Exhibit 99.5

Annual Information Form

Lake Shore Gold Corp

For the year ended December 31, 2010

Dated as of March 30, 2011

Table of Contents

CAUTION REGARDING FORWARD-LOOKING STATEMENTS | 1 |

| |

CORPORATE STRUCTURE | 2 |

| |

NAME, ADDRESS AND INCORPORATION | 2 |

INTERCORPORATE RELATIONSHIPS | 3 |

| |

GENERAL DEVELOPMENT OF THE BUSINESS | 3 |

| |

THREE YEAR HISTORY | 3 |

TRENDS | 6 |

| |

DESCRIPTION OF BUSINESS | 6 |

| |

GENERAL | 6 |

RISK FACTORS | 10 |

MINERAL PROJECTS | 17 |

| |

DESCRIPTION OF CAPITAL STRUCTURE | 35 |

| |

GENERAL DESCRIPTION OF CAPITAL STRUCTURE | 35 |

| |

MARKET FOR SECURITIES | 35 |

| |

TRADING PRICE AND VOLUME | 35 |

| |

DIRECTORS AND OFFICERS | 36 |

| |

NAME, OCCUPATION AND SECURITY HOLDING | 36 |

CONFLICTS OF INTEREST | 44 |

| |

AUDIT COMMITTEE | 44 |

| |

LEGAL PROCEEDINGS | 45 |

| |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 46 |

| |

TRANSFER AGENTS AND REGISTRARS | 46 |

| |

MATERIAL CONTRACTS | 46 |

| |

INTERESTS OF EXPERTS | 46 |

| |

ADDITIONAL INFORMATION | 47 |

| |

GLOSSARY OF TERMS | 48 |

All information in this Annual Information Form (“AIF”) is as of December 31, 2010, unless otherwise indicated.

All information stated to be incorporated by reference in the AIF is filed on the SEDAR website (www.sedar.com).

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

All statements, other than statements of historical fact, contained or incorporated by reference in this AIF including, but not limited to, any information as to the future financial or operating performance of Lake Shore Gold Corp., constitute “forward-looking information” or “forward-looking statements” within the meaning of certain securities laws, including the provisions of the Securities Act (Ontario) and the provisions for “safe harbour” under the United States Private Securities Litigation Reform Act of 1995, and are based on expectations, estimates and projections as of the date of this AIF or, in the case of documents incorporated by reference herein, as of the date of such documents. Forward-looking statements are provided for the purpose of providing information about management’s expectations and plans relating to the future. All of the forward-looking statements made in this Annual Information Form are qualified by these cautionary statements and those made in our other filings with the securities regulators of Canada.

Other than as specifically required by law, the Corporation does not intend, and does not assume any obligation, to explain any material difference between subsequent actual events and such forward-looking statements, or to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events, whether as a result of new information, future events or results or otherwise. These forward-looking statements represent management’s best judgment based on facts and assumptions that management considers reasonable, including that: there are no significant disruptions affecting operations, whether due to labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise; permitting, development, operations, expansion and acquisitions at the Timmins Gold Complex continue on a basis consistent with the Corporation’s current expectations; permitting, development and operations at the Bell Creek Complex continue on a basis consistent with the Corporation’s current expectations; the exchange rate between the Canadian dollar and the U.S. dollar stays approximately consistent with current levels; certain price assumptions for gold and silver hold true; prices for fuel, electricity and other key supplies remains consistent with current levels; production and cost of sales forecasts meet expectations; the accuracy of the Corporation’s current mineral reserve and mineral resource estimates hold true; and labour and materials costs increase on a basis consistent with the Corporation’s current expectations. The Corporation makes no representation that reasonable business people in possession of the same information would reach the same conclusions.

Forward-looking statements include, but are not limited to, possible events, statements with respect to possible events, statements with respect to the future price of gold and other metals, the estimation of mineral resources and reserves, the realization of mineral reserve and resource estimates, the timing and amount of estimated future production, costs of production, expected capital expenditures, costs and timing of the development of new deposits, success of exploration and development activities, permitting time lines, currency fluctuations, requirements for additional capital, government regulation of exploration and mining operations, environmental risks, unanticipated reclamation expenses, title disputes or claims, completion of acquisitions and their potential impact on the Corporation and its operations, limitations on insurance coverage and the timing and possible outcome of pending litigation. In certain cases, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain

1

actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Corporation to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. As well as those factors discussed in the section entitled “Risk Factors” in this AIF, known and unknown risks which could cause actual results to differ materially from projections in forward-looking statements include, among others: fluctuations in the currency markets; fluctuations in the spot and forward price of gold or certain other commodities (such as diesel fuel and electricity); changes in interest rates; changes in national and local government legislation, taxation, controls, regulations and political or economic developments in Canada and Mexico or other countries in which the Corporation may carry on business in the future; business opportunities that may be presented to, or pursued by, the Corporation; the Corporation’s ability to successfully integrate acquisitions; operating or technical difficulties in connection with mining or development activities; employee relations; the speculative nature of gold exploration and development, including the risks of obtaining necessary licenses and permits; diminishing quantities or grades of reserves; and contests over title to properties, particularly title to undeveloped properties. In addition, there are risks and hazards associated with the business of gold exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks).

Although the Corporation has attempted to identify important factors (which it believes are reasonable) that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

CORPORATE STRUCTURE

Name, Address and Incorporation

Lake Shore Gold Corp. (“Lake Shore Gold” or the “Corporation”) was formed through an amalgamation in the Province of British Columbia on July 7, 1987, under the name Iron Lady Resources Inc. The Corporation changed its name to Takepoint Ventures Ltd. on August 25, 1993. On June 25, 2002, the Corporation consolidated its share capital on the basis of one new share for every three old shares, changed its name to Consolidated Takepoint Ventures Ltd. and was continued under the Yukon Business Corporations Act. On December 16, 2002, the Corporation completed a business reorganization and changed its name to “Lake Shore Gold Corp.” On June 4, 2004, Lake Shore Gold was continued under the British Columbia Business Corporations Act and on July 18, 2008 the Corporation was continued under the Canada Business Corporations Act (the “Act”).

The Corporation’s corporate head office and principal place of business is Suite 2000, 181 University Avenue, Toronto Ontario, M5H 3M7. The Corporation also has offices at 1515 Government Road, Timmins, Ontario, P4R 1N4. The Corporation is a reporting issuer in British Columbia, Alberta, Manitoba, Ontario and Québec.

2

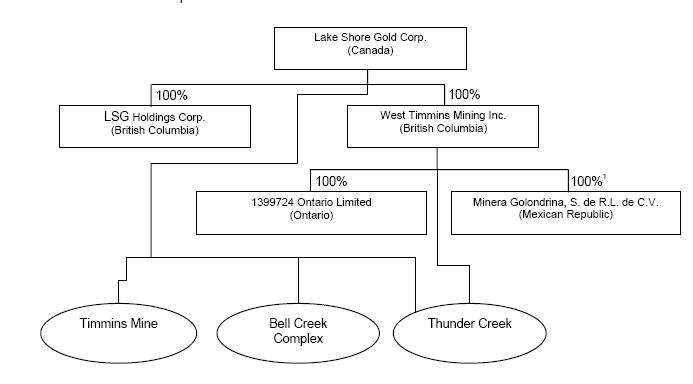

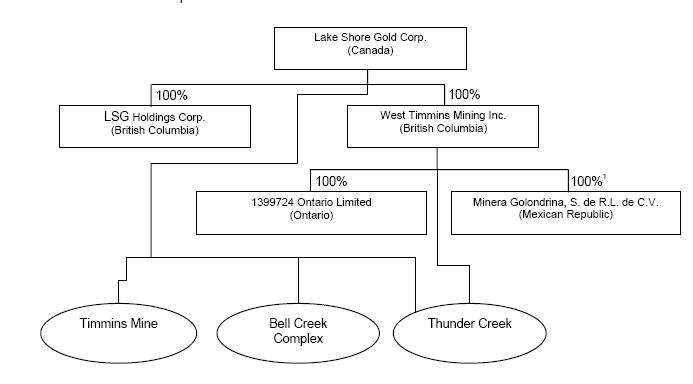

Intercorporate Relationships

The following chart illustrates the Corporation’s principal subsidiaries (collectively, the “Subsidiaries”), together with the governing law of each company and the percentage of voting securities beneficially owned or over which control or direction is exercised by the Corporation, as well as the Corporation’s principal mineral properties. As used in this AIF, except as otherwise required by the context, reference to “Lake Shore Gold” or the “Corporation” means, collectively, Lake Shore Gold Corp. and the Subsidiaries.

