Exhibit (c)(10)

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

Project Rushmore Discussion Materials

February 14th, 2019

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

Table of Contents

I. Situation Overview

II. Status Quo Management Projections Overview III. Abe Financial Analysis IV. Ulysses Financial Analysis V. Transaction Analysis

Supplemental Analysis

Appendix

2

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

I. Situation Overview

3

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

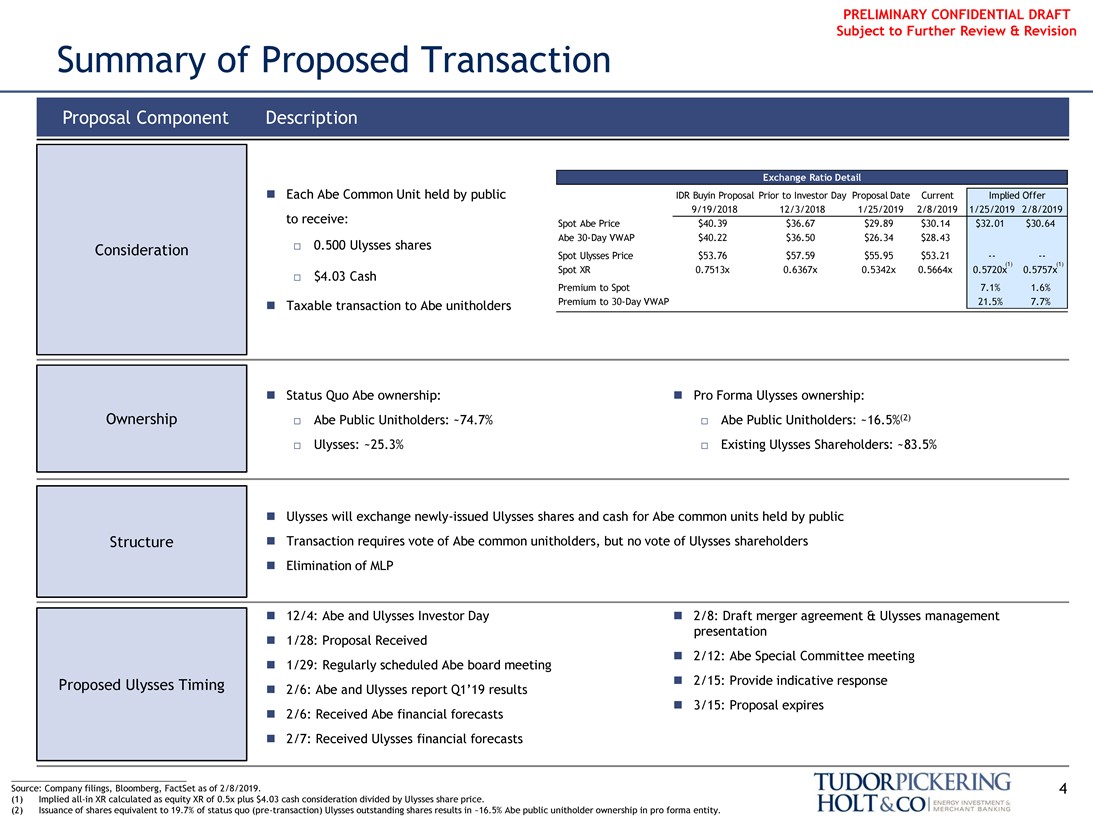

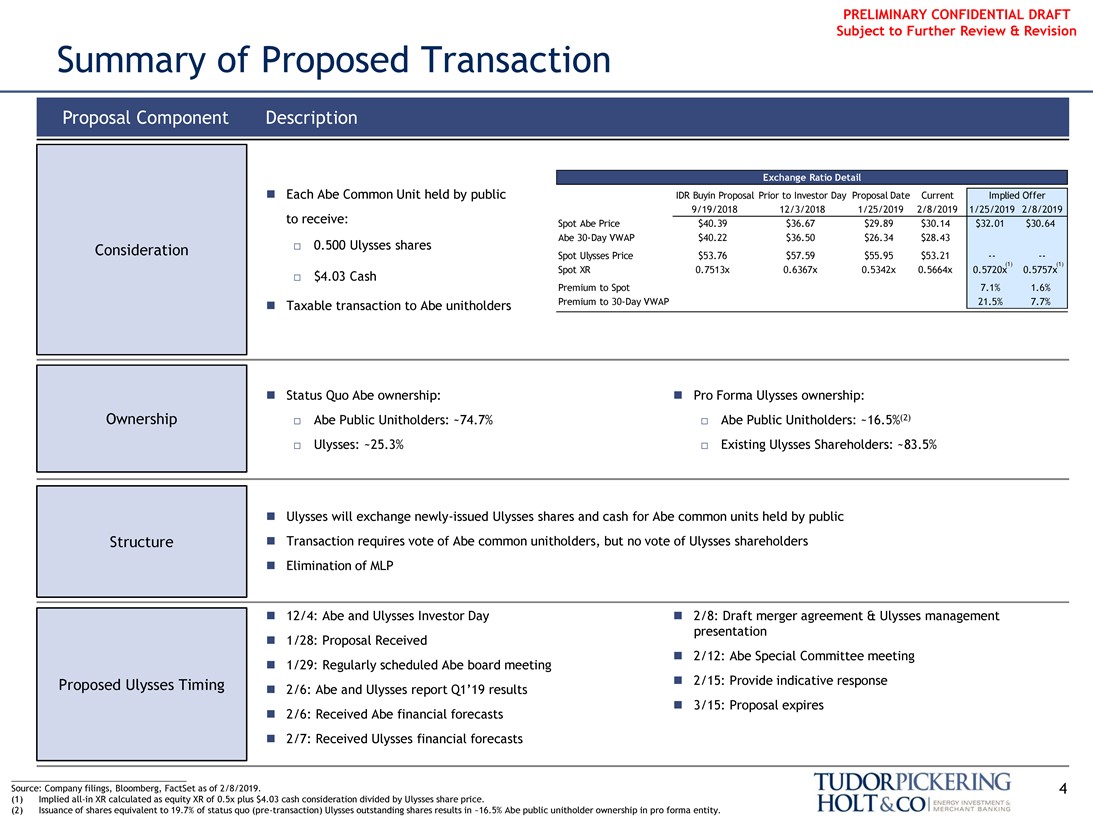

Summary of Proposed Transaction

Proposal Component Description Exchange Ratio Detail

∎ Each Abe Common Unit held by public IDR Buyin Proposal Prior to Investor Day Proposal Date Current Implied Offer 9/19/2018 12/3/2018 1/25/2019 2/8/2019 1/25/2019 2/8/2019 to receive: Spot Abe Price $40.39 $36.67 $29.89 $30.14 $32.01 $30.64 Abe30-Day VWAP $40.22 $36.50 $26.34 $28.43 Consideration 0.500 Ulysses shares Spot Ulysses Price $53.76 $57.59 $55.95 $53.21 -—-

(1) (1)

Spot XR 0.7513x 0.6367x 0.5342x 0.5664x 0.5720x 0.5757x

$4.03 Cash

Premium to Spot 7.1% 1.6%

∎ Taxable transaction to Abe unitholders Premium to30-Day VWAP 21.5% 7.7%

∎ Status Quo Abe ownership:∎ Pro Forma Ulysses ownership:

Ownership Abe Public Unitholders: ~74.7% Abe Public Unitholders: ~16.5%(2)

Ulysses: ~25.3% Existing Ulysses Shareholders: ~83.5%

∎ Ulysses will exchange newly-issued Ulysses shares and cash for Abe common units held by public Structure∎ Transaction requires vote of Abe common unitholders, but no vote of Ulysses shareholders∎ Elimination of MLP

∎ 12/4: Abe and Ulysses Investor Day∎ 2/8: Draft merger agreement & Ulysses management presentation ∎ 1/28: Proposal Received∎ 2/12: Abe Special Committee meeting∎ 1/29: Regularly scheduled Abe board meeting Proposed Ulysses Timing∎ 2/15: Provide indicative response

∎ 2/6: Abe and Ulysses report Q1’19 results

∎ 3/15: Proposal expires∎ 2/6: Received Abe financial forecasts ∎ 2/7: Received Ulysses financial forecasts

Source: Company filings, Bloomberg, FactSet as of 2/8/2019. 4 (1) Impliedall-in XR calculated as equity XR of 0.5x plus $4.03 cash consideration divided by Ulysses share price.

(2) Issuance of shares equivalent to 19.7% of status quo(pre-transaction) Ulysses outstanding shares results in ~16.5% Abe public unitholder ownership in pro forma entity.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

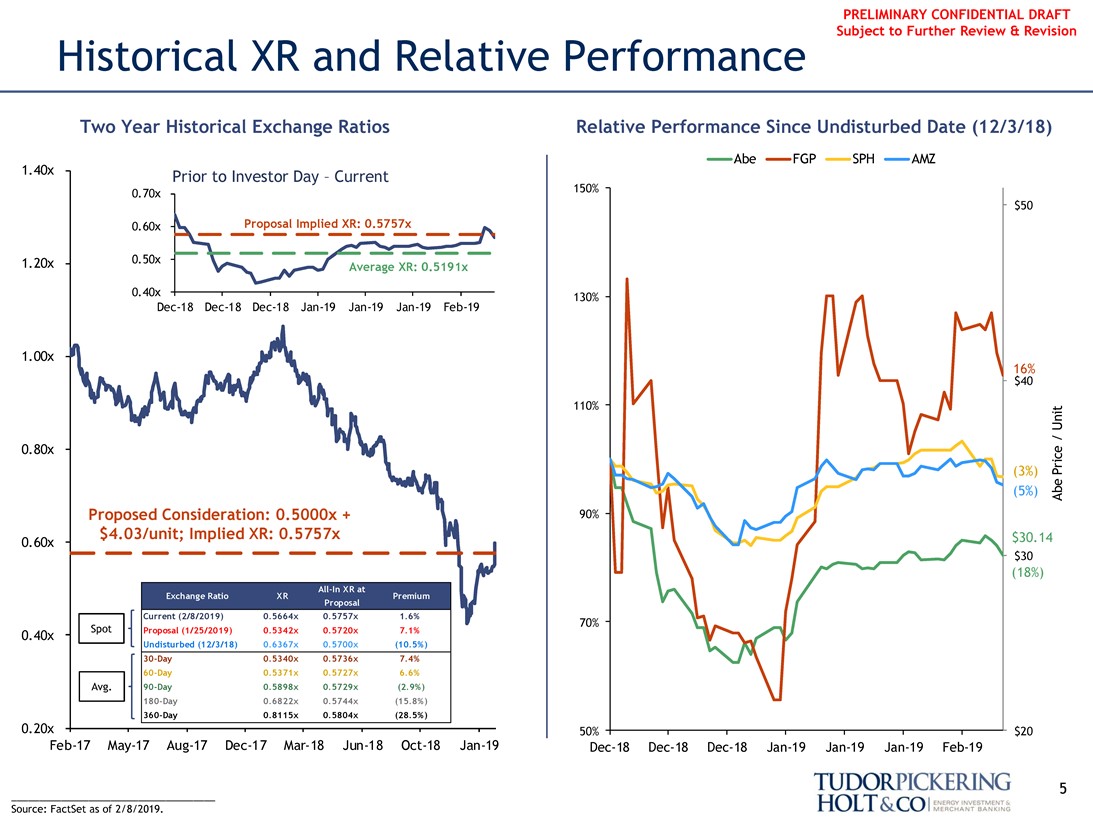

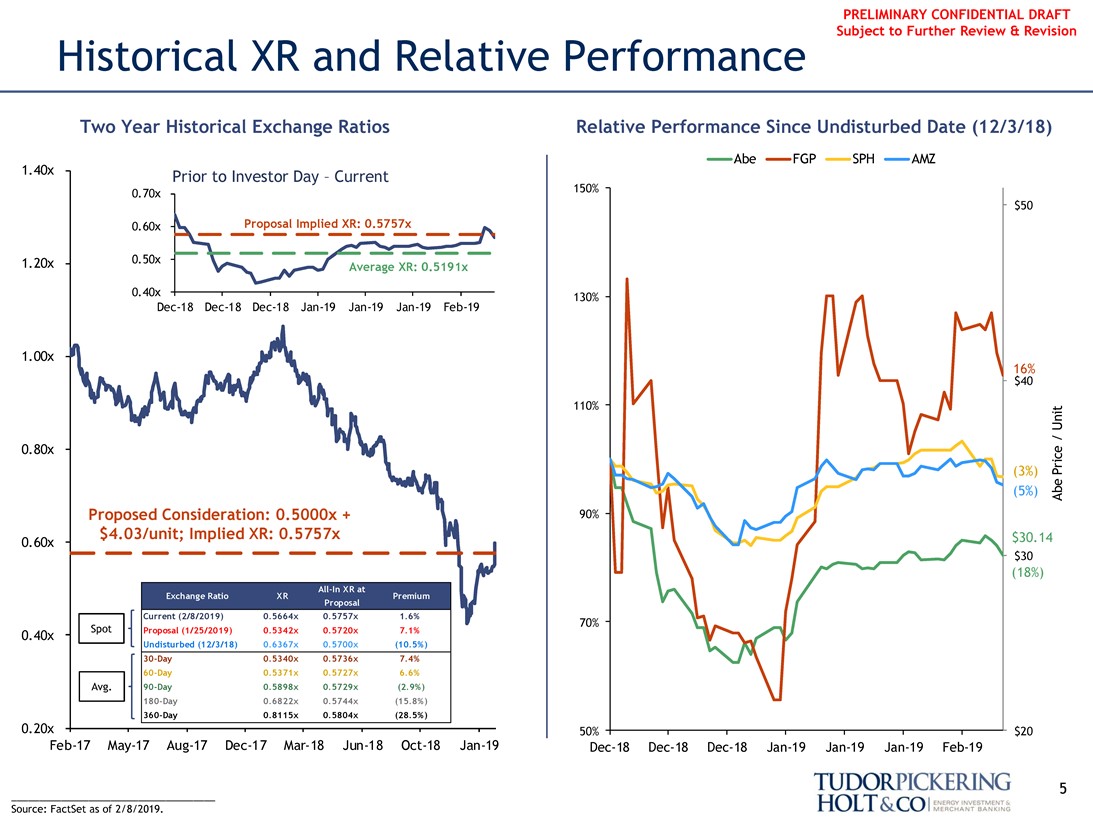

Historical XR and Relative Performance

Two Year Historical Exchange Ratios Relative Performance Since Undisturbed Date (12/3/18)

Abe FGP SPH AMZ

1.40x Prior to Investor Day - Current

0.70x 150% $50

0.60x Proposal Implied XR: 0.5757x

1.20x 0.50x

Average XR: 0.5191x

0.40x 130%Dec-18Dec-18Dec-18Jan-19Jan-19Jan-19Feb-19

1.00x 16% $40

110%

Abe Price / Unit

0.80x (3%) (5%)

Proposed Consideration: 0.5000x + 90% $4.03/unit; Implied XR: 0.5757x $30.14

0.60x $30

(18%)

All-In XR at Proposal

Exchange Ratio XR Premium

Current (2/8/2019) 0.5664x 0.5757x 1.6%

70%

Spot Proposal (1/25/2019) 0.5342x 0.5720x 7.1%

0.40x

Undisturbed (12/3/18) 0.6367x 0.5700x (10.5%)30-Day 0.5340x 0.5736x 7.4%60-Day 0.5371x 0.5727x 6.6% Avg.90-Day 0.5898x 0.5729x (2.9%)180-Day 0.6822x 0.5744x (15.8%)360-Day 0.8115x 0.5804x (28.5%)

0.20x 50% $20

Feb-17May-17Aug-17Dec-17Mar-18Jun-18Oct-18Jan-19Dec-18Dec-18Dec-18Jan-19Jan-19Jan-19Feb-19

5

_____________________________________ Source: FactSet as of 2/8/2019.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

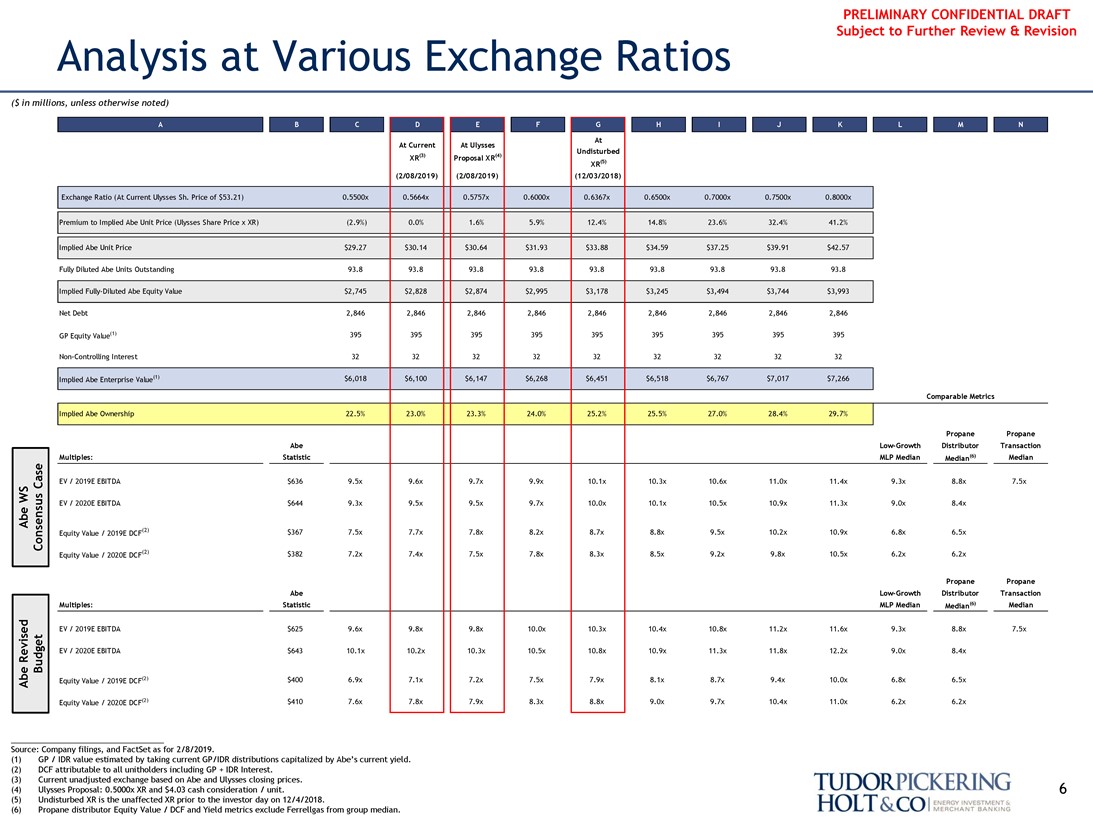

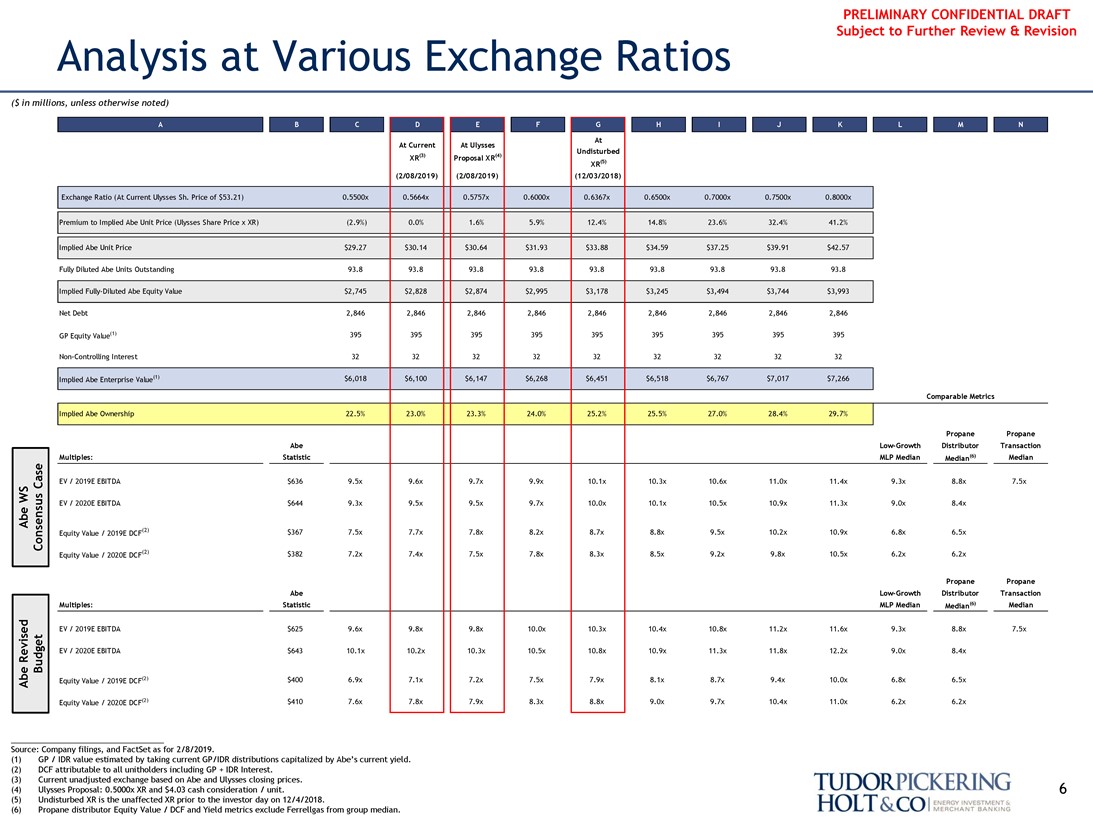

Analysis at Various Exchange Ratios

($ in millions, unless otherwise noted)

A B C D E F G H I J K L M N

At At Current At Ulysses Undisturbed XR(3) Proposal XR(4)

XR(5)

(2/08/2019) (2/08/2019) (12/03/2018)

Exchange Ratio (At Current Ulysses Sh. Price of $53.21) 0.5500x 0.5664x 0.5757x 0.6000x 0.6367x 0.6500x 0.7000x 0.7500x 0.8000x Premium to Implied Abe Unit Price (Ulysses Share Price x XR) (2.9%) 0.0% 1.6% 5.9% 12.4% 14.8% 23.6% 32.4% 41.2% Implied Abe Unit Price $29.27 $30.14 $30.64 $31.93 $33.88 $34.59 $37.25 $39.91 $42.57 Fully Diluted Abe Units Outstanding 93.8 93.8 93.8 93.8 93.8 93.8 93.8 93.8 93.8 Implied Fully-Diluted Abe Equity Value $2,745 $2,828 $2,874 $2,995 $3,178 $3,245 $3,494 $3,744 $3,993 Net Debt 2,846 2,846 2,846 2,846 2,846 2,846 2,846 2,846 2,846

GP Equity Value(1) 395 395 395 395 395 395 395 395 395

Non-Controlling Interest 32 32 32 32 32 32 32 32 32

Implied Abe Enterprise Value(1) $6,018 $6,100 $6,147 $6,268 $6,451 $6,518 $6,767 $7,017 $7,266

Comparable Metrics

Implied Abe Ownership 22.5% 23.0% 23.3% 24.0% 25.2% 25.5% 27.0% 28.4% 29.7%

Propane Propane AbeLow-Growth Distributor Transaction Multiples: Statistic MLP Median Median(6) Median

EV / 2019E EBITDA $636 9.5x 9.6x 9.7x 9.9x 10.1x 10.3x 10.6x 11.0x 11.4x 9.3x 8.8x 7.5x

Case WS

EV / 2020E EBITDA $644 9.3x 9.5x 9.5x 9.7x 10.0x 10.1x 10.5x 10.9x 11.3x 9.0x 8.4x

Abe

Consensus Equity Value / 2019E DCF(2) $367 7.5x 7.7x 7.8x 8.2x 8.7x 8.8x 9.5x 10.2x 10.9x 6.8x 6.5x Equity Value / 2020E DCF(2) $382 7.2x 7.4x 7.5x 7.8x 8.3x 8.5x 9.2x 9.8x 10.5x 6.2x 6.2x

Propane Propane AbeLow-Growth Distributor Transaction Multiples: Statistic MLP Median Median(6) Median

EV / 2019E EBITDA $625 9.6x 9.8x 9.8x 10.0x 10.3x 10.4x 10.8x 11.2x 11.6x 9.3x 8.8x 7.5x Revised EV / 2020E EBITDA $643 10.1x 10.2x 10.3x 10.5x 10.8x 10.9x 11.3x 11.8x 12.2x 9.0x 8.4x

Budget

Abe Equity Value / 2019E DCF(2) $400 6.9x 7.1x 7.2x 7.5x 7.9x 8.1x 8.7x 9.4x 10.0x 6.8x 6.5x Equity Value / 2020E DCF(2) $410 7.6x 7.8x 7.9x 8.3x 8.8x 9.0x 9.7x 10.4x 11.0x 6.2x 6.2x

Source: Company filings, and FactSet as for 2/8/2019.

(1) GP / IDR value estimated by taking current GP/IDR distributions capitalized by Abe’s current yield. (2) DCF attributable to all unitholders including GP + IDR Interest.

(3) Current unadjusted exchange based on Abe and Ulysses closing prices.

(4) Ulysses Proposal: 0.5000x XR and $4.03 cash consideration / unit. 6 (5) Undisturbed XR is the unaffected XR prior to the investor day on 12/4/2018.

(6) Propane distributor Equity Value / DCF and Yield metrics exclude Ferrellgas from group median.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

II. Status Quo Management Projections Overview

7

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

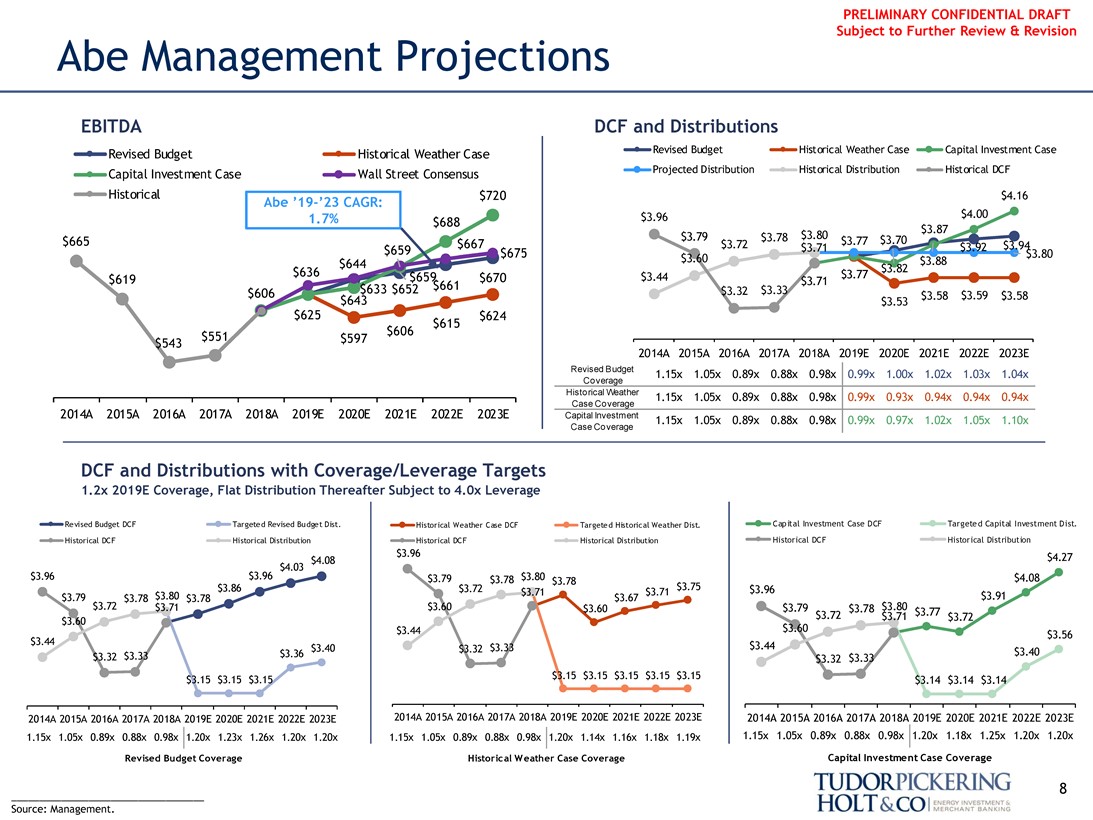

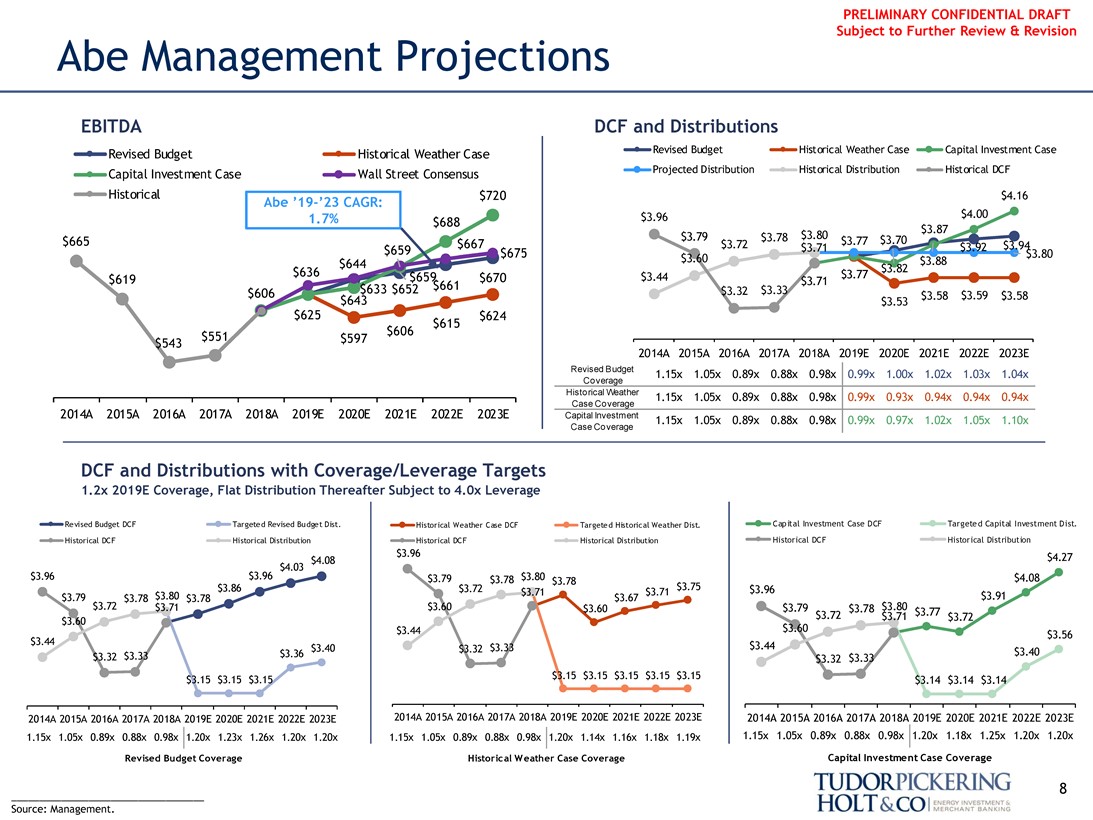

Abe Management Projections

EBITDA DCF and Distributions

Revised Budget Historical Weather Case Revised Budget Historical Weather Case Capital Investment Case Capital Investment Case Wall Street Consensus Projected Distribution Historical Distribution Historical DCF

Historical $720 $4.16

Abe’19-’23 CAGR: 1.7%

$4.00 $688 $3.96 $3.87 $3.79 $3.78 $3.80 $3.70 $665 $667 $3.72 $3.77 $3.94 $659 $675 $3.71 $3.92 $3.60 $3.80 $644 $3.88 $636 $3.82 $619 $659 $670 $3.44 $3.77 $661 $3.71 $606 $633 $652 $3.32 $3.33 $643 $3.58 $3.59 $3.58 $3.53 $625 $624 $615 $551 $606 $543 $597

2014A 2015A 2016A 2017A 2018A 2019E 2020E 2021E 2022E 2023E Revised Budget 1.15x 1.05x 0.89x 0.88x 0.98x 0.99x 1.00x 1.02x 1.03x 1.04x

Coverage

Historical Weather 1.15x 1.05x 0.89x 0.88x 0.98x 0.99x 0.93x 0.94x 0.94x 0.94x

2014A 2015A 2016A 2017A 2018A 2019E 2020E 2021E 2022E 2023E Case Coverage

Capital Investment 1.15x 1.05x 0.89x 0.88x 0.98x 0.99x 0.97x 1.02x 1.05x 1.10x

Case Coverage

DCF and Distributions with Coverage/Leverage Targets

1.2x 2019E Coverage, Flat Distribution Thereafter Subject to 4.0x Leverage

Revised Budget DCF Targeted Revised Budget Dist. Historical Weather Case DCF Targeted Historical Weather Dist. Capital Investment Case DCF Targeted Capital Investment Dist.

