Exhibit (c)(7)

STRICTLY PRIVATE AND CONFIDENTIAL Presentation to the Board of Directors Project Almanack | April 1, 2019 J.P.Morgan

CONFIDENTIAL This presentation was prepared exclusively for the benefit and internal use of the J.P. Morgan client to whom it is directly addressed and delivered (including such client’s subsidiaries, the “Company”) in order to assist the Company in evaluating, on a preliminary basis, the feasibility of a possible transaction or transactions and does not carry any right of publication or disclosure, in whole or in part, to any other party. This presentation is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by J.P. Morgan. Neither this presentation nor any of its contents may be disclosed or used for any other purpose without the prior written consent of J.P. Morgan. The information in this presentation is based upon any management forecasts supplied to us and reflects prevailing conditions and our views as of this date, all of which are accordingly subject to change. J.P. Morgan’s opinions and estimates constitute J.P. Morgan’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Company or which was otherwise reviewed by us. In addition, our analyses are not and do not purport to be appraisals of the assets, stock, or business of the Company or any other entity. J.P. Morgan makes no representations as to the actual value which may be received in connection with neither a transaction nor the legal, tax or accounting effects of consummating a transaction. Unless expressly contemplated hereby, the information in this presentation does not take into account the effects of a possible transaction or transactions involving an actual or potential change of control, which may have significant valuation and other effects. Notwithstanding anything herein to the contrary, the Company and each of its employees, representatives or other agents may disclose to any and all persons, without limitation of any kind, the U.S. federal and state income tax treatment and the U.S. federal and state income tax structure of the transactions contemplated hereby and all materials of any kind (including opinions or other tax analyses) that are provided to the Company relating to such tax treatment and tax structure insofar as such treatment and/or structure relates to a U.S. federal or state income tax strategy provided to the Company by J.P. Morgan. J.P. Morgan’s policies prohibit employees from offering, directly or indirectly, a favorable research rating or specific price target, or offering to change a rating or price target, to a subject company as consideration or inducement for the receipt of business or for compensation. J.P. Morgan also prohibits its research analysts from being compensated for involvement in investment banking transactions except to the extent that such participation is intended to benefit investors. IRS Circular 230 Disclosure: JPMorgan Chase & Co. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters included herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone not affiliated with JPMorgan Chase & Co. of any of the matters addressed herein or for the purpose of avoiding U.S.tax-related penalties. J.P. Morgan is the marketing name for the Corporate and Investment Banking activities of JPMorgan Chase Bank, N.A., JPMS (member, NYSE), J.P. Morgan PLC authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority) and their investment banking affiliates. J.P.Morgan

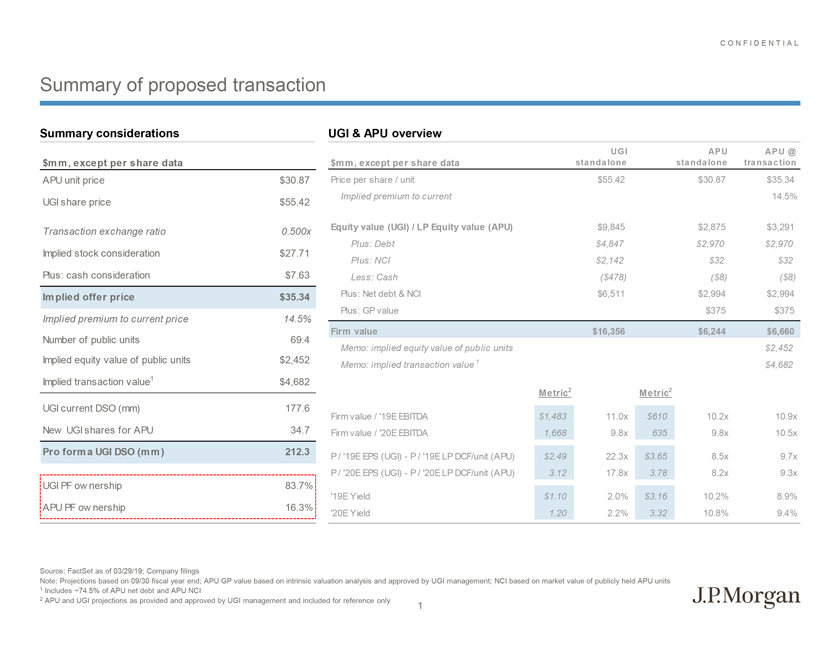

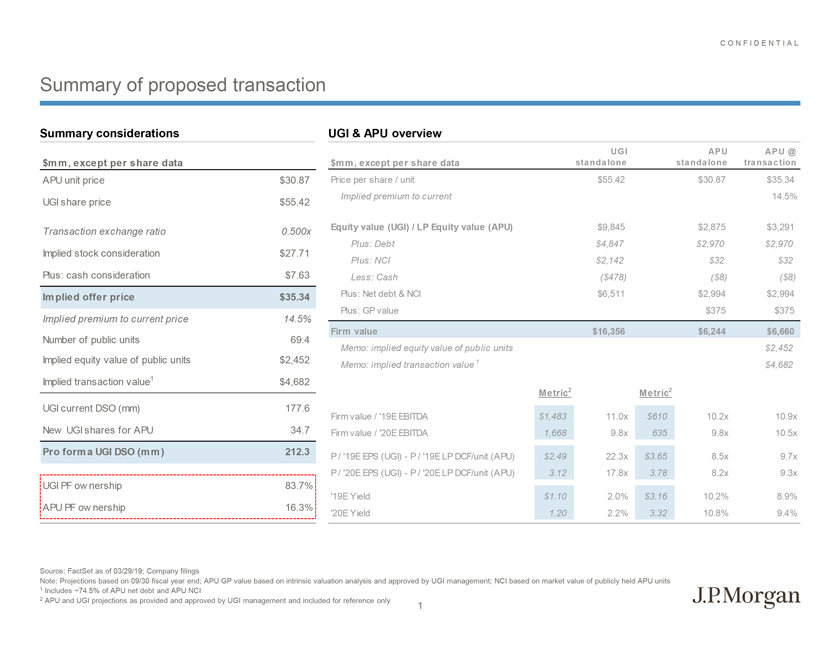

CONFIDENTIAL Summary of proposed transaction Summary considerations $mm, except per share data APU unit price $30.87 UGI share price $55.42 Transaction exchange ratio 0.500x Implied stock consideration $27.71 Plus: cash consideration $7.63 Implied offer price $35.34 Implied premium to current price 14.5% Number of public units 69.4 Implied equity value of public units $2,452 Implied transaction value1 $4,682 UGI current DSO (mm) 177.6 New UGI shares for APU 34.7 Pro forma UGI DSO (mm) 212.3 UGI PF ownership 83.7% APU PF ownership 16.3% UGI & APU overview UGI APU APU @ $mm, except per share data standalone standalone transaction Price per share / unit $55.42 $30.87 $35.34 Implied premium to current 14.5% Equity value (UGI) / LP Equity value (APU) $9,845 $2,875 $3,291 Plus: Debt $4,847 $2,970 $2,970 Plus: NCI $2,142 $32 $32 Less: Cash ($478) ($8) ($8) Plus: Net debt & NCI $6,511 $2,994 $2,994 Plus: GP value $375 $375 Firm value $16,356 $6,244 $6,660 Memo: implied equity value of public units $2,452 Memo: implied transaction value 1 $4,682 Metric2 Metric2 Firm value / ‘19E EBITDA $1,483 11.0x $610 10.2x 10.9x Firm value / ‘20E EBITDA 1,668 9.8x 635 9.8x 10.5x P / ‘19E EPS (UGI)—P / ‘19E LP DCF/unit (APU) $2.49 22.3x $3.65 8.5x 9.7x P / ‘20E EPS (UGI)—P / ‘20E LP DCF/unit (APU) 3.12 17.8x 3.78 8.2x 9.3x ‘19E Yield $1.10 2.0% $3.16 10.2% 8.9% ‘20E Yield 1.20 2.2% 3.32 10.8% 9.4% Source: FactSet as of 03/29/19; Company filings Note: Projections based on 09/30 fiscal year end; APU GP value based on intrinsic valuation analysis and approved by UGI management; NCI based on market value of publicly held APU units 1 Includes ~74.5% of APU net debt and APU NCI 2 APU and UGI projections as provided and approved by UGI management and included for reference only 1 J.P.Morgan

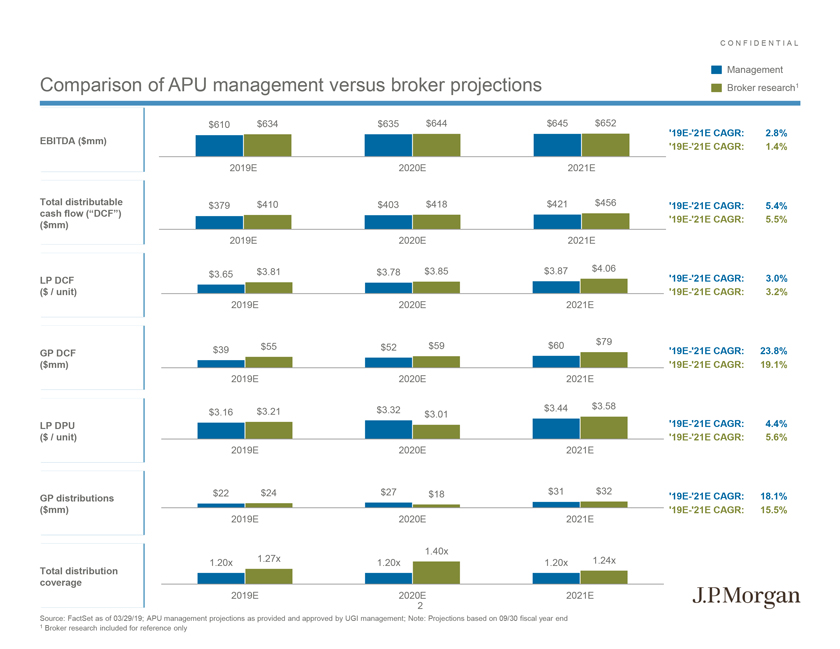

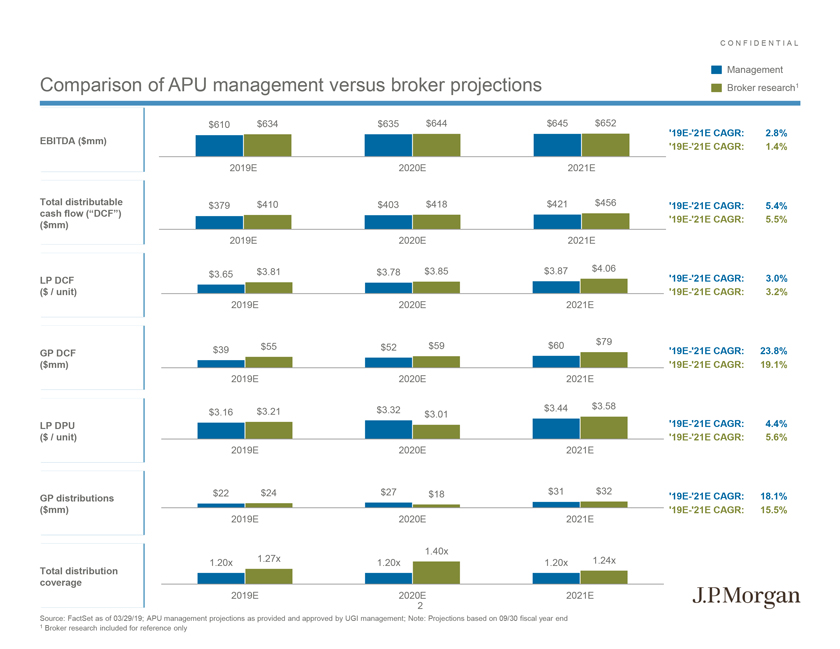

CONFIDENTIAL Comparison of APU management versus broker projections $610 $634 $635 $644 $645 $652‘19E-‘21E CAGR: 2.8% EBITDA ($mm)‘19E-‘21E CAGR: 1.4% 2019E 2020E 2021E Total distributable $379 $410 $403 $418 $421 $456‘19E-‘21E CAGR: 5.4% cash flow (“DCF”) ($mm)‘19E-‘21E CAGR: 5.5% 2019E 2020E 2021E $3.65 $3.81 $3.78 $3.85 $3.87 $4.06 LP DCF‘19E-‘21E CAGR: 3.0% ($ / unit)‘19E-‘21E CAGR: 3.2% 2019E 2020E 2021E $39 $55 $52 $59 $60 $79‘19E-‘21E CAGR: 23.8% GP DCF ($mm)‘19E-‘21E CAGR: 19.1% 2019E 2020E 2021E $3.16 $3.21 $3.32 $3.01 $3.44 $3.58 LP DPU‘19E-‘21E CAGR: 4.4% ($ / unit)‘19E-‘21E CAGR: 5.6% 2019E 2020E 2021E GP distributions $22 $24 $27 $18 $31 $32‘19E-‘21E CAGR: 18.1% ($mm)‘19E-‘21E CAGR: 15.5% 2019E 2020E 2021E 1.40x 1.20x 1.27x 1.20x 1.20x 1.24x Total distribution coverage 2019E 2020E 2021E 2 Source: FactSet as of 03/29/19; APU management projections as provided and approved by UGI management; Note: Projections based on 09/30 fiscal year end 1 Broker research included for reference only J.P.Morgan

