Commodity Index, 12% Morgan Stanley Capital International Europe, Australasia, and Far East, and 5.5% Morgan Stanley Capital International Europe Emerging Markets Index. These indices do not take into account the deduction of expenses associated with a mutual fund such as investment management and accounting fees. An investor cannot invest directly in an index. |

| 9 | The Russell 2000 Index is a widely recognized unmanaged index of common stock prices of small-sized companies. The Russell 2000 Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| 10 | The Blended Index consists of 50% Russell 2000 Index and 50% S&P 400 Mid-Cap Index. |

| 11 | The S&P 400 Mid-Cap Index is a widely recognized unmanaged index of common stock prices of mid-sized companies. The S&P 400 Mid-Cap Index does not take into account the deduction of expenses associated with a mutual fund, such as investment management and accounting fees. One cannot invest directly in an index. |

| 2012 Semi-Annual Report | June 30, 2012 |

2012 Semiannual Report

Portfolio Holdings & Financial Statements

| 2012 Semi-Annual Report | June 30, 2012 |

Schedule of Investments

June 30, 2012 (unaudited)

| The Muirfield Fund | |

| | | Shares or Principal Amount ($) | | | | | |

| | | | | | | | | |

| Registered Investment Companies — 59.8% | |

| Consumer Staples Select Sector SPDR Fund | | | 68,100 | | | | 2,367,837 | |

Energy Select Sector SPDR Fund | | | 55,375 | | | | 3,675,239 | |

| Health Care Select Sector SPDR Fund | | | 145,675 | | | | 5,536,378 | |

| iShares Russell 1000 Growth Index Fund | | | 89,800 | | | | 5,678,054 | |

| iShares Russell 1000 Value Index Fund | | | 110,550 | | | | 7,541,721 | |

Ivy Mid Cap Growth Fund | | | 130,682 | | | | 2,313,078 | |

| JPMorgan Disciplined Equity Fund | | | 554,470 | | | | 9,692,138 | |

PowerShares QQQ Trust | | | 109,905 | | | | 7,051,505 | |

| SPDR Dow Jones Industrial Average ETF Trust | | | 47,750 | | | | 6,133,488 | |

Vanguard Equity Income Fund | | | 130,023 | | | | 6,321,694 | |

| Wells Fargo Advantage Growth Fund | | | 297,879 | | | | 12,221,987 | |

Total Registered Investment Companies (Cost $66,484,418) | | | | | | | 68,533,119 | |

| Money Market Registered Investment Companies — 20.8% | |

The Flex-funds Money Market Fund - Institutional Class, 0.17% (2) | | | 23,827,920 | | | | 23,827,920 | |

Total Money Market Registered Investment Companies (Cost $23,827,920) | | | | | | | 23,827,920 | |

| Bank Obligations — 4.4% | | | | | | | | |

Access National Bank, 0.30%, 7/5/2012 (3) | | | 987 | | | | 987 | |

Allied Bank, 0.30%, 7/5/2012 (3) | | | 434 | | | | 434 | |

Alma Bank, 0.30%, 7/5/2012 (3) | | | 4,804 | | | | 4,804 | |

AloStar Bank of Commerce, 0.30%, 7/5/2012 (3) | | | 3,797 | | | | 3,797 | |

Alpine Bank, 0.30%, 7/5/2012 (3) | | | 3,060 | | | | 3,060 | |

Ameriana Bank, 0.30%, 7/5/2012 (3) | | | 19 | | | | 19 | |

American Enterprise Bank of Florida, 0.30%, 7/5/2012 (3) | | | 492 | | | | 492 | |

American Momentum Bank, 0.30%, 7/5/2012 (3) | | | 5,694 | | | | 5,694 | |

American National Bank, 0.30%, 7/5/2012 (3) | | | 2,277 | | | | 2,277 | |

American National Bank-Fox Cities, 0.30%, 7/5/2012 (3) | | | 215 | | | | 215 | |

American Savings Bank F.S.B., 0.30%, 7/5/2012 (3) | | | 16 | | | | 16 | |

American Savings Bank FSB, 0.30%, 7/5/2012 (3) | | | 155 | | | | 155 | |

Americas United Bank, 0.30%, 7/5/2012 (3) | | | 1,306 | | | | 1,306 | |

AmFirst Bank N.A., 0.30%, 7/5/2012 (3) | | | 38 | | | | 38 | |

Anthem Bank & Trust, 0.30%, 7/5/2012 (3) | | | 873 | | | | 873 | |

Arizona Bank & Trust, 0.30%, 7/5/2012 (3) | | | 4,192 | | | | 4,192 | |

Arvest Bank, 0.30%, 7/5/2012 (3) | | | 220 | | | | 220 | |

Austin Bank of Chicago, 0.30%, 7/5/2012 (3) | | | 869 | | | | 869 | |

Avidia Bank, 0.30%, 7/5/2012 (3) | | | 4,192 | | | | 4,192 | |

Bancorp Bank, 0.30%, 7/5/2012 (3) | | | 10,749 | | | | 10,749 | |

Bank Hapoalim B.M., 0.30%, 7/5/2012 (3) | | | 1,511 | | | | 1,511 | |

Bank Leumi USA, 0.30%, 7/5/2012 (3) | | | 240,000 | | | | 240,000 | |

Bank of America National Association, 0.30%, 7/5/2012 (3) | | | 448 | | | | 448 | |

