Exhibit (c)(6)

Private and confidential – illustrative and for discussion purposes only Analysis subject to change based on revised financials and conclusions of UGI and PWC tax analysis S T R I C T L Y P R I V A T E A N D C O N F I D E N T I A L Discussion materials March 4, 2019 Update

Private and confidential – illustrative and for discussion purposes only Analysis subject to change based on revised financials and conclusions of UGI and PWC tax analysis C O N F I D E N T I A L This presentation was prepared exclusively for the benefit and internal use of the J.P. Morgan client to whom it is directly addressed and delivered (including such client’s subsidiaries, the “Company”) in order to assist the Company in evaluating, on a preliminary basis, the feasibility of a possible transaction or transactions and does not carry any right of publication or disclosure, in whole or in part, to any other party. This presentation is for discussion purposes only and is incomplete without reference to, and should be viewed solely in conjunction with, the oral briefing provided by J.P. Morgan. Neither this presentation nor any of its contents may be disclosed or used for any other purpose without the prior written consent of J.P. Morgan. The information in this presentation is based upon any management forecasts supplied to us and reflects prevailing conditions and our views as of this date, all of which are accordingly subject to change. J.P. Morgan’s opinions and estimates constitute J.P. Morgan’s judgment and should be regarded as indicative, preliminary and for illustrative purposes only. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Company or which was otherwise reviewed by us. In addition, our analyses are not and do not purport to be appraisals of the assets, stock, or business of the Company or any other entity. J.P. Morgan makes no representations as to the actual value which may be received in connection with a transaction nor the legal, tax or accounting effects of consummating a transaction. Unless expressly contemplated hereby, the information in this presentation does not take into account the effects of a possible transaction or transactions involving an actual or potential change of control, which may have significant valuation and other effects. Notwithstanding anything herein to the contrary, the Company and each of its employees, representatives or other agents may disclose to any and all persons, without limitation of any kind, the U.S. federal and state income tax treatment and the U.S. federal and state income tax structure of the transactions contemplated hereby and all materials of any kind (including opinions or other tax analyses) that are provided to the Company relating to such tax treatment and tax structure insofar as such treatment and/or structure relates to a U.S. federal or state income tax strategy provided to the Company by J.P. Morgan. J.P. Morgan’s policies on data privacy can be found at http://www.jpmorgan.com/pages/privacy. J.P. Morgan’s policies prohibit employees from offering, directly or indirectly, a favorable research rating or specific price target, or offering to change a rating or price target, to a subject company as consideration or inducement for the receipt of business or for compensation. J.P. Morgan also prohibits its research analysts from being compensated for involvement in investment banking transactions except to the extent that such participation is intended to benefit investors. IRS Circular 230 Disclosure: JPMorgan Chase & Co. and its affiliates do not provide tax advice. Accordingly, any discussion of U.S. tax matters included herein (including any attachments) is not intended or written to be used, and cannot be used, in connection with the promotion, marketing or recommendation by anyone not affiliated with JPMorgan Chase & Co. of any of the matters addressed herein or for the purpose of avoiding U.S.tax-related penalties. J.P. Morgan is the marketing name for the Corporate and Investment Banking activities of JPMorgan Chase Bank, N.A., JPMS (member, NYSE), J.P. Morgan PLC authorized by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority and their investment banking affiliates. This presentation does not constitute a commitment by any J.P. Morgan entity to underwrite, subscribe for or place any securities or to extend or arrange credit or to provide any other services. Copyright 2018 JPMorgan Chase & Co. All rights reserved. U G I