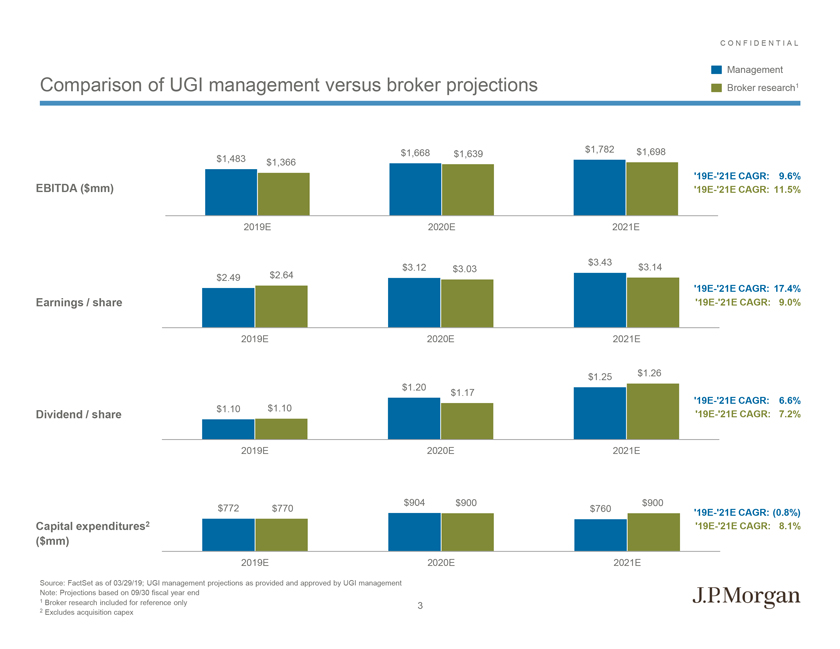

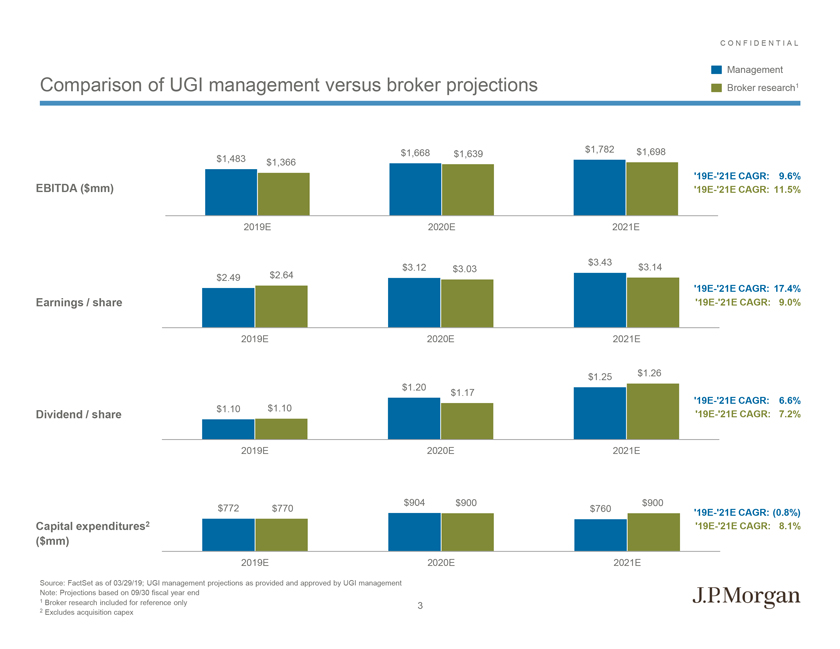

CONFIDENTIAL Comparison of UGI management versus broker projections Management Broker research1 $1,668 $1,782 $1,698 $1,639 $1,483 $1,366‘19E-‘21E CAGR: 9.6% EBITDA ($mm)‘19E-‘21E CAGR: 11.5% 2019E 2020E 2021E $3.43 $2.64 $3.12 $3.03 $3.14 $2.49‘19E-‘21E CAGR: 17.4% Earnings / share‘19E-‘21E CAGR: 9.0% 2019E 2020E 2021E $1.25 $1.26 $1.20 $1.17‘19E-‘21E CAGR: 6.6% $1.10 $1.10 Dividend / share‘19E-‘21E CAGR: 7.2% 2019E 2020E 2021E $904 $900 $900 $772 $770 $760‘19E-‘21E CAGR: (0.8%) Capital expenditures2‘19E-‘21E CAGR: 8.1% ($mm) 2019E 2020E 2021E Source: FactSet as of 03/29/19; UGI management projections as provided and approved by UGI management Note: Projections based on 09/30 fiscal year end 1 Broker research included for reference only 3 2 Excludes acquisition capex J.P.Morgan

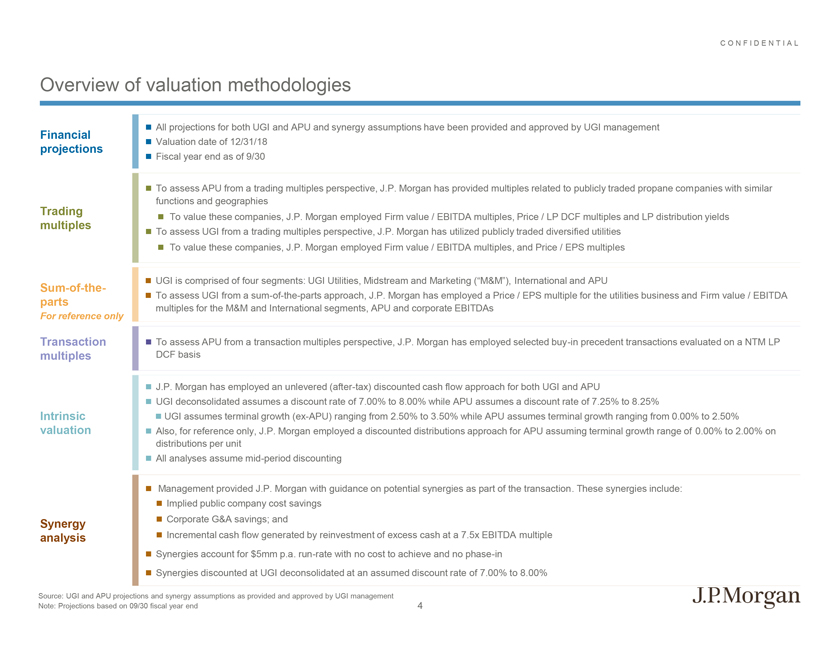

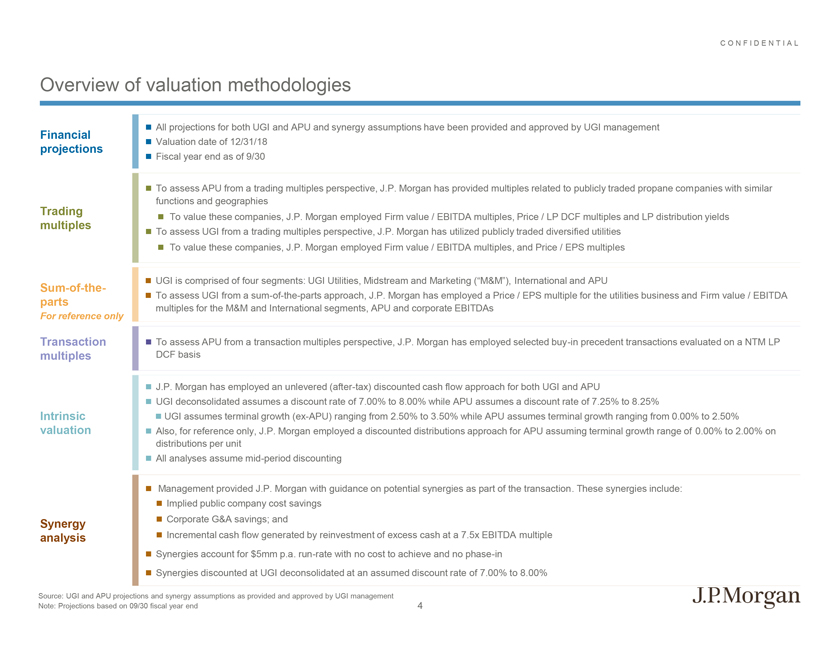

CONFIDENTIAL Overview of valuation methodologies All projections for both UGI and APU and synergy assumptions have been provided and approved by UGI management Financial Valuation date of 12/31/18 projections Fiscal year end as of 9/30 To assess APU from a trading multiples perspective, J.P. Morgan has provided multiples related to publicly traded propane companies with similar functions and geographies Trading To value these companies, J.P. Morgan employed Firm value / EBITDA multiples, Price / LP DCF multiples and LP distribution yields multiples To assess UGI from a trading multiples perspective, J.P. Morgan has utilized publicly traded diversified utilities To value these companies, J.P. Morgan employed Firm value / EBITDA multiples, and Price / EPS multiples UGI is comprised of four segments: UGI Utilities, Midstream and Marketing (“M&M”), International and APUSum-of-the- parts To assess UGI from asum-of-the-parts approach, J.P. Morgan has employed a Price / EPS multiple for the utilities business and Firm value / EBITDA multiples for the M&M and International segments, APU and corporate EBITDAs For reference only Transaction To assess APU from a transaction multiples perspective, J.P. Morgan has employed selectedbuy-in precedent transactions evaluated on a NTM LP multiples DCF basis J.P. Morgan has employed an unlevered(after-tax) discounted cash flow approach for both UGI and APU UGI deconsolidated assumes a discount rate of 7.00% to 8.00% while APU assumes a discount rate of 7.25% to 8.25% Intrinsic UGI assumes terminal growth(ex-APU) ranging from 2.50% to 3.50% while APU assumes terminal growth ranging from 0.00% to 2.50% valuation Also, for reference only, J.P. Morgan employed a discounted distributions approach for APU assuming terminal growth range of 0.00% to 2.00% on distributions per unit All analyses assumemid-period discounting Management provided J.P. Morgan with guidance on potential synergies as part of the transaction. These synergies include: Implied public company cost savings Synergy Corporate G&A savings; and analysis Incremental cash flow generated by reinvestment of excess cash at a 7.5x EBITDA multiple Synergies account for $5mm p.a.run-rate with no cost to achieve and nophase-in Synergies discounted at UGI deconsolidated at an assumed discount rate of 7.00% to 8.00% Source: UGI and APU projections and synergy assumptions as provided and approved by UGI management Note: Projections based on 09/30 fiscal year end 4 J.P.Morgan