Bank of Augusta, 0.30%, 7/5/2012 (3) | | | 917 | | | | 917 | |

| The Muirfield Fund | |

| | | Shares or Principal Amount ($) | | | | | |

| Bank Obligations — continued | | | | | | | | |

Bank of Cadiz and Trust Company, 0.30%, 7/5/2012 (3) | | | 1,055 | | | | 1,055 | |

Bank of Cave City, 0.30%, 7/5/2012 (3) | | | 437 | | | | 437 | |

Bank of England, 0.30%, 7/5/2012 (3) | | | 1,867 | | | | 1,867 | |

Bank of Fayetteville, 0.30%, 7/5/2012 (3) | | | 436 | | | | 436 | |

Bank of Hawaii, 0.30%, 7/5/2012 (3) | | | 4,983 | | | | 4,983 | |

Bank of Houston, 0.30%, 7/5/2012 (3) | | | 2,661 | | | | 2,661 | |

Bank of Jackson Hole, 0.30%, 7/5/2012 (3) | | | 442 | | | | 442 | |

Bank of Manhattan N.A., 0.30%, 7/5/2012 (3) | | | 1,665 | | | | 1,665 | |

Bank of Marin, 0.30%, 7/5/2012 (3) | | | 218 | | | | 218 | |

Bank of Missouri, 0.30%, 7/5/2012 (3) | | | 4,968 | | | | 4,968 | |

Bank of Princeton, 0.30%, 7/5/2012 (3) | | | 651 | | | | 651 | |

Bank of the Ozarks, 0.30%, 7/5/2012 (3) | | | 108 | | | | 108 | |

Bank of the Panhandle, 0.30%, 7/5/2012 (3) | | | 1,062 | | | | 1,062 | |

Bank of the West, 0.30%, 7/5/2012 (3) | | | 13,559 | | | | 13,559 | |

Bar Harbor Bank & Trust, 0.30%, 7/5/2012 (3) | | | 869 | | | | 869 | |

Belmont Savings Bank, 0.30%, 7/5/2012 (3) | | | 4,601 | | | | 4,601 | |

Benchmark Bank, 0.30%, 7/5/2012 (3) | | | 3 | | | | 3 | |

Benefit Bank, 0.30%, 7/5/2012 (3) | | | 1,345 | | | | 1,345 | |

Berkshire Bank, 0.30%, 7/5/2012 (3) | | | 6,256 | | | | 6,256 | |

Beverly Bank & Trust Company National Associa, 0.30%, 7/5/2012 (3) | | | 30 | | | | 30 | |

Biltmore Bank of Arizona, 0.30%, 7/5/2012 (3) | | | 2,408 | | | | 2,408 | |

BMO Harris Bank National Association, 0.30%, 7/5/2012 (3) | | | 2,493 | | | | 2,493 | |

BOKF National Association, 0.30%, 7/5/2012 (3) | | | 5,969 | | | | 5,969 | |

Boone Bank & Trust Co., 0.30%, 7/5/2012 (3) | | | 1,220 | | | | 1,220 | |

Boston Private Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 2,184 | | | | 2,184 | |

Branch Banking and Trust Company, 0.30%, 7/5/2012 (3) | | | 1,980 | | | | 1,980 | |

Brookhaven Bank, 0.30%, 7/5/2012 (3) | | | 250 | | | | 250 | |

Business Bank, 0.30%, 7/5/2012 (3) | | | 1,431 | | | | 1,431 | |

Business Bank, 0.30%, 7/5/2012 (3) | | | 462 | | | | 462 | |

Business Bank of Saint Louis, 0.30%, 7/5/2012 (3) | | | 2,094 | | | | 2,094 | |

Business First Bank, 0.30%, 7/5/2012 (3) | | | 2,092 | | | | 2,092 | |

Cache Valley Bank, 0.30%, 7/5/2012 (3) | | | 3,057 | | | | 3,057 | |

Cadence Bank N.A., 0.30%, 7/5/2012 (3) | | | 209,741 | | | | 209,741 | |

California Bank & Trust, 0.30%, 7/5/2012 (3) | | | 87 | | | | 87 | |

Capital Bank, 0.30%, 7/5/2012 (3) | | | 1,156 | | | | 1,156 | |

Capital One National Association, 0.30%, 7/5/2012 (3) | | | 157,954 | | | | 157,954 | |