Historical DCF Historical Distribution Historical DCF Historical Distribution Historical DCF Historical Distribution

$3.96 $4.27 $4.08 $4.03 $3.96 $3.96 $3.79 $3.78 $3.80 $4.08 $3.78 $3.86 $3.72 $3.75 $3.96 $3.80 $3.71 $3.71 $3.91 $3.79 $3.78 $3.78 $3.67 $3.72 $3.71 $3.60 $3.60 $3.79 $3.78 $3.80 $3.72 $3.71 $3.77 $3.60 $3.72 $3.44 $3.60 $3.56 $3.44 $3.44 $3.40 $3.32 $3.33 $3.40 $3.32 $3.33 $3.36 $3.32 $3.33 $3.15 $3.15 $3.15 $3.15 $3.15 $3.15 $3.15 $3.15 $3.14 $3.14 $3.14

2014A 2015A 2016A 2017A 2018A 2019E 2020E 2021E 2022E 2023E 2014A 2015A 2016A 2017A 2018A 2019E 2020E 2021E 2022E 2023E 2014A 2015A 2016A 2017A 2018A 2019E 2020E 2021E 2022E 2023E 1.15x 1.05x 0.89x 0.88x 0.98x 1.20x 1.23x 1.26x 1.20x 1.20x 1.15x 1.05x 0.89x 0.88x 0.98x 1.20x 1.14x 1.16x 1.18x 1.19x 1.15x 1.05x 0.89x 0.88x 0.98x 1.20x 1.18x 1.25x 1.20x 1.20x

Revised Budget Coverage Historical Weather Case Coverage Capital Investment Case Coverage

8

___________________________________ Source: Management.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

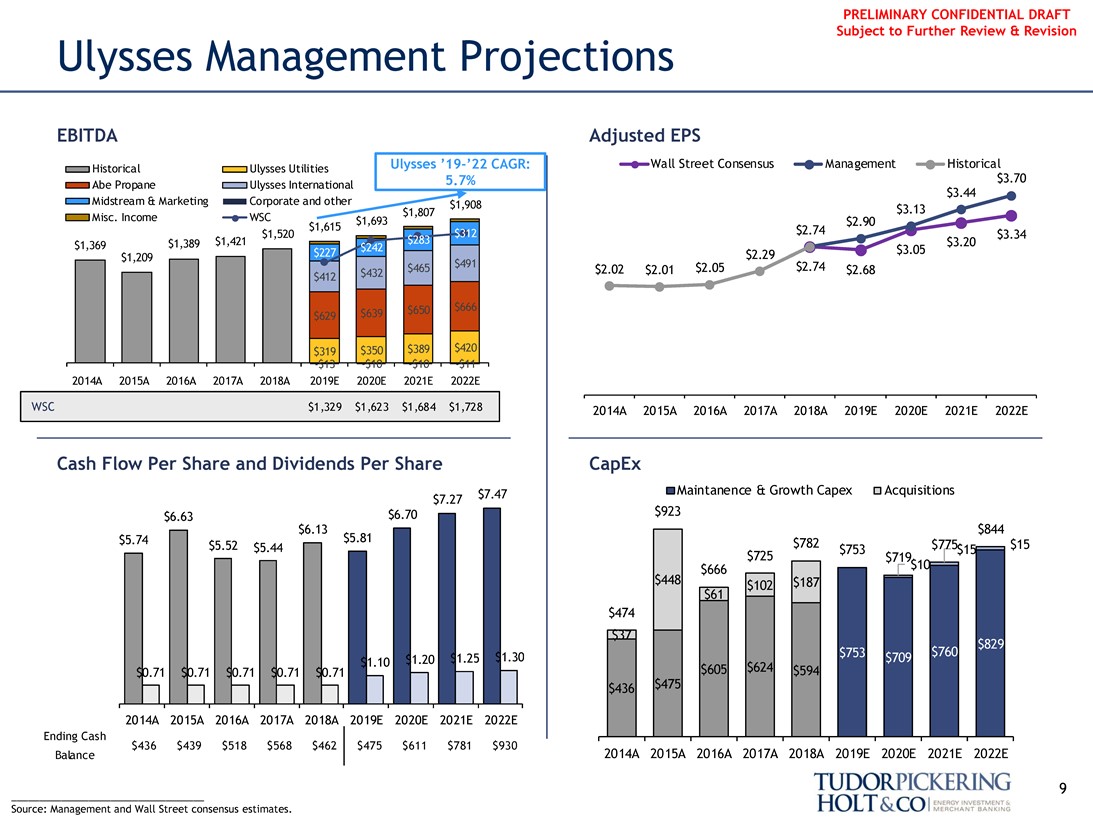

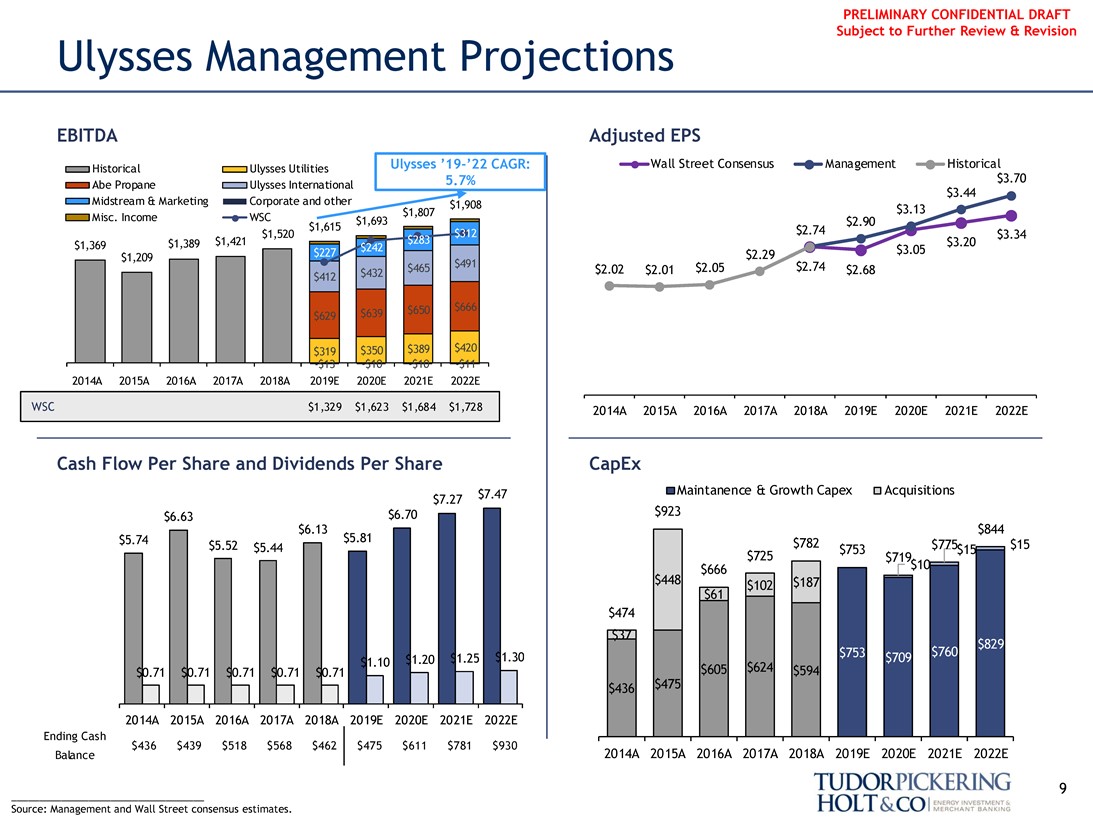

Ulysses Management Projections

EBITDA Adjusted EPS

Historical Ulysses Utilities Ulysses’19-’22 CAGR: Wall Street Consensus Management Historical 5.7% $3.70

Abe Propane Ulysses International $3.44

Midstream & Marketing Corporate and other $1,908 $1,807 $3.13 Misc. Income WSC $1,693 $2.90 $1,615 $2.74 $1,520 $3.34 $1,389 $1,421 $3.20 $1,369 $3.05 $1,209 $491 $2.29 $465 $2.02 $2.01 $2.05 $2.74 $2.68 $412 $432

$312 $283 $242 $227

$650 $666 $629 $639

$319 $350 $389 $420

-$13 -$10 -$10 -$11 2014A 2015A 2016A 2017A 2018A 2019E 2020E 2021E 2022E

WSC $1,329 $1,623 $1,684 $1,728 2014A 2015A 2016A 2017A 2018A 2019E 2020E 2021E 2022E

Cash Flow Per Share and Dividends Per Share CapEx

$7.47 Maintanence & Growth Capex Acquisitions $7.27 $923 $6.63 $6.70 $6.13 $844 $5.74 $5.81 $782 $5.52 $5.44 $753 $775$ 15 $15 $725 $719 $666 $10 $448 $102 $187 $61 $474 $37 $1.30 $1.10 $1.20 $1.25 $0.71 $0.71 $0.71 $0.71 $0.71 $605 $624 $594 $436 $475

$753 $709 $760 $829

2014A 2015A 2016A 2017A 2018A 2019E 2020E 2021E 2022E

Ending Cash $436 $439 $518 $568 $462 $475 $611 $781 $930

Balance 2014A 2015A 2016A 2017A 2018A 2019E 2020E 2021E 2022E

9

Source: Management and Wall Street consensus estimates.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

III. Abe Financial Analysis

10

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

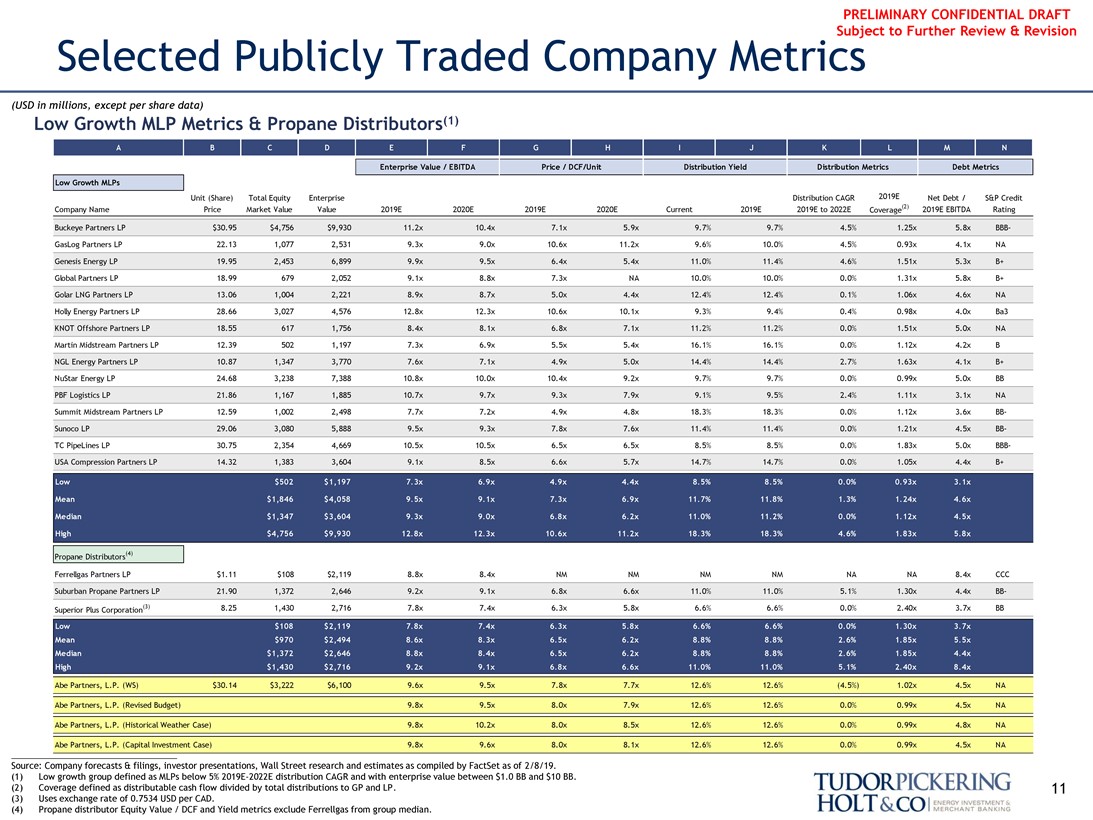

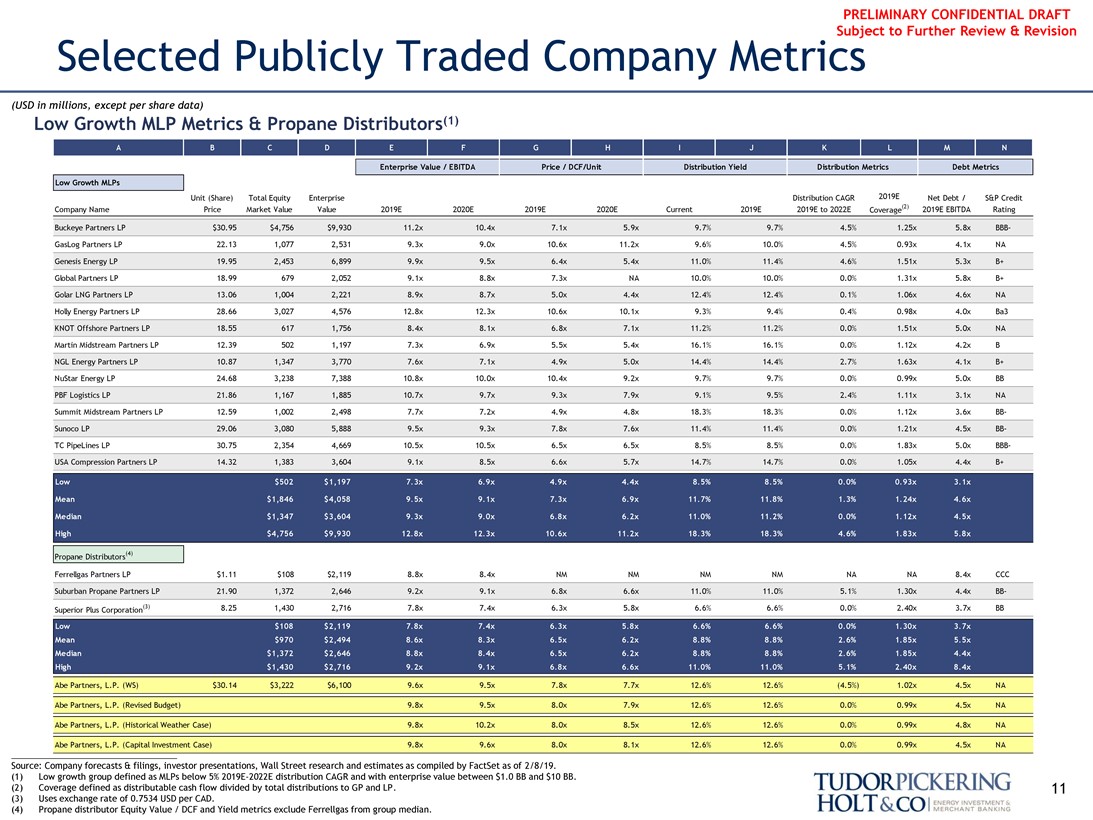

Selected Publicly Traded Company Metrics

(USD in millions, except per share data)

Low Growth MLP Metrics & Propane Distributors(1)

A B C D E F G H I J K L M N

Enterprise Value / EBITDA Price / DCF/Unit Distribution Yield Distribution Metrics Debt Metrics Low Growth MLPs

Unit (Share) Total Equity Enterprise Distribution CAGR 2019E Net Debt / S&P Credit Company Name Price Market Value Value 2019E 2020E 2019E 2020E Current 2019E 2019E to 2022E Coverage(2) 2019E EBITDA Rating Buckeye Partners LP $30.95 $4,756 $9,930 11.2x 10.4x 7.1x 5.9x 9.7% 9.7% 4.5% 1.25x 5.8x BBB-

GasLog Partners LP 22.13 1,077 2,531 9.3x 9.0x 10.6x 11.2x 9.6% 10.0% 4.5% 0.93x 4.1x NA Genesis Energy LP 19.95 2,453 6,899 9.9x 9.5x 6.4x 5.4x 11.0% 11.4% 4.6% 1.51x 5.3x B+ Global Partners LP 18.99 679 2,052 9.1x 8.8x 7.3x NA 10.0% 10.0% 0.0% 1.31x 5.8x B+ Golar LNG Partners LP 13.06 1,004 2,221 8.9x 8.7x 5.0x 4.4x 12.4% 12.4% 0.1% 1.06x 4.6x NA Holly Energy Partners LP 28.66 3,027 4,576 12.8x 12.3x 10.6x 10.1x 9.3% 9.4% 0.4% 0.98x 4.0x Ba3 KNOT Offshore Partners LP 18.55 617 1,756 8.4x 8.1x 6.8x 7.1x 11.2% 11.2% 0.0% 1.51x 5.0x NA Martin Midstream Partners LP 12.39 502 1,197 7.3x 6.9x 5.5x 5.4x 16.1% 16.1% 0.0% 1.12x 4.2x B NGL Energy Partners LP 10.87 1,347 3,770 7.6x 7.1x 4.9x 5.0x 14.4% 14.4% 2.7% 1.63x 4.1x B+ NuStar Energy LP 24.68 3,238 7,388 10.8x 10.0x 10.4x 9.2x 9.7% 9.7% 0.0% 0.99x 5.0x BB PBF Logistics LP 21.86 1,167 1,885 10.7x 9.7x 9.3x 7.9x 9.1% 9.5% 2.4% 1.11x 3.1x NA Summit Midstream Partners LP 12.59 1,002 2,498 7.7x 7.2x 4.9x 4.8x 18.3% 18.3% 0.0% 1.12x 3.6xBB-Sunoco LP 29.06 3,080 5,888 9.5x 9.3x 7.8x 7.6x 11.4% 11.4% 0.0% 1.21x 4.5xBB-TC PipeLines LP 30.75 2,354 4,669 10.5x 10.5x 6.5x 6.5x 8.5% 8.5% 0.0% 1.83x 5.0xBBB-USA Compression Partners LP 14.32 1,383 3,604 9.1x 8.5x 6.6x 5.7x 14.7% 14.7% 0.0% 1.05x 4.4x B+

Low $502 $1,197 7.3x 6.9x 4.9x 4.4x 8.5% 8.5% 0.0% 0.93x 3.1x Mean $1,846 $4,058 9.5x 9.1x 7.3x 6.9x 11.7% 11.8% 1.3% 1.24x 4.6x Median $1,347 $3,604 9.3x 9.0x 6.8x 6.2x 11.0% 11.2% 0.0% 1.12x 4.5x High $4,756 $9,930 12.8x 12.3x 10.6x 11.2x 18.3% 18.3% 4.6% 1.83x 5.8x

Propane Distributors(4)

Ferrellgas Partners LP $1.11 $108 $2,119 8.8x 8.4x NM NM NM NM NA NA 8.4x CCC

Suburban Propane Partners LP 21.90 1,372 2,646 9.2x 9.1x 6.8x 6.6x 11.0% 11.0% 5.1% 1.30x 4.4x BB-

Superior Plus Corporation(3) 8.25 1,430 2,716 7.8x 7.4x 6.3x 5.8x 6.6% 6.6% 0.0% 2.40x 3.7x BB

Low $108 $2,119 7.8x 7.4x 6.3x 5.8x 6.6% 6.6% 0.0% 1.30x 3.7x Mean $970 $2,494 8.6x 8.3x 6.5x 6.2x 8.8% 8.8% 2.6% 1.85x 5.5x Median $1,372 $2,646 8.8x 8.4x 6.5x 6.2x 8.8% 8.8% 2.6% 1.85x 4.4x High $1,430 $2,716 9.2x 9.1x 6.8x 6.6x 11.0% 11.0% 5.1% 2.40x 8.4x

Abe Partners, L.P. (WS) $30.14 $3,222 $6,100 9.6x 9.5x 7.8x 7.7x 12.6% 12.6% (4.5%) 1.02x 4.5x NA Abe Partners, L.P. (Revised Budget) 9.8x 9.5x 8.0x 7.9x 12.6% 12.6% 0.0% 0.99x 4.5x NA Abe Partners, L.P. (Historical Weather Case) 9.8x 10.2x 8.0x 8.5x 12.6% 12.6% 0.0% 0.99x 4.8x NA

Abe Partners, L.P. (Capital Investment Case) 9.8x 9.6x 8.0x 8.1x 12.6% 12.6% 0.0% 0.99x 4.5x NA

Source: Company forecasts & filings, investor presentations, Wall Street research and estimates as compiled by FactSet as of 2/8/19. (1) Low growth group defined as MLPs below 5% 2019E-2022E distribution CAGR and with enterprise value between $1.0 BB and $10 BB.

(2) Coverage defined as distributable cash flow divided by total distributions to GP and LP. 11 (3) Uses exchange rate of 0.7534 USD per CAD.

(4) Propane distributor Equity Value / DCF and Yield metrics exclude Ferrellgas from group median.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

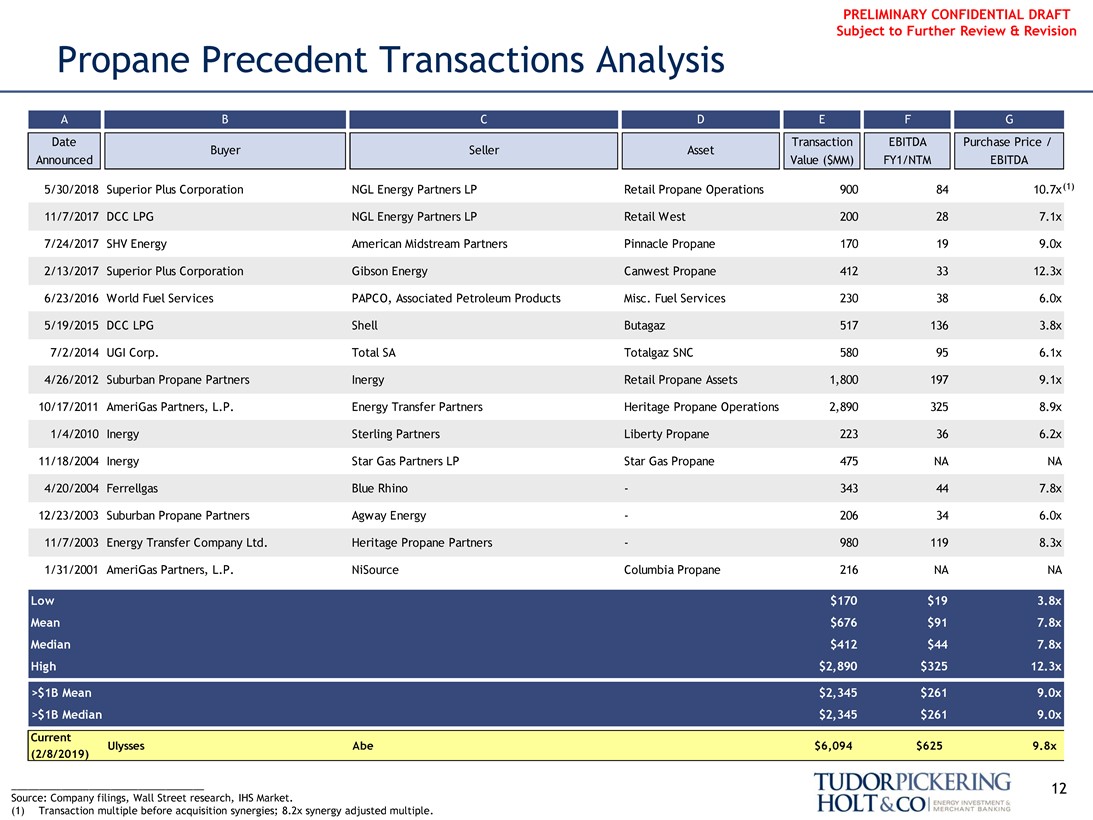

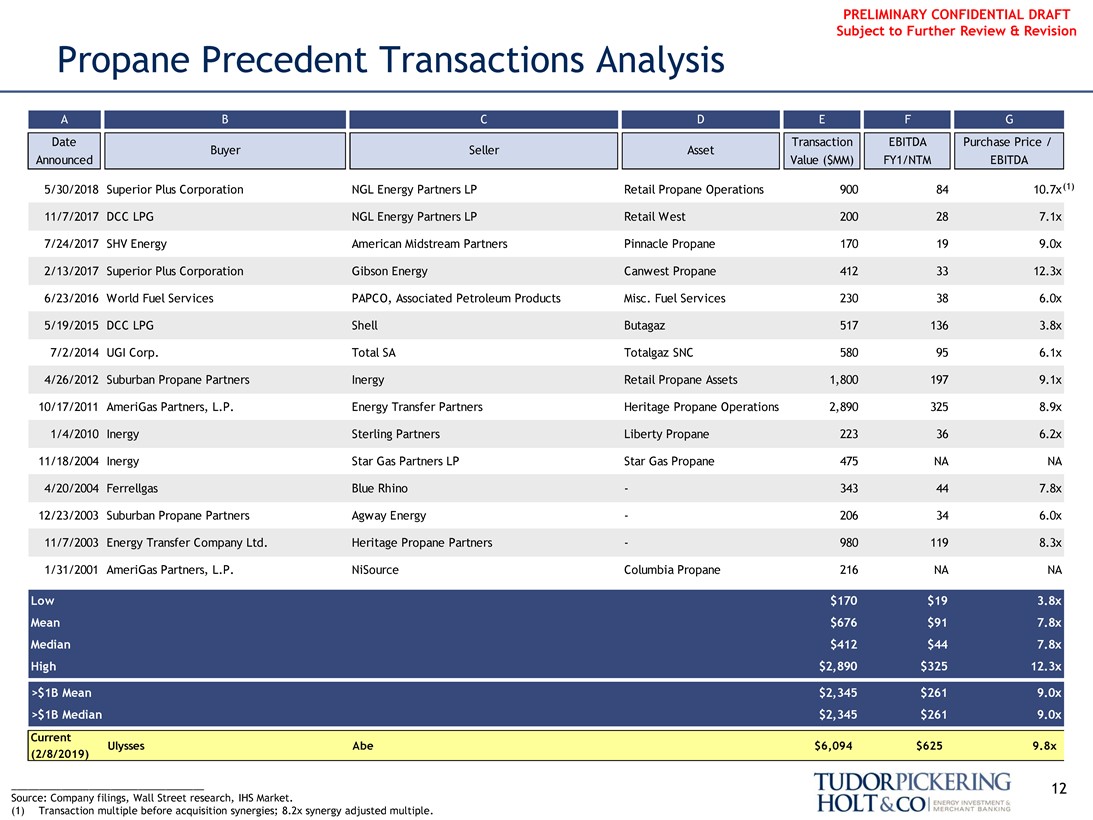

Propane Precedent Transactions Analysis

A B C D E F G

Date Transaction EBITDA Purchase Price / Buyer Seller Asset Announced Value ($MM) FY1/NTM EBITDA

5/30/2018 Superior Plus Corporation NGL Energy Partners LP Retail Propane Operations 900 84 10.7x(1) 11/7/2017 DCC LPG NGL Energy Partners LP Retail West 200 28 7.1x

7/24/2017 SHV Energy American Midstream Partners Pinnacle Propane 170 19 9.0x 2/13/2017 Superior Plus Corporation Gibson Energy Canwest Propane 412 33 12.3x 6/23/2016 World Fuel Services PAPCO, Associated Petroleum Products Misc. Fuel Services 230 38 6.0x 5/19/2015 DCC LPG Shell Butagaz 517 136 3.8x 7/2/2014 UGI Corp. Total SA Totalgaz SNC 580 95 6.1x 4/26/2012 Suburban Propane Partners Inergy Retail Propane Assets 1,800 197 9.1x 10/17/2011 AmeriGas Partners, L.P. Energy Transfer Partners Heritage Propane Operations 2,890 325 8.9x 1/4/2010 Inergy Sterling Partners Liberty Propane 223 36 6.2x 11/18/2004 Inergy Star Gas Partners LP Star Gas Propane 475 NA NA

4/20/2004 Ferrellgas Blue Rhino—343 44 7.8x 12/23/2003 Suburban Propane Partners Agway Energy—206 34 6.0x 11/7/2003 Energy Transfer Company Ltd. Heritage Propane Partners—980 119 8.3x 1/31/2001 AmeriGas Partners, L.P. NiSource Columbia Propane 216 NA NA

Low $170 $19 3.8x Mean $676 $91 7.8x Median $412 $44 7.8x High $2,890 $325 12.3x

>$1B Mean $2,345 $261 9.0x

>$1B Median $2,345 $261 9.0x

Current

Ulysses Abe $6,094 $625 9.8x (2/8/2019)

___________________________________ 12 Source: Company filings, Wall Street research, IHS Market.

(1) Transaction multiple before acquisition synergies; 8.2x synergy adjusted multiple.