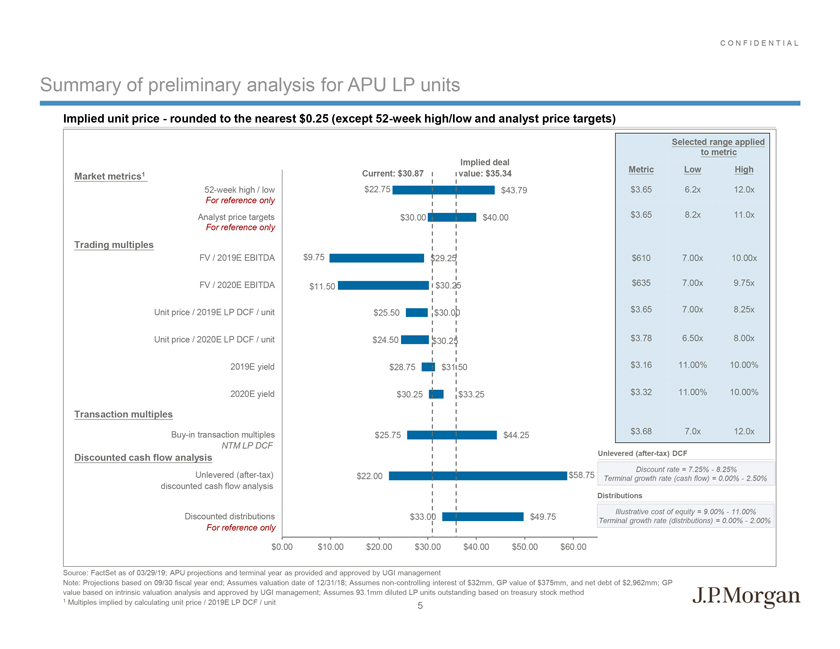

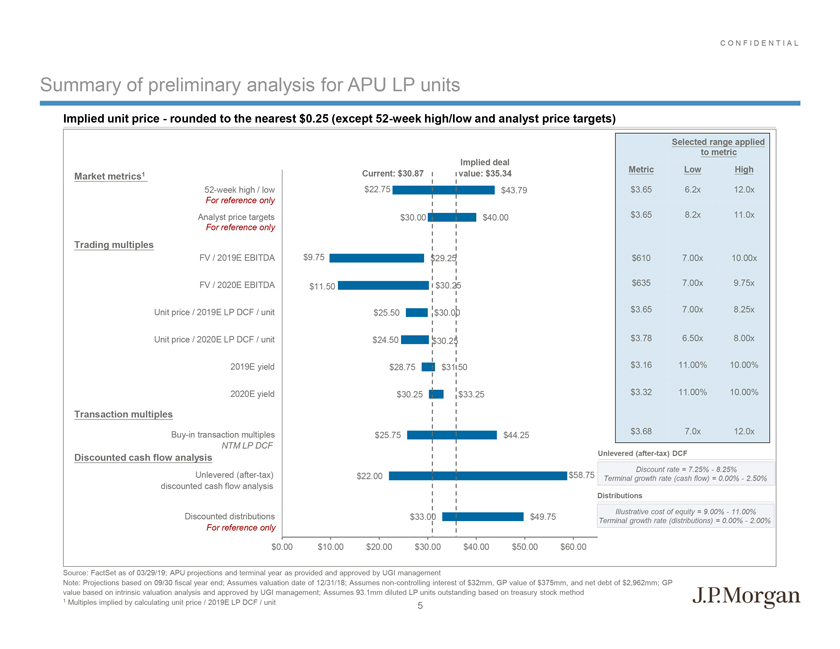

CONFIDENTIAL Summary of preliminary analysis for APU LP units Implied unit price—rounded to the nearest $0.25 (except52-week high/low and analyst price targets) Selected range applied to metric Implied deal Metric Low High Market metrics1 Current: $30.87 value: $35.3452-week high / low $22.75 $43.79 $3.65 6.2x 12.0x For reference only Analyst price targets $30.00 $40.00 $3.65 8.2x 11.0x For reference only Trading multiples FV / 2019E EBITDA $9.75 $29.25 $610 7.00x 10.00x FV / 2020E EBITDA $11.50 $30.25 $635 7.00x 9.75x Unit price / 2019E LP DCF / unit $25.50 $30.00 $3.65 7.00x 8.25x Unit price / 2020E LP DCF / unit $24.50 $30.25 $3.78 6.50x 8.00x 2019E yield $28.75 $31.50 $3.16 11.00% 10.00% 2020E yield $30.25 $33.25 $3.32 11.00% 10.00% Transaction multiplesBuy-in transaction multiples $25.75 $44.25 $3.68 7.0x 12.0x NTM LP DCF Discounted cash flow analysis Unlevered(after-tax) DCF Discount rate = 7.25%—8.25% Unlevered(after-tax) $22.00 $58.75 Terminal growth rate (cash flow) = 0.00%—2.50% discounted cash flow analysis Distributions Illustrative cost of equity = 9.00%—11.00% Discounted distributions $33.00 $49.75 Terminal growth rate (distributions) = 0.00%—2.00% For reference only $0.00 $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 Source: FactSet as of 03/29/19; APU projections and terminal year as provided and approved by UGI management Note: Projections based on 09/30 fiscal year end; Assumes valuation date of 12/31/18; Assumesnon-controlling interest of $32mm, GP value of $375mm, and net debt of $2,962mm; GP value based on intrinsic valuation analysis and approved by UGI management; Assumes 93.1mm diluted LP units outstanding based on treasury stock method 1 Multiples implied by calculating unit price / 2019E LP DCF / unit 5 J.P.Morgan

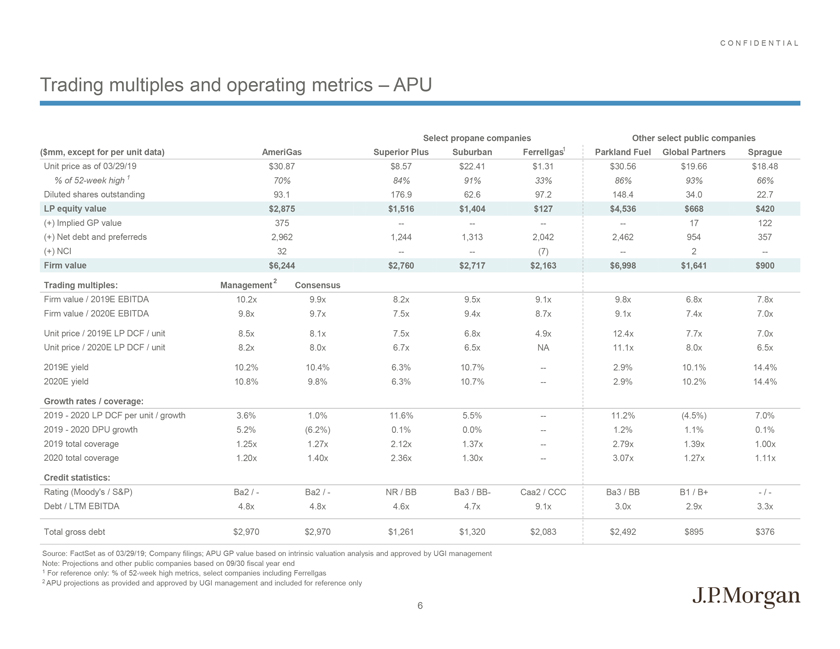

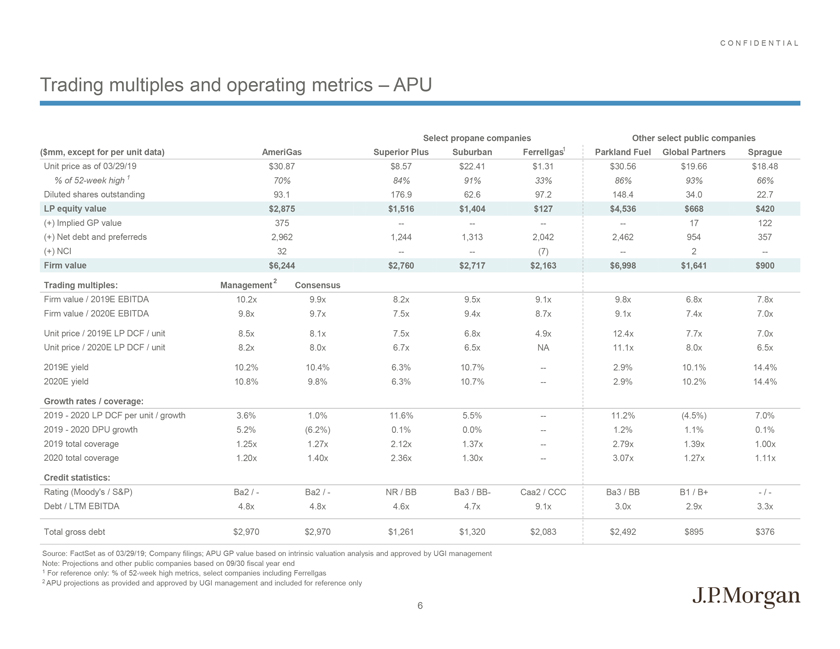

CONFIDENTIAL Trading multiples and operating metrics – APU Select propane companies Other select public companies ($mm, except for per unit data) AmeriGas Superior Plus Suburban Ferrellgas1 Parkland Fuel Global Partners Sprague Unit price as of 03/29/19 $30.87 $8.57 $22.41 $1.31 $30.56 $19.66 $18.48 % of52-week high 1 70% 84% 91% 33% 86% 93% 66% Diluted shares outstanding 93.1 176.9 62.6 97.2 148.4 34.0 22.7 LP equity value $2,875 $1,516 $1,404 $127 $4,536 $668 $420 (+) Implied GP value 375 -———- 17 122 (+) Net debt and preferreds 2,962 1,244 1,313 2,042 2,462 954 357 (+) NCI 32 -—- (7) — 2 — Firm value $6,244 $2,760 $2,717 $2,163 $6,998 $1,641 $900 Trading multiples: Management 2 Consensus Firm value / 2019E EBITDA 10.2x 9.9x 8.2x 9.5x 9.1x 9.8x 6.8x 7.8x Firm value / 2020E EBITDA 9.8x 9.7x 7.5x 9.4x 8.7x 9.1x 7.4x 7.0x Unit price / 2019E LP DCF / unit 8.5x 8.1x 7.5x 6.8x 4.9x 12.4x 7.7x 7.0x Unit price / 2020E LP DCF / unit 8.2x 8.0x 6.7x 6.5x NA 11.1x 8.0x 6.5x 2019E yield 10.2% 10.4% 6.3% 10.7% — 2.9% 10.1% 14.4% 2020E yield 10.8% 9.8% 6.3% 10.7% — 2.9% 10.2% 14.4% Growth rates / coverage: 2019—2020 LP DCF per unit / growth 3.6% 1.0% 11.6% 5.5% — 11.2% (4.5%) 7.0% 2019—2020 DPU growth 5.2% (6.2%) 0.1% 0.0% — 1.2% 1.1% 0.1% 2019 total coverage 1.25x 1.27x 2.12x 1.37x — 2.79x 1.39x 1.00x 2020 total coverage 1.20x 1.40x 2.36x 1.30x — 3.07x 1.27x 1.11x Credit statistics: Rating (Moody’s / S&P) Ba2 /—Ba2 /—NR / BB Ba3 /BB- Caa2 / CCC Ba3 / BB B1 / B+—/—Debt / LTM EBITDA 4.8x 4.8x 4.6x 4.7x 9.1x 3.0x 2.9x 3.3x Total gross debt $2,970 $2,970 $1,261 $1,320 $2,083 $2,492 $895 $376 Source: FactSet as of 03/29/19; Company filings; APU GP value based on intrinsic valuation analysis and approved by UGI management Note: Projections and other public companies based on 09/30 fiscal year end 1 For reference only: % of52-week high metrics, select companies including Ferrellgas 2 APU projections as provided and approved by UGI management and included for reference only 6 J.P.Morgan