(1) In accordance with Mexican law which requires corporations to have at least two shareholders, a 0.002% interest in Minera Golondrina S. de R.L. de C.V. is currently held by Frank Hallam in trust for West Timmins Mining Inc.

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

During the past three years, the Corporation has conducted its mineral exploration activities in Ontario and Québec, with the focus being its Timmins Mine project (the “Timmins Mine” or “Timmins project”, formerly referred to as “Timmins West”) in Ontario.

In December 2007, Lake Shore Gold completed the acquisition from the Porcupine Joint Venture (the “PJV”), a joint venture between Goldcorp Canada Ltd. and Kinross Gold Corporation, of the PJV’s Bell Creek Mine and associated infrastructure located in the Timmins Gold Camp, adjacent to Lake Shore Gold’s Vogel-Schumacher property.

In February 2008, Lake Shore Gold entered into a strategic alliance with Hochschild Mining plc (“Hochschild”), resulting in Hochschild investing $65 million in the Corporation, and becoming a significant shareholder of Lake Shore Gold and a strategic partner for future projects. Lake Shore Gold and Hochschild entered into an agreement governing the future relationship, including terms with respect to Hochschild’s representation on Lake Shore Gold’s board of directors and Hochschild’s shareholding percentage.

3

In April 2008, Lake Shore Gold reached an agreement with Hochschild to complete a second financing transaction contemplated under the Strategic Alliance Agreement, which was completed in June 2008, with proceeds to Lake Shore Gold of $79.6 million.

In July 2008, Lake Shore Gold signed an Exploration Agreement with the Flying Post First Nation (“FPFN”) and Mattagami First Nation (“MFN”) in order to promote a cooperative and mutually respectful relationship between the FPFN and MFN and the Corporation as it moves forward with exploration and advanced exploration work on the Timmins property. The agreement established a framework for ongoing dialogue and consultation between the parties, including providing business, employment and training opportunities for members of the two First Nations groups.

At the end of July 2008, the Corporation commenced shaft sinking work at the Timmins project as part of the advanced exploration program.

In September 2008, Lake Shore Gold commenced driving a ramp from surface to access ore above the 400 metre level at its Timmins Mine property.

In March 2009, Lake Shore Gold completed a bought deal financing of 30,615,871 common shares at $1.55 per common share and 6,616,185 flow-through common shares at $2.00 per flow-through common share for net proceeds of $57.6 million.

Also in March 2009, Lake Shore Gold commenced processing development ore at its Bell Creek Mill, and signed an Exploration Agreement with four First Nations with respect to advanced exploration at the Bell Creek Complex.

In April 2009 Lake Shore Gold obtained approval for the Closure Plan for the Bell Creek Complex Advanced Underground Exploration Program, involving the re-establishment of the Bell Creek shaft and development of a ramp from surface.

In June 2009, Lake Shore Gold announced results from diamond drilling at its Thunder Creek project, including one of the best high-grade intercepts ever drilled in the Timmins Gold Camp, of 12.75 gpt Au over 83.40m in hole TC09-68b.

In August 2009, Lake Shore Gold announced an agreement to complete a business combination with West Timmins Mining Inc., pursuant to which Lake Shore Gold would acquire all of the shares of West Timmins Mining Inc., creating the large-scale, wholly-owned Timmins West Gold Complex on the western Timmins mining trend, incorporating the Corporation’s Timmins Mine and an extensive land package of adjacent exploration properties covering 130 square kilometres.

In October 2009, Lake Shore Gold entered into an agreement with Goldcorp Canada Ltd. and Goldcorp Inc. for the purchase of approximately 28 square kilometres of prospective exploration property in the surrounding vicinity of Lake Shore Gold’s Bell Creek Complex.

In November 2009, Lake Shore Gold completed the business combination with West Timmins Mining Inc. and commenced an advanced underground exploration program at the Thunder Creek project, including two drifts from the Timmins Mine at the 650 Level and 200 Level targeting high-grade mineralization at Thunder Creek.

Also in November 2009, Lake Shore Gold announced an agreement with Hochschild Mining Holdings Ltd. to raise $85.0 million through a private placement of 19.2 million shares at a price of $4.43 per share. In addition, the Corporation announced a structured flow-through financing for the issuance of 2.7 million shares for net proceeds of $15.0 million.

In December 2009, Lake Shore Gold completed the acquisition of the property around its Bell Creek Complex from Goldcorp Canada Ltd. and Goldcorp Inc., as well as closing the $85 million

4

private placement with Hochschild Mining Holdings Ltd. and the first tranche of the flow-through financing (gross proceeds of $8 million).

Also in December 2009, Lake Shore Gold acquired an interest in RT Minerals Corp. by purchasing 6,000,000 common shares, representing 22% of the issued and outstanding shares, and 6,000,000 common share purchase warrants. At the same time the Corporation entered into a strategic alliance agreement with RT Minerals Corp., pursuant to which the Corporation has the right to nominate two directors to the board of RT Minerals Corp. and can acquire a 50% interest in RT Minerals Corp.’s Golden Property.

In January 2010, Lake Shore Gold acquired an additional 1,500,000 common shares and 1,500,000 common share purchase warrants in the capital of RT Minerals Corp., bringing the Corporation’s total shareholdings to 26.2% of the issued and outstanding shares and 36.6% of the fully diluted share capital.

In February 2010, Lake Shore Gold closed the second tranche of the flow-through financing announced in November 2009, for net proceeds of $7.2 million.

In May 2010, Lake Shore Gold completed the sale of the Corporation’s 50% ownership interest in the Ti-pa-haa-kaa-ning Joint Venture to Northern Superior Resources Inc. (“Northern Superior”) in return for the issuance from treasury of 25,000,000 common shares of Northern Superior and warrants to purchase 12,500,000 Northern Superior common shares at a price of $0.30 per share for 5 years. In connection with the sale of the Corporation’s interest in the Ti-pa-haa-kaa-ning Joint Venture, the Corporation and Northern Superior entered into a shareholder rights agreement which provides Lake Shore Gold with the right, for a period of five years, to participate pro rata in future equity financings by Northern Superior in order to maintain its ownership interest. As well, Lake Shore Gold is entitled to nominate two directors for election to Northern Superior’s board.

In June 2010, Lake Shore Gold completed an access ramp at the 200m level connecting the Timmins Mine to the mineralized Rusk Zone at the Thunder Creek deposit.

In October 2010, Lake Shore Gold acquired an additional 12,500,000 common shares of Northern Superior upon the exercise of purchase warrants issued to Lake Shore Gold in connection with the sale in May 2010 of the Corporation’s 50% ownership interest in the Ti-pa-haa-kaa-ning Joint Venture to Northern Superior.

In November 2010, Lake Shore Gold completed the expansion of the Bell Creek Mill to a capacity of 2,000 tonnes per day, and during the month processed approximately 54,000 tonnes of ore, producing approximately 12,000 ounces of gold.