Tudorpickering Holt&co energy investment & merchant banking

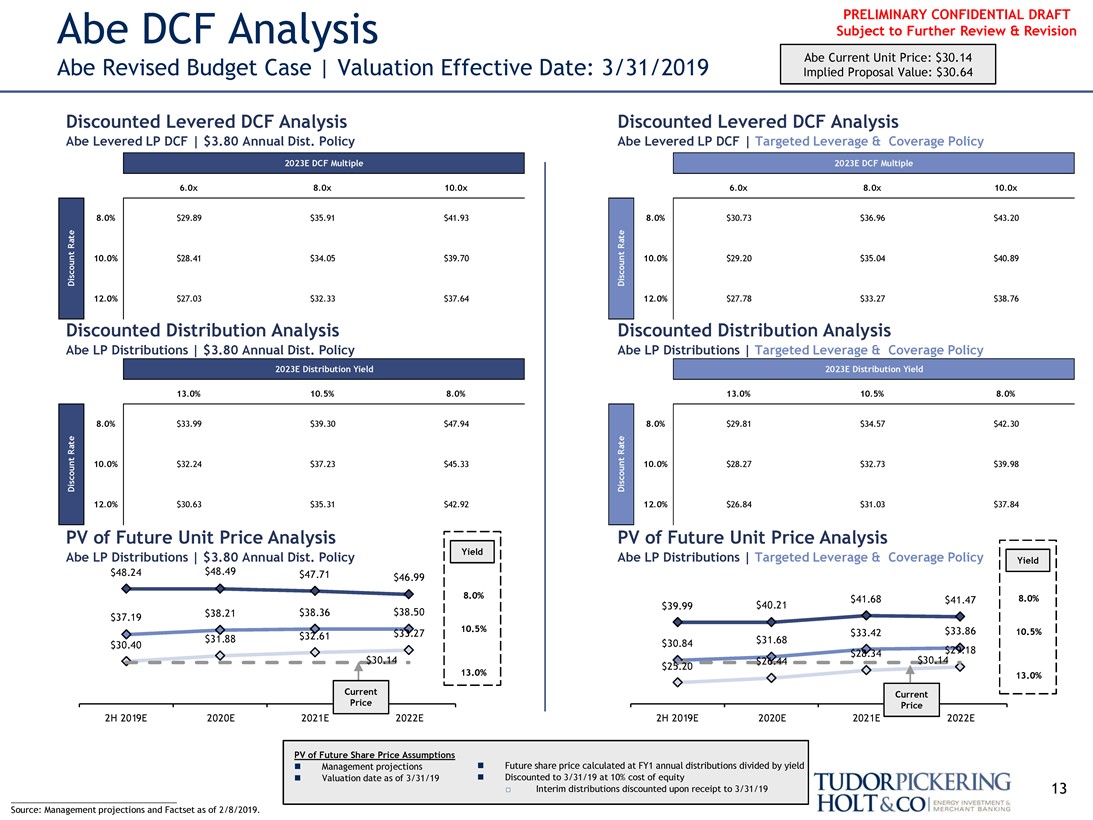

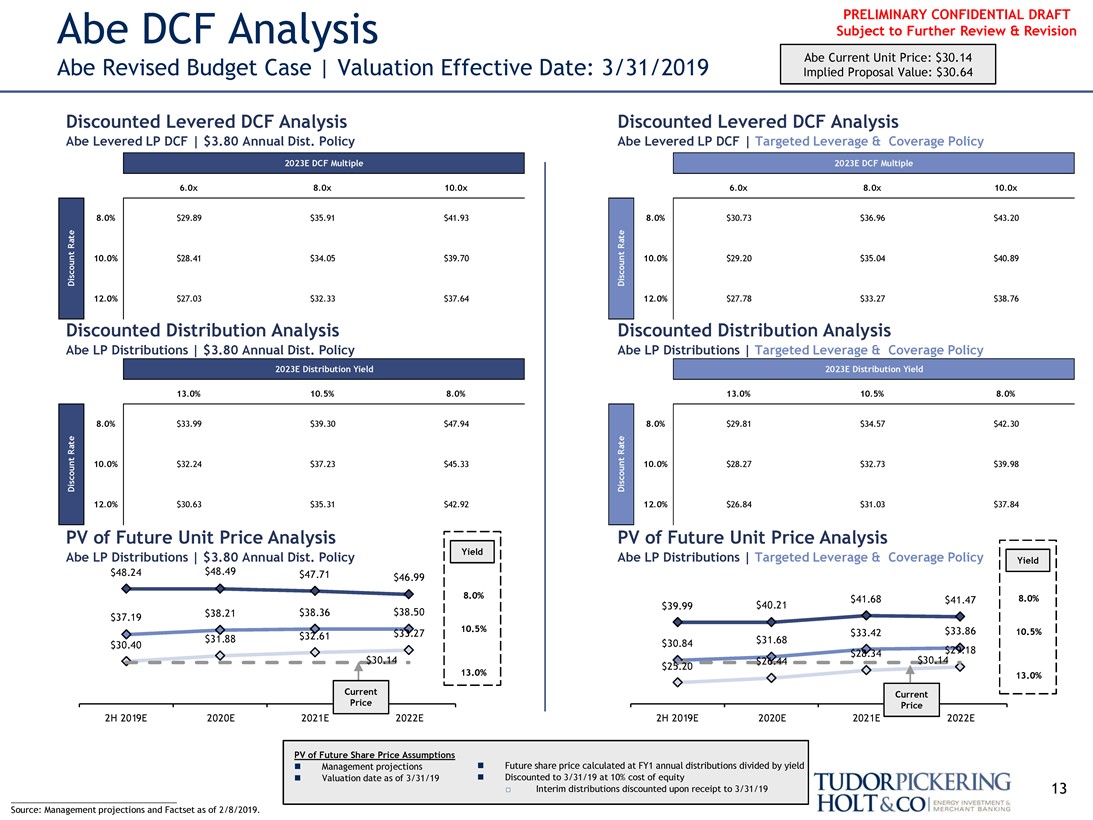

PRELIMINARY CONFIDENTIAL DRAFT Abe DCF Analysis Subject to Further Review & Revision

Abe Revised Budget Case | Valuation Effective Date: 3/31/2019 Abe Current Unit Price: $30.14

Implied Proposal Value: $30.64

Discounted Levered DCF Analysis Discounted Levered DCF Analysis

Abe Levered LP DCF | $3.80 Annual Dist. Policy Abe Levered LP DCF | Targeted Leverage & Coverage Policy

2023E DCF Multiple 2023E DCF Multiple

discount rate discount rate discount rate discount rate

6.0x 8.0x 10.0x 6.0x 8.0x 10.0x

8.0% $29.89 $35.91 $41.93 8.0% $30.73 $36.96 $43.20 10.0% $28.41 $34.05 $39.70 10.0% $29.20 $35.04 $40.89 12.0% $27.03 $32.33 $37.64 12.0% $27.78 $33.27 $38.76

Discounted Distribution Analysis Discounted Distribution Analysis

Abe LP Distributions | $3.80 Annual Dist. Policy Abe LP Distributions | Targeted Leverage & Coverage Policy

2023E Distribution Yield 2023E Distribution Yield

13.0% 10.5% 8.0% 13.0% 10.5% 8.0%

8.0% $33.99 $39.30 $47.94 8.0% $29.81 $34.57 $42.30

10.0% $32.24 $37.23 $45.33 10.0% $28.27 $32.73 $39.98

12.0% $30.63 $35.31 $42.92 12.0% $26.84 $31.03 $37.84

PV of Future Unit Price Analysis PV of Future Unit Price Analysis

Abe LP Distributions | $3.80 Annual Dist. Policy Yield Abe LP Distributions | Targeted Leverage & Coverage Policy Yield $48.24 $48.49 $47.71 $46.99

8.0% $40.21 $41.68 $41.47 8.0% $39.99 $38.21 $38.36 $38.50 $37.19 $33.27 10.5% $33.42 $33.86 10.5% $31.88 $32.61 $31.68 $30.40 $30.84 $30.14 $28.34 $30.14 $ 29.18 $26.44 $25.20

13.0% 13.0% Current Current Price Price

2H 2019E 2020E 2021E 2022E 2H 2019E 2020E 2021E 2022E

PV of Future Share Price Assumptions

∎ Management projections ∎ Future share price calculated at FY1 annual distributions divided by yield∎ Valuation date as of 3/31/19∎ Discounted to 3/31/19 at 10% cost of equity

Interim distributions discounted upon receipt to 3/31/19 13 ___________________________________ Source: Management projections and Factset as of 2/8/2019.

Tudorpickering Holt&co energy investment & merchant banking

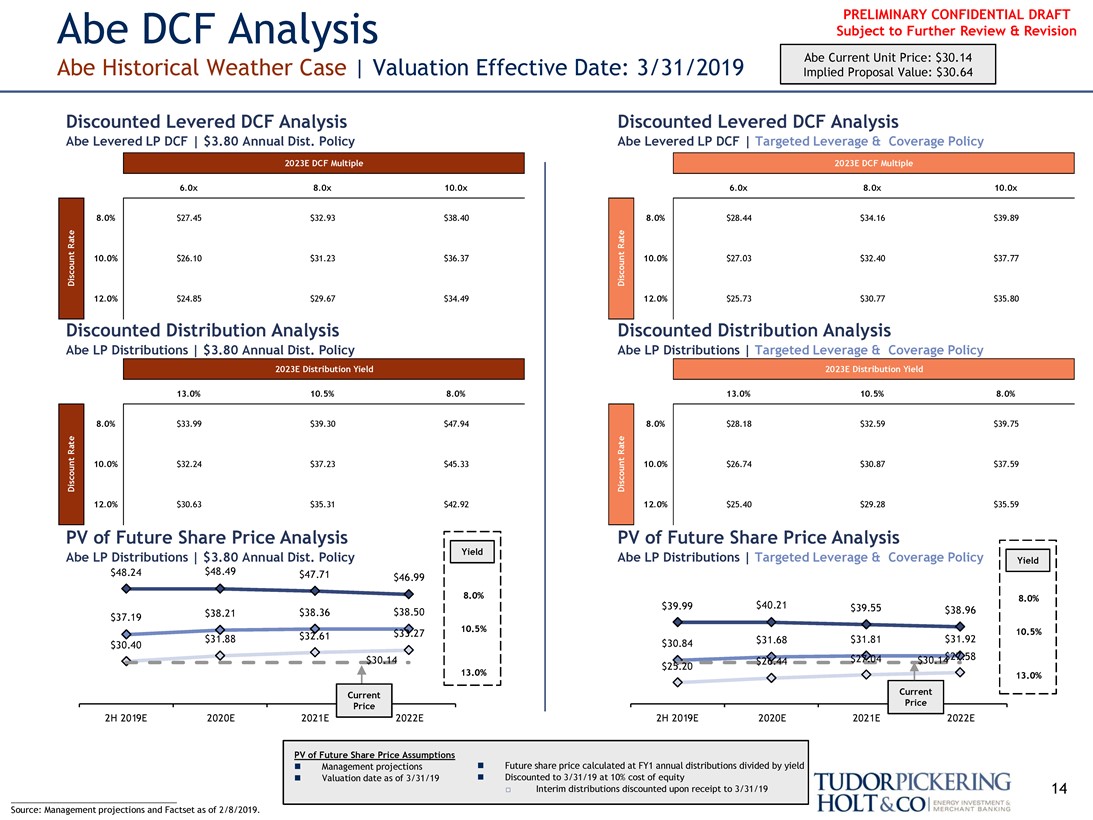

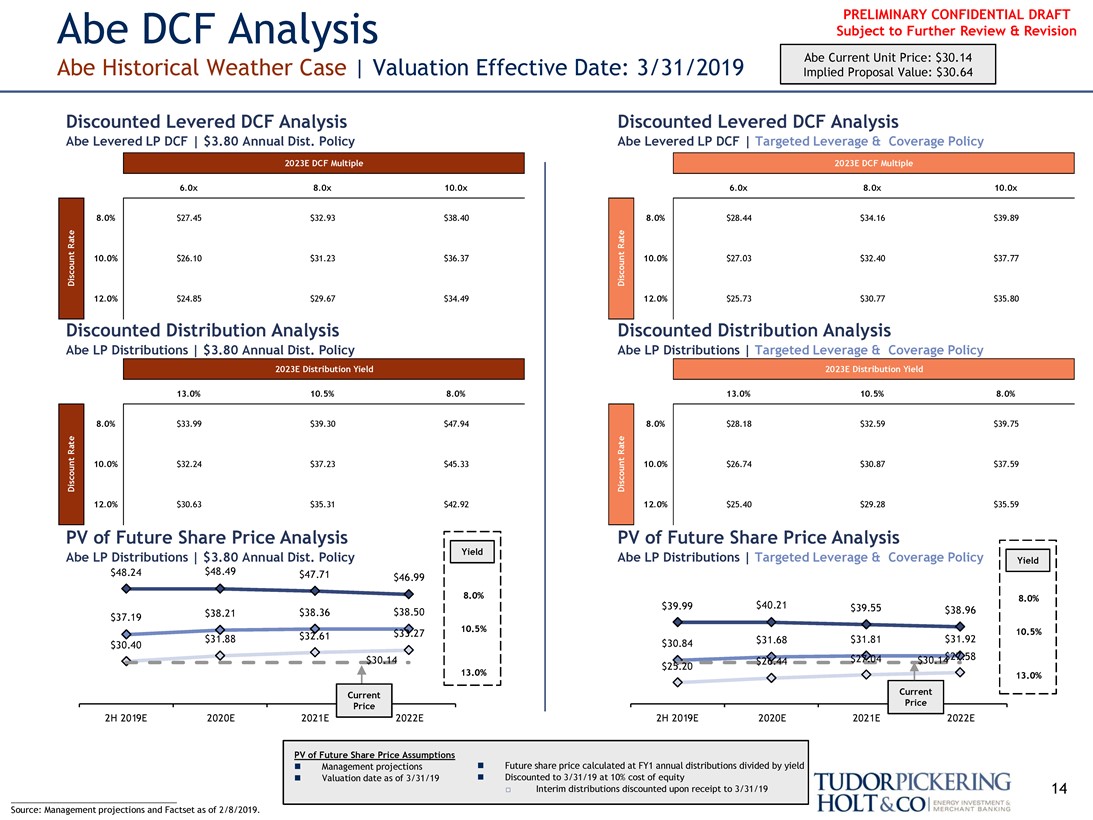

PRELIMINARY CONFIDENTIAL DRAFT Abe DCF Analysis Subject to Further Review & Revision

Abe Historical Weather Case | Valuation Effective Date: 3/31/2019 Abe Current Unit Price: $30.14

Implied Proposal Value: $30.64

Discounted Levered DCF Analysis Discounted Levered DCF Analysis

Abe Levered LP DCF | $3.80 Annual Dist. Policy Abe Levered LP DCF | Targeted Leverage & Coverage Policy

2023E DCF Multiple 2023E DCF Multiple

discount rate discount rate discount rate discount rate

6.0x 8.0x 10.0x 6.0x 8.0x 10.0x

8.0% $27.45 $32.93 $38.40 8.0% $28.44 $34.16 $39.89 10.0% $26.10 $31.23 $36.37 10.0% $27.03 $32.40 $37.77 12.0% $24.85 $29.67 $34.49 12.0% $25.73 $30.77 $35.80

Discounted Distribution Analysis Discounted Distribution Analysis

Abe LP Distributions | $3.80 Annual Dist. Policy Abe LP Distributions | Targeted Leverage & Coverage Policy

13.0% 10.5% 8.0% 13.0% 10.5% 8.0%

8.0% $33.99 $39.30 $47.94 8.0% $28.18 $32.59 $39.75

10.0% $32.24 $37.23 $45.33 10.0% $26.74 $30.87 $37.59

12.0% $30.63 $35.31 $42.92 12.0% $25.40 $29.28 $35.59

PV of Future Share Price Analysis PV of Future Share Price Analysis

Abe LP Distributions | $3.80 Annual Dist. Policy Yield Abe LP Distributions | Targeted Leverage & Coverage Policy Yield $48.24 $48.49 $47.71 $46.99

8.0% $40.21 8.0% $39.99 $39.55 $38.96 $38.21 $38.36 $38.50 $37.19 $33.27 10.5% 10.5% $31.88 $32.61 $31.68 $31.81 $31.92 $30.40 $30.84 $30.14 $25.20 $26.44 $27.04 $30.14 $ 27.58

13.0% 13.0% Current Current Price Price

2023E Distribution Yield 2023E Distribution Yield

2H 2019E 2020E 2021E 2022E 2H 2019E 2020E 2021E 2022E

PV of Future Share Price Assumptions

∎ Management projections ∎ Future share price calculated at FY1 annual distributions divided by yield∎ Valuation date as of 3/31/19∎ Discounted to 3/31/19 at 10% cost of equity

Interim distributions discounted upon receipt to 3/31/19 14 ___________________________________ Source: Management projections and Factset as of 2/8/2019.

Tudorpickering Holt&co energy investment & merchant banking

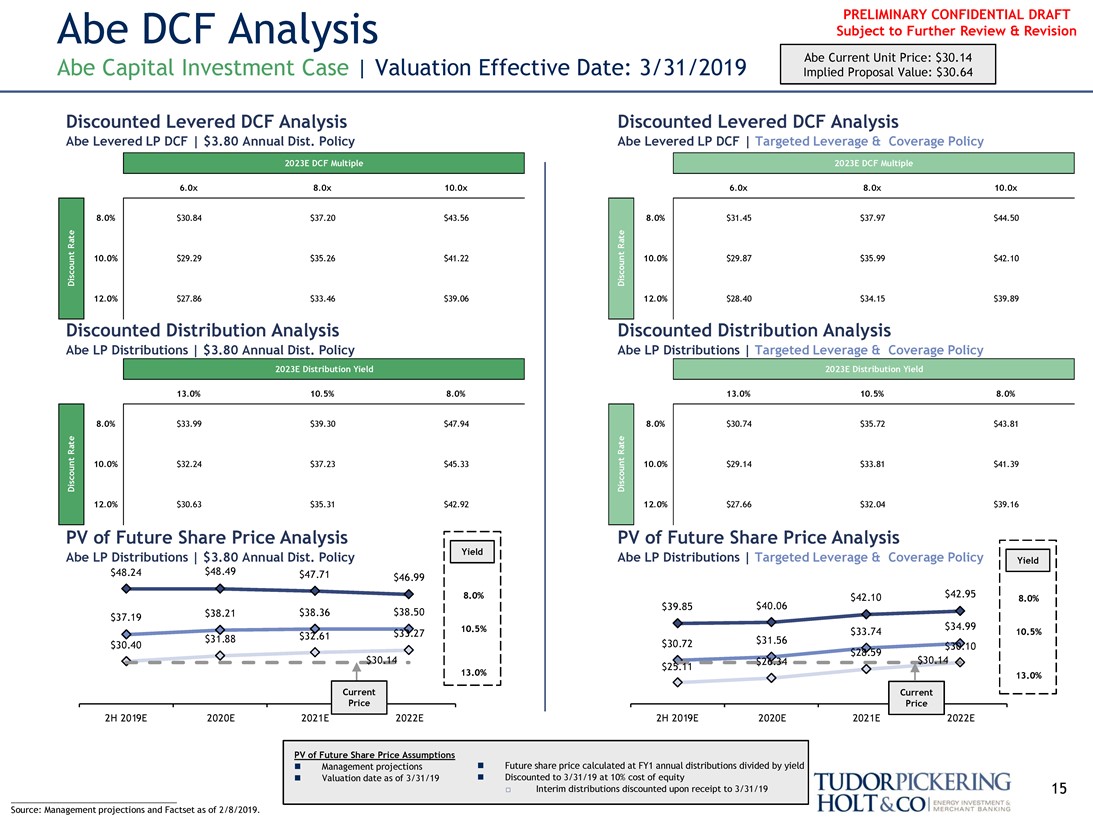

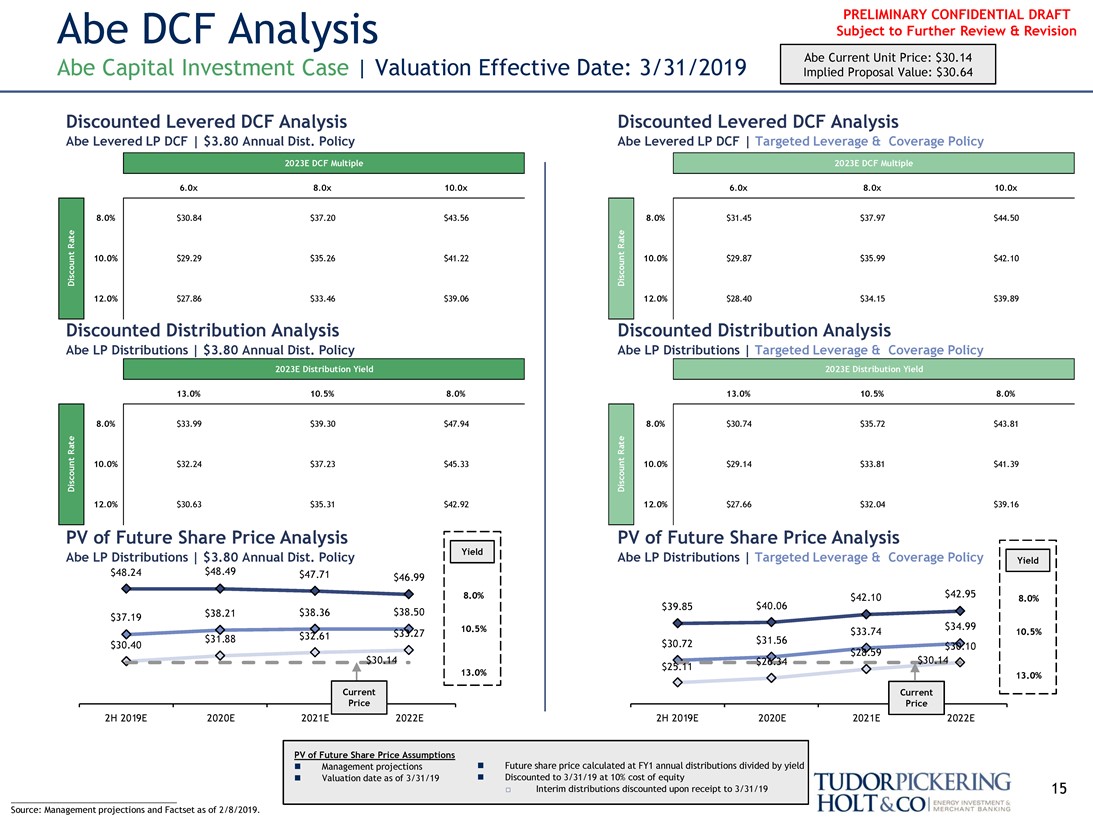

PRELIMINARY CONFIDENTIAL DRAFT Abe DCF Analysis Subject to Further Review & Revision

Abe Capital Investment Case | Valuation Effective Date: 3/31/2019 Abe Current Unit Price: $30.14

Implied Proposal Value: $30.64

Discounted Levered DCF Analysis Discounted Levered DCF Analysis

Abe Levered LP DCF | $3.80 Annual Dist. Policy Abe Levered LP DCF | Targeted Leverage & Coverage Policy

2023E DCF Multiple 2023E DCF Multiple

discount rate discount rate discount rate discount rate

6.0x 8.0x 10.0x 6.0x 8.0x 10.0x

8.0% $30.84 $37.20 $43.56 8.0% $31.45 $37.97 $44.50 10.0% $29.29 $35.26 $41.22 10.0% $29.87 $35.99 $42.10 12.0% $27.86 $33.46 $39.06 12.0% $28.40 $34.15 $39.89

Discounted Distribution Analysis Discounted Distribution Analysis

Abe LP Distributions | $3.80 Annual Dist. Policy Abe LP Distributions | Targeted Leverage & Coverage Policy

13.0% 10.5% 8.0% 13.0% 10.5% 8.0%

8.0% $33.99 $39.30 $47.94 8.0% $30.74 $35.72 $43.81

10.0% $32.24 $37.23 $45.33 10.0% $29.14 $33.81 $41.39

12.0% $30.63 $35.31 $42.92 12.0% $27.66 $32.04 $39.16

PV of Future Share Price Analysis PV of Future Share Price Analysis

Abe LP Distributions | $3.80 Annual Dist. Policy Yield Abe LP Distributions | Targeted Leverage & Coverage Policy Yield $48.24 $48.49 $47.71 $46.99 8.0% $42.10 $42.95 8.0% $39.85 $40.06 $38.21 $38.36 $38.50 $37.19 $34.99 $33.27 10.5% $33.74 10.5% $31.88 $32.61 $31.56 $30.40 $30.72 $30.10 $28.59 $30.14 $26.34 $30.14 $25.11

13.0% 13.0% Current Current Price Price

2023E Distribution Yield 2023E Distribution Yield

2H 2019E 2020E 2021E 2022E 2H 2019E 2020E 2021E 2022E

PV of Future Share Price Assumptions

∎ Management projections ∎ Future share price calculated at FY1 annual distributions divided by yield∎ Valuation date as of 3/31/19∎ Discounted to 3/31/19 at 10% cost of equity

Interim distributions discounted upon receipt to 3/31/19 15 ___________________________________ Source: Management projections and Factset as of 2/8/2019.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

IV. Ulysses Financial Analysis

16

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

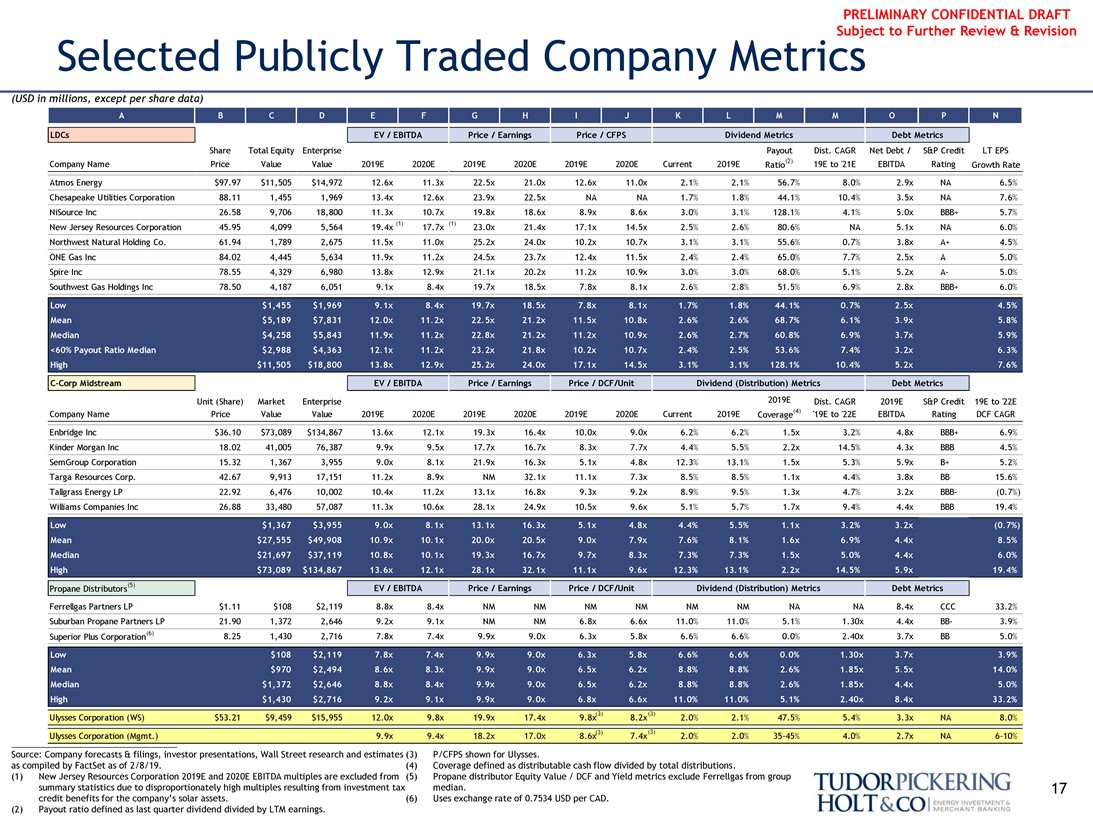

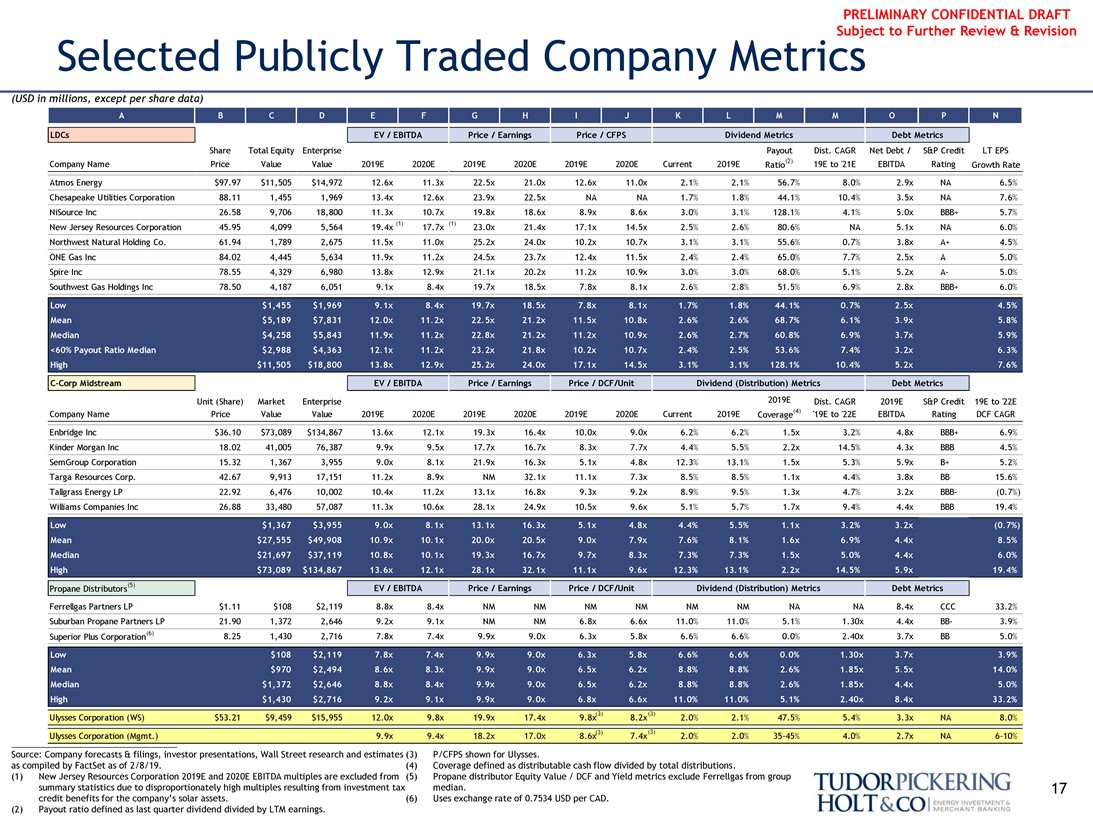

Selected Publicly Traded Company Metrics

(USD in millions, except per share data)