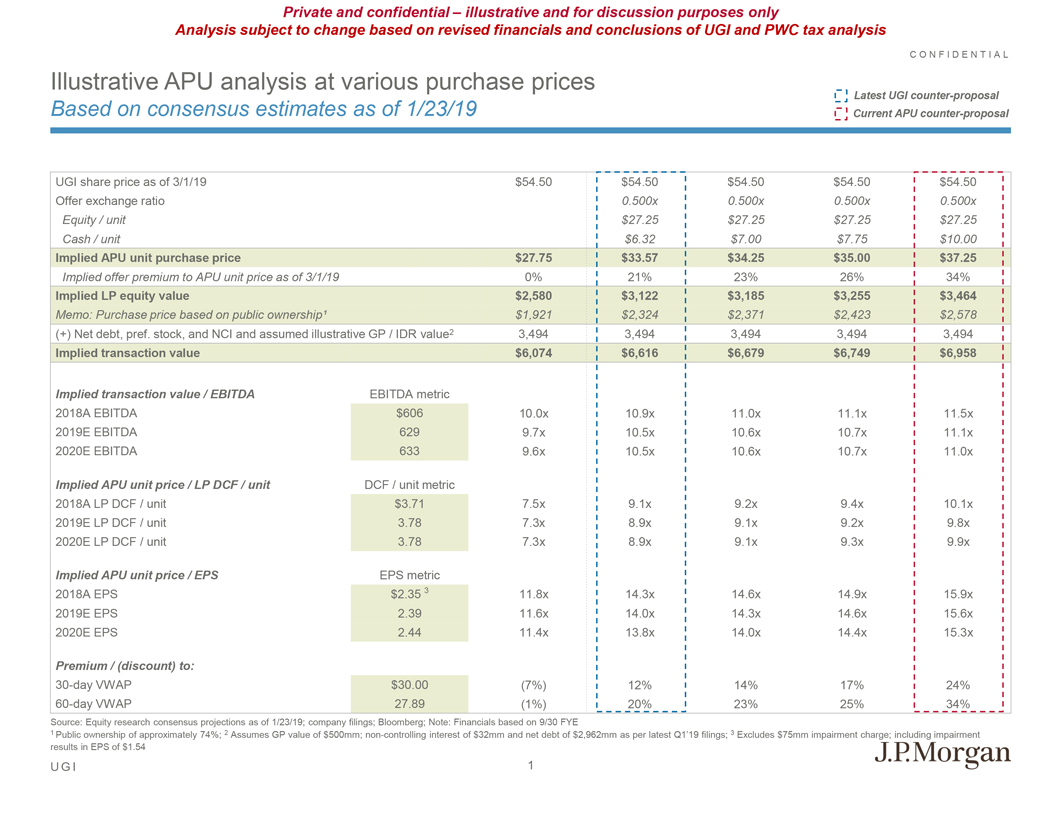

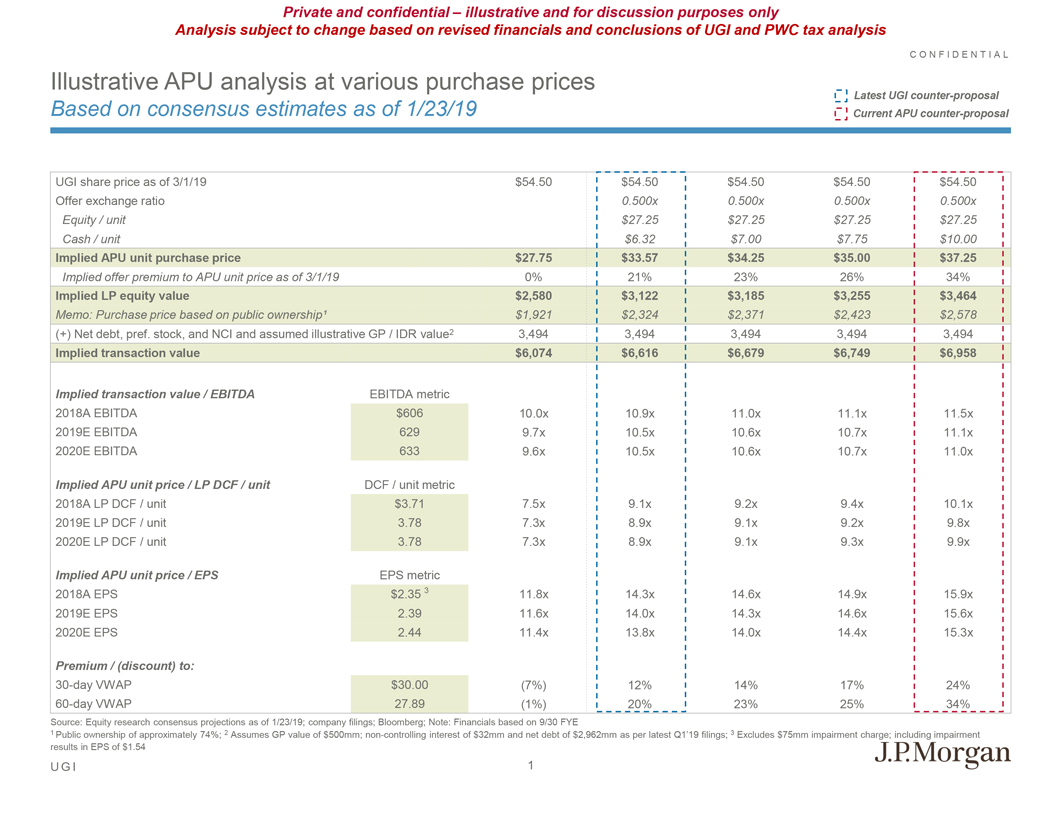

Private and confidential – illustrative and for discussion purposes only Analysis subject to change based on revised financials and conclusions of UGI and PWC tax analysis C O N F I D E N T I A L Illustrative APU analysis at various purchase prices Latest UGI counter-proposal Based on consensus estimates as of 1/23/19 Current APU counter-proposal UGI share price as of 3/1/19 $54.50 $54.50 $54.50 $54.50 $54.50 Offer exchange ratio 0.500x 0.500x 0.500x 0.500x Equity / unit $27.25 $27.25 $27.25 $27.25 Cash / unit $6.32 $7.00 $7.75 $10.00 Implied APU unit purchase price $27.75 $33.57 $34.25 $35.00 $37.25 Implied offer premium to APU unit price as of 3/1/19 0% 21% 23% 26% 34% Implied LP equity value $2,580 $3,122 $3,185 $3,255 $3,464 Memo: Purchase price based on public ownership¹ $1,921 $2,324 $2,371 $2,423 $2,578 (+) Net debt, pref. stock, and NCI and assumed illustrative GP / IDR value2 3,494 3,494 3,494 3,494 3,494 Implied transaction value $6,074 $6,616 $6,679 $6,749 $6,958 Implied transaction value / EBITDA EBITDA metric 2018A EBITDA $606 10.0x 10.9x 11.0x 11.1x 11.5x 2019E EBITDA 629 9.7x 10.5x 10.6x 10.7x 11.1x 2020E EBITDA 633 9.6x 10.5x 10.6x 10.7x 11.0x Implied APU unit price / LP DCF / unit DCF / unit metric 2018A LP DCF / unit $3.71 7.5x 9.1x 9.2x 9.4x 10.1x 2019E LP DCF / unit 3.78 7.3x 8.9x 9.1x 9.2x 9.8x 2020E LP DCF / unit 3.78 7.3x 8.9x 9.1x 9.3x 9.9x Implied APU unit price / EPS EPS metric 2018A EPS $2.35 3 11.8x 14.3x 14.6x 14.9x 15.9x 2019E EPS 2.39 11.6x 14.0x 14.3x 14.6x 15.6x 2020E EPS 2.44 11.4x 13.8x 14.0x 14.4x 15.3x Premium / (discount) to:30-day VWAP $30.00 (7%) 12% 14% 17% 24%60-day VWAP 27.89 (1%) 20% 23% 25% 34% Source: Equity research consensus projections as of 1/23/19; company filings; Bloomberg; Note: Financials based on 9/30 FYE 1 Public ownership of approximately 74%; 2 Assumes GP value of $500mm;non-controlling interest of $32mm and net debt of $2,962mm as per latest Q1’19 filings; 3 Excludes $75mm impairment charge; including impairment results in EPS of $1.54 U G I 1

