Exhibit 99.34

LAKE SHORE GOLD CORP.

MANAGEMENT INFORMATION CIRCULAR

This Information Circular contains information as at March 25, 2011, unless otherwise stated

BUSINESS OF THE MEETING

1. FINANCIAL STATEMENTS

The consolidated financial statements of Lake Shore Gold Corp. (the “Corporation” or “Lake Shore Gold”) for the year ended December 31, 2010 are included in the 2010 Annual Report, which has been mailed separately to registered shareholders and to beneficial owners who have requested to have a copy mailed to them, and will be presented to the shareholders at the Annual and Special Meeting of Shareholders (the “Meeting”).

2. ELECTION OF DIRECTORS

Management proposes to nominate for election to the Corporation’s Board of Directors the persons named in the section “Election of Directors”. Please refer to that section for a biography of each nominee. All of the nominees are currently directors of the Corporation. Each director elected will hold office until the next annual general meeting or until his successor is duly elected or appointed, unless his office is earlier vacated in accordance with the Articles of the Corporation or he becomes disqualified to act as a director.

Unless authority is withheld, the persons named in the accompanying form of proxy (the “Proxy”) intend to vote for these nominees. All of the nominees have established their eligibility and willingness to serve as directors. The Proxy permits shareholders to vote in favour of all nominees, to vote in favour of some nominees and to withhold votes for other nominees, or to withhold votes for all nominees.

Directors’ attendance at Board and committee meetings held in 2010 is set forth in Item 1(g) of the section “Corporate Governance Disclosure”.

3. APPOINTMENT OF AUDITORS

Deloitte & Touche were initially appointed auditors of the Corporation in 2002. The persons whose names are printed on the enclosed Proxy will vote for the appointment of Deloitte & Touche LLP, Chartered Accountants, of 181 Bay Street, Suite 1400, Toronto, Ontario, as auditors for the Corporation to hold office until the next annual general meeting of shareholders, at a remuneration to be fixed by the directors.

4. CONFIRMATION OF SHAREHOLDER RIGHTS PLAN

At the Meeting, shareholders will be asked to consider a resolution to confirm the Shareholder Rights Plan that was adopted by the Corporation on March 29, 2011, as more particularly described below.

5. APPROVAL OF THE STOCK PURCHASE PLAN

At the Meeting, shareholders will be asked to consider a resolution to approve a Stock Purchase Plan, as more particularly described below.

1

6. PARTICULARS OF OTHER MATTERS TO BE ACTED UPON

Management is not aware of any matters to come before the Meeting other than those referred to in the Notice of Meeting. Should any other matters properly come before the Meeting, the Shares represented by the Proxy solicited hereby will be voted on such matters in accordance with the instructions of the proxyholder.

VOTING AND QUORUM

All matters presented to the Meeting require approval by a simple majority of the votes cast at the Meeting, unless stated otherwise.

Quorum for the Meeting will be met if there are at least two persons present, each of whom is entitled to vote at the meeting, and all of whom collectively hold or represent by proxy not less than 25% of the votes entitled to be cast at the meeting. No business shall be transacted at the Meeting unless the requisite quorum is present at the commencement of such Meeting, provided that, if a quorum is present at the commencement of the Meeting, a quorum will be deemed to be present during the remainder of the Meeting.

PERSONS MAKING THIS SOLICITATION OF PROXIES

This Information Circular is furnished in connection with the solicitation of proxies by the management (the “Management”) of the Corporation for use at the Meeting to be held at the time and place and for the purposes set forth in the accompanying Notice of Meeting, and at any adjournment thereof. It is expected that the solicitation will be primarily by mail. Proxies may also be solicited personally by employees of the Corporation. The cost of solicitation will be borne by the Corporation.

GENERAL PROXY INFORMATION

APPOINTMENT OF PROXYHOLDER

The purpose of a proxy is to designate persons who will vote the proxy on a shareholder’s behalf in accordance with the instructions given by the shareholder in the Proxy. The persons whose names are printed in the enclosed form of Proxy are officers or directors of Lake Shore Gold (the “Management Proxyholders”).

A shareholder has the right to appoint a person other than a Management Proxyholder, to represent the shareholder at the Meeting by striking out the names of the Management Proxyholders and by inserting the desired person’s name in the blank space provided or by executing a proxy in a form similar to the enclosed form. A proxyholder need not be a shareholder.

VOTING BY PROXY

Only registered shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Shares represented by a properly executed proxy will be voted or be withheld from voting on each matter referred to in the Notice of Meeting in accordance with the instructions of the shareholder on any ballot that may be called for and if the shareholder specifies a choice with respect to any matter to be acted upon, the Shares will be voted accordingly.

2

If a shareholder does not specify a choice and the shareholder has appointed one of the Management Proxyholders as proxyholder, the Management Proxyholder will vote in favour of the matters specified in the Notice of Meeting and in favour of all other matters proposed by Management at the Meeting.

The enclosed form of proxy also gives discretionary authority to the person named therein as proxyholder with respect to amendments or variations to matters identified in the Notice of the Meeting and with respect to other matters which may properly come before the Meeting. At the date of this Information Circular, Management of Lake Shore Gold knows of no such amendments, variations or other matters to come before the Meeting.

COMPLETION AND RETURN OF PROXY

Completed forms of proxy must be received by Lake Shore Gold’s registrar and transfer agent, Computershare Investor Services Inc., 9th Floor — 100 University Avenue, Toronto, ON M5J 2Y1, not later than forty-eight (48) hours, excluding Saturdays, Sundays and holidays, prior to the time of the Meeting, unless the Chair of the Meeting elects to exercise his discretion to accept proxies received subsequently.

NON-REGISTERED HOLDERS

Only shareholders whose names appear on the records of Lake Shore Gold as the registered holders of Shares or duly appointed proxyholders are permitted to vote at the Meeting. Most shareholders of Lake Shore Gold are “non-registered” shareholders because the Shares they own are not registered in their name but instead registered in the name of a nominee such as a brokerage firm through which they purchased the Shares; bank, trust company, trustee or administrator of selfadministered RRSP’s, RRIF’s, RESP’s and similar plans; or clearing agency such as The Canadian Depository for Securities Limited (a “Nominee”). If you purchased your Shares through a broker, you are likely a non-registered holder.

In accordance with securities regulatory policy, Lake Shore Gold has distributed copies of the Meeting materials, being the Notice of Meeting, this Information Circular and the Proxy, to the Nominees for distribution to non-registered holders.

Nominees are required to forward the Meeting materials to non-registered holders to seek their voting instructions in advance of the Meeting. Shares held by Nominees can only be voted in accordance with the instructions of the non-registered holder. The Nominees often have their own form of proxy, mailing procedures and provide their own return instructions. If you wish to vote by proxy, you should carefully follow the instructions from the Nominee to make sure that your Shares are voted at the Meeting. If you, as a non-registered holder, wish to vote at the Meeting in person, you should appoint yourself as proxyholder by writing your name in the space provided on the request for voting instructions or proxy provided by the Nominee, and return the form to the Nominee in the envelope provided. Do not complete the voting section of the form as your vote will be taken at the Meeting.

In addition, Canadian securities legislation now permits Lake Shore Gold to forward meeting materials directly to non objecting beneficial owners. If Lake Shore Gold or its agent has sent these materials directly to you (instead of through a Nominee), your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the Nominee holding Shares on your behalf. By choosing to send these materials to you directly, Lake Shore Gold (and not the Nominee holding on your behalf) has assumed responsibility for (i) delivering these materials to you and (ii) executing your proper voting instructions.

3

REVOCABILITY OF PROXY

Any registered shareholder who has returned a proxy may revoke it at any time before it has been exercised. In addition to revocation in any other manner permitted by law, a registered shareholder, his attorney authorized in writing or, if the registered shareholder is a corporation, a corporation under its corporate seal or by an officer or attorney thereof duly authorized, may revoke a proxy by instrument in writing, including a proxy bearing a later date. The instrument revoking the proxy must be deposited at the registered office of Lake Shore Gold, at any time up to and including the last business day preceding the date of the Meeting, or any adjournment thereof, or with the Chair of the Meeting on the day of the Meeting. Only registered shareholders have the right to revoke a proxy. Non-Registered Holders who wish to change their vote must arrange for their respective Nominees to revoke the proxy on their behalf.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except as disclosed herein, none of the directors or executive officers of the Corporation, nor any person who has held such a position since the beginning of the last completed financial year of the Corporation, nor any proposed nominee for election as a director of the Corporation, nor any associate or affiliate of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted on at the Meeting other than the election of directors, or in any transaction since the commencement of the Corporation’s last completed financial year or in any proposed transaction not otherwise disclosed herein, which, in either case, has affected or will materially affect the Corporation.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

The Corporation has only one class of shares entitled to be voted at the Meeting, namely, common shares without par value (referred to in this Information Circular as “Shares”). All issued Shares are entitled to be voted at meetings of shareholders and each has one non-cumulative vote. There are 384,402,156 Shares issued and outstanding as at March 30, 2011. Only those shareholders of record on March 30, 2011, will be entitled to vote at the Meeting or any adjournment thereof.