A B C D E F G H I J K L M M O P N

LDCs EV / EBITDA Price / Earnings Price / CFPS Dividend Metrics Debt Metrics

Share Total Equity Enterprise Payout Dist. CAGR Net Debt / S&P Credit LT EPS Company Name Price Value Value 2019E 2020E 2019E 2020E 2019E 2020E Current 2019E Ratio(2) 19E to ‘21E EBITDA Rating Growth Rate Atmos Energy $97.97 $11,505 $14,972 12.6x 11.3x 22.5x 21.0x 12.6x 11.0x 2.1% 2.1% 56.7% 8.0% 2.9x NA 6.5% Chesapeake Utilities Corporation 88.11 1,455 1,969 13.4x 12.6x 23.9x 22.5x NA NA 1.7% 1.8% 44.1% 10.4% 3.5x NA 7.6% NiSource Inc 26.58 9,706 18,800 11.3x 10.7x 19.8x 18.6x 8.9x 8.6x 3.0% 3.1% 128.1% 4.1% 5.0x BBB+ 5.7% New Jersey Resources Corporation 45.95 4,099 5,564 19.4x (1) 17.7x (1) 23.0x 21.4x 17.1x 14.5x 2.5% 2.6% 80.6% NA 5.1x NA 6.0% Northwest Natural Holding Co. 61.94 1,789 2,675 11.5x 11.0x 25.2x 24.0x 10.2x 10.7x 3.1% 3.1% 55.6% 0.7% 3.8x A+ 4.5% ONE Gas Inc 84.02 4,445 5,634 11.9x 11.2x 24.5x 23.7x 12.4x 11.5x 2.4% 2.4% 65.0% 7.7% 2.5x A 5.0% Spire Inc 78.55 4,329 6,980 13.8x 12.9x 21.1x 20.2x 11.2x 10.9x 3.0% 3.0% 68.0% 5.1% 5.2xA- 5.0% Southwest Gas Holdings Inc 78.50 4,187 6,051 9.1x 8.4x 19.7x 18.5x 7.8x 8.1x 2.6% 2.8% 51.5% 6.9% 2.8x BBB+ 6.0%

C-Corp Midstream EV / EBITDA Price / Earnings Price / DCF/Unit Dividend (Distribution) Metrics Debt Metrics

Unit (Share) Market Enterprise 2019E Dist. CAGR 2019E S&P Credit 19E to ‘22E Company Name Price Value Value 2019E 2020E 2019E 2020E 2019E 2020E Current 2019E Coverage(4) ‘19E to ‘22E EBITDA Rating DCF CAGR Enbridge Inc $36.10 $73,089 $134,867 13.6x 12.1x 19.3x 16.4x 10.0x 9.0x 6.2% 6.2% 1.5x 3.2% 4.8x BBB+ 6.9% Kinder Morgan Inc 18.02 41,005 76,387 9.9x 9.5x 17.7x 16.7x 8.3x 7.7x 4.4% 5.5% 2.2x 14.5% 4.3x BBB 4.5% SemGroup Corporation 15.32 1,367 3,955 9.0x 8.1x 21.9x 16.3x 5.1x 4.8x 12.3% 13.1% 1.5x 5.3% 5.9x B+ 5.2% Targa Resources Corp. 42.67 9,913 17,151 11.2x 8.9x NM 32.1x 11.1x 7.3x 8.5% 8.5% 1.1x 4.4% 3.8x BB 15.6% Tallgrass Energy LP 22.92 6,476 10,002 10.4x 11.2x 13.1x 16.8x 9.3x 9.2x 8.9% 9.5% 1.3x 4.7% 3.2xBBB- (0.7%) Williams Companies Inc 26.88 33,480 57,087 11.3x 10.6x 28.1x 24.9x 10.5x 9.6x 5.1% 5.7% 1.7x 9.4% 4.4x BBB 19.4%

Low $1,455 $1,969 9.1x 8.4x 19.7x 18.5x 7.8x 8.1x 1.7% 1.8% 44.1% 0.7% 2.5x 4.5% Mean $5,189 $7,831 12.0x 11.2x 22.5x 21.2x 11.5x 10.8x 2.6% 2.6% 68.7% 6.1% 3.9x 5.8% Median $4,258 $5,843 11.9x 11.2x 22.8x 21.2x 11.2x 10.9x 2.6% 2.7% 60.8% 6.9% 3.7x 5.9% <60% Payout Ratio Median $2,988 $4,363 12.1x 11.2x 23.2x 21.8x 10.2x 10.7x 2.4% 2.5% 53.6% 7.4% 3.2x 6.3% High $11,505 $18,800 13.8x 12.9x 25.2x 24.0x 17.1x 14.5x 3.1% 3.1% 128.1% 10.4% 5.2x 7.6%

Low $1,367 $3,955 9.0x 8.1x 13.1x 16.3x 5.1x 4.8x 4.4% 5.5% 1.1x 3.2% 3.2x (0.7%) Mean $27,555 $49,908 10.9x 10.1x 20.0x 20.5x 9.0x 7.9x 7.6% 8.1% 1.6x 6.9% 4.4x 8.5% Median $21,697 $37,119 10.8x 10.1x 19.3x 16.7x 9.7x 8.3x 7.3% 7.3% 1.5x 5.0% 4.4x 6.0% High $73,089 $134,867 13.6x 12.1x 28.1x 32.1x 11.1x 9.6x 12.3% 13.1% 2.2x 14.5% 5.9x 19.4%

Low $108 $2,119 7.8x 7.4x 9.9x 9.0x 6.3x 5.8x 6.6% 6.6% 0.0% 1.30x 3.7x 3.9% Mean $970 $2,494 8.6x 8.3x 9.9x 9.0x 6.5x 6.2x 8.8% 8.8% 2.6% 1.85x 5.5x 14.0% Median $1,372 $2,646 8.8x 8.4x 9.9x 9.0x 6.5x 6.2x 8.8% 8.8% 2.6% 1.85x 4.4x 5.0% High $1,430 $2,716 9.2x 9.1x 9.9x 9.0x 6.8x 6.6x 11.0% 11.0% 5.1% 2.40x 8.4x 33.2%

Propane Distributors(5) EV / EBITDA Price / Earnings Price / DCF/Unit Dividend (Distribution) Metrics Debt Metrics

Ferrellgas Partners LP $1.11 $108 $2,119 8.8x 8.4x NM NM NM NM NM NM NA NA 8.4x CCC 33.2% Suburban Propane Partners LP 21.90 1,372 2,646 9.2x 9.1x NM NM 6.8x 6.6x 11.0% 11.0% 5.1% 1.30x 4.4xBB- 3.9% Superior Plus Corporation(6) 8.25 1,430 2,716 7.8x 7.4x 9.9x 9.0x 6.3x 5.8x 6.6% 6.6% 0.0% 2.40x 3.7x BB 5.0%

Ulysses Corporation (WS) $53.21 $9,459 $15,955 12.0x 9.8x 19.9x 17.4x 9.8x(3) 8.2x(3) 2.0% 2.1% 47.5% 5.4% 3.3x NA 8.0% Ulysses Corporation (Mgmt.) 9.9x 9.4x 18.2x 17.0x 8.6x(3) 7.4x(3) 2.0% 2.0%35-45% 4.0% 2.7x NA6-10%

Source: Company forecasts & filings, investor presentations, Wall Street research and estimates (3) P/CFPS shown for Ulysses. as compiled by FactSet as of 2/8/19. (4) Coverage defined as distributable cash flow divided by total distributions.

(1) New Jersey Resources Corporation 2019E and 2020E EBITDA multiples are excluded from (5) Propane distributor Equity Value / DCF and Yield metrics exclude Ferrellgas from group summary statistics due to disproportionately high multiples resulting from investment tax median. 17 credit benefits for the company’s solar assets. (6) Uses exchange rate of 0.7534 USD per CAD.

(2) Payout ratio defined as last quarter dividend divided by LTM earnings.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT

Ulysses DCF Analysis | Management Projections Subje to Further Review & Revision

Valuation Effective Date: 3/31/2019

Discounted Unlevered DCF(1) Analysis Discounted Dividend Analysis

Ulysses SQ Dividends | Abe $3.80 Annual Dist. Policy

2023E EBITDA Terminal Multiple 2023E Distribution Yield

discount rate discount rate

8.50x 10.0x 11.5x 2.75% 2.25% 1.75%

4.00% $56.76 $71.32 $85.89 4.50% $45.03 $54.40 $69.14 4.75% $55.19 $69.50 $83.80 5.25% $44.25 $53.46 $67.94 5.50% $53.66 $67.71 $81.77 6.00% $43.50 $52.55 $66.77

Discounted Unlevered DCF Analysis(1,2) Discounted Dividend Analysis

Supplemental Calculation Detail Supplemental Calculation Detail

2H 2019E 2020E 2021E 2022E 2H 2019E 2020E 2021E 2022E

EBITDA $805 $1,697 $1,808 $1,903 Ulysses Dividend / Share $0.55 $1.20 $1.25 $1.30

Unlevered Cash Taxes(3) (88) (173) (166)

Capex (377) (719) (775) Discount Factor 0.987 0.950 0.903 FCF $340 $804 $867 PV of Dividend/Sh. $0.54 $1.14 $1.12

Discount Factor 0.988 0.955 0.911

Disc. FCF $337 $768 $790 Disc. GP Dist. Total $2.80

Disc. SQ Ulysses FCF Total $1,895 Terminal Yield 2.25% Terminal M ultiple 10.0x Terminal Disc. Factor 0.890x Terminal Disc. Factor 0.880

Implied Terminal PV EV $16,946 Implied Terminal PV per Share $50.66

Less SQ Ulysses Net Debt ($4,392) Less SQ Ulysses NCI ($2,103)

Implied Equity Value per Share $53.46

Implied SQ Ulysses Equity Value $12,345 SQ Ulysses Equity Value per Share $69.50

PV of Future Share Price Analysis(4)

Ulysses SQ / PF Dividends Yield $68.09 $69.32 $69.63

1.75%

Assumptions $54.78 $53.08 $54.29

∎ Wall Street Consensus Projections $53.21 2.25% $43.53 $44.72 $45.33

∎ Valuation date as of 3/31/19

∎ Future share price calculated at FY1 annual dividends divided by yield 2.75%

∎ Discounted to 3/31/19 at 5.25% cost of equity Current

Price

â–¡ Interim distributions discounted upon receipt to 3/31/19

Source: Management projections. 2H 2019E 2020E 2021E (1) Net Income attributable tonon-controlling interests is included in consolidated EBITDA; DCF analysis assumes normalized net working capital.

(2) Fully consolidated enterprise value analysis; implied Ulysses share price calculated based on eliminating Abe publicly-owned LP interest at market value. 18 (3) Calculated as management-forecasted cash taxable income + elimination of tax shield from interest expense.

(4) Dividend policy assumed constant in both SQ and PF scenarios , across all operating scenarios.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

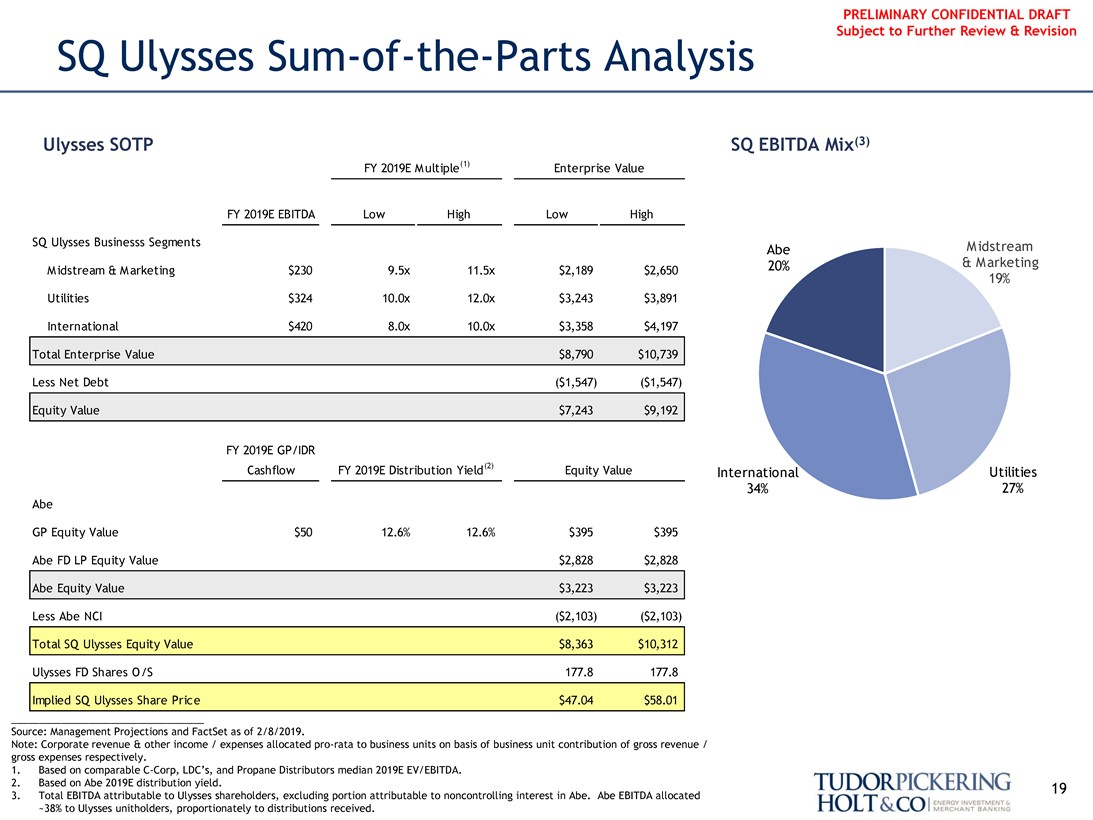

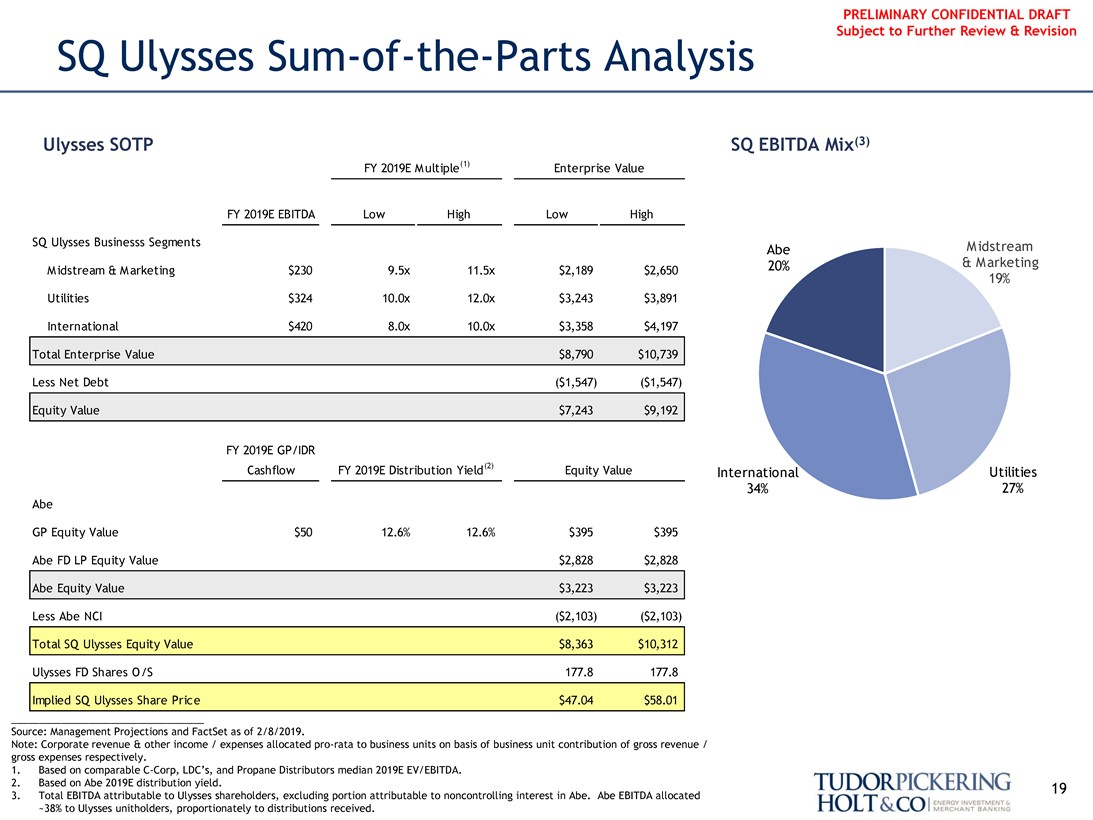

SQ UlyssesSum-of-the-Parts Analysis

Ulysses SOTP SQ EBITDA Mix(3)

FY 2019E Multiple(1) Enterprise Value

FY 2019E EBITDA Low High Low High

SQ Ulysses Businesss Segments Midstream

Abe & Marketing

Midstream & Marketing $230 9.5x 11.5x $2,189 $2,650 20% 19% Utilities $324 10.0x 12.0x $3,243 $3,891

International $420 8.0x 10.0x $3,358 $4,197 Total Enterprise Value $8,790 $10,739 Less Net Debt ($1,547) ($1,547) Equity Value $7,243 $9,192

FY 2019E GP/IDR

Cashflow FY 2019E Distribution Yield(2) Equity Value International Utilities

34% 27%

Abe

GP Equity Value $50 12.6% 12.6% $395 $395 Abe FD LP Equity Value $2,828 $2,828 Abe Equity Value $3,223 $3,223 Less Abe NCI ($2,103) ($2,103) Total SQ Ulysses Equity Value $8,363 $10,312 Ulysses FD Shares O/S 177.8 177.8

Implied SQ Ulysses Share Price $47.04 $58.01

Source: Management Projections and FactSet as of 2/8/2019.

Note: Corporate revenue & other income / expenses allocatedpro-rata to business units on basis of business unit contribution of gross revenue / gross expenses respectively.

1. Based on comparableC-Corp, LDC’s, and Propane Distributors median 2019E EV/EBITDA.

2. Based on Abe 2019E distribution yield. 19

3. Total EBITDA attributable to Ulysses shareholders, excluding portion attributable to noncontrolling interest in Abe. Abe EBITDA allocated ~38% to Ulysses unitholders, proportionately to distributions received.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

V. Transaction Analysis

20

Tudorpickering Holt&co energy investment & merchant banking

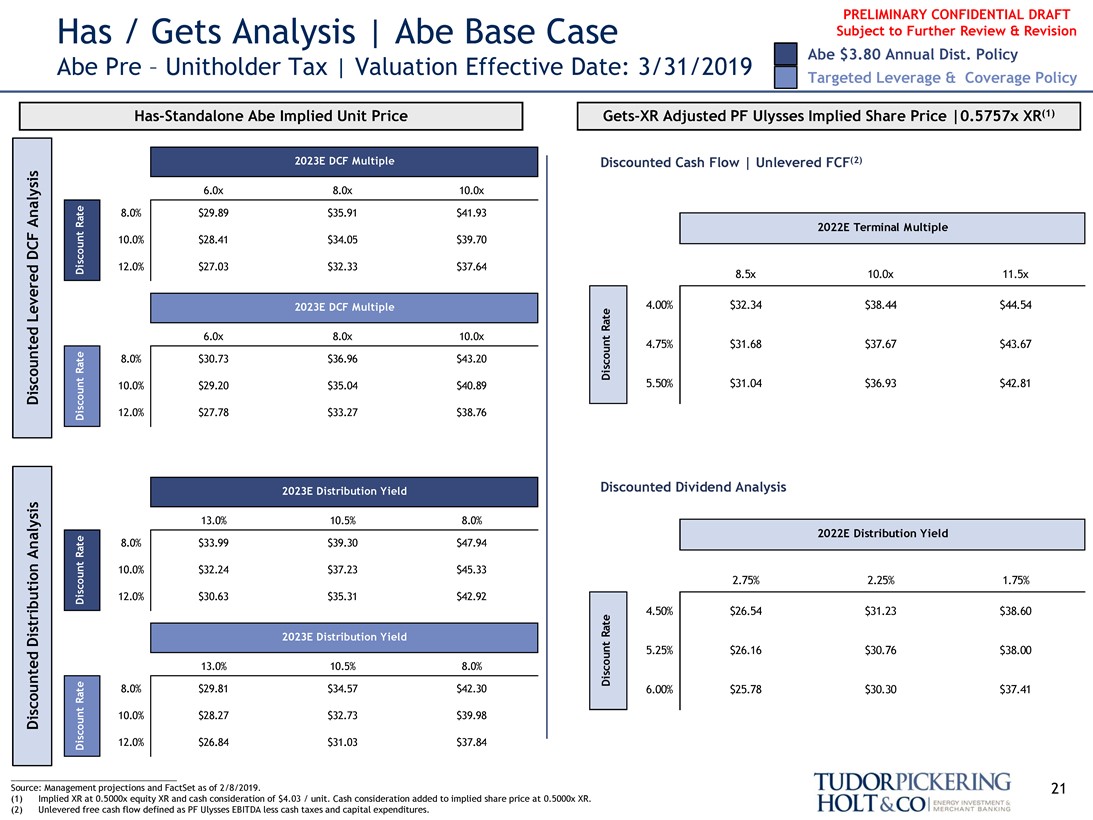

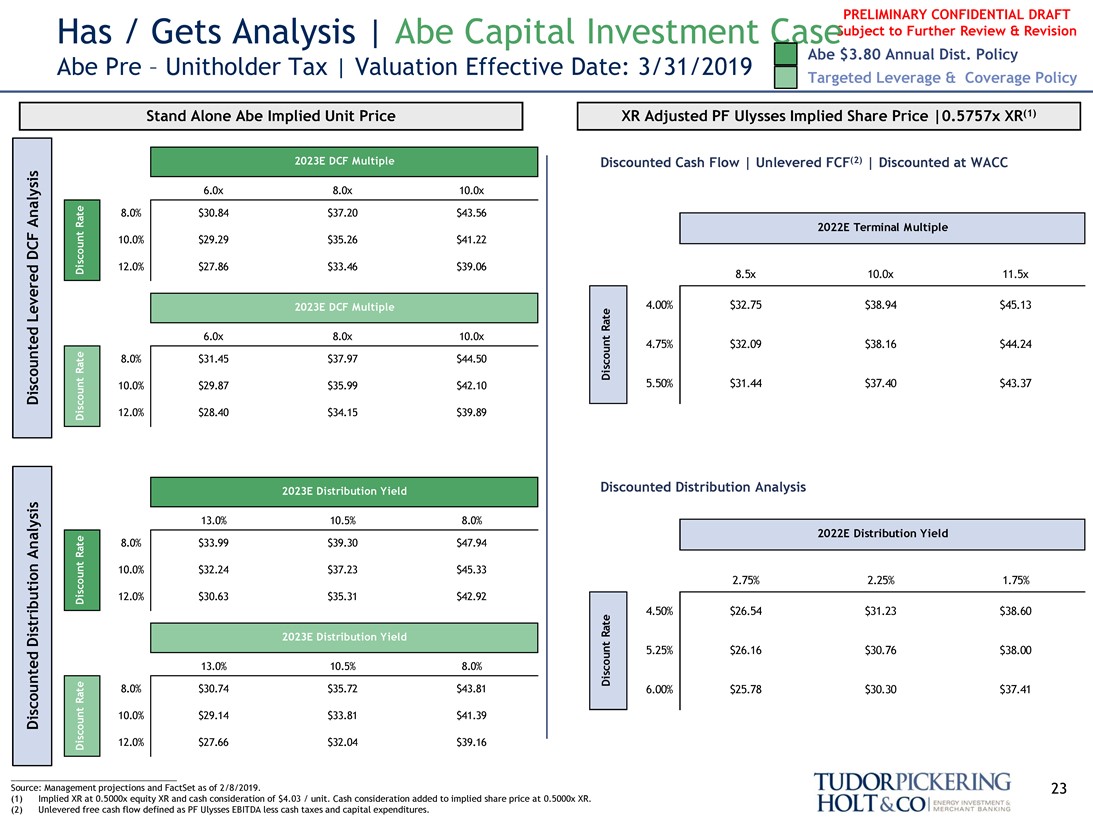

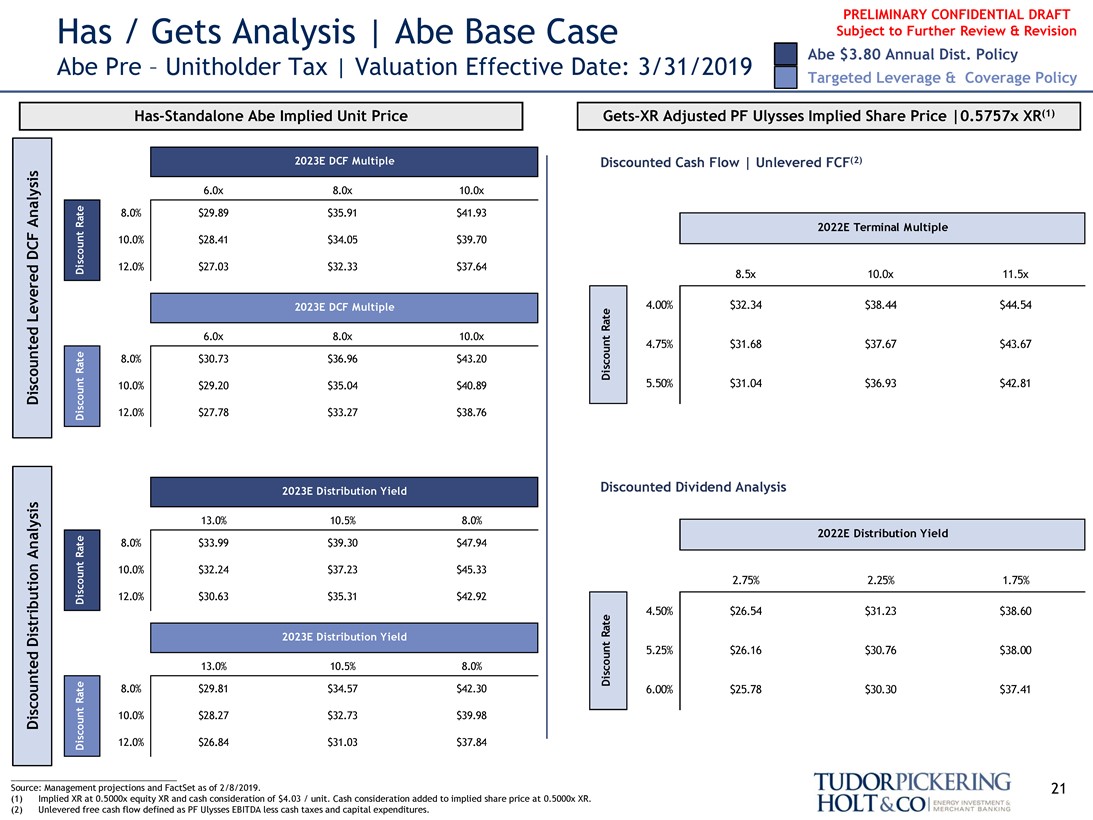

PRELIMINARY CONFIDENTIAL DRAFT Has / Gets Analysis | Abe Base Case Subject to Further Review & Revision

Abe Pre – Unitholder Tax | Valuation Effective Date: 3/31/2019 Abe $3.80 Annual Dist. Policy

Targeted Leverage & Coverage Policy

Has-Standalone Abe Implied Unit PriceGets-XR Adjusted PF Ulysses Implied Share Price |0.5757x XR(1)

Discounted Cash Flow | Unlevered FCF(2)

2023E DCF Multiple 2023E DCF Multiple

2023E Distribution Yield 2023E Distribution Yield

discount rate discount rate discount rate discount rate

6.0x 8.0x 10.0x Analysis 8.0% $29.89 $35.91 $41.93

2022E Terminal Multiple

DCF 10.0% $28.41 $34.05 $39.70 12.0% $27.03 $32.33 $37.64

8.5x 10.0x 11.5x Levered te 4.00% $32.34 $38.44 $44.54

Discounted Distribution Analysis Discounted Levered DCF Analysis

Discount Rate Discount Rate

6.0x 8.0x 10.0x

4.75% $31.68 $37.67 $43.67

8.0% $30.73 $36.96 $43.20 scount

D i

Discounted 10.0% $29.20 $35.04 $40.89 5.50% $31.04 $36.93 $42.81 12.0% $27.78 $33.27 $38.76

Discounted Dividend Analysis

13.0% 10.5% 8.0%

2022E Distribution Yield

Analysis 8.0% $33.99 $39.30 $47.94 10.0% $32.24 $37.23 $45.33 2.75% 2.25% 1.75%

12.0% $30.63 $35.31 $42.92

4.50% $26.54 $31.23 $38.60

Rate

Distribution t

n 5.25% $26.16 $30.76 $38.00 o u

13.0% 10.5% 8.0%

Disc

8.0% $29.81 $34.57 $42.30 6.00% $25.78 $30.30 $37.41

Discounted 10.0% $28.27 $32.73 $39.98

12.0% $26.84 $31.03 $37.84

Source: Management projections and FactSet as of 2/8/2019. 21 (1) Implied XR at 0.5000x equity XR and cash consideration of $4.03 / unit. Cash consideration added to implied share price at 0.5000x XR.

(2) Unlevered free cash flow defined as PF Ulysses EBITDA less cash taxes and capital expenditures.