CapitalMark Bank & Trust, 0.30%, 7/5/2012 (3) | | | 2,903 | | | | 2,903 | |

CapStar Bank, 0.30%, 7/5/2012 (3) | | | 11,181 | | | | 11,181 | |

CapStone Bank, 0.30%, 7/5/2012 (3) | | | 2,126 | | | | 2,126 | |

Cardinal Bank, 0.30%, 7/5/2012 (3) | | | 4,028 | | | | 4,028 | |

Carolina Alliance Bank, 0.30%, 7/5/2012 (3) | | | 115 | | | | 115 | |

Carver Federal Savings Bank, 0.30%, 7/5/2012 (3) | | | 46,382 | | | | 46,382 | |

Cathay Bank, 0.30%, 7/5/2012 (3) | | | 240,000 | | | | 240,000 | |

The accompanying notes are an integral part of these financial statements.

| 2012 Semi-Annual Report | June 30, 2012 |

Schedule of Investments

June 30, 2012 (unaudited)

| The Muirfield Fund | |

| | | Shares or Principal Amount ($) | | | | | |

| | | | | | | | | |

| Bank Obligations — continued | | | | | | | | |

Celtic Bank, 0.30%, 7/5/2012 (3) | | | 2,441 | | | | 2,441 | |

Centennial Bank, 0.30%, 7/5/2012 (3) | | | 466 | | | | 466 | |

Centra Bank Inc., 0.30%, 7/5/2012 (3) | | | 2,084 | | | | 2,084 | |

Central Bank, 0.30%, 7/5/2012 (3) | | | 695 | | | | 695 | |

Central Bank Illinois, 0.30%, 7/5/2012 (3) | | | 32 | | | | 32 | |

Central Bank of Kansas City, 0.30%, 7/5/2012 (3) | | | 38 | | | | 38 | |

CheckSpring Bank, 0.30%, 7/5/2012 (3) | | | 23 | | | | 23 | |

Chemical Bank, 0.30%, 7/5/2012 (3) | | | 399 | | | | 399 | |

Chickasha Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 442 | | | | 442 | |

Citizens Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 3,770 | | | | 3,770 | |

Citizens Bank of Pennsylvania, 0.30%, 7/5/2012 (3) | | | 133 | | | | 133 | |

Citizens National Bank, 0.30%, 7/5/2012 (3) | | | 212 | | | | 212 | |

Citizens National Bank of Bluffton, 0.30%, 7/5/2012 (3) | | | 446 | | | | 446 | |

City First Bank of D.C. National Association, 0.30%, 7/5/2012 (3) | | | 1,597 | | | | 1,597 | |

City National Bank, 0.30%, 7/5/2012 (3) | | | 271 | | | | 271 | |

City National Bank of Sulphur Springs, 0.30%, 7/5/2012 (3) | | | 146 | | | | 146 | |

City National Bank of Taylor, 0.30%, 7/5/2012 (3) | | | 970 | | | | 970 | |

Cole Taylor Bank, 0.30%, 7/5/2012 (3) | | | 79,682 | | | | 79,682 | |

Collin Bank, 0.30%, 7/5/2012 (3) | | | 1,135 | | | | 1,135 | |

Columbia State Bank, 0.30%, 7/5/2012 (3) | | | 3,884 | | | | 3,884 | |

Comerica Bank, 0.30%, 7/5/2012 (3) | | | 4,837 | | | | 4,837 | |

Commencement Bank, 0.30%, 7/5/2012 (3) | | | 1,327 | | | | 1,327 | |

Commerce Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 6,820 | | | | 6,820 | |

Commerce National Bank, 0.30%, 7/5/2012 (3) | | | 81 | | | | 81 | |

Community Bank & Trust, 0.30%, 7/5/2012 (3) | | | 2,970 | | | | 2,970 | |

Community Bank of Oelwein, 0.30%, 7/5/2012 (3) | | | 907 | | | | 907 | |

Community Bank of Santa Maria, 0.30%, 7/5/2012 (3) | | | 103 | | | | 103 | |

Community Bank of the Bay, 0.30%, 7/5/2012 (3) | | | 167 | | | | 167 | |

Community Mutual Savings Bank, 0.30%, 7/5/2012 (3) | | | 1,168 | | | | 1,168 | |

Community Trust Bank, 0.30%, 7/5/2012 (3) | | | 240,000 | | | | 240,000 | |

Compass Bank, 0.30%, 7/5/2012 (3) | | | 240,000 | | | | 240,000 | |

Congaree State Bank, 0.30%, 7/5/2012 (3) | | | 1,252 | | | | 1,252 | |

Congressional Bank, 0.30%, 7/5/2012 (3) | | | 1,356 | | | | 1,356 | |

Cooper State Bank, 0.30%, 7/5/2012 (3) | | | 431 | | | | 431 | |

Crescent State Bank, 0.30%, 7/5/2012 (3) | | | 2,140 | | | | 2,140 | |

Crystal Lake Bank and Trust Company N.A., 0.30%, 7/5/2012 (3) | | | 1 | | | | 1 | |