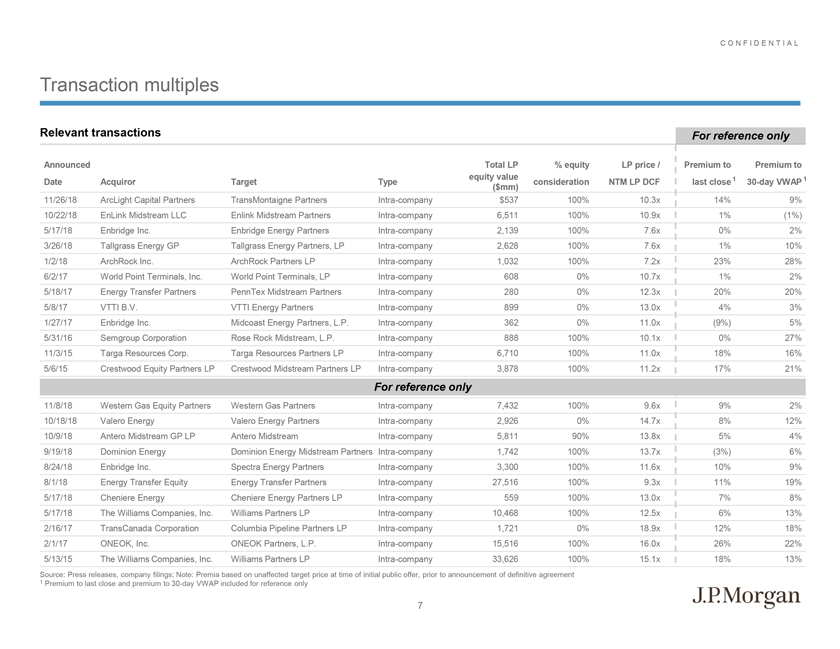

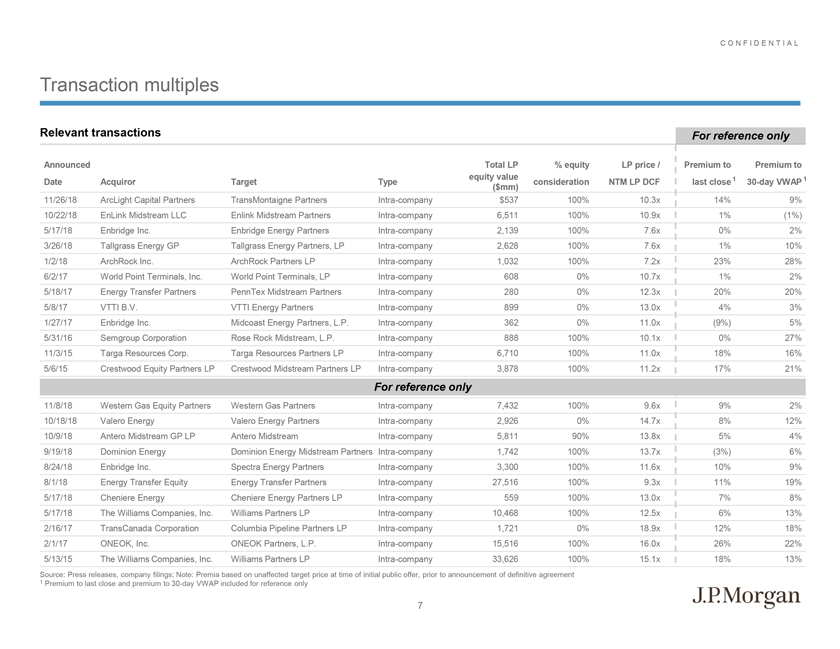

CONFIDENTIAL Transaction multiples Relevant transactions Announced Total LP % equity LP price / Premium to Premium to equity value 1 1 Date Acquiror Target Type consideration NTM LP DCF last close30-day VWAP ($mm) 11/26/18 ArcLight Capital Partners TransMontaigne Partners Intra-company $537 100% 10.3x 14% 9% 10/22/18 EnLink Midstream LLC Enlink Midstream Partners Intra-company 6,511 100% 10.9x 1% (1%) 5/17/18 Enbridge Inc. Enbridge Energy Partners Intra-company 2,139 100% 7.6x 0% 2% 3/26/18 Tallgrass Energy GP Tallgrass Energy Partners, LP Intra-company 2,628 100% 7.6x 1% 10% 1/2/18 ArchRock Inc. ArchRock Partners LP Intra-company 1,032 100% 7.2x 23% 28% 6/2/17 World Point Terminals, Inc. World Point Terminals, LP Intra-company 608 0% 10.7x 1% 2% 5/18/17 Energy Transfer Partners PennTex Midstream Partners Intra-company 280 0% 12.3x 20% 20% 5/8/17 VTTI B.V. VTTI Energy Partners Intra-company 899 0% 13.0x 4% 3% 1/27/17 Enbridge Inc. Midcoast Energy Partners, L.P. Intra-company 362 0% 11.0x (9%) 5% 5/31/16 Semgroup Corporation Rose Rock Midstream, L.P. Intra-company 888 100% 10.1x 0% 27% 11/3/15 Targa Resources Corp. Targa Resources Partners LP Intra-company 6,710 100% 11.0x 18% 16% 5/6/15 Crestwood Equity Partners LP Crestwood Midstream Partners LP Intra-company 3,878 100% 11.2x 17% 21% For reference only 11/8/18 Western Gas Equity Partners Western Gas Partners Intra-company 7,432 100% 9.6x 9% 2% 10/18/18 Valero Energy Valero Energy Partners Intra-company 2,926 0% 14.7x 8% 12% 10/9/18 Antero Midstream GP LP Antero Midstream Intra-company 5,811 90% 13.8x 5% 4% 9/19/18 Dominion Energy Dominion Energy Midstream Partners Intra-company 1,742 100% 13.7x (3%) 6% 8/24/18 Enbridge Inc. Spectra Energy Partners Intra-company 3,300 100% 11.6x 10% 9% 8/1/18 Energy Transfer Equity Energy Transfer Partners Intra-company 27,516 100% 9.3x 11% 19% 5/17/18 Cheniere Energy Cheniere Energy Partners LP Intra-company 559 100% 13.0x 7% 8% 5/17/18 The Williams Companies, Inc. Williams Partners LP Intra-company 10,468 100% 12.5x 6% 13% 2/16/17 TransCanada Corporation Columbia Pipeline Partners LP Intra-company 1,721 0% 18.9x 12% 18% 2/1/17 ONEOK, Inc. ONEOK Partners, L.P. Intra-company 15,516 100% 16.0x 26% 22% 5/13/15 The Williams Companies, Inc. Williams Partners LP Intra-company 33,626 100% 15.1x 18% 13% Source: Press releases, company filings; Note: Premia based on unaffected target price at time of initial public offer, prior to announcement of definitive agreement 1 Premium to last close and premium to30-day VWAP included for reference only 7 J.P.Morgan

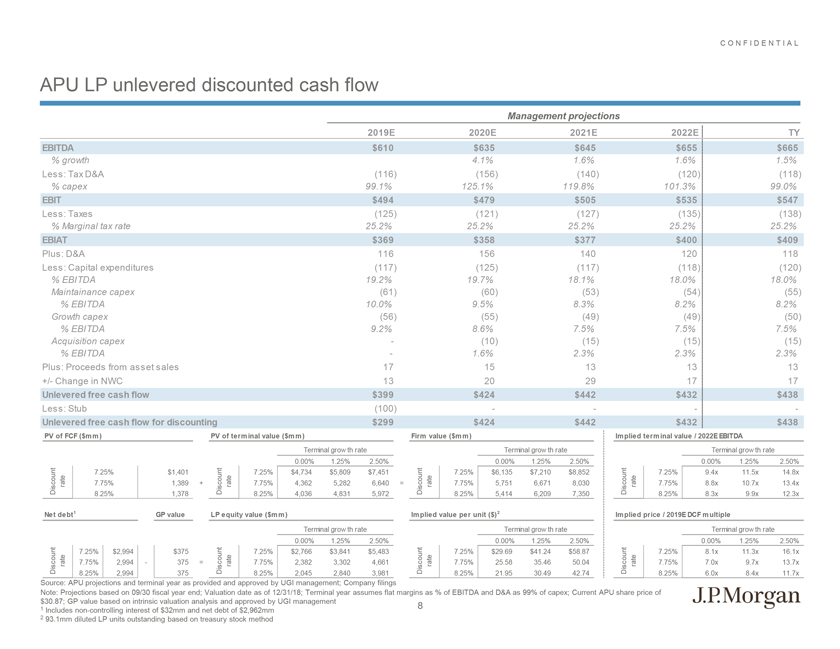

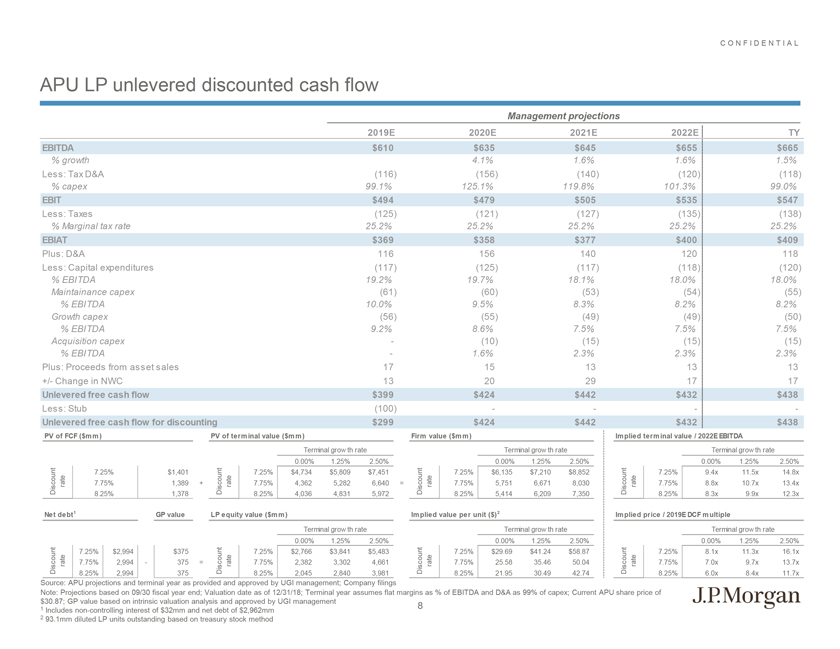

CONFIDENTIAL APU LP unlevered discounted cash flow Management projections 2019E 2020E 2021E 2022E TY EBITDA $610 $635 $645 $655 $665 % growth 4.1% 1.6% 1.6% 1.5% Less: Tax D&A (116) (156) (140) (120) (118) % capex 99.1% 125.1% 119.8% 101.3% 99.0% EBIT $494 $479 $505 $535 $547 Less: Taxes (125) (121) (127) (135) (138) % Marginal tax rate 25.2% 25.2% 25.2% 25.2% 25.2% EBIAT $369 $358 $377 $400 $409 Plus: D&A 116 156 140 120 118 Less: Capital expenditures (117) (125) (117) (118) (120) % EBITDA 19.2% 19.7% 18.1% 18.0% 18.0% Maintainance capex (61) (60) (53) (54) (55) % EBITDA 10.0% 9.5% 8.3% 8.2% 8.2% Growth capex (56) (55) (49) (49) (50) % EBITDA 9.2% 8.6% 7.5% 7.5% 7.5% Acquisition capex—(10) (15) (15) (15) % EBITDA—1.6% 2.3% 2.3% 2.3% Plus: Proceeds from asset sales 17 15 13 13 13 +/- Change in NWC 13 20 29 17 17 Unlevered free cash flow $399 $424 $442 $432 $438 Less: Stub (100) — — Unlevered free cash flow for discounting $299 $424 $442 $432 $438 PV of FCF ($mm) PV of terminal value ($mm) Firm value ($mm) Implied terminal value / 2022E EBITDA Terminal growth rate Terminal growth rate Terminal growth rate 0.00% 1.25% 2.50% 0.00% 1.25% 2.50% 0.00% 1.25% 2.50% 7.25% $1,401 7.25% $4,734 $5,809 $7,451 7.25% $6,135 $7,210 $8,852 7.25% 9.4x 11.5x 14.8x Discount rate 7.75% 1,389 + Discount rate 7.75% 4,362 5,282 6,640 = Discount rate 7.75% 5,751 6,671 8,030 Discount rate 7.75% 8.8x 10.7x 13.4x 8.25% 1,378 8.25% 4,036 4,831 5,972 8.25% 5,414 6,209 7,350 8.25% 8.3x 9.9x 12.3x Net debt1 GP value LP equity value ($mm) Implied value per unit ($)2 Implied price / 2019E DCF multiple Terminal growth rate Terminal growth rate Terminal growth rate 0.00% 1.25% 2.50% 0.00% 1.25% 2.50% 0.00% 1.25% 2.50% 7.25% $2,994 $375 7.25% $2,766 $3,841 $5,483 7.25% $29.69 $41.24 $58.87 7.25% 8.1x 11.3x 16.1x Discount ate r 7.75% 2,994—375 = Discount ate r 7.75% 2,382 3,302 4,661 Discount r ate 7.75% 25.58 35.46 50.04 Discount r ate 7.75% 7.0x 9.7x 13.7x 8.25% 2,994 375 8.25% 2,045 2,840 3,981 8.25% 21.95 30.49 42.74 8.25% 6.0x 8.4x 11.7x Source: APU projections and terminal year as provided and approved by UGI management; Company filings Note: Projections based on 09/30 fiscal year end; Valuation date as of 12/31/18; Terminal year assumes flat margins as % of EBITDA and D&A as 99% of capex; Current APU share price of $30.87; GP value based on intrinsic valuation analysis and approved by UGI management 8 1 Includesnon-controlling interest of $32mm and net debt of $2,962mm 2 93.1mm diluted LP units outstanding based on treasury stock method J.P.Morgan