Tudorpickering Holt&co energy investment & merchant banking

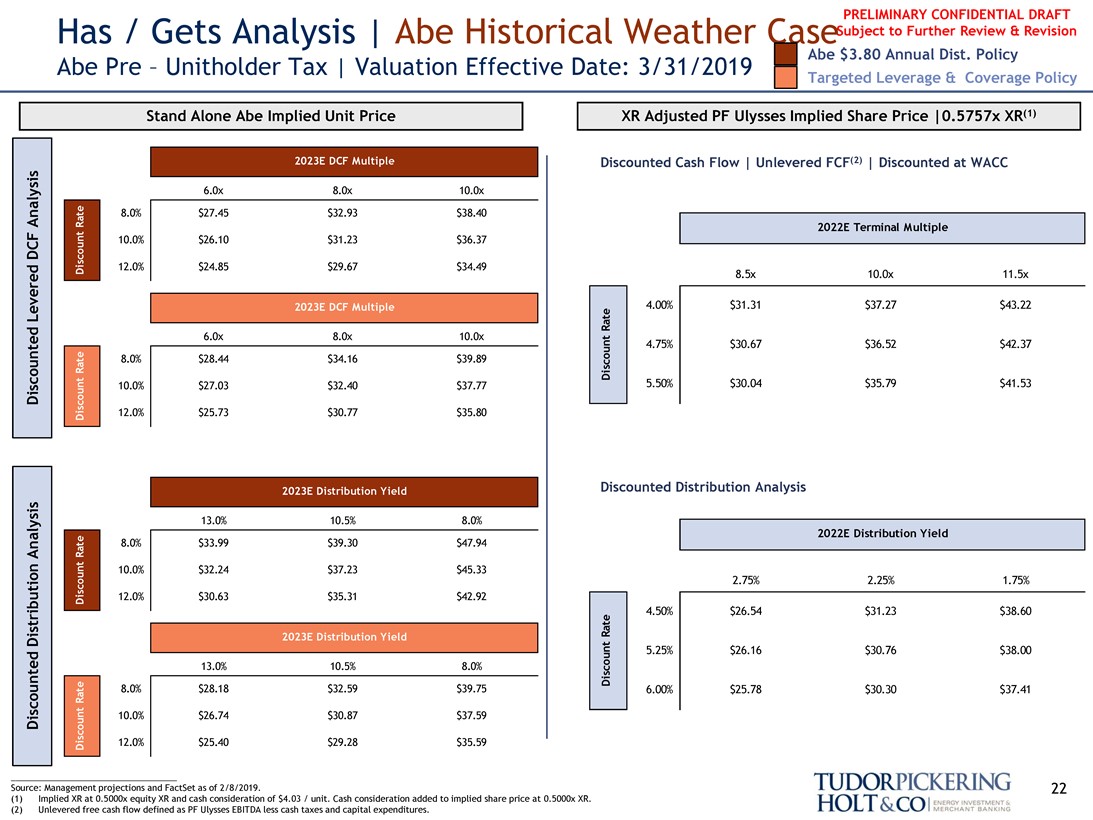

PRELIMINARY CONFIDENTIAL DRAFT

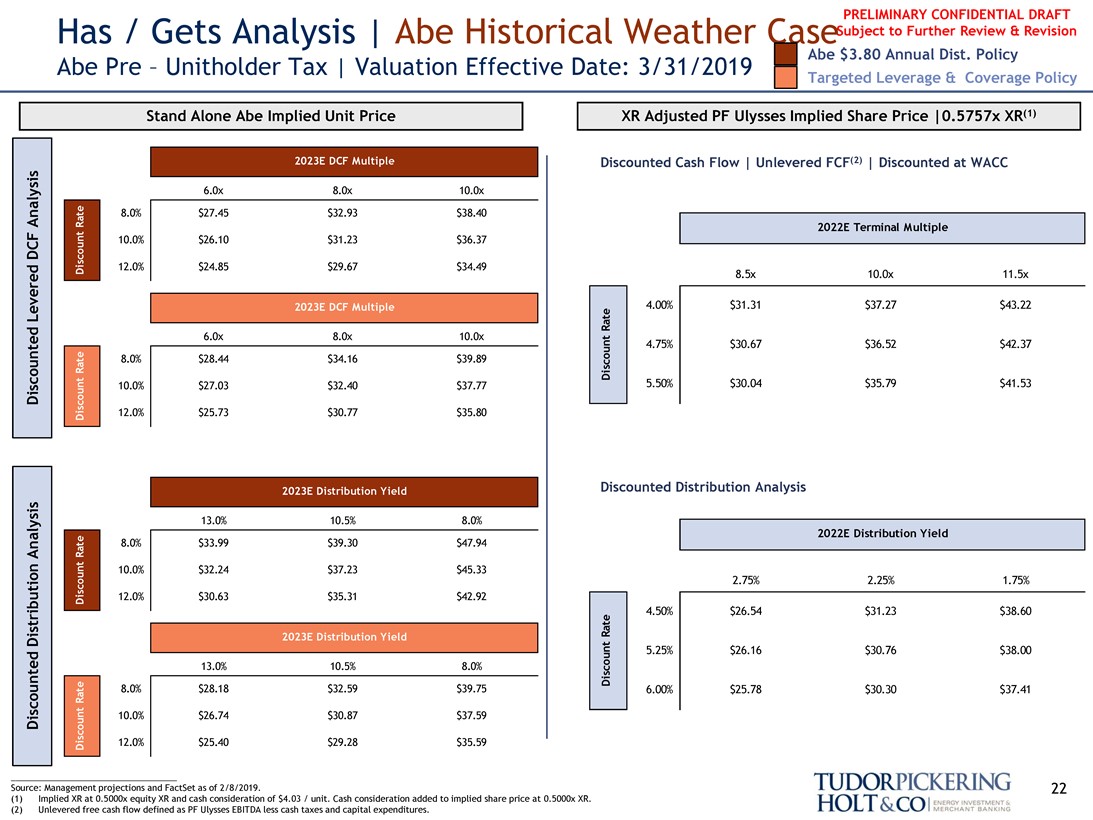

Has / Gets Analysis | Abe Historical Weather Case Subject to Further Review & Revision

Abe Pre – Unitholder Tax | Valuation Effective Date: 3/31/2019 Abe $3.80 Annual Dist. Policy

Targeted Leverage & Coverage Policy

Stand Alone Abe Implied Unit Price

2023E DCF Multiple

Discount Rate

Discounted Levered DCF Analysis

2023E DCF Multiple

Discount Rate

2023E Distribution Yield

Discount Rate

Discounted Distribution Analysis

2023E Distribution Yield

Discount Rate

XR Adjusted PF Ulysses Implied Share Price |0.5757x XR(1)

Discounted Cash Flow | Unlevered FCF(2) | Discounted at WACC

2022E Terminal Multiple

Discount Rate

Discounted Distribution Analysis

2022E Distribution Yield

Discount Rate

Source: Management projections and FactSet as of 2/8/2019.

(1) Implied XR at 0.5000x equity XR and cash consideration of $4.03 / unit. Cash consideration added to implied share price at 0.5000x XR. (2) Unlevered free cash flow defined as PF Ulysses EBITDA less cash taxes and capital expenditures.

6.0x 8.0x 10.0x 8.0% $27.45 $32.93 $38.40 10.0% $26.10 $31.23 $36.37 12.0% $24.85 $29.67 $34.49

6.0x 8.0x 10.0x 8.0% $28.44 $34.16 $39.89 10.0% $27.03 $32.40 $37.77 12.0% $25.73 $30.77 $35.80

13.0% 10.5% 8.0% 8.0% $33.99 $39.30 $47.94 10.0% $32.24 $37.23 $45.33 12.0% $30.63 $35.31 $42.92

13.0% 10.5% 8.0% 8.0% $28.18 $32.59 $39.75 10.0% $26.74 $30.87 $37.59 12.0% $25.40 $29.28 $35.59

8.5x 10.0x 11.5x 4.00% $31.31 $37.27 $43.22 4.75% $30.67 $36.52 $42.37 5.50% $30.04 $35.79 $41.53

2.75% 2.25% 1.75% 4.50% $26.54 $31.23 $38.60 5.25% $26.16 $30.76 $38.00 6.00% $25.78 $30.30 $37.41

TUDORPICKERING HOLT&CO energy investment & merchant banking

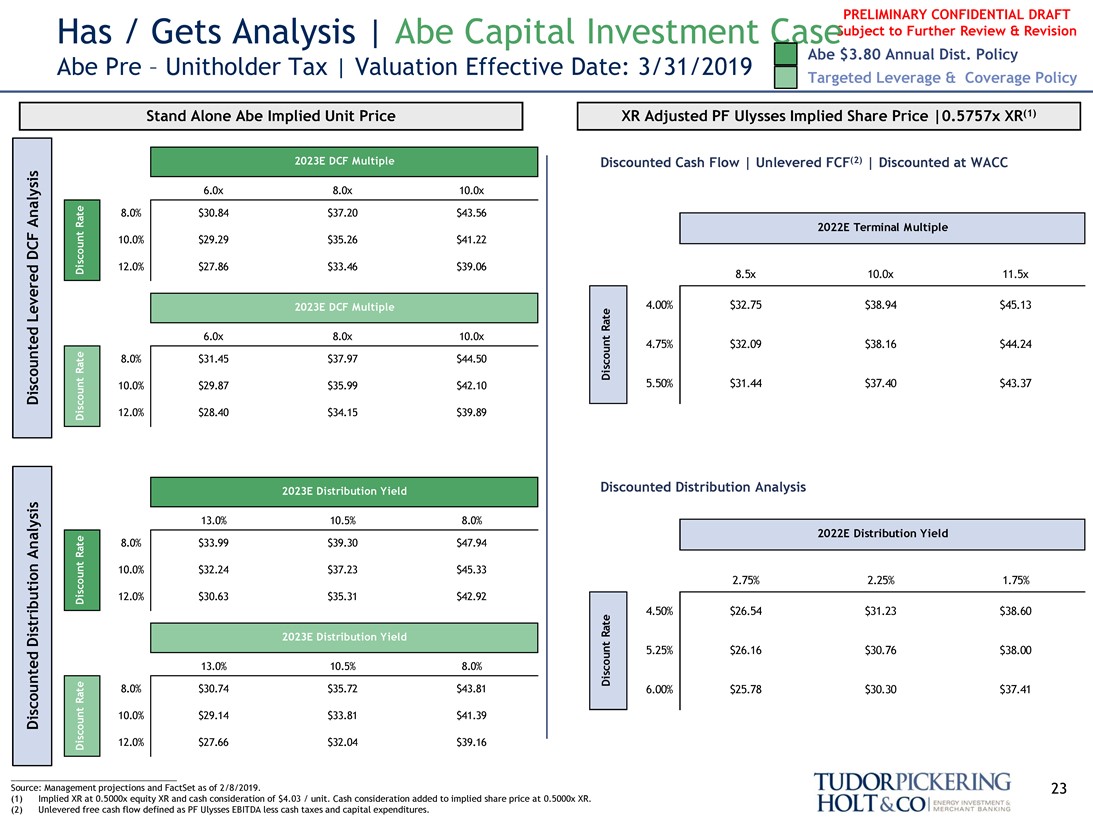

PRELIMINARY CONFIDENTIAL DRAFT

Has / Gets Analysis | Abe Capital Investment Case Subject to Further Review & Revision

Abe Pre – Unitholder Tax | Valuation Effective Date: 3/31/2019 Abe $3.80 Annual Dist. Policy

Targeted Leverage & Coverage Policy

Stand Alone Abe Implied Unit Price XR Adjusted PF Ulysses Implied Share Price |0.5757x XR(1)

2023E DCF Multiple 2023E DCF Multiple

2023E Distribution Yield 2023E Distribution Yield

discount rate discount rate discount rate discount rate

Discounted Cash Flow | Unlevered FCF(2) | Discounted at WACC

6.0x 8.0x 10.0x Analysis 8.0% $30.84 $37.20 $43.56

2022E Terminal Multiple

DCF 10.0% $29.29 $35.26 $41.22 12.0% $27.86 $33.46 $39.06

8.5x 10.0x 11.5x Levered te 4.00% $32.75 $38.94 $45.13

6.0x 8.0x 10.0x

4.75% $32.09 $38.16 $44.24

8.0% $31.45 $37.97 $44.50 Discounted Levered dcf analysis

Discounted 10.0% $29.87 $35.99 $42.10 5.50% $31.44 $37.40 $43.37 12.0% $28.40 $34.15 $39.89

Discounted Distribution Analysis

13.0% 10.5% 8.0%

2022E Distribution Yield

Analysis 8.0% $33.99 $39.30 $47.94 10.0% $32.24 $37.23 $45.33 2.75% 2.25% 1.75%

12.0% $30.63 $35.31 $42.92

4.50% $26.54 $31.23 $38.60

5.25% $26.16 $30.76 $38.00 o u

13.0% 10.5% 8.0%

8.0% $30.74 $35.72 $43.81 6.00% $25.78 $30.30 $37.41

Discounted 10.0% $29.14 $33.81 $41.39

12.0% $27.66 $32.04 $39.16

Source: Management projections and FactSet as of 2/8/2019. 23 (1) Implied XR at 0.5000x equity XR and cash consideration of $4.03 / unit. Cash consideration added to implied share price at 0.5000x XR.

(2) Unlevered free cash flow defined as PF Ulysses EBITDA less cash taxes and capital expenditures.

TUDORPICKERING HOLT&CO energy investment & merchant banking

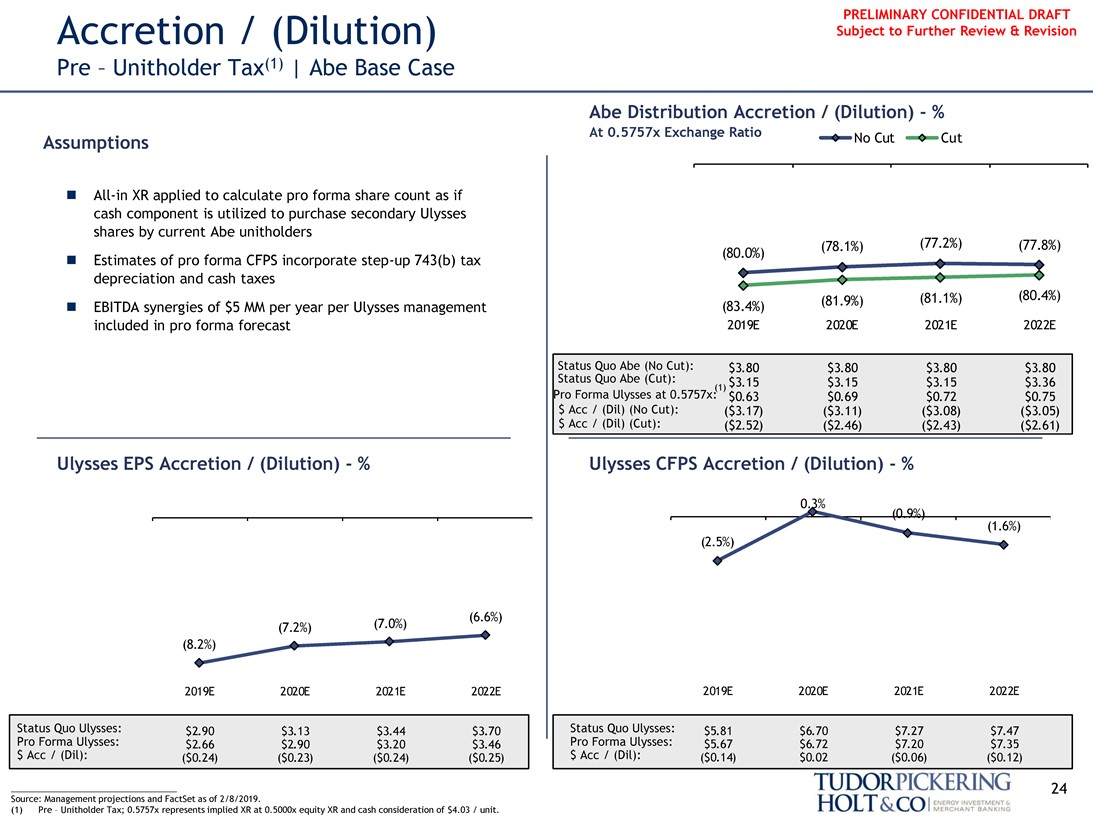

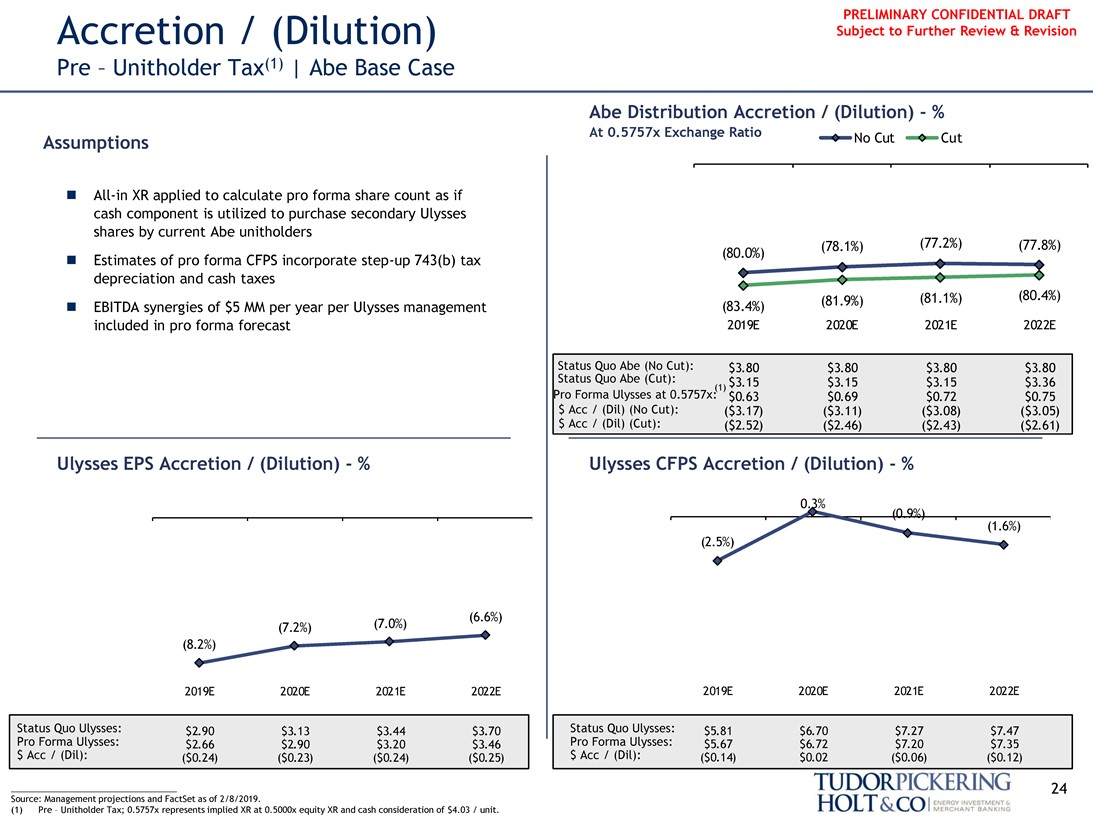

PRELIMINARY CONFIDENTIAL DRAFT Accretion / (Dilution) Subject to Further Review & Revision

Pre – Unitholder Tax(1) | Abe Base Case

Abe Distribution Accretion / (Dilution)—%

At 0.5757x Exchange Ratio No Cut Cut

Assumptions

(78.1%) (77.2%) (77.8%)

∎All-in XR applied to calculate pro forma share count as if (80.0%) cash component is utilized to purchase secondary Ulysses shares by current Abe unitholders (81.1%) (80.4%)

(83.4%) (81.9%) (77.2%) (77.8%) (78.1%) (80.0%)

∎ Estimates of pro forma CFPS incorporatestep-up 743(b) tax 2019E 2020E 2021E 2022E depreciation and cash taxes

(81.9%) (81.1%) (80.4%)

∎ EBITDA synergies of $5 MM per year per Ulysses management (83. $3.4%) 80 $3.80 $3.80 $3.80 included in pro forma forecast 2019E $3.15 2020E $3.15 2021E $3.15 $ 2022E 3.36 $0.63 $0.69 $0.72 $0.75

($3.17) ($3.11) ($3.08) ($3.05) Status Quo Abe (No Cut): ($ $3. 2.80 52) ($ $3. 2.80 46) ($ $2. 3.43) 80 ($ $2. 3.61) 80

Status Quo Abe (Cut): (1) $3.15 $3.15 $3.15 $3.36

Pro Forma Ulysses at 0.5757x: $0.63 $0.69 $0.72 $0.75 $ Acc / (Dil) (No Cut): ($3.17) ($3.11) ($3.08) ($3.05) $ Acc / (Dil) (Cut): ($2.52) ($2.46) ($2.43) ($2.61)

Ulysses EPS Accretion / (Dilution)—% Ulysses CFPS Accretion / (Dilution)—%

0.3%

(0.9%) (1.6%) (2.5%)

(6.6%) (7.2%) (7.0%) (8.2%)

2019E 2020E 2021E 2022E 2019E 2020E 2021E 2022E

Status Quo Ulysses: $2.90 $3.13 $3.44 $3.70 Status Quo Ulysses: $5.81 $6.70 $7.27 $7.47 Pro Forma Ulysses: $2.66 $2.90 $3.20 $3.46 Pro Forma Ulysses: $5.67 $6.72 $7.20 $7.35 $ Acc / (Dil): ($0.24) ($0.23) ($0.24) ($0.25) $ Acc / (Dil): ($0.14) $0.02 ($0.06) ($0.12)

___________________________________ 24 Source: Management projections and FactSet as of 2/8/2019.

(1) Pre – Unitholder Tax; 0.5757x represents implied XR at 0.5000x equity XR and cash consideration of $4.03 / unit.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

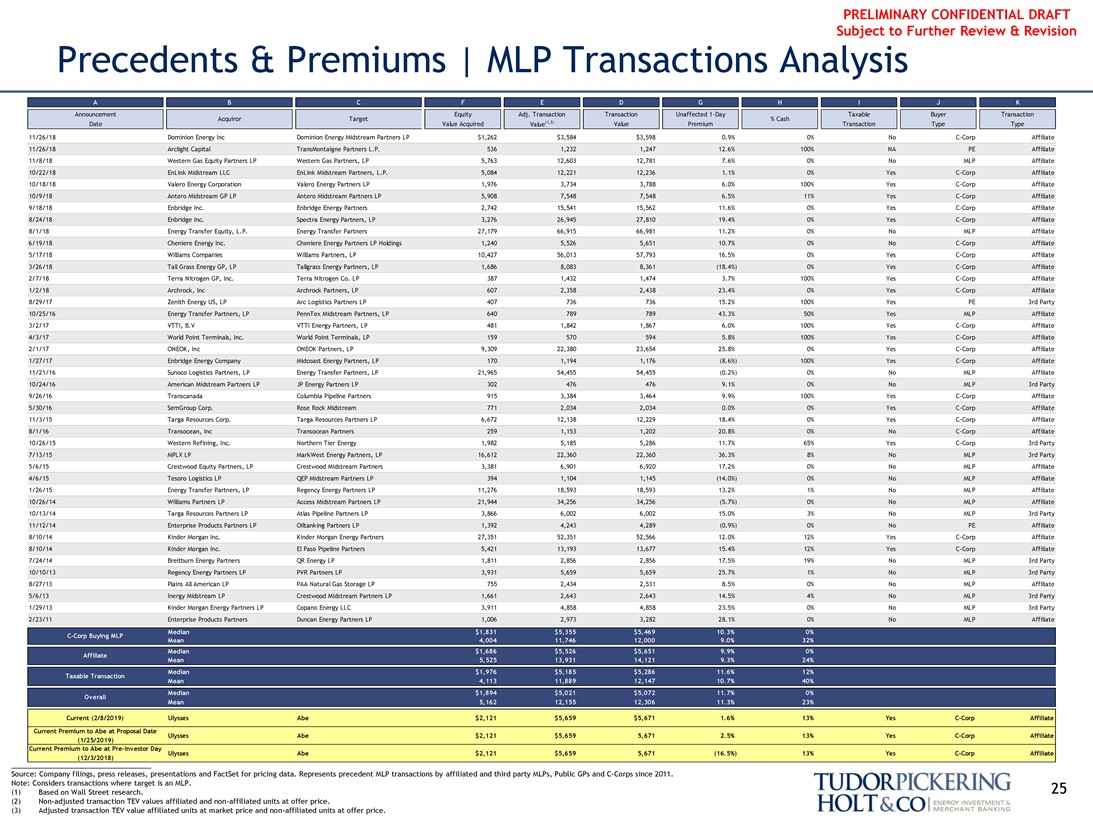

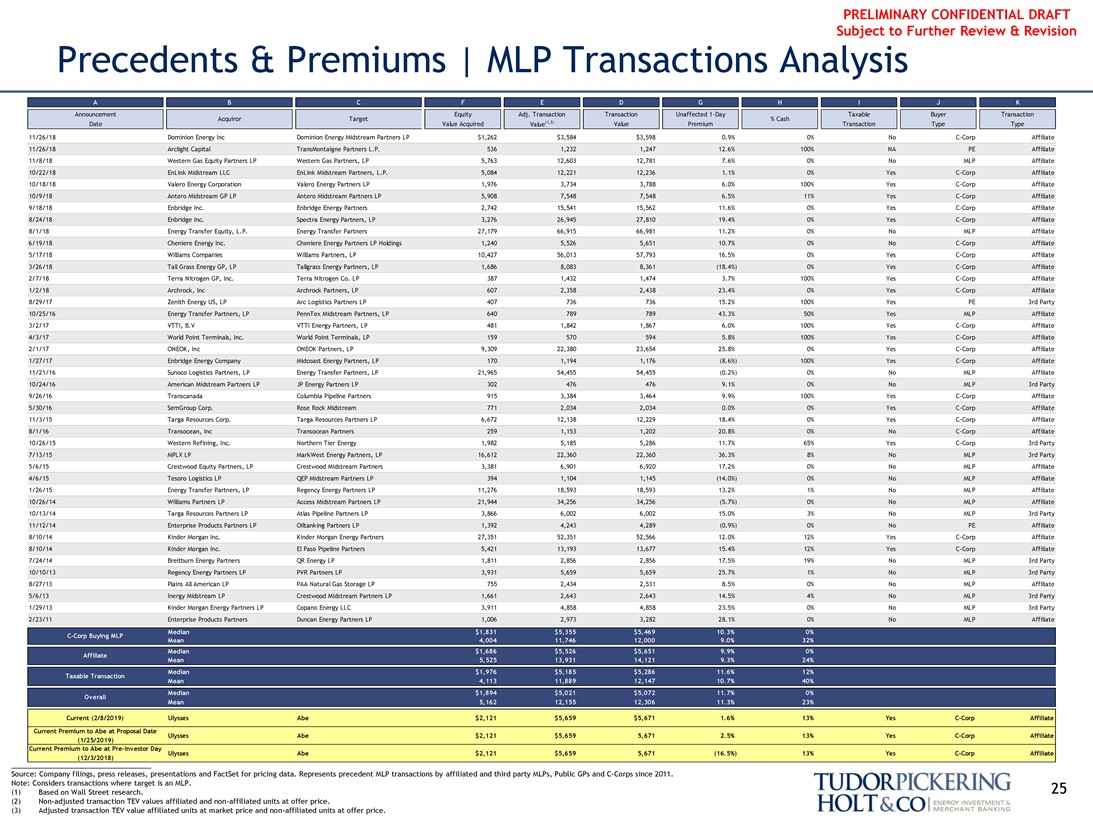

Precedents & Premiums | MLP Transactions Analysis

A B C F E D G H I J K

Announcement Equity Adj. Transaction Transaction Unaffected1-Day Taxable Buyer Transaction Acquiror Target % Cash Date Value Acquired Value(1,3) Value Premium Transaction Type Type

11/26/18 Dominion Energy Inc Dominion Energy Midstream Partners LP $1,262 $3,584 $3,598 0.9% 0% NoC-Corp Affiliate 11/26/18 Arclight Capital TransMontaigne Partners L.P. 536 1,232 1,247 12.6% 100% NA PE Affiliate 11/8/18 Western Gas Equity Partners LP Western Gas Partners, LP 5,763 12,603 12,781 7.6% 0% No MLP Affiliate 10/22/18 EnLink Midstream LLC EnLink Midstream Partners, L.P. 5,084 12,221 12,236 1.1% 0% YesC-Corp Affiliate 10/18/18 Valero Energy Corporation Valero Energy Partners LP 1,976 3,734 3,788 6.0% 100% YesC-Corp Affiliate 10/9/18

Antero Midstream GP LP Antero Midstream Partners LP 5,908 7,548 7,548 6.5% 11% YesC-Corp Affiliate 9/18/18 Enbridge Inc. Enbridge Energy Partners 2,742 15,541 15,562 11.6% 0% YesC-Corp Affiliate 8/24/18 Enbridge Inc. Spectra Energy Partners, LP 3,276 26,945 27,810 19.4% 0% YesC-Corp Affiliate 8/1/18 Energy Transfer Equity, L.P. Energy Transfer Partners 27,179 66,915 66,981 11.2% 0% No MLP Affiliate 6/19/18 Cheniere Energy Inc. Cheniere Energy Partners LP Holdings 1,240 5,526 5,651 10.7% 0% NoC-Corp Affiliate 5/17/18 Williams Companies Williams Partners, LP 10,427 56,013 57,793 16.5% 0% YesC-Corp Affiliate 3/26/18 Tall Grass Energy GP, LP Tallgrass Energy Partners, LP 1,686 8,083 8,361 (18.4%) 0% YesC-Corp Affiliate 2/7/18 Terra Nitrogen GP, Inc. Terra Nitrogen Co. LP 387 1,432 1,474 3.7% 100% YesC-Corp Affiliate 1/2/18 Archrock, Inc Archrock Partners, LP 607 2,358 2,438 23.4% 0% YesC-Corp Affiliate 8/29/17 Zenith Energy US, LP Arc Logistics Partners LP 407 736 736 15.2% 100% Yes PE 3rd Party 10/25/16 Energy Transfer Partners, LP PennTex Midstream Partners, LP 640 789 789 43.3% 50% Yes MLP Affiliate 3/2/17 VTTI, B.V VTTI Energy Partners, LP 481 1,842 1,867 6.0% 100% YesC-Corp Affiliate 4/3/17 World Point Terminals, Inc. World Point Terminals, LP 159 570 594 5.8% 100% YesC-Corp Affiliate 2/1/17 ONEOK, Inc ONEOK Partners, LP 9,309 22,380 23,654 25.8% 0% YesC-Corp Affiliate 1/27/17 Enbridge Energy Company Midcoast Energy Partners, LP 170 1,194 1,176 (8.6%) 100% YesC-Corp Affiliate 11/21/16 Sunoco Logistics Partners, LP Energy Transfer Partners, LP 21,965 54,455 54,455 (0.2%) 0% No MLP Affiliate 10/24/16 American Midstream Partners LP JP Energy Partners LP 302 476 476 9.1% 0% No MLP 3rd Party 9/26/16 Transcanada Columbia Pipeline Partners 915 3,384 3,464 9.9% 100% YesC-Corp Affiliate 5/30/16 SemGroup Corp. Rose Rock Midstream 771 2,034 2,034 0.0% 0% YesC-Corp Affiliate 11/3/15 Targa Resources Corp. Targa Resources Partners LP 6,672 12,138 12,229 18.4% 0% YesC-Corp Affiliate 8/1/16 Transocean, Inc Transocean Partners 259 1,153 1,202 20.8% 0% NoC-Corp Affiliate 10/26/15 Western Refining, Inc. Northern Tier Energy 1,982 5,185 5,286 11.7% 65% YesC-Corp 3rd Party 7/13/15 MPLX LP MarkWest Energy Partners, LP 16,612 22,360 22,360 36.3% 8% No MLP 3rd Party 5/6/15 Crestwood Equity Partners, LP Crestwood Midstream Partners 3,381 6,901 6,920 17.2% 0% No MLP Affiliate 4/6/15 Tesoro Logistics LP QEP Midstream Partners LP 394 1,104 1,145 (14.0%) 0% No MLP Affiliate 1/26/15 Energy Transfer Partners, LP Regency Energy Partners LP 11,276 18,593 18,593 13.2% 1% No MLP Affiliate 10/26/14 Williams Partners LP Access Midstream Partners LP 21,944 34,256 34,256 (5.7%) 0% No MLP Affiliate 10/13/14 Targa Resources Partners LP Atlas Pipeline Partners LP 3,866 6,002 6,002 15.0% 3% No MLP 3rd Party 11/12/14 Enterprise Products Partners LP Oiltanking Partners LP 1,392 4,243 4,289 (0.9%) 0% No PE Affiliate 8/10/14 Kinder Morgan Inc. Kinder Morgan Energy Partners 27,351 52,351 52,566 12.0% 12% YesC-Corp Affiliate 8/10/14 Kinder Morgan Inc. El Paso Pipeline Partners 5,421 13,193 13,677 15.4% 12% YesC-Corp Affiliate 7/24/14 Breitburn Energy Partners QR Energy LP 1,811 2,856 2,856 17.5% 19% No MLP 3rd Party 10/10/13 Regency Energy Partners LP PVR Partners LP 3,931 5,659 5,659 25.7% 1% No MLP 3rd Party 8/27/13 Plains All American LP PAA Natural Gas Storage LP 755 2,434 2,531 8.5% 0% No MLP Affiliate 5/6/13 Inergy Midstream LP Crestwood Midstream Partners LP 1,661 2,643 2,643 14.5% 4% No MLP 3rd Party 1/29/13 Kinder Morgan Energy Partners LP Copano Energy LLC 3,911 4,858 4,858 23.5% 0% No MLP 3rd Party 2/23/11 Enterprise Products Partners Duncan Energy Partners LP 1,006 2,973 3,282 28.1% 0% No MLP Affiliate

Current (2/8/2019) Ulysses Abe $2,121 $5,659 $5,671 1.6% 13% YesC-Corp Affiliate Current Premium to Abe at Proposal Date Ulysses Abe $2,121 $5,659 5,671 2.5% 13% YesC-Corp Affiliate (1/25/2019) Current Premium to Abe atPre-Investor Day Ulysses Abe $2,121 $5,659 5,671 (16.5%) 13% YesC-Corp Affiliate

Median $1,831 $5,355 $5,469 10.3% 0% C-Corp Buying MLP Mean 4,004 11,746 12,000 9.0% 32% Median $1,686 $5,526 $5,651 9.9% 0% Affiliate Mean 5,525 13,931 14,121 9.3% 24% Median $1,976 $5,185 $5,286 11.6% 12% Taxable Transaction Mean 4,113 11,889 12,147 10.7% 40% Median $1,894 $5,021 $5,072 11.7% 0% Overall Mean 5,162 12,155 12,306 11.3% 23%

___________________________________ (12/3/2018)

Source: Company filings, press releases, presentations and FactSet for pricing data. Represents precedent MLP transactions by affiliated and third party MLPs, Public GPs andC-Corps since 2011.