Delta Trust & Bank, 0.30%, 7/5/2012 (3) | | | 4,330 | | | | 4,330 | |

DeWitt Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 322 | | | | 322 | |

Diamond Bank, 0.30%, 7/5/2012 (3) | | | 3,222 | | | | 3,222 | |

| The Muirfield Fund | |

| | | Shares or Principal Amount ($) | | | | | |

| |

| Bank Obligations — continued | | | | | | | | |

DMB Community Bank, 0.30%, 7/5/2012 (3) | | | 3,070 | | | | 3,070 | |

Dollar Bank Federal Savings Bank, 0.30%, 7/5/2012 (3) | | | 1,095 | | | | 1,095 | |

Dubuque Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 431 | | | | 431 | |

Eagle Bank and Trust Company, 0.30%, 7/5/2012 (3) | | | 1,118 | | | | 1,118 | |

EagleBank, 0.30%, 7/5/2012 (3) | | | 240,000 | | | | 240,000 | |

East River Bank, 0.30%, 7/5/2012 (3) | | | 115 | | | | 115 | |

East West Bank, 0.30%, 7/5/2012 (3) | | | 240,511 | | | | 240,511 | |

Empire National Bank, 0.30%, 7/5/2012 (3) | | | 434 | | | | 434 | |

Encore Bank National Association, 0.30%, 7/5/2012 (3) | | | 319 | | | | 319 | |

Encore National Bank, 0.30%, 7/5/2012 (3) | | | 125 | | | | 125 | |

Enterprise Bank & Trust, 0.30%, 7/5/2012 (3) | | | 7,692 | | | | 7,692 | |

Equity Bank A National Association, 0.30%, 7/5/2012 (3) | | | 994 | | | | 994 | |

Exchange Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 2,303 | | | | 2,303 | |

Exchange State Bank, 0.30%, 7/5/2012 (3) | | | 433 | | | | 433 | |

Fannin Bank, 0.30%, 7/5/2012 (3) | | | 1 | | | | 1 | |

Farmers & Merchants Bank of Long Beach, 0.30%, 7/5/2012 (3) | | | 69 | | | | 69 | |

Farmers & Merchants State Bank, 0.30%, 7/5/2012 (3) | | | 124 | | | | 124 | |

Farmers and Merchants State Bank of Blooming , 0.30%, 7/5/2012 (3) | | | 839 | | | | 839 | |

Farmers Bank, 0.30%, 7/5/2012 (3) | | | 135 | | | | 135 | |

Farmers Exchange Bank, 0.30%, 7/5/2012 (3) | | | 1,580 | | | | 1,580 | |

Farmers State Bank, 0.30%, 7/5/2012 (3) | | | 1 | | | | 1 | |

Fidelity Bank, 0.30%, 7/5/2012 (3) | | | 2,975 | | | | 2,975 | |

Fifth Third Bank, 0.30%, 7/5/2012 (3) | | | 240,000 | | | | 240,000 | |

First Bank & Trust, 0.30%, 7/5/2012 (3) | | | 2 | | | | 2 | |

First Bank Financial Centre, 0.30%, 7/5/2012 (3) | | | 103 | | | | 103 | |

First Choice Bank, 0.30%, 7/5/2012 (3) | | | 1,929 | | | | 1,929 | |

First Commercial Bank, 0.30%, 7/5/2012 (3) | | | 102 | | | | 102 | |

First Commercial Bank, 0.30%, 7/5/2012 (3) | | | 853 | | | | 853 | |

First Community Bank, 0.30%, 7/5/2012 (3) | | | 2,057 | | | | 2,057 | |

First County Bank, 0.30%, 7/5/2012 (3) | | | 5,903 | | | | 5,903 | |

First Federal Bank, 0.30%, 7/5/2012 (3) | | | 1,589 | | | | 1,589 | |

First Foundation Bank, 0.30%, 7/5/2012 (3) | | | 11,657 | | | | 11,657 | |

First International Bank & Trust, 0.30%, 7/5/2012 (3) | | | 136 | | | | 136 | |

First Internet Bank of Indiana, 0.30%, 7/5/2012 (3) | | | 4,820 | | | | 4,820 | |

