Exhibit (c)(13)

PRELIMINARY CONFIDENTIAL DRAFT Subject to Further Review & Revision

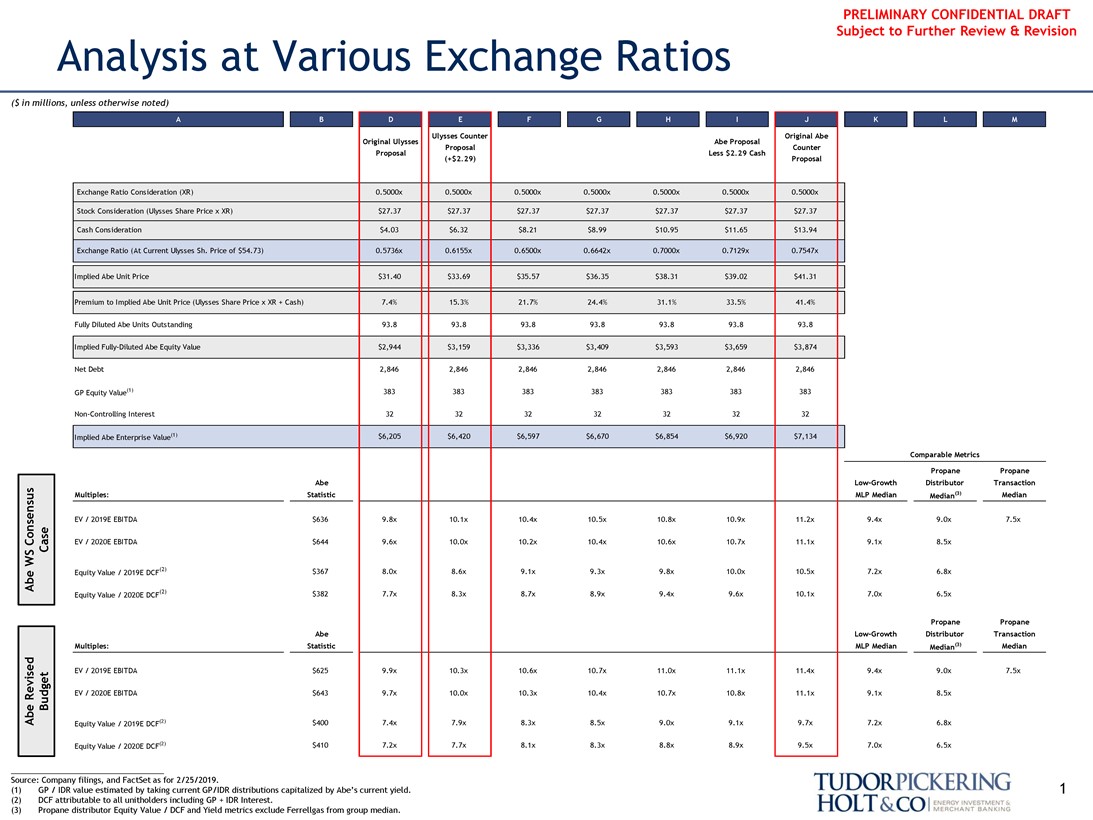

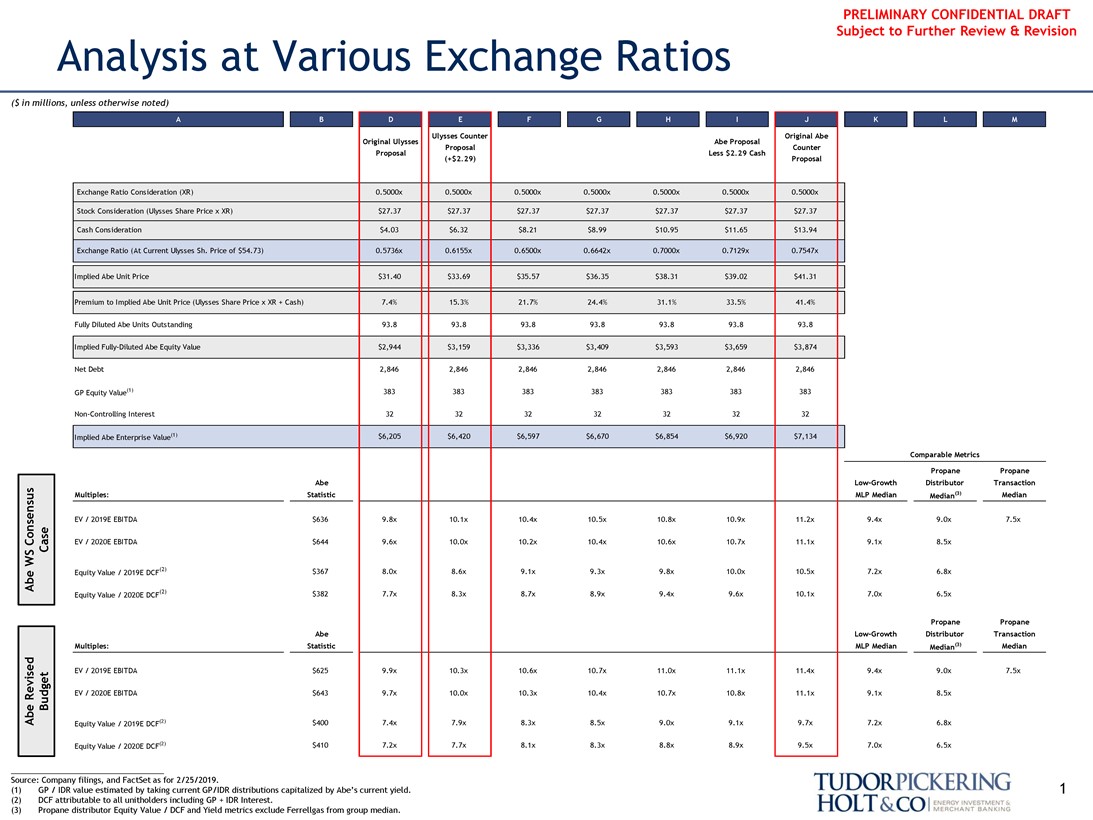

Analysis at Various Exchange Ratios

($ in millions, unless otherwise noted)

A B D E F G H I J K L M

Ulysses Counter Original Abe Original Ulysses Abe Proposal Proposal Counter Proposal Less $2.29 Cash

(+$2.29) Proposal

Exchange Ratio Consideration (XR) 0.5000x 0.5000x 0.5000x 0.5000x 0.5000x 0.5000x 0.5000x Stock Consideration (Ulysses Share Price x XR) $27.37 $27.37 $27.37 $27.37 $27.37 $27.37 $27.37 Cash Consideration $4.03 $6.32 $8.21 $8.99 $10.95 $11.65 $13.94 Exchange Ratio (At Current Ulysses Sh. Price of $54.73) 0.5736x 0.6155x 0.6500x 0.6642x 0.7000x 0.7129x 0.7547x

Implied Abe Unit Price $31.40 $33.69 $35.57 $36.35 $38.31 $39.02 $41.31 Premium to Implied Abe Unit Price (Ulysses Share Price x XR + Cash) 7.4% 15.3% 21.7% 24.4% 31.1% 33.5% 41.4% Fully Diluted Abe Units Outstanding 93.8 93.8 93.8 93.8 93.8 93.8 93.8 Implied Fully-Diluted Abe Equity Value $2,944 $3,159 $3,336 $3,409 $3,593 $3,659 $3,874 Net Debt 2,846 2,846 2,846 2,846 2,846 2,846 2,846

GP Equity Value(1) 383 383 383 383 383 383 383

Non-Controlling Interest 32 32 32 32 32 32 32

Implied Abe Enterprise Value(1) $6,205 $6,420 $6,597 $6,670 $6,854 $6,920 $7,134