To the knowledge of the directors and executive officers of the Corporation, no person or company beneficially owns, directly or indirectly, or exercises control or direction over, Shares carrying 10% or more of the voting rights attached to all outstanding Shares of the Corporation.

ELECTION OF DIRECTORS

The following information concerning the proposed nominees has been furnished by each of them. All of the directors are ordinarily resident in Canada. Included in this information are details of directors’ committee memberships and equity ownership. All nominees are currently directors of the Corporation. All successful nominees are elected for a term of one year, expiring at the next annual general meeting.

4

ALAN C. MOON

Alberta, Canada | | Alan C. Moon is an independent businessman, corporate director and consultant since 1997. Prior thereto Mr. Moon held a number of executive positions with TransAlta Corporation which he joined in 1985. From 1994 to 1997 he was President and COO of TransAlta Energy Corporation. Mr. Moon has obtained the Institute of Corporate Directors ICD.D designation. |

| | |

Position with Corporation: | | Director, Chair of the Board (Independent) |

| | |

Director since: | | 2005 |

| | |

Committees: | | Audit Committee Corporate Governance & Nominating Committee |

| | |

Securities held: | | 188,700 common shares 313,000 options to acquire common shares |

| | |

Principal Occupation: | | President of Crescent Enterprises Inc.; Corporate Director |

| | |

Sits on other boards: | | · Northern Superior Resources Inc. · TransAtlantic Petroleum Ltd. · AvenEx Energy Corp. · Pembrook Mining Corp. |

| | |

ANTHONY P. MAKUCH

Ontario, Canada | | President and CEO of the Corporation since March 2008; Senior Vice President and Chief Operating Officer for FNX Mining Corporation Inc. from January 2006 to March 2008. Mr. Makuch is a Professional Engineer (Ontario) with over 25 years of management, operations and technical experience in the mining industry, having managed numerous projects in Canada and the United States from advanced exploration through production. He has been a frequent recipient of mine safety performance awards. He holds a Bachelor of Science Degree (Honours Applied Earth Sciences) from the University of Waterloo, both a Master of Science Degree in Engineering and a Master of Business Administration from Queen’s University, and has obtained the Institute of Corporate Directors ICD.D designation from the University of Toronto Rotman School of Business. |

| | |

Position with Corporation: | | President & Chief Executive Officer, Director |

| | |

Director since: | | 2007 |

| | |

Committees: | | n/a |

| | |

Securities held: | | 100,000 common shares 3,439,300 options to acquire common shares |

| | |

Principal Occupation: | | President & Chief Executive Officer of the Corporation |

| | |

Sits on other boards: | | · Pembrook Mining Corp. |

5

PETER CROSSGROVE

Ontario, Canada | | Mr. Crossgrove is the Chairman and acting CEO of Excellon Resources Inc., a silver-lead and silver-zinc concentrate producer. Prior to May 2005, Mr. Crossgrove was the Chairman of Masonite International Corporation, a door manufacturing company. Mr. Crossgrove is also a director of the Canadian Partnership Against Cancer. He holds an undergraduate degree from McGill University and Concordia University and a master’s degree in business administration from the University of Western Ontario. Mr. Crossgrove is a recipient of the Queen’s Jubilee Medal, a Member of the Order of Canada and a Member of the Order of Ontario. |

| | |

Position with Corporation: | | Director (Independent) |

| | |

Director since: | | 2009 |

| | |

Committees: | | Corporate Governance & Nominating Committee (Chair) Compensation Committee |

| | |

Securities held: | | 195,353 common shares

240,500 options to acquire common shares |

| | |

Principal Occupation: | | Acting CEO of Excellon Resources Inc. |

| | |

Sits on other boards: | | · Barrick Gold Corporation · Excellon Resources Inc. · Lateegra Gold Corp. · QLT Inc. · Dundee REIT · Pelangio Mines Inc. · Detour Gold Corporation (Vice-Chairman) |

| | |

DANIEL G. INNES

British Columbia, Canada | | Daniel G. Innes holds an MSc in geology and has over 38 years’ experience in the mining industry. Mr. Innes was also a founding principal, director, and VP Exploration of Southwestern Resources Corp. and founder and director of Aurora Platinum Corp. and Lake Shore Gold Corp. He has worked in a variety of metal environments in many parts of the world, mainly Brazil, Peru, Chile, Argentina, Mexico, USA, Canada, China, and Australia. |

| | |

Position with Corporation: | | Director (Independent) |

| | |

Director since: | | 2003 |

| | |

Committees: | | Health, Safety, Environment and Community Committee (Chair) Compensation Committee |

| | |

Securities held: | | 772,400 common shares

313,000 options to acquire common shares |

| | |

Principal Occupation: | | President of D.G. Innes & Associates Ltd. |

| | |

Sits on other boards: | | · Zincore Metals Inc. · Pembrook Mining Corp. · Radon Environmental Management Corp |

6

ARNOLD KLASSEN

British Columbia, Canada | | Arnold Klassen is a Chartered Accountant and Certified Public Accountant and has over 30 years’ of experience in accounting, audit and tax, with 23 years of experience in the Mining Industry. Mr. Klassen is currently President of AKMJK Consulting Ltd., a private consulting company, and prior to that was the Vice President of Finance for Dynatec Corporation from 1988 to 2007. Dynatec Corporation was a publicly traded TSX listed company from 1997 to 2007. He held a similar position with the Tonto Group of Companies from 1984 to 1998. Mr. Klassen holds a degree in Commerce from the University of British Columbia and spent seven years with KPMG prior to becoming Vice President of Finance with the Tonto Group of Companies. Mr. Klassen has obtained the Institute of Corporate Directors ICD.D designation. |

| | |

Position with Corporation: | | Director (Independent) |

| | |

Director since: | | 2008 |

| | |

Committees: | | Audit Committee (Chair) Corporate Governance & Nominating Committee |

| | |

Securities held: | | 19,800 common shares

263,000 options to acquire common shares |

| | |

Principal Occupation: | | President of AKMJK Consulting Ltd. |

| | |

Sits on other boards: | | · Northern Superior Resources Inc. · Zincore Metals Inc. |

| | |

JONATHAN GILL

Ontario, Canada | | Mr. Gill is a Professional Engineer who brings more than 45 years of mining experience to the board of Lake Shore Gold, much of it working in senior mine management roles for Inco Limited in its Ontario and Manitoba divisions and for PT Inco in Indonesia. Since retiring in 2003, Mr. Gill has worked on a number of project assignments for Inco, both in Canada and at the Goro project in New Caledonia; as well as for other companies involving reviews of such projects as FNX Mining Company´s Sudbury operations, the Ambatovy nickel project in Madagascar and the Onca Puma project in Brazil. Mr. Gill is a member of the Association of Professional Engineers of Ontario and is a former employer Chair of Ontario´s Mining Legislative Review Committee. Mr. Gill is currently pursuing the ICD.D designation. |

| | |

Position with Corporation: | | Director (Independent) |

| | |

Director since: | | 2008 |

| | |

Committees: | | Compensation Committee (Chair) Health, Safety, Environment & Community Committee |

| | |

Securities held: | | 20,000 common shares

243,000 options to acquire common shares |

| | |

Principal Occupation: | | Independent Consultant |

| | |

Sits on other boards: | | n/a |

7

| | |

FRANK HALLAM

British Columbia, Canada | | Mr. Hallam has extensive operating and corporate finance experience at the senior management level with several publicly listed resource companies. Mr. Hallam was the key architect of the Western Bushveld Joint Venture between Platinum Group Metals Ltd. and Anglo Platinum Ltd. He was also the original founder of New Millennium Metals Corporation, a predecessor to Platinum Group Metals Ltd. Mr. Hallam was a co-founder of MAG Silver Corp. and served as CFO of MAG from 2003 to 2010 and since 2010 serves as a director. From 1994 until 2002 he was a director and CFO of Tan Range Exploration Corporation, focused on gold exploration and development throughout East Africa working with groups such as JCI Limited, Barrick Gold Corporation and Newmont Mining Corporation. He was a co- founder of West Timmins Mining Inc. and served as CFO from September 13, 2006 to August 7, 2008 and a director from September 13, 2006 until November 6, 2009. Mr. Hallam also has extensive experience in oil & gas exploration and development. He was previously an auditor with Coopers and Lybrand, specialized in their Mining Practice. He is a chartered accountant and has a degree in business administration from Simon Fraser University. |

| | |

Position with Corporation: | | Director (Independent) |

| | |

Director since: | | 2009 |

| | |

Committees: | | Audit Committee

Health, Safety, Environment & Community Committee |

| | |

Securities held: | | 481,935 common shares

433,500 options to acquire common shares |

| | |

Principal Occupation: | | Chief Financial Officer of Platinum Group Metals Ltd. |

| | |

Sits on other boards: | | · Platinum Group Metals Ltd. · MAG Silver Corp. · West Kirkland Mining Inc. · Nextraction Energy Corp. |

STATEMENT OF EXECUTIVE COMPENSATION

Unless otherwise stated, “dollars” or “$” means Canadian dollars.