Also in November 2010, Lake Shore Gold completed the access ramp at the 650m level connecting the Timmins Mine to the mineralized Rusk Zone at the Thunder Creek deposit.

In December 2010, Lake Shore Gold’s Closure Plan for mine production at the Timmins Mine was filed by Ontario’s Ministry of Northern Development and Mines.

Also in December 2010, Lake Shore Gold issued an initial resource estimate for the Bell Creek Mine containing 8,427,000 tonnes with an average grade of 4.40 grams per tonne Au (“gpt”) for a total of 1,192,900 contained ounces in the inferred category, and 1,790,000 tonnes at 4.36 gpt for 251,200 contained ounces in the measured and indicated categories. (See “Mineral Projects — Bell Creek Complex” below.)

In January 2011, Lake Shore Gold declared commercial production at its Timmins Mine.

5

Also in January 2011, Lake Shore Gold made additional investments in each of RT Minerals Corp. and Northern Superior. The transaction with RT Minerals Corp. involved the transfer of certain non-core properties to RT Minerals Corp. for common shares of RT Minerals Corp. issued from treasury, as well as a subscription for additional shares and warrants. Lake Shore Gold also acquired RT Minerals Corp.’s interest in the Golden Property and certain back-in rights to RT Minerals Corp.’s interest in the Meunier joint venture. The Corporation acquired additional shares in Northern Superior through a structured transaction in connection with a financing by Northern Superior, allowing the Corporation to maintain its percentage ownership at 25.5%.

In February 2011, Lake Shore Gold finalized a US$50 million, three-year corporate revolving credit facility with UniCredit Bank AG, to provide the Corporation with financial flexibility for future capital expenditures and general corporate purposes.

Trends

Management is not aware of any trend, commitment, event or uncertainty outside the ordinary course of business that would be reasonably expected to have a material effect on Lake Shore Gold’s business, financial condition or results of operations as at the date of this AIF.

DESCRIPTION OF BUSINESS

General

Lake Shore Gold is a rapidly growing gold mining company anchored in the Timmins Gold Camp of Northern Ontario. With a current workforce of approximately 600 employees and contractors, the Company is transitioning into a mid-tier gold producer through the successful exploration and development of a number of quality projects and exploration properties. The Company’s first mine, Timmins Mine, achieved commercial production effective January 1, 2011, with the Thunder Creek and Bell Creek projects being developed over the next two to three years. Properties such as 144, Gold River Trend, Marlhill Mine, Vogel and Wetmore provide the Company with significant potential for additional discoveries in Timmins in support of future growth. The Company’s production is delivered to its wholly owned milling facility, located on the east side of Timmins, which has a current operating capacity of 2,000 tonnes per day with plans being developed for further expansion. Lake Shore Gold also owns extensive land positions throughout other parts of the Abitibi Greenstone belt in Northern Ontario and Quebec, as well as in Mexico, which provide attractive longer-term exploration potential.

Principal Properties

1. Timmins Gold Camp

The following Lake Shore Gold properties are part of an area known as the “Timmins Gold Camp”. The Timmins Gold Camp has been a substantial producer of gold since its discovery in the early 1900s.

a. Timmins Mine

Lake Shore Gold acquired 100% of the Timmins Mine property in 2004 through a business combination with Holmer Gold Mines Limited. The Timmins Mine consists of a contiguous block of 23 claims (12 leased claims, which are grouped into two 21-year leases and 11 individual patented claims) covering approximately 395 hectares. One of the claims (which does not contain any portion of the current reserves or resources on the Timmins Mine property) is subject to a 1.5% net smelter returns royalty, which the Corporation can purchase for $1.0 million. All 23 claims cover both mining and surface rights.

6

Timmins Mine is located at the west end of the Timmins gold mining district. In late 2007, the Corporation established an initial mineral reserve and commenced work on an advanced underground exploration program. The program involved driving a ramp from surface and sinking a 710 metre shaft in order to expose and ultimately develop on mineralization in the Footwall, Ultramafic, Vein and Main Zones of the Timmins deposit, as well as to support an underground diamond drilling program to both confirm and expand the currently identified reserve and to identify new resources.

The Timmins shaft was completed to the 710 metre level early in 2010. Installation of the skips, loading pocket steel, hoist upgrades and surface dump infrastructure were completed by early May 2010, at which time the shaft was commissioned and the skipping of waste commenced. Initial work off the shaft involved access development on the 650 Level towards the Ultramafic 1(“UM1”) and 1a (“UM1a”) zones as well as ramping to the 630 and 610 Levels. The 630 Level access development was largely completed during the second quarter of 2010, including the silling of the initial stope test blocks between the 630 and 650 levels. During the second half of 2010, the Corporation’s production from the UM1 and UM1a zones was 121,000 and 29,000 tonnes of ore, respectively, at average grades of 7.7 grams per tonne and 4.3 grams per tonne, respectively. The realized head grades from both correlates very closely with the geological estimate of 7.3 gpt and 4.5 gpt, respectively, for the UM1 and UM1a zones. The ramp at Timmins Mine advanced to below the 290 Level as of the end of 2010, with approximately 100,500 tonnes (9,425 ounces) being mined from stopes between the 140 and 260 metre levels during 2010.

Commercial production at Timmins Mine was declared effective January 1, 2011.

b. Bell Creek Complex

The Bell Creek Complex includes the Bell Creek Mine and Mill as well as the contiguous Vogel and Schumacher properties, comprising 3 crown mining leases, 5 freehold patents and 2 private mining leases, covering 451.2 hectares. The Bell Creek mine is a former producer with attractive exploration potential. The mine includes a shaft, hoist, headframe, ore bin, collar house, hoist building, mine dry, office complex, and underground mine workings. The Vogel/Schumacher properties cover approximately 1.6 kilometres between the high-grade Hoyle Pond and Bell Creek mines. A Closure Plan for the Bell Creek Complex Advanced Exploration Program has been approved by and filed with Ontario´s Ministry of Northern Development, Mines and Forestry.

During 2010, approximately 5,500 meters of ramp and lateral development was completed at the Bell Creek Mine. As of December 31, 2010, over 1,050 metres of sill development along the North A Zone on the 320,330, 345,355 and 370 levels had been completed. The mineralization encountered in the development to date is consistent with results from previous surface diamond drilling, and shows a distinct east-west trending and steeply southward dipping gold rich quartz vein and alteration zone with widths of up to 3.00 meters. As of year end the main ramp had reached the 385 Level.

On December 1, 2010, the Corporation reported an initial NI 43-101 resource for the Bell Creek Mine. The reported resource contains 8,427,000 tonnes with an average grade of 4.40 grams per tonne gold for a total of 1,192,900 contained ounces in the inferred category and 1,790,000 tonnes at 4.36 grams per tonne for 251,200 contained ounces in the measured and indicated categories. The base case resource was estimated assuming a long term gold price of US$1,125 per ounce of gold and a cut off grade of 2.20 grams per tonne.

On February 21, 2011 the Corporation issued 2.985 million shares to purchase back a 5% net smelter returns royalty related to the Bell Creek Mine property. Pursuant to the December 2007 agreement governing the purchase of Bell Creek, the Corporation is entitled to recover one half of the cost of acquiring the royalty from the PJV. The Bell Creek Mine remains subject to a further 2% net smelter returns royalty payable to the PJV.

7

c. Thunder Creek

The Thunder Creek property is a 54-claim unit package adjacent to and southwest of the Timmins Mine. In November 2009 Lake Shore Gold completed a business combination with West Timmins Mining Inc. (“WTM”) consolidating ownership of the Thunder Creek property.