Comparable Metrics

Propane Propane AbeLow-Growth Distributor Transaction Multiples: Statistic MLP Median Median(3) Median

EV / 2019E EBITDA $636 9.8x 10.1x 10.4x 10.5x 10.8x 10.9x 11.2x 9.4x 9.0x 7.5x Consensus EV / 2020E EBITDA $644 9.6x 10.0x 10.2x 10.4x 10.6x 10.7x 11.1x 9.1x 8.5x

WS Case

Abe Equity Value / 2019E DCF(2) $367 8.0x 8.6x 9.1x 9.3x 9.8x 10.0x 10.5x 7.2x 6.8x Equity Value / 2020E DCF(2) $382 7.7x 8.3x 8.7x 8.9x 9.4x 9.6x 10.1x 7.0x 6.5x

Propane Propane AbeLow-Growth Distributor Transaction Multiples: Statistic MLP Median Median(3) Median

EV / 2019E EBITDA $625 9.9x 10.3x 10.6x 10.7x 11.0x 11.1x 11.4x 9.4x 9.0x 7.5x Revised EV / 2020E EBITDA $643 9.7x 10.0x 10.3x 10.4x 10.7x 10.8x 11.1x 9.1x 8.5x

Budget

Abe Equity Value / 2019E DCF(2) $400 7.4x 7.9x 8.3x 8.5x 9.0x 9.1x 9.7x 7.2x 6.8x Equity Value / 2020E DCF(2) $410 7.2x 7.7x 8.1x 8.3x 8.8x 8.9x 9.5x 7.0x 6.5x

Source: Company filings, and FactSet as for 2/25/2019.

(1) GP / IDR value estimated by taking current GP/IDR distributions capitalized by Abe’s current yield. 1

(2) DCF attributable to all unitholders including GP + IDR Interest.

(3) Propane distributor Equity Value / DCF and Yield metrics exclude Ferrellgas from group median.

TUDORPICKERING HOLT & CO ENERGY INVESTMENT & MERCHANT BANKING