Compensation Discussion and Analysis

This section of the Information Circular explains how the Corporation’s executive compensation program is designed and operated with respect to the President and CEO (referred to as “CEO” in the narrative discussion in this section and under the section entitled “Executive Compensation Tables”), Chief Financial Officer (“CFO”), and the three other most highly compensated executives included in this reported financial year (together with the CEO and CFO collectively referred to as the “NEOs”, and each a “NEO”). This section also identifies the objectives and material elements of compensation awarded to the NEOs and the reasons for the compensation. For a complete understanding of the executive compensation program, this Compensation Discussion and Analysis should be read in conjunction with the Summary Compensation Table and other executive compensation-related disclosure included in this Information Circular.

8

The philosophy of the Compensation Committee of the Board of Directors (the “Compensation Committee”) is to determine compensation for the Corporation’s executive officers relative to the performance of the Corporation in executing on its objectives. Executive officers receive both fixed compensation and performance-based variable incentive compensation, which together represents Total Direct Compensation.

The Compensation Committee’s assessment of corporate performance is based on a number of qualitative and quantitative factors including execution of on-going projects and transactions, safety, operational performance and progress on key growth initiatives. A percentage of each NEO’s particular incentive award is based on the Compensation Committee’s determination of the overall performance of the Corporation, in addition to the Compensation Committee’s review of the NEOs’ individual performance. The Compensation Committee’s decisions with respect to Total Direct Compensation for NEOs for 2010 are noted below in the section “Compensation Decisions for 2010”.

Named Executive Officers

The CEO at the end of the most recently completed financial year-end was Anthony Makuch, who took office as the CEO as of March 1, 2008.

The CFO at the end of the most recently completed financial year-end was Mario Stifano, who took office as of October 15, 2008.

The three other most highly compensated executive officers for the last financial year were Brian Hagan, Executive Vice-President, Mike Kelly, Senior Vice-President of Operations, and Eric Kallio, Vice President of Exploration.

Objectives of the Compensation Program

In order for Lake Shore Gold to continue its fast-paced growth into a mid-tier gold producer, the Corporation requires experienced mining personnel with a proven track record of success in building and establishing mining operations. It is a key element of the Corporation’s Compensation Philosophy that compensation be competitive within the market in which the Corporation competes for talent. In addition, compensation should accomplish the following:

· attract, retain and motivate senior executives in a highly competitive industry and business environment;

· link executive compensation to corporate performance and creating shareholder value; and

· reward successful achievement of corporate and individual performance objectives.

Market Benchmarking

Lake Shore Gold’s policy is to provide total executive compensation that is competitive with the median of the marketplace compensation levels, provided performance meets individual and company targets. The Corporation participates annually in the Hay Group Global Mining Compensation review and in the PWC Coopers Consulting Mining Industry Salary Survey (the “Coopers Survey”). The Corporation uses as its principal benchmark the Coopers Survey data with respect to the following 64 Canadian companies:

Adriana Resources Inc. | | Entree Gold Inc. | | Northgate Minerals Corp. |

| | | | |

Agnico-Eagle Mines Ltd. | | Farallon Mining Ltd. | | NovaGold Resources Inc. |

| | | | |

Alamos Gold Inc. | | First Quantum Minerals Ltd. | | Osisko Mining Corporation |

| | | | |

Amerigo Resources Ltd. | | Quadra FNX Mining Ltd. | | Pan American Silver Corp. |

9

ArcelorMittal | | Fortuna Silver Mines Inc. | | Potash Corp. of Saskatchewan, Inc. |

| | | | |

Aura Minerals Inc. | | Gammon Gold, Inc. | | Quadra FNX Mining Ltd. |

| | | | |

Aurizon Mines Ltd. | | Globestar Mining Corp. | | Red Back Mining Inc. |

| | | | |

B2gold Corporation | | Goldcorp Inc. | | San Gold Corporation |

| | | | |

Baja Mining Corp. | | Golden Predator Corp. | | Shore Gold Inc. |

| | | | |

Barrick Gold Corporation | | HudBay Minerals, Inc. | | Silver Standard Resources Inc. |

| | | | |

BHP Billiton Ltd. | | IAMGOLD Corp. | | Silvercorp Metals Inc. |

| | | | |

Breakwater Resources Ltd. | | Imperial Metals Corp. | | South American Silver Corp. |

| | | | |

Cameco Corp. | | Inmet Mining Corporation | | St Andrew Goldfields Ltd. |

| | | | |

Capstone Mining Corp. | | Ivernia Inc. | | Stornoway Diamond Corp. |

| | | | |

Centerra Gold Inc. | | Kinross Gold Corporation | | Taseko Mines Ltd. |

| | | | |

Claude Resources, Inc. | | Kirkland Lake Gold Inc. | | Teck Resources Limited |

| | | | |

Copper Mountain Mining Corporation | | Lundin Mining Corporation | | Terrane Metals Corp. |

| | | | |

Denison Mines Corp. | | Malaga Inc | | Uranium One Inc. |

| | | | |

Detour Gold Corporation | | Mercator Minerals Limited | | Western Coal Corp. |

| | | | |

Dundee Precious Metals Inc. | | Minefinders Corp. Ltd. | | Yamana Gold, Inc. |

| | | | |

Eldorado Gold Corp. | | New Gold, Inc. | | |

| | | | |

Endeavour Silver Corp. | | Newmont Mining Corp. | | |

The Corporation believes that the large sample population included in this survey data provides a reliable market median, as outliers have less influence on the results. Lake Shore Gold is at the 52nd percentile in market capitalisation for this group.

Elements of Executive Compensation

Total Direct Compensation represents the combined value of fixed compensation and performance-based variable incentive compensation, comprising: base salary, short-term incentive in the form of an annual cash bonus, and long-term incentives in the form of stock options.

The allocation of Total Direct Compensation value to these different compensation elements is not based on a formula, but rather is intended to reflect market practices as well as the Compensation Committee’s discretionary assessment of an executive officer’s past contribution and ability to contribute to future short and long-term business results.

Base Salary

In determining base salary levels, the Corporation considers the level of responsibility, level of experience and ability, and overall performance of each NEO. Lake Shore Gold generally targets base salary at the median of the market, as represented by the 2010 Cooper’s Survey data of the “all participant group”. In certain circumstances, the Corporation will, however, target base salaries above the median for individuals considered to be critical to the Corporation’s long term success and who are part of the Corporation’s succession planning. The salaries of the CEO and CFO are above the median, at approximately the 75th percentile, for their positions, and the salaries of the other three NEOs are at approximately the median for each of their positions.

10

Short-term Incentives

Executive officers are eligible for annual cash bonuses based upon corporate, divisional and individual performance goals and objectives, which are established annually by the Board of Directors and in alignment with the Corporation’s business plan and budget for the year. The annual incentive plan is designed to reward executive officers for their success in achieving the objectives. The maximum cash bonus that an executive officer can earn is expressed as a percentage of base salary. The percentage increases with the level of responsibility and ability of the individual to affect the Corporation’s performance. The following were the total eligible percentage bonuses available for 2010 for the NEOs:

Anthony Makuch | | 165% |

President & CEO | | |

| | |

Mario Stifano | | 75% |

CFO | | |

| | |

Michael Kelly | | 112.5% |

SVP Operations | | |

| | |

Brian Hagan | | 90% |

EVP | | |

| | |

Eric Kallio | | 71.25% |

VP Exploration | | |

Long-term Incentives

Long-term incentive (“LTI”) compensation is currently provided through the granting of stock options. The LTI is designed to provide a direct link between executive compensation and longer term corporate performance and growth, and to create long-term shareholder value. The Corporation’s stock option plan is generally in line with the market in terms of structure and guidelines, eligibility, number and frequency of shares granted, and vesting provisions (more details of which are provided below). Participants benefit only if the market value of Lake Shore Gold’s common shares at the time of stock option exercise is greater than the exercise price of the stock options at the time of grant. Unless otherwise specified by the Board at the time of grant, stock options vest 331/2% on each anniversary of the grant date for a period of three years and expire five years from the grant date.

Stock Options

Stock Option Granting Process

The Compensation Committee is responsible for approving all individual stock option grants to non-executive employees, and for recommending to the Board for its approval any stock option grants for executive officers.

Stock option grants may be assessed at the time an employee joins the Corporation and thereafter annually. Employees may also be eligible for an option grant at the time of a promotion. The Corporation has adopted a Stock Option Grant Policy which provides for a grant of a number of options based on a pre-approved salary administration structure, involving a calculation of an employee’s target long-term incentive based on a specified percentage of the employee’s annual salary, divided by the grant date fair value of an option using the Black-Scholes Model, and multiplied by 3. In certain circumstances, the CEO and the VP of Human Resources may make

11

recommendations to the Compensation Committee regarding individual stock option awards for recipients where a variance from the policy is proposed.