Note: Considers transactions where target is an MLP. 25 (1) Based on Wall Street research.

(2)Non-adjusted transaction TEV values affiliated andnon-affiliated units at offer price.

(3) Adjusted transaction TEV value affiliated units at market price andnon-affiliated units at offer price.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

Supplemental Analysis

26

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT

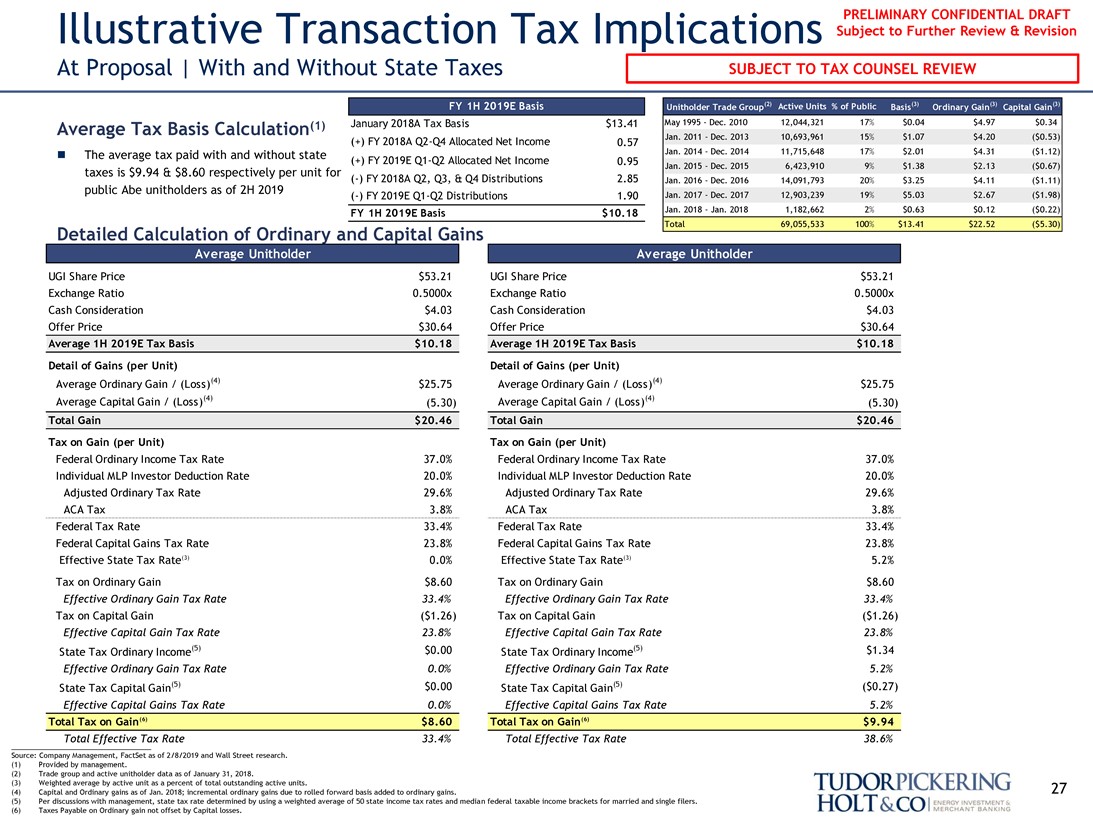

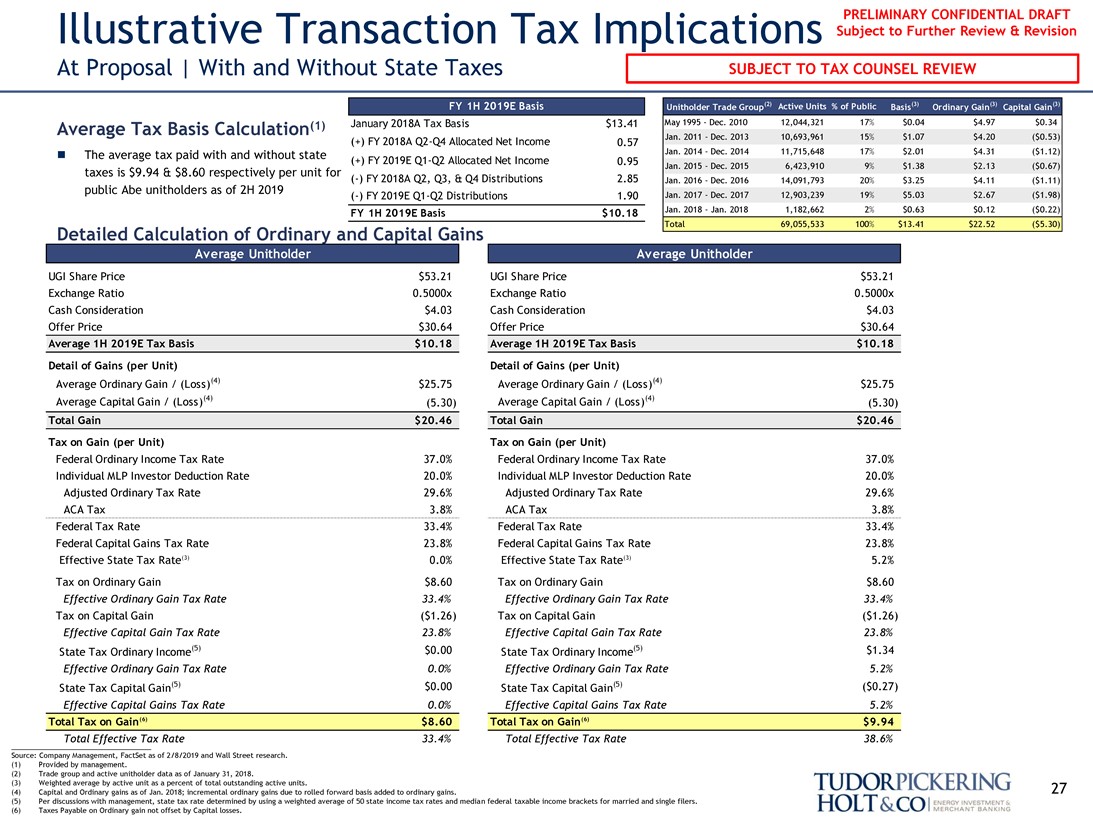

Illustrative Transaction Tax Implications Subject to Further Review & Revision

At Proposal | With and Without State Taxes SUBJECT TO TAX COUNSEL REVIEW

FY 1H 2019E Basis Unitholder Trade Group(2) Active Units % of Public Basis(3) Ordinary Gain(3) Capital Gain(3)

Average Tax Basis Calculation(1) January 2018A Tax Basis $13.41 May 1995—Dec. 2010 12,044,321 17% $0.04 $4.97 $0.34 (+) FY 2018AQ2-Q4 Allocated Net Income Jan. 2011—Dec. 2013 10,693,961 15% $1.07 $4.20 ($0.53) 0.57 Jan. 2014—Dec. 2014 11,715,648 17% $2.01 $4.31 ($1.12)

∎ The average tax paid with and without state

(+) FY 2019EQ1-Q2 Allocated Net Income 0.95

Jan. 2015—Dec. 2015 6,423,910 9% $1.38 $2.13 ($0.67)

taxes is $9.94 & $8.60 respectively per unit for

public Abe unitholders as of 2H 2019 (-) FY 2018A Q2, Q3, & Q4 Distributions 2.85 Jan. 2016—Dec. 2016 14,091,793 20% $3.25 $4.11 ($1.11) (-) FY 2019EQ1-Q2 Distributions 1.90 Jan. 2017—Dec. 2017 12,903,239 19% $5.03 $2.67 ($1.98) FY 1H 2019E Basis $10.18 Jan. 2018—Jan. 2018 1,182,662 2% $0.63 $0.12 ($0.22) Total 69,055,533 100% $13.41 $22.52 ($5.30)

Detailed Calculation of Ordinary and Capital Gains

Average Unitholder Average Unitholder

UGI Share Price $53.21 UGI Share Price $53.21 Exchange Ratio 0.5000x Exchange Ratio 0.5000x Cash Consideration $4.03 Cash Consideration $4.03 Offer Price $30.64 Offer Price $30.64

Average 1H 2019E Tax Basis $10.18 Average 1H 2019E Tax Basis $10.18 Detail of Gains (per Unit) Detail of Gains (per Unit)

Average Ordinary Gain / (Loss)(4) $25.75 Average Ordinary Gain / (Loss)(4) $25.75 Average Capital Gain / (Loss)(4) (5.30) Average Capital Gain / (Loss)(4) (5.30)

Total Gain $20.46 Total Gain $20.46 Tax on Gain (per Unit) Tax on Gain (per Unit)

Federal Ordinary Income Tax Rate 37.0% Federal Ordinary Income Tax Rate 37.0% Individual MLP Investor Deduction Rate 20.0% Individual MLP Investor Deduction Rate 20.0% Adjusted Ordinary Tax Rate 29.6% Adjusted Ordinary Tax Rate 29.6% ACA Tax 3.8% ACA Tax 3.8% Federal Tax Rate 33.4% Federal Tax Rate 33.4% Federal Capital Gains Tax Rate 23.8% Federal Capital Gains Tax Rate 23.8% Effective State Tax Rate(3) 0.0% Effective State Tax Rate(3) 5.2% Tax on Ordinary Gain $8.60 Tax on Ordinary Gain $8.60

Effective Ordinary Gain Tax Rate 33.4% Effective Ordinary Gain Tax Rate 33.4%

Tax on Capital Gain ($1.26) Tax on Capital Gain ($1.26)

Effective Capital Gain Tax Rate 23.8% Effective Capital Gain Tax Rate 23.8%

State Tax Ordinary Income(5) $0.00 State Tax Ordinary Income(5) $1.34

Effective Ordinary Gain Tax Rate 0.0% Effective Ordinary Gain Tax Rate 5.2%

State Tax Capital Gain(5) $0.00 State Tax Capital Gain(5) ($0.27)

Effective Capital Gains Tax Rate 0.0% Effective Capital Gains Tax Rate 5.2%

Total Tax on Gain(6) $8.60 Total Tax on Gain(6) $9.94

___________________________________ Total Effective Tax Rate 33.4% Total Effective Tax Rate 38.6%

Source: Company Management, FactSet as of 2/8/2019 and Wall Street research. (1) Provided by management.

(2) Trade group and active unitholder data as of January 31, 2018.

(3) Weighted average by active unit as a percent of total outstanding active units. 27 (4) Capital and Ordinary gains as of Jan. 2018; incremental ordinary gains due to rolled forward basis added to ordinary gains.

(5) Per discussions with management, state tax rate determined by using a weighted average of 50 state income tax rates and median federal taxable income brackets for married and single filers. (6) Taxes Payable on Ordinary gain not offset by Capital losses.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

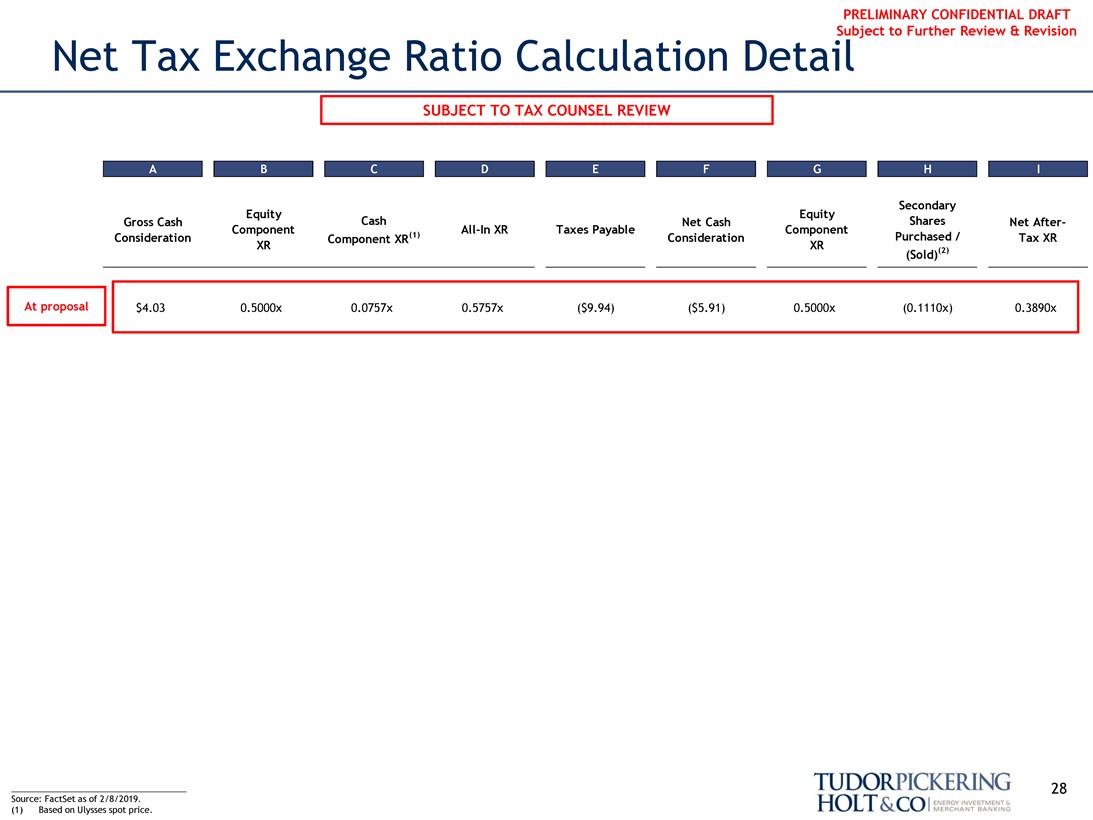

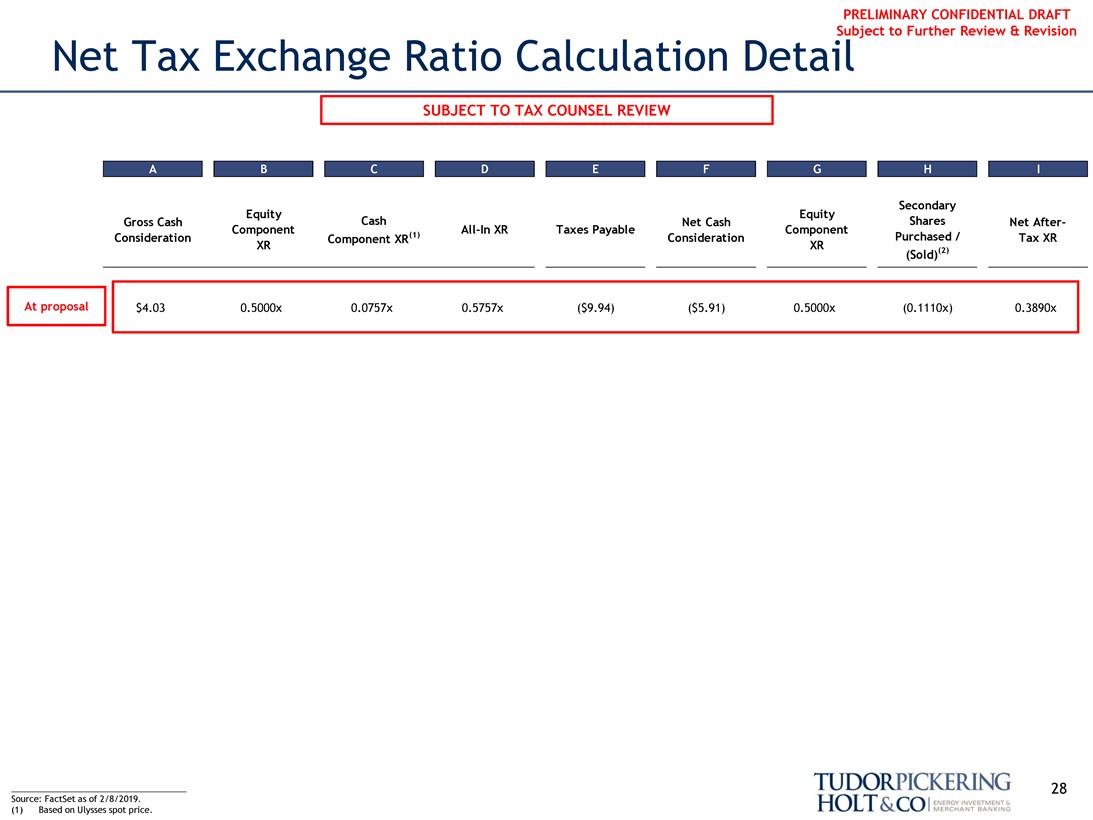

Net Tax Exchange Ratio Calculation Detail

SUBJECT TO TAX COUNSEL REVIEW

A B C D E F G H I

Secondary Equity Equity

Gross Cash Cash Net Cash Shares Net After-Component(1) All-In XR Taxes Payable Component Consideration Component XR Consideration Purchased / Tax XR

XR XR (2) (Sold)

At proposal $4.03 0.5000x 0.0757x 0.5757x ($9.94) ($5.91) 0.5000x (0.1110x) 0.3890x

_____________________________________ 28 Source: FactSet as of 2/8/2019.

(1) Based on Ulysses spot price.

Tudorpickering Holt&co energy investment & merchant banking

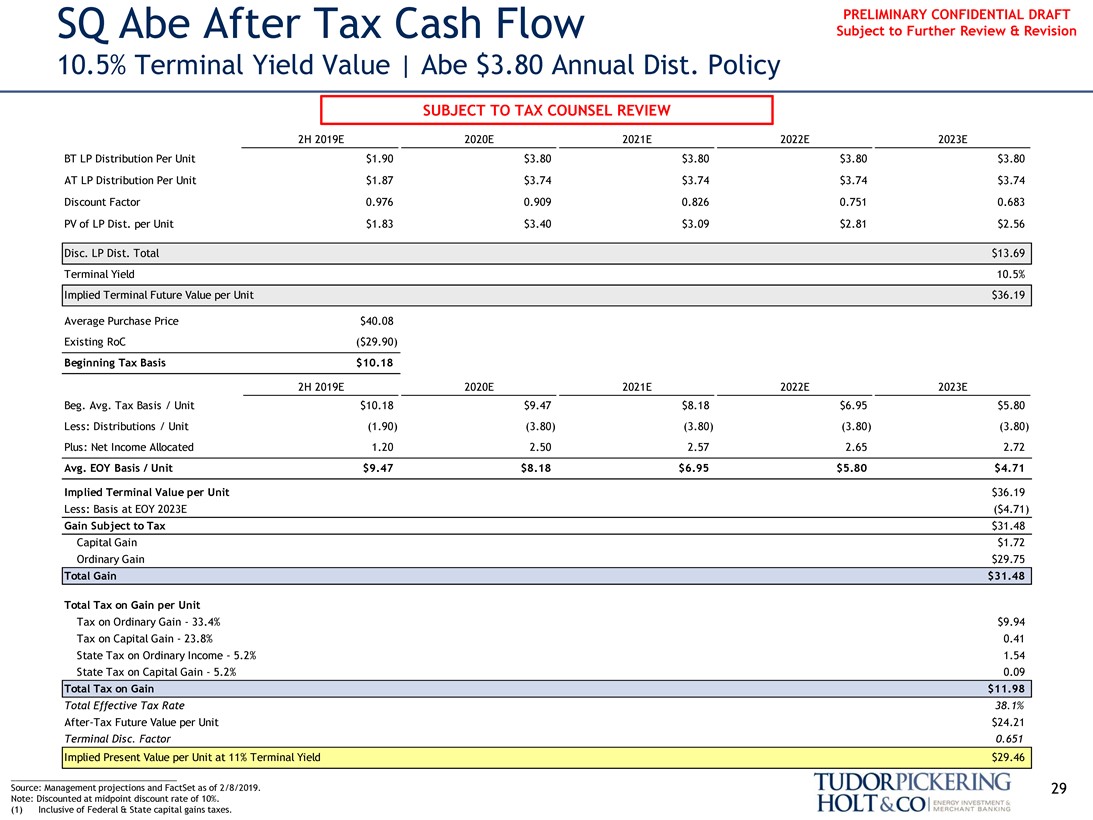

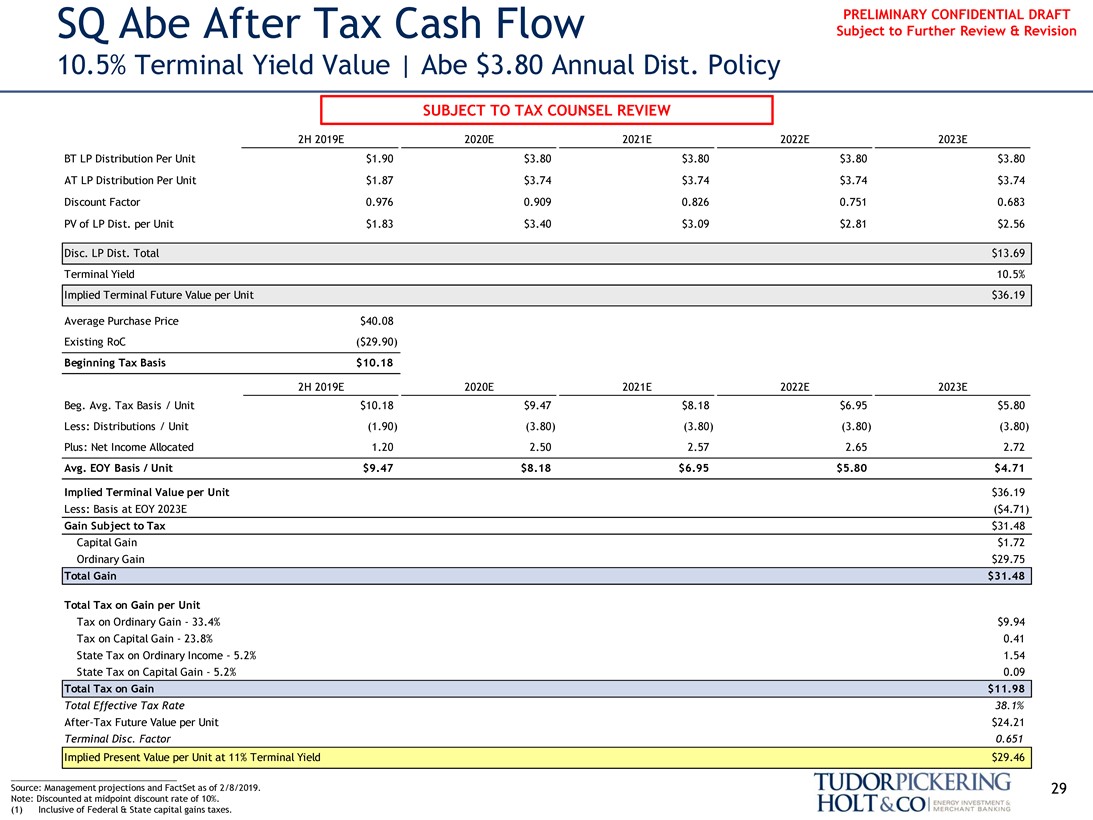

PRELIMINARY CONFIDENTIAL DRAFT SQ Abe After Tax Cash Flow Subject to Further Review & Revision

10.5% Terminal Yield Value | Abe $3.80 Annual Dist. Policy

SUBJECT TO TAX COUNSEL REVIEW

2H 2019E 2020E 2021E 2022E 2023E

BT LP Distribution Per Unit $1.90 $3.80 $3.80 $3.80 $3.80 AT LP Distribution Per Unit $1.87 $3.74 $3.74 $3.74 $3.74 Discount Factor 0.976 0.909 0.826 0.751 0.683 PV of LP Dist. per Unit $1.83 $3.40 $3.09 $2.81 $2.56

Disc. LP Dist. Total $13.69 Terminal Yield 10.5% Implied Terminal Future Value per Unit $36.19

Average Purchase Price $40.08 Existing RoC ($29.90)

Beginning Tax Basis $10.18

2H 2019E 2020E 2021E 2022E 2023E

Beg. Avg. Tax Basis / Unit $10.18 $9.47 $8.18 $6.95 $5.80 Less: Distributions / Unit (1.90) (3.80) (3.80) (3.80) (3.80) Plus: Net Income Allocated 1.20 2.50 2.57 2.65 2.72

Avg. EOY Basis / Unit $9.47 $8.18 $6.95 $5.80 $4.71

Implied Terminal Value per Unit $36.19 Less: Basis at EOY 2023E ($4.71)

Gain Subject to Tax $31.48 Capital Gain $1.72 Ordinary Gain $29.75

Total Gain $31.48

Total Tax on Gain per Unit

Tax on Ordinary Gain - 33.4% $9.94 Tax on Capital Gain - 23.8% 0.41 State Tax on Ordinary Income - 5.2% 1.54 State Tax on Capital Gain - 5.2% 0.09

Total Tax on Gain $11.98

Total Effective Tax Rate 38.1%

After-Tax Future Value per Unit $24.21

Terminal Disc. Factor 0.651

Implied Present Value per Unit at 11% Terminal Yield $29.46

Source: Management projections and FactSet as of 2/8/2019. 29 Note: Discounted at midpoint discount rate of 10%.

(1) Inclusive of Federal & State capital gains taxes.