First Interstate Bank, 0.30%, 7/5/2012 (3) | | | 80 | | | | 80 | |

First N.A., 0.30%, 7/5/2012 (3) | | | 1,858 | | | | 1,858 | |

First National Bank, 0.30%, 7/5/2012 (3) | | | 4,171 | | | | 4,171 | |

First National Bank, 0.30%, 7/5/2012 (3) | | | 104 | | | | 104 | |

First National Bank - Fox Valley, 0.30%, 7/5/2012 (3) | | | 147 | | | | 147 | |

First National Bank in Green Forest, 0.30%, 7/5/2012 (3) | | | 221 | | | | 221 | |

First National Bank in Sioux Falls, 0.30%, 7/5/2012 (3) | | | 102 | | | | 102 | |

The accompanying notes are an integral part of these financial statements.

| 2012 Semi-Annual Report | June 30, 2012 |

Schedule of Investments

June 30, 2012 (unaudited)

| The Muirfield Fund | |

| | | Shares or Principal Amount ($) | | | | | |

| |

| Bank Obligations — continued | | | | | | | | |

First National Bank of America, 0.30%, 7/5/2012 (3) | | | 111 | | | | 111 | |

First National Bank of Fort Smith, 0.30%, 7/5/2012 (3) | | | 164 | | | | 164 | |

First National Bank of Long Island, 0.30%, 7/5/2012 (3) | | | 10,706 | | | | 10,706 | |

First National Bank of Omaha, 0.30%, 7/5/2012 (3) | | | 70 | | | | 70 | |

First National Bank of Santa Fe, 0.30%, 7/5/2012 (3) | | | 2,406 | | | | 2,406 | |

First Premier Bank, 0.30%, 7/5/2012 (3) | | | 3,221 | | | | 3,221 | |

First Security Bank, 0.30%, 7/5/2012 (3) | | | 8,935 | | | | 8,935 | |

First Security Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 11 | | | | 11 | |

First State Bank, 0.30%, 7/5/2012 (3) | | | 875 | | | | 875 | |

First State Bank, 0.30%, 7/5/2012 (3) | | | 40 | | | | 40 | |

First State Bank of DeQueen, 0.30%, 7/5/2012 (3) | | | 924 | | | | 924 | |

First State Bank of Northwest Arkansas, 0.30%, 7/5/2012 (3) | | | 626 | | | | 626 | |

First Trade Union Bank, 0.30%, 7/5/2012 (3) | | | 167 | | | | 167 | |

First Utah Bank, 0.30%, 7/5/2012 (3) | | | 107 | | | | 107 | |

First Virginia Community Bank, 0.30%, 7/5/2012 (3) | | | 892 | | | | 892 | |

First Western Bank, 0.30%, 7/5/2012 (3) | | | 9 | | | | 9 | |

First-Citizens Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 10,582 | | | | 10,582 | |

FirstAtlantic Bank, 0.30%, 7/5/2012 (3) | | | 104 | | | | 104 | |

FirstBank, 0.30%, 7/5/2012 (3) | | | 1,326 | | | | 1,326 | |

FirstBank Puerto Rico, 0.30%, 7/5/2012 (3) | | | 240,000 | | | | 240,000 | |

FirstMerit Bank National Association, 0.30%, 7/5/2012 (3) | | | 218 | | | | 218 | |

Flagship Community Bank, 0.30%, 7/5/2012 (3) | | | 102 | | | | 102 | |

Flatirons Bank, 0.30%, 7/5/2012 (3) | | | 1,327 | | | | 1,327 | |

Florida Business Bank, 0.30%, 7/5/2012 (3) | | | 434 | | | | 434 | |

Florida Parishes Bank, 0.30%, 7/5/2012 (3) | | | 87 | | | | 87 | |

Forrest City Bank NA, 0.30%, 7/5/2012 (3) | | | 213 | | | | 213 | |

Fortune Bank, 0.30%, 7/5/2012 (3) | | | 1,402 | | | | 1,402 | |

Fox Chase Bank, 0.30%, 7/5/2012 (3) | | | 893 | | | | 893 | |

Franklin Synergy Bank, 0.30%, 7/5/2012 (3) | | | 3,885 | | | | 3,885 | |

Frost National Bank, 0.30%, 7/5/2012 (3) | | | 131 | | | | 131 | |

Genesee Regional Bank, 0.30%, 7/5/2012 (3) | | | 3,091 | | | | 3,091 | |

Georgia Bank & Trust Company of Augusta, 0.30%, 7/5/2012 (3) | | | 2,347 | | | | 2,347 | |

Georgia Banking Company, 0.30%, 7/5/2012 (3) | | | 1,407 | | | | 1,407 | |

German American Bancorp, 0.30%, 7/5/2012 (3) | | | 651 | | | | 651 | |

Glacier Bank, 0.30%, 7/5/2012 (3) | | | 7,385 | | | | 7,385 | |

Glens Falls National Bank and Trust Company, 0.30%, 7/5/2012 (3) | | | 32 | | | | 32 | |