The Compensation Committee deliberates and considers the calculated number under the Stock Option Grant Policy as well as other information in order to determine the CEO’s stock option grant recommendation to the Board.

The Compensation Committee reviews the appropriateness of the stock option grant recommendations from management for all eligible employees and may accept or adjust these recommendations.

Stock option grants are not contingent on the number, term or current value of other outstanding compensation previously awarded to the individual, except in the case of a promotion, where previous option grants may be considered in determining an appropriate grant to bring the promoted employee’s option holdings into line with his or her new position.

Stock Option Plan Amendments

The Board has the authority to discontinue the stock option plan at any time without shareholder approval. The Board may also make certain amendments to the plan without shareholder approval, including such amendments as setting the vesting date of a given grant and changing the expiry date of an outstanding stock option which does not entail an extension beyond the original expiry date. No amendments can be made to the stock option plan that adversely affect the rights of any option holder regarding any previously granted options without the consent of the option holder.

Management does not have a right to amend, suspend or discontinue the stock option plan. The stock option plan also provides that certain amendments be approved by the shareholders of Lake Shore Gold as provided by the rules of the Toronto Stock Exchange (“TSX”).

Other Compensation

Executive officers receive other benefits that the Corporation believes are reasonable and consistent with its overall executive compensation program. These benefits, which are based on competitive market practices, support the attraction and retention of executive officers. Benefits include a defined contribution pension plan (as described below), traditional health and welfare programs, and limited executive perquisites.

Certain executive officers who work at the Corporation’s head office are eligible for a Corporation-paid reserved parking stall which in 2010 was valued at approximately $3,700 for a full year.

How the Corporation Determines Compensation

The Role of the Compensation Committee

The Compensation Committee approves, or recommends for approval, all compensation to be awarded to the NEOs. The Compensation Committee directs management to gather information on its behalf, and provide initial analysis and commentary. The Compensation Committee reviews this material along with other information received from external advisors in its deliberations before considering or rendering decisions.

The Compensation Committee has full discretion to adopt or alter management recommendations or to consult its own external advisors.

12

The Compensation Committee believes it is important to follow appropriate governance practices in carrying out its responsibilities with respect to the development and administration of executive compensation and benefit programs. Governance practices followed by the Compensation Committee include holding in-camera sessions without management present and, when necessary, obtaining advice from external consultants.

In November 2010 the Compensation Committee engaged Hugessen Consulting Inc. (“Hugessen”) as executive compensation consultants. Hugessen reported to the Chair of the Compensation Committee and provided input to the Committee on the competitiveness and effectiveness of the current design and administration of the short term and long term incentive plans, and reviewed the compensation provided to the executive officers. Hugessen also provided input and guidance on the compensation paid to the non-executive directors. The decisions made by the Committee also reflect additional factors and considerations other than the information provided by Hugessen.

The Compensation Committee specifically directed Hugessen to carry out the following:

1. Review of compensation philosophy and peer groups.

2. Review the competitiveness of the Lake Shore Gold’s compensation of NEOs with respect to:

a. Base salary;

b. Total cash compensation (base salary + cash bonus); and

c. Total Direct Compensation (total cash compensation + present value of LTI).

3. Review executive stock ownership guidelines and practices among the market peer group.

4. Review and comment on the short-term and long-term incentive plan designs and their alignment with corporate strategy, competitive practice and best practice.

5. Review the level and form of non-executive director compensation with respect to:

a. Cash retainer and value of equity retainer;

b. Committee chair premiums;

c. Meeting fees;

d. Board Chair compensation; and

e. Any other relevant information.

Lake Shore Gold paid Hugessen $24,000 in 2010 and $90,000 in 2011 for these services.

The Role of Management

Management has direct involvement in and knowledge of the business goals, strategies, experiences and performance of the Corporation. As a result, management plays an important role in the compensation decision-making process. The Compensation Committee engages in active discussions with the CEO concerning the determination of performance objectives, including individual goals and initiatives for NEOs, and whether, and to what extent, criteria for the previous year have been achieved for those individuals. The CEO may also provide a self-assessment of his own individual performance objectives and/or results achieved, if requested by the Compensation Committee.

The CEO makes recommendations to the Compensation Committee regarding the amount and type of compensation awards for other members of executive management. The CEO does not engage in discussions with the Compensation Committee regarding his own compensation. The VP of Human Resources provides the Compensation Committee and the Chair of the Board with relevant market

13

data and other information as requested, in order to support the Compensation Committee’s deliberations regarding the CEO’s compensation and subsequent recommendation to the Board.

Performance Assessment

The Compensation Committee’s comprehensive assessment of the overall business performance of Lake Shore Gold, including corporate performance against objectives (both quantitative and qualitative), business circumstances and, where appropriate, relative performance against peers, provides the context for individual executive officer evaluations for all direct compensation awards.

The Compensation Committee’s assessment of performance is based on key performance indicators (“KPIs”) set annually for each member of senior management. The KPIs have three components with a weighting attached to each component. The first component is based on corporate objectives for financial performance, growth through development and exploration, and compliance with health, safety and environmental targets. The second component is based on operational objectives and includes production and development targets for the year. The third component is based on divisional objectives related to the executive’s role within the organization. All objectives may include a combination of quantitative and qualitative measures. In addition to the specified KPIs, the Compensation Committee and Board reserve the discretion to increase the bonus award to any particular NEO where deemed appropriate.

The Compensation Committee, in consultation with the CEO, reviews the achievements and overall contribution of each individual executive officer who reports to the CEO. The Board Chair and Compensation Committee have in-camera discussions to complete an independent assessment of the performance of the CEO. The Compensation Committee then determines an overall individual performance rating for each individual executive officer.

A summary of the 2010 KPIs and results are noted in the section “Compensation Decisions Made for 2010”, below.

Internal Equity and Retention Value

Executive officer pay relative to other executives (“internal equity”) is generally considered in establishing compensation levels. The difference between one executive officer’s compensation and that of the other NEOs reflects, in part, the difference in their relative responsibilities.

The Compensation Committee also considers the retentive potential of its compensation decisions. Retention of the NEOs is critical to business continuity and succession planning.

Previously Awarded Compensation

The Compensation Committee approves or recommends compensation awards which are not contingent on the number, term or current value of other outstanding compensation previously awarded to the individual. The Compensation Committee believes that reducing or limiting current stock option grants or other forms of compensation because of prior gains realized by an executive officer would unfairly penalize the officer and reduce the motivation for continued high achievement.

Compensation Decisions Made For 2010

The following tables set out the performance objectives for 2010 for each NEO along with the percentage of short-term incentive available for achieving each objective, as well as the Compensation Committee’s determination of the amount to be paid for achievement, expressed as a percentage:

14

Anthony Makuch

| | Total Bonus available | | Bonus awarded | |

| | for achievement as a | | as a percentage | |

Objectives | | percentage of salary | | of salary | |

Share price performance at 90th percentile relative to peer group | | 30 | | 20 | |

Execute a strategy with Hochschild Mining plc in relation to the standstill expiring November 2010, which ensures equal treatment of all shareholders | | 22.5 | | 15 | |

Achieve cash flow and capital expenditures 10% below budget and ensure adequate liquidity for future growth | | 30 | | 30 | |

Execute planned development of Timmins West Mine Complex and Bell Creek Complex and position mines for future production goals | | 15 | | 10 | |

Increase total resources by 100% | | 15 | | 10 | |

Succession planning | | 15 | | 8 | |

Zero reportable environmental incidences | | 3.75 | | 2.5 | |

Total Injury Frequency Rate (incidents per 200,000 man hours) not more than 3 | | 3.75 | | 0 | |

Achieve 100,000 ounces in gold production | | 30 | | 18 | |

Board discretion | | | | 11.5 | |

TOTAL | | 165 | | 125 | |

Mario Stifano

| | Total Bonus available | | Bonus awarded | |

| | for achievement as a | | as a percentage | |

Objectives | | percentage of salary | | of salary | |

Share price performance at 90th percentile relative to peer group | | 3.75 | | 3.75 | |

Commercial production by Q4 | | 7.5 | | 7.5 | |

Achieve cash flow and capital expenditures 10% below budget | | 7.5 | | 7.5 | |

Ensure the Corporation has adequate liquidity through line of credit or other financing | | 15 | | 10 | |

Zero reportable environmental incidences | | 1.875 | | 1.25 | |

Total Injury Frequency Rate (incidents per 200,000 man hours) not more than 3 | | 1.875 | | 0 | |

Achieve 100,000 ounces in gold production | | 15 | | 9 | |

Achieve IFRS implementation on time and under budget | | 7.5 | | 5 | |

Maintain timely and accurate financial reporting | | 7.5 | | 5 | |

Implement policies and procedures to transition accounting and financial reporting to commercial production | | 7.5 | | 5 | |