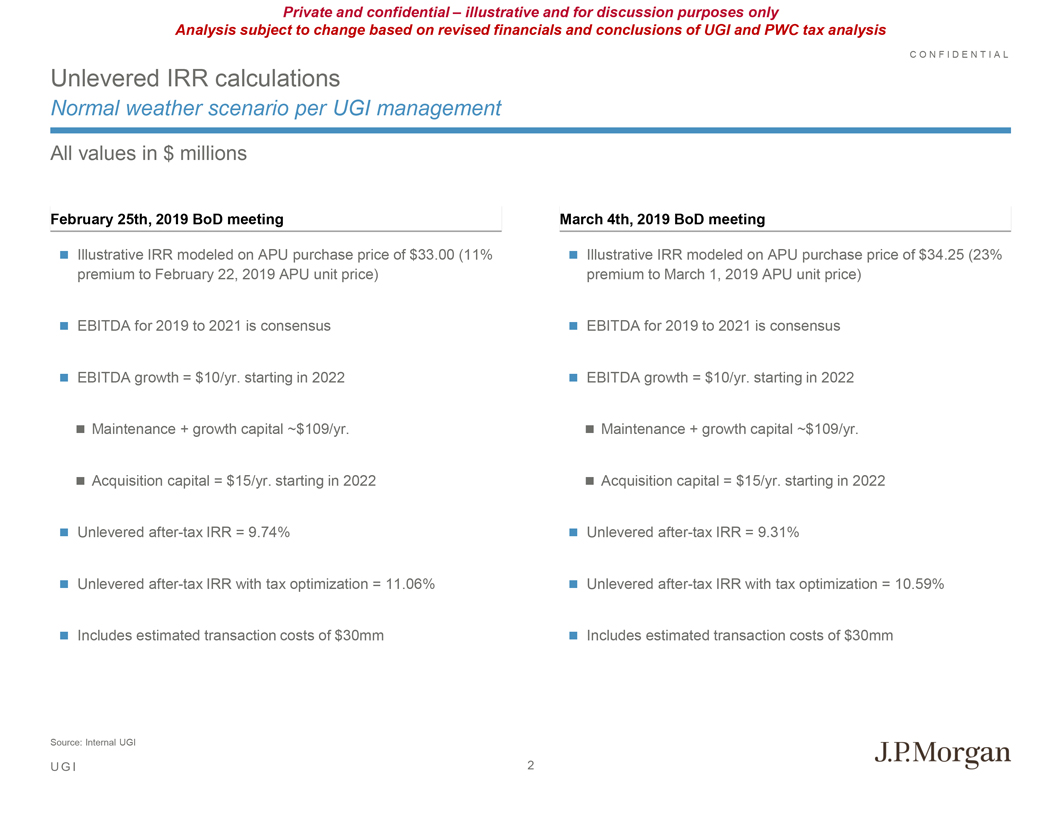

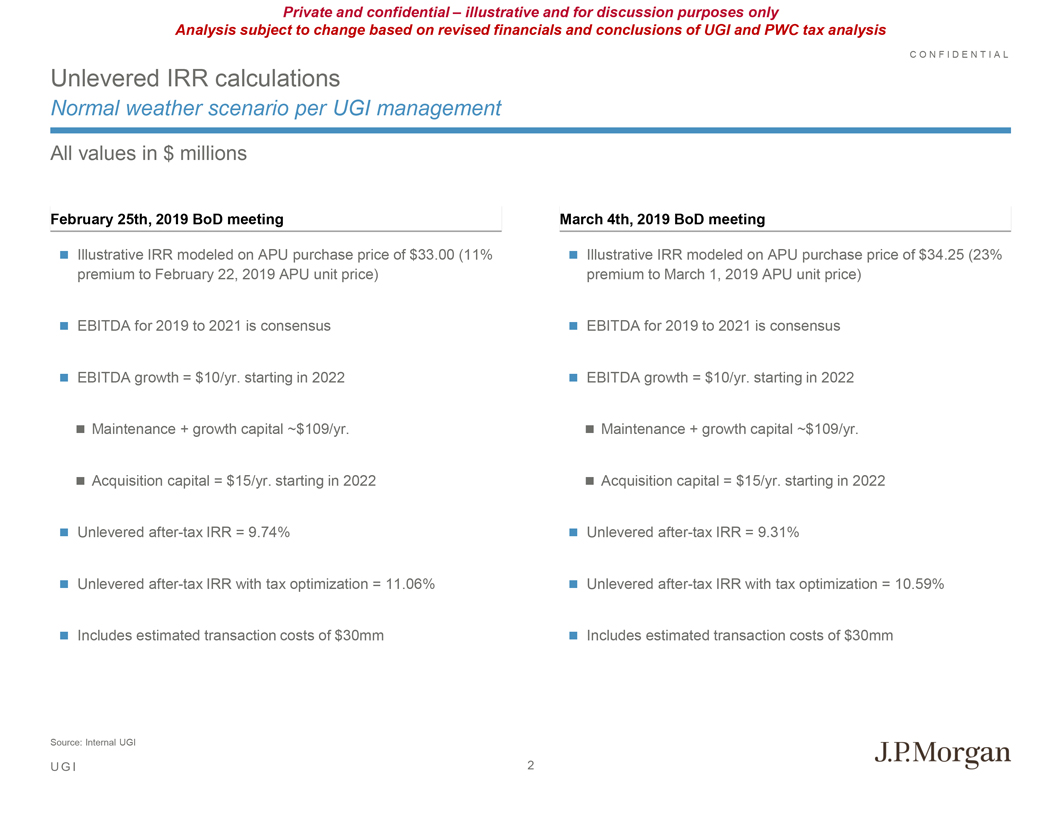

Private and confidential – illustrative and for discussion purposes only Analysis subject to change based on revised financials and conclusions of UGI and PWC tax analysis C O N F I D E N T I A L Unlevered IRR calculations Normal weather scenario per UGI management All values in $ millions February 25th, 2019 BoD meeting March 4th, 2019 BoD meeting Illustrative IRR modeled on APU purchase price of $33.00 (11% Illustrative IRR modeled on APU purchase price of $34.25 (23% premium to February 22, 2019 APU unit price) premium to March 1, 2019 APU unit price) EBITDA for 2019 to 2021 is consensus EBITDA for 2019 to 2021 is consensus EBITDA growth = $10/yr. starting in 2022 EBITDA growth = $10/yr. starting in 2022 Maintenance + growth capital ~$109/yr. Maintenance + growth capital ~$109/yr. Acquisition capital = $15/yr. starting in 2022 Acquisition capital = $15/yr. starting in 2022 Unleveredafter-tax IRR = 9.74% Unleveredafter-tax IRR = 9.31% Unleveredafter-tax IRR with tax optimization = 11.06% Unleveredafter-tax IRR with tax optimization = 10.59% Includes estimated transaction costs of $30mm Includes estimated transaction costs of $30mm Source: Internal UGI U G I 2