Following completion of the business combination with West Timmins, the Corporation commenced an advanced underground exploration program, which involved drifting across to high-grade mineralization at Thunder Creek from the 200 Level of the Timmins Mine ramp and the 650 Level near the Timmins Mine shaft to facilitate development on the mineralization and to support an underground drilling program. The 200 Level access drift from the Timmins Mine surface ramp reached the 300 Level at Thunder Creek deposit near the end of June 2010. In early November 2010, the drift to Thunder Creek from the 650 Level near the Timmins Mine shaft reached the mineralization on the 730 Level and the cross-cutting of the mineralized zone commenced in mid-November. Plans for 2011 include continued drilling to define and expand the deposit in order to complete an initial NI 43-101 resource estimate for the project during the second half of 2011.

Certain claims in the Thunder Creek land package are subject to net smelter returns royalties ranging from 1% to 3%.

d. Thorne

The Thorne Property consists of 125 staked claims covering approximately 4,864 ha. The Thorne Property hosts a number of individual zones which collectively make up the Golden River Trend. The Golden River Trend is an east — west trending mineralized deformation and alteration zone, which parallels the Destor Porcupine fault system, located approximately 3 km south of the Corporation’s Thunder Creek and Timmins Mines deposits. Discovered in 1996, the Golden River Trend hosts a NI 43-101 compliant inferred gold resource of 4,154,096 tonnes grading 3.33 grams per tonne for a total of 444,471 ounces and numerous other zones of gold mineralization which have been discovered since the last resource update in 1998. All zones remain open to depth and a number of untested geophysical anomalies indicate potential to significantly expand the gold mineralized system along strike.

Certain claims in the Thorne land package are subject to net smelter returns royalties ranging from 2% to 5%.

e. 144 Property

The 144 Property consists of 34 staked claims covering the western extension of the Golden River Trend from the adjacent Thorne Property. Geologically, the 144 Property shares a number of similarities with the adjacent Thunder Creek and Timmins Mine properties, covering 4.0 kilometres of the same volcanic/ultramafic intrusive/sedimentary contacts found on these properties.

Certain claims in the 144 land package are subject to net smelter returns royalties ranging from 2% to 5%.

2. Casa Berardi

The Corporation has a 50% earn-in right on the Casa Berardi property, as provided in an option agreement with Aurizon Mines Ltd. (“Aurizon”), entered into during the third quarter of 2007. The Casa Berardi property covers 227 claims in an east and west block surrounding Aurizon’s Casa Berardi mine, and covers an area of 11,594 hectares along a 30 kilometre section of the Casa Berardi fault, a major structural zone that is host to a number of gold and base metal deposits. The Corporation can earn its 50% interest by spending $5.0 million over five years. The Corporation is the operator during the earn-in period. Lake Shore Gold has spent a total of $4.6 million on the Casa Berardi property to December 31, 2010.

8

The Corporation carried out a drill program consisting of 6 holes (1,748 meters) in September 2010. The program was focused on the Porphyry Creek prospect which is located in the west portion of the project and on the north side of the Casa Berardi Trend and designed to follow up on previously drilled holes in this area from 2008 and expand outwards into nearby areas. All results of the drill program have now been received and indicate mainly low grade gold values with the best result being 28.41 gpt over 2.40 metres in close proximity to the 2008 drilling. Based on the above, additional work will be done in the future but no definite time frame has been established.

Production and Sale of Gold

Lake Shore Gold generates revenue through the extraction and sale of gold from its mineral properties. Gold has two primary uses: product fabrication and bullion investment. Fabricated gold has a variety of uses, including jewelry, electronics, dentistry, industrial applications, medals, medallions and official coins.

Lake Shore Gold commenced commercial production at the Timmins Mine on January 1, 2011; none of the Corporation’s other properties are in commercial production. Prior to January 1, 2011, Lake Shore Gold was a development-stage company.

The Corporation produces gold doré bars at its Bell Creek Mill. Because doré is an alloy consisting primarily of gold but also containing silver and other metals, doré bars are sent to refiners to produce bullion that meets the required market standard of 99.99% pure gold. All gold doré produced by the Bell Creek Mill is shipped to Johnson Matthey for processing at its refinery in Brampton, Ontario, Canada. Once the gold is refined, Lake Shore Gold actively manages sales by soliciting offers from institutional purchasers for a specified number of ounces of gold (and any silver byproduct resulting from the refining process. Ownership of the refined gold and any silver is transferred to the purchaser at the refinery.

As a development-stage company, Lake Shore Gold did not report any revenue in its financial statements for the financial years ended December 31, 2010, and December 31, 2009.

Specialized Skill and Knowledge

The skill and knowledge required to develop a producing mine includes experience in exploration, development, construction, mine operations, metallurgical processing and environmental compliance. Lake Shore Gold employs a number of technical personnel with relevant experience, education and professional designations, and constantly evaluates the need for additional employees with particular expertise. In addition, from time to time, as necessary, Lake Shore Gold engages professionals in the geological, metallurgical, engineering, environmental and other relevant disciplines as consultants. Lake Shore Gold endeavours to maintain attractive remuneration and compensation packages in order to attract and retain personnel with the necessary qualifications, skills and experience, and to date has been able to meet the Corporation’s staffing requirements.

Competitive Conditions

Lake Shore Gold has numerous competitors in Canada, including many large established mining companies having substantial capabilities and greater financial and technical resources than Lake Shore Gold.

Employees

The Corporation had 407 employees at the end of 2010, and 183 contractors working at its sites.

9

Risk Factors

The following is a brief description of those distinctive or special characteristics of Lake Shore Gold’s operations and industry, which may have a material impact on, or constitute risk factors in respect of, Lake Shore Gold’s financial performance, business and operations.

Dependence on Timmins Mine and Bell Creek Mill

The Corporation’s operations at the Timmins Mine and the Bell Creek Mill will account for all of the Corporation’s commercial production in 2011, and will continue to account for all of the Corporation’s commercial production until Thunder Creek, Bell Creek Mine, and any other potential mines on the Corporation’s properties, are placed into commercial production. Any adverse condition affecting mining or milling conditions at the Timmins Mine or the Bell Creek Mill could be expected to have a material adverse effect on the Corporation’s financial performance and results of operations. The Corporation also anticipates using revenue generated by its operations at the Timmins Mine to finance a substantial portion of the capital expenditures required at its development projects. Unless the Corporation can successfully bring into production Thunder Creek, Bell Creek or other mineral projects on its existing properties, or otherwise acquire gold-producing assets, the Corporation will be dependent on the Timmins Mine for the majority of its gold production. Further, there can be no assurance that the Corporation’s current exploration and development programs at its properties will result in any new economically viable mining operations or yield new mineral reserves to replace and expand current mineral reserves.

Uncertainty of Production Estimates

The Corporation’s gold production may fall below estimated levels as a result of mining accidents such as cave-ins, rock falls, rock bursts or flooding, or as a result of other operational difficulties. In addition, production may be unexpectedly reduced if, during the course of mining, unfavourable ground conditions or seismic activity are encountered, ore grades are lower than expected, the physical or metallurgical characteristics of the ore are less amenable than expected to mining or treatment, or dilution increases. Accordingly, there can be no assurance that the Corporation will achieve current or future production estimates.

Mineral Exploration, Development and Production Activities Inherently Risky

The business of mineral exploration and extraction involves a high degree of risk. Few properties that are explored are ultimately developed into production and there is a risk that none of the Corporation’s properties, other than the Timmins Mine, will ultimately be developed into economic mines. Among the many uncertainties inherent in any gold exploration and development program are the location of economic orebodies, the development of appropriate metallurgical processes, the receipt of necessary governmental permits and the construction of mining and processing facilities. Substantial expenditures are required to pursue such exploration and development activities. Other risks involved in extraction operations and the conduct of exploration programs include unusual or unexpected formations, formation pressures, seismic activity, fires, power outages, labour disruptions, flooding, explosions, rock bursts, cave-ins, landslides, variations in grade, deposit size, density and other geological problems, hydrological conditions, metallurgical and other processing problems, mechanical equipment performance problems, the unavailability of materials and equipment including fuel, unanticipated transportation costs, unanticipated regulatory changes, unanticipated or significant changes in the costs of supplies including, but not limited to, petroleum, and adverse weather conditions and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Although Lake Shore Gold carries liability insurance with respect to its mineral exploration operations, Lake Shore Gold may become subject to liability for damage to life and property, environmental damage, cave-ins or hazards against which it cannot insure or against which it may elect not to insure.