Board and CEO discretion | | | | 5 | |

TOTAL | | 75 | | 59 | |

Brian Hagan

| | Total Bonus available | | Bonus awarded | |

| | for achievement as a | | as a percentage | |

Objectives | | percentage of salary | | of salary | |

Commercial production by Q4 | | 9 | | 6 | |

Achieve cash flow and capital expenditures 10% below budget | | 4.5 | | 3 | |

Zero reportable environmental incidences | | 2.25 | | 1.5 | |

Total Injury Frequency Rate (incidents per 200,000 man hours) not more than 3 | | 2.25 | | 0 | |

Achieve 100,000 ounces in gold production | | 18 | | 10.8 | |

Maintain compliance with HS&E management systems | | 4.5 | | 3 | |

Obtain approvals for Bell Creek | | 9 | | 4.8 | |

Obtain approvals for Timmins Mine | | 9 | | 6 | |

Have OHSAS 18000 elements in place by year end | | 9 | | 5.4 | |

Have ISO 14001 elements in place by year end | | 9 | | 5.4 | |

Implement Behaviour Based Safety, Workplace Demonstrations & Refresher Training | | 4.5 | | 0 | |

Negotiate impact and benefits agreement with First Nations | | 9 | | 6 | |

Board and CEO discretion | | | | 12 | |

TOTAL | | 90 | | 63.9 | |

15

Michael Kelly

| | Total Bonus available | | Bonus awarded | |

| | for achievement as a | | as a percentage | |

Objectives | | percentage of salary | | of salary | |

Achieve cash flow and capital expenditures 10% below budget | | 5.625 | | 5.625 | |

Execute planned development of Timmins West Mine Complex and Bell Creek Complex and position mines for future production goals | | 11.25 | | 7.5 | |

Zero reportable environmental incidences | | 2.8125 | | 1.875 | |

Total Injury Frequency Rate (incidents per 200,000 man hours) not more than 3 | | 2.8125 | | 0 | |

Commercial production by Q4 | | 28.125 | | 18.75 | |

Achieve 100,000 ounces in gold production | | 11.25 | | 6.75 | |

Achieve scheduled development for Timmins Mine and Bell Creek | | 5.625 | | 3.75 | |

Have OHSAS 18000 elements in place by year end | | 5.625 | | 3.375 | |

Have ISO 14001 elements in place by year end | | 5.625 | | 3.375 | |

Develop plans for deepening shaft at Timmins West Complex beginning 2011 | | 11.25 | | 0 | |

Develop plans for deepening shaft at Bell Creek Complex beginning 2011 | | 11.25 | | 6 | |

Succession planning | | 5.625 | | 3.375 | |

Finalize mill expansion plans | | 5.625 | | 3.75 | |

Board and CEO discretion | | | | 7.5 | |

TOTAL | | 112.5 | | 71.625 | |

Eric Kallio

| | Total Bonus available | | Bonus awarded | |

| | for achievement as a | | as a percentage | |

Objectives | | percentage of salary | | of salary | |

Share price performance at 90th percentile relative to peer group | | 3.75 | | 2.5 | |

Achieve cash flow and capital expenditures 10% below budget | | 3.75 | | 3.75 | |

Zero reportable environmental incidences | | 1.875 | | 1.25 | |

Total Injury Frequency Rate (incidents per 200,000 man hours) not more than 3 | | 1.875 | | 0 | |

Achieve 100,000 ounces in gold production | | 11.25 | | 6.75 | |

Have OHSAS 18000 elements in place by year end | | 1.875 | | 1.25 | |

Have ISO 14001 elements in place by year end | | 1.875 | | 1.25 | |

Replace resources at Timmins Mine | | 11.25 | | 7.5 | |

Advance models at Thunder Creek to facilitate advanced exploration work | | 7.5 | | 6.25 | |

Identify 1.5 million ounces of resources at Bell Creek Complex | | 7.5 | | 7.5 | |

Identify new target opportunities at Bell Creek West | | 3.75 | | 2.5 | |

Identify new target opportunities at West Timmins properties | | 3.75 | | 3.75 | |

Identify new target opportunities at Casa Berardi | | 3.75 | | 2.5 | |

Management of project evaluations and land management including exploration and asset maximization plan for Mexican assets | | 1.875 | | 1.25 | |

Maintain aggressive exploration program within approved budget of $28.9 million | | 1.875 | | 1.25 | |

Recruitment of personnel and development for succession planning | | 3.75 | | 2.5 | |

Board and CEO discretion | | | | 5 | |

TOTAL | | 71.25 | | 56.75 | |

The Compensation Committee assessed the individual performance of each of the NEOs subjectively in light of their contributions towards the overall performance of the Corporation in meeting its corporate and operational objectives, and the achievement of divisional targets. The Committee, in the exercise of its discretion, also considered each NEOs contributions to special projects and other activities deemed worthy of recognition, which advanced the interests of the Corporation but were not otherwise reflected in stated objectives.

Further information regarding Lake Shore Gold’s corporate financial and business performance can be found in Management’s Discussion and Analysis for the year ended December 31, 2010, filed on SEDAR (www.sedar.com).

16

Decisions Related To Executive Compensation That Were Taken After Year End

Following year-end, the Compensation Committee considered and approved salary increases for certain officers, including the CEO, of up to 20%, to align the officers with the median average salary for the position based on the Coopers Survey data, or to recognise the significant role and contributions of a particular NEO in the ongoing success of the Corporation.

In addition, based on Hugessen’s review and other factors, the Board adopted stock ownership guidelines for executives. All executives other than the CEO will be required to hold shares of the Corporation with a value equal to their annual salary, and the CEO will be required to hold shares of the Corporation with a value equal to twice his annual salary. All executives will have until March 2016 to comply.

The Compensation Committee is also developing a performance share unit plan as part of the Corporation’s long term incentive compensation for executives, which would reduce the Corporation’s reliance on stock options as long term incentive compensation. Further work with respect to the implementation and adoption of the plan is required and will be carried out over the course of the year.

Performance Graph

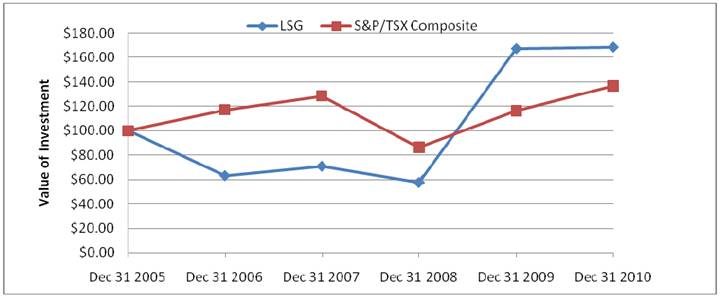

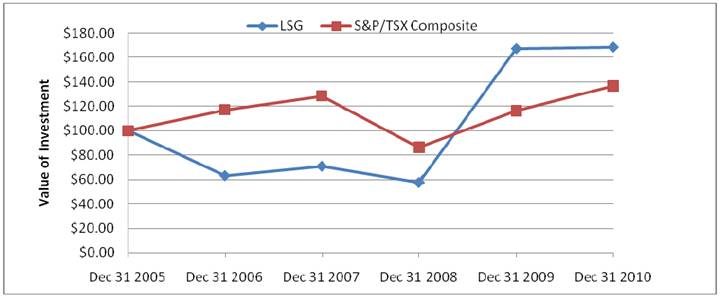

The following graph compares the yearly percentage change in the Corporation's cumulative total shareholder return on its Shares (being the percentage increase (or decrease) in the trading price of its Shares on a yearly basis based on an investment in the Corporation's Shares on December 31, 2005 with the cumulative total shareholder return of the S&P/TSX Composite Index assuming reinvestment of dividends. For comparison purposes it is assumed that $100 had been invested in the Corporation's Shares and in the securities contained in the S&P/TSX Composite Index on December 31, 2005, and compounded annually thereafter. On December 31, 2005, the closing price of the Corporation’s stock on the TSX was $2.47.

Date | | Dec 31 2005 | | Dec 31 2006 | | Dec 31 2007 | | Dec 31 2008 | | Dec 31 2009 | | Dec 31 2010 | |

LSG | | $ | 100 | | $ | 63.16 | | $ | 70.85 | | $ | 57.49 | | $ | 167.21 | | $ | 168.42 | |

S&P/TSX Composite | | $ | 100 | | $ | 117.26 | | $ | 128.79 | | $ | 86.28 | | $ | 116.53 | | $ | 137.05 | |

All of the current NEOs joined the Corporation after 2007. Since 2007, the overall trend in the Corporation’s stock price has been upward, more than doubling over that period. The Compensation

17

Committee believes the increase in the stock price reflects, in part, the efforts of the executive officers in moving the Corporation and its business forward during that period and growing the Corporation from an exploration company into a mining company. The Compensation Committee believes those same factors justify the increases in executive compensation that have occurred over the same period.