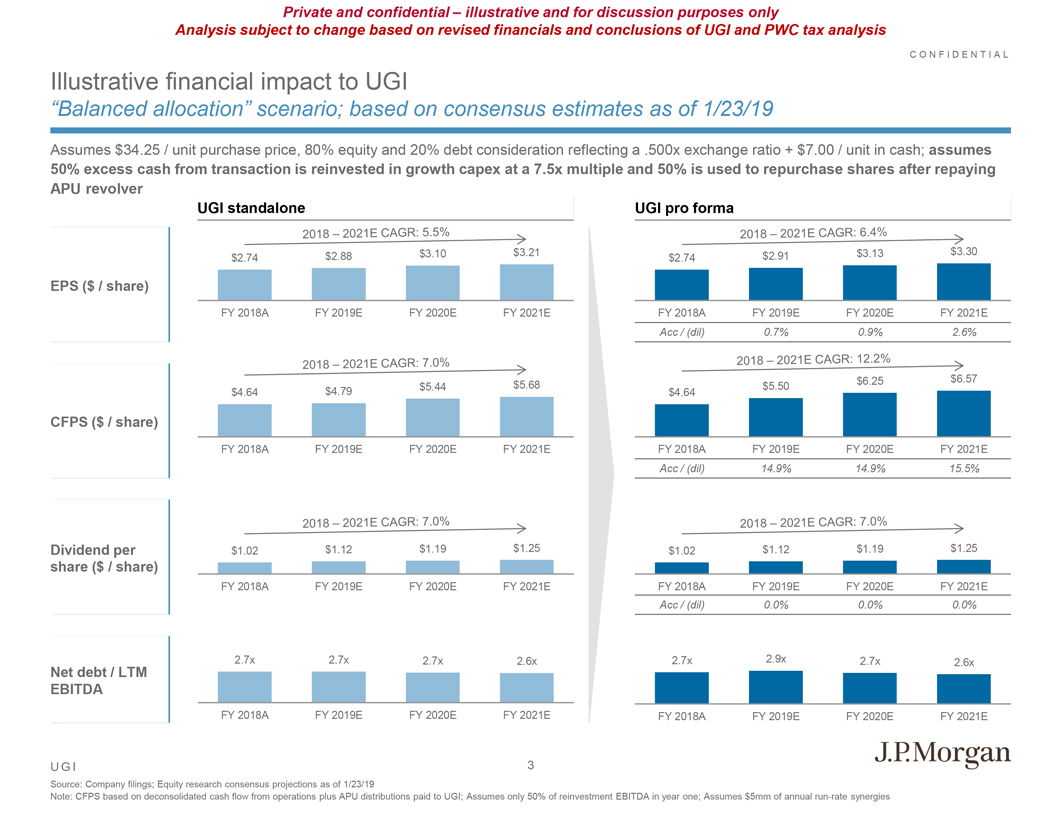

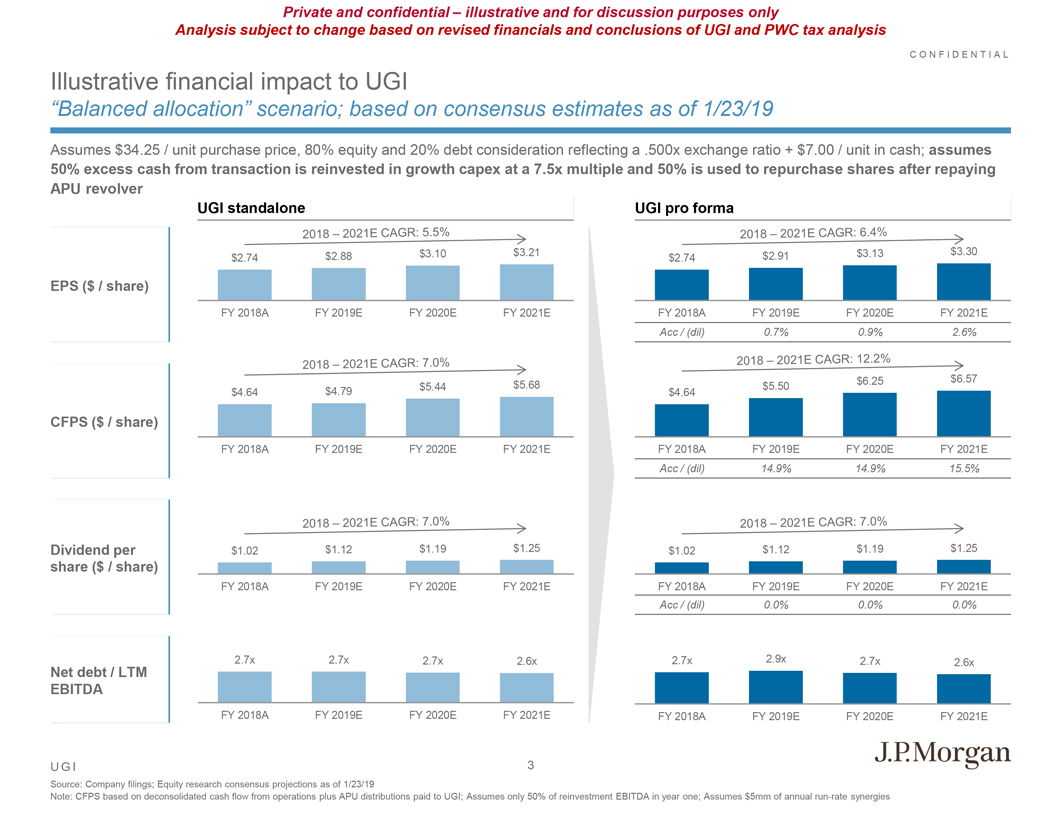

Private and confidential – illustrative and for discussion purposes only Analysis subject to change based on revised financials and conclusions of UGI and PWC tax analysis C O N F I D E N T I A L Illustrative financial impact to UGI “Balanced allocation” scenario; based on consensus estimates as of 1/23/19 Assumes $34.25 / unit purchase price, 80% equity and 20% debt consideration reflecting a .500x exchange ratio + $7.00 / unit in cash; assumes 50% excess cash from transaction is reinvested in growth capex at a 7.5x multiple and 50% is used to repurchase shares after repaying APU revolver UGI standalone UGI pro forma $2.88 $3.10 $3.21 $2.91 $3.13 $3.30 $2.74 $2.74 EPS ($ / share) FY 2018A FY 2019E FY 2020E FY 2021E FY 2018A FY 2019E FY 2020E FY 2021E Acc / (dil) 0.7% 0.9% 2.6% $6.25 $6.57 $5.44 $5.68 $5.50 $4.64 $4.79 $4.64 CFPS ($ / share) FY 2018A FY 2019E FY 2020E FY 2021E FY 2018A FY 2019E FY 2020E FY 2021E Acc / (dil) 14.9% 14.9% 15.5% Dividend per $1.02 $1.12 $1.19 $1.25 $1.02 $1.12 $1.19 $1.25 share ($ / share) FY 2018A FY 2019E FY 2020E FY 2021E FY 2018A FY 2019E FY 2020E FY 2021E Acc / (dil) 0.0% 0.0% 0.0% 2.7x 2.7x 2.7x 2.6x 2.7x 2.9x 2.7x 2.6x Net debt / LTM EBITDA FY 2018A FY 2019E FY 2020E FY 2021E FY 2018A FY 2019E FY 2020E FY 2021E U G I 3 Source: Company filings; Equity research consensus projections as of 1/23/19 Note: CFPS based on deconsolidated cash flow from operations plus APU distributions paid to UGI; Assumes only 50% of reinvestment EBITDA in year one; Assumes $5mm of annualrun-rate synergies