Golden Pacific Bank National Association, 0.30%, 7/5/2012 (3) | | | 102 | | | | 102 | |

Gotham Bank of New York, 0.30%, 7/5/2012 (3) | | | 1,903 | | | | 1,903 | |

| The Muirfield Fund | |

| | | Shares or Principal Amount ($) | | | | | |

| |

| Bank Obligations — continued | | | | | | | | |

Grand Savings Bank, 0.30%, 7/5/2012 (3) | | | 1,095 | | | | 1,095 | |

Grand Valley Bank, 0.30%, 7/5/2012 (3) | | | 431 | | | | 431 | |

Green Bank National Association, 0.30%, 7/5/2012 (3) | | | 2,381 | | | | 2,381 | |

Guaranty Bank, 0.30%, 7/5/2012 (3) | | | 1,335 | | | | 1,335 | |

Guaranty Bond Bank, 0.30%, 7/5/2012 (3) | | | 18,610 | | | | 18,610 | |

GulfShore Bank, 0.30%, 7/5/2012 (3) | | | 1,327 | | | | 1,327 | |

Happy State Bank, 0.30%, 7/5/2012 (3) | | | 136 | | | | 136 | |

Heartland Bank, 0.30%, 7/5/2012 (3) | | | 16 | | | | 16 | |

Heartland Bank, 0.30%, 7/5/2012 (3) | | | 8 | | | | 8 | |

Helena National Bank, 0.30%, 7/5/2012 (3) | | | 776 | | | | 776 | |

Heritage Oaks Bank, 0.30%, 7/5/2012 (3) | | | 4,623 | | | | 4,623 | |

Hingham Institution for Savings, 0.30%, 7/5/2012 (3) | | | 4,192 | | | | 4,192 | |

Home Federal Bank, 0.30%, 7/5/2012 (3) | | | 1,409 | | | | 1,409 | |

Horizon Bank National Association, 0.30%, 7/5/2012 (3) | | | 143 | | | | 143 | |

Hyperion Bank, 0.30%, 7/5/2012 (3) | | | 221 | | | | 221 | |

IBERIABANK, 0.30%, 7/5/2012 (3) | | | 240,000 | | | | 240,000 | |

Icon Bank of Texas National Association, 0.30%, 7/5/2012 (3) | | | 300 | | | | 300 | |

Independence Bank, 0.30%, 7/5/2012 (3) | | | 69 | | | | 69 | |

Independent Bank of Texas, 0.30%, 7/5/2012 (3) | | | 104 | | | | 104 | |

Inland Bank and Trust, 0.30%, 7/5/2012 (3) | | | 19 | | | | 19 | |

Integrity Bank, 0.30%, 7/5/2012 (3) | | | 888 | | | | 888 | |

Investors Community Bank, 0.30%, 7/5/2012 (3) | | | 434 | | | | 434 | |

Isabella Bank, 0.30%, 7/5/2012 (3) | | | 113 | | | | 113 | |

Israel Discount Bank of New York, 0.30%, 7/5/2012 (3) | | | 240,000 | | | | 240,000 | |

JPMorgan Chase Bank National Association, 0.30%, 7/5/2012 (3) | | | 68 | | | | 68 | |

Kaiser Federal Bank, 0.30%, 7/5/2012 (3) | | | 433 | | | | 433 | |

Katahdin Trust Company, 0.30%, 7/5/2012 (3) | | | 2,338 | | | | 2,338 | |

KeyBank National Association, 0.30%, 7/5/2012 (3) | | | 1,679 | | | | 1,679 | |

KeySource Commercial Bank, 0.30%, 7/5/2012 (3) | | | 150 | | | | 150 | |

Lake Forest Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 1 | | | | 1 | |

Lake National Bank, 0.30%, 7/5/2012 (3) | | | 8 | | | | 8 | |

Landmark Community Bank, 0.30%, 7/5/2012 (3) | | | 873 | | | | 873 | |

Landmark National Bank, 0.30%, 7/5/2012 (3) | | | 228 | | | | 228 | |

Leader Bank National Association, 0.30%, 7/5/2012 (3) | | | 1,031 | | | | 1,031 | |

Legacy Bank, 0.30%, 7/5/2012 (3) | | | 103 | | | | 103 | |

Legacy National Bank, 0.30%, 7/5/2012 (3) | | | 438 | | | | 438 | |

LegacyTexas Bank, 0.30%, 7/5/2012 (3) | | | 8 | | | | 8 | |

Level One Bank, 0.30%, 7/5/2012 (3) | | | 2,638 | | | | 2,638 | |

Lewis & Clark Bank, 0.30%, 7/5/2012 (3) | | | 432 | | | | 432 | |

Libertad Bank SSB, 0.30%, 7/5/2012 (3) | | | 400 | | | | 400 | |

Liberty Bank, 0.30%, 7/5/2012 (3) | | | 3,419 | | | | 3,419 | |

The accompanying notes are an integral part of these financial statements.