Summary Compensation Table

(a) | | (b) | | (c) | | (d) | | (e) | | (f1) | | (f2) | | (g) | | (h) | | (i) | |

| | | | | | | | | | Non-Equity Incentive

Plan Compensation

($) | | | | | | | |

| | | | | | Share- | | Option- | | | | Long- | | | | | | | |

| | | | | | based | | based | | Annual | | Term | | Pension | | All Other | | Total | |

Name and | | | | Salary | | Awards | | Awards | | Incentive | | Incentive | | Value | | Compensation | | Compensation | |

Principal Position | | Year | | ($) | | ($) | | ($) (4) | | Plans | | Plans | | ($) | | ($) | | ($) | |

Anthony Makuch (1) | | 2010 | | 600,000 | | — | | 2,518,910 | | 750,000 | | — | | 22,000 | | — | | 3,890,910 | |

| | 2009 | | 500,000 | | | | 1,009,985 | | 550,000 | | | | 30,000 | | — | | 2,089,985 | |

| | 2008 | | 333,333 | | | | 1,377,740 | | 460,000 | | | | 20,000 | | 330,000 | | 2,521,073 | |

Mario Stifano (2) | | 2010 | | 324,000 | | — | | 650,041 | | 179,010 | | — | | 19,440 | | — | | 1,172,491 | |

| | 2009 | | 270,000 | | | | 307,922 | | 148,500 | | | | 16,200 | | — | | 742,622 | |

| | 2008 | | 57,719 | | | | 125,865 | | 28,500 | | | | 2,700 | | | | 186,284 | |

Brian Hagan | | 2010 | | 265,000 | | — | | 270,850 | | 141,113 | | — | | 15,900 | | | | 692,863 | |

| | 2009 | | 250,000 | | | | 277,130 | | 156,250 | | | | 15,000 | | 49,315 | | 698,380 | |

| | 2008 | | 127,841 | | | | 207,870 | | 90,000 | | | | 6,875 | | | | 481,900 | |

Eric Kallio | | 2010 | | 252,000 | | — | | 529,620 | | 136,710 | | — | | 15,120 | | — | | 933,450 | |

| | 2009 | | 210,000 | | | | 307,922 | | 131,250 | | | | 12,600 | | — | | 661,772 | |

| | 2008 | | 80,500 | | | | 161,828 | | 40,250 | | | | 2,100 | | | | 284,678 | |

Mike Kelly (3) | | 2010 | | 280,000 | | — | | 581,374 | | 200,550 | | — | | 16,800 | | — | | 1,078,724 | |

| | 2009 | | 13,820 | | | | 543,385 | | 6,910 | | | | 0 | | | | 564,115 | |

(1) Anthony Makuch was appointed CEO of the Corporation effective March 1, 2008.

(2) Mario Stifano was appointed CFO of the Corporation effective October 15, 2008.

(3) Mike Kelly was appointed Senior Vice-President, Operations, effective December 14, 2009, and ceased to be an officer of the Corporation on February 24, 2011.

(4) The fair value of option-based awards is determined using the Black-Scholes option pricing model using the following assumptions: no dividends are to be paid; volatility of 67%; risk free interest rate of 1.79%, and expected life of 3.5 years.

Each of the NEOs is employed by the Corporation pursuant to an employment contract which sets out the NEO’s base salary and target bonus entitlements.

Incentive Plan Awards

OUTSTANDING SHARE-BASED AWARDS AND OPTION-BASED AWARDS

(a) | | (b) | | (c) | | (d) | | (e) | | (g) | | (j) | |

| | Option-based Awards | | Share-based Awards | |

| | | | | | | | | | | | Market or | |

| | | | | | | | | | Number of | | Payout | |

| | | | | | | | | | Shares or | | Value of | |

| | Number of | | | | | | | | Units | | Share- | |

| | Securities | | | | | | Value of | | of Shares | | based | |

| | Underlying | | Option | | | | Unexercised | | That | | Awards | |

| | Unexercised | | Exercise | | Option | | In-The-Money | | Have Not | | That Have | |

| | Options | | Price | | Expiration | | Options | | Vested | | Not Vested | |

Name | | (#) | | ($) | | Date | | ($)(1) | | (#) | | ($) | |

Anthony Makuch | | 1,152,300 | | 1.73 | | 1/2/2013 | | 2,800,089 | | — | | — | |

| | 400,000 | | 0.80 | | 11/6/2013 | | 1,344,000 | | | | | |

| | 492,000 | | 4.13 | | 11/17/2014 | | 14,760 | | | | | |

| | 1,395,000 | | 3.65 | | 10/05/2015 | | 711,450 | | | | | |

Mario Stifano | | 375,000 | | 0.89 | | 10/15/2013 | | 1,226,250 | | — | | — | |

| | 150,000 | | 4.13 | | 11/17/2014 | | 4,500 | | | | | |

18

| | 360,000 | | 3.65 | | 10/05/2015 | | 183,600 | | | | | |

Brian Hagan | | 150,000 | | 1.63 | | 5/5/2013 | | 379,500 | | — | | — | |

| | 300,000 | | 0.80 | | 11/6/2013 | | 1,008,000 | | | | | |

| | 135,000 | | 4.13 | | 11/17/2014 | | 4,050 | | | | | |

| | 150,000 | | 3.65 | | 10/05/2015 | | 76,500 | | | | | |

Eric Kallio | | 300,000 | | 1.28 | | 8/11/2013 | | 864,000 | | — | | — | |

| | 150,000 | | 4.13 | | 11/17/2014 | | 4,500 | | | | | |

| | 150,000 | | 3.15 | | 06/30/2015 | | 151,500 | | | | | |

| | 150,000 | | 3.65 | | 10/05/2015 | | 76,500 | | | | | |

Mike Kelly | | 300,000 | | 3.74 | | 12/13/2014 | | 126,000 | | | | | |

| | 180,000 | | 3.15 | | 06/30/2015 | | 181,800 | | | | | |

| | 150,000 | | 3.65 | | 10/05/2015 | | 76,500 | | | | | |

(1) Based on the December 31, 2010, closing price on the TSX, which was $4.16.

INCENTIVE PLAN AWARDS - VALUE VESTED OR EARNED DURING THE YEAR

(a) | | (b) | | (c) | | (d) | |

| | Option-Based Awards - | | Share-based Awards - | | | |

| | Value Vested During the | | Value Vested During the | | Non-equity Incentive Plan Compensation | |

| | Year | | Year | | - Value Earned During the Year | |

Name | | ($) | | ($) | | ($) | |

Anthony Makuch | | 837,320 | | — | | 750,000 | |

Mario Stifano | | 340,000 | | — | | 179,010 | |

Brian Hagan | | 265,850 | | — | | 141,113 | |

Eric Kallio | | 334,500 | | — | | 136,710 | |

Mike Kelly | | 374,000 | | — | | 200,550 | |

Pension Plan Benefits

DEFINED CONTRIBUTION PLAN

(a) | | (b) | | (c) | | (d) | | (e) | |

| | Accumulated Value at | | | | | | Accumulated Value at | |

| | Start of Year | | Compensatory | | Non-compensatory | | Year End | |

Name | | ($) | | ($) | | ($) | | ($) | |

Anthony Makuch | | 49,243.78 | | 22,000 | | 9,034.57 | | 80,278.35 | |

Mario Stifano | | 20,034.42 | | 19,440 | | 830.07 | | 40,304.49 | |

Brian Hagan | | 22,287.65 | | 15,900 | | 3,660.71 | | 41,848.36 | |

Eric Kallio | | 17,176.08 | | 15,120 | | 3,044.18 | | 35,340.26 | |

Mike Kelly | | 0 | | 16,800 | | 797.48 | | 17,597.48 | |

Every full time employee is eligible to participate in the Corporation’s pension plan as of the first day of the month following the employee’s date of hire, and the employee’s pension entitlement vests after one full year of continuous membership in the plan. The normal retirement age for the Corporation’s

19

pension plan is 55. A terminated member can convert his or her pension plan assets into income (in the form of a life income fund or an annuity) at age 45 (10 years prior to the normal retirement date).

Contributions are calculated as 6% of an employee’s base salary, and the potential income to the employee at the time of payout is a function of the returns generated based on the investment decisions made, which are controlled by the employee. The Canada Revenue Agency stipulates the minimum and maximum amount that can be withdrawn annually from a locked-in retirement account by an employee based on a prescribed rate, the value of the account and the employee’s age.

The Corporation does not have any policies on granting extra years of credited service.

The Corporation does not currently have any deferred compensation plans.

Termination and Change of Control Benefits

Each NEO of the Corporation has an employment agreement in place which provides for a payment in the event that the NEO is terminated other than for cause, or in the event that a Triggering Event (as described below) occurs within 12 months following a Change of Control (as described below).

A “Change of Control” will have occurred if any one of the following circumstances transpires (a) more than 50% of the current Board is replaced other than through natural attrition; (b) anyone acquires 50% or more of the Corporation’s common shares or the shareholders approve such an acquisition; (c) the Corporation disposes of a majority of its property or assets or the shareholders approve such a disposition; (d) the Corporation becomes insolvent or bankrupt.