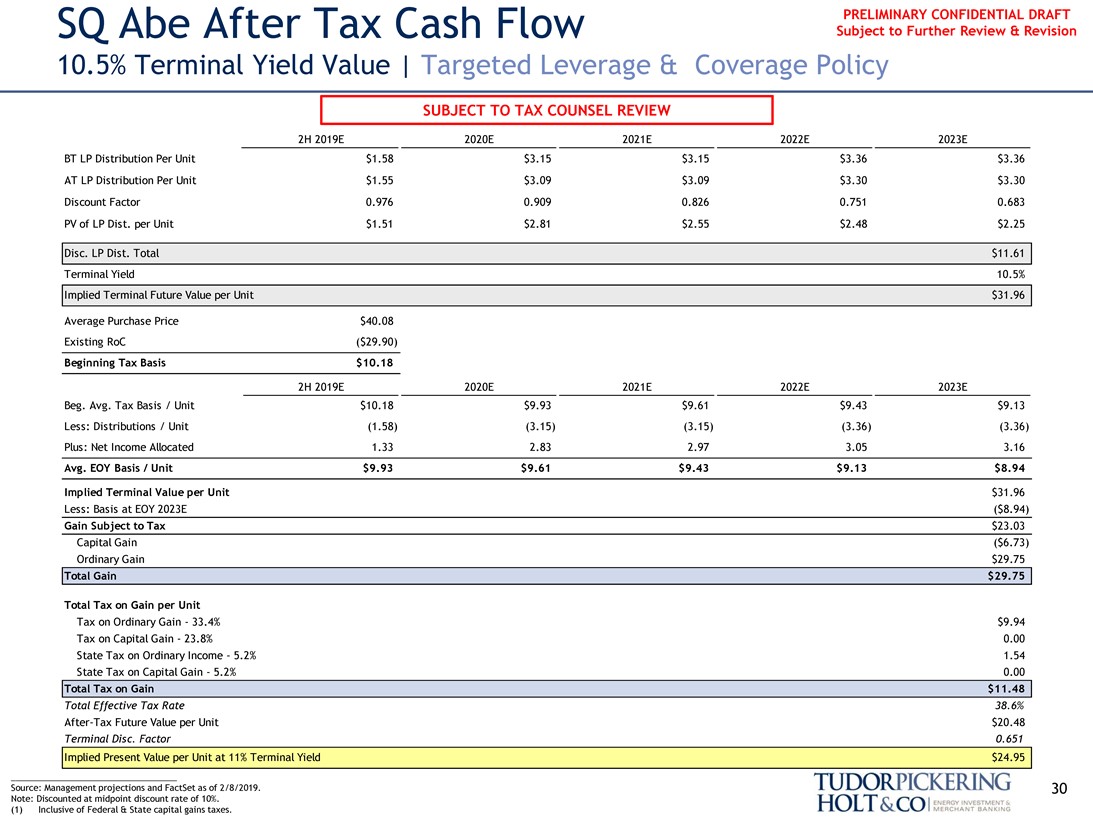

Tudorpickering Holt&co energy investment & merchant banking

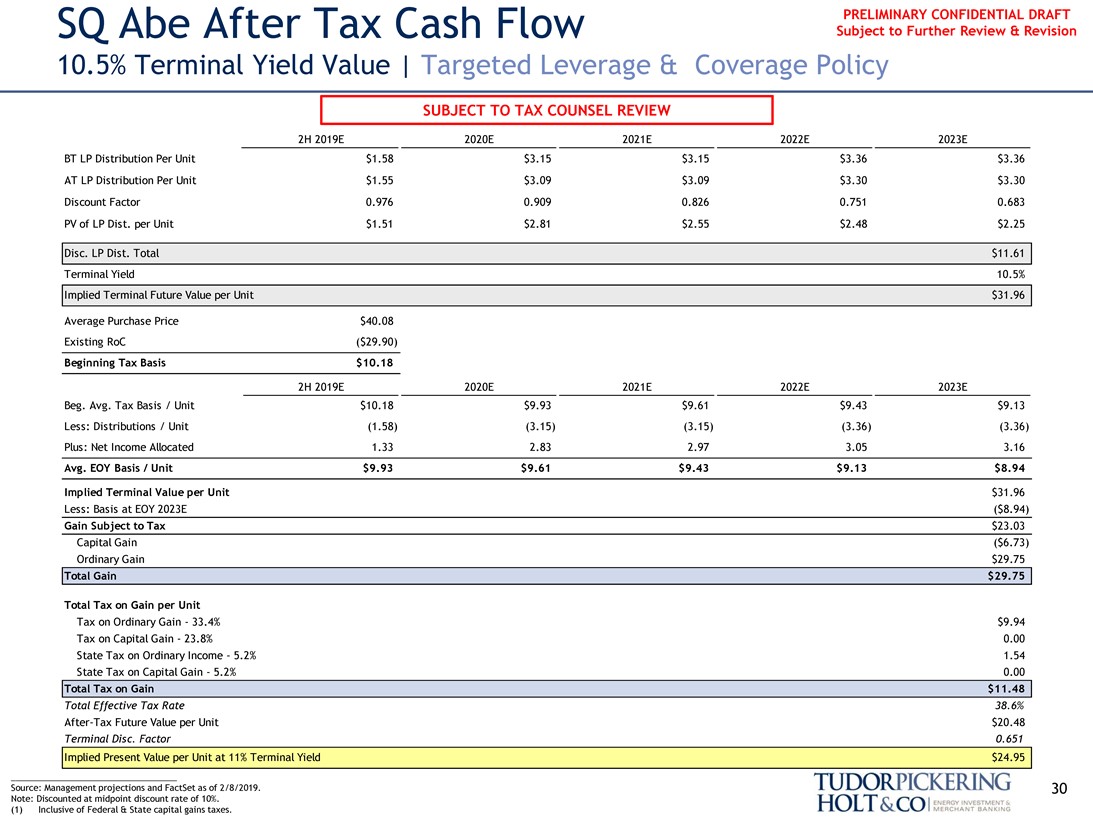

PRELIMINARY CONFIDENTIAL DRAFT SQ Abe After Tax Cash Flow Subject to Further Review & Revision

10.5% Terminal Yield Value | Targeted Leverage & Coverage Policy

SUBJECT TO TAX COUNSEL REVIEW

2H 2019E 2020E 2021E 2022E 2023E

BT LP Distribution Per Unit $1.58 $3.15 $3.15 $3.36 $3.36 AT LP Distribution Per Unit $1.55 $3.09 $3.09 $3.30 $3.30 Discount Factor 0.976 0.909 0.826 0.751 0.683 PV of LP Dist. per Unit $1.51 $2.81 $2.55 $2.48 $2.25

Disc. LP Dist. Total $11.61 Terminal Yield 10.5% Implied Terminal Future Value per Unit $31.96

Average Purchase Price $40.08 Existing RoC ($29.90)

Beginning Tax Basis $10.18

2H 2019E 2020E 2021E 2022E 2023E

Beg. Avg. Tax Basis / Unit $10.18 $9.93 $9.61 $9.43 $9.13 Less: Distributions / Unit (1.58) (3.15) (3.15) (3.36) (3.36) Plus: Net Income Allocated 1.33 2.83 2.97 3.05 3.16

Avg. EOY Basis / Unit $9.93 $9.61 $9.43 $9.13 $8.94

Implied Terminal Value per Unit $31.96 Less: Basis at EOY 2023E ($8.94)

Gain Subject to Tax $23.03 Capital Gain ($6.73) Ordinary Gain $29.75

Total Gain $29.75

Total Tax on Gain per Unit

Tax on Ordinary Gain - 33.4% $9.94 Tax on Capital Gain - 23.8% 0.00 State Tax on Ordinary Income - 5.2% 1.54 State Tax on Capital Gain - 5.2% 0.00

Total Tax on Gain $11.48

Total Effective Tax Rate 38.6%

After-Tax Future Value per Unit $20.48

Terminal Disc. Factor 0.651

Implied Present Value per Unit at 11% Terminal Yield $24.95

Source: Management projections and FactSet as of 2/8/2019. 30 Note: Discounted at midpoint discount rate of 10%.

(1) Inclusive of Federal & State capital gains taxes.

Tudorpickering Holt&co energy investment & merchant banking

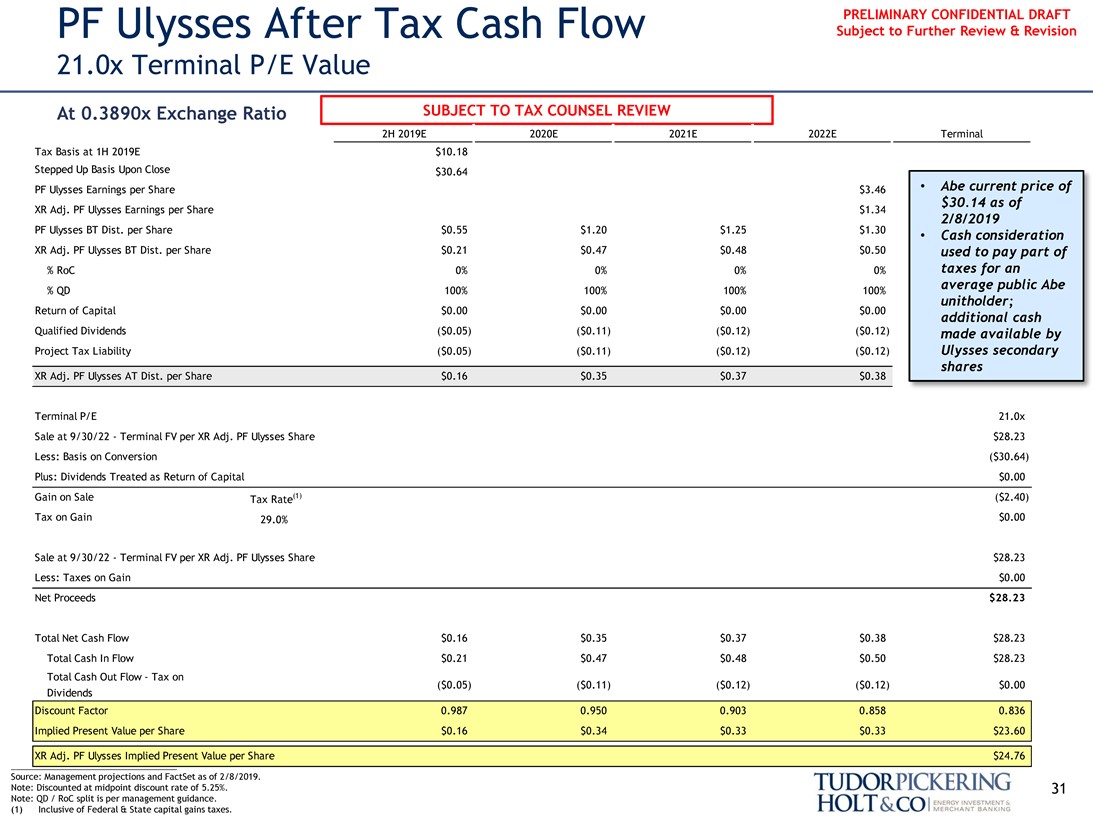

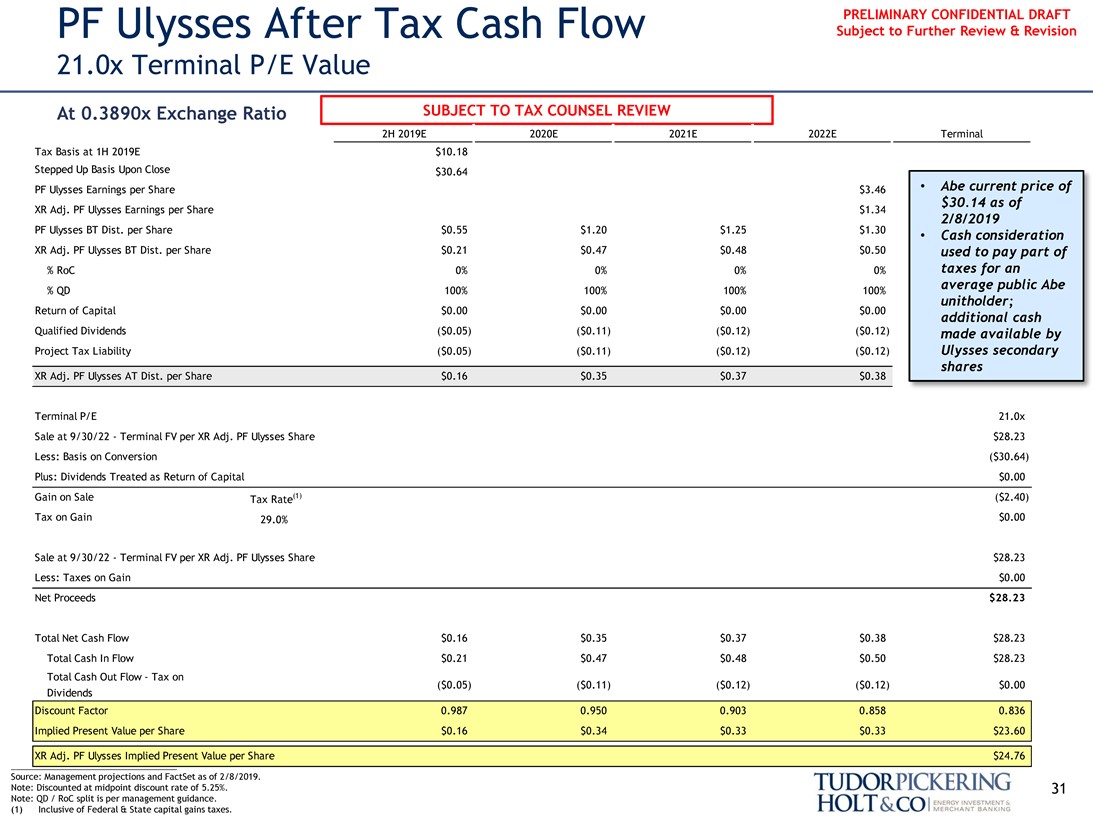

PRELIMINARY CONFIDENTIAL DRAFT PF Ulysses After Tax Cash Flow Subject to Further Review & Revision

21.0x Terminal P/E Value

At 0.3890x Exchange Ratio SUBJECT TO TAX COUNSEL REVIEW

2H 2019E 2020E 2021E 2022E Terminal Tax Basis at 1H 2019E $10.18 Stepped Up Basis Upon Close $30.64

PF Ulysses Earnings per Share $3.46 • Abe current price of

$30.14 as of

XR Adj. PF Ulysses Earnings per Share $1.34

PF Ulysses BT Dist. per Share $0.55 $1.20 $1.25 $1.30 2/8/2019

• Cash consideration

XR Adj. PF Ulysses BT Dist. per Share $0.21 $0.47 $0.48 $0.50 used to pay part of

% RoC 0% 0% 0% 0% taxes for an

% QD 100% 100% 100% 100% average public Abe

unitholder;

Return of Capital $0.00 $0.00 $0.00 $0.00 additional cash Qualified Dividends ($0.05) ($0.11) ($0.12) ($0.12) made available by Project Tax Liability ($0.05) ($0.11) ($0.12) ($0.12) Ulysses secondary

shares

XR Adj. PF Ulysses AT Dist. per Share $0.16 $0.35 $0.37 $0.38

Terminal P/E 21.0x Sale at 9/30/22—Terminal FV per XR Adj. PF Ulysses Share $28.23 Less: Basis on Conversion ($30.64) Plus: Dividends Treated as Return of Capital $0.00 Gain on Sale Tax Rate(1) ($2.40) Tax on Gain 29.0% $0.00

Sale at 9/30/22—Terminal FV per XR Adj. PF Ulysses Share $28.23 Less: Taxes on Gain $0.00 Net Proceeds $28.23

Total Net Cash Flow $0.16 $0.35 $0.37 $0.38 $28.23 Total Cash In Flow $0.21 $0.47 $0.48 $0.50 $28.23 Total Cash Out Flow—Tax on

($0.05) ($0.11) ($0.12) ($0.12) $0.00 Dividends Discount Factor 0.987 0.950 0.903 0.858 0.836 Implied Present Value per Share $0.16 $0.34 $0.33 $0.33 $23.60

XR Adj. PF Ulysses Implied Present Value per Share $24.76

Source: Management projections and FactSet as of 2/8/2019.

Note: Discounted at midpoint discount rate of 5.25%. 31 Note: QD / RoC split is per management guidance.

(1) Inclusive of Federal & State capital gains taxes.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Summary of Material Changes Subject to Further Review & Revision

Updates since 2/12/2019 Materials

∎ Adjusted terminal distributable cash flow multiple range to 6.0x – 10.0x for Abe Dscounted Distributable Cash Flow analysis∎ Adjusted terminal yield range to 8.0% – 13.0% for Abe Discounted Distribution analysis∎ Incorporated two additional corporate propane precedent transactions∎ Adjusted to unlevered cash taxes in Ulysses Unlevered Discounted Cash Flow Analysis

32

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

Appendix

33

Tudorpickering Holt&co energy investment & merchant banking

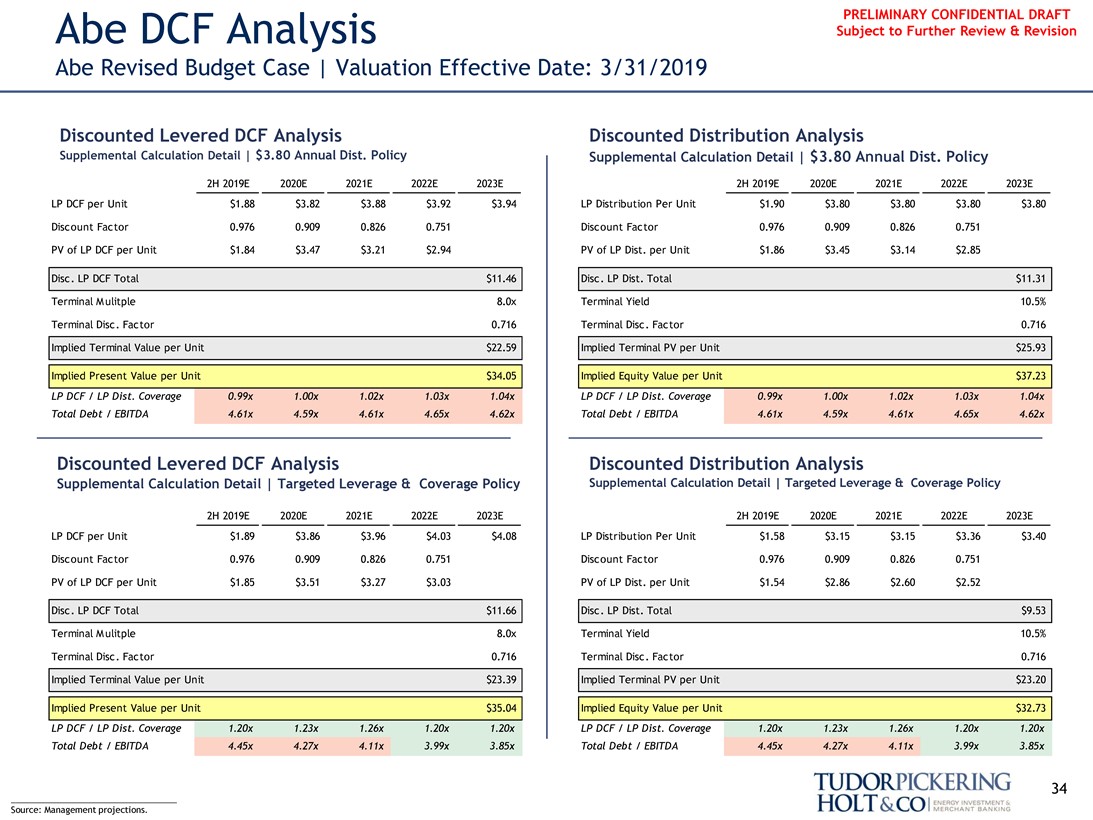

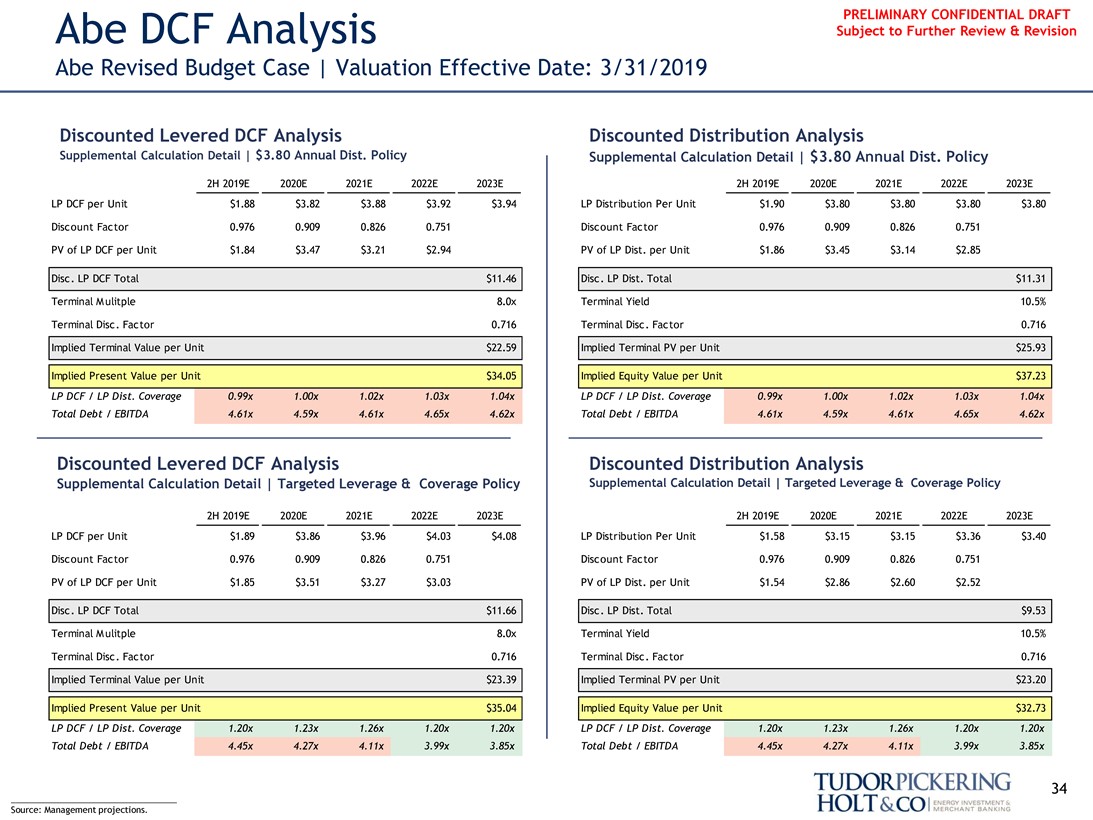

PRELIMINARY CONFIDENTIAL DRAFT Abe DCF Analysis Subject to Further Review & Revision

Abe Revised Budget Case | Valuation Effective Date: 3/31/2019

Discounted Levered DCF Analysis Discounted Distribution Analysis

Supplemental Calculation Detail | $3.80 Annual Dist. Policy Supplemental Calculation Detail | $3.80 Annual Dist. Policy

2H 2019E 2020E 2021E 2022E 2023E 2H 2019E 2020E 2021E 2022E 2023E

LP DCF per Unit $1.88 $3.82 $3.88 $3.92 $3.94 LP Distribution Per Unit $1.90 $3.80 $3.80 $3.80 $3.80 Discount Factor 0.976 0.909 0.826 0.751 Discount Factor 0.976 0.909 0.826 0.751 PV of LP DCF per Unit $1.84 $3.47 $3.21 $2.94 PV of LP Dist. per Unit $1.86 $3.45 $3.14 $2.85 Disc. LP DCF Total $11.46 Disc. LP Dist. Total $11.31 Terminal Mulitple 8.0x Terminal Yield 10.5% Terminal Disc. Factor 0.716 Terminal Disc. Factor 0.716 Implied Terminal Value per Unit $22.59 Implied Terminal PV per Unit $25.93

Implied Present Value per Unit $34.05 Implied Equity Value per Unit $37.23

LP DCF / LP Dist. Coverage 0.99x 1.00x 1.02x 1.03x 1.04x LP DCF / LP Dist. Coverage 0.99x 1.00x 1.02x 1.03x 1.04x Total Debt / EBITDA 4.61x 4.59x 4.61x 4.65x 4.62x Total Debt / EBITDA 4.61x 4.59x 4.61x 4.65x 4.62x

Discounted Levered DCF Analysis Discounted Distribution Analysis

Supplemental Calculation Detail | Targeted Leverage & Coverage Policy Supplemental Calculation Detail | Targeted Leverage & Coverage Policy

2H 2019E 2020E 2021E 2022E 2023E 2H 2019E 2020E 2021E 2022E 2023E

LP DCF per Unit $1.89 $3.86 $3.96 $4.03 $4.08 LP Distribution Per Unit $1.58 $3.15 $3.15 $3.36 $3.40 Discount Factor 0.976 0.909 0.826 0.751 Discount Factor 0.976 0.909 0.826 0.751 PV of LP DCF per Unit $1.85 $3.51 $3.27 $3.03 PV of LP Dist. per Unit $1.54 $2.86 $2.60 $2.52 Disc. LP DCF Total $11.66 Disc. LP Dist. Total $9.53 Terminal Mulitple 8.0x Terminal Yield 10.5% Terminal Disc. Factor 0.716 Terminal Disc. Factor 0.716 Implied Terminal Value per Unit $23.39 Implied Terminal PV per Unit $23.20

Implied Present Value per Unit $35.04 Implied Equity Value per Unit $32.73

LP DCF / LP Dist. Coverage 1.20x 1.23x 1.26x 1.20x 1.20x LP DCF / LP Dist. Coverage 1.20x 1.23x 1.26x 1.20x 1.20x Total Debt / EBITDA 4.45x 4.27x 4.11x 3.99x 3.85x Total Debt / EBITDA 4.45x 4.27x 4.11x 3.99x 3.85x

___________________________________ 34 Source: Management projections.

Tudorpickering Holt&co energy investment & merchant banking

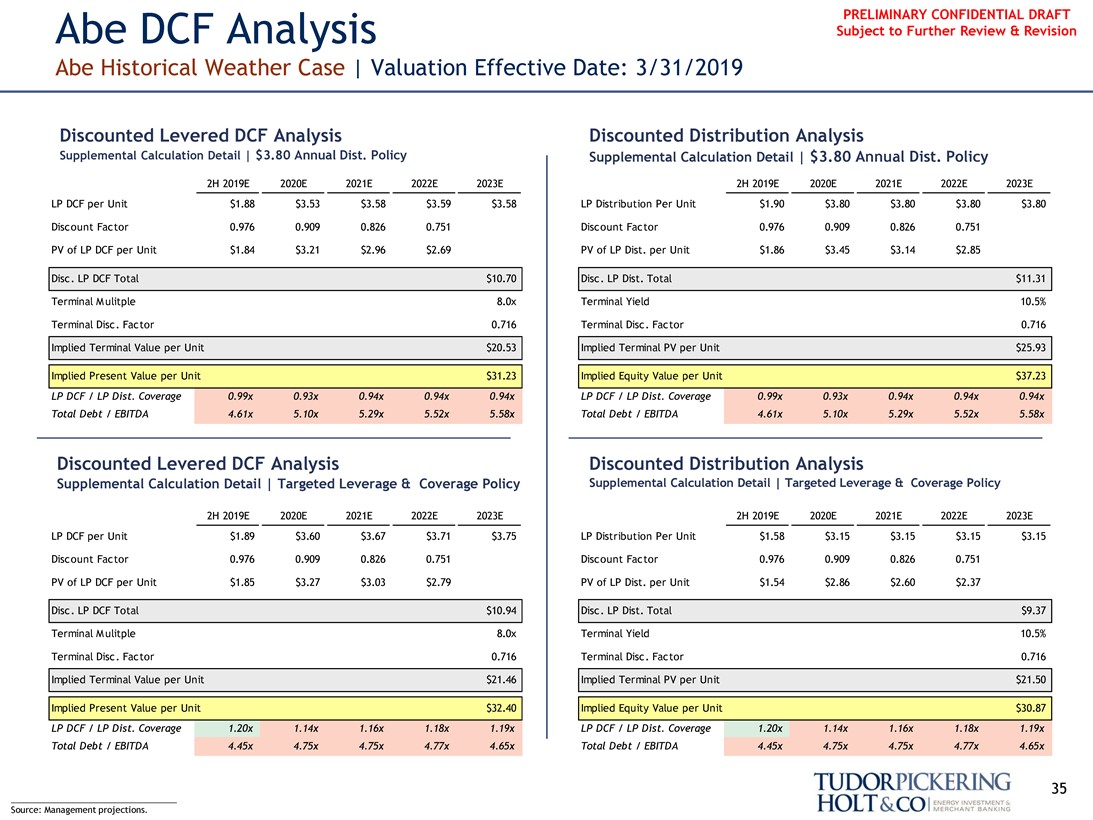

PRELIMINARY CONFIDENTIAL DRAFT Abe DCF Analysis Subject to Further Review & Revision

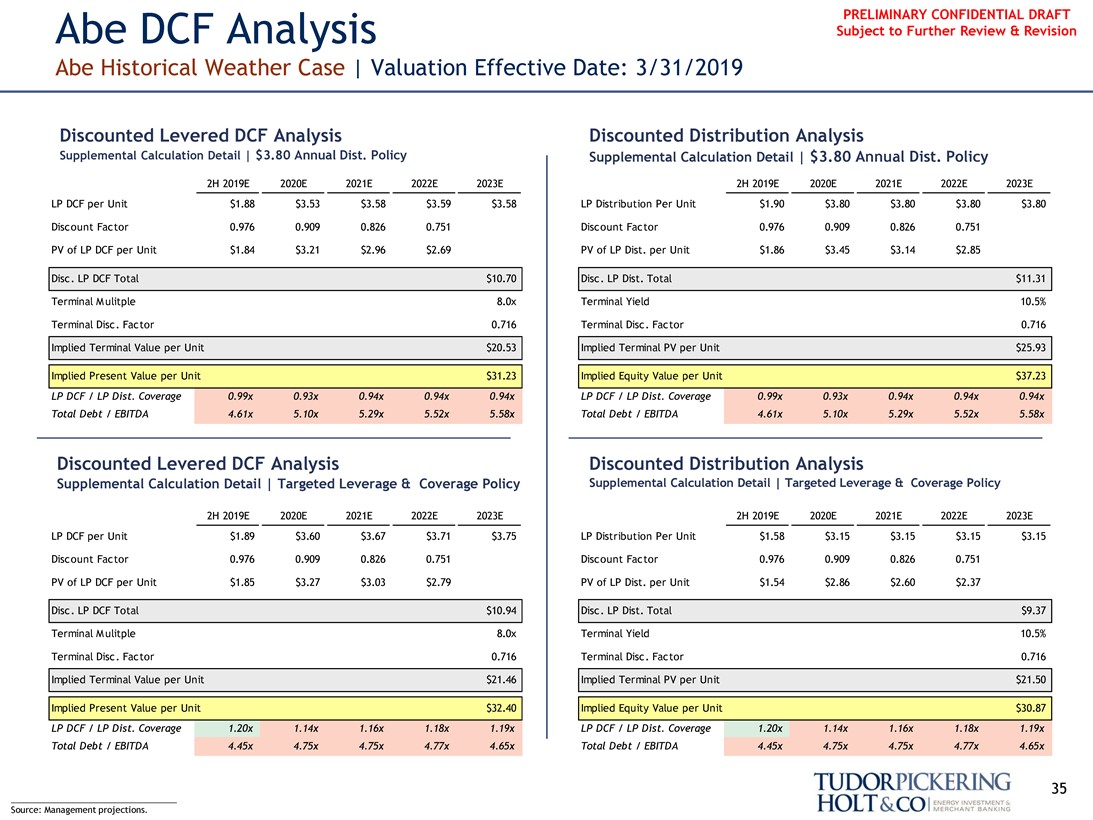

Abe Historical Weather Case | Valuation Effective Date: 3/31/2019

Discounted Levered DCF Analysis Discounted Distribution Analysis

Supplemental Calculation Detail | $3.80 Annual Dist. Policy Supplemental Calculation Detail | $3.80 Annual Dist. Policy

2H 2019E 2020E 2021E 2022E 2023E 2H 2019E 2020E 2021E 2022E 2023E

LP DCF per Unit $1.88 $3.53 $3.58 $3.59 $3.58 LP Distribution Per Unit $1.90 $3.80 $3.80 $3.80 $3.80 Discount Factor 0.976 0.909 0.826 0.751 Discount Factor 0.976 0.909 0.826 0.751 PV of LP DCF per Unit $1.84 $3.21 $2.96 $2.69 PV of LP Dist. per Unit $1.86 $3.45 $3.14 $2.85 Disc. LP DCF Total $10.70 Disc. LP Dist. Total $11.31 Terminal Mulitple 8.0x Terminal Yield 10.5% Terminal Disc. Factor 0.716 Terminal Disc. Factor 0.716 Implied Terminal Value per Unit $20.53 Implied Terminal PV per Unit $25.93

Implied Present Value per Unit $31.23 Implied Equity Value per Unit $37.23

LP DCF / LP Dist. Coverage 0.99x 0.93x 0.94x 0.94x 0.94x LP DCF / LP Dist. Coverage 0.99x 0.93x 0.94x 0.94x 0.94x Total Debt / EBITDA 4.61x 5.10x 5.29x 5.52x 5.58x Total Debt / EBITDA 4.61x 5.10x 5.29x 5.52x 5.58x

Discounted Levered DCF Analysis Discounted Distribution Analysis

Supplemental Calculation Detail | Targeted Leverage & Coverage Policy Supplemental Calculation Detail | Targeted Leverage & Coverage Policy

2H 2019E 2020E 2021E 2022E 2023E 2H 2019E 2020E 2021E 2022E 2023E

LP DCF per Unit $1.89 $3.60 $3.67 $3.71 $3.75 LP Distribution Per Unit $1.58 $3.15 $3.15 $3.15 $3.15 Discount Factor 0.976 0.909 0.826 0.751 Discount Factor 0.976 0.909 0.826 0.751 PV of LP DCF per Unit $1.85 $3.27 $3.03 $2.79 PV of LP Dist. per Unit $1.54 $2.86 $2.60 $2.37 Disc. LP DCF Total $10.94 Disc. LP Dist. Total $9.37 Terminal Mulitple 8.0x Terminal Yield 10.5% Terminal Disc. Factor 0.716 Terminal Disc. Factor 0.716 Implied Terminal Value per Unit $21.46 Implied Terminal PV per Unit $21.50