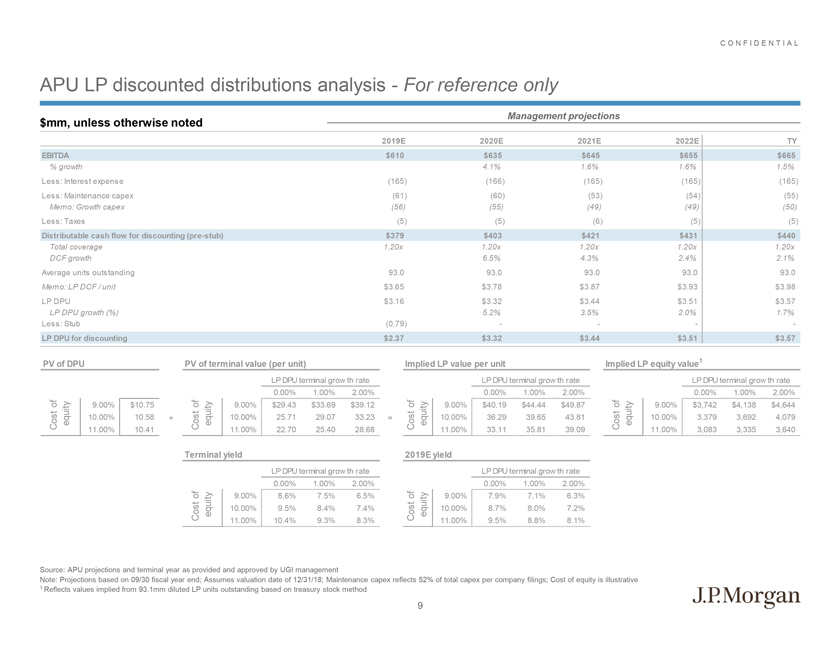

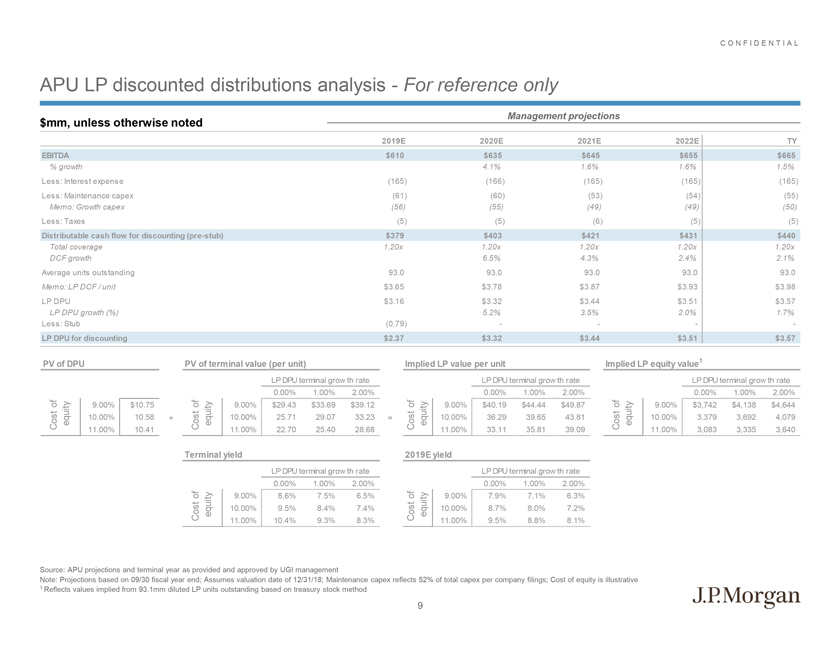

CONFIDENTIAL APU LP discounted distributions analysis—For reference only Management projections $mm, unless otherwise noted 2019E 2020E 2021E 2022E TY EBITDA $610 $635 $645 $655 $665 % growth 4.1% 1.6% 1.6% 1.5% Less: Interest expense (165) (166) (165) (165) (165) Less: Maintenance capex (61) (60) (53) (54) (55) Memo: Growth capex (56) (55) (49) (49) (50) Less: Taxes (5) (5) (6) (5) (5) Distributable cash flow for discounting(pre-stub) $379 $403 $421 $431 $440 Total coverage 1.20x 1.20x 1.20x 1.20x 1.20x DCF growth 6.5% 4.3% 2.4% 2.1% Average units outstanding 93.0 93.0 93.0 93.0 93.0 Memo: LP DCF / unit $3.65 $3.78 $3.87 $3.93 $3.98 LP DPU $3.16 $3.32 $3.44 $3.51 $3.57 LP DPU growth (%) 5.2% 3.5% 2.0% 1.7% Less: Stub (0.79) — — LP DPU for discounting $2.37 $3.32 $3.44 $3.51 $3.57 PV of DPU PV of terminal value (per unit) Implied LP value per unit Implied LP equity value1 LP DPU terminal growth rate LP DPU terminal growth rate LP DPU terminal growth rate 0.00% 1.00% 2.00% 0.00% 1.00% 2.00% 0.00% 1.00% 2.00% Cost of equity 9.00% $10.75 9.00% $29.43 $33.69 $39.12 Cost of equity 9.00% $40.19 $44.44 $49.87 Cost of equity 9.00% $3,742 $4,138 $4,644 Cost of equity 10.00% 10.58 + 10.00% 25.71 29.07 33.23 = 10.00% 36.29 39.65 43.81 10.00% 3,379 3,692 4,079 11.00% 10.41 11.00% 22.70 25.40 28.68 11.00% 33.11 35.81 39.09 11.00% 3,083 3,335 3,640 Terminal yield 2019E yield LP DPU terminal growth rate LP DPU terminal growth rate 0.00% 1.00% 2.00% 0.00% 1.00% 2.00% Cost of equity 9.00% 8.6% 7.5% 6.5% Cost of equity 9.00% 7.9% 7.1% 6.3% 10.00% 9.5% 8.4% 7.4% 10.00% 8.7% 8.0% 7.2% 11.00% 10.4% 9.3% 8.3% 11.00% 9.5% 8.8% 8.1% Source: APU projections and terminal year as provided and approved by UGI management Note: Projections based on 09/30 fiscal year end; Assumes valuation date of 12/31/18; Maintenance capex reflects 52% of total capex per company filings; Cost of equity is illustrative 1 Reflects values implied from 93.1mm diluted LP units outstanding based on treasury stock method 9 J.P.Morgan

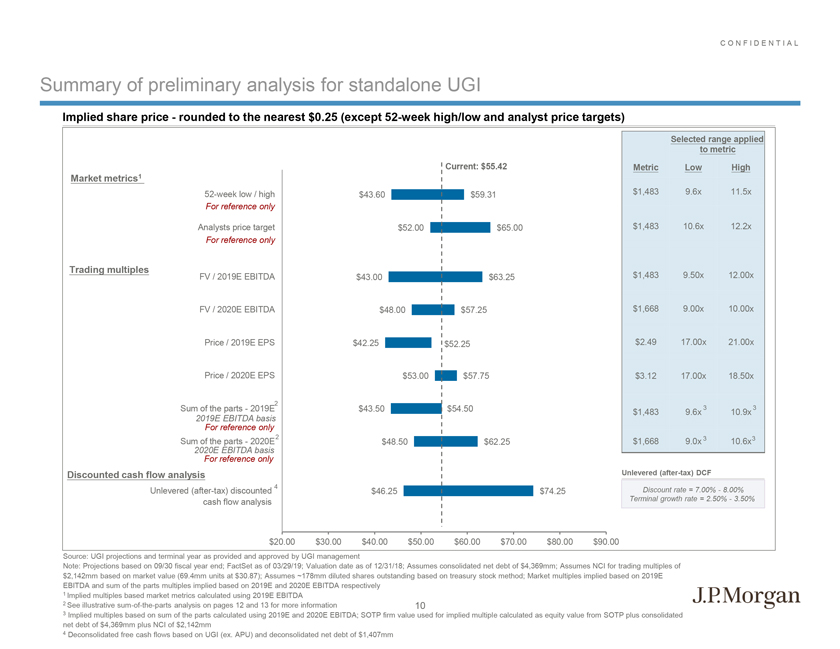

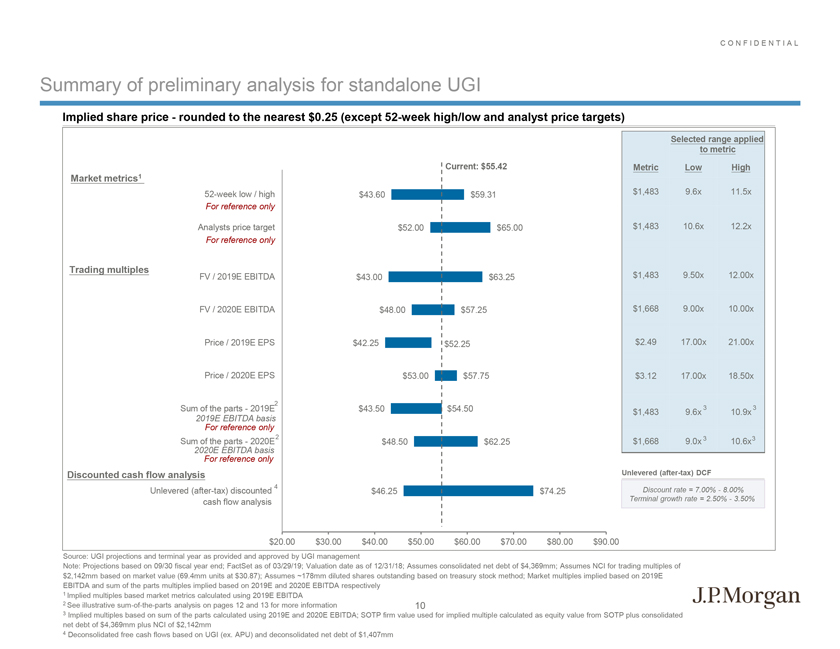

CONFIDENTIAL Summary of preliminary analysis for standalone UGI Implied share price—rounded to the nearest $0.25 (except52-week high/low and analyst price targets) Selected range applied to metric Current: $55.42 Metric Low High Market metrics152-week low / high $43.60 $59.31 $1,483 9.6x 11.5x For reference only Analysts price target $52.00 $65.00 $1,483 10.6x 12.2x For reference only Trading multiples FV / 2019E EBITDA $43.00 $63.25 $1,483 9.50x 12.00x FV / 2020E EBITDA $48.00 $57.25 $1,668 9.00x 10.00x Price / 2019E EPS $42.25 $52.25 $2.49 17.00x 21.00x Price / 2020E EPS $53.00 $57.75 $3.12 17.00x 18.50x 2 Sum of the parts—2019E $43.50 $54.50 3 3 $1,483 9.6x 10.9x 2019E EBITDA basis For reference only 2 3 3 Sum of the parts—2020E $48.50 $62.25 $1,668 9.0x 10.6x 2020E EBITDA basis For reference only Discounted cash flow analysis Unlevered(after-tax) DCF 4 Discount rate = 7.00%—8.00% Unlevered(after-tax) discounted $46.25 $74.25 cash flow analysis Terminal growth rate = 2.50%—3.50% $20.00 $30.00 $40.00 $50.00 $60.00 $70.00 $80.00 $90.00 Source: UGI projections and terminal year as provided and approved by UGI management Note: Projections based on 09/30 fiscal year end; FactSet as of 03/29/19; Valuation date as of 12/31/18; Assumes consolidated net debt of $4,369mm; Assumes NCI for trading multiples of $2,142mm based on market value (69.4mm units at $30.87); Assumes ~178mm diluted shares outstanding based on treasury stock method; Market multiples implied based on 2019E EBITDA and sum of the parts multiples implied based on 2019E and 2020E EBITDA respectively 1 Implied multiples based market metrics calculated using 2019E EBITDA 2 See illustrativesum-of-the-parts analysis on pages 12 and 13 for more information 10 3 Implied multiples based on sum of the parts calculated using 2019E and 2020E EBITDA; SOTP firm value used for implied multiple calculated as equity value from SOTP plus consolidated net debt of $4,369mm plus NCI of $2,142mm 4 Deconsolidated free cash flows based on UGI (ex. APU) and deconsolidated net debt of $1,407mm J.P.Morgan