A “Triggering Event” means the occurrence of any one of the following events without the agreement of the NEO: (i) an adverse change in any of the duties, powers, rights, discretion, prestige, salary, benefits or perquisites of the NEO; (ii) a diminution of the title of the NEO; (iii) a change in the position or body to whom the NEO reports; or (iv) a change in the hours or location of the NEO’s employment.

As well, the Corporation’s Stock Option Plan provides that all unvested options vest and become immediately exercisable upon a change of control, which is defined under the Stock Option Plan to mean the acquisition by any person (alone or together with joint actors) of not less than 20% of the issued and outstanding common shares of the Corporation.

In the event of a termination without cause, or both a Change of Control and Triggering Event,

· the CEO would be entitled to a payment equal to 24 months’ salary plus bonus and benefits coverage (or payment of an amount sufficient to obtain comparable benefits coverage);

· the Senior Vice President of Operations would be entitled to a payment equal to 12 months’ if the termination occurred in the second year, and 18 months’ if the termination occurred in any year thereafter; and

· each other NEO would be entitled to a payment of 12 months’ salary plus bonus and continued benefits coverage (or payment of an amount sufficient to obtain comparable benefits coverage).

There are no significant conditions or obligations with which a NEO must comply in order to receive payment.

Other significant terms of the agreements relating to the payments described above are that: none of the NEOs is required to mitigate his damages; each NEO is entitled to the full payment even if he obtains alternative employment; and the payment constitutes a full and final settlement of any claims that might otherwise exist as a result of termination of the NEO’s employment.

20

The following table sets out the estimated payments in the event of a termination or Triggering Event following a Change of control, assuming that the event giving rise to the payment occurred on the last business day of 2010.

PAYMENTS UPON TERMINATION OR CHANGE OF CONTROL

| | Amount in respect of | | Amount in respect of | | Amount in respect of | | | |

| | salary | | bonus | | benefits | | | |

| | $ | | $ | | $ | | TOTAL | |

Anthony Makuch | | 1,200,000 | | 1,100,000 | | 15,949 | | $ | 2,315,949 | |

Mario Stifano | | 324,000 | | 179,010 | | 6,823 | | $ | 509,833 | |

Brian Hagan | | 265,000 | | 156,250 | | 6,600 | | $ | 427,850 | |

Eric Kallio | | 252,000 | | 131,250 | | 6,438 | | $ | 389,688 | |

Mike Kelly | | 280,000 | | 140,000 | | 4,149 | | $ | 424,149 | |

Director Compensation

DIRECTOR COMPENSATION TABLE

(a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) | | (h) | |

| | | | Share- | | Option- | | Non-Equity | | | | | | | |

| | Fees | | based | | based | | Incentive Plan | | Pension | | All Other | | Total | |

| | Earned | | Awards | | Awards | | Compensation | | Value | | Compensation | | Compensation | |

Name | | ($) | | ($) | | ($) (2) | | ($) | | ($) | | ($) | | ($) | |

Alan Moon | | 118,731 | | — | | 184,178 | | — | | — | | — | | 302,909 | |

Daniel G. Innes | | 89,269 | | — | | 184,178 | | — | | — | | — | | 273,447 | |

Arnold Klassen | | 118,000 | | — | | 184,178 | | — | | — | | — | | 302,178 | |

Peter Crossgrove | | 110,019 | | — | | 184,178 | | — | | — | | — | | 294,197 | |

Frank Hallam | | 78,500 | | — | | 184,178 | | — | | — | | — | | 262,678 | |

Jonathan Gill | | 122,000 | | — | | 184,178 | | — | | — | | — | | 306,178 | |

Anthony Makuch (1) | | | | | | | | | | | | | | | |

(1) Mr. Makuch does not receive any compensation for his role as director and his compensation as President and CEO is reported in the Summary Compensation Table above.

(2) The fair value of option-based awards is determined using the Black-Scholes option pricing model using the following assumptions: no dividends are to be paid; volatility of 67%; risk free interest rate of 1.79%, and expected life of 3.5 years.

Material Factors Necessary to Understand Director Compensation

The compensation scheme for non-executive directors for 2010 included the following cash payments:

· an annual fee of $50,000;

· an additional annual fee of $25,000 for the Chair of the Board;

· an additional annual fee of $15,000 for the Chair of the Audit Committee;

· an additional annual fee of $5,000 for the Chair of each other committee of the Board;

· an additional $1,500 for each meeting attended, in person or by telephone;

21

· an additional $1,500 for each non-meeting day of service provided by a director in his capacity as such; and

· an additional $1,500 per meeting attended in person for each director who has to travel from outside the province where the meeting is held.

Directors are also reimbursed for travel and other expenses incurred in attending meetings and the performance of their duties.

For 2011, the Compensation Committee commissioned a report on non-executive director compensation from Hugessen Consulting. Hugessen was paid to conduct an analysis on the level and form of non-executive director compensation using the following comparator peer group:

Agnico Eagle

IAMGOLD Corp

Eldorado Gold Corp

Centerra Gold

Yamana Gold

Northgate Minerals

Red Back Mining

Inmet Mining Corporation

Quadra FNX Mining

Aurizon Mines Ltd

New Gold Inc

HudBay Minerals Corp

The report reviewed director compensation including:

· Cash retainer and value of equity retainer;

· Committee chair premiums;

· Meeting fees;

· Board Chair compensation; and

· Other travel fees, flat fees, etc.

Hugessen commented that the compensation for the non-executive Board Chair was below the 25th percentile, and that compensation for other director roles was generally positioned at median of peer group.

Based on the results of the review and other factors taken into consideration, the Board approved an increase to the annual fee for the Chair of Board to $75,000. The Board also adopted Hugessen’s recommendation to increase the stock ownership guidelines for non-executive directors; non-executive directors are now required to hold shares of the Corporation valued at $150,000, and must comply by March 2014. There were no other changes made to the Board Compensation.

22

Director Option-based Awards

DIRECTOR OUTSTANDING SHARE-BASED AWARDS AND OPTION-BASED AWARDS

(a) | | (b) | | (c) | | (d) | | (e) | | (g) | | (j) | |

| | Option-based Awards | | Share-based Awards | |

| | | | | | | | | | Number of | | | |

| | | | | | | | | | Shares or | | Market or | |

| | Number of | | | | | | | | Units | | Payout Value | |

| | Securities | | | | | | Value of | | of Shares | | of Share- | |

| | Underlying | | Option | | | | Unexercised | | That | | based Awards | |

| | Unexercised | | Exercise | | Option | | In-The-Money | | Have Not | | That Have Not | |

| | Options | | Price | | Expiration | | Options | | Vested | | Vested | |

Name | | (#) | | ($) | | Date | | ($)(2) | | (#) | | ($) | |

Alan Moon | | 50,000 | | 1.75 | | 11/23/2011 | | 120,500 | | — | | — | |

| | 50,000 | | 1.96 | | 11/20/2012 | | 110,000 | | | | | |

| | 60,000 | | 0.80 | | 11/6/2013 | | 201,600 | | | | | |

| | 51,000 | | 4.13 | | 11/17/2014 | | 1,530 | | | | | |

| | 102,000 | | 3.65 | | 10/05/2015 | | 52,020 | | | | | |

Daniel G. Innes | | 50,000 | | 1.75 | | 11/23/2011 | | 120,500 | | — | | — | |

| | 50,000 | | 1.96 | | 11/20/2012 | | 110,000 | | | | | |

| | 60,000 | | 0.80 | | 11/6/2013 | | 201,600 | | | | | |

| | 51,000 | | 4.13 | | 11/17/2014 | | 1,530 | | | | | |

| | 102,000 | | 3.65 | | 10/05/2015 | | 52,020 | | | | | |

Arnold Klassen | | 50,000 | | 1.60 | | 5/25/2013 | | 128,000 | | — | | — | |

| | 60,000 | | 0.80 | | 11/6/2013 | | 201,600 | | | | | |

| | 51,000 | | 4.13 | | 11/17/2014 | | 1,530 | | | | | |

| | 102,000 | | 3.65 | | 10/05/2015 | | 52,020 | | | | | |

Jonathan Gill | | 50,000 | | 1.27 | | 8/8/2013 | | 144,500 | | — | | — | |

| | 60,000 | | 0.80 | | 11/6/2013 | | 201,600 | | | | | |

| | 51,000 | | 4.13 | | 11/17/2014 | | 1,530 | | | | | |

| | 102,000 | | 3.65 | | 10/05/2015 | | 52,020 | | | | | |

Peter Crossgrove | | 36,500 | | 2.12 | | 06/24/2014 | | 74,460 | | — | | — | |

| | 102,000 | | 4.13 | | 11/17/2014 | | 3,060 | | | | | |

| | 102,000 | | 3.65 | | 10/05/2015 | | 52,020 | | | | | |

Frank Hallam | | 237,250 | | 0.55 | | 9/21/2011 | | 856,472.5 | | — | | — | |

| | 73,000 | | 0.82 | | 1/7/2014 | | 243,820 | | | | | |

| | 36,500 | | 2.12 | | 6/24/2014 | | 74,460 | | | | | |

| | 102,000 | | 4.13 | | 11/17/2014 | | 3,060 | | | | | |

| | 102,000 | | 3.65 | | 10/05/2015 | | 52,020 | | | | | |

Anthony Makuch (1) | | | | | | | | | | | | | |

(1) Option information for Mr. Makuch is disclosed above in the table describing Outstanding Share-Based Awards and Option-Based Awards for officers.