Implied Present Value per Unit $32.40 Implied Equity Value per Unit $30.87

LP DCF / LP Dist. Coverage 1.20x 1.14x 1.16x 1.18x 1.19x LP DCF / LP Dist. Coverage 1.20x 1.14x 1.16x 1.18x 1.19x Total Debt / EBITDA 4.45x 4.75x 4.75x 4.77x 4.65x Total Debt / EBITDA 4.45x 4.75x 4.75x 4.77x 4.65x

___________________________________ 35 Source: Management projections.

Tudorpickering Holt&co energy investment & merchant banking

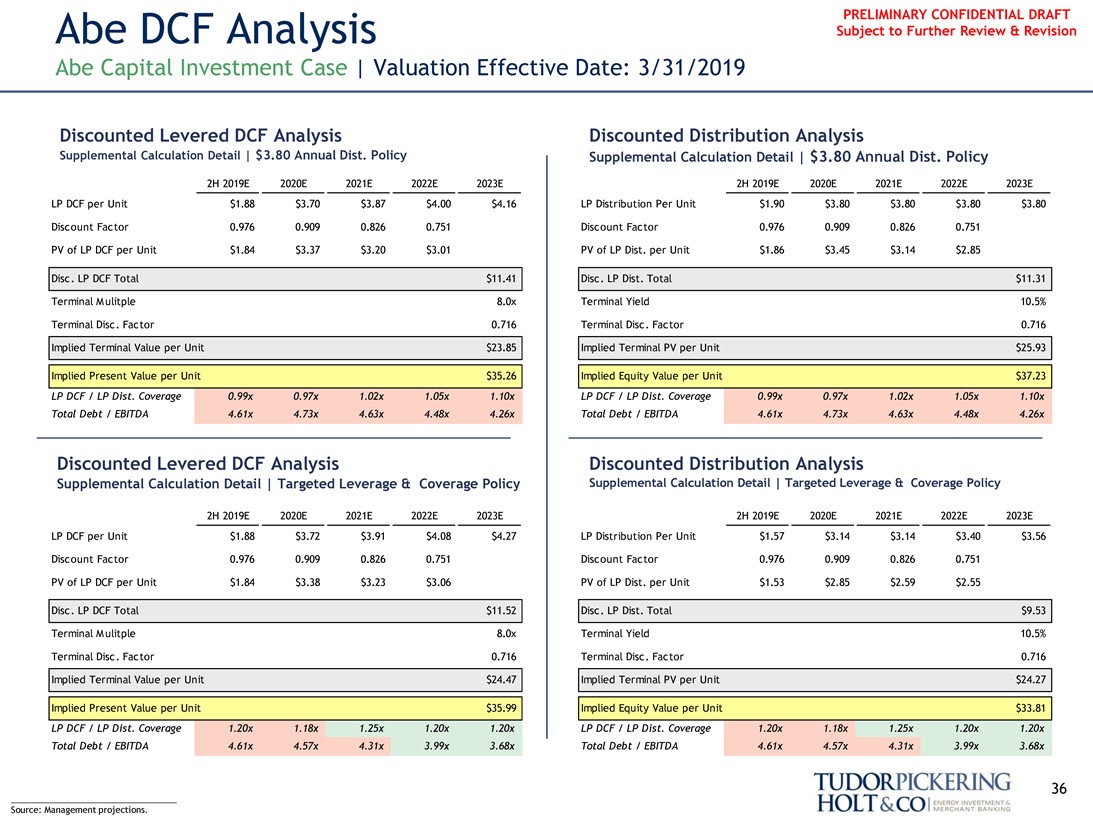

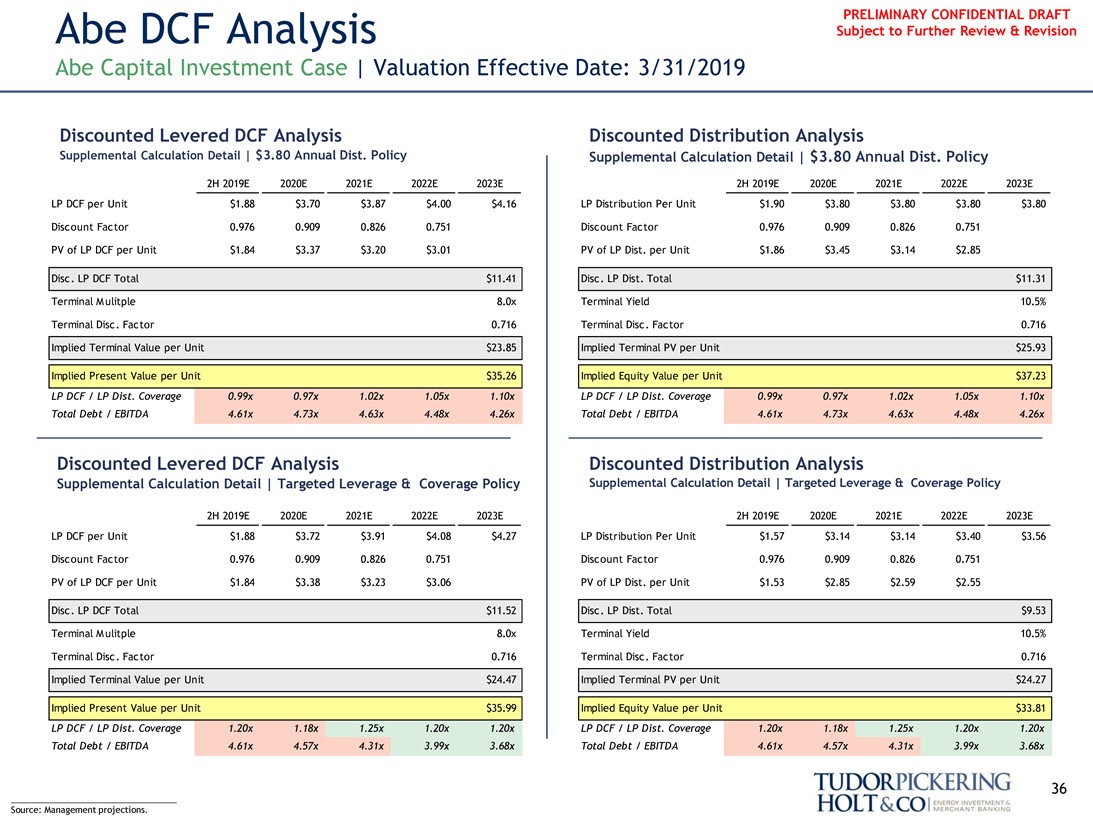

PRELIMINARY CONFIDENTIAL DRAFT Abe DCF Analysis Subject to Further Review & Revision

Abe Capital Investment Case | Valuation Effective Date: 3/31/2019

Discounted Levered DCF Analysis Discounted Distribution Analysis

Supplemental Calculation Detail | $3.80 Annual Dist. Policy Supplemental Calculation Detail | $3.80 Annual Dist. Policy

2H 2019E 2020E 2021E 2022E 2023E 2H 2019E 2020E 2021E 2022E 2023E

LP DCF per Unit $1.88 $3.70 $3.87 $4.00 $4.16 LP Distribution Per Unit $1.90 $3.80 $3.80 $3.80 $3.80 Discount Factor 0.976 0.909 0.826 0.751 Discount Factor 0.976 0.909 0.826 0.751 PV of LP DCF per Unit $1.84 $3.37 $3.20 $3.01 PV of LP Dist. per Unit $1.86 $3.45 $3.14 $2.85 Disc. LP DCF Total $11.41 Disc. LP Dist. Total

$11.31 Terminal Mulitple 8.0x Terminal Yield 10.5% Terminal Disc. Factor 0.716 Terminal Disc. Factor 0.716 Implied Terminal Value per Unit $23.85 Implied Terminal PV per Unit $25.93

Implied Present Value per Unit $35.26 Implied Equity Value per Unit $37.23

LP DCF / LP Dist. Coverage 0.99x 0.97x 1.02x 1.05x 1.10x LP DCF / LP Dist. Coverage 0.99x 0.97x 1.02x 1.05x 1.10x Total Debt / EBITDA 4.61x 4.73x 4.63x 4.48x 4.26x Total Debt / EBITDA 4.61x 4.73x 4.63x 4.48x 4.26x

Discounted Levered DCF Analysis Discounted Distribution Analysis

Supplemental Calculation Detail | Targeted Leverage & Coverage Policy Supplemental Calculation Detail | Targeted Leverage & Coverage Policy

2H 2019E 2020E 2021E 2022E 2023E 2H 2019E 2020E 2021E 2022E 2023E

LP DCF per Unit $1.88 $3.72 $3.91 $4.08 $4.27 LP Distribution Per Unit $1.57 $3.14 $3.14 $3.40 $3.56 Discount Factor 0.976 0.909 0.826 0.751 Discount Factor 0.976 0.909 0.826 0.751 PV of LP DCF per Unit $1.84 $3.38 $3.23 $3.06 PV of LP Dist. per Unit $1.53 $2.85 $2.59 $2.55 Disc. LP DCF Total $11.52 Disc. LP Dist. Total $9.53 Terminal Mulitple 8.0x Terminal Yield 10.5% Terminal Disc. Factor 0.716 Terminal Disc. Factor 0.716 Implied Terminal Value per Unit $24.47 Implied Terminal PV per Unit $24.27

Implied Present Value per Unit $35.99 Implied Equity Value per Unit $33.81

LP DCF / LP Dist. Coverage 1.20x 1.18x 1.25x 1.20x 1.20x LP DCF / LP Dist. Coverage 1.20x 1.18x 1.25x 1.20x 1.20x Total Debt / EBITDA 4.61x 4.57x 4.31x 3.99x 3.68x Total Debt / EBITDA 4.61x 4.57x 4.31x 3.99x 3.68x

___________________________________ 36 Source: Management projections.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

Cost of Capital

37

Tudorpickering Holt&co energy investment & merchant banking

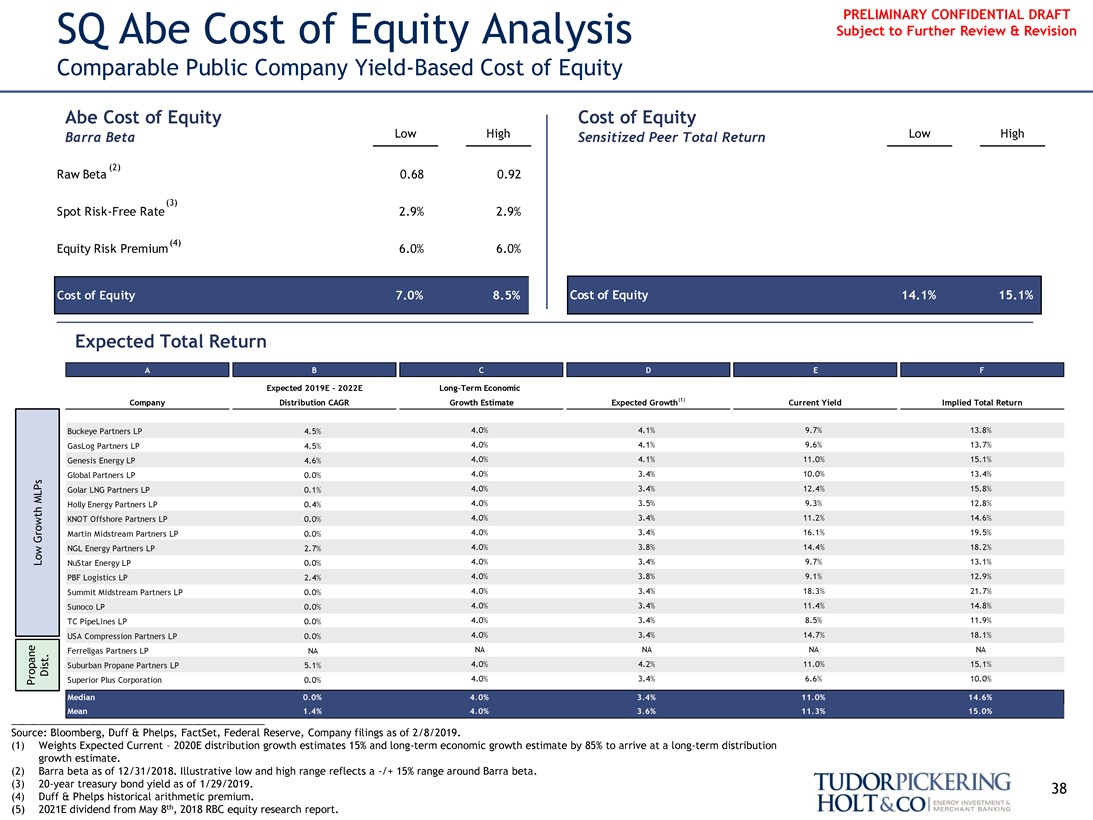

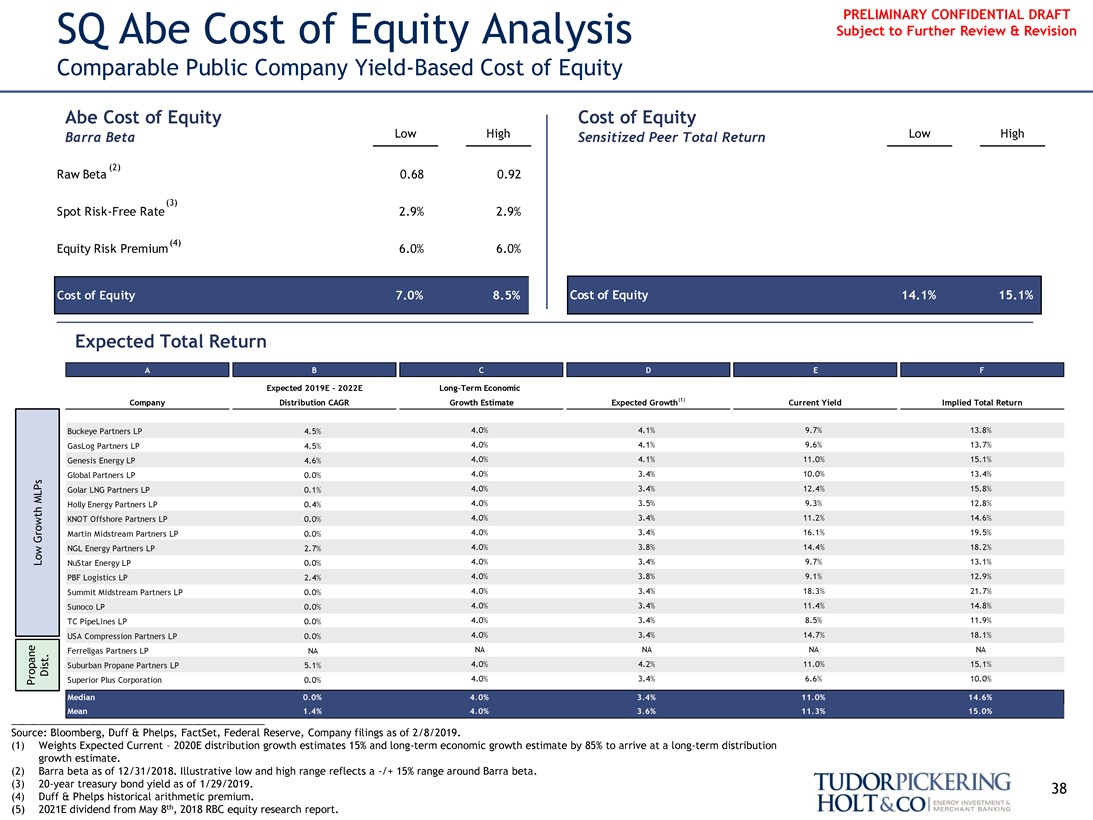

PRELIMINARY CONFIDENTIAL DRAFT SQ Abe Cost of Equity Analysis Subject to Further Review & Revision

Comparable Public Company Yield-Based Cost of Equity

Abe Cost of Equity Cost of Equity

Barra Beta Low High Sensitized Peer Total Return Low High

(2)

Raw Beta 0.68 0.92

(3)

Spot Risk-Free Rate 2.9% 2.9%

(4)

Equity Risk Premium 6.0% 6.0%

Cost of Equity 7.0% 8.5% Cost of Equity 14.1% 15.1%

A B C D E F

Expected Total Return

Expected 2019E—2022E Long-Term Economic

Company Distribution CAGR Growth Estimate Expected Growth(1) Current Yield Implied Total Return

Buckeye Partners LP 4.5% 4.0% 4.1% 9.7% 13.8% GasLog Partners LP 4.5% 4.0% 4.1% 9.6% 13.7% Genesis Energy LP 4.6% 4.0% 4.1% 11.0% 15.1% Global Partners LP 0.0% 4.0% 3.4% 10.0% 13.4% MLPs Golar LNG Partners LP 0.1% 4.0% 3.4% 12.4% 15.8% Holly Energy Partners LP 0.4% 4.0% 3.5% 9.3% 12.8% KNOT Offshore Partners LP 0.0% 4.0% 3.4% 11.2% 14.6% Growth Martin Midstream Partners LP 0.0% 4.0% 3.4% 16.1% 19.5% NGL Energy Partners LP 2.7% 4.0% 3.8% 14.4% 18.2% Low NuStar Energy LP 0.0% 4.0% 3.4% 9.7% 13.1% PBF Logistics LP 2.4% 4.0% 3.8% 9.1% 12.9% Summit Midstream Partners LP 0.0% 4.0% 3.4% 18.3% 21.7% Sunoco LP 0.0% 4.0% 3.4% 11.4% 14.8% TC PipeLines LP 0.0% 4.0% 3.4% 8.5% 11.9% USA Compression Partners LP 0.0% 4.0% 3.4% 14.7% 18.1% NA NA NA NA

Ferrellgas Partners LP NA

Dist. Suburban Propane Partners LP 5.1% 4.0% 4.2% 11.0% 15.1% Propane Superior Plus Corporation 0.0% 4.0% 3.4% 6.6% 10.0%

Median 0.0% 4.0% 3.4% 11.0% 14.6% Mean 1.4% 4.0% 3.6% 11.3% 15.0%

______________________________________________ Source: Bloomberg, Duff & Phelps, FactSet, Federal Reserve, Company filings as of 2/8/2019.

(1) Weights Expected Current – 2020E distribution growth estimates 15% and long-term economic growth estimate by 85% to arrive at a long-term distribution growth estimate.

(2) Barra beta as of 12/31/2018. Illustrative low and high range reflects a -/+ 15% range around Barra beta.

(3)20-year treasury bond yield as of 1/29/2019. 38 (4) Duff & Phelps historical arithmetic premium.

(5) 2021E dividend from May 8th, 2018 RBC equity research report.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

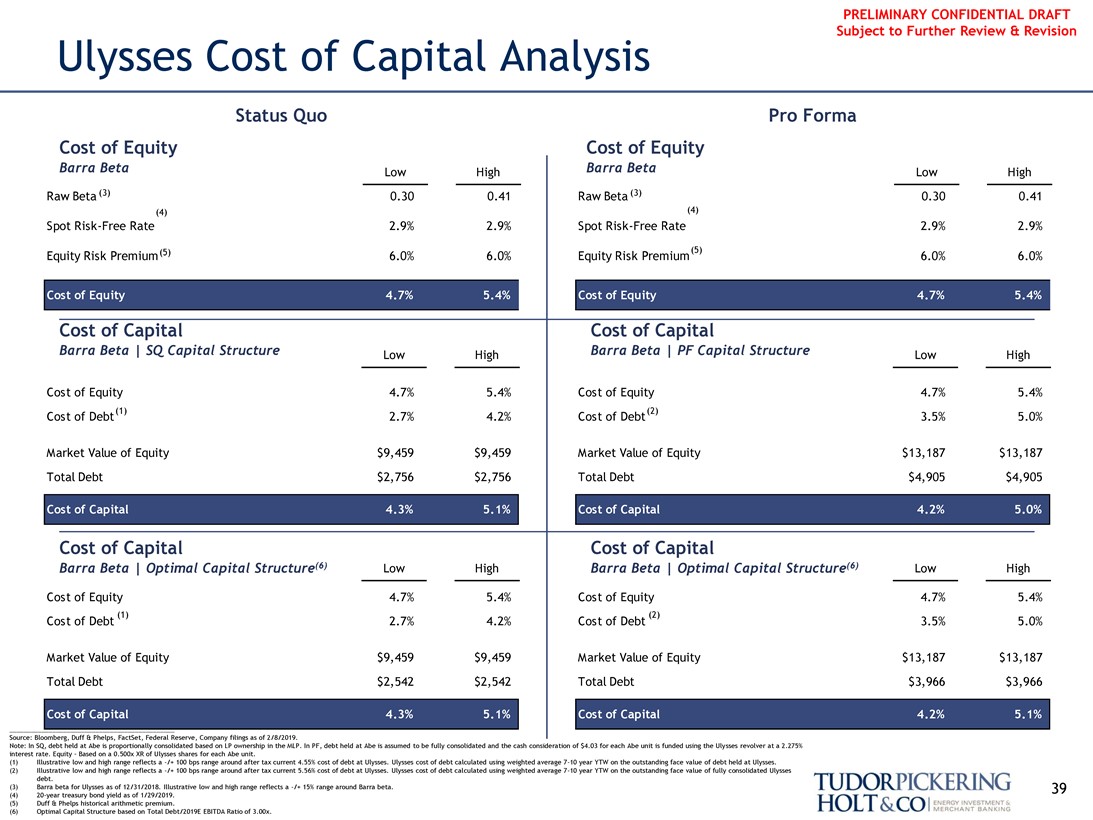

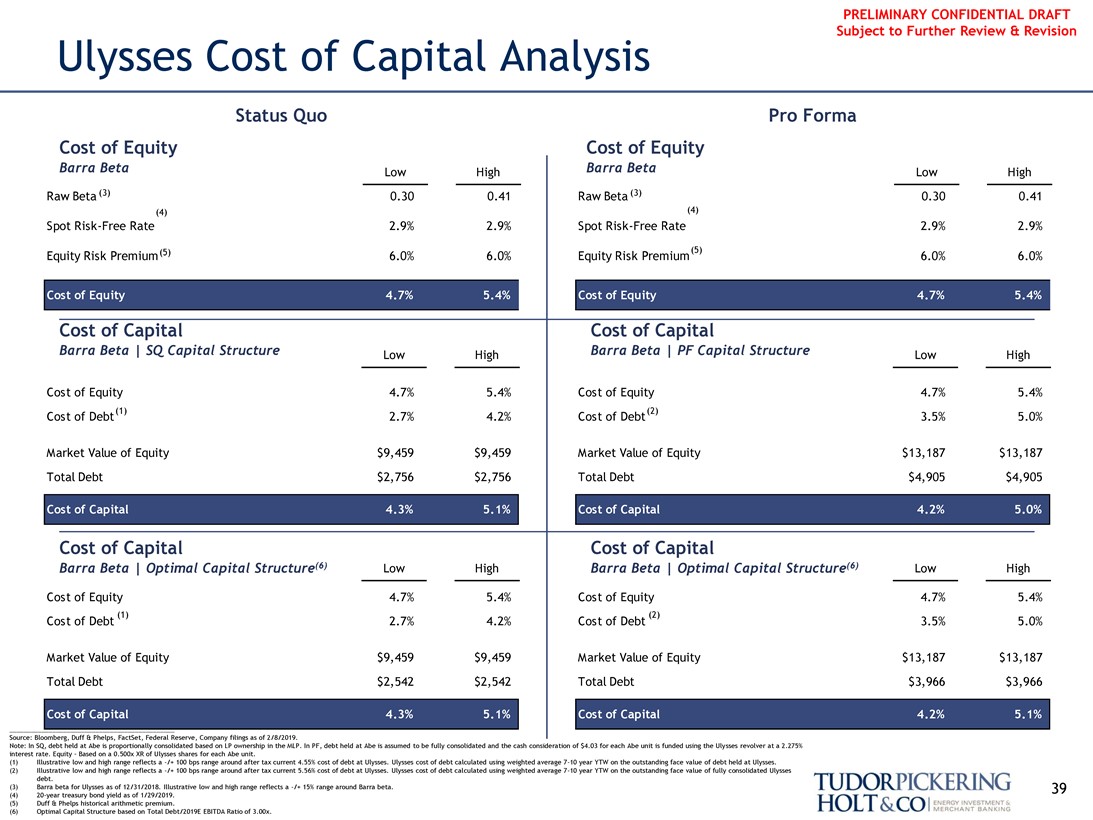

Ulysses Cost of Capital Analysis

Status Quo Pro Forma Cost of Equity Cost of Equity

Barra Beta Low High Barra Beta Low High Raw Beta (3) 0.30 0.41 Raw Beta (3) 0.30 0.41

(4) (4)

Spot Risk-Free Rate 2.9% 2.9% Spot Risk-Free Rate 2.9% 2.9%

Equity Risk Premium(5) 6.0% 6.0% Equity Risk Premium(5) 6.0% 6.0%

Cost of Equity 4.7% 5.4% Cost of Equity 4.7% 5.4%

Cost of Capital Cost of Capital

Barra Beta | SQ Capital Structure Low High Barra Beta | PF Capital Structure Low High

Cost of Equity 4.7% 5.4% Cost of Equity 4.7% 5.4% Cost of Debt(1) 2.7% 4.2% Cost of Debt(2) 3.5% 5.0%

Market Value of Equity $9,459 $9,459 Market Value of Equity $13,187 $13,187 Total Debt $2,756 $2,756 Total Debt $4,905 $4,905

Cost of Capital 4.3% 5.1% Cost of Capital 4.2% 5.0%

Cost of Capital Cost of Capital

Barra Beta | Optimal Capital Structure(6) Low High Barra Beta | Optimal Capital Structure(6) Low High

Cost of Equity 4.7% 5.4% Cost of Equity 4.7% 5.4%

(1) (2)

Cost of Debt 2.7% 4.2% Cost of Debt 3.5% 5.0%

Market Value of Equity $9,459 $9,459 Market Value of Equity $13,187 $13,187 Total Debt $2,542 $2,542 Total Debt $3,966 $3,966

Cost of Capital 4.3% 5.1% Cost of Capital 4.2% 5.1%

Source: Bloomberg, Duff & Phelps, FactSet, Federal Reserve, Company filings as of 2/8/2019.

Note: In SQ, debt held at Abe is proportionally consolidated based on LP ownership in the MLP. In PF, debt held at Abe is assumed to be fully consolidated and the cash consideration of $4.03 for each Abe unit is funded using the Ulysses revolver at a 2.275% interest rate. Equity - Based on a 0.500x XR of Ulysses shares for each Abe unit.

(1) Illustrative low and high range reflects a -/+ 100 bps range around after tax current 4.55% cost of debt at Ulysses. Ulysses cost of debt calculated using weighted average7-10 year YTW on the outstanding face value of debt held at Ulysses. (2) Illustrative low and high range reflects a -/+ 100 bps range around after tax current 5.56% cost of debt at Ulysses. Ulysses cost of debt calculated using weighted average7-10 year YTW on the outstanding face value of fully consolidated Ulysses debt.

(3) Barra beta for Ulysses as of 12/31/2018. Illustrative low and high range reflects a -/+ 15% range around Barra beta. 39 (4)20-year treasury bond yield as of 1/29/2019.

(5) Duff & Phelps historical arithmetic premium.

(6) Optimal Capital Structure based on Total Debt/2019E EBITDA Ratio of 3.00x.

Tudorpickering Holt&co energy investment & merchant banking

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

Disclosure Statement

Tudor, Pickering, Holt & Co. does not provide accounting, tax or legal advice. This presentation does not constitute a tax opinion and cannot be used by any taxpayer for the purpose of avoiding tax penalties. We (i) make no conclusion on the valuation or About The Firm pricing for tax purposes or the effects of federal income tax laws on any party and (ii) have assumed that the party’s intended tax treatment will be respected. Each person should seek legal, regulatory, accounting and tax advice based on his, her or its Tudor, Pickering, Holt & Co. is an integrated energy investment and merchant particular circumstances from independent advisors regarding the evaluation and bank, providing high quality advice and services to institutional and corporate impact of any transactions or matters described herein. clients. Through the company’s two broker-dealer units, Tudor, Pickering, Holt & Co. Securities, Inc. (TPHCSI) and Tudor Pickering Holt & Co Advisors LP (TPHCA), The information contained herein is confidential (except for information relating to members FINRA, together with affiliates in the United Kingdom and Canada, the United States tax issues) and may not be reproduced in whole or in part except as set company offers securities and investment banking services to the energy forth in a written agreement between the Audit Committee of the Board of Directors community. Perella Weinberg Partners Capital Management LP is an SEC of AmeriGas Propane, Inc. and Tudor, Pickering, Holt & Co. registered investment adviser that delivers a suite of energy investment strategies. Tudor, Pickering, Holt & Co. assumes no responsibility for independent verification of third-party information and has relied on such information being complete and The firm, headquartered in Houston, Texas, has approximately 170 employees accurate in all material respects. To the extent such information includes estimates and offices in Calgary, Canada; Denver, Colorado; New York, New York; and and forecasts of future financial performance (including estimates of potential cost London, England. savings and synergies) prepared by, reviewed or discussed with the managements of your company and/ or other potential transaction participants or obtained from public

Contact Us sources, we have assumed that such estimates and forecasts have been reasonably

Houston (Research, Sales and Trading):713-333-2960 prepared on bases reflecting the best currently available estimates and judgments of Houston (Investment Banking):713-333-7100 such managements (or, with respect to estimates and forecasts obtained from public Houston (Asset Management):713-337-3999 sources, represent reasonable estimates). These materials were designed for use by Denver (Sales):303-300-1900 specific persons familiar with the business and the affairs of your company and Tudor, Denver (Investment Banking):303-300-1900 Pickering, Holt & Co. materials.

New York (Investment Banking):212-610-1660

New York (Research, Sales):212-610-1600 Under no circumstances is this presentation to be used or considered as an offer to London: +011 44(0) 20 7268 2800 sell or a solicitation of any offer to buy, any security. Prior to making any trade, you Calgary:403-705-7830 should discuss with your professional tax,

accounting, or regulatory advisers how such particular trade(s) affect you. This brief statement does not disclose all of the risks www.TPHco.com and other significant aspects of entering into any particular transaction.

Copyright 2019 — Tudor, Pickering, Holt & Co. Tudor, Pickering, Holt & Co. operates in the United Kingdom under the trading name Perella Weinberg Partners UK LLP (authorized and regulated by the Financial Conduct Authority), and in Canada through its affiliate, Tudor, Pickering, Holt & Co. Securities

– Canada, ULC, located in Calgary, Alberta.

40

Tudorpickering Holt&co energy investment & merchant banking