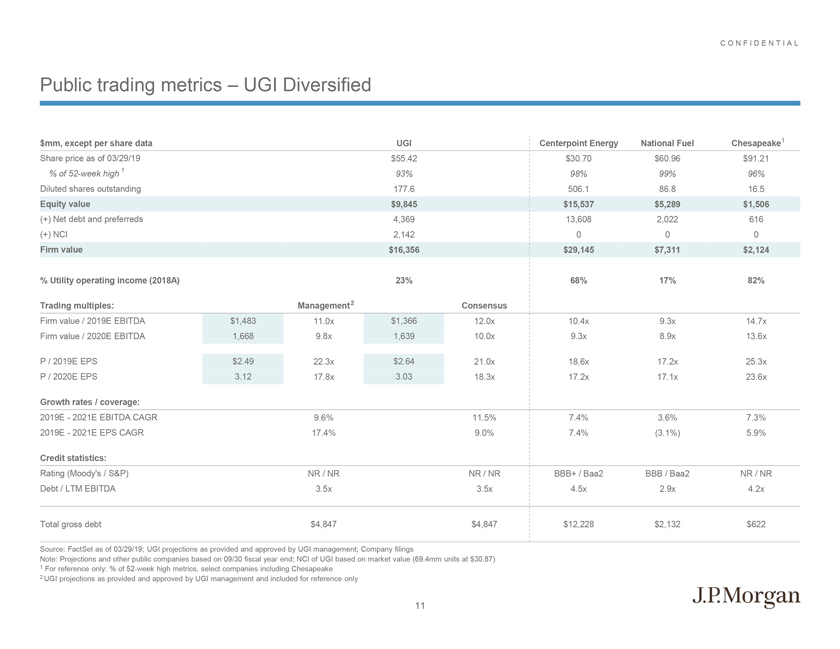

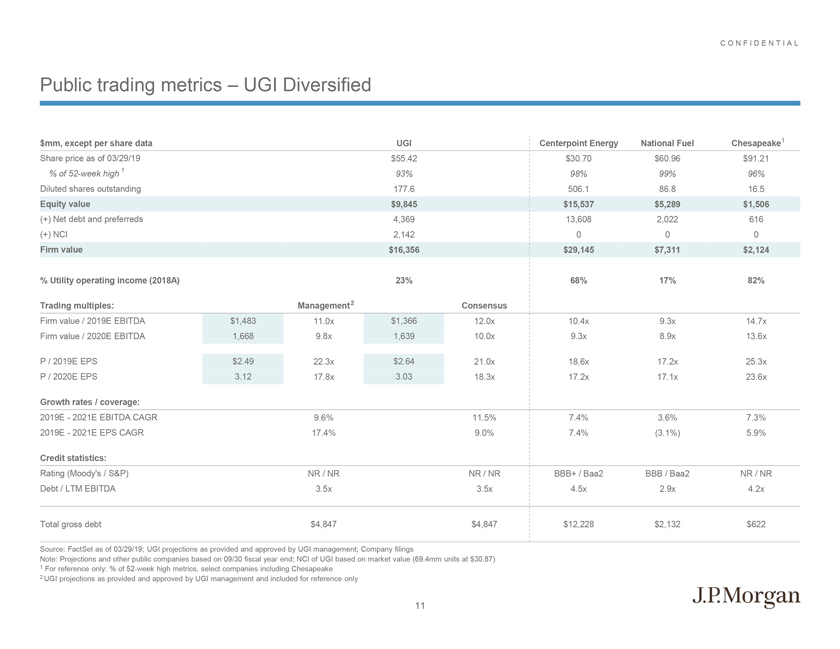

CONFIDENTIAL Public trading metrics – UGI Diversified $mm, except per share data UGI Centerpoint Energy National Fuel Chesapeake 1 Share price as of 03/29/19 $55.42 $30.70 $60.96 $91.21 % of52-week high 1 93% 98% 99% 96% Diluted shares outstanding 177.6 506.1 86.8 16.5 Equity value $9,845 $15,537 $5,289 $1,506 (+) Net debt and preferreds 4,369 13,608 2,022 616 (+) NCI 2,142 0 0 0 Firm value $16,356 $29,145 $7,311 $2,124 % Utility operating income (2018A) 23% 68% 17% 82% Trading multiples: Management 2 Consensus Firm value / 2019E EBITDA $1,483 11.0x $1,366 12.0x 10.4x 9.3x 14.7x Firm value / 2020E EBITDA 1,668 9.8x 1,639 10.0x 9.3x 8.9x 13.6x P / 2019E EPS $2.49 22.3x $2.64 21.0x 18.6x 17.2x 25.3x P / 2020E EPS 3.12 17.8x 3.03 18.3x 17.2x 17.1x 23.6x Growth rates / coverage: 2019E—2021E EBITDA CAGR 9.6% 11.5% 7.4% 3.6% 7.3% 2019E—2021E EPS CAGR 17.4% 9.0% 7.4% (3.1%) 5.9% Credit statistics: Rating (Moody’s / S&P) NR / NR NR / NR BBB+ / Baa2 BBB / Baa2 NR / NR Debt / LTM EBITDA 3.5x 3.5x 4.5x 2.9x 4.2x Total gross debt $4,847 $4,847 $12,228 $2,132 $622 Source: FactSet as of 03/29/19; UGI projections as provided and approved by UGI management; Company filings Note: Projections and other public companies based on 09/30 fiscal year end; NCI of UGI based on market value (69.4mm units at $30.87) 1 For reference only: % of52-week high metrics, select companies including Chesapeake 2 UGI projections as provided and approved by UGI management and included for reference only 11 J.P.Morgan

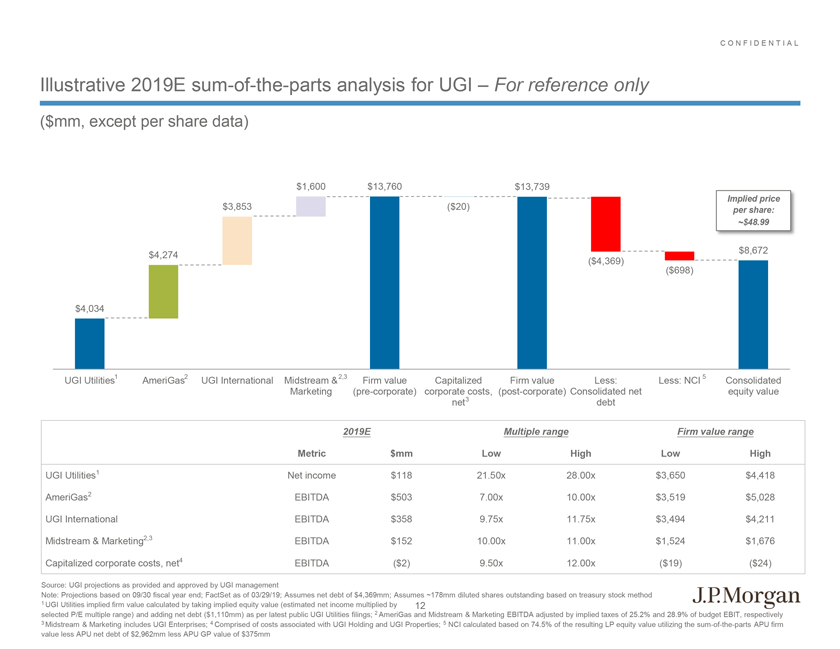

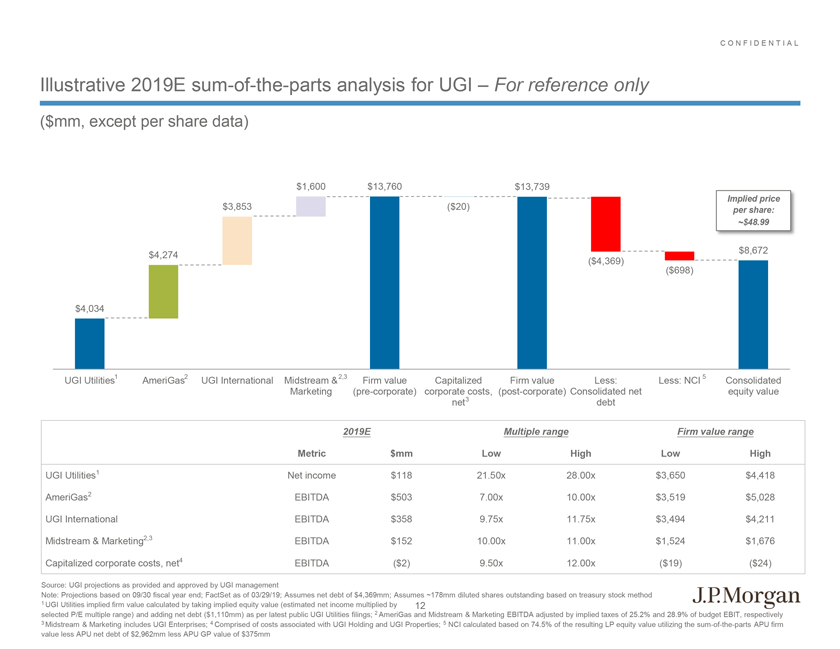

CONFIDENTIAL Illustrative 2019Esum-of-the-parts analysis for UGI – For reference only ($mm, except per share data) 2019E Multiple range Firm value range Metric $mm Low High Low High UGI Utilities1 Net income $118 21.50x 28.00x $3,650 $4,418 AmeriGas2 EBITDA $503 7.00x 10.00x $3,519 $5,028 UGI International EBITDA $358 9.75x 11.75x $3,494 $4,211 Midstream & Marketing2,3 EBITDA $152 10.00x 11.00x $1,524 $1,676 Capitalized corporate costs, net4 EBITDA ($2) 9.50x 12.00x ($19) ($24) Source: UGI projections as provided and approved by UGI management Note: Projections based on 09/30 fiscal year end; FactSet as of 03/29/19; Assumes net debt of $4,369mm; Assumes ~178mm diluted shares outstanding based on treasury stock method 1 UGI Utilities implied firm value calculated by taking implied equity value (estimated net income multiplied by 12 selected P/E multiple range) and adding net debt ($1,110mm) as per latest public UGI Utilities filings; 2 AmeriGas and Midstream & Marketing EBITDA adjusted by implied taxes of 25.2% and 28.9% of budget EBIT, respectively 3 Midstream & Marketing includes UGI Enterprises; 4 Comprised of costs associated with UGI Holding and UGI Properties; 5 NCI calculated based on 74.5% of the resulting LP equity value utilizing thesum-of-the-parts APU firm value less APU net debt of $2,962mm less APU GP value of $375mm J.P.Morgan