10

Assuming discovery of an economic orebody, depending on the type of mining operation involved, several years may elapse from the initial phases of drilling until commercial operations are commenced and during such time the economic feasibility of production may change. Accordingly, there can be no assurance that the Corporation’s current or future exploration and development programs will result in any new economically viable mining operations or yield new mineral reserves to replace and expand current mineral reserves.

Uncertainty of Mineral Resources and Reserves

The figures for mineral resources and reserves stated in this AIF, or in the documents incorporated by reference, are estimates and no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery of gold will be realized. Market price fluctuations of gold, in addition to increased production costs or reduced recovery rates may render resources uneconomic. Moreover, short-term operating factors relating to the mineral deposits, such as the need for orderly development of the deposits or the processing of new or different grades of ore, may cause any mining operation to be unprofitable in any particular accounting period.

Until mineral reserves or mineral resources are actually mined and processed, mineral resources and mineral reserve grades must be considered as estimates only. In addition, mineral reserves and mineral resources may vary depending on, among other things, metal prices and currency exchange rates. Any material change in mineral reserves, mineral resources, grade or stripping ratio may affect the economic viability of the properties. In addition, there can be no assurance that gold recoveries or other metal recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

The Corporation’s mineral projects, other than the Timmins Mine which is in commercial production, are in the exploration or advanced exploration stage. Until mineral resources on these exploration properties are categorized as “mineral reserves” under NI 43-101, the known mineralization at these projects is not determined to be economic. The Corporation’s ability to put its advanced exploration properties into production will be dependent upon the results of further drilling and evaluation. There is no certainty that expenditures made in the exploration of the Corporation’s mineral properties will result in the identification of commercially recoverable quantities of ore or that mineral reserves will be mined or processed profitably. Greater assurance will require completion of final comprehensive feasibility studies and, possibly, further associated exploration and other work that concludes a potential mine at each of these projects is likely to be economic.

Risk of Project Delay

There are significant risks that the commencement and completion of construction of a mine on the Timmins project could be delayed due to circumstances beyond the Corporation’s control. Such risks include delays in obtaining environmental and construction authorizations and permits, delays in finalizing all necessary detailed engineering and construction contracts, as well as unforeseen difficulties encountered during the construction process.

The Corporation May Not Meet Key Production and Other Cost Estimates

A decrease in the amount and a change in the timing of the production outlook for the Timmins project will directly impact the amount and timing of the Corporation’s cash flow from operations. The actual impact of such a decrease on the Corporation’s cash flow from operations would depend on the timing of any changes in production and on actual prices and costs. Any change in the amount or timing of these projected cash flows that would occur due to production shortfall, changes in prices or costs, labour disruptions, or reduced availability of required equipment or suppliers would, in turn, result in delays in receipt of such cash flows and may require additional financing to fund capital expenditures.

11

Global Financial Condition

Global financial conditions in recent years have been characterized by weakness and uncertainty, and access to public financing has been negatively impacted by disruptions in the credit and capital markets. These factors may impact the ability of the Corporation to obtain equity or debt financing in the future on terms favourable to the Corporation. Additionally, these factors, as well as other related factors, may cause decreases in asset values that are deemed to be other than temporary, which may result in impairment losses. If such increased levels of volatility and market turmoil continue, the Corporation’s operations could be adversely impacted and the trading price of its common shares may be adversely affected.

Fluctuation of Mineral Prices

The success of the Timmins Mine and the Corporation’s other properties will be primarily dependent on the future price of gold. Gold prices are subject to significant fluctuation and are affected by a number of factors which are beyond the control of the Corporation. Such factors include, but are not limited to, interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of major gold-producing countries throughout the world. The price of gold and other base and precious metals has fluctuated widely in recent years, and future serious price declines could cause continued development of, and commercial production from, the Corporation’s properties to be impracticable or uneconomic. Depending on the price of gold and base metals, projected cash flow from planned mining operations may not be sufficient and the Corporation could be forced to discontinue development and may lose its interest in, or may be forced to sell, some of its properties. Future production from the Corporation’s mining properties is dependent on gold prices that are adequate to make these properties economically viable.

Furthermore, reserve calculations and life-of-mine plans using significantly lower gold prices could result in material write-downs of the Corporation’s investment in mining properties and increased amortization, reclamation and closure charges. In addition to adversely affecting the Corporation’s mineral reserve estimates and its financial condition, declining commodity prices can impact operations by requiring a reassessment of the feasibility of a particular project. Such reassessment may be the result of a management decision or may be required under financing arrangements related to a particular project. Even if the project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays or may interrupt operations until the reassessment can be completed.

Currency Fluctuations

Currency fluctuations may affect the costs the Corporation incurs in its operations and may affect the Corporation’s operating results and cash flows. Gold is sold throughout the world based principally on the U.S. dollar price, but the Corporation’s operating and capital expenses are incurred in Canadian dollars. The appreciation of the Canadian dollar against the U.S. dollar can reduce the Corporation’s revenues relative to the costs at the Corporation’s operations, making such operations less profitable.

Fluctuations in External Factors Affecting Costs

The Corporation’s production costs are dependent on a number of factors, including refining charges, production royalties based on the price of gold, and the cost of inputs used in mining operations, including equipment, labour (including contractors), steel, chemical reagents and energy. All of these factors are beyond the Corporation’s control. If the Corporation’s total production costs per ounce of gold rise above the market price of gold and remain so for any sustained period, the Corporation may experience losses and may curtail or suspend some or all of its exploration, development and mining activities.

12

History of Net Losses; Uncertainty of Additional Financing

Prior to January 1, 2011, the Corporation had not recorded any revenues from operations nor had the Corporation operated in commercial production on any property. Despite the commencement of commercial production at Timmins Mine on January 1, 2011, there can be no assurance that significant losses will not continue to occur or that the Corporation will be profitable in the future. The Corporation’s operating expenses and capital expenditures may increase with mining activities at Timmins Mine and advancing exploration, development and commercial production of Thunder Creek, Bell Creek and other properties in which the Corporation has an interest. The Corporation may continue to incur losses unless and until such time as it generates sufficient revenues from commercial production to fund all of its continuing operations. The development of the Corporation’s properties will require the commitment of substantial resources.

The Corporation may require significant capital in order to fund its capital and operating costs. The Corporation may require additional financing from external sources to meet such requirements. There can be no assurance that such financing will be available to the Corporation or, if it is, that it will be offered on acceptable terms. If additional financing is raised through the issuance of equity or convertible debt securities of the Corporation, the interests of shareholders in the net assets of the Corporation may be diluted. Any failure of the Corporation to obtain required financing on acceptable terms could have a material adverse effect on the Corporation’s financial condition, results of operations and liquidity and require the Corporation to cancel or postpone planned capital investments.