| 2012 Semi-Annual Report | June 30, 2012 |

Schedule of Investments

June 30, 2012 (unaudited)

| The Muirfield Fund | |

| | | Shares or Principal Amount ($) | | | | | |

| |

| Bank Obligations — continued | | | | | | | | |

Liberty Bank, 0.30%, 7/5/2012 (3) | | | 430 | | | | 430 | |

Liberty Bank National Association, 0.30%, 7/5/2012 (3) | | | 1 | | | | 1 | |

Liberty Bank of Arkansas, 0.30%, 7/5/2012 (3) | | | 3,955 | | | | 3,955 | |

Libertyville Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 1 | | | | 1 | |

Lifestore Bank, 0.30%, 7/5/2012 (3) | | | 104 | | | | 104 | |

Lone Star National Bank, 0.30%, 7/5/2012 (3) | | | 4,878 | | | | 4,878 | |

MainStreet Bank, 0.30%, 7/5/2012 (3) | | | 2,352 | | | | 2,352 | |

Manufacturers Bank, 0.30%, 7/5/2012 (3) | | | 46,382 | | | | 46,382 | |

MB Financial Bank N.A., 0.30%, 7/5/2012 (3) | | | 137 | | | | 137 | |

mBank, 0.30%, 7/5/2012 (3) | | | 984 | | | | 984 | |

Mercantil Commercebank National Association, 0.30%, 7/5/2012 (3) | | | 542 | | | | 542 | |

Mercantile Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 1,840 | | | | 1,840 | |

Mercantile Bank of Michigan, 0.30%, 7/5/2012 (3) | | | 5,175 | | | | 5,175 | |

Merchants & Farmers Bank, 0.30%, 7/5/2012 (3) | | | 213 | | | | 213 | |

Merchants Bank, 0.30%, 7/5/2012 (3) | | | 53 | | | | 53 | |

Meridian Bank, 0.30%, 7/5/2012 (3) | | | 272 | | | | 272 | |

Metropolitan Capital Bank & Trust, 0.30%, 7/5/2012 (3) | | | 1,911 | | | | 1,911 | |

Metropolitan National Bank, 0.30%, 7/5/2012 (3) | | | 12,123 | | | | 12,123 | |

Midwest Regional Bank, 0.30%, 7/5/2012 (3) | | | 51 | | | | 51 | |

Mifflin County Savings Bank, 0.30%, 7/5/2012 (3) | | | 212 | | | | 212 | |

MileStone Bank, 0.30%, 7/5/2012 (3) | | | 651 | | | | 651 | |

Miners Bank, 0.30%, 7/5/2012 (3) | | | 873 | | | | 873 | |

Minnesota Bank & Trust, 0.30%, 7/5/2012 (3) | | | 1,838 | | | | 1,838 | |

Morris Bank, 0.30%, 7/5/2012 (3) | | | 161 | | | | 161 | |

National Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 1,134 | | | | 1,134 | |

National Bank of California, 0.30%, 7/5/2012 (3) | | | 41 | | | | 41 | |

Needham Bank, 0.30%, 7/5/2012 (3) | | | 3,036 | | | | 3,036 | |

New Mexico Bank & Trust, 0.30%, 7/5/2012 (3) | | | 1,506 | | | | 1,506 | |

Newburyport Five Cents Savings Bank, 0.30%, 7/5/2012 (3) | | | 19 | | | | 19 | |

NOA Bank, 0.30%, 7/5/2012 (3) | | | 130 | | | | 130 | |

Noah Bank, 0.30%, 7/5/2012 (3) | | | 774 | | | | 774 | |

North Jersey Community Bank, 0.30%, 7/5/2012 (3) | | | 2,188 | | | | 2,188 | |

North Shore Community Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 1 | | | | 1 | |

Northbrook Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 9 | | | | 9 | |

Northern Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 4,789 | | | | 4,789 | |

Nuvo Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 1,356 | | | | 1,356 | |

| The Muirfield Fund | |

| | | Shares or Principal Amount ($) | | | | | |

| Bank Obligations — continued | | | | | | | | |

Oak View National Bank, 0.30%, 7/5/2012 (3) | | | 211 | | | | 211 | |

Oasis Bank SSB, 0.30%, 7/5/2012 (3) | | | 28 | | | | 28 | |

OceanFirst Bank, 0.30%, 7/5/2012 (3) | | | 103 | | | | 103 | |

Ohio Commerce Bank, 0.30%, 7/5/2012 (3) | | | 473 | | | | 473 | |

Old Plank Trail Community Bank National Assoc, 0.30%, 7/5/2012 (3) | | | 46 | | | | 46 | |