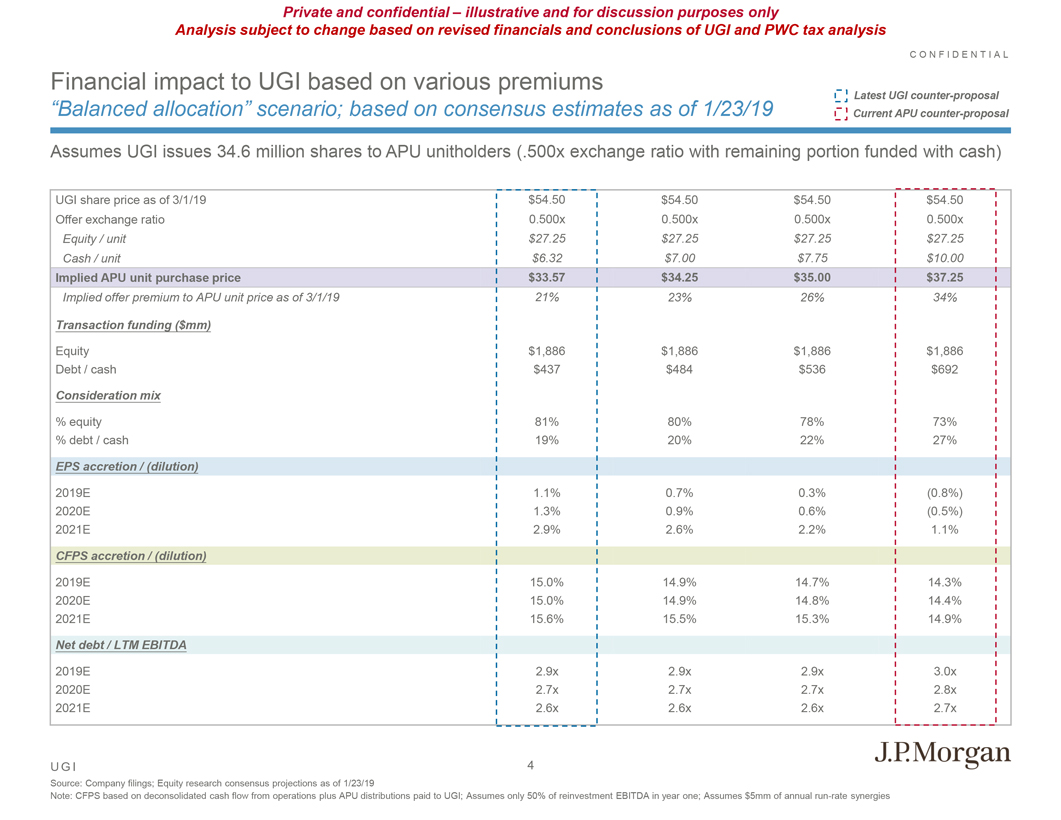

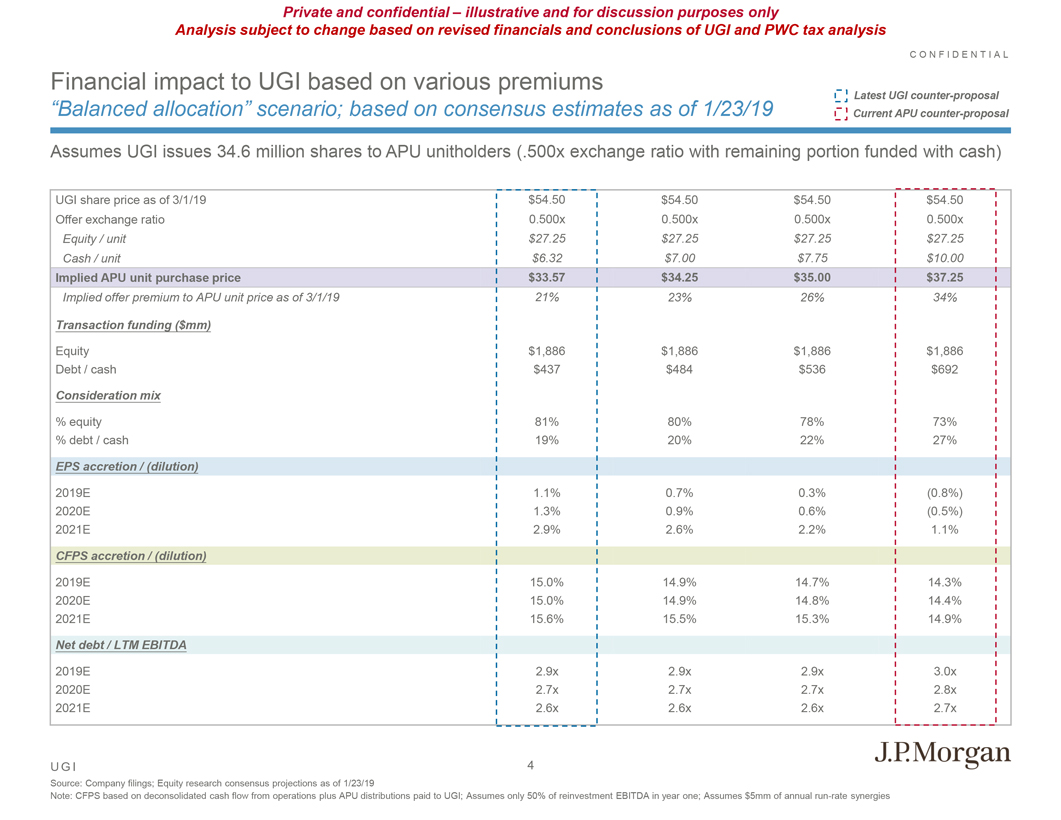

Private and confidential – illustrative and for discussion purposes only Analysis subject to change based on revised financials and conclusions of UGI and PWC tax analysis C O N F I D E N T I A L Financial impact to UGI based on various premiums Latest UGI counter-proposal “Balanced allocation” scenario; based on consensus estimates as of 1/23/19 Current APU counter-proposal Assumes UGI issues 34.6 million shares to APU unitholders (.500x exchange ratio with remaining portion funded with cash) UGI share price as of 3/1/19 $54.50 $54.50 $54.50 $54.50 Offer exchange ratio 0.500x 0.500x 0.500x 0.500x Equity / unit $27.25 $27.25 $27.25 $27.25 Cash / unit $6.32 $7.00 $7.75 $10.00 Implied APU unit purchase price $33.57 $34.25 $35.00 $37.25 Implied offer premium to APU unit price as of 3/1/19 21% 23% 26% 34% Transaction funding ($mm) Equity $1,886 $1,886 $1,886 $1,886 Debt / cash $437 $484 $536 $692 Consideration mix % equity 81% 80% 78% 73% % debt / cash 19% 20% 22% 27% EPS accretion / (dilution) 2019E 1.1% 0.7% 0.3% (0.8%) 2020E 1.3% 0.9% 0.6% (0.5%) 2021E 2.9% 2.6% 2.2% 1.1% CFPS accretion / (dilution) 2019E 15.0% 14.9% 14.7% 14.3% 2020E 15.0% 14.9% 14.8% 14.4% 2021E 15.6% 15.5% 15.3% 14.9% Net debt / LTM EBITDA 2019E 2.9x 2.9x 2.9x 3.0x 2020E 2.7x 2.7x 2.7x 2.8x 2021E 2.6x 2.6x 2.6x 2.7x U G I 4 Source: Company filings; Equity research consensus projections as of 1/23/19 Note: CFPS based on deconsolidated cash flow from operations plus APU distributions paid to UGI; Assumes only 50% of reinvestment EBITDA in year one; Assumes $5mm of annualrun-rate synergies