Limitations under Credit Facility

The Corporation’s secured revolving $50 million bank credit facility limits, among other things, the Corporation’s ability to permit the creation of certain liens, make investments, dispose of the Corporation’s material assets or, in certain circumstances, pay dividends. In addition, the bank credit facility limits the Corporation’s ability to incur additional indebtedness and requires the Corporation to maintain specified financial ratios and meet financial condition covenants. Events beyond the Corporation’s control, including changes in general economic and business conditions, may affect the Corporation’s ability to satisfy these covenants, which could result in a default under one or both of the bank credit facilities or the notes, if issued. As of the date of this AIF the Corporation had not drawn any amounts under the bank credit facility, but the Corporation may draw on the bank credit facility to fund part of the capital expenditures required in connection with its current development projects. If an event of default under the bank credit facility occurs, the Corporation would be unable to draw down further on that facility and the lenders could elect to declare all principal amounts outstanding thereunder at such time, together with accrued interest, to be immediately due and it could cause an event of default under the other credit facility. An event of default under the bank credit facility may also give rise to an event of default under existing and future debt agreements and, in such event, the Corporation may not have sufficient funds to repay amounts owing under such agreements.

Uncertainty in Executing, Managing and Integrating Acquisitions

The Corporation occasionally evaluates opportunities to acquire shares or assets of other mining businesses. Such acquisitions may be significant in size, may change the scale of the Corporation’s business and may expose the Corporation to new geographic, political, operating, financial or geological risks. The Corporation’s success in its acquisition activities depends on its ability to identify suitable acquisition candidates, acquire them on acceptable terms and integrate their operations successfully with those of the Corporation. Any acquisition would be accompanied by risks, such as the difficulty of assimilating the operations and personnel of any acquired businesses; the potential disruption of the Corporation’s ongoing business; the inability of management to maximize the financial and strategic position of the Corporation through the successful integration of acquired assets and businesses; the maintenance of uniform standards, controls, procedures and policies; the impairment of relationships with employees, customers and contractors as a result of any integration of new management personnel; and the potential

13

unknown liabilities associated with acquired assets and businesses. In addition, the Corporation may need additional capital to finance an acquisition. Debt financing related to any acquisition may expose the Corporation to the risks related to increased leverage, while equity financing may cause existing shareholders to suffer dilution.

Possible Loss of Interests in Exploration Properties; Possible Failure to Obtain Mining Licenses

Certain agreements pursuant to which Lake Shore Gold acquired or may acquire interests in certain properties provide that Lake Shore Gold must make a series of payments in cash and/or common shares over certain time periods, expend certain minimum amounts on the exploration of the properties or contribute its share of ongoing expenditures. If Lake Shore Gold fails to make such payments or expenditures in a timely fashion, Lake Shore Gold may lose its interest in those properties. Further, with respect to any exploration property, Lake Shore Gold may not be able to obtain the necessary licenses or permits to conduct mining operations on the properties, and thus would realize no benefit from its exploration activities on such properties.

The Majority of Lake Shore Gold’s Properties Contain No Known Mineral Reserves

With the exception of the Timmins Mine, there are no known mineral reserves on Lake Shore Gold’s properties. Additional work is required before Lake Shore Gold can ascertain if any mineralization may be economically viable and if any of its properties have a body of commercially viable ore. Exploration for minerals is a speculative venture necessarily involving substantial risk. If the expenditures Lake Shore Gold makes on its properties do not result in discoveries of mineralization that can be economically recovered, the value of exploration and acquisition expenditures may be lost and the value of Lake Shore Gold stock will be negatively impacted.

Title Risks

The acquisition of title to mineral properties is a very detailed and time-consuming process. Title to, and the area of, the mineral property may be disputed. There is no guarantee that such title will not be challenged or impaired. There may be challenges to the title of the properties in which the Corporation has an interest, which, if successful, could result in the loss or reduction of the Corporation’s interest in the properties.

Although title to its material properties has been reviewed by or on behalf of Lake Shore Gold, no assurances can be given that there are no title defects affecting the properties. Title insurance generally is not available for mining claims in Canada and Lake Shore Gold’s ability to ensure that it has obtained secure claim to individual mineral properties may be severely constrained. Lake Shore Gold has not conducted surveys of all of the claims in which it holds direct or indirect interests, therefore, the precise area and location of such claims may be in doubt. The properties may be subject to prior unregistered liens, agreements, transfers or claims including native land claims, and title may be affected by, among other things, undetected defects. In addition, Lake Shore Gold may be unable to conduct work on the properties as permitted or to enforce its rights with respect to its properties.

Obligations and Potential Liabilities with Respect to Bell Creek

Under the agreement for the acquisition of the Bell Creek Complex, Lake Shore Gold assumed all liabilities relating to, and has provided a full indemnity to the seller in connection with, the mineral properties, surface buildings, mill and tailings, past, present and future. While Lake Shore Gold conducted due diligence with a view to determining, among other things, what these obligations and liabilities may be, there is no assurance that Lake Shore Gold has been able to determine accurately the existence or extent or potential cost of any such obligations and liabilities. Failure to determine adequately or at all the existence or extent or potential cost of any such obligations and liabilities could, in the future, have a material adverse impact on Lake Shore Gold’s profitability, business prospects, results of operations and financial condition.

14

Environmental Risks

Mining operations have inherent risks and liabilities associated with pollution of the environment and the disposal of waste products occurring as a result of mineral exploration and production. Laws and regulations involving the protection and remediation of the environment and the governmental policies for implementation of such laws and regulations are constantly changing and are generally becoming more restrictive. Lake Shore Gold cannot give any assurance that, notwithstanding its precautions, breaches of environmental laws (even if inadvertent) or environmental pollution will not materially and adversely affect its financial condition and its results from operations.

Previous mining operations may have caused environmental damage at certain of Lake Shore Gold’s properties. It may be difficult or impossible to assess the extent to which such damage was caused by Lake Shore Gold or by the activities of previous operators, in which case, any indemnities and exemptions from liability may be ineffective.

There is no assurance that future changes in environmental regulation, if any, will not adversely affect the Corporation’s operations. Environmental hazards may exist on the properties on which the Corporation holds interests which are unknown to the Corporation at present and which have been caused by previous or existing owners or operators of the properties. Reclamation costs are uncertain and planned expenditures may differ from the actual expenditures required.

Risks Associated with Joint Venture Agreements

Lake Shore Gold’s interests in various of its properties may, in certain circumstances, become subject to the risks normally associated with the conduct of joint ventures. In the event that any of Lake Shore Gold’s properties become subject to a joint venture, the existence or occurrence of one or more of the following circumstances and events could have a material adverse impact on Lake Shore Gold’s profitability or the viability of its interests held through joint ventures, which could have a material adverse impact on Lake Shore Gold’s business prospects, results of operations and financial condition: (i) disagreements with joint venture partners on how to conduct exploration; (ii) inability of joint venture partners to meet their obligations to the joint venture or third parties; and (iii) disputes or litigation between joint venture partners regarding budgets, development activities, reporting requirements and other joint venture matters.

Third Party Reliance

Lake Shore Gold’s rights to acquire an interest in certain resource properties may have been granted by third parties who themselves held only a lease or an option to acquire such properties. If such persons fail to fulfill their obligations, Lake Shore Gold could lose such interest in the properties and may have no meaningful recourse, as it may not have any direct contractual arrangements with the underlying property holders.

Risks Relating to Statutory and Regulatory Compliance

The current and future operations of Lake Shore Gold, including exploration, development activities and commercial production are and will be governed by laws and regulations governing mineral claims acquisition, prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in exploration activities and in the development and operation of mines and related facilities generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Lake Shore Gold has received all necessary permits for the mining operations and the exploration and development work it is presently conducting, but there can be no assurance that all permits, if any, which Lake Shore Gold may require for future exploration, construction of mining facilities and conduct of mining operations will be obtainable

15

on reasonable terms or on a timely basis, or that such laws and regulations would not have an adverse effect on any project which Lake Shore Gold may undertake.

Failure to comply with applicable laws, regulations and permits may result in enforcement actions thereunder, including the forfeiture of claims, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions. Lake Shore Gold may be required to compensate those suffering loss or damage by reason of its mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations and permits. Lake Shore Gold is not currently covered by any form of environmental liability insurance. See “Insurance Risk”.