(2) Based on the December 31, 2010, closing price on the TSX, which was $4.16.

Option grants to directors are intended as a long term incentive and vest in equal portions over three years.

INCENTIVE PLAN AWARDS - VALUE VESTED OR EARNED DURING THE YEAR

(a) | | (b) | | (c) | | (d) | |

| | | | Share-based Awards - | | Non-equity Incentive Plan | |

| | Option-Based Awards - Value | | Value Vested During the | | Compensation - Value Earned During | |

| | Vested During the Year | | Year | | the Year | |

Name | | ($) | | ($) | | ($) | |

Alan Moon | | 86,210 | | — | | — | |

Daniel G. Innes | | 86,210 | | — | | — | |

Arnold Klassen | | 86,210 | | — | | — | |

Jonathan Gill | | 107,377 | | — | | — | |

Peter Crossgrove | | 140,420 | | — | | — | |

Frank Hallam | | 140,420 | | — | | — | |

Anthony Makuch (1) | | | | | | | |

23

(1) Option information for Mr. Makuch is disclosed above in the table describing Incentive Plan Awards - Value Vested or Earned During the Year for officers.

To ensure that directors’ interests are aligned with those of the Corporation’s shareholders, the Board adopted a policy in 2008 that requires each director to hold shares of the Corporation with a market value of not less than $50,000. Directors have three years from the earlier of the date the policy was implemented and the date they joined the board to satisfy the requirement. The following table indicates whether each director has satisfied the requirement as of March 25, 2011.

Director | | Shares | | Value | | | |

Alan C. Moon | | 188,700 | | $ | 766,122 | | Currently satisfies requirement | |

Daniel G. Innes | | 772,400 | | $ | 3,135,944 | | Currently satisfies requirement | |

Arnold Klassen | | 19,800 | | $ | 80,388 | | Currently satisfies requirement | |

Peter Crossgrove | | 195,353 | | $ | 793,133 | | Currently satisfies requirement | |

Frank Hallam | | 481,935 | | $ | 1,956,656 | | Currently satisfies requirement | |

Jon Gill | | 20,000 | | $ | 81,200 | | Currently satisfies requirement | |

EQUITY COMPENSATION PLAN INFORMATION

The following table sets out certain information, as at the end of the Corporation’s most recently completed financial year.

| | | | | | Number of securities | |

| | | | | | remaining available for | |

| | Number of Securities to be | | | | future issuance under equity | |

| | issued upon exercise of | | Weighted-average exercise | | compensation plans | |

| | outstanding options, | | price of outstanding options, | | (excluding securities | |

| | warrants and rights | | warrants and rights ($) | | reflected in column (a)) | |

Plan Category | | (a) | | (b) | | (c) | |

Equity Compensation plans | | 18,739,769 | (1) | $ | 2.9719 | | 19,160,755 | |

approved by security holders | | 1,199,750 | (2) | $ | 1.2084 | | n/a | |

Equity compensation plans not approved by security holders | | 513,000 | (3) | $ | 3.85 | | n/a | |

Total | | | | | | | |

(1) Securities issuable under the Corporation’s Stock Option Plan (described below).

(2) Securities issuable by the Corporation under the West Timmins Mining Inc. stock option plan as a result of the business combination on November 6, 2009.

(3) Securities issuable by the Corporation under warrants issued in connection with certain acquisitions of property.

INDEBTEDNESS OF DIRECTORS AND OFFICERS

None of the current or former directors, employees or executive officers of the Corporation, none of the proposed directors of the Corporation and none of the associates of such persons is or has been indebted to the Corporation at any time since the beginning of the Corporation’s last completed financial year. Furthermore, none of such persons were indebted to a third party during such period

24

where their indebtedness was the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Corporation or its subsidiaries.

MANAGEMENT CONTRACTS

Management services for the Corporation or its subsidiaries are not performed by persons other than the executive officers of the Corporation (see “Statement of Executive Compensation”).

CORPORATE GOVERNANCE DISCLOSURE

The following Corporate Governance Disclosure is provided pursuant to National Policy 58-201 Corporate Governance Guidelines as well as National Instrument 58-101, Disclosure of Corporate Governance Practices.

1. Board of Directors

a. The following directors have been determined by the Board to be independent, as defined in National Instrument 58-101, as they are not members of management and are free from any interest and any business or other relationship which could, or could reasonably be perceived to, materially interfere with the director’s ability to act with the best interests of the Corporation, other than interests and relationships arising from shareholding: Alan C. Moon, Jonathan Gill, Arnold Klassen, Peter Crossgrove, Daniel Innes and Frank Hallam.

b. Anthony Makuch is the President and CEO and is therefore not considered independent for the purposes of National Instrument 58-101.

c. A majority of directors is independent.

d. Certain of the current directors are presently a director of one or more other reporting issuers, as follows:

Director | | Other Issuer |

Alan C. Moon | | Northern Superior Resources Inc. |

| | TransAtlantic Petroleum Corp. |

| | AvenEx Energy Corp. |

Daniel G. Innes | | Zincore Metals Corp. |

Arnold Klassen | | Northern Superior Resources Inc. |

| | Zincore Metals Inc. |

Peter Crossgrove | | Barrick Gold Corporation |

| | Excellon Resources Inc. |

| | Lateegra Gold Corp. |

| | QLT Inc. |

| | Dundee REIT |

| | Pelangio Mines Inc. |

| | Detour Gold Corporation (Vice-Chairman) |

Frank Hallam | | Platinum Group Metals Ltd. |

| | MAG Silver Corp. |

| | West Kirkland Mining Inc. |

| | Nextraction Energy Corp. |

25

e. Each regularly scheduled Board meeting is either preceded or followed by an in camera meeting which members of management do not attend. The Chair informs management of the substance of these meetings to the extent that action is required by management. During 2010 the directors met four times when members of management were not in attendance.

f. The Chair of the Board, Alan C. Moon, is an independent director, which enhances the Board’s ability to function independently of management. It is the Chair’s responsibility to ensure that the relationships between management, shareholders and the Board are efficient and effective. The Chair acts as a resource for the CEO and at all times retains an independent perspective to represent the best interests of the Corporation.

g. The following chart illustrates the number of meetings of the Board and each committee, and the directors’ attendance during 2010, with each director’s attendance shown relative to the number of meetings in which he was eligible to participate.

| | Board | | Committees | |

| | | | | | | | Corporate | | | | Health, Safety | |

| | | | | | | | Governance and | | | | Environment and | |

Director | | Regular | | Special | | Audit | | Nominating | | Compensation | | Community | |

Alan C. Moon | | 4/4 | | 4/4 | | — | | 4/4 | | 7/7 | | — | |

Daniel G. Innes | | 4/4 | | 4/4 | | — | | — | | — | | 4/4 | |

Anthony Makuch | | 4/4 | | 4/4 | | — | | — | | — | | — | |

Arnold Klassen | | 4/4 | | 4/4 | | 4/4 | | — | | — | | — | |

Jonathan Gill | | 4/4 | | 4/4 | | — | | — | | 4/4 | | 4/4 | |

Frank Hallam | | 4/4 | | 4/4 | | 2/2 | | — | | — | | 2/2 | |

Peter Crossgrove | | 4/4 | | 4/4 | | — | | 4/4 | | — | | — | |

2. Board Mandate

The mandate of the Board is to supervise the management of the Corporation and to act in the best interests of the Corporation. The Board acts in accordance with the Canada Business Corporations Act; the Corporation’s Articles of Continuance; the Corporation’s Code of Business Conduct and Ethics; the Mandate of the Board and the charters of the Board’s committees and other applicable laws and policies. The Board approves significant decisions that affect the Corporation before they are implemented. As a part of its overall responsibility for the stewardship of the Corporation, the Board assumes responsibility for the following:

a. Stewardship

The Board sets and supervises standards of corporate governance that create a culture of integrity throughout the Corporation, and guides the operations of the Corporation and management in compliance with the Corporation’s constating documents and Canadian corporate law, securities legislation in each jurisdiction in which the Corporation is a reporting issuer, and other applicable laws.

b. Strategic Planning

The Board is actively involved in the Corporation’s strategic planning process. Management discusses and reviews materials relating to the strategic plan with the Board. The Board is responsible for reviewing and approving the strategic plan, which takes into account the opportunities and risks of the business. Following the

26