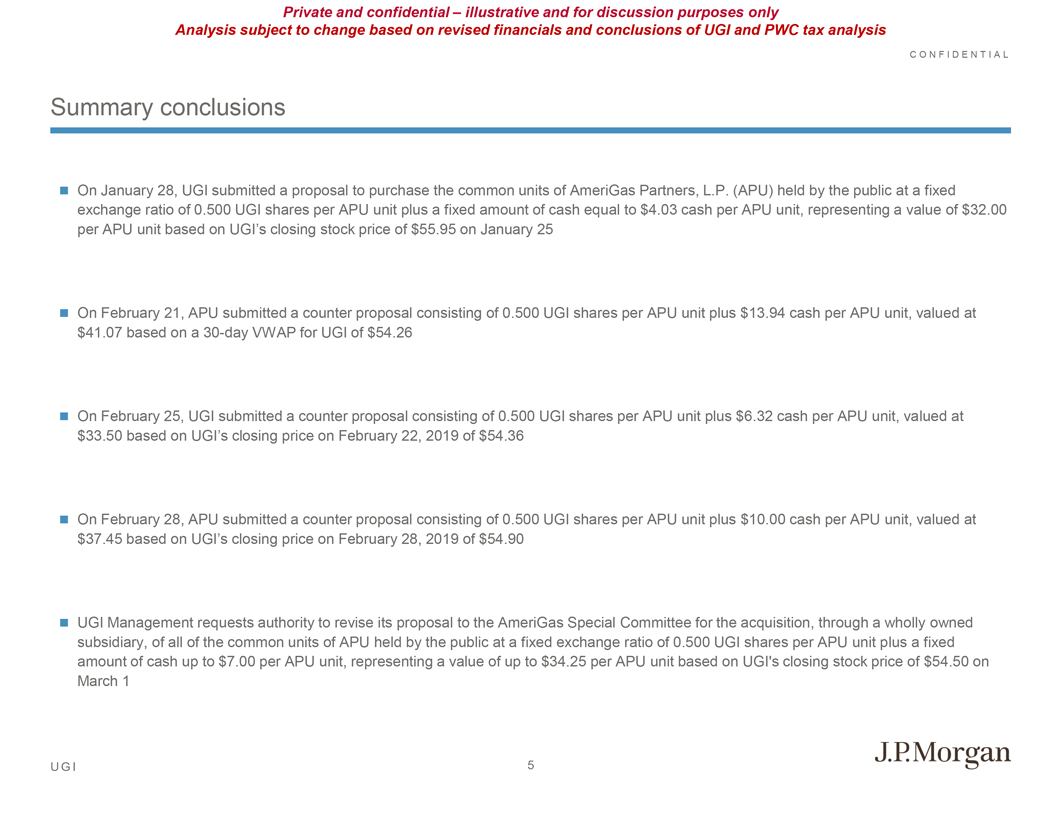

Private and confidential – illustrative and for discussion purposes only Analysis subject to change based on revised financials and conclusions of UGI and PWC tax analysis C O N F I D E N T I A L Summary conclusions On January 28, UGI submitted a proposal to purchase the common units of AmeriGas Partners, L.P. (APU) held by the public at a fixed exchange ratio of 0.500 UGI shares per APU unit plus a fixed amount of cash equal to $4.03 cash per APU unit, representing a value of $32.00 per APU unit based on UGI’s closing stock price of $55.95 on January 25 On February 21, APU submitted a counter proposal consisting of 0.500 UGI shares per APU unit plus $13.94 cash per APU unit, valued at $41.07 based on a30-day VWAP for UGI of $54.26 On February 25, UGI submitted a counter proposal consisting of 0.500 UGI shares per APU unit plus $6.32 cash per APU unit, valued at $33.50 based on UGI’s closing price on February 22, 2019 of $54.36 On February 28, APU submitted a counter proposal consisting of 0.500 UGI shares per APU unit plus $10.00 cash per APU unit, valued at $37.45 based on UGI’s closing price on February 28, 2019 of $54.90 UGI Management requests authority to revise its proposal to the AmeriGas Special Committee for the acquisition, through a wholly owned subsidiary, of all of the common units of APU held by the public at a fixed exchange ratio of 0.500 UGI shares per APU unit plus a fixed amount of cash up to $7.00 per APU unit, representing a value of up to $34.25 per APU unit based on UGI’s closing stock price of $54.50 on March 1 U G I 5