Existing and possible future laws, regulations and permits governing operations and activities of exploration and development companies, or more stringent implementation thereof, could have a material adverse impact on Lake Shore Gold and cause increases in capital expenditures or require abandonment of, or delays in, exploration.

Insurance Risk

The Corporation’s business is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labour disputes or slowdowns, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment or laws, and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to the Corporation’s properties or the properties of others, delays in development or mining, monetary losses and possible legal liability.

Although the Corporation maintains insurance to protect against certain risks in such amounts as it considers to be reasonable, its insurance will not cover all the potential risks associated with its operations. The Corporation may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to the Corporation or to other companies in the mining industry on acceptable terms. The Corporation might also become subject to liability for pollution or other hazards which may not be insured against or which the Corporation may elect not to insure against because of premium costs or other reasons. Losses from these events may cause the Corporation to incur significant costs that could have a material adverse effect upon its financial performance and results of operations.

Competition

The Corporation’s business is intensely competitive, and the Corporation competes with other mining companies, many of which have greater resources and experience. Competition in the precious metals mining industry is primarily for: (i) mineral rich properties which can be developed and produced economically; (ii) the technical expertise to find, develop, and produce such properties; (iii) the labour to operate the properties; and (iv) the capital for the purpose of financing development of such properties. Many competitors not only explore for and mine precious metals, but conduct refining and marketing operations on a world-wide basis and some of these companies have much greater financial and technical resources than the Corporation. Such competition may result in the Corporation being unable to acquire desired properties, recruit or retain qualified employees or acquire the capital necessary to fund its operations and develop its properties. The Corporation’s inability to compete with other mining companies for these mineral deposits could have a material adverse effect on the Corporation’s results of operations.

16

Dependence on Key Management and Employees

The success of the operations and activities of Lake Shore Gold is dependent to a significant extent on the efforts and abilities of its management, key employees and outside contractors. Relationships between the Corporation and its employees may be affected by changes in the scheme of labour relations that may be introduced by relevant government authorities in the jurisdictions that the Corporation operates. Changes in applicable legislation or in the relationship between the Corporation and its employees or contractors may have a material adverse effect on the Corporation’s business, results of operations and financial condition. The Corporation’s ability to manage its operating, development, exploration and financing activities will depend in large part on the efforts of key management personnel. The loss of the services of one or more of these individuals could adversely affect Lake Shore Gold’s profitability, results of operations and financial condition. The Corporation faces significant competition for qualified personnel and there can be no assurance that the Corporation will be able to attract and retain such personnel. The Corporation does not hold key person insurance on any of these individuals.

Volatility of Market Price of Securities

The trading price of the Corporation’s common shares has been and may continue to be subject to large fluctuations which may result in losses to investors. The trading price of the Corporation’s common shares may increase or decrease in response to a number of events and factors, including:

· changes in the market price of gold;

· current events affecting the economic situation in Canada, the United States and elsewhere;

· trends in the mining industry and the markets in which the Corporation operates;

· changes in financial estimates and recommendations by securities analysts;

· acquisitions and financings;

· quarterly variations in operating results;

· the operating and share price performance of other companies that investors may deem comparable; and

· purchases or sales of blocks of the Corporation’s common shares.

Wide price swings are currently common in the markets on which the Corporation’s securities trade. This volatility may adversely affect the prices of the Corporation’s common shares regardless of the Corporation’s operating performance. As well, there can be no assurance that an active market for the securities of the Corporation will be sustained.

Mineral Projects

Timmins Mine Property

Robert Kusins, P. Geo., Jacques Samson, P. Geo., Heather Miree, P. Geo., Todd Fayram, P.E., and George Darling, P. Eng., prepared a technical report in accordance with NI 43-101 entitled “Updated NI 43-101 Technical Report on the Timmins Mine Property, Ontario, Canada” dated October 1, 2009 (the “Timmins Mine Report”). Robert Kusins, Jacques Samson, Heather Miree, Todd Fayram and George Darling are each qualified persons under NI 43-101. The following extract is the Executive Summary from the Timmins Mine Report and readers should consult the Timmins Mine Report to obtain further particulars regarding the Timmins Mine Project. The Timmins Mine Report is available for review electronically on SEDAR at www.sedar.com under Lake Shore Gold’s profile and is incorporated by reference in its entirety herein.

17

EXECUTIVE SUMMARY (ITEM 3)

History

The Timmins Mine Project (Project) of Lake Shore Gold Corp. (LSG) is located in Northern Ontario, within the city limits of Timmins (population 45,000). Timmins was established in 1912 as a by-product of the Porcupine Gold Rush and it is still one of the richest mineral producing areas in the western hemisphere. Strategically located in the heart of the Porcupine gold camp, it is easily accessible to the more densely populated areas of Southern Ontario, 300 km north of Sudbury and 700 km north of Toronto, by highway, rail and air transport. The Project property is located at the intersection of Highways 101 and 144 approximately 20 km west of Timmins.

Gold was discovered on the Project property in 1911 but did not receive serious exploration attention until the 1990’s when Holmer Gold Mines Limited (“Holmer”) completed 44 diamond drill holes totalling about 9,000 m and issued a mineral resources estimate. LSG entered into an option agreement with Holmer in 2003, continued drilling and updated the mineral resources estimate in 2004, in accordance with National Instrument 43-101 (“NI 43-101”), to 1.3 Mt at a grade of 10.96 g/t of gold in the Indicated category.

In December 2004, LSG acquired a 100% interest in the Project and immediately conducted an aggressive deep drilling campaign that was completed in October 2006.

In January 2007, LSG signed a Letter Agreement with Goldcorp Canada Ltd., manager of the Porcupine Joint Venture (a joint venture between Goldcorp Canada Ltd. and Kinross Gold Corporation), to acquire the Bell Creek mine and mill facilities, adjacent to LSG Vogel-Schumacher properties.

In April 2007, LSG received notice of acceptance of its certified closure plan for the Project from the Ontario Ministry of Northern Development and Mines, allowing the initiation of an advanced exploration program (AEP).

In August 2007 LSG released the results of a prefeasibility study for the Project, which supported the economic development of the property. In October 2007 LSG filed a NI 43-101 Technical Report on the Project property, estimating Indicated mineral resources of 3.3 Mt grading 8.62 g/t Au (905,000 contained ounces of gold) and Inferred mineral resources of 0.97 Mt grading 5.62 g/t Au. The mineral reserves were estimated at 3.4 Mt grading 7.59 g/t (826,000 contained ounces of gold) in the Probable category.

At the end of July 2008, LSG commenced shaft sinking at the Project location. The 710 m shaft is expected to be completed during the third quarter of 2009. A program of level development, bulk sampling and underground diamond drilling is scheduled for the remainder of 2009. In early September 2008, LSG commenced driving a ramp from surface to access mineral reserves above the 400 meter level.

In March 2009, LSG began processing development material from the Project at the Bell Creek Mill, which was refurbished to a capacity of 1,500 tpd. LSG forecasts pouring 30,000 ounces of gold in 2009 from the processing of development material.

In August 2009 LSG and WTM agreed to a business combination which triggered an update to the current NI43-101 Technical Report on the Project.

Mineral Resources Estimate

Mineral resources of 3.2 Mt grading 8.56 g/t Au (893,000 contained ounces) or 12.24 g/t Au uncut (1,278,000 oz) were estimated in the Indicated category. The estimation process followed CIM guidelines, in accordance with NI 43-101 definitions.

18

In addition, Inferred mineral resources of 0.89 Mt grading 5.74 g/t Au (165,000 contained ounces) were estimated. The deposit remains open down-plunge.