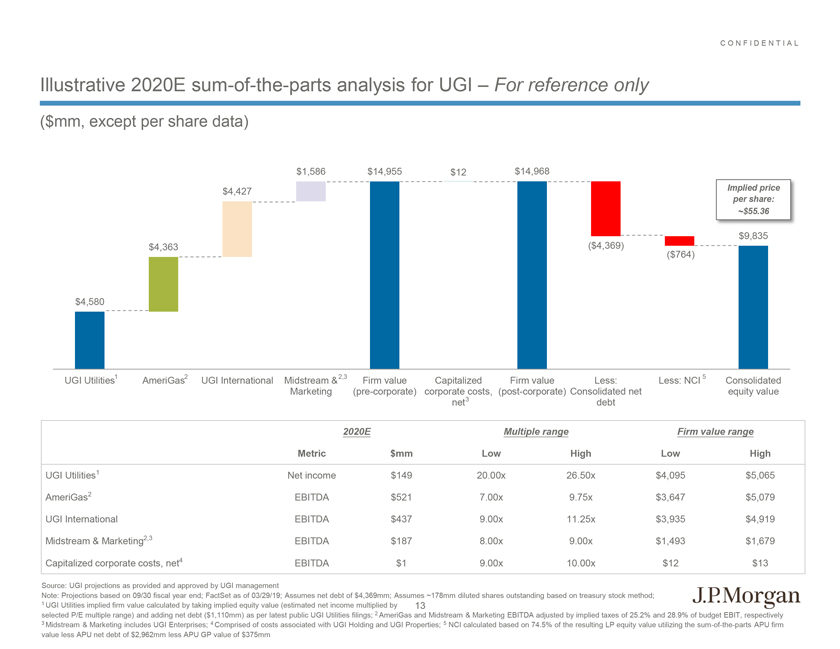

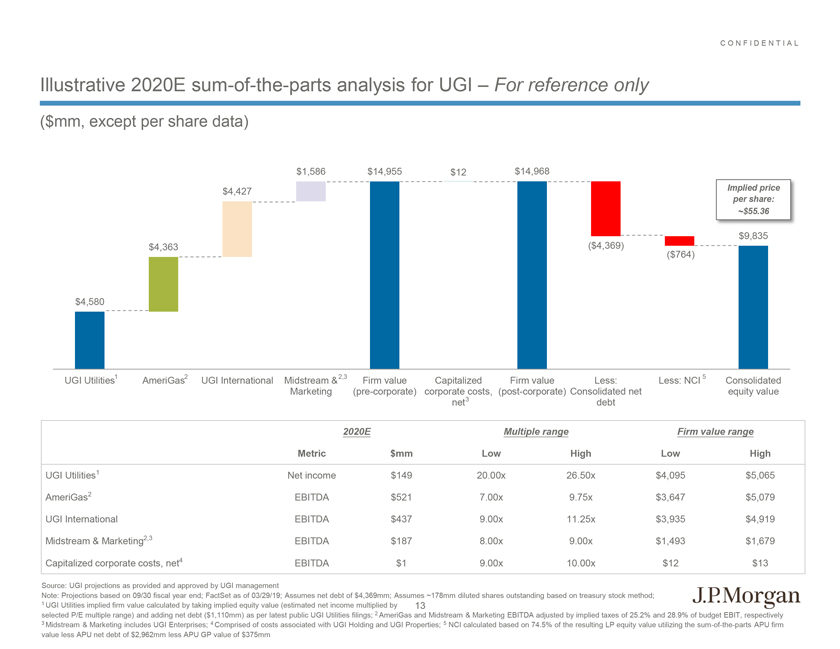

CONFIDENTIAL Illustrative 2020Esum-of-the-parts analysis for UGI – For reference only ($mm, except per share data) 2020E Multiple range Firm value range Metric $mm Low High Low High UGI Utilities1 Net income $149 20.00x 26.50x $4,095 $5,065 AmeriGas2 EBITDA $521 7.00x 9.75x $3,647 $5,079 UGI International EBITDA $437 9.00x 11.25x $3,935 $4,919 Midstream & Marketing2,3 EBITDA $187 8.00x 9.00x $1,493 $1,679 Capitalized corporate costs, net4 EBITDA $1 9.00x 10.00x $12 $13 Source: UGI projections as provided and approved by UGI management Note: Projections based on 09/30 fiscal year end; FactSet as of 03/29/19; Assumes net debt of $4,369mm; Assumes ~178mm diluted shares outstanding based on treasury stock method; 1 UGI Utilities implied firm value calculated by taking implied equity value (estimated net income multiplied by 13 selected P/E multiple range) and adding net debt ($1,110mm) as per latest public UGI Utilities filings; 2 AmeriGas and Midstream & Marketing EBITDA adjusted by implied taxes of 25.2% and 28.9% of budget EBIT, respectively 3 Midstream & Marketing includes UGI Enterprises; 4 Comprised of costs associated with UGI Holding and UGI Properties; 5 NCI calculated based on 74.5% of the resulting LP equity value utilizing thesum-of-the-parts APU firm value less APU net debt of $2,962mm less APU GP value of $375mm J.P.Morgan

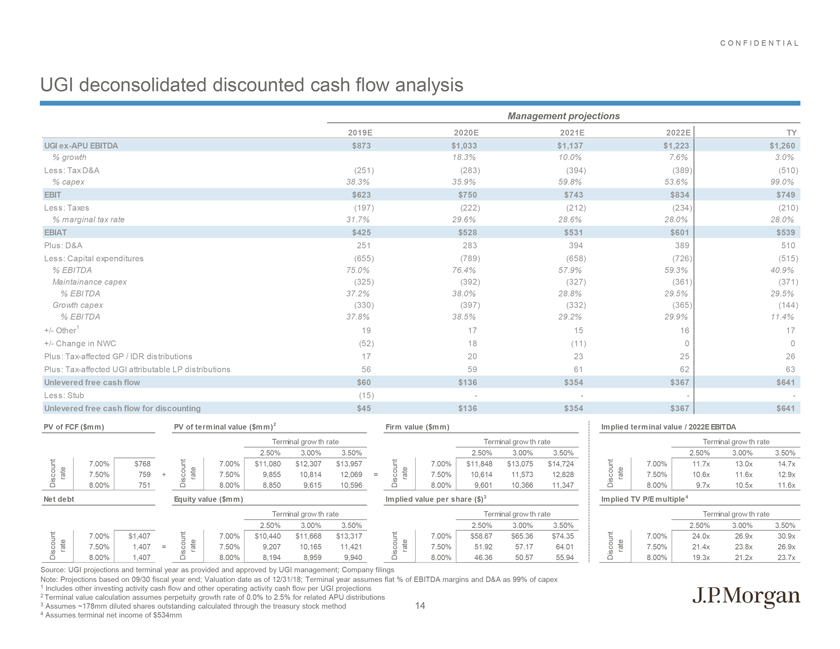

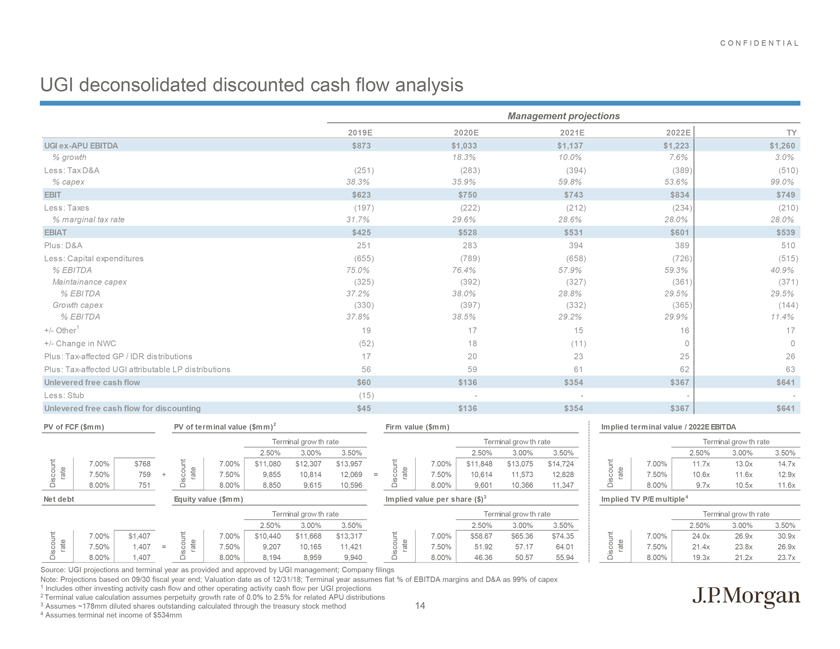

CONFIDENTIAL UGI deconsolidated discounted cash flow analysis Management projections 2019E 2020E 2021E 2022E TY UGIex-APU EBITDA $873 $1,033 $1,137 $1,223 $1,260 % growth 18.3% 10.0% 7.6% 3.0% Less: Tax D&A (251) (283) (394) (389) (510) % capex 38.3% 35.9% 59.8% 53.6% 99.0% EBIT $623 $750 $743 $834 $749 Less: Taxes (197) (222) (212) (234) (210) % marginal tax rate 31.7% 29.6% 28.6% 28.0% 28.0% EBIAT $425 $528 $531 $601 $539 Plus: D&A 251 283 394 389 510 Less: Capital expenditures (655) (789) (658) (726) (515) % EBITDA 75.0% 76.4% 57.9% 59.3% 40.9% Maintainance capex (325) (392) (327) (361) (371) % EBITDA 37.2% 38.0% 28.8% 29.5% 29.5% Growth capex (330) (397) (332) (365) (144) % EBITDA 37.8% 38.5% 29.2% 29.9% 11.4% +/- Other1 19 17 15 16 17 +/- Change in NWC (52) 18 (11) 0 0 Plus:Tax-affected GP / IDR distributions 17 20 23 25 26 Plus:Tax-affected UGI attributable LP distributions 56 59 61 62 63 Unlevered free cash flow $60 $136 $354 $367 $641 Less: Stub (15) — — Unlevered free cash flow for discounting $45 $136 $354 $367 $641 PV of FCF ($mm) PV of terminal value ($mm)2 Firm value ($mm) Implied terminal value / 2022E EBITDA Terminal growth rate Terminal growth rate Terminal growth rate 2.50% 3.00% 3.50% 2.50% 3.00% 3.50% 2.50% 3.00% 3.50% Discount rate 7.00% $768 + Discount rate 7.00% $11,080 $12,307 $13,957 = Discount rate 7.00% $11,848 $13,075 $14,724 Discount rate 7.00% 11.7x 13.0x 14.7x 7.50% 759 7.50% 9,855 10,814 12,069 7.50% 10,614 11,573 12,828 7.50% 10.6x 11.6x 12.9x 8.00% 751 8.00% 8,850 9,615 10,596 8.00% 9,601 10,366 11,347 8.00% 9.7x 10.5x 11.6x Net debt Equity value ($mm) Implied value per share ($)3 Implied TV P/E multiple 4 Terminal growth rate Terminal growth rate Terminal growth rate 2.50% 3.00% 3.50% 2.50% 3.00% 3.50% 2.50% 3.00% 3.50% Discount rate 7.00% $1,407 = Discount rate 7.00% $10,440 $11,668 $13,317 Discount rate 7.00% $58.67 $65.36 $74.35 Discount rate 7.00% 24.0x 26.9x 30.9x 7.50% 1,407 7.50% 9,207 10,165 11,421 7.50% 51.92 57.17 64.01 7.50% 21.4x 23.8x 26.9x 8.00% 1,407 8.00% 8,194 8,959 9,940 8.00% 46.36 50.57 55.94 8.00% 19.3x 21.2x 23.7x Source: UGI projections and terminal year as provided and approved by UGI management; Company filings Note: Projections based on 09/30 fiscal year end; Valuation date as of 12/31/18; Terminal year assumes flat % of EBITDA margins and D&A as 99% of capex 1 Includes other investing activity cash flow and other operating activity cash flow per UGI projections 2 Terminal value calculation assumes perpetuity growth rate of 0.0% to 2.5% for related APU distributions 3 Assumes ~178mm diluted shares outstanding calculated through the treasury stock method 14 4 Assumes terminal net income of $534mm J.P.Morgan

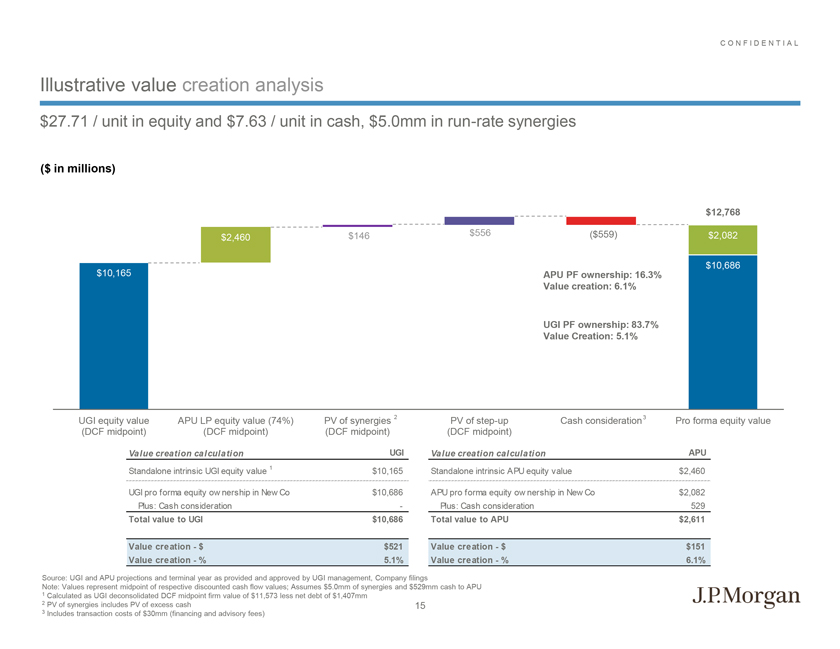

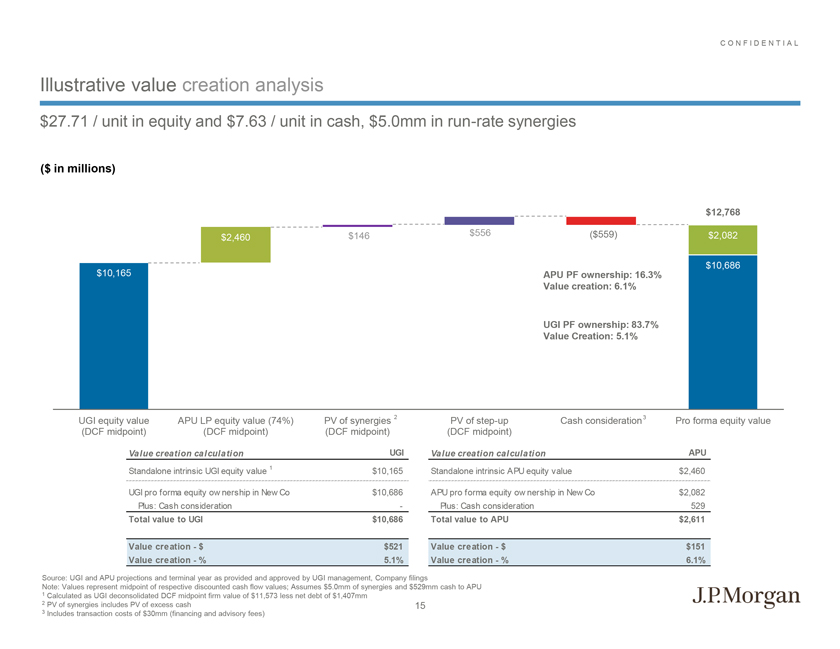

CONFIDENTIAL Illustrative value creation analysis $27.71 / unit in equity and $7.63 / unit in cash, $5.0mm inrun-rate synergies ($ in millions) Value creation calculation UGI Standalone intrinsic UGI equity value 1 $10,165 UGI pro forma equity ownership in New Co $10,686 Plus: Cash consideration—Total value to UGI $10,686 Value creation—$ $521 Value creation—% 5.1% Value creation calculation APU Standalone intrinsic APU equity value $2,460 APU pro forma equity ownership in New Co $2,082 Plus: Cash consideration 529 Total value to APU $2,611 Value creation—$ $151 Value creation—% 6.1% Source: UGI and APU projections and terminal year as provided and approved by UGI management, Company filings Note: Values represent midpoint of respective discounted cash flow values; Assumes $5.0mm of synergies and $529mm cash to APU 1 Calculated as UGI deconsolidated DCF midpoint firm value of $11,573 less net debt of $1,407mm 2 PV of synergies includes PV of excess cash 15 3 Includes transaction costs of $30mm (financing and advisory fees) J.P.Morgan