One Bank & Trust National Association, 0.30%, 7/5/2012 (3) | | | 212 | | | | 212 | |

OneWest Bank FSB, 0.30%, 7/5/2012 (3) | | | 3,047 | | | | 3,047 | |

Ossian State Bank, 0.30%, 7/5/2012 (3) | | | 81 | | | | 81 | |

Pacific Commerce Bank, 0.30%, 7/5/2012 (3) | | | 2,502 | | | | 2,502 | |

Pacific Enterprise Bank, 0.30%, 7/5/2012 (3) | | | 2,855 | | | | 2,855 | |

Paragon Commercial Bank, 0.30%, 7/5/2012 (3) | | | 9,584 | | | | 9,584 | |

Parkside Financial Bank & Trust, 0.30%, 7/5/2012 (3) | | | 1,326 | | | | 1,326 | |

Peapack-Gladstone Bank, 0.30%, 7/5/2012 (3) | | | 1 | | | | 1 | |

Pegasus Bank, 0.30%, 7/5/2012 (3) | | | 318 | | | | 318 | |

Peoples Bank National Association, 0.30%, 7/5/2012 (3) | | | 116 | | | | 116 | |

Peoples Bank of Commerce, 0.30%, 7/5/2012 (3) | | | 870 | | | | 870 | |

Peoples Community Bank, 0.30%, 7/5/2012 (3) | | | 1,287 | | | | 1,287 | |

Peoples United Bank, 0.30%, 7/5/2012 (3) | | | 240,000 | | | | 240,000 | |

Petit Jean State Bank, 0.30%, 7/5/2012 (3) | | | 766 | | | | 766 | |

Pine Bluff National Bank, 0.30%, 7/5/2012 (3) | | | 547 | | | | 547 | |

Plaza Bank, 0.30%, 7/5/2012 (3) | | | 104 | | | | 104 | |

PNC Bank National Association, 0.30%, 7/5/2012 (3) | | | 2,029 | | | | 2,029 | |

Post Oak Bank N.A., 0.30%, 7/5/2012 (3) | | | 434 | | | | 434 | |

Premier Bank, 0.30%, 7/5/2012 (3) | | | 2,347 | | | | 2,347 | |

Premier Bank, 0.30%, 7/5/2012 (3) | | | 1,127 | | | | 1,127 | |

PrinsBank, 0.30%, 7/5/2012 (3) | | | 542 | | | | 542 | |

Private Bank Minnesota, 0.30%, 7/5/2012 (3) | | | 1,330 | | | | 1,330 | |

ProAmérica Bank, 0.30%, 7/5/2012 (3) | | | 2,343 | | | | 2,343 | |

Professional Business Bank, 0.30%, 7/5/2012 (3) | | | 434 | | | | 434 | |

Progress Bank and Trust, 0.30%, 7/5/2012 (3) | | | 441 | | | | 441 | |

Quad City Bank and Trust Company, 0.30%, 7/5/2012 (3) | | | 4,938 | | | | 4,938 | |

Quontic Bank, 0.30%, 7/5/2012 (3) | | | 102 | | | | 102 | |

RBS Citizens National Association, 0.30%, 7/5/2012 (3) | | | 147 | | | | 147 | |

Regent Bank, 0.30%, 7/5/2012 (3) | | | 107 | | | | 107 | |

Regions Bank, 0.30%, 7/5/2012 (3) | | | 11,552 | | | | 11,552 | |

Renasant Bank, 0.30%, 7/5/2012 (3) | | | 4,106 | | | | 4,106 | |

Republic Bank, 0.30%, 7/5/2012 (3) | | | 435 | | | | 435 | |

Republic Bank & Trust, 0.30%, 7/5/2012 (3) | | | 257 | | | | 257 | |

Republic Bank & Trust Company, 0.30%, 7/5/2012 (3) | | | 103 | | | | 103 | |

River Community Bank N.A., 0.30%, 7/5/2012 (3) | | | 1,020 | | | | 1,020 | |

The accompanying notes are an integral part of these financial statements.

| 2012 Semi-Annual Report | June 30, 2012 |

Schedule of Investments

June 30, 2012 (unaudited)

| The Muirfield Fund | |

| | | Shares or Principal Amount ($) | | | | | |

| |

| Bank Obligations — continued | | | | | | | | |

RiverBend Bank, 0.30%, 7/5/2012 (3) | | | 21 | | | | 21 | |

Riverside Bank, 0.30%, 7/5/2012 (3) | | | 132 | | | | 132 | |

Riverview Bank, 0.30%, 7/5/2012 (3) | | | 869 | | | | 869 | |

Rockland Trust Company, 0.30%, 7/5/2012 (3) | | | 5,732 | | | | 5,732 | |

RSNB Bank, 0.30%, 7/5/2012 (3) | | | 1,628 | | | | 1,628 | |