The gold mineralization occurs in ten geological zones. In the Main Zone and the three Vein zones, mineralization is associated with quartz/tourmaline veining and stringers along with small, varying amounts of pyrite and arsenopyrite. Mineralized zones are typically 1 to 7 m wide in the Veins and Main zone. In the three Ultramafic and three Footwall Zones, the gold values occur mainly within the alteration halo adjacent to the veins in zones up to 20 m wide and are closely related to the pyrite content. These types of mineralization are typical of deposits in the Porcupine mining camp.

Mineral Reserves Estimate

Mineral reserves of 3.4 Mt grading 7.52 g/t (812,000 ounces contained) were estimated in the Probable category, using a 3.00 g/t cut-off grade. The estimation process followed CIM guidelines, in accordance with NI 43-101 definitions.

The Consultant’s estimate of underground mineral reserves is based on LSG’s polygonal and block model (the latter covering the veins and main zones within 120 metres from surface) used for mineral resources estimation. The Consultant converted the mineral resources models into several wire frames and modeled them using Mine2-4D software. The Consultant then validated this conversion by cross-referencing back to the original LSG mineral resources estimate.

Mine Plan

The mineral reserves estimate was based on the following parameters developed by the Consultant as part of the mine plan:

· Mining recovery: 86 to 92%;

· Dilution: 12% for cut and fill mining and 27% for long-hole stoping, using dilution grades of 0 and 1 g/t Au respectively;

· Minimum mining width: 2.0 to 3.5 m;

· Mill recovery: 95%; and

· Total site operating cost: $95.08/t ore processed.

Project parameters and highlights are shown in Table S-2.

The mine plan is based on utilizing the shaft and ramp to surface facilities that remain from the Advanced Exploration Project (AEP). The Consultant has estimated that after completion of the AEP ($140M), a pre-production capital cost (Capex) of $33M will be required to start production. Once completed, the production phase Capex is estimated at $29M. The planned production rate of 1,500 t/d was based on the selected mining methods and the steeply dipping orebody geometry. Ore will be loaded onto highway trucks and hauled to the Bell Creek Mill, approximately 42 km from the mine site. Mine waste rock will be utilized as backfill material in the mine.

The total Capex is estimated at $202M.

Processing

The Project gold deposit appears to be very amenable to cyanide leaching, yielding a high recovery rate, typically in excess of 95%. Based on extensive test work, a preliminary process design was developed using conventional ball milling followed by agitated cyanide leaching and carbon in pulp (“CIP”) gold recovery.

19

The initial ore treatment design rate is 1,500 tpd with approximately 29,000 ounces of gold produced per quarter over the seven year production life (i.e. approximately 772,000 ounces recovered).

The original mill had been expanded a number of times until the 1,500 tpd capacity was reached in 2001. The main equipment includes two grinding mills, rated at 1,400 and 400 hp, five leach tanks, eight CIP tanks, and a gold recovery circuit based on carbon - pressure. The mill was under care and maintenance from 2002 until start-up in May 2009.

The BC Mill also includes an adjacent conventional tailings disposal facility that has been determined to be suitable and expandable to accommodate the present mineral reserves at the Project. Permits are still valid as the entire complex has been kept on ‘operational’ status with the regulators. Modifications to account for the properties of the Project’s ore were incorporated in the implementation program and are consistent with the planned initial 1,500 tpd mining rate.

The re-commissioning of the BC Mill, including upgrading of the tailings and water management installations was completed for $1.8M. Expansion of the tailings facility to ultimately accommodate about an additional 5 Mt has been determined to be feasible. Staged expansions have been estimated at a cost of $2.4M for the 3 million tonnes of tailings expected from the planned Project ore over the seven year mine life. Total milling costs have been estimated at $17.62/t ore processed.

Work Force

Total payroll is calculated at 154 at the Project site and 51 at the BC Mill. Staff of 15 management and administration personnel will be required, for a total workforce of 220.

Economics

Cost estimates and discounted cash flow analysis indicate that the Project will be potentially economic, as shown in Table S-3 (Canadian dollars unless stated otherwise); the execution of an AEP is therefore justified.

Only the pre-tax economics are presented as the Project benefits from large tax write-off pools that are expected to reduce the after-tax internal rate of return (IRR) by only minimal amounts. The pre-tax economic indicators are positive, as indicated by an IRR of 28% (US$950/oz gold price) when taking the AEP cost into account or 240% when ignoring AEP costs expensed to date.

Table S-2: Project Updated Parameters and Highlights.

Mineral reserves | | 3.4 Mt | | 7.52 g/t Au (cut); 812,000 oz. Au (base case) |

Mining rate | | 1,500 | | Tonnes per day |

Tonnage mined per year at Timmins Mine | | 532,500 | | Tonnes |

Mine life | | 7.5 | | Years |

Minimum mining widths | | 2.0 | | Metres |

Mining method: primary | | | | Open stoping (long hole sublevel and Uppers mining) |

Mining method: secondary | | | | Mechanized cut and fill |

Dilution | | 12 to 27 % | | |

Milling: | | | | Cyanide leaching and CIP recovery |

Metallurgical recovery | | 95% | | |

Trucking distance (app.) Capital expenditures | | 40.0 | | Kilometres |

20

Pre-production advanced exploration capital | | $ | 140 | | Million |

Capital | | $ | 33 | | Million |

Sustaining capital (including mine closure) | | $ | 29 | | Million |

Operating Costs | | $ | 202 | | Million total Capex |

Mining | | $ | 69.66 | | Per tonne of ore |

Processing | | $ | 17.62 | | Per tonne of ore (assumes no other source of mill feed) |

Trucking | | $ | 5.44 | | Per tonne of ore |

G&A | | $ | 2.36 | | Per tonne of ore |

Project operating costs | | $ | 95.08 | | Per tonne of ore total |

Cash cost per ounce | | US$ | 369 | | Per ounce base case (production phase) |

Project payback | | | 3 | | Years |

Production start | | | Q4 | | 2010 |

IRR (pre tax, production phase) | | | 28% | | (Base case including AEP costs) |

| | | 240% | | (excluding AEP costs expensed to date) |

NPV for the Base Case | | $M | | | |

At 0% | | | 300 | | (No AEP cost: $425M) |

At 5% | | | 184 | | (No AEP cost: $295M) |

At 8% | | | 135 | | (No AEP cost: $240M) |

At 15% | | | 62 | | (No AEP cost: $153M) |

Table S-3: AEP Stage Economics

Present Day (2009) Economics (Base Case)

| | Total | | | | | | | | | |

| | Cost | | | | Costs/tonne | | Economics Pre-tax 100% Equity | |

AEP: (net of gold credit) | | 202M | | Mining Ore | | 69.66/t | | Gold Price | | | |

Timmins Mine | | 252M | | Processing | | 17.62/t | | Price | | US$950/oz | |

BC Mill | | 60M | | Trucking | | 5.44/t | | Pre-Tax | | | |

| | 8M | | G & A | | 2.36/t | | 100% Equity | | | |

Total Project Expenditures | | 522M | | Total Ore | | 95.08/t | | | | | |

| | | | | | | | | | | |

Overall Economic Return on Investment with AE costs: | | 28% IRR @ US$950/oz | |

Overall Economic Return on Investment without AE costs: | | 240% IRR @ US$950/oz | |

The expenditures of $140M for the AEP should be viewed with the same caution and risks associated with other mining exploration programs. The resources for the Project have been carefully and prudently established from significant surface drilling, which limits the potential downside risk that the actual ore grades encountered during the mine life could differ from those estimated to date. The bulk sampling program will determine the orebody grade more accurately than estimates from surface drilling.

In addition, there are a number of potential factors that could change the economics of the Project:

· Increased grades from re-calculation of the cutting factor;

· Optimized mining methods to minimize dilution;

· Higher sustained mining rates during early years of production;

· Increased external dilution from plan;

· Continuity of the vein structures to be tested during bulk sampling and pre-production.

21

Thunder Creek Project