CONFIDENTIAL Agenda Page 1 Appendix 16 J.P.Morgan

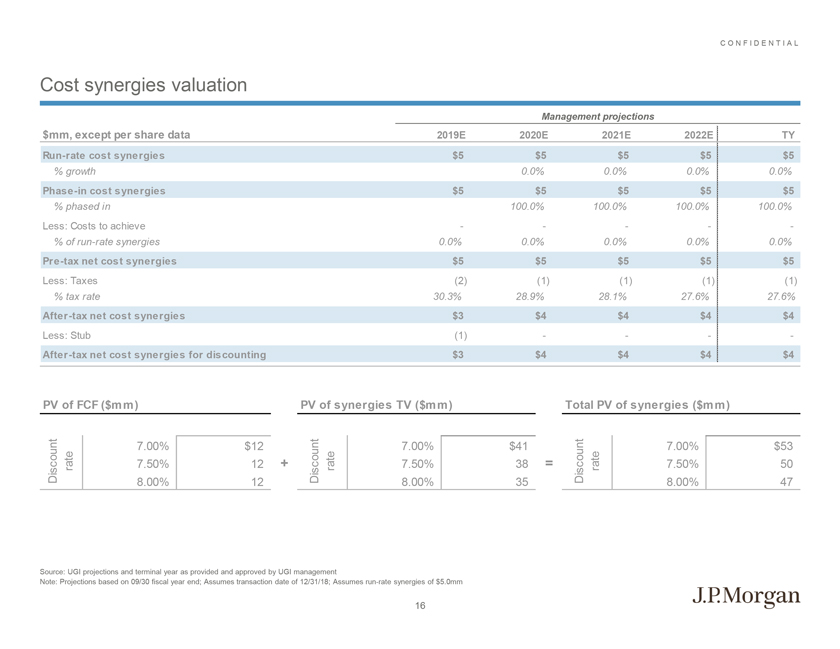

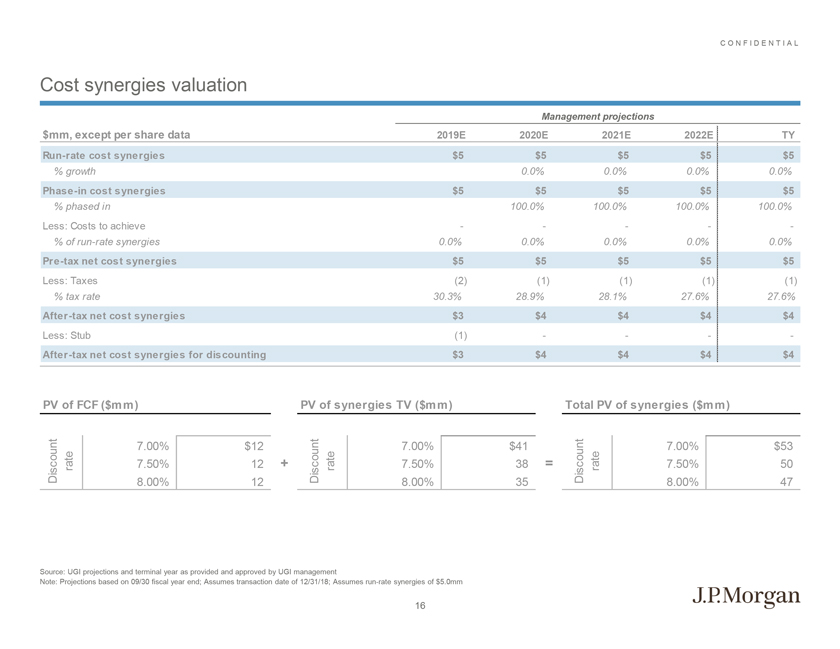

CONFIDENTIAL Cost synergies valuation Management projections $mm, except per share data 2019E 2020E 2021E 2022E TYRun-rate cost synergies $5 $5 $5 $5 $5 % growth 0.0% 0.0% 0.0% 0.0%Phase-in cost synergies $5 $5 $5 $5 $5 % phased in 100.0% 100.0% 100.0% 100.0% Less: Costs to achieve — ——% ofrun-rate synergies 0.0% 0.0% 0.0% 0.0% 0.0% Pre-tax net cost synergies $5 $5 $5 $5 $5 Less: Taxes (2) (1) (1) (1) (1) % tax rate 30.3% 28.9% 28.1% 27.6% 27.6% After-tax net cost synergies $3 $4 $4 $4 $4 Less: Stub (1) — — After-tax net cost synergies for discounting $3 $4 $4 $4 $4 PV of FCF ($mm) PV of synergies TV ($mm) Total PV of synergies ($mm) Discount rate 7.00% $12 + Discount rate 7.00% $41 = Discount rate 7.00% $53 7.50% 12 7.50% 38 7.50% 50 8.00% 12 8.00% 35 8.00% 47 Source: UGI projections and terminal year as provided and approved by UGI management Note: Projections based on 09/30 fiscal year end; Assumes transaction date of 12/31/18; Assumesrun-rate synergies of $5.0mm 16 J.P.Morgan

CONFIDENTIAL Excess cash reinvestment valuation Management projections $mm 2019E 2020E 2021E 2022E TY APU distributions saved $219 $230 $239 $243 Less: Incremental tax on APU ownership (41) (54) (58) (63) Less: Incremental tax affected interest (23) (23) (23) (23) Less: Incremental UGI dividends paid (38) (42) (43) (45) Plus: Interest savings on APU revolver 4 9 8 6 Less: APU revolver payment (247) (45) — Excess cash (post APU revolver paydown)—$76 $122 $119 Reinvested excess cash1—38 61 59 Assumed EBITDA multiple 7.5x 7.5x 7.5x 7.5x EBITDA—$5 $13 $21 $22 Less: D&A—(2) (7) (12) (5) EBIT—$3 $6 $9 $17 Less: Taxes—(1) (2) (2) (5) % marginal tax rate 30.3% 28.9% 28.1% 27.6% 27.6% EBIAT—$2 $5 $6 $12 Plus: D&A2—2 7 12 5 Less: Maintenance capex3—(1) (3) (5) (5) Less: Growth capex—(38) (61) (59) Unlevered free cash flow—($35) ($53) ($46) $12 Less: Stub — ——Unlevered free cash flow for discounting—($35) ($53) ($46) $12 PV of FCF ($mm) PV of TV ($mm) Total PV ($mm) Terminal growth rate Terminal growth rate 2.50% 3.00% 3.50% 2.50% 3.00% 3.50% 7.00% ($114) 7.00% $211 $239 $274 7.00% $97 $125 $160 Discount rate 7.50% (113) + Discount rate 7.50% 187 209 237 = Discount rate 7.50% 74 96 124 8.00% (112) 8.00% 168 185 207 8.00% 56 74 95 Source: UGI and APU projections and terminal year as provided and approved by UGI management; Company filings Note: Projections based on 09/30 fiscal year end; Valuation date as of 12/31/18 17 ¹ Assumes 50% of the total excess cash is reinvested 2 Assumes15-year MACRs depreciation 3 Assumes maintenance capex as 24% of EBITDA J.P.Morgan

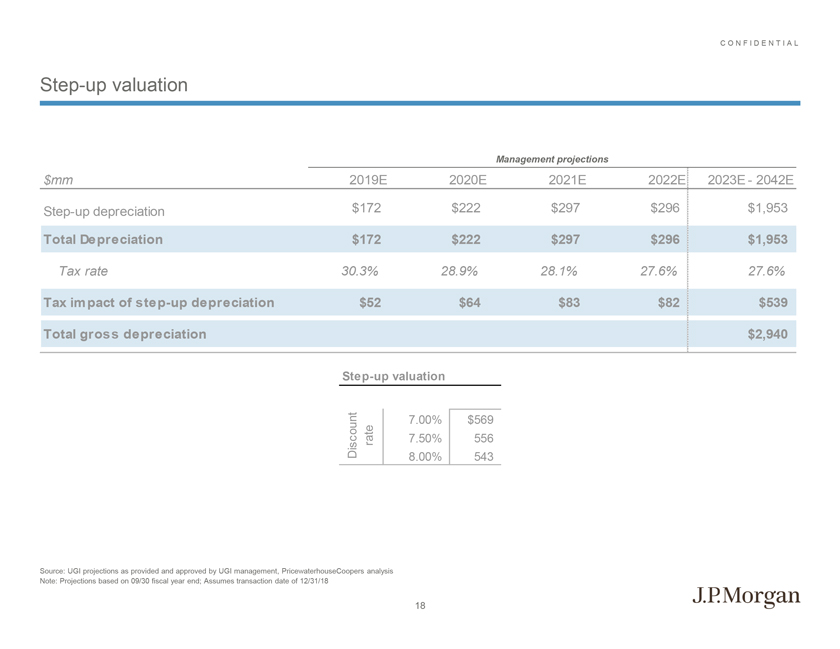

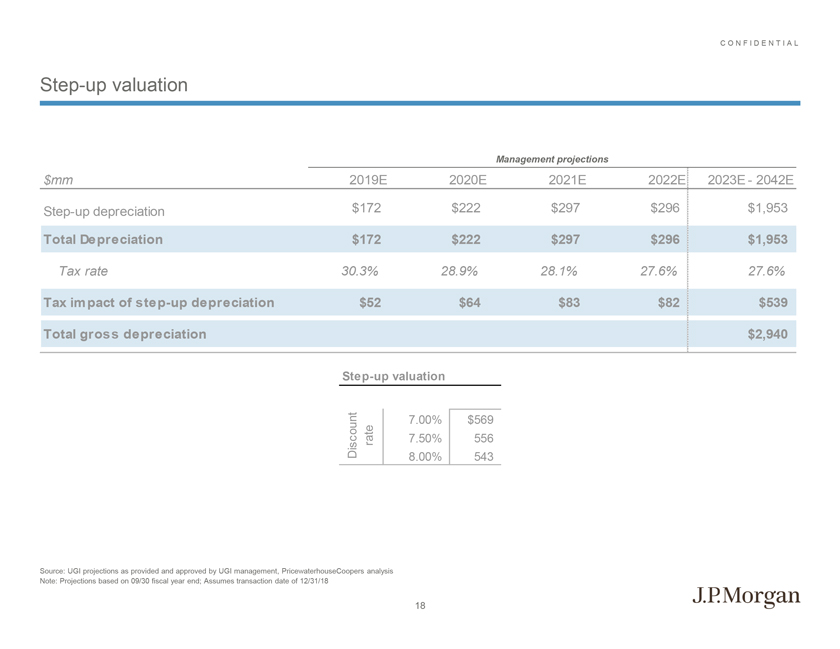

CONFIDENTIALStep-up valuation Management projections $mm 2019E 2020E 2021E 2022E 2023E—2042EStep-up depreciation $172 $222 $297 $296 $1,953 Total Depreciation $172 $222 $297 $296 $1,953 Tax rate 30.3% 28.9% 28.1% 27.6% 27.6% Tax impact ofstep-up depreciation $52 $64 $83 $82 $539 Total gross depreciation $2,940Step-up valuation Discount rate 7.00% $569 7.50% 556 8.00% 543 Source: UGI projections as provided and approved by UGI management, PricewaterhouseCoopers analysis Note: Projections based on 09/30 fiscal year end; Assumes transaction date of 12/31/18 J.P.Morgan